How to Start Investing 2025

Rather than letting your money sit in the bank, it's better to invest it so that you can earn even while sleeping. Although many people are huge advocates of investing, they're not exactly sure how to start investing.

What can you invest in? How to make sure your investments are a success? This guide will discuss how investing works, the type of investments you can make, and tips for beginners.

By the end, you'll have a clear idea of how to start investing in stocks, bonds, annuities, etc.

Start trading or investing in stocks right now with Interactive Brokers!

What is Investing?

Investing refers to the act of allocating money or other resources, expecting them to generate a profit or income. You can invest in many different assets, including stocks, bonds, mutual funds, ETFs, real estate investment trusts (REITs), etc.

You can make short-term investments or longer-term ones, depending on the end result you wish to achieve or the profit you intend to gain.

The main goal of investing is to have a bigger pool of assets that you can cash out anytime you want to spend it for other purposes. For instance, you can purchase real estate today in the hopes of selling it for a higher price five years from now.

Where to invest in 2025 - top 12 optionsHow Does Investing Work?

When investing, you buy financial assets that have the potential to increase in value with time. These assets could be real estate, bonds, mutual funds, etc.

Suppose you invest in the stocks of a new company. With time, the company becomes bigger and more successful. The progress ultimately impacts the price of the stocks, making their value increase.

In this way, the value of your financial assets increases with time without you having to make any significant effort. Similarly, if you buy real estate, its price may increase in the next few years.

You can then sell the property and cash out your profit. When you invest for multiple years and increase your capital every year, compound interest comes into play.

Compound interest is the concept where the money you make from your investments is reinvested into your portfolio, allowing it to generate its own returns even further.

Compounding interest can help your capital grow exponentially if done correctly and on a regular basis. Suppose you invest $1000 this year by putting it in a savings account that gives 3% annual interest.

Your total at the end of the year will be $1030, at a 3% profit of $30. Now, if you reinvest $1030 the following year and get the same 3% interest, you will have higher returns of $30.9.

If you reinvest this $1030.9, the 3% of this will be even higher the next year. If you keep doing this, your investments will grow with time, bringing you more in profits.

Since this is a smaller example, the increase in profits may not seem like a lot. But if you apply this concept to hundreds of thousands of dollars, compound interest can quickly multiply your investments.

Compound interest is how most people make their money since it allows them to make money consistently, as long as they keep reinvesting.

Learn How To Invest $5 000 WiselyLong Term Investing Example

Long-term investments yield better results since they give more opportunity for compounding your capital. Let's take the example of two friends.

Both of them have $50,000. Friend A spends all his money on buying designer merchandise and taking out loans for purchasing houses and cars. Their lavish lifestyle will not allow the money to last for a long time since they're not investing in anything.

Friend B, on the other hand, invests 20% of the capital, which is $10,000, in stocks. Their initial investment is the amount of money they are investing upfront. Every month, they contribute $500 from their income to the principal amount.

They do this for ten years and compound their capital every year. For the past century, the average stock market return has been 10% annually. Using the 10% benchmark, Friend B would have approximately $121,561.97 in 10 years.

Meanwhile, Friend A wouldn't have profited off their money since they did not choose to invest it anywhere. They may even be in debt, considering they took out loans, presumably at high interest rates.

Keep in mind that Friend B was able to earn this much profit by simply investing 20% of their savings. The more you invest, the higher your profits are. You can use the compound interest calculator to calculate your estimated returns for a certain investment amount.

Why Are Assets Getting More Expensive?

Assets, such as stocks, become more expensive over time due to the better performance of the company. When a company starts, it may only have a handful of employees and fewer resources to work with.

As it grows, the efficiency of performance and labor productivity increase. Consequently, the business does better and brings in more profits. Due to this, the assets' prices also increase as the business is not only performing more efficiently, but its products or services are also high in demand.

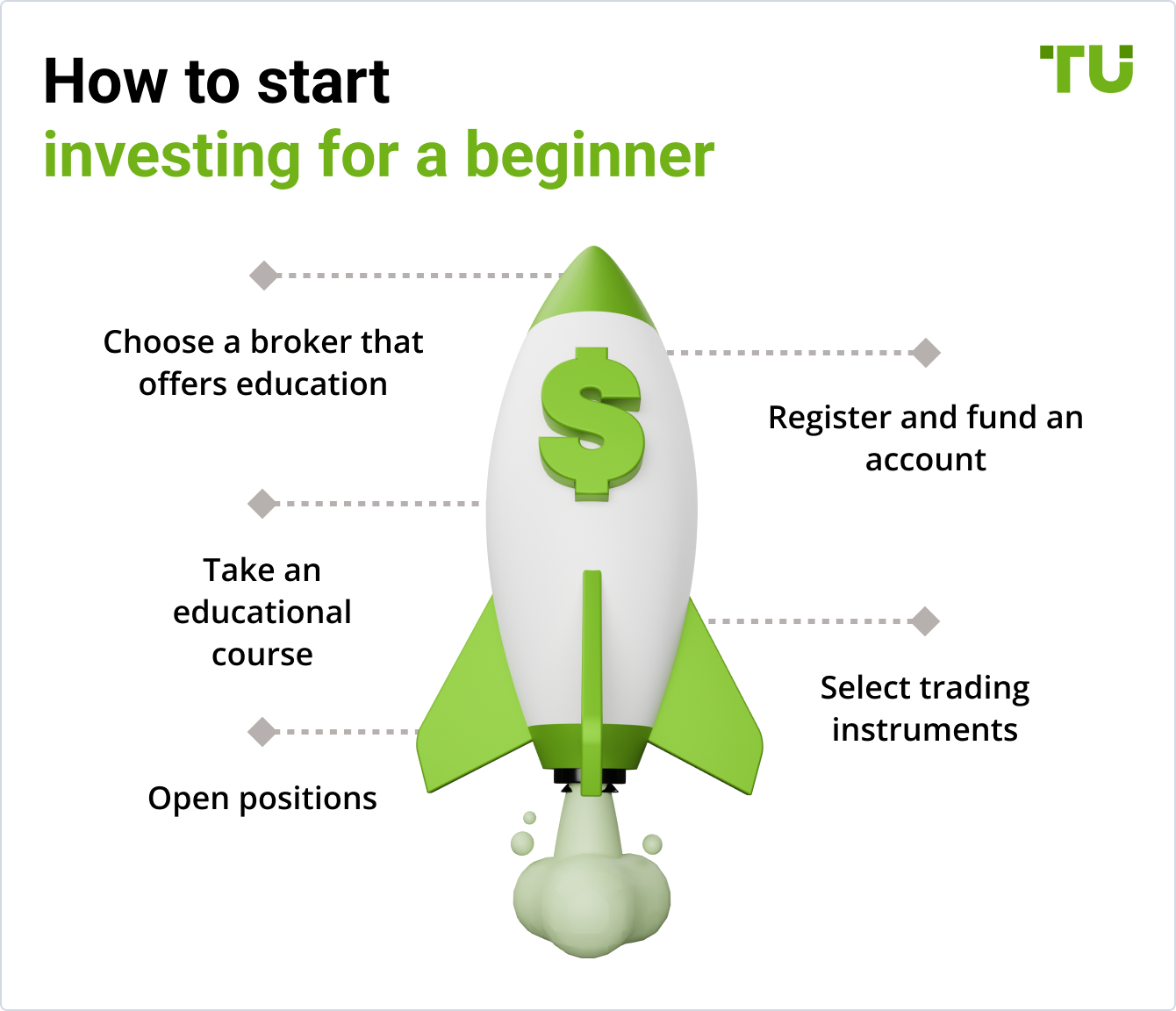

Top 7 Best investing companies for beginnersHow to Start Investing For Beginners - A Step By Step Guide

Beginners often have a hard time getting the hang of investment terminology and concepts since they lack experience. You don't need to be rich or have an exceptionally high income to begin investing.

These steps will help you get started with your first investment and teach you all the basics to not only help you become a more knowledgeable investor but also protect yourself from scams and frauds.

Set Clear Long-Term Goals

Before you even decide what you want to invest in or how much of your savings you wish to invest, you must decide your end goals. What do you want to do with the money a few decades down the line?

A compelling goal is the starting point for any investment journey. For instance, you might want to have financial independence when you're 40. You may not want to work a nine-to-five for the rest of your life.

Or, you may want to live on interest without needing to work at all. That's where long-term investments come in handy. With these types of investments, you can expect higher returns the longer you let the money sit in the investment.

Some people invest because they want early retirement. If your invested money is bringing you enough to live a comfortable life, you can easily quit your job and focus on your interests or traveling.

Top 10 stocks to invest inPay Off Your Debts

Debt is never good news, whether you're investing or not. Debt can damage long-term investments since most or all of your returns could be spent on paying off the money you owe.

Your goal should be to have no debt at all or to pay it off as soon as possible.

Decide How Much To Invest

When it comes to investing, there's no standard percentage you have to follow. The sweet spot is different for everyone, depending on their income and expenditure.

However, experts normally suggest investing around 10% to 30% of your income, with 15% being the most recommended percentage.

Matt Rogers, Director of Financial Planning at eMoney Advisor, suggests the 50/15/5 rule for investments. According to this rule, you should spend 50% of your income on necessities, such as debt repayment, healthcare, food, transport, etc.

15% of your income should be invested, and 5% should be saved for a rainy day. That leaves 30% of your income. You can use it for discretionary expenses, such as entertainment. Or, you should invest this amount too.

Make sure that the amount you invest is feasible for you. If you invest too much, you'll have too little for your necessary expenditures. Do the math based on your income and expenses. Then, choose the right percentage that works for you.

How to invest $500 for beginnerOpen an Investment Account

An investment account is where your invested money sits. You can invest virtually anything such as cash, shares (stocks), bonds, and real estate. There are different accounts for each investment type.

These are the four common types:

-

-

IRA (Individual Retirement Account): Roth or Traditional

-

401k (Corporate Sponsored Accounts)

-

College Savings Account

If you get an investment account from a major US bank, it should be sufficient for you. These accounts offer multiple options, such as ETFs and stocks. Additionally, they offer low commissions and can be quite flexible.

However, if you plan to invest in an ETF like Vanguard VTSAX or another low-cost index fund, you can easily do so via a robo-advisor too. It's the easiest and cheapest way to start investing for beginners with little money.

Here's a comparison of some investment accounts:

| Broker | Minimum Investment Amount | Investment Assets | IRA Account | Robo Advisory | |

|---|---|---|---|---|---|

$0 |

Stocks, Options, Bonds, Cryptocurrencies, Forex |

Yes |

Yes |

||

$500 |

Stocks, ETFs, Mutual funds, Fixed income, Options |

Yes |

No |

||

$0 |

Mutual Funds, Exchange-Traded Funds (ETFs), Money Market Funds, Stocks, International Stocks, Bonds and Fixed Income Products, Options, Futures. |

Yes |

Yes |

Interactive Brokers

Interactive Brokers offers a wide range of asset classes, including options, bonds, futures, and stocks across 33 countries and 135 markets. The platform has excellent fundamental and technical analysis to help investors.

It accepts clients from over 220 countries, providing low-margin interest rates and remarkable trading tools.

eOptions

eOptions is an ideal brokerage account for cost-focused and active traders since it has low margin rates, low optional contract fees, and automated trading. Although the platform has a full suite of services, it specializes in options trading.

Other tradable securities include ETFs, mutual funds, bonds, and stocks.

Charles Schwab

Charles Schwab is one of the best online brokerage platforms, offering products and tools for all traders and investors.

Besides facilitating trading for ETFs, stocks, and mutual funds, the platform also has a number of research guides, calculators, and educational resources for online brokers.

Types of Investments You Should KnowStart Investing as Soon as Possible

It's best to invest as soon as possible. The sooner you invest, the higher your returns will be by the age of 65. Investing early gives you a higher advantage since you can give your investments enough time to grow.

Again, compounding comes into play here. Suppose Person A, aged 25, invests $2000 in a 401(k) over ten years at a growth of 10%. At the age of 65, when they retire, they'll have $556,197.

Meanwhile, Person B invests the same amount over 30 years at the age of 34. When they retire at the age of 65, their returns will be $328,988 despite investing three times what Person A invested.

That's because Person A let their interest compound for an extra nine years. The sooner you invest, the higher your returns will be if your investment continues growing at a stable rate.

How to Invest $10,000 in 2025 - Top 10 IdeasHow to Begin Investing - Top 5 Tips

Here are some tips on how to start investing for beginners.

Explore IRA accounts

An individual retirement account or IRA lets you save for retirement in a tax-advantaged account. It doesn't matter how old you are, whether you're already retired or not, or what your income is.

Anyone who has an income can open an IRA, including people who have a 401(k) account. When you open an IRA, you can invest in a number of financial products, such as ETFs, bonds, mutual funds, and stocks.

You can also open a self-directed IRA. It allows the investors to make all decisions themselves. Thus, you get access to broader investment types, including commodities and real estate.

All three options mentioned in the table above offer IRA accounts. For instance, Schwab lets you open a traditional IRA, Roth, or Rollover IRA account. If you have a child with earned income, you can also open a custodial IRA for them, giving them a head start on their savings.

How To Make Quick Money In FinanceConsider Robo Advisory Services

A robo advisor is a digital platform providing automated, algorithm-driven financial planning services at a low cost. It allocates investments based on your situation and goals.

Here's how it works. You sign up for an account online.

The robo advisor asks you about the following things:

-

Age

-

Income

-

Expected retirement age

-

-

The time horizon for the money you want to invest in equities

-

Other financial goals.

Investors answer these questions according to their individual preferences, and the robo advisor invests accordingly. Some robo advisors don't even require you to open a brokerage account for this purpose since they offer direct indexing services.

The best part of using a robo advisor is that you get financial recommendations without paying commissions or loads.

Best investing companiesIf you are not sure how to choose a robo advisor, here are some options:

-

Betterment: Betterment makes investing easier and better by giving you the support and tools you need to make better investment decisions. The platform doesn't have a minimum balance requirement for Digital Investing. The annual account fee is just 0.5% of the investor's fund balance.

-

Wealthfront: Wealthfront is another robo advisor that offers multiple investment options, such as bonds, stocks, cash, and ETFs. It also has free financial advice for home buying, retirement, and college planning. Fees depend on the investment vehicle you choose.

Diversify Your Portfolio

Portfolio diversification refers to spreading your investment across different investment vehicles to minimize volatility.

It works by investing in a variety of securities that don't move in the same direction at the same time. While individual stocks and bonds might rise or fall, their overall long-term trend is up.

In other words, by diversifying your portfolio, you reduce risk since some of your investments won't be affected by the movement in another one. To diversify your portfolio, you must buy different assets that are weakly correlated with each other.

For instance, you can buy stocks for companies in different industries so that the movement in the price of one stock doesn't affect the price of the other. In this way, even if one stock isn't bringing many returns, the other will be giving you profits.

On the other hand, if you invest all your money in one investment vehicle, a dip in price could lead to extreme losses.

How to make money online in financeLearn Investing Strategies

How to start investing in stocks without much experience? Learn investing strategies so that you can make informed decisions about your money.

Here are some helpful investing strategies:

-

Value Investing: It refers to buying stocks that are undervalued or trading below their intrinsic value. Since the stocks are worth more than what the price states, it gives you an opportunity to make money when they go up in price.

-

Dividend Growth Investing: In this strategy, you buy shares of companies that are financially strong with high-growth potential. Since these companies consistently pay dividends annually, they're less volatile than other companies.

Some people even combine value and dividend growth investing. For instance, they might invest in undervalued stocks that also pay dividends. This gives you the opportunity to make money on both ends - when the stock goes up in price and when it pays dividends.

If you're interested, you can also check out books written by avid investors. John Rothchild and Peter Lynch's One Up on Wall Street is a great resource. You can also read A Random Walk Down Wall Street by Burton Malkiel to learn time-tested strategies for successful investing.

Be patient

Finally, it's very important to be patient because the market is highly volatile, and factors like political instability and financial uncertainty affect investment vehicles.

Investment is a long-term process, requiring investors to be patient and wait for the market to turn in their favor.

Investing for Beginners - Wise Ideas to Get StartedBiggest Investor's Mistakes

Beginners often make a few mistakes in investing that can easily be avoided.

Pay Too Much Attention to the Short Term Performance

As we've already mentioned, investments are a long-term thing. If you focus too much on the short-term performance of an investment vehicle, you'll end up overlooking the bigger picture.

To get higher returns on investments, it's important to look at the long-term performance of any asset.

Don't Pay Attention to Taxes and Fees

Commissions can be a real bummer in terms of investment returns.

But what about the taxman? Investment costs that stem from things like commissions and management fees can make quite a big dent in your returns when you look at them on an annual basis.

Focus on minimizing taxes and choose appropriate platforms to lower your account management fees. In this way, you can maximize your returns.

Falling in Love With Some Assets

Diversification is the key. No matter how much you like an asset, you must resist the urge to overweight it.

For example, despite its great performance and appeal, you should avoid getting too much into cryptocurrency as an individual asset. Even though it's an attractive investment – low transaction fees and fast processing – it can really be a double-edged sword at times due to high volatility.

You should diversify your portfolio to ensure higher long-term returns.

Inflexibility

Being flexible is an important part of being an investor. Although you don't have to rush to make decisions, you must be prompt in rebalancing your portfolio when required.

For instance, if you notice that some of your investments are doing better than others, you should use this as an opportunity to sell the under-performing assets and put those funds into more lucrative opportunities.

How to Invest $100k - Top 10 IdeasWhat Can I Invest in 2025?

Fortunately, investing is easier than ever today. Here are some assets you can invest in.

Stocks

Stocks are the most popular and cheapest way to invest. All you need is a brokerage account and some money. Your broker will take care of the rest.

Warren Buffet is the best example of someone who became a billionaire by investing in stocks of undervalued and well-managed companies. He says that compound interest is an investor's best friend.

His advice is to start early. You can either start young or hope to live a very long life if you wish to get the most out of your stock investments.

ETFs

An ETF (Exchange-Traded Fund) is an investment that tracks an index like the Dow Jones, S&P 500, or Nasdaq Composite Index. These are different from mutual funds because they trade on the open market. Trading the Nasdaq index offers unique opportunities for investors due to the wide range of companies, primarily in the technology sector. Key aspects of successful trading include thorough analysis, understanding market trends, and employing proven strategies.

The Invesco QQQ (QQQ) is another example. It mostly has technology stocks and indexes the Nasdaq 100. Meanwhile, the SPDR S&P 500 (SPY) is the most widely known exchange-traded fund, tracking the S&P 500 index.

Since ETFs invest in so many stocks, they provide you with a diversified portfolio that delivers results similar to those of index funds. Warren Buffet recommends investing in the S&P 500 index fund as it holds 500 of the largest US companies.

Bonds

Bonds are another way to get your feet wet with investments.

The appeal of investing in bonds is that they are less risky than stocks. A bond pays a fixed dividend until it matures, and the price does not fluctuate as much as a stock's.

They're an ideal way to park your money if you're saving up for something big, like retirement.

Cryptocurrencies

Cryptocurrency has been a wild ride these last few years. Bitcoin, the most popular cryptocurrency, has risen from less than a dollar to $47,319.30 today.

People have made a lot of money investing in Bitcoin and other cryptocurrencies, but it's important to remember that they are very risky.

Since cryptocurrency can be very volatile, experts recommend only investing 10% of your income in it.

Real Estate Funds

A real estate fund is a mutual fund investing in securities offered by public real estate companies. These funds allow you to get in early on famous real estate deals.

The fund is generally spearheaded by a sponsor with substantial experience in real estate. The fund manager analyzes individual opportunities and executes them using the fund's capital.

After a set period, the profits are distributed among investors, based on the performance of the real estate.

Some real estate funds only focus on specific asset types, such as multi-family properties.

How to Invest $20,000 Right Now - 12 Smart IdeasWhere To Invest Money by Countries

Summary

By now, you should have a clear idea of how to start investing in stocks, mutual funds, or any other type of asset. It's imperative to diversify your portfolio, learn investment strategies, be patient, and rebalance your portfolio as the need be.

The bottom line is to start early so that you can maximize your profits, thanks to compounding. Additionally, the longer time you have, the more assets you can invest in, letting your returns grow every year.

FAQs

How Can I Invest With $100?

You can start investing with an amount as small as $100 by investing in a stock, using fractional shares to buy stocks, putting the amount in your 401(k), or using a robo advisor app.

Is Buying 1 Share of Stock Worth It?

Yes, it is. You can start with a single share and grow your portfolio with time.

How Long Does It Take To Make Money From Investments?

Technically, you can make money instantly if the stock you've invested in increases in price. But for your investments to mature properly, you need to give them a few years' time.

Why Should I Start Investing Early?

The earlier you start investing, the more time your investments will have to compound. Plus, you can invest in different assets and give your investments due time to mature for higher gains.

Glossary for novice traders

-

1

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

2

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

3

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Roth IRA

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings account available in the United States. It allows individuals to contribute after-tax income to the account, and the contributions grow tax-free. When qualified withdrawals are made in retirement, including both contributions and earnings, they are typically tax-free as well.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).