Forex Market Hours | Schedule and Trading Sessions

Forex is an international currency trading market that operates 24 hours a day, except on holidays and weekends. Technically, Forex is considered an over-the-counter market, since the main currency turnover takes place on ECN platforms. However, institutional banks and exchanges are directly involved in trading as liquidity providers and intermediaries that ensure the execution of transactions between all counterparties. Despite the round-the-clock operation, trading time is divided into so-called trading sessions, on which the volumes, volatility, and liquidity of individual currency pairs depend. Accordingly, trading sessions have an impact on the strategies applied.

In this review, you will learn:

What are trading sessions, and what are their types.

The schedule of trading sessions and hours of the Forex market.

The best time to trade Forex since both liquidity and volatility depend on the trading session and time of day.

What days of the week are best for Forex trading.

This review will be useful for novice traders who are looking for opportunities to optimize their trading strategies.

Hours of the Forex market

The round-the-clock operation of the Forex market is divided into trading sessions. A “trading session” is a period during which exchanges and banks in the same region trade currencies. When their working day ends, the working day begins for banks and exchanges located in another region. And because the sessions overlap, trading takes place around the clock. Find out how to trade Forex after hours in the TU article.

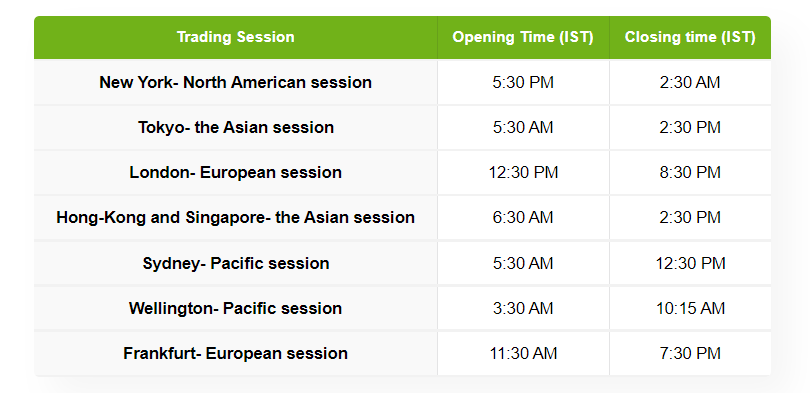

The trading period is divided into four sessions: American (New York), European (London), Asian (Tokyo), and Pacific (Sydney). Their hours are indicated by Greenwich Mean Time (GMT), so each trader adjusts the time according to their region.

FX Sessions

The trading session determines trading volumes. Because the United Kingdom is the leader in terms of the number and volume of trades, it stands to reason that the activity of traders is at its peak during the London (European) session. Large volumes and a large number of traders determine liquidity; if there are a lot of participants in the market, trade counterparties will be found quickly, which means that the spread is narrowest at times of high liquidity. On the other hand, during these periods, each party will try to use the trend to its benefit.

Conclusion:

-

Periods of trading sessions with the highest liquidity and volatility are perfect for scalping, where a narrow spread is critical.

-

The quieter periods of the American and European sessions are suitable for trending intraday strategies and swing trading. They provide more stable price movement, but some drawdowns can be used at your discretion.

-

The Asian session is suitable for flat strategies.

Here are some interesting statistics:

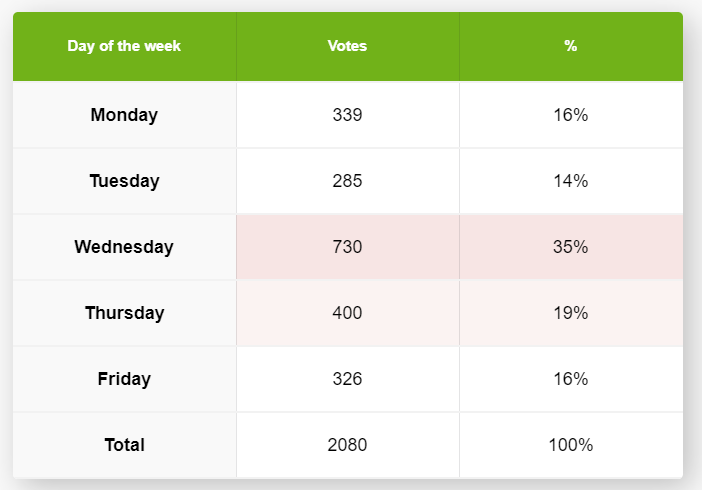

The best day to trade

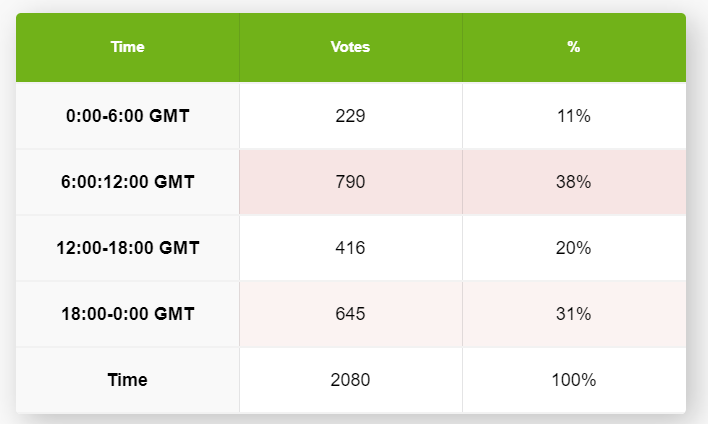

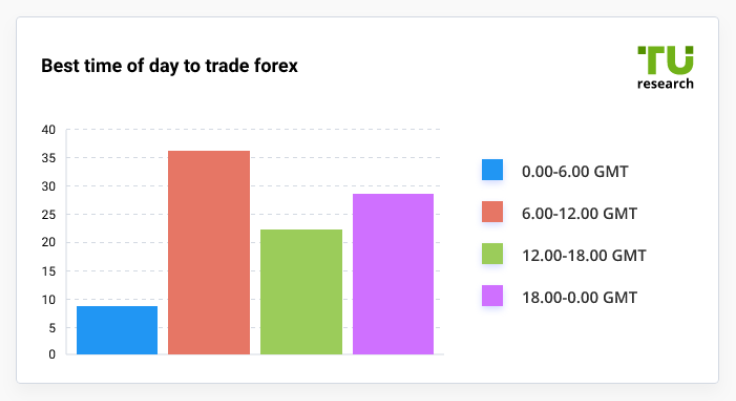

The best time of day to trade Forex:

The best time of day to trade Forex

The best time to work on Forex depends on the region

The specifics of trading in a particular region are discussed in greater detail below and with reference to trading sessions that fall within the main (business hours) trading times.

The best time to trade Forex in the UK

The London (European) trading session lasts from 8:00 to 16:00 GMT. It partially overlaps with the American session, and this period is considered the period of the most active trading. The largest volumes of trades are observed on the market between 13:00 and 16:00 GMT, along with the greatest liquidity and volatility. But on the other hand, a market with high volatility is difficult to predict. Therefore, for novice traders, the period preceding the overlap is preferable.

The best time of day to trade Forex

According to statistics, most traders still prefer the quieter period between the start of the London session and the start of the American session. During this period, trend strategies and swing trading strategies work well, as can be seen in trading systems based on the use of corrections to open trades at the best price.

Major institutional market makers are participating in trading activities during the overlap of the London and American sessions. During that period, the trend may change direction dramatically. Market makers can "push" the price to the points of accumulation of stops by using the volume of orders placed, and taking the money of private traders at the best price. Frequent false breakouts of trend lines, channel edges, and patterns are possible.

What you need to know about the London session:

The best time to work on Forex for novice traders is 6:00-12:00 GMT.

The best strategy is the "London explosion". That’s when the London session begins immediately after the Tokyo (Asian) one. And at their overlap, there is often a sharp surge in business activity. The strategy’s essence is to place pending orders to capitalize on a sharp price impulse.

The London session is recommended for active traders.

The best time to trade Forex in Australia

The Sydney (Pacific) trading session accounts for about 4-5% of all Forex liquidity. This is the smallest figure, even lower than the Asian session’s trading turnover.

Highlights of the Pacific session:

Session time (Sydney) is 22:00-7:00 GMT.

The greatest activity is seen at the start of the session, with the first two hours accounting for the largest volume of orders.

The most traded currency pair is EUR/USD, which accounts for approximately 27% of the total volume. USD/JPY is in second place.

Because of the low liquidity, the recommended strategies are channel trading on time frames beginning with H1.

Even though the largest trading volume falls on EUR/USD, novice traders are advised to start with the USD/AUD pair. Australia is a "standalone" country that does not take part in geopolitical confrontations. The value of its currency is determined by global raw material demand and natural disasters. As a result, this pair is considered relatively easy to forecast in the medium and long term. It clearly shows resistance and support levels, as well as patterns and trend lines.

The best time to trade Forex in India

India is one of the most convenient regions for Forex trading. Because of its time zone location, day trading overlaps with almost all active trading periods of the main sessions.

Trading sessions

Intraday trading is done here with the same efficiency as it is done with almost any currency pair, including cross-rates:

According to statistics, the best hours to work on Forex are 6:00-12:00 GMT, and 18:00-00:00 GMT.

Thursday and Friday are the most volatile days, excluding short-term fluctuations following the release of key news.

More than 70% of the volume of foreign exchange trading falls on "major" pairs, and the remaining part falls on cross-rates.

In terms of trade volumes and activity, India is inferior to the UK and the USA, but holds a strong place in the Top 5. Traders here trade almost at any time, with no distinction between "best" and "worst" hours.

The best time to trade Forex in South Africa

Traders in this region are not among the most active market participants. The South African rand, the most widely used local currency, falls into the "exotic" category. It has a high spread and low liquidity because it opens long-term trades without reference to trading sessions.

Other aspects of Forex trading in South Africa:

Wednesday is the best day in terms of profitability. Although Friday is considered a day of increased volatility, many trades are closed at a loss on this day.

The best time to trade is 06:00-12:00 GMT.

Currency pairs - USD, EUR, GBP, and ZAR.

Local traders are attempting to adjust to busy trading periods such as the American and European sessions.

Use of the Forex work schedule in trading strategies

Tips for novice traders:

-

Use short-term scalping only on liquid currency pairs. The EUR/USD pair works best at the overlap of the European and American sessions.

-

Avoid opening trades in the first 2-3 hours after the weekend. Large traders are evaluating the news background and forecasting for the coming week at this time, so the price may move chaotically.

-

Keep in mind in your strategy that market activity drops sharply in the last 3-4 hours before holidays and weekends. Many close trades to avoid a gap. The absence of applications reduces market volume and liquidity, resulting in a flat.

-

Install the spread indicator on the platform. Even better, integrate an information panel that alerts you to changes in volatility and the spread level. Remember that the spread expands with an abnormal increase in volatility due to an imbalance in the volume of buyers or sellers. This happens more often at the time of the release of news in the USA or Europe during the American and European sessions.

The overlaps of trading sessions or the beginning of European or American sessions can be used in breakout strategies. The momentum that started at these moments often turns out to be the beginning of a strong movement, especially if it is confirmed by the breakout of key levels or the edges of patterns.

Trading session indicators

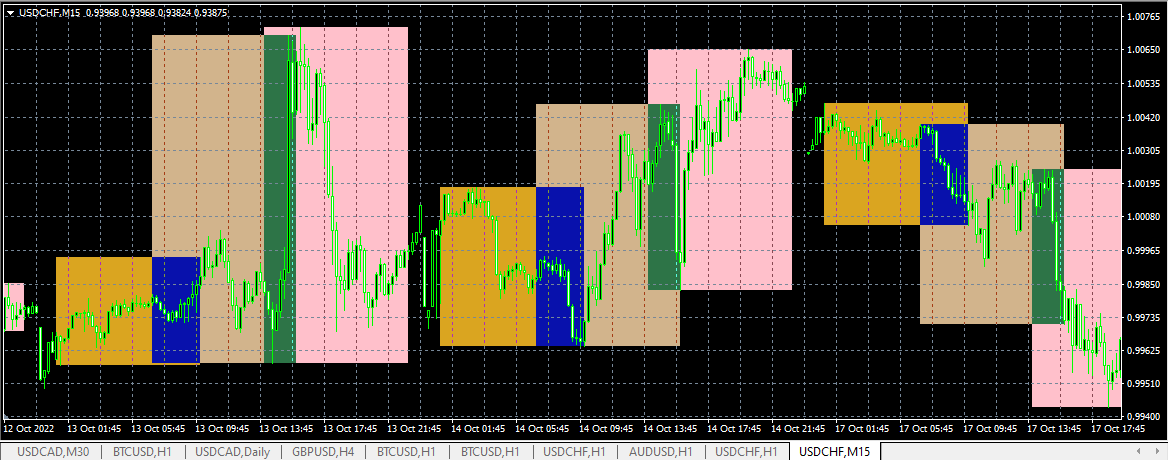

Trading session indicators plot sessions directly on the price chart. An example of such an indicator is i-Sessions. It allows you to track gaps that occur at the overlap of sessions, and quickly determine the level of volatility of a particular session period by the height of rectangles, the nature of the trend, and its dependence on GMT.

Trading session indicators

To clarify: In this example, the Pacific session is combined with the Asian session at the developers' discretion. Sessions are distributed according to GMT (not by the time set on the trading platform). Blue rectangles mark the overlaps of sessions.

Experts at the Traders Union also recommend using the following tools:

Volatility calculator. Although this tool shows average daily volatility without reference to trading sessions, it can be used to build trading systems with varying levels of aggressiveness. For example, trades on pairs with the highest volatility can be opened during the most active trading periods.

ProTrader information panel. It displays the level of the current spread and indicator data, including ATR. Using ATR, you can monitor changes in volatility through changes in trading activity.

Scripts showing the spread expansion and the size of possible gapping will also be useful.

Conclusion

The hours of the Forex market and trading sessions determine the volume and liquidity of the market. A floating spread, the presence or absence of gapping, the presence or absence of a trend, and unpredictable volatility are all dependent on the above. These parameters determine the nature of the strategy used:

Scalping and intraday trend strategies with reversal of positions work well at times of high activity (the start of the European session and its overlap with the American one).

In quieter periods (Asian and Pacific sessions), intra-channel trading is used, as well as looking for a breakout of the flat edges.

The most profitable day is Wednesday. The middle of active trading occurs following the plans made at the start of the week. By the end of the week, the trend may be fading.

Do not try to get tied to the Forex work schedule. Choose the strategy and time that are most comfortable for you. Self-confidence and emotional stability are the keys to success.

FAQ

Which currency pairs are best suited for various trading sessions?

The currency pair is considered the best instrument at the time when the most orders are placed on it, indicating the asset’s high liquidity. Accordingly, different pairs will have the greatest volatility in different sessions:

-

Pacific session (Sydney) - 22:00-7:00 GMT. The best currency pairs are EUR/USD, AUD/USD, and NZD/USD.

-

Asian session (Tokyo) - 23:00-8:00 GMT. The best currency pairs are USD/JPY, EUR/JPY, and GBP/JPY.

-

European session (London) - 8:00-16:00 GMT. The best currency pairs are EUR/USD, GBP/USD, and USD/CHF.

-

American session (New York) - 13:00-22:00 GMT. The best currency pairs are EUR/USD and other pairs with USD.

During trading sessions, consider the summer and winter.

Which currency pair and which session should a novice trader choose?

You choose the trading session yourself depending on the region and your work comfort. The majority of traders trade during the day in sessions that correspond to their time zone. Some people are more comfortable working in the evenings after their primary job or at night. You can also adjust to a certain strategy. Scalping works best on EUR/USD in the European and American sessions. Positional trading works best on raw materials and "exotic" currencies without reference to the session. Swing trading is best done with the CAD, AUD, and NZD currencies.

How does the choice of strategy relate to the work schedule in Forex?

For long-term or positional strategies, it does not matter in which session the trade will be opened. The timing is important for strategies whose effectiveness depends on volatility, narrow spreads, and gapping: scalping, channel strategies (trading inside the channel), flat breakouts, and intraday trend strategies. When it comes to volatile pairs, traders try to open such trades at the start of the European or American sessions.

What tools are available to optimize the opening of trades with reference to trading sessions?

The schedule of trading sessions is not very convenient because you need to constantly monitor it. It is more convenient to use indicators that put sessions on the price chart. An example of such an indicator, i-Sessions, is described above.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.