How to Trade Yuan in Forex?

The yuan (CNY) is the official currency of the People's Republic of China. It is a fiat currency, which means that it is not backed by any physical commodity, such as gold or silver. The yuan is divided into 10 jiao, which are further divided into 10 fen.

-

The onshore yuan. It is used in mainland China, and regulated by the People's Bank of China (PBOC).

-

The offshore yuan. It is the currency that is used outside of mainland China. It is not regulated by the PBOC.

The Yuan, represented by the symbol ¥, serves as the official currency of the People's Republic of China and holds a crucial position in the global economy. Its management is overseen by the People's Bank of China. The Yuan is commonly abbreviated as CNY for Onshore Yuan and CNH for Offshore Yuan, each variant possessing distinct characteristics. In this article, you can look at what the Yuan is, the types of Yuan, and how to trade Yuan. Keep reading to find out.

Start trading currencies now with RoboForex!-

How is yuan used in trade?

The yuan is extensively used in international trade, offering a direct transaction avenue for companies importing goods and services from China. It's employed for payments, with the flexibility for international contracts to be denominated in yuan. This allows specifying that payments will be executed in the Chinese currency. Additionally, the yuan serves a crucial role in hedging against currency risk, providing companies exposed to fluctuations a means to protect themselves from yuan depreciation.

What is Yuan?

The Yuan, denoted by the symbol ¥, comes in two types:

-

Onshore Yuan (CNY),

-

and Offshore Yuan (CNH).

The Onshore Yuan operates within mainland China, adhering to regulations set by the People's Bank of China, primarily catering to domestic transactions. In contrast, the Offshore Yuan engages in international trade, providing flexibility in global transactions and being subject to market dynamics extending beyond China's borders.

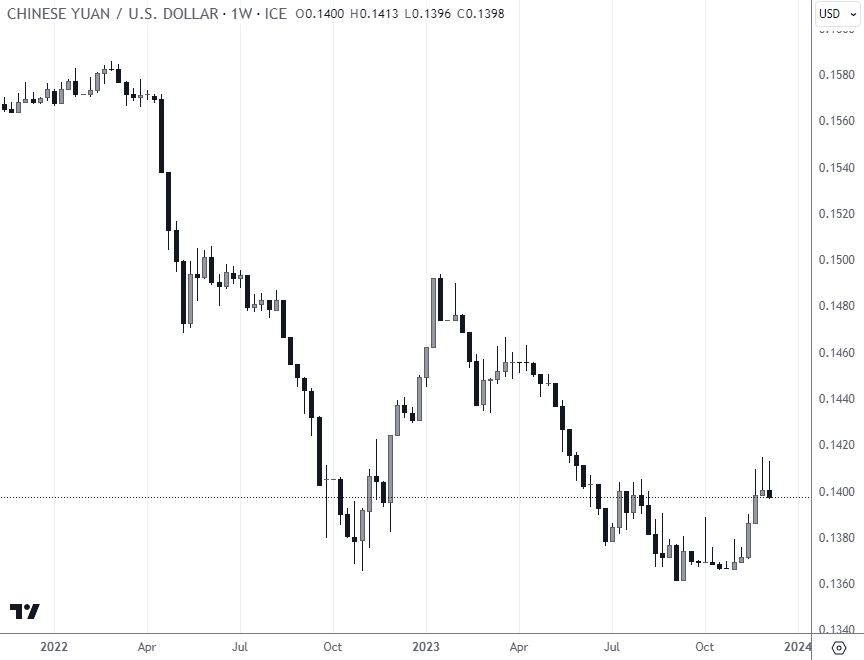

CNY/USD weekly chart, data from InterContinental Exchange

While not the Yuan, the Hong Kong Dollar (HKD) holds notable significance due to its unique connection. Hong Kong, despite its affiliation with China, upholds a distinct currency. Grasping the intricacies of the relationship between HKD and Yuan is essential for adeptly navigating the region's financial landscape.

Investing in the Yuan entails many advantages, driven by China's robust and expansive economy. China's global influence is rising as the world's second-largest economic entity. According to IMF in 2022, the yuan accounted for 2.7% of global foreign exchange reserves, up from 1.1% in 2010.

For those outside China, getting into the Chinese Yuan, or "renminbi," is facilitated through foreign exchange (forex) markets. The Yuan's value is subject to fluctuations influenced by global and Chinese economic conditions and fiscal and economic policies. The consistent growth of China's economy renders the Yuan appealing to foreign investors. However, a critical consideration lies in the Chinese government's active currency management, aiming to sustain a favorable exchange rate for exports, influencing its price movements. Investors must take this aspect into account when embarking on Yuan investments.

How to Trade Yuan

The yuan's accessibility to international investors has also increased as China has liberalized its capital account. In 2022, foreign investors held a record $3.3 trillion in yuan-denominated assets.

Various pathways exist for engaging in yuan transactions, each possessing distinct characteristics. Let's explore three major methods: Spot Forex Trading (or CFD) through a broker, Futures, and ETF/ETN.

-

Spot Forex Trading

Spot Forex Trading, or foreign exchange trading, constitutes the primary avenue for yuan trading. This method entails traders purchasing and selling yuan at the prevailing market rate. Trading yuan through spot forex requires establishing an account with a forex broker. Once traders complete the account setup, they can execute buy and sell orders for yuan using the broker's trading platform. -

Futures

Turning to Futures, these contractual agreements facilitate the future purchase or sale of an asset at a predetermined price. Yuan futures contracts feature on exchanges like the CME (Chicago Mercantile Exchange). Engaging in yuan futures trading necessitates opening an account with a futures broker. After setting up the account, traders can buy or sell yuan futures contracts via the broker's platform. -

ETFs and ETNs

In the domain of Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs), these financial instruments track the performance of an underlying asset or index. Numerous ETFs and ETNs are crafted to replicate the performance of yuan-denominated assets. To participate in trading yuan ETFs or ETNs, individuals need to establish an account with a brokerage firm. Once the account is active, traders can execute buy or sell orders for yuan ETFs or ETNs using the brokerage firm's trading platform.

Best Forex brokers

Conclusion

In 2022, the yuan was the fifth most traded currency in the foreign exchange market. As China's influence continues to grow, the Yuan's importance in the global economy will likely expand, making it a currency worth considering for strategic investment.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.