Strategies of working with a trailing stop in trading

In this article, we will explain what a trailing stop loss order is, how to set it, what the order types are and the benefit it could bring to a trader. We will also review the most popular strategies using the trailing stop orders, their pros and cons, the markets where they are effective and the markets where they aren’t.

What is a Trailing Stop Order?

A trailing stop loss order is the same stop-loss order, but a ‘moving’ one. This means that the trailing stop order follows the price at a set distance, which allows traders to minimize the loss and lock in the potential profit.

Risk management is the key element of trading in the financial and other markets. A wrong approach to risk management could lead to zero profit at best and the loss of investment in the worst case scenario, which is what happens most of the time. When planning a position and entering the market, every trader must have a specific plan not only for the profit, but also for the loss.

Therefore, you need to clearly determine the amount you are ready to part with in case your decision turns out to be wrong one. Based on this amount, a trader either closes an unprofitable position manually once a certain number of points is reached or sets a ‘protection’ order, i.e. the Stop-Loss order.

In the first case, traders can be more flexible about the time of closing the unprofitable position based on the situation, for example, if a plunge or a surge of the price against the trend is observed after the release of some macroeconomic data, and the price then returns to the trend and continues to grow or fall. If a trader is confident about the briefness of such a surge/plunge, he/she can decide not to close the position and thus avoid a loss.

However, there is always a probability of a trader making a mistake, and the price deviation from the trend could turn into a reversal, causing the trader much higher loss. In order to avoid that, a trader can make a firm decision to close the position at a loss not exceeding a specific amount and set a traditional Stop-Loss order at the required distance in points.

In that case, you can avoid substantial loss, but risk finding yourself in the situation that was described above. In this case, there is another option, i.e. setting a Trailing Stop Loss order. It works in the same way as the traditional Stop-Loss order, but the difference is that you can use the trailing stop order to reduce your loss, break even, or even close your position at some profit.

Everything is done automatically, i.e. the stop-loss order ‘trails’ as the price moves by a set number of points. This way, the human factor, when greed takes precedence over common sense, and the trader suffers a loss that he cannot afford and is not able to recapture is excluded. Meanwhile, when trading the trend, if a stop loss order is triggered, he/she may not only not suffer a loss, but also remain with some profit.

How do trailing stops work?

A trailing stop loss order follows favorable price movement at a set distance. Once the price moves the predetermined number of points, the order becomes active and starts ‘tracking’ the price movement. As the price moves towards the open position, the trailing stop order moves the same distance, and if the price moves against the position, the order remains at the set position and is triggered, with the trader exiting the trade either with a planned loss or some profit, if the price moved in the ‘right’ direction by more points than were set.

Trailing stop order vs Stop-loss order – pros and cons

A stop-order limits and minimizes losses, while a trailing stop order allows you to lock in the profit on the position in case of trend reversal, but only if the price moves at a larger distance than that set for the trailing stop order.

For example, if the distance from the price is set at 50 points, a trader will suffer a loss of 50 points in case of price reversal. In this case, the order is triggered as the trailing stop-loss order. If the price moved 70 points from the entry point, in case of a reversal and triggering of the order, the trader will earn a profit of 20 points. In this case, the order is triggered as the trailing stop order.

Since each of these types of trailing orders performs its own specific task, there is no sense in discussing the pros and cons of each of them.

9 Best Forex Signals ProvidersHow to set a trailing stop loss

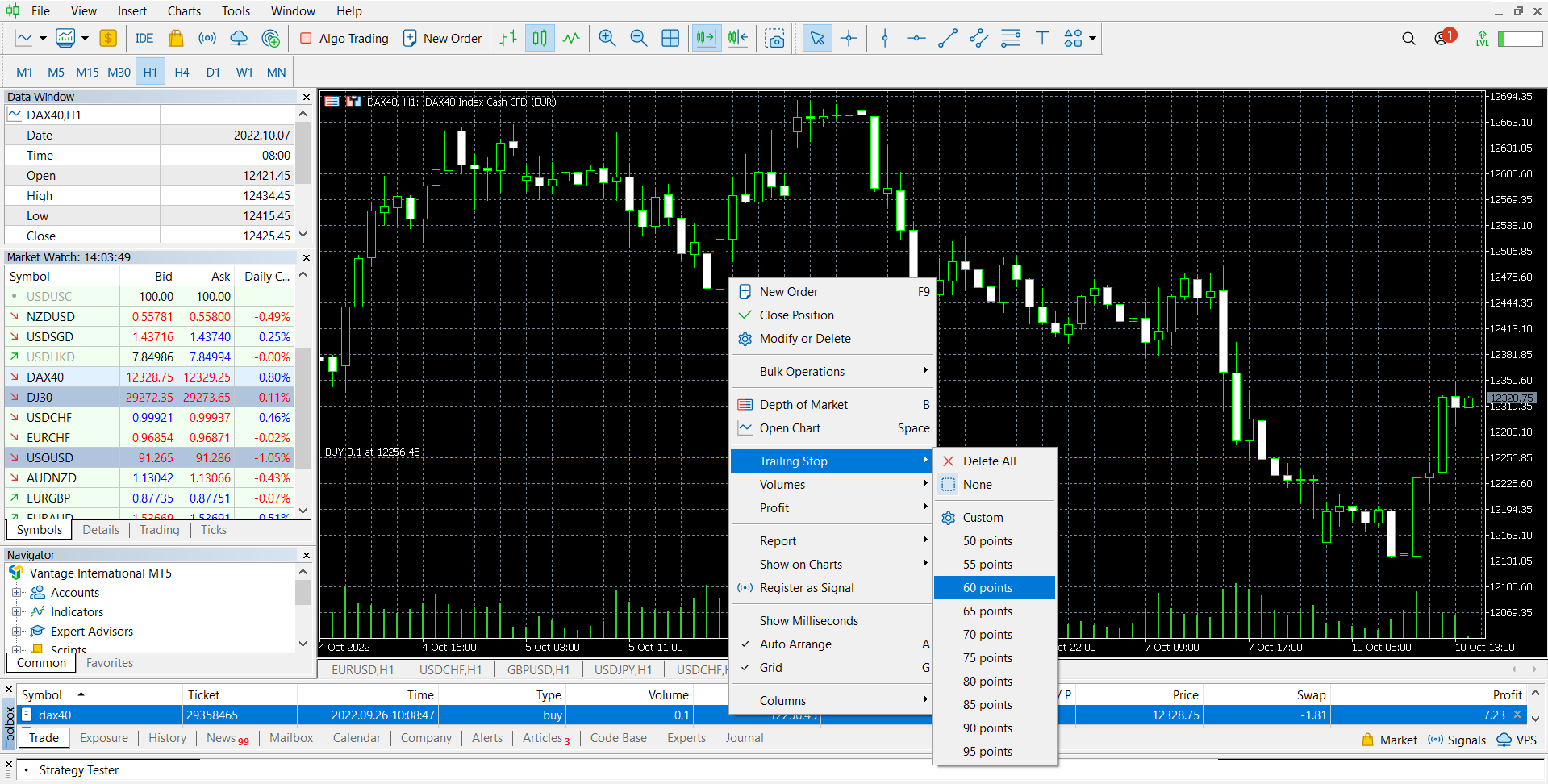

Setting and activating a trailing stop order is quite simple and does not require special knowledge. On MetaTrader, the most popular trading platform, you need to right-click on an open position, select Trailing Stop, and set the number of points.

Setting a trailing stop loss order in Metatrader

Trading strategies using a trailing stop

Calculating a trailing stop-loss order is rather a complex task. On the one hand, a trader needs to limit his/her potential loss, but one the other hand, they have to avoid the order getting triggered during a temporary rollback. Support/resistance levels are traditionally used, with the trailing stop-loss orders set below or above them.

Setting a trailing stop-loss on moving averages

These levels are identified using various instruments, specifically moving averages, horizontal and descending resistance lines and ascending support lines, etc. In a flat and a movement in a certain direction within a clear corridor, it is also enough to also draw lines along the price lows and highs.

Example with moving averages

Trailing stop loss example using moving averages

This example is suitable for medium and long-term traders. It is a day chart with 20, 50 and 100-day MA. We can see a stable downward trend on the chart, where the price continues to decline after reaching a rollback.

Let’s assume that a short position was opened on a rollback after the breakout of the support level and crossover of the moving averages. It would be advisable to set a trailing stop-loss order over the 100-day MA, i.e. approximately 200 points from the opening price. Therefore, in case of a false breakout and trend reversal, a trader would have suffered a fixed loss of 200 points, which is generally acceptable for a long-term term trader, whose target is at least 400 points. At the same time, if the trend continues, as we can see on the example above, the size of potential loss would decrease, while later on a trader could expect a 200-point guaranteed profit in case the trailing stop order is triggered on a correctional rollback.

Using a trailing stop to trade the trend

In addition to using a trailing stop to limit your losses, you can also use it to open positions on the trend. In this example, the 50-day moving average is showing a good area of resistance levels you can use to sell. However, in this case, you will need to adjust the levels to sell in the trailing stop manually. After opening a position, a stop-loss order is placed over the 100-day MA. It will work in the same way also if you enter the market not in the very beginning, i.e. not at the reversal, but as the price moves on rebounds.

Using a trailing stop to trade the trend

In the example above, we use the descending resistance level instead of the MA. Based on the market, you need to set a trailing stop-loss order at a certain distance from the descending line.

Trailing stop example

You can use a Buy Limit Order, i.e. closing of the position, together with the trailing stop. In order to determine potential levels for closing the position, you can draw a descending support line, in the area of which the buy limit order is set.

An experienced trader can use support and resistance levels, including ‘intermediate ones’ for partial closing of the position, both at a profit or loss. This means that a stop-loss can be set for a part of the position above the 50-day MA, and for the rest of the position – above the 100-day MA. In the hope of the breakout of the descending support line and ‘vertical’ fall by a considerable distance, a buy limit order (closing) can also be set for a part of the position.

Top 8 Best Trend IndicatorsHere is another example of placing a trailing stop-loss order.

An example of placing a trailing stop-loss order

If you enter the market on the trend during a rollback, a stop-loss order can also be set above the previous high (resistance).

In case of sharp moving along the trend, you can reduce the trailing stop order distance, i.e. lock in a higher profit than previously planned. Later on, if the price rolls back in the opposite direction, you can re-open the position by placing a trailing stop-loss order based on the above principle.

Best Trading StrategiesHow to avoid typical mistakes when trading with a trailing stop

It is an indisputable advantage that you can limit your loss automatically as the trend develops, which allows you not to give all of your attention to only one position, and also provides an opportunity to not only limit your potential loss, but also to lock in your guaranteed profit.

In terms of drawbacks, this type of protection orders is the most effective in a dynamic, i.e. volatile market with an active trend. In slow-moving markets without a clear market trend, the effectiveness of the orders is considerably lower. Also, in many cases, you have to adjust the parameters of a trailing stop order manually.

Also, this order type is generally most effective in medium and long-term trading, as it is better to use trading robots configured to use a trailing stop and limit orders to close a position for day trading or scalping.

The main mistakes of placing stop-loss orders include a very ‘close’ distance, which means that the order is triggered if the price rolls back, and in that case a trader suffers a loss, although the price rebounds and continues its movement in the right direction, or a very ‘far’ distance, when in case the order is triggered, a trader suffers a very big loss.

In order to avoid making mistakes when placing trailing stop-loss orders, traders need to accurately identify the trend, and support and resistance levels. Also fundamental factors influencing the price performance need to be taken into account. If the fundamental factors do not support the current movement, it means there is a high risk that such movement would not be stable.

In addition to using moving averages, traders should consider such an indicator as the ATR (Average True Range) – a decrease in volatility can signal a fading trend and a possible reversal, and the RSI indicator – a strong overbought or oversold zone can also signal a fading / reversal of the trend.

Best Brokers 2024

Summary

In conclusion, trailing stop orders are mostly used by experienced traders, as in theory everything looks much simpler and more optimistic on certain examples than it is in reality. In order to use this instrument, you have to consider a multitude of factors, otherwise instead of making your work easier and more effective, it could lead only to worse results.

FAQ

What is a Trailing Stop Order?

A trailing stop loss order is the same stop-loss order, but a ‘moving’ one. This means that the trailing stop order follows the price at a set distance, which allows traders to minimize the loss and lock in the potential profit.

How does a trailing stop order work?

A trailing stop loss order follows the price movement at a set distance. Once the price moves the predetermined number of points, the order becomes active and starts ‘tracking’ the price movement.

How to set a trailing stop?

Setting and activating a trailing stop order is quite simple and does not require special knowledge. On MetaTrader, the most popular trading platform, you need to right-click on an open position, select Trailing Stop, and set the number of points.

What indicators can be useful for setting a trailing stop order?

Moving averages help determine potential support/resistance levels, the ATR shows increase or decrease in volatility and the RSI is useful for determining the overbought/oversold level of an instrument.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.