The most valuable currencies in the world 2024

Top highest currencies in the world in 2023:

| Currency | Price |

|---|---|

Kuwaiti dinar |

USD 3.2484 |

Bahraini dinar |

USD 2.6486 |

Omani rial |

USD 2.5930 |

Jordanian dinar |

USD 1.4103 |

Cayman Islands dollar |

USD 1.2195 |

The 2008 financial crisis proved that the U.S. economy is not stable, implying that the U.S. dollar is not a stable currency. Due to close economic and trade relationships between countries, the global wave of bankruptcies affected many economies. The domino effect caused the U.S. economic crisis to spread to other countries. At the time, safe haven currency assets, i.e. currencies that have risen in value relative to other currencies, were identified. More specifically, these are their currencies into which investor capital flowed, causing their value to fall to a lesser extent, for example, the Swiss franc.

The pandemic, which destroyed logistics chains and reduced consumer demand, and, as a result, production output, had an equally significant impact on the global economy. It also had an impact on the landscape of the Top 15 currencies in the world.

What are the highest currencies?

The highest currency is a national currency with a stable value against other currencies under all market conditions. A strong currency is a sign of a stable, balanced economy. According to established rules, the U.S. dollar, the world’s main reserve currency, is used as an equivalent. The ratio of national currencies to the USD indirectly shows the ratio of national economies to the U.S. economy.

What does a strong currency mean for the country’s economy:

-

A reliable currency indicates that the country’s inflation is either non-existent or at a controlled low level. Deflation has its drawbacks, but if the inflation in a country with a strong currency is lower than in the country with base currency, the price of the strong currency does not decrease.

-

A country with a higher interest rate has a stronger currency. As the discount rate increases, the interest rates on deposits and loans increase. The value of the national currency, determined by interest, is also growing. However, this statement is true for a developing, managed economy since no one will invest money in the currency of a country where discount rates are raised to combat hyperinflation.

-

A country with a stable economy attracts foreign investors, who open deposits at local banks, buy company stocks, and so on, strengthening the national currency.

-

The country with the lowest prices for popular goods in the domestic market has a strong currency. After all, to buy a product, a foreign buyer must first buy local currency.

A strong currency benefits importers but not exporters. Exporters sell goods for USD, which are exchanged on the local currency market. They benefit from the low price of the local currency. Importers, on the other hand, are forced to buy USD to purchase goods from foreign partners, and therefore they benefit from the high price of the local currency. The role of the Central Bank is to monitor the balance.

Top 15 most valuable currencies in the world

Top 15 strongest currencies in the world 2024:

-

Kuwaiti dinar – USD 3.2484.

-

Bahraini dinar – USD 2.6486 USD (USD 2.65).

-

Omani rial – USD 2.5930 USD (USD2.60).

-

Jordanian dinar – USD 1.4103 USD (USD1.41).

-

Cayman Islands dollar – USD 1.2195 (USD 1.20).

-

Gibraltar pound – USD 1.21075.

-

Falkland Islands pound – USD 1.21.

-

Pound sterling – USD 1.2096.

-

Swiss franc – USD 1.0639.

-

Euro – USD 1.0435.

-

U.S. dollar – USD 1.

-

Panama balboa – USD 0.9996 (USD 1).

-

Bahamian dollar – USD 0.9971.

-

Canadian dollar – USD 0.7495.

-

Singapore dollar – USD 0.7275.

The world’s three strongest currencies have been in this order for many years. The rest change their positions from time to time. Sometimes other currencies also make this rating. For example, in 2011-2013, the Australian dollar was worth more than $1. At the moment, the euro is in a precarious position because its exchange rate in January 2023 fell below the USD for the first time since 2002.

1. Kuwaiti dinar (KWD)

Kuwaiti dinar/U.S. Dollar Chart

Today, the Kuwaiti dinar is the world’s strongest currency, and it has held this status for several years. In 2007, the country abandoned pegging to the USD in favor of a multi-currency basket. The secret of the high value of the dinar is the country’s large oil deposits and the low cost of their production. It is the low cost of production and export quotas set by OPEC that place the dinar among the world’s strongest currencies. With relatively equal market prices and fixed volumes, the one with lower costs is the winner. The country has almost no unemployment and no value-added tax. Because the government recognizes the risks of dependence on oil prices, it established a sovereign wealth reserve fund to maintain the exchange rate.

2. Bahraini dinar (BHD)

Bahraini dinar/U.S Dollar Chart

The situation is similar in Bahrain. As in the case of Kuwait, Bahrain has large deposits of energy resources, which are the main source of income. However, unlike Kuwait, Bahrain’s currency is pegged to the U.S. dollar. The regulator has sufficient gold and foreign exchange reserves to keep the national currency firmly within a narrow range. Interesting fact: the national currency of Saudi Arabia is the second legal tender in Bahrain.

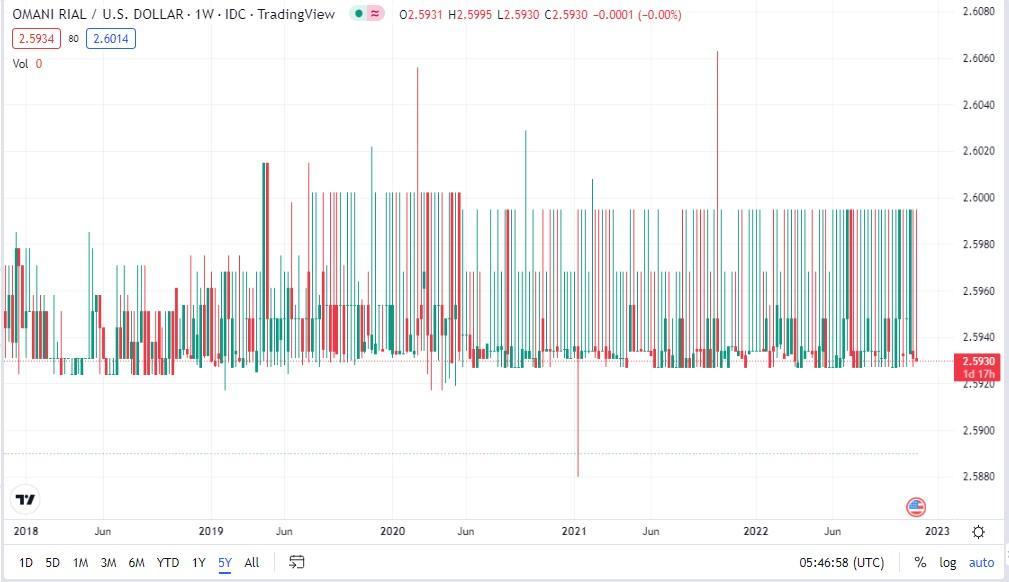

3. Omani rial (OMR)

Omani Rial/U.S Dollar Chart

In Oman, the national currency was pegged to the U.S. dollar in 1973. The exchange rate was last adjusted in 1986, and it has remained at 2.6 USD since then. There is a slight deviation due to the dynamics of supply and demand, but the fluctuation range is so narrow that it can be ignored. The reason for stability, as in the cases of Kuwait and Bahrain, is oil exports. Falling oil prices and continued military conflicts in the Middle East are offset by gold and foreign exchange reserves. Recently, the government has been trying to diversify budget revenue items by gradually increasing the share of metallurgy, gas production, and tourism.

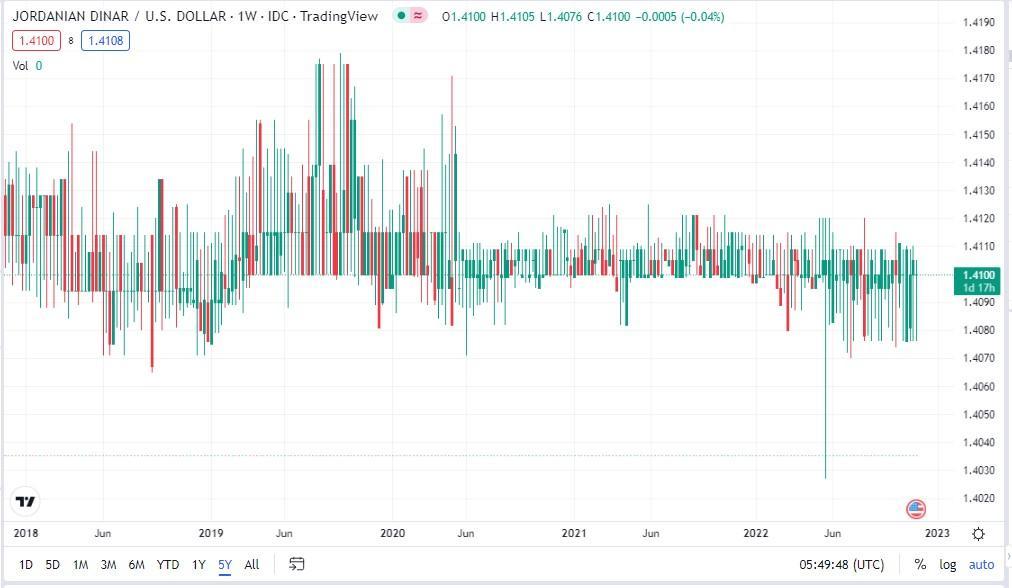

Top Forex Facts and Statistics You Should Know4. Jordanian dinar (JOD)

Jordanian Dinar/U.S Dollar Chart

The price of this currency has been pegged to the U.S. dollar since 1995 (theoretically, it is pegged to special drawing rights (SDR), but in practice, it is pegged to the U.S. dollar). The national currency was pegged to the U.S. dollar to maintain the stability of the national economy and U.S. investments. A stable pegged exchange rate ensures peace of mind for foreign investors using the dinar to invest in local businesses, as well as for various programs funded by SDR. But whether Jordan will be able to maintain strict pegging in the future is a complicated question. Since 2011, the country has been experiencing a slowdown in economic growth, and there are no large oil reserves to support the budget.

5. Cayman Islands dollar (KYD)

The national currency of the Cayman Islands is also pegged to the U.S. dollar, with a fixed rate of 1.20, though there are still minor fluctuations. The status of the country helps to maintain a fixed rate within the jurisdiction. This small island state is an offshore tax haven. The country is among the Top 5 largest offshore financial centers in the world, where banking, insurance, trust investment, and hedge funds operate.

6. Gibraltar pound (GIP)

Gibraltar Pound/U.S Dollar Chart

Gibraltar’s national currency has historically been pegged to the British pound sterling. Initially, the currencies of Spain and the United Kingdom were in use in Gibraltar. The 1934 law authorized the country to issue its own currency, pegged to the pound. The country’s economy has a narrow specialization: agriculture does not exist here, and industry is represented by ship repair plants. The main industries are finance, tourism, and services. With a small level of inflation, the standard of living in Gibraltar is above average, while the income from re-export allows for maintaining the exchange rate at a fixed level.

Best Forex Pairs to Trade7. Falkland Islands pound (FKP)

This is a very particular currency and its price chart is not easy to find. Like Gibraltar, the Falkland Islands are an overseas territory of the UK. However, Spain lays a claim on Gibraltar, while Argentina lays a claim on the Falkland Islands. Despite uncertain legal status, the islands have their own national currency, which is rigidly pegged to the GBP at a ratio of 1:1. The population barely reaches 3,500 people, nevertheless, the country earns very well on the export of seafood and wool, which allows it to maintain the stability of the national currency price.

8. Pound Sterling (GBP)

Pound Sterling/U.S Dollar Chart

Before the U.S. dollar came to dominate global economic relations, the British pound was the dominant currency. The Bank of England deliberately set a higher exchange rate, but unlike previous banks with strong currencies, it refused to peg the pound to the U.S. dollar. The country is one of the world’s leading economies and one of the top business, stock exchange, and financial centers. The high price of the national currency is supported by positive macroeconomic statistics. Although Brexit and Europe’s geopolitical problems have shaken the pound’s position against the U.S. dollar, it remains more valuable.

Pound-to-dollar price – GBP/USD Forex Chart9. Swiss franc (CHF)

Swiss franc/U.S Dollar Chart

The Swiss franc ranks first in the rating of the most reliable currencies. CHF stability is ensured by a perfectly structured monetary policy, a managed banking system, a low level of public debt, and partial isolation from the EU. The CHF price rose against the background of the debt crisis in the United States. In 2015, the Central Bank unpegged the Swiss franc from the euro, and now the currency is seen as a safe haven asset in the event of problems with the economies of the United States and the Eurozone.

USD/CHF forecast by Traders Union – Analysis, Rate & Chart10. Euro (EUR)

Euro/U.S Dollar Chart

The euro is the world’s second reserve currency after the U.S. dollar, with approximately 25 countries pegged to it. It also ranks second after the USD in terms of trade turnover. The stability of the currency price is ensured by the European Central Bank’s monetary policy, which has delegated some financial management powers to local Central Banks. However, history shows that the Eurozone has its weaknesses that could cause EUR/USD price to eventually drop below 1.0000. In particular, there are problems with the stability of the banking systems of Italy and Spain, migration problems, problems of high reliance on the supply of energy resources, etc.

11. U.S. dollar (USD)

The U.S. dollar is the world’s most popular and freely convertible currency, serving as the financial equivalent. The dominance of the U.S. dollar is related to the country’s policy in the pre-war years and during the Second World War. In the early 1900s, the U.S. economy was in a deplorable state, and the British pound played the leading role in international payments. In the 1930s-1940s, the U.S. managed to accumulate gold reserves (part of the evacuated gold reserves of Norway, Poland, Belgium, and the Netherlands). The war that engulfed Europe deprived it of its economic advantage in the international arena, and the United States assumed this role. Many countries began to use the gold-backed U.S. dollar for gold and foreign exchange reserves. Although the U.S. dollar is no longer pegged to gold, it is still used as the equivalent of gold and foreign exchange reserves.

How to short US dollar and other currencies on the Forex market?12. Panamanian balboa (PAB)

Since 1934, the Panamanian currency has been rigidly pegged to the U.S. dollar at a ratio of 1:1. Any Central Bank can peg its currency to a fixed value of another currency. However, simply pegging is not enough; the exchange rate must also be supported. To that end, effective monetary policy tools, gold reserves, and a stable balance of payments are needed. Panama has all of the above.

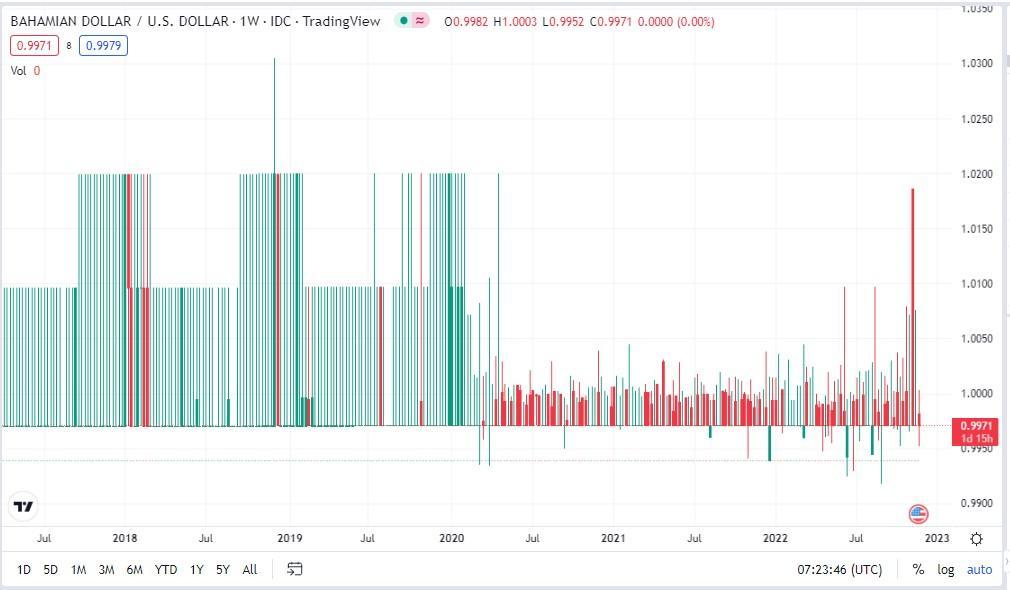

13. Bahamian dollar (BSD)

Bahamian dollar/U.S Dollar Chart

The Bahamian national currency is pegged to the U.S. dollar at a ratio of 1:1. The Bahamian dollar can serve as a reserve investment asset in a critical situation.

14. Canadian dollar (CAD)

Canadian Dollar/U.S Dollar Chart

The Canadian dollar ranks 6th in the world in terms of trade turnover. The country has a developed economy due to the volume of natural resources. Also, Canada has extensive oil fields, including shale, as well as uranium deposits (2nd place in the world in uranium reserves). The CAD price is strongly influenced by the USD price against other currencies since the U.S. is Canada’s key trade partner.

USD/CAD forecast by Traders Union – Analysis, Rate & Chart15. Singapore dollar (SGD)

Singapore Dollar/U.S Dollar Chart

Singapore has one of the strongest economies in the Pacific region. With a relatively small domestic market, the country has built strong foreign economic relations. Trading partners are Japan, Hong Kong, China, and other countries in the Asian region. Singapore is also an international financial center. The monetary policy of the Central Bank is relatively flexible but regulated. The Central Bank determines the volatility corridor, which leaves opportunities for earnings on intraday and medium-term strategies.

The Australian and New Zealand dollars (AUD and NZD) were not included in the list. At the time of the rating, their prices were below USD 0.7. This does not mean that these currencies are weak or that their economies are experiencing difficulties. This is rather a temporary event caused by local fundamental factors. For example, the AUD price has crossed the 0.8 USD mark multiple times.

Blue bottom linkNZD USD forecast by Traders Union – Analysis, Rate & ChartWhy is it important to know the strongest currencies in the world

For traders and investors, a currency represents several values:

-

it is an asset for speculative trading. Any currency priced higher or lowerthan the U.S. dollar and has a volatility corridor can be used for speculation, i.e. where there is no pegging to the price of a specific currency. Pairs with a fixed peg are also suitable for trading as cross-rates. For example, the BHD/USD price is stable due to the peg. You can earn money by speculating on the BHD/EUR price;

-

it is an asset for saving money in times of global economic challenges. A strong currency means that the Central Bank has sufficient resources to support the national currency, resulting in a balanced economy;

-

it is an indicator of the stability of the economy and the low risk of investing in other economic sectors.

The weak exchange rate of the national currency against the USD does not mean that the asset is not suitable for trading. Maybe, that is the policy of the Central Bank. If the economy shows no signs of hyperinflation, significant disproportion in the balance of payments, or moderate volatility, the currency can be considered an investment asset.

The Most Active Currency Pairs To Trade NowWhat impacts the value of currencies

The main factors impacting the value of currencies are:

-

macroeconomic statistics. This includes discount rates, GDP growth rates, inflation, unemployment, and other labor market indicators, the balance of payments, production statistics, financial indicators, etc.

-

the cost of resources that play a key role in exports or imports. For example, India is one of the largest oil importers. The growth of oil costs increases the inflation of the rupee against the U.S. dollar.

-

trade relations. The growth of exports to other countries makes the national currency stronger. As a reverse example, there are the U.S. and China trade wars, which weakened the USD against the euro.

-

natural disasters, force majeure events. For example, fires in Australia in 2019-2020 reduced agricultural exports and caused the AUD price to fall.

-

geopolitical and military conflicts.

Also, the influence of particular news needs to be considered. For example, in case macroeconomic statistics of both countries (in a currency pair) are released at the same time, it is necessary to determine which news will cause greater volatility of the price.

Which currencies are the weakest in the world

The list of the weakest currencies includes countries with weak economies that have structural problems, such as high inflation, unemployment, lack of production, import orientation, internal military conflicts, international sanctions, etc. In recent years, the list of the world’s Top 10 weakest currencies has remained mostly the same, with only the position in the ranking changing.

Top 10 weakest currencies

-

Iranian rial. Rial began to devaluate in 1979, after the revolution, when investors decided to withdraw money from an unstable country that got involved in an international conflict. The government imposed restrictions on the purchase of foreign currency, which led to an increase in the black market and an inflation rate of more than 400%. In recent years, the country has been under severe sanctions related to the deployment of Iran’s nuclear program.

-

Vietnamese dong. The country is attempting to completely rebuild its economy by putting it on the market rails. Analysts believe that if the country continues to develop a market economy, the dong will soon fall out of the Top 10 weakest currencies.

-

Lao kip. This is the only currency that was initially pegged to the USD with a purposefully low exchange rate. The kip has been gradually strengthening over the past few years, but the exchange rate is under the strict control of the Central Bank.

-

Indonesian rupiah. The country’s economy is considered to be steadily developing, but the measures implemented thus far have done nothing to strengthen the rupiah.

-

Sierra Leonean leone. The economy of this African country is ruined by the war and the pandemic (Ebola).

-

Uzbek sum. The low rate is caused by a lack of economic development. The country lacks natural resources, exports, and technological capabilities.

-

Franc of the Republic of Guinea. This African country, rich in diamonds and gold, is known for lawlessness and progressive poverty.

-

Paraguayan guarani. Existing exports are not enough to meet the needs of the economy. Among other issues, the majority of the population lives below the poverty line, there are no jobs in the country, the education quality is poor, and corruption is widespread.

-

Colombian peso. The country has the same problems as Paraguay.

-

Cambodian riel. The country’s population has never recognized the local currency. Even today, most of the population prefers to use the U.S. dollar.

It would be fair to add the Venezuelan bolivar to this list. In 2019, inflation was around 9600%, and in 2020, it was nearly 3000%. At that time, Venezuela led the ranking of the weakest currencies in the world. However, in 2021, the third printing in the previous 13 years was held, removing six zeros from the bolivar. Formally, the bolivar lost its place in the rating for this reason, but this did not change the fact that the country’s economy has been in a severe crisis for a long time, despite large oil reserves and high oil prices.

Conclusion

A strong currency is not always good, just as a weak currency is not always bad. A strong currency can serve as a safe have asset during global economic crises, provided that the price is regulated by market factors. Both strong and weak currencies can be an asset for making money on short-term speculation if their price is regulated by the market and the low exchange rate of a weak currency is not caused by deep, structural problems in the economy.

FAQ

What is the world’s "number one" currency?

USD. The U.S. dollar accounts for about 87-89% of all foreign exchange transactions in the world. Historically, gold, as a freely convertible asset, has passed the baton to the dollar. Initially, the dollar was pegged to a fixed amount of gold. The gold standard and gold parities were completely abolished by the 1976 Jamaica Conference, and the dollar was given the leading role in international settlements.

Why the USD has become the most popular currency:

The U.S. economy is the strongest in the world. The country ranks first in terms of GDP. The ability of the government to keep the economy stable secures the U.S. money supply.

The need for a freely convertible equivalent. For international settlements, an asset was needed that would play the role of “universal money”, which allows one to determine the value of another currency or product. The U.S. dollar plays this role.

An international reserve asset. The U.S. dollar is included in the gold and currency reserves of most countries.

USD dominance can end at any moment. However, this will lead to the collapse of the entire global economy.

What is the safest currency in the world?

The Swiss franc (CHF) is considered the safest among currencies. The 2008 crisis showed that the U.S. economy is not very resistant to force majeure events. The Swiss economy is isolated from the EU and is as balanced as possible. Therefore, the franc is considered a protective asset on par with gold and is used as a safe haven currency.

Which currency is the strongest in the world, and why?

Kuwaiti dinar is the strongest currency in the world.. It is not pegged to the U.S. dollar, the country has the lowest oil production costs (Kuwait is one of the leaders in oil exports), low taxes and almost no unemployment.

Which currencies are the weakest in the world?

Some countries benefit from maintaining a low exchange rate for their national currency. This is especially true for export-oriented countries with less developed domestic markets. Devaluation may also be caused by an imbalance in the budget’s expenditures and revenuesas a result of the misbalance in favor of imports and rising import prices (for example, the cause of inflation is an increase in energy product prices). The weakest currencies in the world are Bolivar (Venezuela), Rial (Iran), Dong (Vietnam), Kip (Laos), Rupee (Indonesia), and Sum (Uzbekistan).

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.