When it comes to the word investing, most people visualize handling massive amounts of money and monitoring the exchange of millions of dollars on stock tickers and applications. It can be intimidating for new people to approach the stock market, especially when preconceived notions about what it takes to become an investor.

The reality is that anyone can invest in the stock market. One doesn’t need to personify the Wolf of Wall Street to start investing. It’s a misconception that a massive bank account is necessary to begin investing. Even with little initial investment, investing in stocks can yield some excellent returns.

Many people don’t realize the importance of investing in stocks early. Investing is an efficient way to build wealth over a certain period. It’s essential to understand how the market works to get started with investing. Without a proper understanding of the basics, earning decent returns on the investment will be difficult.

Here’s a beginner’s guide to investing in the stock market that anyone can use!

1 Step 1. Choose Your Stock Investing Strategy

The first step that any beginner investor needs to take is picking an investment strategy that suits their needs. It can be daunting for newcomers who are completely unfamiliar with investing in stock to find a place to start.

That’s why one of the best places for new investors to begin is by looking at their financial situation. By looking at their financial situation, they’ll be able to assess whether they have enough money for investing.

After assessing the financial situation, it’s time to move on towards investment goals. All individuals have different goals, and investors must determine what they're are looking to achieve in the stock market. By defining a goal, it becomes much easier to pick an investment strategy that works.

Another key aspect in helping decide what investment strategy to pick is individuals' risk tolerance. Risk tolerance refers to the variability in the investment returns that an investor is willing to withstand in the investment portfolio. High-risk investments mean greater returns, while low-risk investments are safer but don’t yield the same returns as quickly. It’s crucial to determine how much risk the investor is comfortable with before finalizing their investment plan.

Following these initial steps will help investors decide on an investing strategy. Following an investment strategy can make picking the right stocks for the investment portfolio much easier!

Learn About Portfolio Diversification

Many How To Invest In Stocks guides throw around the term portfolio diversification without really explaining it. Portfolio diversification is a risk management concept that can help any investor create a sustainable investment portfolio.

The concept of portfolio diversification is to invest in various asset classes and securities to ensure that the investment portfolio's overall risk remains low. Even if the investor wants to invest in stocks, they can diversify while remaining in the same asset class.

The purpose of portfolio diversification is not to help investors maximize returns on their portfolio but to minimize risk. By reducing the level of risk, new investors can maintain a much more sustainable investment portfolio. Hence, all newbies need to focus on learning as much as they can about portfolio diversification.

Consider Dividend Stocks for Long-Term Returns

Investors that are looking to trade actively and exponentially increase their investment are eye-catching. However, this is not the only way to proceed. If an investor's goal is to receive regular income over a long time, investing in dividend stocks is a good choice.

Dividends stocks give out a portion of the company’s earnings regularly. In America, dividend stocks pay investors a set amount after every quarter. The very best dividend stocks increase their payouts over time. That allows investors to build an improving cash stream that compounds every year. After receiving the dividends, investors can also choose to reinvest them!

Only the biggest companies pay out dividends, which is why dividend stocks are a good low-risk investment for a new investor’s portfolio. There are two main ways that investors can buy dividend stocks. They can choose to invest in individual dividend stocks or go with an index fund or dividend exchange-traded fund.

The difference between the two is that a dividend fund provides the benefit of instant diversification. It’s essentially a portfolio of dividend stocks. If there’s an issue with one stock, the others will still provide investors with a healthy dividend. Alternatively, investing in individual dividend stocks provides the advantage of specifically picking stocks that will provide a high yield but carries a higher risk.

How to Invest in Penny Stocks? (High Risk)

Penny stocks are companies that trade on a very low share price. Most of the time, that price is lower than $1, making them super appealing to beginner investors. It’s easy to get caught up buying cheap stocks, then selling them for significant profit when the prices increase.

However, even though penny stocks cost very little, they fall under the highly speculative and high-risk category. This is because of a lack of liquidity, a significant discrepancy between the asking price and bid price for an asset, and small market capitalization.

Investors that want to trade in penny stocks will need to find brokers that deal in smaller markets. These stocks aren’t available on the NYSE and Nasdaq. These major stock exchanges have listing requirements that need to be met, including a minimum share price.

While penny stocks can be lucrative investments, it’s a difficult strategy for new investors to follow. Those that manage to get the hang of things can reap the benefits of investing in high-risk penny stocks!

2 Step 2. Decide How Much To Invest In Stocks

Once investors have a fair idea of their investment goals and strategy, they can move on to deciding how much they want to invest in stocks. There’s a common misconception that it requires immense wealth to make investments in the stock market. That isn’t the case.

However, rookie investors can often struggle with deciding how much they should invest in stocks. Here’s a complete guide on how to determine what proportion of income to invest in stocks.

How To Determine What Proportion Of Income You Should Invest?

Investors should look to put 10-15% of their income towards investing in stocks. For example, if an individual earns $5000, they should devote between $500 to $1000 to investing in stocks.

An individual’s age and time until retirement play an important role in determining the appropriate amount they should invest in stocks.

Investors that are younger and have a lot of time until retirement don’t need to contribute a major proportion of their income. In comparison, older investors closing in on their retirement should spend a greater proportion of their income on investing in stocks.

If the investor is risk-averse, they’re likely to spend a lower portion of their income on investing in stocks.

How to Invest in Stocks with Little Money?

Investors with little money have a few options they can use to begin their investing journey. Investors can start building their investment portfolio with little money by using a Robo-advisor. Robo-advisors have now been a part of the stock investment industry for nearly a decade. They’ve made investing simple and accessible for everyone.

Typically, a Robo-advisor will ask the investor a few questions to determine their goals and risk tolerance. After selecting these, the Robo-advisor will invest the client’s money into a diversified low-cost portfolio of stocks. The algorithms present help ensure that the advisor continues to rebalance the portfolio and optimizes the returns.

Previously, investing in the stock market was challenging. There were broker fees, trade commissions, and several other costs. However, the emergence of online brokers and applications has made it much easier to invest in the stock market with little money. It’s now possible for investors to start with as little as $1. If you are wondering how to trade stocks with $100, read the Traders Union article.

3 Step 3. Consider Main Instruments to Start Investing in Stocks

Investors have a wide variety of investment instruments to choose between. That’s why the next step is considering the main instruments. Four main instruments trade on the stock market, which are listed below:

Shares/Stocks

The most common instrument that investors can start with is stocks (these consist of shares). Typically, investors purchase stocks intending to sell them for a profit at a future date, earning them a return on their investment.

- Capital gains

- Dividends

- Tax advantages

- Easy transactions

- Capital losses

- Some stocks are high risk

- Several additional fees

Derivatives

Derivatives are a complex form of stocks, and they also go by the name future and options stocks. These are essentially contracts to buy or sell a commodity on a specific date for a pre-determined rate.

A futures contract gives the investor the right to purchase or sell a certain amount at a set rate. On the other hand, an options contract has the same feature, but there’s no obligation.

Derivatives are more challenging to trade in comparison to other financial instruments. Only investors that have an intermediate understanding of how the market works should trade in derivatives.

- Risk management

- Flexible contracts

- Leverage

- Mismanagement can lead to potentially large losses

- Complex

Bonds

Bonds are among the safest methods of investing in the stock market. They’re low-risk investments because they guarantee a certain interest rate at a specific date. Even if the interest rate fluctuates, it won’t drop below the specified limit after issuance.

While they’re very safe investment options, bonds don’t provide the same level of profits that stock and derivative trading provide.

- Fixed returns

- Lower risk

- Less volatility

- Low returns in comparison to other instruments

- Require large investment

- Not as liquid as stocks

Mutual Funds

Mutual funds are collective investment pools where several people come together to invest money. As a result, the level of risk is lower than individual investments. The fund managers then use the pooled money to manage an investment portfolio.

There are three main ways that investors receive a return from mutual funds:

- Investors will earn dividends from the stocks and interest on bonds that the portfolio holds.

- If the funds sell any securities with higher prices, they’ll pass on the capital gains to investors in a distribution.

- If the price of the stocks held in the mutual funds portfolio goes up, the fund manager can choose to hold the stock. Holding the stock would lead to an increase in the market value of the mutual funds share. Investors can then sell these shares at a profit.

- Simple diversification

- Professional portfolio management

- Liquidity

- Multiple options

- Low cost

- Lack of control

- Active funds tend to be expense

- Tax Implications

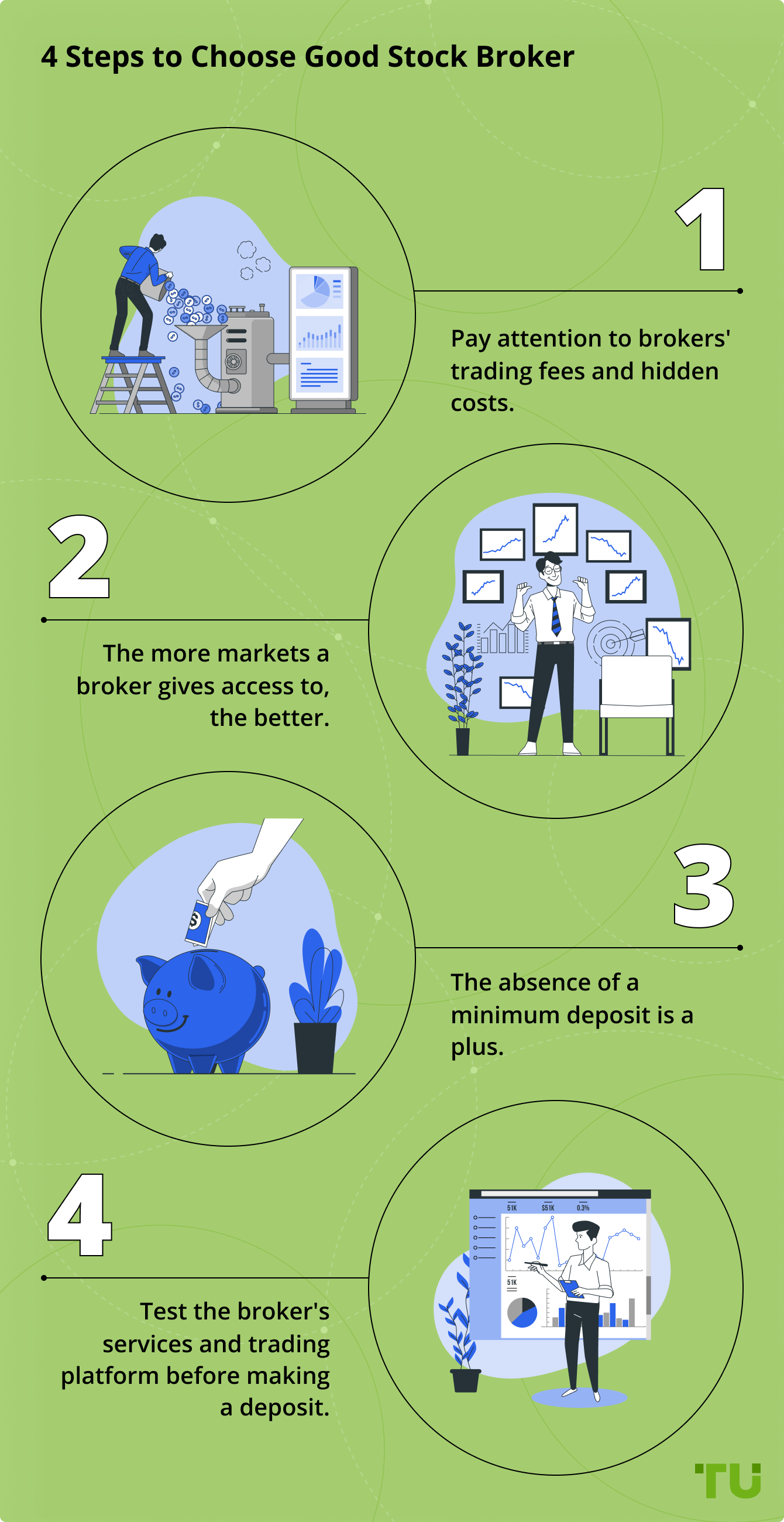

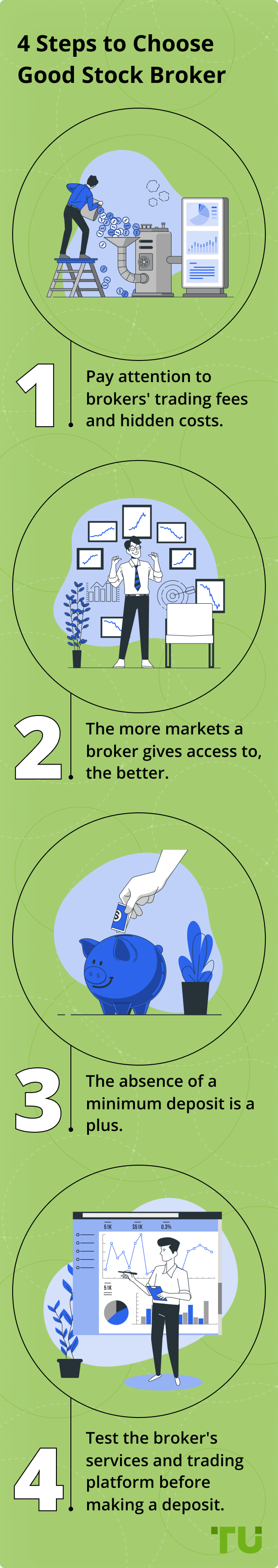

4 Step 4. Find the Right Stockbroker

There are many requirements to being a genuinely profitable investor, such as finding the right stockbroker. There are hundreds of online trading platforms and stockbrokers to choose from.

Finding the best online stockbroker is similar to picking an investing strategy. The investor needs to assess their needs and goals and then select the platform that aligns with the criteria. By narrowing down on their requirements, investors will identify which stockbroker fits them the best.

New investors should look for stockbrokers that are accessible, have low costs, provide easy support, have various educational tools and stock trading courses.

Finding the right online stockbroker is crucial for any new investors entering the market. That’s why it’s essential to take a look at the best online stockbrokers in 2023!

eToro – Best for Web Trading

eToro is an excellent choice for novice traders. The company offers a proprietary trading platform with a convenient user interface. A demo account and instruments for learning how to trade are available. A copy trading service is an important advantage of eToro for beginners. It allows novice traders to learn from more experienced colleagues by watching how they open positions. In addition, copy trading can bring your passive income, even if you are still learning how to trade stocks.

Webull – Best for Casual Investors

Investors looking for a casual introduction to investing in the stock market will love what Webull offers. They have a slick and user-friendly interface for both their mobile app and website.

However, underneath the surface is a set of powerful tools for active traders as well. The only thing that holds it back is the lack of educational support and access to a few asset classes like mutual funds.

TD Ameritrade – Best for Active and Beginner Investors

TD Ameritrade is the best overall platform for both active trades and new investors. It provides access to high-quality trading platforms, no commissions on stocks, options, and ETF trades.

The investment options also include a wide variety of mutual funds. They offer decent customer support and free access to educational research that will help any new investor.

Fidelity – Best for Mobile Investors

The highlight of the Fidelity package is the brilliant mobile app. It offers a significantly better experience than all the other online trading apps.

Fidelity also provides investors with a variety of investment options along with high-quality research tools and trading platforms. It’s a great platform for investors that want a quality mobile investing experience.

Robinhood – Best for Low-Income Investors

Robinhood doesn’t offer many features that other online trading platforms offer, but it’s the only service that’s completely free.

The platform still provides free stock, options contracts, ETFs, and cryptocurrency trading. It’s the best choice for investors looking to limit their costs and engage in some crypto trading.

5 Step 5. Take into Account Stockbrokers Fees and Commissions

Like traditional stockbrokers, online stockbrokers have their fees as well. However, recent legislation ensures that most online platforms can offer commissions free trading on most investment options.

There are still a few fees that new investors need to consider when signing up with an online platform. The most ones are minimum deposit requirements, stock trade fees, and broker assistance fees.

Here’s a breakdown of the fees investors can expect while using online trading platforms.

| Stock fees | ETF fees | Mutual Funds fees |

Inactivity Fees |

|

|---|---|---|---|---|

| Webull | $0 | $0 | $0 | $75 |

| TD Ameritrade | $0 | $0 | $0 | $75 |

| Fidelity | $0 | $0 | $0 | $0 |

| Robinhood | $0 | $0 | $0 | $0 |

| Etrade | $0 | $0 | $0 | $75 |

6 Step 6. Manage Your Portfolio Keeping Your Goals In Mind

By following the above steps, all investors should have a valid and functioning investment portfolio. If done correctly, the investment portfolio will have a diverse group of assets that will help minimize the level of risk.

However, even after doing that, the investor still has to continue working on maintenance. Understanding portfolio management has to do with the fundamentals. Every investor should keep these fundamentals in mind when managing a portfolio:

Here’s a breakdown of the fees investors can expect while using online trading platforms.

Focus on the long term

Don’t skip on research

Diversify

Don’t make any rash decisions

Make small and regular investments

By following these golden rules, investors can ensure that their investments remain on track. Their portfolio provides optimal returns while retaining minimal risk.

Rebalancing Portfolio

To ensure that the investment portfolio retains its original level of risk, it’s important to periodically analyze and rebalance the portfolio. If investors want to make long-term investment portfolios, they have to understand the concept of rebalancing.

After a certain time, all stocks inside the investment portfolio will provide a different return. The differing returns will cause the weights in the portfolio to change and risk increases. Rebalancing is simply the process of buying and selling necessary portions of the investment portfolio to revert every asset class to its original weightage.

Alternatively, rebalancing can also help align the investment portfolio to the investor’s new investment strategy.

When to sell your stocks?

An essential requirement of becoming a profitable investor is knowing when to sell a stock. Experienced investors tend to establish a price range while buying a stock. When setting this price range, it’s essential to ensure that the current price is substantially lower than the estimated value.

Keeping an eye on the stock isn’t enough, though. Investors must also keep an eye on the business's performance. If the business's performance declines, it’s a good idea to sell the stock to avoid incurring any significant losses.

Stockbroker Account Opening Example

This is how new investors can open accounts with online stockbrokers. This is the process for Webull.

Sign Up For An Account

Investors must enter their details and set up their accounts. They have the choice to sign up via email or phone number.

Open Accountt

After logging in, click on the ‘Open Account’ option.

The application for the account will open and must be filled completely.

Agreements and Disclosures

Webull will show users a few disclosures they must agree to before the account can open. Users should read through them and then click I Agree.

Verify Email

For users who signed up via phone number, Webull will require an email address.

Wait For Approval

After verifying an email address, Webull will take 2-3 business days to verify and approve applications. Once users have their accounts approved, they can add their bank account and start trading.

How Much Can Investors Earn by Starting Investing in Stocks?

The amount investors can earn from the stock market depends on how much the stock market goes up or goes down while you’re holding assets. Each market has an index that indicates its performance. That index can give investors an inclination of how much investors can expect to earn or lose in a given year.

According to analysts, over the past 100 years, the stock market has an average return of between 7%-10%. It’s important to understand that this is an average return, and actual market conditions are prone to significant change.

Can You Lose Money Investing in Stocks?

Investors can lose significant amounts of money in the stock market. The stock market is prone to external crashes, and misguided investment decisions can result in investors losing money.

Main Risks

Two major risks come with investing in shares. These are:

Volatility

Share prices can increase dramatically and have the potential to decrease significantly and even reach zero.

Credit Risk

Ordinary shareholders are the last line of creditors. That means if the company goes bankrupt, the investors aren’t going to get their money back.

How to Earn More with Traders Union?

Investors looking to deal with foreign exchange markets will have to deal with high commission fees for Forex brokers. Luckily, they can offset these by signing up with Traders Union.

By doing so, investors will receive compensation from Traders Union for the commission fees they pay to brokers. That means that investors will earn more from their investments and get access to a wider variety of investment instruments via the foreign markets.

Traders Union is an international union for Forex traders around the world. It’s the first and largest association of Forex traders around the world. The main goal of the Traders Union is consulting and providing legal support for traders.

Summary

There are six major steps that any investor needs to follow. First, they’ll need to see what investment strategy suits their needs the most. The second step involves deciding how much to invest. A general rule of thumb is to start with 10-15% of income. Then comes the fun part of deciding what main financial instruments should become a part of the investment portfolio.

The next step involves getting the right online stockbroker. Once the broker is finalized, investors can purchase their assets and have a proper investment portfolio. Finally, the investor must move on towards maintaining their investment portfolio. That involves analyzing the portfolio and rebalancing the assets as necessary.

How to invest in stocks in different countries

FAQ

Do all stocks pay a dividend?

No, only stocks from the biggest companies pay a dividend. Other forms of stocks can be traded to earn a dividend.

Are all online stockbrokers free?

No, there are very few online stockbrokers that are completely free. While investors are signing up with these platforms

Can I start investing with $1?

It’s technically possible for anyone with $1 to start investing and trading. However, it’ll take some expert-level trading to help make that $1 into anything significant.

Can anyone sign up with Traders Union?

Anyone looking to make transactions in the Forex market can join Traders Union and get the benefits.