Top 6 Best Currency ETFs For 2024

The top 6 Forex currency ETFs to invest in 2024:

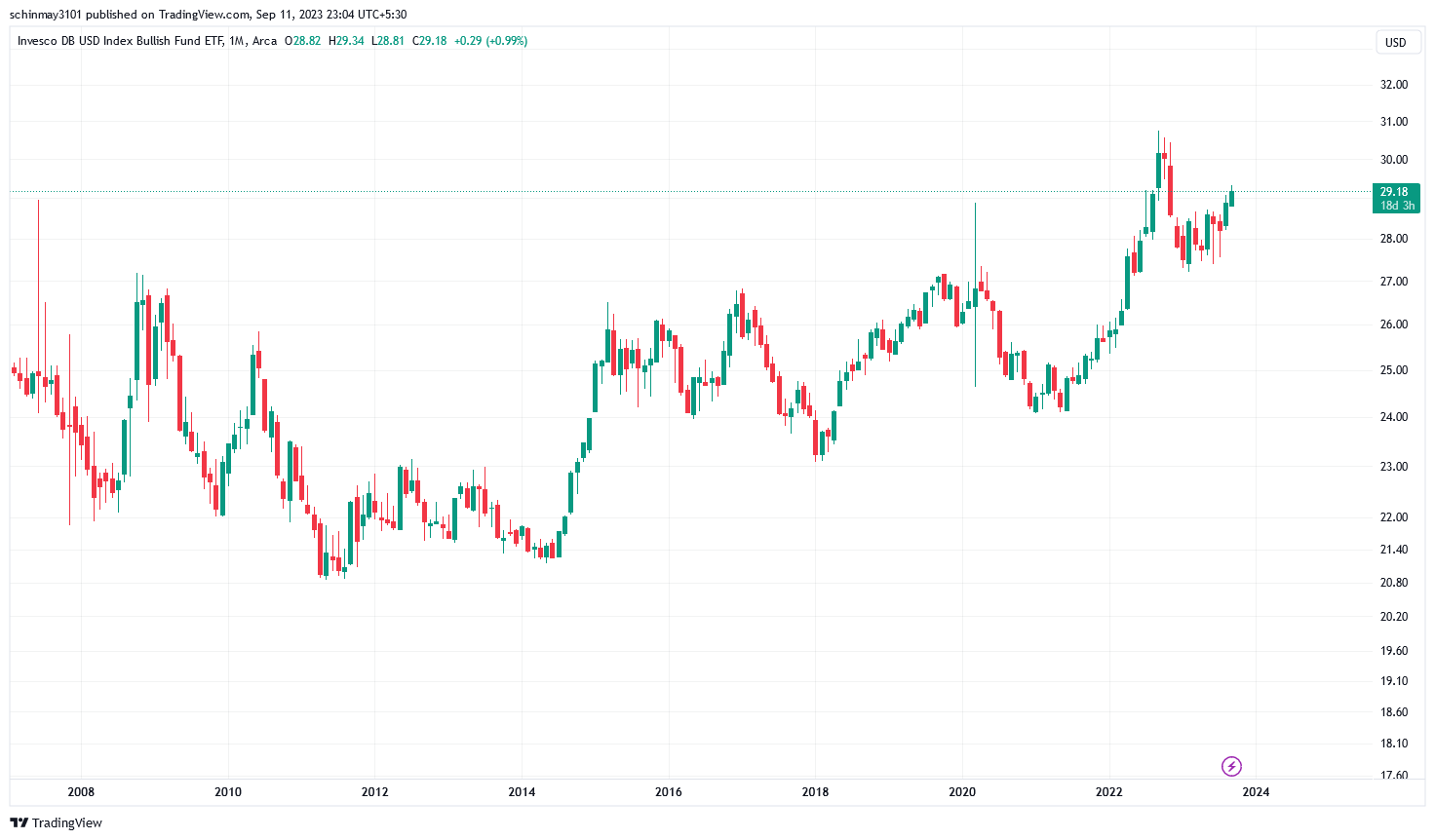

Invesco DB US Dollar Index Bullish Fund (UUP)

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

Invesco CurrencyShares Swiss Franc Trust (FXF)

WisdomTree Emerging Currency Strategy Fund (CEW)

Invesco CurrencyShares Japanese Yen Trust (FXY)

Invesco CurrencyShares Euro Trust (FXE)

As we step into 2023, investors keen on diversifying their portfolios and exploring opportunities in the foreign exchange market should have their eyes on Forex currency ETFs. These Exchange-Traded Funds (ETFs) offer an accessible and strategic gateway to currency trading, allowing investors to leverage the movements of major global currencies. In this review, the experts at TU delve into the top six Forex currency ETFs that stand out as investment options for the year 2023.

Do you want to start trading Forex? Open an account on Roboforex!Invesco DB US Dollar Index Bullish Fund (UUP)

UUP Performance Since Inception

YTD |

5.36% |

Expense Ratio |

0.78% |

Focus |

Long USD, Short G10 Basket |

1 Year Return |

0.63% |

3 Year Return |

5.65% |

5 Year Return |

3.83% |

Source |

etfdb.com |

The Invesco DB US Dollar Index Bullish Fund stands as the largest currency ETF in terms of assets under management. It tracks the fluctuations in the U.S. dollar's value against major global currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

This fund comprises a diverse range of U.S. Dollar Index futures contracts. Its recent strong performance reflects the dollar's robustness against international currencies. It's an excellent choice for active traders who seek to capitalize on trends and employ strategies reliant on short trading and futures contracts.

UP tracks the DB Long USD Currency Portfolio Index ER, which reflects alterations in the U.S. dollar's value relative to a selection of global currencies. It sets itself apart from this benchmark by maintaining a higher-than-average exposure to the euro. In particular, the fund takes short positions against the euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK), and Swiss franc (CHF). Recently, UUP has exhibited stronger performance compared to other currency funds, driven by the overall robustness of the U.S. dollar and the Federal Reserve's commitment to maintaining a tighter monetary policy stance.

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

USDU Performance Since Inception

YTD |

4.91% |

Expense Ratio |

0.50% |

Focus |

Long USD, Short Global Basket |

1 Year Return |

1.44% |

3 Year Return |

4.28% |

5 Year Return |

2.76% |

Source |

etfdb.com |

As the name suggests, the WisdomTree Bloomberg U.S. Dollar Bullish Fund is an attractive option for investors who hold a bullish outlook on the U.S. dollar. This fund can diversify traditional stock and bond portfolios due to its negative correlation with international stock and bond returns.

USDU invests in short-term currency futures and U.S. Treasury securities, focusing on liquid currencies to provide total returns surpassing the Bloomberg Dollar Total Return Index. It enables investors to leverage an appreciating dollar against foreign currencies effectively.

USDU offers broad exposure to the U.S. dollar against a basket of 10 global currencies. It aims to benefit from a strong U.S. economy, rising interest rates, and geopolitical uncertainties. Its value proposition centers on the U.S. economy's strength and stability, making it an appealing choice for risk-averse investors.

Invesco CurrencyShares Swiss Franc Trust (FXF)

FXF Performance Since Inception

YTD |

3.25% |

Expense Ratio |

0.40% |

Focus |

Long CHF, Short USD |

1 Year Return |

8.18% |

3 Year Return |

-0.21% |

5 Year Return |

0.62% |

Source |

etfdb.com |

The FXF ETF provides investors with the opportunity to participate in the Swiss franc's performance relative to the U.S. dollar, with its value rising when the franc gains momentum and falls when the dollar rises. FXF is an apt choice for investors looking to safeguard themselves against potential currency exchange rate fluctuations or those who are betting on a decline in the U.S. dollar's value. It uniquely stands out as the exclusive ETF option for individuals interested in gaining exposure to the CHF/USD exchange rate. The Trust's primary objective is to mirror the Swiss franc's price in U.S. dollars, offering both institutional and retail investors a straightforward and cost-efficient means of reaping investment advantages akin to holding Swiss francs.

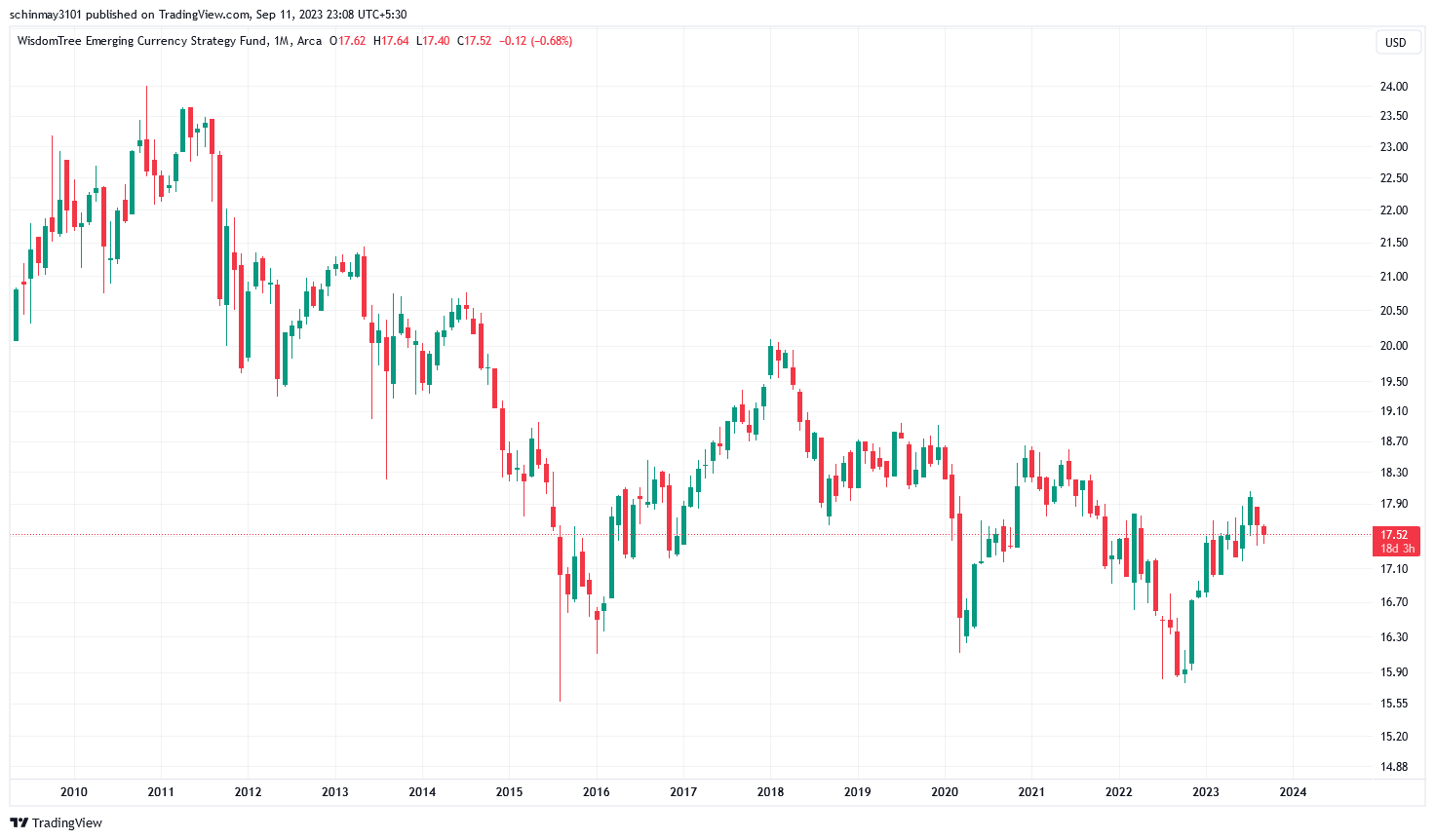

WisdomTree Emerging Currency Strategy Fund (CEW)

CEW Performance Since Inception

YTD |

3.52% |

Expense Ratio |

0.55% |

Focus |

Long Emerging Markets Basket, Short USD |

1 Year Return |

7.30% |

3 Year Return |

0.23% |

5 Year Return |

0.70% |

Source |

etfdb.com |

The WisdomTree Emerging Currency Strategy Fund is an actively managed fund targeting a selection of currencies from emerging market nations across Latin America, Asia, emerging Europe, and the Middle East/Africa Region. Although the fund's contracts have an ultra-low duration, many of the currencies within it remain highly volatile. Nevertheless, CEW serves as a high-quality choice for investors seeking comprehensive exposure to emerging foreign currencies worldwide.

Invesco CurrencyShares Japanese Yen Trust (FXY)

FXY Performance Since Inception

YTD |

-11.25% |

Expense Ratio |

0.40% |

Focus |

Long JPY, Short USD |

1 Year Return |

-3.13% |

3 Year Return |

-10.94% |

5 Year Return |

-6.09% |

Source |

etfdb.com |

For those keen on tracking the Japanese yen's price in U.S. dollars, the Invesco CurrencyShares Japanese Yen Trust provides a convenient solution. FXY demonstrated a robust 10%+ gain in the last quarter of 2022 and the first month of 2023, aligning with J.P. Morgan's bullish yen outlook, making it a promising option for Forex investors seeking new opportunities.

FXY offers exposure to the Japanese yen, making it valuable for investors interested in Asian markets amid Japan's economic innovation and adaptation. With a market value of $178 million as of July 14, 2023, FXY holds potential for appreciation, particularly if the yen strengthens due to factors such as Japan's economic recovery, fiscal stimulus, or geopolitical tensions. It earns its spot on the list as the yen is perceived as undervalued against the dollar, and FXY offers a cost-effective and liquid avenue to enter the Japanese currency market.

The underperformance of this ETF, as suggested by its negative compounded returns, is attributable to the weak JPY. This weakness is largely contributed by the interest rate gap between Japan and US. The potential for this ETF is strengthened by the hope of rebound and recovery in the Japanese Yen.

Invesco CurrencyShares Euro Trust (FXE)

FXE Performance Since Inception

YTD |

0.86% |

Expense Ratio |

0.40% |

Focus |

Long EUR, Short USD |

1 Year Return |

8.02% |

3 Year Return |

-3.66% |

5 Year Return |

-2.07% |

Source |

etfdb.com |

The Invesco CurrencyShares Euro Trust focuses on tracking the euro's price in U.S. dollars. What sets FXE apart from the other funds on our list is that it directly holds euros instead of using derivatives like futures contracts. If you anticipate that the euro could strengthen in comparison to the U.S. dollar, this ETF presents a strategic choice to enhance a diversified portfolio.

Like most currency ETFs, FXE is not intended for long-term holding. It's a suitable choice for investors who believe that the euro is undervalued when measured against the dollar. In the event of euro appreciation, FXE's value is likely to rise. Likewise, recent losses in the fund can be attributed to the dollar's recent strength.

FXE provides exposure to the European currency without requiring you to open a foreign currency account or engage in Forex market trading. As of July 14, 2023, it boasts a market value of $300 million, indicating a strong market presence and growth potential, especially with Europe's ongoing economic recovery. This option enriches your portfolio by offering a diversified and liquid means to access the euro, one of the world's most widely traded and influential currencies.

What are Forex currency ETFs?

Forex currency ETFs, or exchange-traded funds, are investment vehicles that offer individuals exposure to foreign exchange markets and various currencies. These ETFs enable investors to participate in currency movements and exchange rate fluctuations, just like trading individual currencies. They function much like traditional ETFs, allowing investors to buy and sell shares on stock exchanges, but instead of holding stocks or bonds, they track the performance of foreign currencies.

Currency ETFs can represent single currencies or a basket of multiple currencies, and their portfolios often consist of currency futures contracts. These investments are both a means of diversifying one's portfolio and a way to speculate on currency movements, with potential risks and rewards. Currently, the currency ETF market is relatively small, with a limited number of options available, and it includes both traditional currency ETFs and cryptocurrency-focused ones.

How do currency ETFs work?

Currency ETFs operate as financial instruments that combine characteristics of both stocks and Mutual Funds. Like stocks, these exchange-traded funds are traded on stock exchanges, allowing investors to buy and sell shares. However, similar to Mutual Funds, they pool investors' funds to create portfolios that track specific asset classes, sectors, or benchmark indexes.

Essentially, ETFs are designed to provide an efficient and cost-effective means for investors to trade currencies during regular market hours. They offer a way to gain exposure to the foreign exchange market, which is the largest global market. Such ETFs are essentially managed portfolios focused on currency investments, and they come in various forms, some backed by foreign currency bank deposits and others not.

Investors turn to currency ETFs for their Forex market exposure, as well as to reduce risks and transaction costs associated with currency trading. These funds primarily derive their value from changes in spot exchange rates, making them integral for currency investors.

Currency ETF managers employ diverse strategies to achieve their fund objectives. These strategies may include holding cash/currency deposits, short-term debt in specific currencies, and Forex derivative contracts. ETFs have democratized access to foreign exchange markets, making them more accessible to a broader range of investors.

Currency ETFs often serve as diversification tools within traditional investment portfolios and offer opportunities for arbitrage between currency pairs. They can also act as hedges against macroeconomic events. Depending on the product chosen, investors can gain exposure to different currencies or diversified baskets of currencies, each presenting distinct risk-reward profiles. The principles of diversification and risk management, fundamental in modern finance, are equally relevant when participating in currency markets through these ETFs.

Pros and cons of investing in currency ETFs

Investing in currency ETFs comes with its own set of advantages and disadvantages, which are important to consider. Here's a list of the pros and cons:

👍 Pros

• Diversification and hedging

Currency ETFs offer an avenue to diversify your investment portfolio geographically and financially. They can also act as a hedge against currency risk, providing stability when currencies fluctuate.

• Accessibility

These ETFs simplify access to foreign exchange markets. Investors can gain exposure to global currencies without delving into complex Forex trading strategies.

• Flexibility and liquidity

Currency ETFs are traded on exchanges just like stocks, which means they are highly liquid and flexible. Buying and selling them is straightforward and efficient.

• Limiting currency risk

Currency-hedged ETFs are available for investors looking to minimize currency risk while investing in foreign currencies. These ETFs help protect against unfavorable currency movements.

👎 Cons

• Exchange rate risk

Currency ETFs are sensitive to fluctuations in currency exchange rates. Adverse movements can negatively impact the value of these funds and eliminate returns.

• Inflation impact

Currency value can decrease due to inflation in a foreign country. This can diminish the returns on investments held in that currency.

• Geopolitical risk

Political instability and shifts in economic policies within a country can influence the value of its currency. Such events can pose risks to currency investments.

• Tracking error

Currency ETFs may not always mirror the exact price movements of the underlying currency. Factors like fees, expenses, market disruptions, or other variables can lead to differences in performance, introducing tracking errors.

What are the factors that affect currency ETFs?

Several factors influence the performance of currency ETFs, and understanding these factors is crucial for investors. Let's delve into the key factors that can affect currency ETFs:

Economic Factors

Economic indicators such as a country's economic growth, government debt levels, trade balances, and commodity prices like oil and gold can influence a currency's value. Economic stability and strength often bolster a currency's attractiveness.

Interest rates

Interest rates play a pivotal role in currency ETF performance. Higher interest rates can attract foreign investors seeking better returns, leading to increased demand for a currency and a potential rise in its value.

Geopolitical decisions

Geopolitical events like trade agreements, sanctions, and political instability can have significant impacts on currency ETFs. Negative developments in these areas can lead to declines in currency values.

Currency hedging

Currency-hedged ETFs are designed to mitigate currency risk when investing in foreign stocks. These ETFs aim to protect against unfavorable currency movements, providing a shield for investors.

External influences

Factors such as national debt levels, inflation rates, and broader economic conditions can exert pressure on currency ETFs, introducing risks that investors should monitor.

Performance of underlying assets

Currency ETFs are closely tied to the performance of their underlying assets, whether stocks, bonds, or other investments. The health of these assets can impact the overall value of the currency ETF.

Exchange rates

Exchange rates between currencies can significantly affect the value of currency ETFs. Fluctuations in exchange rates can lead to value swings in currency ETFs.

Market sentiment

The outlook of the broader investor class, known as market sentiment, can sway the performance of currency ETFs. Positive sentiment can drive up their value, while negative sentiment can lead to declines.

Volatility

Currency ETFs can be more volatile compared to other ETF types due to the inherent volatility of currency markets. Currency fluctuations can also introduce price swings.

Liquidity

The liquidity of a currency ETF can impact its value. ETFs with low liquidity may face challenges in buying and selling, potentially affecting their value.

How to find the best currency ETF to invest in?

Experts suggest the following steps to fund the best currency ETF to invest in

Research multiple options

Begin your quest by researching the available currency ETFs in the market. Explore a range of options to understand the landscape.

Currency exposure

Identify currency ETFs that align with your desired currency exposure. If you intend to invest in a specific currency, focus on ETFs that track that currency's performance.

Expense ratio

Evaluate the expense ratio of each ETF. This figure represents the annual fee charged by the fund for managing its operations. Opt for ETFs with lower expense ratios to maximize your potential returns.

Liquidity matters

Liquidity plays a crucial role. Seek out ETFs with high liquidity, as these are characterized by substantial trading volumes and offer ease of buying and selling.

Performance analysis

Analyze the historical performance of ETFs over different timeframes, such as one year, three years, and five years. Prioritize ETFs with consistent track records of performance.

Risk assessment

Understand the risk associated with each ETF. Look for funds that align with your risk tolerance and investment objectives. ETFs with lower risk profiles may be suitable for conservative investors.

Best stock brokers 2024

FAQs

Are currency ETFs a good investment?

Currency ETFs can be a suitable investment depending on your financial goals and risk tolerance. They offer exposure to foreign currencies and can help diversify your portfolio. However, like any investment, they come with their own set of risks, including currency exchange rate fluctuations. It's essential to assess your investment objectives and consult with a financial advisor to determine if currency ETFs align with your strategy.

What ETF tracks currency?

Several ETFs are designed to track currency values, with each focusing on different currencies or strategies. Examples include the Invesco CurrencyShares series, such as the Invesco CurrencyShares Euro Trust (FXE) and the Invesco DB US Dollar Index Bullish Fund (UUP). Additionally, WisdomTree offers currency-related ETFs like the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU).

What is the most successful ETF?

Determining the "most successful" ETF can vary depending on the criteria used, such as total returns, assets under management (AUM), or other factors. Historically, some of the most successful ETFs have included funds tracking major stock indices like the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust (QQQ).

Which ETF has the best returns?

ETF performance can vary widely depending on market conditions and investment objectives. Identifying the ETF with the "best" returns depends on factors like the time frame considered and the asset class being tracked.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).