How To Work With The Financial Reporting Calendar

How to use the financial reporting calendar:

Buy shares before closing the shareholder register - make money on dividends

Buy shares if financial statements are better than expected

Close trades at the time of reporting if you are afraid of high volatility

A financial reporting calendar is an important tool for investors, analysts, and other market participants. It allows you to track the dates of company financial statements, which is essential for making informed investment decisions.

In this article, we will discuss how to use a financial reporting calendar. We will cover how to find it, how to interpret the information it provides, and how to use it for your purposes.

What is a financial reporting calendar?

A financial reporting calendar is a tool that provides dates and time frames for the release of financial reports by companies. It encompasses the following key events:

Reporting periods. Indicates the time intervals for which companies provide their financial information. These periods can be quarterly or annual.

Publication dates. Specifies when it is anticipated that a company will release its reports. This includes dates for preliminary announcements and final reports.

Investor conferences. Dates when a company holds conferences for investors to present its financial results, provide commentary, and respond to questions.

Dividends. If a company pays dividends, the calendar may include announcement dates, ex-dividend dates, and payment dates.

Annual shareholder meetings. Dates when shareholders gather to approve financial reports and make important decisions.

This calendar helps investors and analysts keep track of crucial dates, enabling them to make decisions based on current financial information.

Best stock brokers

How to find a financial reporting calendar

A financial reporting calendar can be found on various websites dedicated to finance and investing. For example, it can be found on the websites of companies, exchanges, investment banks, and other financial institutions.

You can also use specialized services that collect information about company financial reporting calendars from various sources. These services include, for example, Investing, Finviz, Seeking Alpha, and GuruFocus.

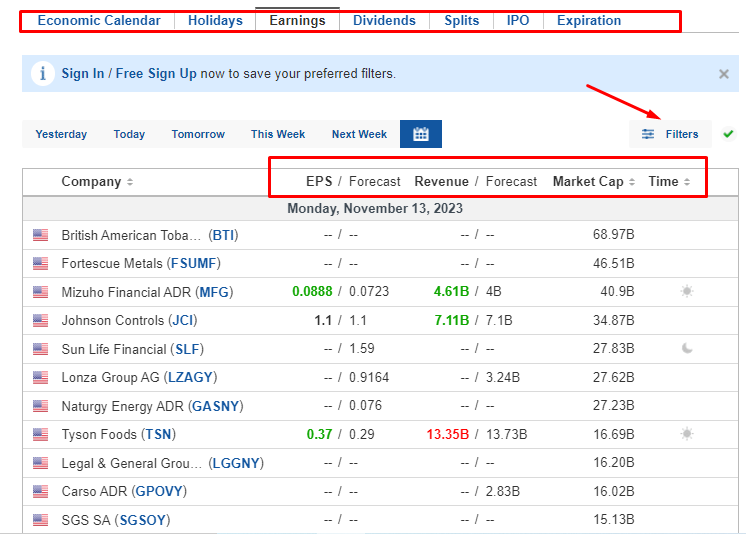

Image: Economic calendar section

How to use a financial reporting calendar

A financial reporting calendar can be used for various purposes. Here are a few examples:

Track the dates of company financial statements in which you invest. This will allow you to receive timely information about the financial results of companies and make appropriate investment decisions.

Analyze the financial results of companies before making investment decisions. Studying financial statements allows you to get a more complete picture of the activities of companies and assess their investment potential.

Compare the financial results of companies. Comparing the financial statements of companies allows you to identify the strengths and weaknesses of their activities.

Market Movement forecasting. Traders can use the dates of financial report releases to predict expected market fluctuations. For instance, positive results may contribute to stock price increases, while negative outcomes may lead to declines.

Effective trading strategy planning. Knowing the timing of report releases allows traders to adapt their strategies. Some prefer to avoid trading around significant announcements, while others aim to trade during heightened market activity.

Risk mitigation. Steering clear of trading during periods of major report releases helps avoid sudden market movements, reducing risks and preserving capital.

Reacting to dividends. The calendar includes dates for announcements, ex-dividend dates, and dividend payouts, crucial for those trading stocks based on dividend income.

Informed decision-making. Having access to the financial reporting calendar empowers traders to make informed decisions based on fundamental analysis and an understanding of anticipated market events.

The financial reporting calendar becomes an integral part of a trader's toolkit, aiding in a better understanding of the market context and enabling informed decision-making.

Trading strategies using the financial reporting calendar

Leading-Buy Strategy

This strategy involves buying a company's stock before its financial statements are released. Investors who use this strategy believe that the prices of stocks of companies that exceed analyst expectations will rise in anticipation of the release of the reports.

To use this strategy, investors should track the dates of financial statements for companies they are interested in. They should then assess the financial performance of these companies to determine how well they meet analyst expectations. If investors believe that a company's financial performance will exceed analyst expectations, they can buy that company's stock before the release of the reports.

Leading-Sell Strategy

This strategy involves selling a company's stock before its financial statements are released. Investors who use this strategy believe that the prices of stocks of companies that do not meet analyst expectations will fall in anticipation of the release of the reports. If investors believe that a company's financial performance will not meet analyst expectations, they can sell that company's stock before the release of the reports.

Dividend Gap Trading Strategy

A dividend gap is a drop in the price of a stock on the day after the ex-dividend date. It occurs because shareholders who own shares on the ex-dividend date receive dividends, but shareholders who purchase shares after the ex-dividend date do not receive dividends.

The dividend gap trading strategy involves buying a company's shares before the ex-dividend date and selling them on the day after the ex-dividend date. Investors who use this strategy believe that the price of the stock will drop by the amount of the dividend on the day after the ex-dividend date.

To use this strategy, investors need to track the ex-dividend dates for companies they are interested in. They then need to assess the size of the dividends that will be paid to shareholders. If investors believe that the size of the dividend will be significant, they can buy shares of that company before the ex-dividend date.

Conclusion

Financial reporting calendars are a useful tool that can be used for a variety of purposes. However, it is important to remember that using a financial reporting calendar does not guarantee success in investing. Investors should conduct their own analysis of financial statements to make informed investment decisions.

Here are some additional points to consider:

Financial reporting calendars can be a valuable resource for investors, but they should not be used as a substitute for careful research.

Investors should read financial statements carefully and understand the company's financial position before making any investment decisions.

Investors should also consider other factors that can affect the price of a stock, such as economic conditions, industry trends, and company-specific news.

By following these tips, investors can use financial reporting calendars to make more informed investment decisions.

FAQs

How do you make a financial calendar?

A financial calendar can be made manually or using a software program. To create a financial calendar manually, you will need to gather information about the financial reporting dates for the companies you are interested in. This information can be found on company websites, investor relations websites, and financial news websites. Once you have gathered the information, you can create a table or spreadsheet that lists the company name, the reporting date, and the type of report (e.g., earnings report, balance sheet, cash flow statement).

What is the financial calendar?

A financial calendar is a tool that tracks the dates when companies are scheduled to release their financial statements. This information can be used by investors to make informed investment decisions. For example, an investor might use a financial calendar to find out when a company will be releasing its earnings report. The investor can then read the report to see how the company is performing and make a decision about whether to buy, sell, or hold the stock.

How to trade using a financial reporting calendar?

Use the calendar to plan trading activities around major events. This may involve adjusting positions before key announcements, avoiding trading during volatile periods, or capitalizing on expected market movements following specific reports.

Where can I find a financial reporting calendar?

There are a number of places where you can find a financial reporting calendar. Some financial websites, such as Google Finance and Yahoo Finance, have financial reporting calendars that you can access for free. You can also find financial reporting calendars on the websites of individual companies and investor relations websites.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Team that worked on the article

Alex Smith is a professional day trader for a proprietary trading firm within the foreign exchange (forex) and crypto markets. His area of expertise is day trading and swing trading within the 15min-4hr time frames for both the London and NY open.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).