Top 10 Most traded currencies and currency pairs - Traders Union

Most traded currencies and currency pairs in 2024:

US dollar (USD) — the most traded currency in the world;

Euro (EUR) — the world's reserve currency, accounting for 30.5% of global foreign exchange;

Japanese yen (JPY) — the country's official currency and the third most traded currency in the world;

EUR/USD — the most crucial Forex pair;

USD/JPY — a crucial currency pair to monitor for equity markets;

GBP/USD — the third most traded currency pair, makes up for almost 13 percent of trading volumes.

This article will examine the most traded currencies, which account for almost 90% of all trades. We will also consider the most traded currency pairs in the world, the best currency pairs for Forex traders, and the best currencies for travelers.

-

What factors impact the trading volume of currency pairs?

Factors like interest rates, economic growth, political stability, central bank policies, risk sentiment, and seasonal fluctuations in the demand and supply of currencies.

-

What is the difference between a currency pair and a cross?

A currency pair involves trading the U.S. dollar against another major currency. A cross is trading between two non-USD major currencies.

-

Which commodity currencies have high liquidity?

Commodity currencies like the Australian dollar (AUD), New Zealand Dollar (NZD) and Canadian dollar (CAD) see substantial trading volumes.

-

How can traders benefit from trading exotic currency pairs?

Exotic pairs tend to be more volatile, offering more significant trading opportunities via wider spreads and larger pip movements.

Most traded currencies in the Forex

The Forex is the world's largest market, which quotes almost 24/24 with the largest trading volumes. There are many currency pairs to trade. For a novice trader, the question arises quickly: What are the best currency pairs to trade? The answer is not that simple because the best Forex pairs to trade vary for each trader. A Japanese investor may prefer the Yen, while a French investor will prefer the Euro against the U.S. dollar.

Whether an experienced or knowledgeable trader, you often look for the most profitable currency pairs. And it is true that it is difficult to make a choice, but do not despair - there are a few criteria to consider when choosing which currency to trade.

How to Trade Currencies OnlineWhat are the most traded currencies in the world?

1. U.S dollar (USD)

With a global daily average trading volume of over $7.5 trillion, the U.S. dollar is the most traded currency in the world. The Dollar has such a strong precedent in Forex markets that all major currency pairs in Forex trading contain the Dollar. These key pairs account for over 85% of all FX trades.

The U.S. dollar attained the number one slot following the country's economic dominance after the second world war. The U.S. GDP represented 15% of the world economy at the time. As a result, other countries began using dollars in international trade to avoid currency conversion expenses.

2. Euro (EUR)

The Euro is a relative newbie compared to other prominent currencies, having only been the actual currency of most European Union countries in 2002. The Euro has overtaken the French franc, Italian lira, German Deutschmark, Spanish peseta, and other well-known currencies and is now used by 19 of the EU's 27 member States.

The Euro is the recognized currency of the world's largest trading bloc and the world's reserve currency, accounting for 30.5% of global foreign exchange and ranking second to the U.S. dollar. The Euro has witnessed enormous price swings throughout the 21 years of its existence, trading below the U.S. dollar at launch, increasing to a peak of nearly $1.60 in 2008, and dropping back to parity in 2022.

3. Japanese yen (JPY)

The Japanese Yen is the country's official currency and the third most traded currency in the world, with a daily average volume of $1.25 trillion. It is also the third largest reserve currency, accounting for around 4.9% of global currency reserves.

The Japanese Yen, the country's official currency in 1871, was backed by gold until World War II when it lost most of its value. With U.S. backing, the Yen was effectively refloated in 1945 and strengthened, thanks to a combination of currency interventions by the government and a vibrant export market that guaranteed a trade surplus. The Yen has since returned to its levels from the late 1980s after hitting an all-time high versus the U.S. dollar in 1995. The Yen is most frequently coupled with the U.S. dollar and Chinese yuan due to its 16.7% market share and importance as a primary medium of exchange in the Asia-Pacific region.

4. The pound sterling (GBP)

The Pound Sterling is the official currency of the U.K. and its territories. It is the fourth traded currency worldwide, with a daily average volume of nearly $422 billion. And it is also the fourth-largest reserve currency, with an estimated 4.5% of the value of the world's reserves.

The success of the U.K. economy has a significant impact on the Pound's value, with information on inflation rates, the monetary policies of the Bank of England (BoE), GDP, and employment reports all potentially having an impact. The U.K.'s altered connection with Europe has also impacted its worth recently.

EUR to GBP price forecast5. Australian Dollar

The Australian Dollar completes the top five international currencies, accounting for more than 6% of all FX volumes. The Australian Dollar (A$) superseded the Australian Pound (a holdover from the country's status as a British colony) in 1966 and is mainly used alongside the U.S. dollar, Yen, and renminbi. The currency continues to hold unchallenged financial hegemony in the Oceanic region and is extensively employed in the trade of fuel ore, unprocessed minerals, and cattle.

Commodity prices and the "terms of trade," or the difference between the price of Australia's imports and exports, significantly impact the Australian Dollar's value. Changes in the trade volumes and prices of these commodities can also impact the Australian Dollar (AUD). Australia is a prominent exporter of coal, iron, and copper, among other mined commodities, as well as a major importer of oil.

The extent of the nation's foreign debt also affects the currency's value; if this factor rises, the value of the Australian Dollar relative to the currencies of its top trading partners is expected to decline.

How to trade commodities on the stock exchange6. Canadian Dollar

The Canadian Dollar ranks sixth among the top ten most often used currencies worldwide. Due to Canada's relatively good economic situation, solid sovereign position, and the stability of the nation's legal and political systems, the Canadian Dollar (CAD), which accounts for 6.2% of worldwide Forex activity, is a regional reserve currency. This is also true of Australia's Dollar (AUD).

Canada and the Canada Dollar are frequently considered metrics of U.S. economic activity, revealing insights that may not be obvious by direct observation. This is thanks to a shared border with the U.S. and significant amounts of reciprocal trade. Most of the Canadian Dollar's currency pair is the U.S. dollar, despite Central and South American banks frequently holding it as a store of value.

7. Swiss Franc

Although Switzerland's famed banking secrecy regulations are no longer as strict as they once were, the Swiss franc is one of the world's most powerful currencies, maintaining considerable independence within the Eurozone.

Since 2005, the Swiss central bank has held 1,290 tonnes of gold reserves to safeguard the CHF, with a 20% gold value backing. Although Switzerland's strong banks, stable government, robust economy, and unwavering neutrality helped retain the currency's " haven" status, this assistance was discontinued in 2014. As a result, when the global economy encounters a hiccup, CHF is frequently the first stop for Forex traders.

8. Chinese Renminbi (RMB/CNY)

The Chinese renminbi, the yuan, is East Asia's most widely used currency. The CNY, formerly a strictly regulated, non-fungible currency, has been partially convertible since 2012 and trades only within a constrained range determined by the Chinese central government.

The renminbi is convertible on current accounts only (as of 2013); capital accounts are unaffected. The renminbi, which accounts for 7% of global Forex flows, is gaining acceptance in international trade and is being adopted as a reserve currency by more than a dozen African countries. Very often, CNY and USD are coupled.

The most valuable currencies in the worldTop 6 most traded currency pairs in the world

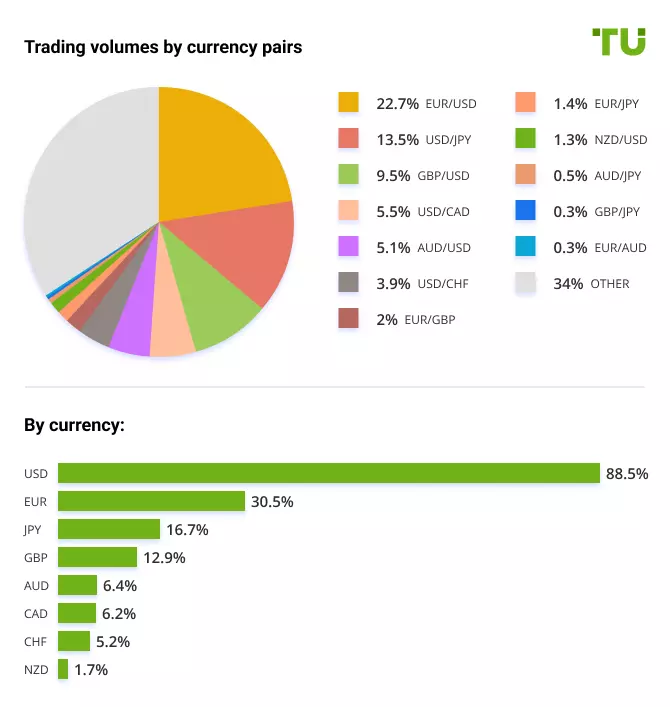

Trading volumes by currency pairs

EUR/USD

The Euro/U.S Dollar is the most crucial Forex pair. The currencies are the most traded globally and have the first and second largest reserve currencies accounting for 22.7% of trading volumes. This pair is used in almost a quarter of all currency transactions.

The Euro is the newest currency among the major pairs. It was launched in 1999, initially replacing 11 national currencies but is now used by over 300 million individuals in nineteen European countries.

The U.S Dollar is the world's primary reserve currency and controls trade internationally. The Federal Reserve, the nation's central bank, regulates the flow of U.S. dollars. The U.S. dollar remains a haven in times of crisis and the primary global reserve currency, despite predictions that it will eventually cede its dominant position to the Euro.

Euro to Dollar Signals and Price PredictionsUSD/JPY

The U.S. dollar against the Japanese Yen is the second most traded currency pair, with 13.5% of trading volumes. And this is because the Yen is the third most traded currency worldwide and a well-liked reserve currency.

For equity markets, this is the crucial currency pair to monitor. The Japanese Yen is usually seen as a haven in times of uncertainty. This is a result of various factors, such as the super low-interest rates in Japan since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and historical, traditional factors. A rising yen usually means falling stock markets.

This is a crucial currency pair to monitor for equity markets. In uncertain times, the Japanese Yen is frequently regarded as a refuge of safety. This is due to several causes, including Japan's historically low-interest rates since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and conventional historical factors. A rising yen frequently signals a decline in stock prices.

GBP/USD

The British Pound against the Dollar is the third most traded currency pair. It makes up for 9.5 percent of trading volumes. The currency pair is usually called "the cable" by traders and investors, which comes from the 19th century when the exchange rate was transmitted across the Atlantic by a submarine cable.

Pound to Dollar (GBP to USD) Signals and Price PredictionsAUD/USD

The Australian Dollar, the official currency of the Australian Commonwealth since 1966, replaced the Australian Pound (which includes Australia, seven dependent territories, and three countries). The Australian Dollar (AUD) is one of the world's most traded currencies (fifth behind USD, EUR, JPY, and GBP), accounting for 5.1% of trading volumes. Iron ore, coal, petroleum gas, gold, and aluminum oxide are just a few of the essential commodities that the Australian economy produces and exports in significant quantities. For this reason, the Australian Dollar is also referred to as a commodity currency and the Canadian Dollar.

AUD/USD forecast for today by Traders Union analystsUSD/CAD

The Canadian Dollar, sometimes known as the loonie in foreign exchange trading, is the name of the one-dollar coin featuring a picture of the loon, a common bird in Canada. It makes up 5.5% of the trading volume. Due to the close ties between their economies as neighbors, the Canadian and American dollars have a strong correlation. Canada exports 85% of its total output to the U.S. while importing 50% of its total imports of goods and services. Oil and lumber are two of Canada's largest exports, and the price of oil is a key determinant in determining the value of the Canadian Dollar. Because of this, the Canadian Dollar is included in a group of currencies known as commodity currencies.

US dollar to Canadian dollar Signals and Price PredictionsUSD/CHF

The currency code, CHF, is derived from the former Latin name for Switzerland, Confoederatio Helvetica, with the F standing for Franc. The Swiss Franc is also called the "Swissie" in the world of currency trading. The Swiss Franc is also supported by significant gold reserves, making Switzerland's economy one of Europe's most prosperous and secure.

The Swiss have been reluctant to adopt the Euro or enlist in the EU. With its historical neutrality regarding international wars, the Swiss Franc's stability is one factor that makes it a haven currency. The currency pair also, like the USD/CAD, accounts for 3.9% of the trading volume.

USD/CHF forecast by Traders Union – Analysis, Rate & ChartWhat are the best Forex pairs for traders?

The most liquid Forex pairs frequently have the lowest spreads and fastest execution for traders. Learn the five Forex pairs that are exchanged the most globally.

1. EUR/USD

The pair is the most popular Forex pair, and this is because it has the highest volume and one of the lowest spreads. It is sometimes known as the "fibre". Its popularity is also due, not unexpectedly, to the fact that it is the finest way to express one's opinion on the two biggest economies in the world—the United States and the Eurozone.

Political developments that affect the Dollar, the Euro, and their interrelationship significantly impact the EUR/USD pair. For instance, if the Federal Reserve intervenes in market activity to support the Dollar, you may anticipate a rise in the Dollar's value relative to the Euro and a fall in the value of the EUR/USD pair.

2. USD/YEN

The USD/JPY is a significant currency pair as well. After EUR/USD, the U.S Dollar to Japanese Yen is the second most traded currency pair. Simply put, this currency pair shows how many Japanese Yen are needed to buy one U.S. dollar. Although the USD/JPY pair often has very high liquidity, the JPY can also be considered a " haven" currency during economic turmoil worldwide. The JPY, however, is frequently referred to as the "Gateway to the East," and political and economic developments in China and Korea can significantly impact the currency.

3. GBP/USD

The British Pound against the Dollar is the third most traded Forex pair. As two of the most prominent western economies, the U.S. and the U.K. have a close trading relationship. However, the continuous uncertainty brought on by the U.K.'s plans to leave the EU ("Brexit") has made the GBP/USD more volatile. The EUR/GBP cross pair illustrates how heavily the Pound is traded vs. the Euro.

4. USD/CNY

The U.S. dollar and the Chinese renminbi, the yuan, make up this pair, the fourth most traded Forex pair. It provides information on the exchange rate between the two biggest exporters and economies worldwide.

Because the Chinese government intentionally lowered the price to maintain its competitive exports on the international market, the value of the yuan historically has been low compared to the U.S. dollar.

5. USD/CAD

The USD/CAD is the world's fifth most trading Forex pair. As key economic partners and fiscal neighbors, the U.S. and Canadian dollars have a strong association.

Yet, given that Canada's economy primarily depends on the sale of crude, the value of the Canadian Dollar is also strongly associated with commodity prices, remarkably the oil price. As a result, if you want to convert USD to CAD, it is crucial to keep an eye on the price of oil to choose when to buy.

Top Forex Facts and Statistics You Should KnowWhat are the best currencies for travelers?

The best currencies for travelers depend on the particular destination of the traveler. For example, if a tourist or traveler travels to Seychelles, it is advisable to change his money to Seychelles rupees. This is because it will be the most accepted currency in Seychelles.

However, a traveler may exchange local currency with the U.S. dollar, Euro, and other most traded currencies. This is another best option because each country has a money exchange point where the most popular currencies can be changed.

Best options to play against the dollarBest Forex brokers

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

Team that worked on the article

Oghenesurvwe Dibofu is a passionate writer and a contributor to the Traders Union website, who loves writing about tech, finance, and the crypto industry. Her writing style is often characterized as creative, engaging, and vibrant. She works tirelessly to learn new writing styles and deepen her knowledge of the finance industry. Her motto is “Write with passion, edit with precision.”

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).