What Are Economic Indicators And How Do They Affect The Forex Market?

Economic indicators are statistics that measure the health of an economy. They are published by governments, central banks, and other organizations on a regular basis.

Economic indicators can be used for a variety of purposes, including:

Evaluating the current state of the economy.

Predicting the future state of the economy.

Making policy decisions.

Making investment decisions.

Economic indicators and multipliers are tools that allow assessing the state of an individual company, industry, the country's economy and the global economy. The dynamics of their changes can help to make a forecast of future prospects and asset value. In this review you will get acquainted with the types of economic indicators, their essence and learn how to use them for forecasting.

What are economic indicators and how do they affect the Forex market?

Economic indicators are statistics that measure the health of an economy. They are published by governments, central banks, and other organizations on a regular basis. Forex traders use economic indicators to assess the strength or weakness of a country's economy and to make predictions about future exchange rates.

Types of economic indicators

Economic indicators can be classified into three main categories:

-

Macroeconomic indicators measure the overall health of an economy. They include Gross Domestic Product (GDP), unemployment, inflation, and interest rates.

-

Microeconomic indicators measure the performance of specific sectors or industries within an economy. They include retail sales, industrial production, and housing starts.

-

Financial indicators measure the performance of financial markets. They include stock prices, bond yields, and exchange rates.

Economic indicators can have a significant impact on the Forex market. When an economic indicator is released, it can cause traders to buy or sell currencies in anticipation of future changes in exchange rates.

For example, if a country's GDP growth rate is higher than expected, it could lead to an increase in demand for that country's currency. This is because investors may view the country as a more attractive investment destination.

Conversely, if a country's unemployment rate is higher than expected, it could lead to a decrease in demand for that country's currency. This is because investors may view the country as a riskier investment destination.

In addition to the economic indicators mentioned above, there are a number of other factors that can affect the Forex market. These include:

Political events can have a significant impact on exchange rates. For example, a change in government or a major political scandal can lead to volatility in the Forex market.

Natural disasters can also cause volatility in the Forex market. For example, a hurricane or earthquake can disrupt trade and production, leading to changes in exchange rates.

Technological advancements can also affect the Forex market. For example, the development of new trading platforms and technologies can make it easier for traders to trade currencies, leading to increased volatility.

By understanding the factors that can affect the Forex market, traders can improve their chances of making successful trades.

How economic indicators are used

Economic indicators can be used for a variety of purposes, including:

-

Evaluating the current state of the economy. Economic indicators can be used to assess how well the economy is performing at present.

-

Predicting the future state of the economy. Economic indicators can be used to forecast how the economy will perform in the future.

-

Making policy decisions. Governments and central banks use economic indicators to make decisions about policy, such as tax policy, monetary policy, and fiscal policy.

-

Making investment decisions. Businesses and individuals use economic indicators to make investment decisions, such as investing in new businesses or buying securities.

Economic indicators are an important tool for understanding the state of the economy and making informed decisions.

A government can use GDP data to assess how well the economy is growing. If GDP is growing at a rapid pace, it may indicate that the economy is in good health.

A central bank can use inflation data to assess how quickly prices are rising. If inflation is too high, the central bank may raise interest rates to slow the growth of prices.

A business can use sales data to assess how well it is performing. If sales are growing, it may indicate that the business is successful.

A private investor can use corporate earnings data to assess how well companies are performing. If corporate earnings are growing, it may indicate that investing in those companies is a good option.

Economic indicators can be useful for a wide range of people and organizations. They can be used to understand the state of the economy and make informed decisions.

Key economic indicators for Forex traders

There are many economic indicators that can affect the Forex market. However, some of the most important indicators for Forex traders include:

GDP is a measure of the total value of goods and services produced in a country. It is one of the most important economic indicators because it provides a broad overview of the health of an economy.

Unemployment is a measure of the percentage of the labor force that is unemployed. It is a key indicator of economic growth because it measures the availability of labor.

Inflation is a measure of the rate at which prices are rising. It is a key indicator of the cost of living and the purchasing power of consumers.

Interest rates are the rates at which banks charge each other for loans. They are a key indicator of monetary policy and can have a significant impact on exchange rates.

Gross domestic product (GDP)

Gross domestic product (GDP) is the total value of all goods and services produced in a country in a given period of time. It is one of the most important economic indicators, as it provides a measure of the size and strength of an economy.

GDP is calculated using the following formula:

GDP = C + I + G + NX

where:

C is consumption by households;

I is investment;

G is government spending;

NX is net exports (exports - imports).

GDP can be calculated in both nominal and real terms. Nominal GDP is the value of goods and services produced at current prices. Real GDP is the value of goods and services produced at constant prices, that is, the prices of a base year.

An increase in GDP indicates an expansion of the economy. A decrease in GDP indicates a contraction of the economy.

GDP is an important indicator for government, businesses, and investors. Government uses GDP to assess the state of the economy and develop economic policy. Businesses use GDP to make decisions about production, investment, and expansion. Investors use GDP to make decisions about buying and selling securities.

👍 Here are some key advantages of using the GDP indicator:

• It provides a general overview of the size and strength of an economy.

• It can be used to compare economic performance across countries.

• It can be used to forecast future economic growth.

👎 Here are some disadvantages of using the GDP indicator:

• It can be distorted by factors such as inflation and exchange rate fluctuations.

• It does not take into account all aspects of the economy, such as quality of life and income inequality.

Overall, GDP is an important economic indicator that can be used to assess the state of the economy and make informed decisions.

The central bank's key rate

The central bank's key rate is the interest rate at which central banks lend money to commercial banks for short periods of time. It is one of the main tools of monetary policy used by central banks to regulate the economy.

Central banks use the key rate to achieve two main goals:

Controlling inflation. If inflation is too high, the central bank can raise the key rate to make loans more expensive. This, in turn, should lead to a slowdown in economic activity and a decrease in inflation.

Supporting economic growth. If the economy is in recession, the central bank can lower the key rate to make loans cheaper. This, in turn, should lead to a stimulation of economic activity and economic growth.

The key rate is typically determined by the central bank's monetary policy committee. The committee makes a decision to raise, lower, or keep the key rate at the same level based on an analysis of the current economic conditions.

Here are some key effects of the key rate:

On lending rates. The higher the key rate, the higher the lending rates charged by commercial banks to their customers. This makes loans more expensive and can reduce demand for goods and services.

On the cost of money. The higher the key rate, the higher the cost of money. This means that people and businesses have to pay more to use money.

On the exchange rate. The higher the key rate, the more competitive the national currency market becomes. This can lead to an increase in the exchange rate.

The key rate is an important tool of monetary policy that can have a significant impact on the economy.

Inflation

Inflation is the general increase in prices of goods and services in an economy. It is measured by the Consumer Price Index (CPI), which tracks the change in the cost of a basket of goods and services consumed by a typical household.

Inflation can be caused by a variety of factors, including:

Increased demand. If demand for goods and services exceeds supply, prices may rise.

Increased money supply. If a central bank prints more money, it can lead to rising prices.

Increased commodity prices. If prices of commodities, such as oil and gas, rise, it can lead to rising prices of goods and services that use them.

Inflation can have both positive and negative consequences. On the one hand, it can lead to economic growth as people spend more money. On the other hand, it can lead to a decrease in people's purchasing power and an increase in income inequality.

Central banks typically aim to keep inflation low to ensure economic stability. They can use a variety of tools to control inflation, including changing interest rates and the money supply.

Here are some key effects of inflation:

Change in purchasing power. Inflation reduces the purchasing power of money. This means that less goods and services can be bought for the same amount of money.

Change in interest rates. Inflation can lead to higher interest rates. This is because central banks aim to keep inflation at a certain level.

Change in the value of investments. Inflation can lead to a decrease in the value of investments. This is because future cash flows will have lower purchasing power.

Change in the level of income inequality. Inflation can lead to an increase in income inequality. This is because people with low incomes spend more money on essential goods and services, which are typically more susceptible to inflation.

Inflation is an important economic indicator that can have a significant impact on the economy.

Sources where you can find economic indicators

Here are 5 sources where you can find economic indicators:

Government and central bank websites. Most governments and central banks publish economic indicators on their official websites. These data are typically the most reliable and up-to-date.

International organizations. Organizations such as the World Bank, the International Monetary Fund, and the Organization for Economic Co-operation and Development also publish economic indicators. These data can be useful for comparing indicators across countries.

Media. Many media outlets, such as Bloomberg, CNBC, and Reuters, publish economic indicators. These data can be useful for obtaining short-term market information.

Financial companies. Many financial companies, such as Fidelity Investments and Vanguard, provide access to economic indicators. These data can be useful for investors who want to track the performance of specific companies or industries.

Economic websites and apps. There are many economic websites and apps that provide access to data. These resources can be useful for those who want to track a wide range of economic indicators.

Here are some specific examples of sources of economic indicators:

For the United States:

• U.S. Census Bureau

• U.S. Department of Labor

• Federal Reserve System

• U.S. Department of Commerce

• U.S. Department of Agriculture

For the United Kingdom:

• Office for National Statistics

• Bank of England

• HM Treasury

• Department for International Trade

• Department for Environment, Food and Rural Affairs

For the European Union:

• Eurostat

• European Central Bank

• European Commission

• European Investment Bank

• European Bank for Reconstruction and Development

When choosing a source for economic indicators, it is important to consider the following factors:

Accuracy and timeliness of data. It is important to ensure that the data is accurate and up-to-date.

Scope. It is important to choose a source that provides data across a wide range of indicators.

Ease of use. It is important to choose a source that is easy to use and understand.

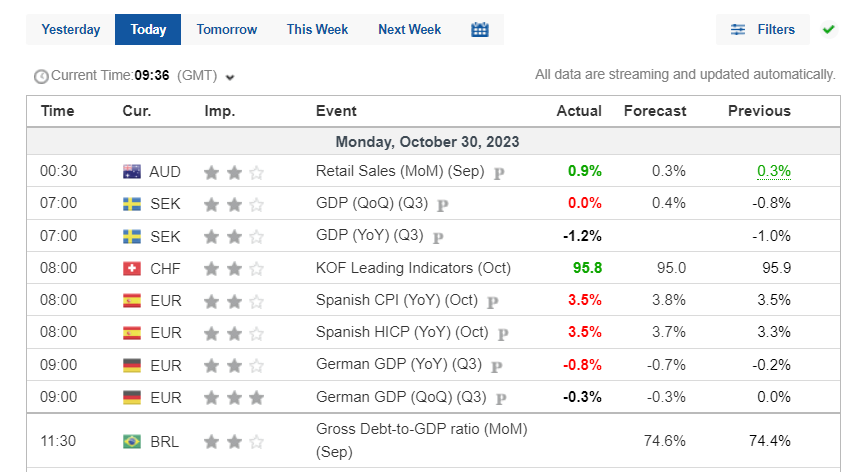

Economic calendar

An economic calendar is a tool that tracks important economic events, such as data releases, speeches by officials, and major financial market events. It is used by investors, traders, and other market participants to assess the current state of the economy and forecast future price movements.

Image: Economic calendar

An economic calendar typically includes the following types of events:

Data releases. This includes data on indicators such as GDP, inflation, unemployment, and interest rates.

Speeches by officials. This includes speeches by central bankers, finance ministers, and other high-ranking officials.

Major financial market events. This includes events such as central bank meetings, the release of new financial products, and corporate events.

An economic calendar can be useful for investors for several reasons. First, it can help investors track important events that could affect asset prices. Second, it can help investors forecast future price movements. Third, it can help investors make informed investment decisions.

Economic calendars are available in a variety of forms, including online services, mobile apps, and print publications. Some of the most popular economic calendars include:

When using an economic calendar, it is important to consider the following factors:

Accuracy. It is important to make sure that the economic calendar you are using is accurate and up-to-date.

Completeness. It is important to make sure that the economic calendar covers all important economic events.

Ease of use. It is important to make sure that the economic calendar is easy to use and has a clear interface.

An economic calendar is a valuable tool for investors, traders, and other market participants. It can help you track important economic events and make informed investment decisions.

Conclusion

Economic indicators are an important tool for Forex traders. By understanding how economic indicators affect the Forex market, traders can make more informed decisions about when to buy or sell currencies.

FAQ

What economic factors affect the Forex market?

Interest rates, economic growth, inflation, political stability, and current account balance are the main economic factors that affect the Forex market.

Why are indicators important in Forex trading?

Indicators are important in Forex trading because they can help traders to identify trends, potential reversals, and support and resistance levels. This information can then be used to make informed trading decisions.

How does the economic calendar affect Forex?

The economic calendar affects Forex by influencing market sentiment and volatility. When important economic events are released, traders and investors may buy or sell currencies based on their expectations of the data. This can lead to increased trading activity and price volatility.

What indicators do Forex traders use with economic indicators?

Some of the most popular indicators used by Forex traders include moving averages, Bollinger Bands, RSI, Stochastic Oscillator, MACD, and Ichimoku Kinko Hyo.

Glossary for novice traders

-

1

Economic indicators

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Team that worked on the article

Alex Smith is a professional day trader for a proprietary trading firm within the foreign exchange (forex) and crypto markets. His area of expertise is day trading and swing trading within the 15min-4hr time frames for both the London and NY open.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).