The 5 Most Important Order Types For Beginning Traders

The 5 most important order types are:

-

1

Market Orders - an order to buy or sell at the current market price

-

2

Limit Orders - an order to buy or sell at a specified price or better

-

3

Stop Loss Orders - an order that becomes a market order once a specified price (the "stop price") is reached or passed

-

4

Stop Limit Orders - when the stop price is reached, the order becomes a limit order to buy/sell at a specified limit price or better

-

5

Trailing Stop Orders - this order sets the stop price at a fixed amount or percentage below (for a long position) or above (for a short position) the market price. The stop price then adjusts as the market price moves favorably, "trailing" it

In this educational piece, we delve into essential order types every aspiring trader should grasp: Market, Limit, Stop-Loss, Stop-Limit, Trailing-Stop, and some advanced order types.

We demystify their mechanics, elucidate their advantages, and outline their associated risks. By astutely employing these tools, novice traders can curtail risk, enhance success rates, and execute trades with precision, sidestepping emotional pitfalls and potential drawdowns.

These order types serve as a toolkit for navigating the intricacies of trading across diverse markets and all asset classes, including Foreign Exchange, equities & commodities, enhancing risk management and disciplined trading.

Greatly enhance your trading potential and discipline, whilst minimizing emotion-led decision making with this deep dive into fundamental order types.

Discover their inner workings, advantages, and potential pitfalls. Join us to equip yourself with the knowledge to commence trading in a professional, structured manner and improve your ability to trade profitably, in a sustainable manner.

What are the different order types in trading?

Let’s take a look at the different order types in trading.

Market Orders

A market order is the simplest and quickest way for a trader to buy or sell an asset.

It involves executing the trade immediately at the current market price, ensuring swift entry or exit. While it offers speed and certainty, market orders may occasionally result in less favorable prices due to market fluctuations, so it's crucial to use them when precision is less critical, or when swift execution is needed.

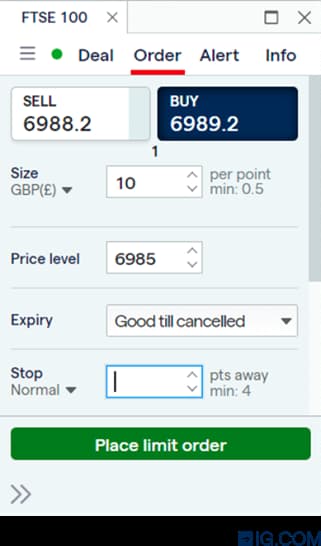

Using the screenshot example below, we can explain how a market order would be executed.

-

A BUY Market Order would

the blue button BUY 6989.2. -

A SELL Market Order would

the white button SELL 6988.2

Screenshot. Execution of a market order (Image courtesy of IG Markets.com)

Limit Orders

A limit order enables a trader to specify the exact price they are willing to buy or sell an asset, assisting traders to target favorable entry or exit points and maintain control over trade execution.

Limit orders do not guarantee immediate execution, but ensure transaction at a specific chosen price.

Limit order (buy/sell)

Buy limit order

If a trader wanted to buy the above at USD133 (green line) when it currently trades at USD139 (white line), the trader can place a (buy) limit order with a limit price of USD133 (green line).

If the price moved to USD133 (or lower,) the limit order would have been executed.

Had the price NOT reached USD 133, no trade execution would have taken place.

Sell limit order

If a trader wished to sell at USD142, they would place a sell limit order at USD142 (red line).

If the price reached USD142 (or higher), the limit order would be executed at USD142 (or higher).

If the stock failed to reach USD142 (or above), no trade execution would have taken place.

Stop-loss Orders

An essential risk management tool enabling a trader to set a predetermined price to sell and limit potential future losses. This order is a safety net, protecting capital by automatically executing a sell order if the market moves against the position. It's a key tool in a traders toolbox to maintain discipline and minimize downside deviations.

Note: Some trading platforms use slight variations in order “terminology”.

Although these are intended to assist junior traders, they have the potential to create confusion.

Always use a broker you are comfortable with.

Limit order (buy/sell)

Using our previous example, make note that the red and green lines have been reversed.

Long position. If the trader bought at USD139 (white line) and wanted to exit the position if the price should drop to USD133 (or lower), they would place a “Stop sell” order at USD 133 (red line), triggering the stop sell order if the price hit USD133 (or lower).

Note: If slippage took place, it is possible that the order could be executed at a price lower than the desired sell stop price at USD133.

Short position. If a trader was “short selling” which applies more to Foreign Exchange, futures and derivatives than stocks, we can use this “Stop buy” example as well.

-

1

If a trader decided to sell at USD139, anticipating that the price would fall and they would be able to generate a profit buy buying back at a lower level such as USD133, the trader would use a “Limit order” or on some platforms/brokers a “Take profit” order at USD 133.

This would generate a profit of USD139 minus USD 133, being USD6 (multiplied by however many units they had in the transaction) before brokerage fees. -

2

To protect potential losses on this short trade at USD 139, the trader could place a “Stop buy” at USD 142, to protect future losses, should the asset move higher than USD 142.

Stop-limit Orders

A stop-limit order combines precision with risk management. It includes two prices: the stop price, triggering the order, and the limit price for execution. When the stop price is met, it becomes a limit order, ensuring execution near the chosen price, offering both control and risk management.

Order placement process:

-

1

Open the "Order" window by clicking on the symbol that the user wishes to trade.

-

2

Select "Pending Order"

-

3

Select "Buy Stop Limit"

-

4

Specify the Stop price that the customer wants. Please note that for Buy Stop Limit Orders, "Stop Price" will be displayed as "Price".

-

5

Specify the Limit Price. Note that for Buy Stop Limit Orders, "Stop Limit Price" will be displayed as "Limit Price".

-

6

Click "Place" to place the Buy Stop Limit Order.

Here is an example of a Buy Stop Limit Order:

-

1

The trader specifies the Stop Price (on this chart Stop Price is labeled as “Price").

-

2

Once the stop price is matched, a buy limit order is automatically placed at the traders desired price. This buy limit order is usually placed below the buy stop price as per the buy stop limit.

-

3

Orders match only if the buy limit price aligns with the buy stop limit order. If not, market orders won't execute. Traders use pending orders to handle price fluctuations before prices rise again.

Locate order types and set specific desired stop prices and buy limit prices.

Example of a Buy Stop Limit Order

Locate order types and set specific desired stop prices and buy limit prices.

Stop-limit Orders

Stop-limit Orders

Stop-limit Orders

Stop-limit Orders

A trailing stop adjusts its stop price with favorable market moves, locking in profits. It stays fixed if the market reverses, combining protection and flexibility in trading strategies. Read also about: Generating profits using on-chain metrics and indicators in the TU article.

Best Forex brokers

Related terms for introductory traders

We'll simplify the trading language for new traders, making your learning journey easier with essential terminology and vocabulary commonly used in financial markets.

Bid price

The “bid price” is the highest price a buyer in the market is willing to pay for an asset and the price at which a trader can instantly sell the asset, essentially meeting or matching the highest bid. Understanding the bid price is crucial for executing well-timed and informed sell orders.

Example: If a USDJPY is currently 149.30/31, 149.30 is the bid price.

Ask price

The “ask price” is the lowest price a seller is willing to part with an asset in a market. When a buyer is looking to buy an asset, this is the lowest immediate price they are able to buy at.

Example: If a USDJPY is currently 149.30/31, 149.31 is the ask price.

Spread

The “spread” refers to the difference between the bid (buy) price and the ask (sell) price of an asset.

It represents the transaction cost for traders and is crucial for cost effective trading.

A wider spread can increase the cost of trading, potentially impacting profitability, while a narrower spread is often more favorable for traders.

Liquidity

Liquidity is the ease with which assets can be bought or sold in a market.

Higher liquidity offers smoother transactions and narrower bid-ask spreads, while lower liquidity can lead to slower trades and wider spreads between the bid price and ask price, impacting trade cost. It reflects the market's depth and activity, influencing trade execution.

Understanding liquidity is vital for optimal trade planning and risk management.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual price at execution. It occurs due to market volatility or order size, potentially resulting in higher costs or different outcomes than initially anticipated.

Managing and minimizing slippage is a key consideration in effective trading strategies.

How do main order types work?

-

Market orders. Market orders are used when the primary concern is fast and guaranteed execution, not the price. They are filled almost instantly during market hours. Risks - in volatile markets the actual execution price may differ from the expected price.

-

Limit orders. Used when a trader wants to specify the maximum price they are willing to pay (buy order) or the minimum price they are willing to receive (sell order). Risks - there's no guarantee that the order will be executed, as the market price might never reach the limit price.

-

Stop loss orders(SL). Used to protect capital should adverse price action take place. Should be set at a predetermined level just below the bid price when initiating a buy transaction. For a short position(selling), it should be placed at a predetermined level above the short entry ask price.

Note: These “predetermined levels” are at a traders discretion and advisable in the 5-20% range from the transaction entry level.

This is to allow for price volatility. Anything less than 5% or exceeding 20%, signifies an inaccurate price entry of the trade. Risks - slippage and volatility enhance the risk of stop loss orders being executed unnecessarily. Additionally, slippage may increase the loss size. Acute market assessment “may” assist in minimizing these risks.

-

Stop limit orders. Use when precise execution is crucial. Set a stop price to trigger the order and a limit price to determine the desired execution level. Use when entering a trade to secure both price accuracy and enhance risk management, especially in volatile markets. Risks - slippage and high volatility risk stop-limit orders. May happen if the stop triggers, but the market misses the limit, causing missed opportunities. Volatility can prevent limit execution, exposing trades to adverse moves.

-

Trailing stop orders. Stop levels placed at either a percentage or a numerical distance from the current market price. Used when seeking to lock in profits as the market moves in your favor whilst protecting against price reversals. Secure gains whilst allowing for further profit potential, especially in trending markets. Risks - trailing stops risk early exits in volatile markets and don't guard against gaps, exposing trades to abrupt moves. Prudent evaluation of market conditions and stop placement is crucial to mitigate these risks.

Professional traders leverage all order types to enhance risk management and maintain discipline, assisting in executing precise and emotion-free trades, minimizing losses and securing profits. This approach fosters profitable and sustainable trading by reducing impulsive decisions and controlling risk.

FAQs

Can I change my order type after placing a trade?

Traders can adjust orders after placement but with conditions. Typically, changes are allowed if the market hasn't executed the order. However, once a trade is executed, modifications may not be possible. Specific rules and platform policies should be consulted for clarity on post-trade order adjustments.

When would you use a stop loss order versus a stop limit order?

Choose a stop-loss order for immediate execution at the market price to limit losses.

Use a stop-limit order when precision in entry or exit is more important; it involves setting both a trigger and desired execution price, allowing control over accuracy but possibly slower execution.

The decision hinges on your trading strategy and risk tolerance.

Would I use a regular stop loss if I prioritize closing the trade?

A trader should use a regular stop-loss order if their top priority is closing the trade to limit potential losses. It ensures immediate execution at the market price when the stop price is reached, prioritizing swift closure.

Would I use a stop limit for more control on the execution price?

A trader would use a stop-limit order for more precise control over the execution price. This order type allows them to set both a trigger price and a specific execution price, offering a higher level of accuracy and control compared to other order types.

Do all brokers offer trailing stop orders?

Not all brokers offer trailing stop orders. Availability of order types can vary between brokers, so it's essential to check with your specific broker to determine whether they provide trailing stop orders as part of their trading services.

Are there any additional “advanced” order types beyond the basics?

Yes, there are many order types. Here are a few:

OCO (One Cancels the Other) Order. This order combines two orders, typically a stop order and a limit order. If one order is executed, the other is canceled.

GTC (Good 'Til Canceled) Order. A GTC order remains active until executed or canceled by the trader, regardless of the time frame.

IFD (Immediate or Cancel) Order. An IFD order requires that one part of the order be executed immediately, and if that's not possible, the entire order is canceled. It's commonly used for complex strategies.

Team that worked on the article

Mr. Walsh commenced his career within Interbank Capital markets in Johannesburg in 1990 broking USDDEM as well as USDZAR spot and forward FX with the worlds leading interbank broker M.W. Marshalls of London, now ICAP Pte. Ltd. Shortly after a stint in London, he was offered a role at the same firm in the Singapore office in early 1993, where he was a leading broker in Asia on the USDSDEM desk. In late 1996 as electronic broking platforms made an aggressive push into the interbank spot markets, he was offered a senior role on the G20 FX Forwards desk where he enjoyed a long and lucrative tenure until 2009.He left ICAP after a long tenure after being approached by MF Global (Singapore) for the role of "Regional Head, Asia - FX Institutional Sales". He oversaw 4 countries and reported directly to New York after successfully revamping the FX operations in Asia. After the unfortunate demise of the firm in early 2012, he took a 2 year sabbatical, keeping occupied as a Proprietary trader and managing a small private portfolio covering FX Derivatives, US Equity Options and Futures.

Mr. Walsh is currently CEO of a boutique investment management firm, assisting institutional investors source best-in-class investment strategies & portfolios that have historically generated high risk-adjusted returns, uncorrelated to traditional asset classes. He is also a contributor to the Traders Union website, an informational source for traders and investor.

Mr. Walsh is a competitive endurance athlete and spends his spare time training and racing in long distance multi-sport events globally.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.