Forex Quotes - How to Read and Understand Forex Quotations

There is real money to be made in forex trading. However, it’s far from easy work — it takes a lot of self-education on the financial markets and the specifics of currency trading. And if you’re going to start learning forex, you’ll need to start with the basics — like how to read forex quotes. Don’t worry, even though it may seem difficult to a complete novice; we’ve prepared an in-depth guide on Forex quotes!

Understanding currency pairs

A currency pair is just what it sounds like — quotations of two currencies, where their values are quoted against each other.

Currency Pairs Example

The first currency you see listed in a pair is called the “base currency,” while the second one is the quote currency.

These currency pairs are there to show us the relative values of currencies compared to one another. For example, a EUR/CAD currency pair shows you how much CAD you need to buy one EUR unit. In this example, the EUR is the Euro, while the CAD is the Canadian Dollar — all currencies are listed and identified via a three-letter alphabetic code, recognized on the international market.

There are countless currency pairs in the world — or rather, as many as there are currencies. The total sum of currency pairs can change, as currencies (though not often) come and go.

However, not all currency pairs have the same trading volume — which is the number of trades over a given time period.

The currency pairs with the biggest volume are, logically, called the major currencies, and they include:

-

EUR/USD — Euro vs. the U.S. dollar

-

USD/CAD — the Canadian dollar vs. the U.S. dollar

-

USD/CHF — the Swiss franc vs. the dollar

-

USD/JPY — dollar vs. the Japanese yen

-

AUD/USD — the Australian dollar vs. the U.S. dollar

-

GBP/USD — the British pound vs. the dollar

These major currency pairs generally enjoy the most liquid markets and are traded from Monday to Thursday, 24 hours a day.

On the other hand, there are plenty of minor currencies, also called “crosses” as well — currency pairs that don’t contain the US dollar as the base or quote currency. Such pairs come with wider spreads and less liquidity compared to the major currency pairs — though they are still sufficiently liquid.

As you might have assumed, the crosses with the biggest trading volume are between individual currencies that aren’t the US dollar, but they’re still majors: like EUR/CHF or EUR/GBP. Conversely, you can also trade in exotic currency pairs — these include currencies used in emerging markets. They have far wider spreads and much less liquidity. A good example is the USD/SGD pair — the US dollar and the Singapore dollar.

Bid and Ask Price

Every forex quote has two parts — a bid and an ask.

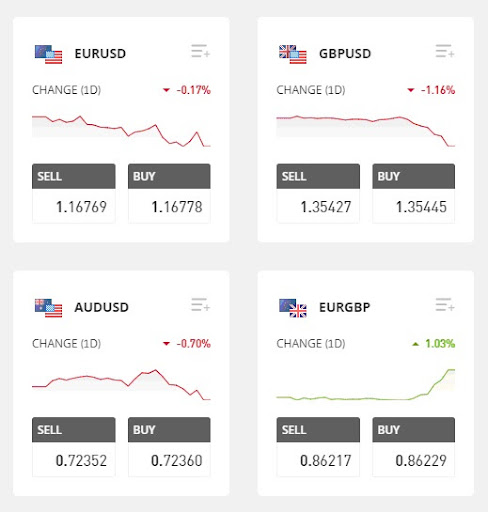

Bid and Ask Price

In the case of EUR/USD, the bid is 1.16769, while the ask is 1.16778. If this seems confusing to you, don’t worry — some brokers clarify the terms by clearly labeling them as “sell” or “buy”. However, as most of them still use the Ask and Bid terminology, it’s useful to understand which price is the asking, and which one is the bidding price.

When you see “buy” and “sell, the actions are clearly viewed from your perspective. However, the “ask” and “bid” terminology is viewed from the broker’s perspective instead of your own.

Ask price

If you’re a potential buyer, from the broker’s perspective, you’re paying the price that the broker’s asking for the currency — so the “asking” price is really your buying price.

Bid price

If you’re looking to sell, you’ll be doing so in practice by “accepting” the bid from your broker — making this the “bidding” price. Remember: the “bidding” price is actually your selling price.

How bid and ask prices change

If you’re looking at a currency pair where the USD is your base currency and the quote increases — in practice, this means that the quote currency has weakened and the USD has become stronger. This reflects the bid and ask price as well.

In simpler terms: if you see your currency quote rising, the base currency is becoming stronger, and a falling quote means the base currency is becoming weaker.

What is Spread

The “spread” is defined as the difference between the highest bid price that a broker is prepared to pay to buy a currency from you, and the ask price at which that same broker would sell that same currency to you. The concept of a spread isn’t unique to the forex market, as it exists with any trading instrument — and this difference is where the broker actually makes money.

That’s why the spread is also referred to as the “brokerage commission”, the “buy-sell spread”, or the “bid-ask spread”. However, these are all general terms for the concept of spread — you should also know that there are different, more specific kinds of spread.

Fixed spread

The fixed spread for a specific trading instrument (in this case, currencies) exists when trading conditions are unchanged over the course of a particular trading session. This is attractive to traders for obvious reasons — they always have a handle on their trading costs, which allows them to construct a more detailed trading strategy.

Still, brokers have the option to change this fixed spread depending on volatility — so it’s not unconditionally fixed.

Floating spread

A variable, or floating spread may change with the shifting winds of the market situation — often arbitrarily. This spread is entirely formed based on order volumes; in other words, the supply and demand on the global market. The more orders there are for a particular currency pair, the more liquid it will be — and consequently, the spread will become smaller.

What is zero spread?

When choosing brokers, you will likely hear of “zero spread” offers — this is a marketing ploy designed to attract traders. Essentially, brokers that advertise “zero spread” are prepared to give you the bare minimum difference between buying and selling prices. However, even with instant order execution, this is never zero. Seeing as brokers still have to make money on trades, they will find other ways of extracting profit from a zero spread account — essentially bringing you right back to having a spread, just less transparently. They may simulate a fixed spread through commissions, smaller or bigger leverage, a larger minimum deposit, slower execution speed, etc.

What is a pip?

A pip is just an acronym for “price interest point” or “percentage in point”. It represents a measure of how a currency pair has changed in the forex market. It’s measured either by the underlying currency or the currency pair quote.

What is pip value?

A single pip is just the tiniest amount a currency quote can change by on the forex market. For US-based currency pairs, this is 0.0001 of the US dollar — otherwise known as one basis point. Similarly, a pip value is a basic expression when referencing losses or gains in a position — measured as the price of a one-pip move for the specific currency.

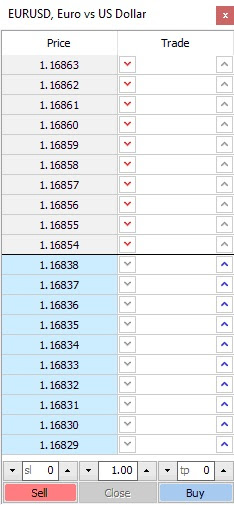

Understanding order books

Once you get into forex trading, you’ll quickly hear of “order books”. If you’re not familiar with the term, it’s merely a list of buy and sell orders for a particular financial instrument or security, organized by price level and displayed electronically.

Importantly, an order book will provide the number of bids or asks at every price point — which is the market depth. Plus, it will give you an insight into the market participants who are making the buy and sell orders, even though many choose to stay anonymous.

Still, these lists are essential for traders because they provide valuable market information and increase market transparency. The level of detail you’ll see in an order book depends on the broker you’re using. For instance, eToro’s order book merely shows the trade volume, and not the individual trades.

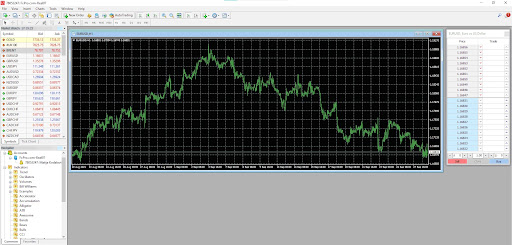

EURUSD Сhart on eToro

Real-life example of Forex quotes

Now that we’ve examined the theory behind reading forex quotes — let’s see how this works in practice.

Forex Quotes in MT4

It’s important to understand that your experience will vary depending on which broker and platform you use. In this case, we’ve logged into the MetaTrader 4 terminal via the FxPro broker.

FList of all the Quotes on MT4

On the left, you can see a list of all the quotes for different currency pairs — with their names on the left and their bid and ask prices on the right.

EURUSD Chart on MT4

If you want to see the previous trends for any particular currency pair, you can turn on a tick chart or a simple 2D chart. In this case, we’ve opted for the EUR/USD pair.

Order Book on MT4

If you want, you can also view the order book for the same currency pair — showing you all of the trading orders for it in real time.

Top 3 Forex brokers

As you can see, a lot is riding on what Forex broker you choose in the very beginning. That’s why we’re going to take a look at some of the biggest brokers on the global market.

FxPro

There’s a reason why we picked FxPro for our showcase above — it’s definitely one of the most popular choices for forex traders. They provide plenty of tools for fundamental and technical analysis, as well as a variety of trading platforms.

Their spreads go as low as 0.1 pips, though their average commission is pretty high at $13.2. Still, they have no withdrawal commissions, and they provide access to plenty of other trading instruments besides forex.

Admiral Markets

Admiral Markets is another popular choice — they’ve got all the major platforms such as МТ4, MetaTrader Supreme Edition, MT5, and WebTrader. Also, their $1 minimum deposit is quite attractive to novice forex traders that don’t want to put down a lot of money right away.

The broker’s spread is in the range of 0-0.5 pips, which isn’t the lowest out there. Still, you can trade in currency pairs, futures, stocks, and cryptocurrencies. Plus, they’ve got no withdrawal commissions and their average swap commission is just $5.

XM

XM offers just two platforms — МТ4 and MT5. Still, they’re the most popular ones, and the broker also offers 16 platform modifications. The minimum deposit depends on the account you choose, and it can go up to $100.

The same goes for the spread, though it definitely doesn’t have the best offer on the market in this regard — depending on your account, it can be between 0.6-1 pip, and a fixed $3.5 spread. The diversity of available assets is decent, seeing as you can trade in currency pairs (including cross rates), stock indices, shares, energy products, and precious metals include gold, silver and other.

Summary

Knowing how to read and understand currency pairs is one of the most basic pieces of knowledge you’ll need to master forex trading. Every currency pair, which consists of the relative values of a base currency and a quote currency, is represented via bid and ask prices on broker’s platforms. Learning how to read these, and their order books that give you more market information, is an essential skill for any forex trader.

FAQs

How do you read a currency base?

The transaction currency — mostly called the “base currency” is the first one you’ll see in any Forex quote. It’s followed by the second, quote currency, which is also called the counter currency.

How many currency pairs should I trade?

For new traders, it’s often a good idea to focus on no more than two currency pairs. Most traders end up choosing USD/JPY and EUR/USD because of the sheer volume of information for these two pairs.

What is the best time to trade currency pairs?

Usually, the overlap between 8 AM and noon at the New York and London exchanges is where most trade volume occurs.

How are currencies abbreviated?

All currencies have three-letter ISO designations.

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.