What Is a Trailing Stop Order?

A trailing stop order will help you customize your stop orders more precisely and save you money. In this article, you will find the definition of a trailing stop order and instructions on using it correctly.

What Is a Trailing Stop Order and How to Use It?

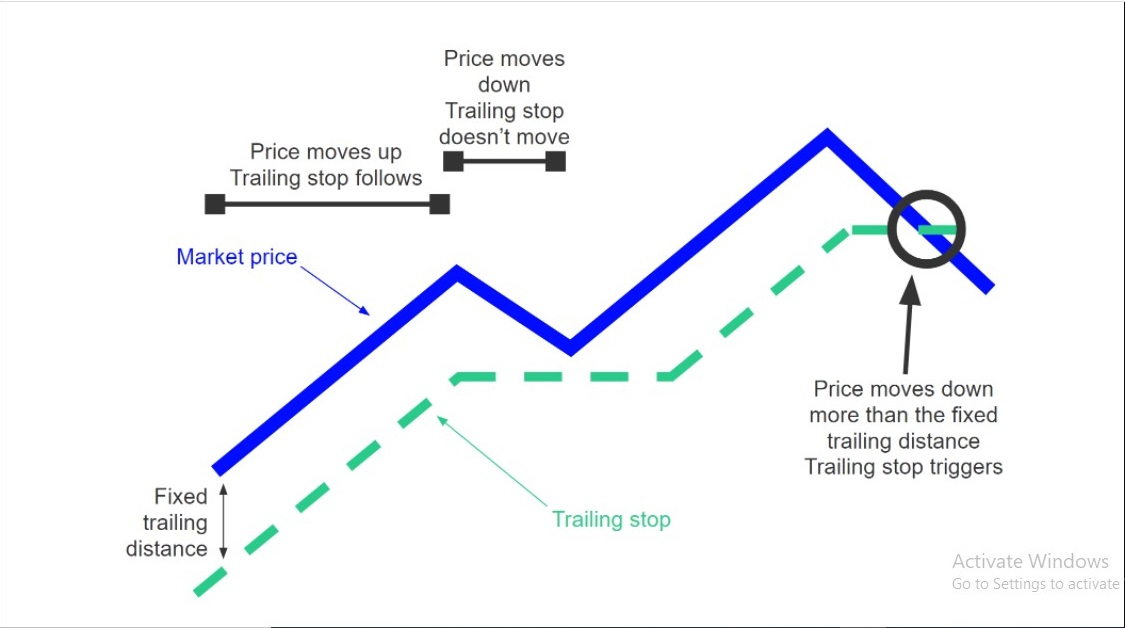

Trailing stop orders helps you protect your potential profits, and it also provides you with downside protection. The order calibrates the stop price by a set percentage or amount of points below or above the stock's market price, and it also has an attached trailing amount. Trailing stops offer you a way to mitigate risk, and traders often use them as an exit strategy.

Read more about Best Forex StrategyWhat is a Trailing Stop Order?

A trailing stop order is a contingent order that utilizes a trailing sum to determine when and how to offer a market order instead of a specific stop price. The trailing amount, expressed in points or percents, then continues to follow (or "trails") the value of a stock as it climbs up (for trading volumes) or down (for buy orders).

When the stock moves in a favorable direction, your trailing stop price moves with it. When moving in an undesirable direction, your trailing stock price remains the same. Market order triggering happens when your stock price gets to the trailing stop price. Execution of the market order then happens using the best available stock value.

Where to Buy Stocks? Learn more about ItTrailing stop orders come in several forms

Use of percentages as a trailing amount: When using percentages as trailing amounts, keep in mind that the real point scattered between the current market price and the trigger price will change upon recalculation of the trigger price.

When using a percentage as the trailing amount for sell orders, the point distance between the stock's price and the trigger price grows as prices rise. Since the percentage is on new, lower-cost buy orders that use a percentage as the trailing amount, the point distance between the security's price and the trigger price will narrow as prices dip.

Trailing Stop Limit Order

This allows setting up a triggering delta. It defines how much a market price can fall before you want to sell or rise when you buy. Here, you can specify the same as a percentage or a dollar amount.

Once you've set the trigger delta, Investor's Edge constantly recalculates the valuation that will activate your order predicated on the stock's market price as it keeps moving in the desired direction. It rises for a sell order and falls for a buy order. Upon shifting of the current market price, your trigger cost remains constant.

Is trading profitable? Read more information about itTrailing Stop-Loss

You can increase the efficacy of a trailing loss by pairing the same with a trailing stop. A trailing stop order is a trade order where the stop-loss price stays unfixed at a solitary, unconditional dollar amount. It is, however, set at a % or dollar amount just below the market rate.

Trailing Stop Sell

For trailing stop sell orders, the trigger valuation's recomputing is the latest top bid as the inside valuation rises to record highs. The original "high" is the inside bid when the trailing stop is activated, so the "new" high is the best price the portfolio reaches above that original value. If the price level rises above the initial offer, readjusting of the trigger price is the same as the new high, less the trailing quantity.

How to Use a Trailing Stop Order in Trading?

Buy Stop Trailing Order

A buy trailing stop order pursues "trails," the cheapest stock rate by a trail you specify. A buy market order trigger occurs if the stock price rises beyond its most affordable rate by the trailing price or perhaps more and you can procure the equity at the best price possible.

Sell Stop Trailing Order:

Using a trail you specify, a sell trailing stop order follows the top price of a stock. When the stock falls well below the highest possible price by the trailing or maybe more, your sell trailing stop order is now a sell market order. The stock is, therefore, sold at the best available price.

An Example of a Trailing Stop Order

Trailing Stop Orders Examples

Below are some practical examples of trailing stop orders:

Buy Trailing Stop Order

Let’s assume you’re interested in buying TIGO. However, you believe that its value will dip, but you still want to wait to buy it. You also think that if TIGO's value goes up by a certain amount (e.g., 5%), it can even go higher. To minimize potential costs, you proceed to set your trail at 5%. Here, your stop price should always remain 5% above TIGO's lowest price.

If the current trading price of TIGO is $110 per share, your stop price will start at $115.50, 5% greater than TIGO's current price.

If the stock price of TIGO remains between $110 and $115.50, the stop price will remain at $115.50.

If the stock price of TIGO falls to $100, the stop price goes up to $105. Five percent above the new lowest price.

If TIGO rises to the stop price ($105) or stronger, it triggers a buy market order. You can therefore purchase TIGO at the best available price.

Sell Stop Trailing Order:

You’re the owner of TIGO, and you think that TIGO's value will rise. However, you still want to help safeguard your investment if TIGO's value falls. If your trail is at 5%, your stop price will continue to be 5% below TIGO's highest price.

If TIGO is currently trading at $100 per share, your stop price will start at $95, 5% lower than the current price.

If the stock price of TIGO remains between $100 and $95, the stop price will remain at $95.

If its stock price rises to $110, it updates to $104.50, 5% lower than the new highest price.

If the price of TIGO falls to the stop price ($95) or lower, it triggers a sell market order. You can then purchase TIGO at the best available price.

How to Place a Trailing Stop Order

When buying and selling a particularly volatile exchange rate with unpredictable price movements, a trailing stop-loss, for example, may be helpful. However, keep in mind that increased fluctuation levels may cause prompting of your stop-loss early on.

Trailing stop orders may pose risks due to their dependence on trigger pricing, heightened by market uncertainty, market trade data, and other domestic and foreign system factors.

Stop Loss vs. Stop Limit: definition and differenceIn trailing stop orders, you follow the following steps:

Step 1

Enter a Trailing Stop Sell Order: You want to purchase a certain amount of company shares, lock in a profit, and limit losses. Set the trailing amount to a specific figure below the current market rate. First, create a SELL order, and then decide on the trail amount to determine the initial stop price.

Step 2

Transmit your order: You then send your order.

Step 3

When the market price increases, the trailing price is automatically adjusted considering the trailing amount

Upon order submission:

Step 4

Your stop price is the same as the one initially set upon falling the market price. Further falling of the market price to reach your stop price prompts the trailing stop order to complete a market order to sell the shares you purchased, limiting your losses.

The Metatrader platform uses the "Terminal" window's open position context menu command with the same name to set the trailing stop. Then, choose the desired distance value between the Stop Loss level and the current price in the opened list. Each open position can only have one trailing stop.

Read more about top-10 MT4 signalsFollowing the completion of the preceding actions, the terminal checks if the open position is lucrative upon the arrival of new quotes. As soon as the earnings in points are equal to or exceed the defined threshold, the order to position the Stop Loss order is automatically issued. The order level is a certain distance away from its current price.

Furthermore, the Stop Loss level automatically follows the price if the price moves in a somewhat more profitable path. However, if the position's profitability falls, the order's modification won't happen. As a result, the financial gain of the trade position is instantaneous. After each automatic Stop-Loss order adjustment, a register comes up in the terminal report.

Professional Tips for Using Trailing Stops

When you’re using trailing stops, your intention should be to reduce losses as much as possible.

Below are some of the tips to make sure you achieve this goal:

-

Cut your losses short to prevent losing too much capital. Retrospectively, allow your winners to keep going without prematurely closing them.

-

Have an automatically fixed trailing stop. Set this to the maximum distance in between the stop loss and the price level further in the path of your trading activities. Your stop loss will remain in place as long as the price stays within this range.

-

Move average-based trailing stop losses to help you find dynamic and logical levels to transpose your stop losses.

Best Trading Platforms

Robo Forex MT4 - Best For Forex

It includes all the features and functionality required for novice and experienced financial market traders. Furthermore, the terminal comprises embedded features and opportunities only available on MQL platforms.

Three types of order execution

50 ready-to-use indicators for technical analysis

Essential tools for graphic analysis

Opportunity to program your trading robot

Interactive Brokers - Best for Professionals

In terms of products, tools, and technology, Interactive Brokers has many uses. It is best suited for professional traders and advanced, active traders looking to take advantage of a powerful variety of applications and global access to a diverse portfolio of investments. With interactive brokers, you can trade any of these assets from either a single or integrated account.

Top 10 Forex Brokers in the WorldSummary

There are considerable risks associated with using trailing stops. These include stock splits, vulnerability to pricing gaps, market closures, the effect of fast markets on prices, liquidity, and lack of markets for specific stocks. To avert and mitigate against these risks, blending trailing stops with conventional stop-losses can help to minimize losses and safeguard profits.

FAQs

Can Beginners take part in trailing Stop Orders?

Anyone can take part in the use of trailing stop orders. Tools exist to help both beginners and advanced traders.

Which tools can I use for different order types?

Depending on what you're interested in (either trading in forex or investment), you can either use Robo Forex or Interactive brokers, respectively.

Is it advisable to explore trailing stop orders as an exit strategy?

Though it offers considerable benefits, trailing stop orders also pose significant risks, and it is essential to do extensive research first. However, trailing stop orders can help you preserve profits and limit your losses as an investor.

How can you mitigate risks associated with trailing stop orders?

You can Blend trailing stops with conventional stop-losses can help to minimize losses and safeguard your profits.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.