When to Sell Stocks – Top 5 Triggers You Should Know

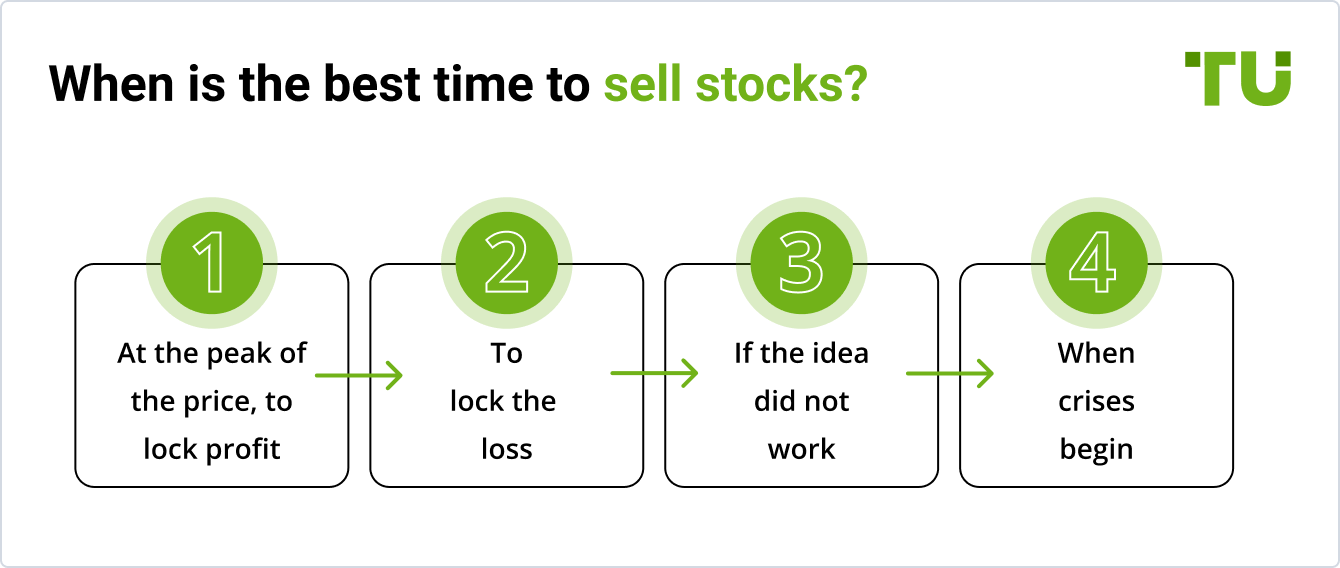

Selling stock is an action caused by several universal reasons. They equally apply to professional stock traders and to retail investors. We singled out 5 triggers that make traders send stock selling orders to the brokers:

Selling Stock to Make Profit

Selling Stock to Fix Loss

Selling Stock, when the initial idea is not working anymore

Selling Stock For Financial Needs

Buffett Approach to Selling Stocks

Below, we will review each of these triggers. Understanding them will help you avoid losses when you sell stocks.

General Ideas For Selling Stocks

Generally speaking, any transaction in the financial market may be caused by:

-

1

Conclusions made on the basis of fundamental news. For example, when a report indicates a decline in profits and the company’s management predicts a further drop in sales volumes.

-

2

Results of the technical analysis. For example, selling stocks once the price reaches a strong resistance level.

We would also add a third factor for making a decision to sell stocks and that is personal reasons. For example, you may urgently need the money for a house makeover or for a gift at your kid’s wedding.

We will try to cover these three factors briefly in this article.

No.1 Selling Stock For Making Profit

When you perform transactions in the stock market, you must have a plan, because stock trading is not gambling. This plan must include your expectations of the price.

Once the price reaches the level of your best expectations, it will be quite rational to sell the stocks (fully or a part of the position) to earn a return on the right idea.

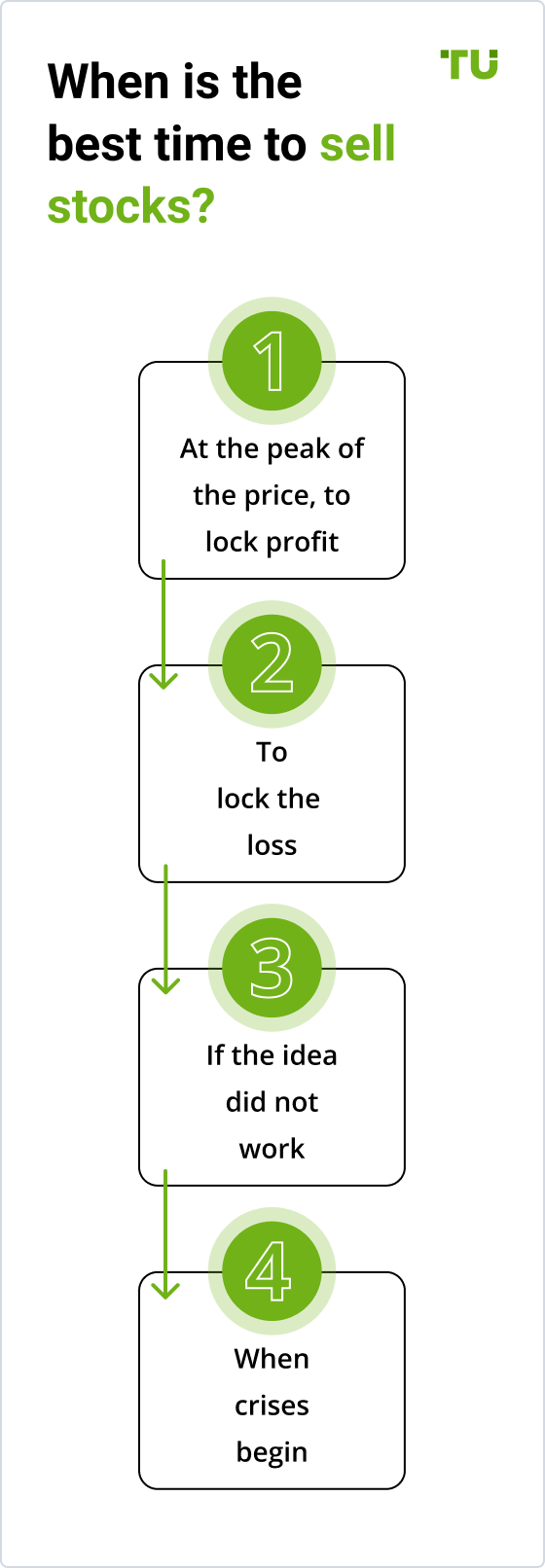

In order to determine the levels, when you can sell stock to make profit, you can use the prompts of the professional Wall Street analysts. For popular stocks, there are rankings and assessments available from different sources. For example, you can find those on MarketWatch, Bloomberg and The Wall Street Journal.

The screenshot below shows that at the time of publication of this article the analysts assigned BUY rating to AAPL stocks, while the average target price was $166.21.

AAPL Analyst Ratings

If you follow the forecast of the analysts and buy the stock, and then it reaches the level of $166.21, it will mean that the forecast came true and your decision to sell the stock to make profit will be justified.

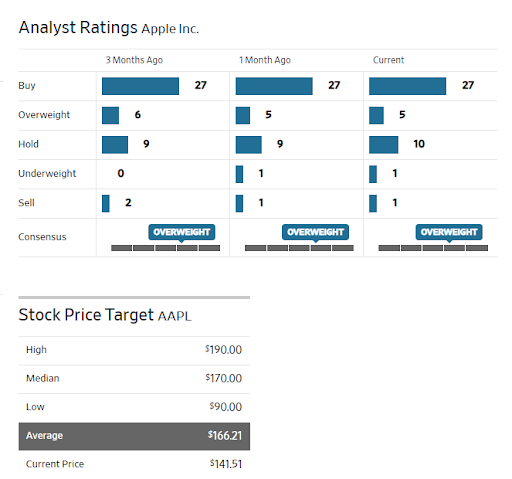

Another situation comes from technical analysis. Let’s say that you built a line of an upward trend (1) for NFLX stock based on the 3 reference points.

NFLX Technical Analysis

When the price dropped (2) to this line in autumn 2019 you bought the stock, let’s say, at $280. You could even increase your position in spring 2020 (3) against the background of the panic caused by the pandemic, upon seeing that the stock is acting stronger than the market. In summer 2020, the price reached the top line (4) of the channel built from the top of 2018. Technically, selling stock at $550 would be the right decision.

No.2 Selling Stock for Fixing Loss

As we’ve already mentioned, when you buy stocks you must have a plan with your specific expectations. If the expectations are justified, you will make profit by selling stocks (as we showed above).

But what about the situations when reality falls short of expectations?

There is no doubt that you need to sell stocks and accept the loss. This is certainly more difficult emotionally, than locking in the profit. However, in order to preserve your capital, it is critical that you learn to accept the loss.

Take, for example, TSLA stocks. Let’s assume that you built an ascending channel based on the reference points, which are shown on the day chart below with arrows.

TSLA Technical Analysis

When the price dropped to the lower trend line (1), at around $675, you bought the stock. The fact that it did not bounce up sharply could have alerted you, but you decided to act according to plan and not sell stocks until the price reaches the top border of the channel. However, the candlestick of May 10 (2) clearly indicates that the plan is not working. The price is dropping beyond the channel, and, what’s even more unpleasant, on a growing volume, which indicates sales pressure. You need to urgently close the position and sell stocks at a loss, before it becomes catastrophic.

To avoid experiencing negative emotions from making a difficult decision, we recommend using a Stop Loss order, which is executed automatically. For example, in the above situation, it would have been appropriate to set it at around $640. Your target was at around $800, and therefore a $35 loss is an acceptable risk compared to $125 return potential.

You can’t be successful in every single one of your traders. By selling stocks at a loss, you lose a battle, but you don’t lose a war. All champions experienced defeats. By controlling the risks and choosing stocks with high potential, you want your return to cover your losses, and thus earn you a profit in the long run.

No.3 Selling Stock, when the initial idea is not working anymore

Trading ideas can come from any place in the Universe of new opportunities.

Some ideas may be related to:

-

Fundamental events, such as a change of interest rates, news release about level of employment, a change in the rating of the stock by investment banks, a change in the composition of stock indices.

-

Signals of technical analysis, such as a crossing a psychological level, breakout of the pattern of technical analysis, divergences of oscillators, signals of volume indicators, etc.

Regardless of which idea you choose to base your trade on, it usually becomes clear very fast whether the idea is working or not. When the idea is working, you will have the pleasant chore of watching your return grow.

However, if the idea is not working, try not to give it a second chance. If that is the case, you need to sell the stock without any regret and find the reason why your idea did not work. You need to understand what to do to avoid making mistakes in the future.

For example, you are employing a dividend portfolio strategy and buying stocks with the best price/dividend ratio. However, several months in you see that your strategy is not bringing the desired result. You sell the stocks from this portfolio. Several positions will be closed at a profit and others at a loss. In this situation, you will simply realize that the price/dividend ratio is not enough for a transaction.

The other option is when the market leaders change. For example, you bought AMZN stock, which grew actively in price despite the quarantine restrictions in 2020, including because the company benefited from its employees working from home.

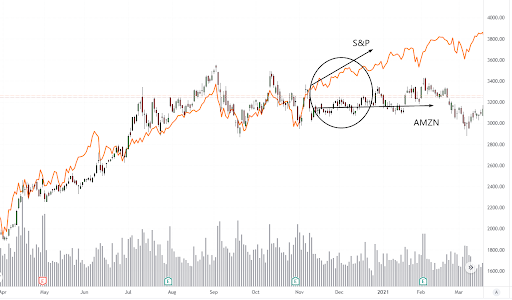

S&P500 and AMZN Charts

Let’s assume that you bought AMZN stock at the $3,000 breakout expecting further growth, and, unfortunately discovered, that the stock price went sideways, while the market continued to rally (see the image above). The idea didn’t work and the only solution was to sell the AMZN stock.

Tip. Don’t take it as a personal defeat. The idea that didn’t work is a common situation. Switch to other opening opportunities instead of overanalyzing and criticizing yourself.

No.4 Selling Stock For Financial Needs

Opening positions in the stock market you will quickly notice that the price is a stubborn thing and does not always behave the way you expected it to. It is the same in life. You cannot predict everything when you plan your life. From time to time you may need to spend money on the things you could not have predicted.

That’s fine. Stocks are a way of saving and multiplying capital. There is a time when you transfer money into stocks, but it is not a one-way street. There will be a time to extract capital from the stocks and transfer it into cash to address your needs – buy property, spend money for your health, move, support family members, etc.

In this case, it is important not to sell stocks that form the basis of your portfolio. For example, if you focus on S&P 500 in the long-term, try to hold the index funds untouched in order not to disrupt your main financial targets. Try to make do with the sale of stocks that you bought for short-term speculative goals or other stocks that don’t disrupt the main profile of your portfolio.

No.5 Buffett Approach to Selling Stocks

The best way to become skillful is to turn to a professional. The same goes for stock selling. Warren Buffett is arguably the best investor in the world. What does he think about stock selling?

Interestingly, the Oracle of Omaha prefers not to sell stocks at all.

Buffett Approach to Selling Stocks

Warren is for long-term owning of stock, for as long as the company remains excellent and has:

-

continuous growth;

-

quality control system working for the benefit of shareholders;

-

consistently high return on equity;

-

high level of retained earnings;

-

low level of expenses required for maintaining current operations.

There is sense in selling stocks of such a company if the aforementioned circumstances change or if alternative investment looks more promising.

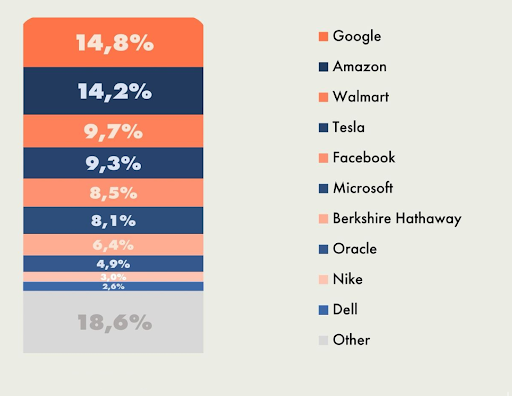

A similar approach was described in The Intelligent Investor by Benjamin Graham. Having read it at the age of 19, Warren has been following its principles throughout his entire career. Look at the structure of portfolios of the richest Americans. Think that the specified stocks have increasing internal value, which makes them a good acquisition. Why sell the stocks that represent a successful business?

Structure of portfolios of the richest Americans

Tip. Read several books on fundamental analysis of stocks. Compare them with the chart. Notice how strong fundamentals help a company to get through tough times.

What is The Best Time to Sell Stocks?

There is no universal answer to this question. Let’s be objective, in order to answer it you need to know what is the purpose of selling these stocks. And what was the purpose of buying these stocks? And then, you have to account for a multitude of factors, including the signals of technical analysis.

Be that as it may, we offer you two options, when the decision on selling stocks will most probably be the right one.

Option 1. Selling stocks amid general hype

If shoe shine boys are giving stock tips, then it’s time to get out of the market.”

It is not so important who said this on the eve of the 1929 stock market crash – Joe Kennedy, J.P. Morgan or John Rockefeller. The meaning behind the phrase is what’s important. If everybody talks about how good it is to buy stocks, think about selling them.

A more recent example is the dotcom bubble burst in 2000.

Dotcom bubble burst in 2000

From time to time, speculative bubbles form at the exchanges, when the growth of assets attracts an abnormally high number of retail investors looking to get rich quick. The price curve in these cases goes up exponentially. At that, it is too early to sell as selling is still risky, but buying is already risky, because it is too late.

Analyze the history of burst bubbles in order to be ready to sell stocks at a time, when everybody else only dreams of buying them.

Option 2. Selling stocks amid a global economic recession

Usually, a stock index grows 8% per year, with stocks from different industries showing various dynamics of growth. Some industries may decline, even when the majority are showing growth.

However, if all stocks start to simultaneously drop in price, you don’t need an IQ of over 130 to understand that things are not good and that it’s time to sell stocks. A decline in quotations may indicate serious economic issues, or it can be associated with global shocks, politics, wars and disasters.

In these situations, only few companies will continue to show stable growth. Therefore, it would be prudent for an ordinary investor to sell stocks and secure cash, and then wait for a more favorable situation.

Energy Select Sector Charts

The chart shows decline in stocks of different sectors in spring 2020, when the world entered the Covid-19 pandemic. The stocks of technology companies (broken green line) performed best, but it was still dangerous for the deposit not to sell them.

Summary

The majority of investors are interested in learning which stock to buy. However, selling stocks also bears great significance.

In this article, we listed 5 reasons that might motivate you to sell stocks.

In conclusion, here are several tips from 20 professional stock traders Traders Union works with:

don’t try to sell stocks at the peak of the market;

give preference to selling stocks of the companies that perform weaker than the broad market index;

take notice of the fundamental indicators of the company in order to sell the part of business that does not perform well enough;

control your risks. Sell or reduce the number of stocks that pose a threat to your portfolio.

FAQs

How do I sell stocks?

You need to send a trading order to your broker. It is a reverse of the buy procedure. As a rule, you create an order and send it on your trading platform. The exchange must be open in order for it to be executed. If you are experiencing difficulties, contact customer support for assistance.

Can the falling stocks reduce my account to zero?

If you bought stocks with leverage, the chances of this unfavorable outcome are higher. If you bought your stocks for your own money, the account will be reduced to zero once the price of all stocks you bought drops to zero, which is highly unlikely if you are buying stocks of major companies, such as Apple, Google, Exxon, Berkshire.

Can I sell stocks if the exchange is not open yet?

99.9% you cannot. In reality, brokers can trade stocks in the OTC market, but this service is usually unavailable to ordinary investors.

Is there a commission charge on the sale of stocks, when I had already paid commission when I bought them?

It depends on your broker. As a rule, a commission is charged on both. However, your broker may offer zero commission for these services.

Glossary for novice traders

-

1

Extra

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

-

2

Upward Trend

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

-

3

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).