How to Trade Forex News – Important Tips

Trading news is one of the key sources of currency rate fluctuations. Often, even a rumor about possible decrease of an interest rate of a country’s central bank can have a substantial impact on the quotes, which could move thousands of pips in a matter of minutes.

In the Forex market, all strategies based on the reactions of traders to macroeconomic events happening in the world right now are called trading the news. To put it simply, as soon as the news comes out, a trader opens a position, the market reacts and the trader earns a profit.

Theoretically, trading the news in Forex is one of the simplest strategies, which is particularly relevant for intraday traders. However, in practice, using these types of strategies requires a deep understanding of the mechanisms underlying the market’s reaction to the news releases. Let’s review these mechanisms in detail and understand how to use them in the right way.

The importance of trading news for the Forex market

When you trade Forex news, you need to understand that the key factor in this is not the news itself, but the reaction of other players to it. All players know about the news that is about to come out, analyze it, consider it in their forecasts and set their expectations based on it, thus permanently changing the market. Therefore, an experienced trader makes their forecast not based on the news, but on the expected changes of the quotes of the chosen assets that will follow the news release as a result of actions of other traders.

Technically, the system of trading the news is relevant for any trader, because all rate fluctuations are generally linked to the news. We see more active trading every time economic publications come out (they are released based on a specific schedule). On the other hand, the reaction of the market to economic events is almost always uneven.

Different assets react differently to the same news. Therefore, the task of the strategy based on trading Forex news is to find the event that will impact the chosen asset the most. The more significant the event is and the more it impacts the target segment, the higher the volatility of assets will be after the news is released. The strategy of trading the news requires knowledge to be successful. In order to prepare correctly for the market reaction to the news, you have to know about the news in advance. For this, traders use economic calendars and actively monitor major news channels (for example Bloomberg).

Pros of trading Forex news

The first and biggest benefit is the probability of considerable fluctuations of quotes after the announcement of the event. At that, the traders know the catalyst of the market movement and see the scale of such movement. Essentially, they have everything they require to make the right decision.

This brings us to the second benefit of trading Forex news – traders have an opportunity to determine the most liquid assets right away and react to them accurately without taking into account additional factors. The trading news strategy does not require technical analysis; it can be used as a fully independent method.

Types of news

Trading the news strategy takes into consideration two types of events – unexpected and periodical. In the majority of cases, traders work with periodical events, the ones published on schedule (the already mentioned Economic calendar). Since the time of the news release is known in advance, traders can prepare and by the time when the news is released they will know how it will impact the market and how other players will react.

Unexpected events include natural disasters, military conflicts and other geopolitical phenomena that cannot be predicted. However, you have to know how to work with them, or rather how to react to them, quickly analyzing the price chart, because the unexpected events are the ones that make the quotes do some major flips.

How to Trade Forex News - Examples

We already said what the trader’s main task is – to find an event that will have the strongest impact on the quotes of the assets they’ve chosen to trade.

Several sources are used to make finding such events easier:

Economic calendars. They are often published by the brokers for trading news, and, if necessary, such calendars are easy to find online.

Built-in features of the trading platforms. Today, nearly all platforms (for example, MT4 and MT5) have integrated news indicators, which you can set up to be displayed right on the platform charts.

News channels. These are mostly used to monitor unexpected events, but they also provide relevant information on the planned events.

For convenience, the events are ranked by significance, with more important ones causing greater volatility of the asset. A specialized feature of trading platforms, as a rule, gives its own rating to the news. Economic calendars also feature expert forecasts for each event. You can safely use these indicators, but you can also conduct your own analysis and select the optimal event for your own strategy based on the trading Forex news.

Experienced traders, who have grasped the full depth of the fundamental analysis say that you have to be careful to work with the news, because on the one hand knowing current economic processes (central bank rates, unemployment level, etc.) provides an excellent idea about the price movement. However, on the other hand, unexpected events (let’s say a bankruptcy of a major niche company or dismissal of an important political figure) can completely reverse that situation in a matter of seconds.

Every news event impacts the market in its own way. Moreover, every event impacts each specific asset and the relationship between the assets in its own way. The secret of the best strategy for trading the news is, as we’ve mentioned before, to be prepared for the event in advance and set deferred orders for opening positions in advance.

- 1

Expecting the news release

- 2

On the eve of the news release

- 3

News release and market reaction

Let’s review these three stages of the strategy for trading Forex news in detail, using illustrative examples to show you what a trader's actions should be at one point or another.

Expecting the news release

Let’s assume that the Federal Open Market Committee (FOMC) is expected to release its latest report in a few days. It is one of the key events on the economic calendar. Several days prior to the release, experts start throwing in their analytical opinions and forecasts into the information space. You should rely only on the experts for making decisions, but it is advisable to review their opinion in order to understand how the market will change overall and, most importantly, how the players will react to the event. In order to trade Forex news successfully, you need to understand that now, with all the automatic software for managing the bids, the most liquid assets will be snatched up in no time as soon as the news is published. This is the reason why preliminary analysis is so important – setting deferred orders requires risk and that’s where the analytics from the market sharks from Reuters, IDC and Bloomberg come in.

On the eve of the news release

Depending on the scale of the event, this could be a period of several days to several hours before the release. By that time, every trader trading Forex news has already ‘placed their bet’. Here, we can observe the biggest paradox of the strategy for trading the news: the event is the catalyst for the change in the quotes and that is true. However, prices start to climb before the news is released, because the orders have been placed in advance. When the news is released, the market reaction will be small, because by that time, the orders have been placed and the release of the news doesn’t change anything for anybody.

News release

No matter how perfect your strategy for trading the news is, there can be three options at this stage:

The situation is consistent with the forecast;

The situation is better than the forecast;

The situation is worse than the forecast.

Going back to the paradox, how should the market react if the forecast came true and it was positive? Growth should be expected, right? But we already know that the traders who expected this outcome already bought the assets and received a profit. Therefore, there will not be a growth, at least not an active one.

If the news release turns out to be worse than the forecast, there will be fewer buyers, because the majority will decide to profit from the bets on asset weakening. And at that moment, the price may drop significantly in a matter of a few hours.

Finally, the third option is the most complicated one in the strategy of trading the news. If the news release turned out to be better than expected, the price should theoretically hike. However, that’s only in theory, because in practice a colossal number of factors that are simply unpredictable arises in this situation. For example, there will be players who will take profit from the exit from long positions, thus causing prices to decline. In this case, however, the decline will be short term.

Examples of trading the economic calendar

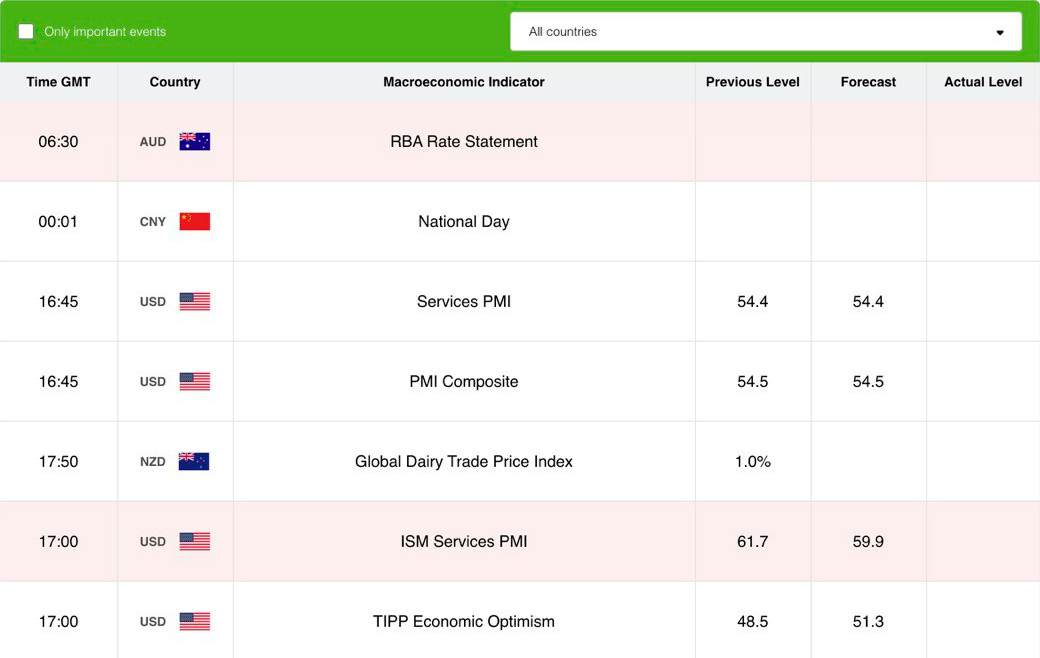

On the screenshot of the economic calendar below, you can clearly see that the British pound is showing an excellent position. If we are trading Forex news, the strategy in this case pushes us to choose a highly volatile pair of GBP/JPY. Why Japanese yen? Because at the moment the screenshot was made, the Japanese exchange was closed and could not have any impact on the market.

Economic Calendar

Many traders believe that trading binary options based on the news is the most profitable option, as there are no spreads, while the guaranteed profit is 70-80% of the trade size.

Therefore, the strategy for trading binary options based on Forex news in our case implies opening a trade for the increase of price in the GBP/JPY pair. Once again, the Japanese market has no impact on Yen at that moment, while the economic calendar promises strengthening of the British pound position. We set the “UP” condition and set the timeframe at 6 minutes. In this period, another tsunami hasn’t hit Japan and a revolution hasn’t happened in the UK, therefore the price predictably increased.

Here’s another example, this time with a US dollar. We open an economic calendar and review the data on the USA. The screenshot below shows the news on main indices, which we need in order to implement our strategy of trading binary options based on the news. Just as on the previous screenshot, we can see the latest information on the just released news (the first column), expert forecasts on the indicator (second column) and the result for the previous news release (third column).

See the business activity? Its index is lower than expected and lower than earlier, which means that the price of the US dollar will decline. We select the pair with the Japanese yen (USD/JPY) on the trading platform (once again, because the exchange in Japan is not open at the moment), specify the “DOWN” condition and set the timeframe for 5 minutes. Again, there are no earthquakes or meteorites falling in Japan; therefore the US dollar is sliding down against yen once the timeframe expires. Having invested $70 in the trade, we earned $53.9 in net profit. That’s how trading the news works. Binary options, as we’ve already said, are perfect for using such strategies.

How and what kinds of trading news do I monitor?

Trading Forex news implies working not only with the economic calendar. Taking into consideration that almost all novice traders work with the pairs where the US dollar is one of the currencies, they need to focus on the news releases that are local for the USA. Strictly speaking, these news releases are important for all currency pairs, because the American economy is a dominating one.

Here are the events to monitor first and foremost:

The so-called ‘jobs report’ (shows the employment situation);

Information on the Federal Reserve System rate;

Report on the GDP and price index;

Reports on indices – ‘business climate’ and ‘economic outlook’.

However, these reports are not enough to trade the news (including trading options), because there are also the European Union, New Zealand, Australia, Japan and a number of other economically powerful countries that have their own events and these events surely have an impact on the global market. So how do you ‘catch’ their news? It is rather difficult to watch a dozen channels a day without pausing, after all.

In order to ensure successful trading in the Forex market based on news, you need to monitor several key indicators. These include the interest rate of the central bank, inflation and unemployment, retail sales and growth of industrial output. Also business sentiment, production and consumer surveys and reports are also important.

However, watching and considering all these news releases requires so much time that no trader can afford it. Therefore, based on the current situation in the global market, you will need to decide independently, which news releases are more important at the moment (for example, CPI) and which can be dismissed for the time being (for example unemployment report).

On the other hand, the meetings of the Federal Open Market Committee are always the events that strongly impact all pairs with the USD. This is the biggest complexity of trading Forex news – you have to skillfully filter them. You won’t be able to do it without experience, which you will gain as you practice regularly.

What pairs are best for trading the news?

It seems logical that the strategy of trading Forex news is easiest to implement with the pairs where the US dollar is one currency. It is true, but not for all the pairs.

Here are the combinations that are usually recommended for the beginners:

EUR/USD

GBP/JPY

USD/JPY

EUR/CHF

AUD/USD

CHR/JPY

It is easier to trade these pairs, as the absolute majority of even local news impacts their quotations. However, you can just as well trade gold or, for example, oil based on the news. Trading cryptocurrency news is also possible, but could be somewhat difficult for novice traders in terms of monitoring key events.

Specifics of a strategy for trading the news for the beginners

To make it simple, the strategy consists of two steps. The first step is to determine the range of the news channels that show the most important events in the global economy. The second step is to select the currency pair that will be impacted the most by the news you monitor. Then, all you have to do is to monitor the channels and ‘place your bets’.

Here is a universal version of a strategy for trading Forex news for the beginners:

If you found a significant event related to the US dollar, it will mostly change the volatility of the USD/EUR pair.

If you found an important event related to any other currency, it is best to choose the pair with this currency and the US dollar.

For example, you are monitoring the ZEW report and can see that the Swiss franc is about to experience a drawdown, then you take the USD/CHF pair. This strategy for trading the news will be the simplest for the beginners and involve the lowest risks. The most important part is that it will teach you to find the right news and make relevant forecasts.

The advantage of trading the news is that the trader knows in advance when the news they need will be released. This means that the traders don’t need to spend a lot of time working, analyzing and forecasting only short timeframes within the set intervals. This process will take less time as you gain experience.

Examples of news releases and how they impacted the quotes

The unemployment report in the US released in December 2015 showed that employers added 290,000 jobs, although the planned number of 185,000, while the unemployment rate held steady. Immediately after the release of the report, the euro rate against the US dollar dropped by 0.06%.

Also in December 2015, news was released reporting an important decline in the industrial production in China. Following the release of the news yuan dropped against the dollar from 6.45 to 6.58, which was totally predictable.

In January 2016, Francois Hollande announced that the unemployment in France was 10%. Government bonds dropped instantly by 3%, although the government was prepared for it, introducing an emergency economic recovery plan. As a result the bonds grew 5%, covering for the decrease.

In the three previous examples, the result of the news release was indeed predictable, which allowed the traders to profit well from it. Now, let’s see a situation, in which a chain of events led to a complicated finale.

In December 2015, the head of the European Central Bank announced that the annual inflation had been revised from 0.3% to 0.1%. The statement was followed by clarification that the inflation forecast for the following year was revised to 1.1% against the earlier forecast 1.5%, and for 2017 – 1.7% instead of 1.8%. The following events seemed quite evident to all – the main euro index STOXX60 grows and euro follows. The index did increase, but the euro dropped against the US dollar from 1.13 to 1.11. This was caused by the actions of the international regulator – interest rate on deposits were reduced by 0.2%, margin loan rate stopped at 0.3%, while refinancing rate was fixed at 0.05%. As a result, the euro no longer looked so attractive compared to the American currency and traders started selling it in large amounts.

Tips on trading Forex news

It is best to open the chart price on the chosen currency pair approximately 15 minutes before the information on an important event is expected to be released. A trader evaluates the current market price of the asset and sets two deferred orders – a Sell-Stop at 5-10 pips below this price, and a Buy-Stop, but at 5-10 pips higher than the current price. Usually, the number of pips is determined by the volatility of the asset – if it is low, traders usually set 5 pips, if it is high – 10 pips.

Next, the strategy of trading Forex news envisages a short waiting period and, if the price begins to grow after the release of the news, the Buy-Stop orders are filled and the Sell-Stop orders are deleted. If the price of the currency pair drops, the Buy-Stop orders are deleted and the Sell Stop orders are filled. It is also possible that the market will not actively react to the event. In that case, both orders will be deleted and the trader will continue to analyze the news releases waiting for a better event.

As we already showed in the examples above, trading binary options based on news is simpler. In the case with currency pairs, the typical algorithm implies opening two deferred orders: a sell order and one buy order – sell at higher than the current price, buy at lower than the current price. The number of pips is determined by the volatility of the pair. After the news is released, the market might not react and then both orders are closed. If the market does react, the unnecessary orders are closed and the once placed to benefit from the good forecast are filled.

This strategy for trading Forex news seems simple, but you should not forget about the risks. High profits require high investment, which increases the risks of losing a substantial amount in case the forecast was not good. When trading the news, it is important to make decisions quickly. Working with Stop Loss orders is also rather risky, because in case of sharp price fluctuations, the risk of slippage is high, namely the price may have already changed in the time it took the broker to deliver the trader’s order to the interbank exchange.

Slippage happens on highly volatile pairs in case of sharp and strong market reaction. You can’t fully eliminate the risks, but you can minimize them. Experienced traders have their own strategies for trading Forex news, but the beginners can be advised, for starters, not to rely solely on the economic calendar and news releases.

You always have to insure yourself against serious losses by setting Stop Loss orders at plus/minus 20 pips of the price of the asset at the time of entering a position. Also, it is recommended to use a Trailing Stop that can move Stop Loss if the price grows. If you are using Trailing Stop, you don’t need to set Take Profit, because the Stop will follow the price until it peaks and will close at the chart’s pivot point.

What factors should the beginners who decided to trade news take into consideration

Prepare all instruments in advance.

For news traders these include the economic calendar, scrupulously chosen news channels and, if necessary, built-in features of the trading platform.The strategy also needs to be worked through in advance.

It seems that news traders just follow news announcements, but it is not so. We have already said in the beginning that the decisions of the traders change the market and not the news releases. News announcements serve only as an impulse, while you place your orders based on trends and volatility.Always limit your risk level.

You should not submit to temptation to set a very long or very short position; only the experienced sharks can afford to do that, and even they sometimes miss.Stick to the plan.

This means that even if the strategy is a losing one, wait for the final reaction of the market. This kind of waiting does not cancel the actions aimed at minimizing the risks, but every strategy needs to be applied to the end in order to know its pros and cons.

Some novice traders believe that there are special Forex brokers for trading the news. There are no such brokers. However, you need to consider the quality of the service and availability of partners of the broker, because it impacts the speed of transferring the orders to the interbank exchange. After all, as we have seen it is critically important for a news trader to have their orders at the interbank exchange very quickly. This is definitely a factor to consider and choose a broker from the TU list of brokers for news trading with ECN account.

FAQs

What is trading Forex news?

Trading Forex news is a strategy that involves monitoring important macroeconomic events and trading based on releases of the news on these events. This primarily includes publications of regular reports of major financial organizations (for example reports on the rates of the Federal Reserve System of the USA).

Where do I find significant events?

Economic calendar is the first and most important instrument of a news trader; it can be easily found online. Additional, but just as important, sources are different news channels, for example Reuters, IDC, Bloomberg. It is important for a trader to focus on the news of the country of the currency they are working with.

What are the best assets for trading news?

Essentially all assets, including resources (for example, gold) and cryptocurrencies can be traded. Many news traders choose binary options, because there is no spread there. As for currencies, the beginners are recommended to start with the pairs with the US dollar, Australian dollar, Japanese yen, British pound and Swiss franc.

What does a typical strategy for trading news look like?

A trader finds an important event and chooses an asset. Fifteen minutes before the news is released, he/she sets deferred buy and sell orders, and also sets Stop Loss and Take Profit (or Trailing Stop). Then, once the news has been released, the trader is simply waiting for the market reaction and closes the unnecessary orders accordingly.

Glossary for novice traders

-

1

ECN

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

-

2

Long position

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.

-

3

Day trader

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).