5 Steps To Invest In The S&P 500 Index Fund

How To Buy An S&P 500 Index Fund:

-

Choose a Fund: Research S&P 500 index funds focusing on low expense ratios and no sales loads.

-

Pick a Broker: Select a broker that offers a wide range of ETFs and funds with no trading fees.

-

Open an Account: Set up and fund your investment account through your chosen broker.

-

Buy Shares: Place an order for your chosen S&P 500 index fund, using market or limit orders.

-

Monitor Investments: Keep track of your fund's performance and consider rebalancing periodically.

The S&P 500 stands as a pillar of stability and potential growth for investors in the financial markets. Whether you're a seasoned trader or new to the market, understanding the allure of index trading is vital.

But what exactly makes the S&P 500 a popular choice among investors? This article serves as your compass in navigating the intricacies of buying an S&P 500 index fund, detailing the steps to make this potentially lucrative investment.

-

Is an S&P 500 index fund a good investment?

An S&P 500 index fund can be a good investment for its diversification, historical return pattern, and low management costs.

What is the S&P 500?

The S&P 500, or Standard & Poor's 500, is an American stock market index comprising 500 of the largest companies listed on stock exchanges in the United States. This index is the best single gauge of large-cap U.S. equities. An interesting fact is that this index isn't just about size, it's also about market relevance. The companies included are industry leaders, making the S&P 500 a barometer for the U.S. economy's health.

The S&P 500 isn't static. It's a living, breathing entity, regularly updated to reflect the changing landscape of the American economy. Companies are added or removed based on their market capitalization, liquidity, and industry representation. This ensures that the index remains a relevant and accurate reflection of the U.S. stock market.

The S&P 500 has shown systematic growth since its launch in 1957

Investing in the S&P 500, therefore, offers a way to tap into the performance of these major companies. It's like holding a slice of America's corporate power in your investment portfolio. In essence, when you invest in the S&P 500, you're betting on the collective success of America's top companies.

What is an S&P 500 Index Fund?

An S&P 500 index fund is a financial vehicle designed to mimic the performance of the S&P 500 Index. It's a type of mutual fund or exchange-traded fund (ETF) that pools investors' money to purchase a portfolio of assets that correspond to the index. The fund's success is tied directly to the collective performance of the S&P 500's constituent companies.

For example, the Vanguard 500 Index Fund (VFIAX) and the SPDR S&P 500 ETF Trust (SPY) are two prominent S&P 500 index funds that aim to offer investors exposure to the 500 companies within the index, providing a diversified portfolio with a single investment.

Why invest in the S&P 500 Index Fund?

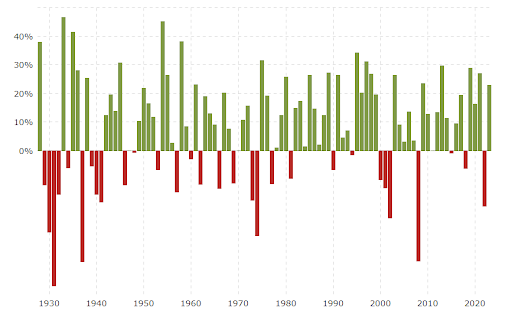

Investing in an S&P 500 index fund offers the opportunity to participate in the U.S. stock market's growth while mitigating some risks associated with individual stock investing. The visual provided, depicting the S&P 500 Historical Annual Returns, shows a series of vertical bars representing the index's annual performance over many decades.

Macrotrends.net

S&P 500 Historical Annual Returns

The green bars illustrate years of positive returns, sometimes climbing over 30%. Conversely, the red bars indicate years with negative returns. Despite these fluctuations, the trend over time reflects growth. The ability of the S&P 500 to recover from downturns and continue growing suggests resilience and a propensity for long-term value increase.

The image underscores a crucial point - while individual years vary, the general trajectory for the S&P 500 index has been upward. This highlights the potential for long-term capital appreciation, which makes S&P 500 index funds a compelling choice for investors looking to build and accumulate wealth over time.

Additionally, the diversification inherent in an index fund can provide a buffer against volatility thus mitigating risk, as the impact of any single company's stock is limited.

Investing in an S&P 500 index fund is a strategy that aligns with the principle of riding out market waves and harnessing the growth potential of America's largest corporations. It's a testament to the philosophy of passive investing, where rather than trying to outguess the market, one benefits from the market's overall upward momentum.

Best stock brokers 2025

5 Steps to Invest in an S&P 500 Index Fund

Deciding to invest in an S&P 500 index fund is a significant step towards financial growth. Once you've solidified your investment timeframe and objectives, the following five steps provide a roadmap to navigate the process:

-

Research and Choose an S&P 500 Index Fund: Begin by investigating various S&P 500 index funds. Consider factors like historical performance, expense ratio, and fund management.

-

Choose a Broker: Select a reputable broker that aligns with your investment goals and offers the index fund of your choice. Preferably, choose one with no trading fees for cost-efficiency.

-

Open and Fund Your Account: Create an investment account with your chosen broker and deposit funds to start trading.

-

Place Your Order: Once your account is funded, you can place an order to buy shares of the chosen S&P 500 index fund.

-

Monitor and Rebalance (Optional): Keep an eye on your investment to ensure it continues to meet your financial goals. Rebalancing may be necessary to maintain your desired asset allocation.

Each of these steps moves you closer to being a participant in the vast ecosystem of the U.S. stock market through the S&P 500 index fund. While we will explore each step in more detail, understanding the overview of the process can prepare you for the exciting investment journey ahead.

Step 1: Research and choose an S&P 500 Index Fund

When selecting an S&P 500 index fund, it’s recommended to scrutinize two main cost-related criteria:

-

Expense ratio: This is a measure of what it costs an investment company to operate a mutual fund or ETF, expressed as a percentage of the fund’s assets. A lower expense ratio is preferable, as it translates to less cost for the investor. For a cost-conscious investor, targeting funds with an expense ratio of less than 0.10 percent means minimal fees and more of your money working for you.

-

Sales load: This refers to a commission fee charged when you buy or sell a mutual fund. Essentially, it’s a form of commission. Typically, you'll want to avoid sales loads to maximize your investment, especially with index funds where the goal is to replicate the index performance at minimal cost. ETFs generally do not carry a sales load, making them an attractive option for investors looking to keep costs down.

Many S&P 500 index funds boast some of the lowest expense ratios in the investment world. Even without pinpointing the absolute lowest-cost fund, you can benefit from the inherently efficient nature of index investing. For instance, a fund with an expense ratio of less than 0.10 percent will only cost you about $10 per year for every $10,000 invested.

For further reading on low-cost index funds, consider going over our article on Best low cost index funds to invest in 2024.

Step 2: Choose a broker

Selecting the right broker is a pivotal step in your investment process. Aim for brokers that offer a broad array of ETFs and mutual funds with no trading fees. This will ensure that you have access to a variety of S&P 500 index funds and can trade without worrying about additional costs eating into your returns.

A competent broker should provide not only a robust trading platform but also educational resources to aid in your investment decisions. Also, find a broker that aligns with your investment strategy and can support your growth as an investor.

Step 3: Open and fund your account

Once you've chosen a broker, the next step is to open an account. This process typically involves providing some personal information, setting up security features, and possibly completing a brief questionnaire about your investment goals and risk tolerance.

After your account is established, you'll need to fund it. You can transfer funds electronically from a bank account, mail a check, or roll over assets from another account. Once the funds are cleared, you're set to invest.

Step 4: Place your order

With your account funded, you're now ready to place your order. Navigate to the trading section of your broker's platform, search for your chosen S&P 500 index fund, and decide how many shares you want to purchase.

You'll have options for the type of order, whether it’s a market order, buying at the current price, or a limit order. Confirm the order and price point you chose, and once executed, you'll be the owner of shares in an S&P 500 index fund.

Step 5: Monitor and rebalance (optional)

Investing is not a set-it-and-forget-it endeavor. Monitoring your investment allows you to see how it aligns with your financial goals and whether any adjustments are necessary.

Rebalancing may be needed if your portfolio drifts from your target asset allocation. An optional strategy to consider is DCA (dollar-cost averaging) - investing a fixed amount regularly, regardless of the share price. This serves to reduce the impact of volatility and mitigate risk. The DCA method can smooth out the price at which you acquire shares over time.

Who is buying the S&P 500 good for?

Investing in the S&P 500 index fund is well-suited for a range of investors with diverse financial goals. Here are a few use cases:

-

Long-term investors: Those planning for retirement or long-term wealth accumulation can benefit from the historical upward trend of the S&P 500.

-

Passive investors: Individuals who prefer a "set-and-forget" strategy will find the low-maintenance nature of an index fund appealing.

-

Risk-averse investors: Investors seeking exposure to the stock market with a reduced risk of volatility may opt for the diversified portfolio that an S&P 500 index fund offers.

👍 Pros of investing in the S&P 500 Index Fund

• Diversification: An S&P 500 index fund provides instant diversification across 500 large-cap companies, which can mitigate risk.

• Historical performance: Historically, the S&P 500 has delivered strong and steady long-term returns, representing the robust nature of the U.S. economy.

• Simplicity: Buying into an S&P 500 index fund is straightforward and eliminates the complexity of picking individual stocks.

👎 Cons of investing in the S&P 500 Index Fund

• Market risk: Despite diversification, an S&P 500 index fund still carries market risk and can decline in value during market downturns.

• Lack of flexibility:Market risk: Investors have no control over the fund’s individual stock holdings and cannot make changes based on personal convictions or insights.

• Performance caps: While the index fund can mirror the market's performance, it also means investors won't outperform the market, missing out on potential higher returns from individual stock selections.

Summary

The S&P 500 index fund stands as a cornerstone investment for those seeking a blend of simplicity, diversification, and the potential for solid long-term growth. It offers a straightforward path to participate in the financial markets, appealing to many investors from the passive to the strategic.

While it comes with inherent market risks and somewhat lacks the thrill of individual stock picking, its historical performance is a testament to its enduring value. As with any investment, it's essential to align it with your individual goals, risk tolerance, and investment horizon.

Glossary for novice traders

-

1

Upward Trend

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Algorithmic trading

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Robo-Advisor

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.