How to Switch Forex Brokers? Comprehensive Guide

How to change Forex broker and transfer funds:

-

Research and compare brokers

-

Open an account with the new broker

-

Request a transfer initiation form from your new broker.

-

Notify your current broker

-

Adjust your trading strategy

Regardless of your level of experience, changing Forex brokers can have a big effect on your ability to trade and make money. TU professionals will carefully guide you through the necessary procedures in this guide to help you switch brokers while protecting your hard-earned money.

-

Can I change brokers without selling?

Yes, you can switch brokers without selling your investments. This process is carried out by the new broker after filling out a transfer initiation form. It lets you move your investments directly from one broker to another without liquidating them.

-

How do you tell your broker you are switching?

You will need to send a message to your broker’s customer care, notifying them of your request to transfer to another broker.

-

How do I transfer money from my brokerage account?

To transfer money from your brokerage to another, you will need to send a message to the new broker’s customer care for a transfer initiation form.

-

Does it cost money to switch brokers?

Yes, there may be fees associated with switching brokers. When you move your account, your current broker might charge an outbound transfer fee. These fees vary among brokers.

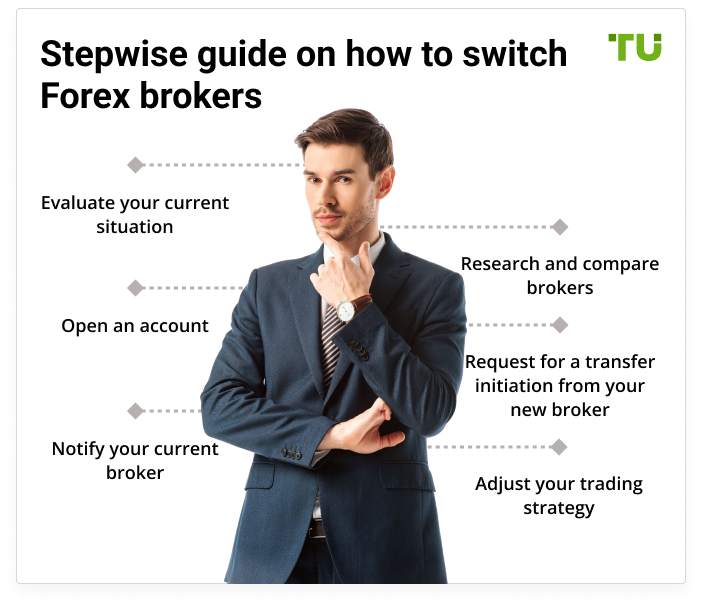

Stepwise guide on how to switch Forex brokers

Below is a comprehensive guide that TU experts have highlighted on how to switch Forex brokers:

Evaluate your current situation: Understand why you want to switch brokers. Is it due to dissatisfaction, better trading conditions, or regulatory concerns? Review your past trades, account performance, and any issues you’ve encountered with your current broker.

Research and compare brokers: Research reputable brokers based on factors like regulation, trading platforms, fees, spreads, and customer support. You can easily use Traders Union's Find my Broker tool to choose a broker based on dozens of parameters. Evaluate each broker’s features, including available currency pairs, leverage, and account types. Look for unbiased reviews from other traders to gauge the broker’s reliability.

Open an account with the new broker: Based on your research, select a new broker that aligns with your trading goals. Follow the broker’s account opening process. Provide the necessary documents for verification.

Request for a transfer initiation from your new broker: If your current broker allows broker-to-broker transfers, consider transferring your funds to your new broker. You will also have to inform your new broker of the transfer initiation form. You can also withdraw and use your new broker’s payment method to fund your new account.

Notify your current broker: Inform your current broker about your decision to switch. Request a transfer of your account balance. Ensure there are no open trades, pending withdrawals, or outstanding fees.

Adjust your trading strategy: Familiarise yourself with the new broker’s trading platform, tools, and features. Start with smaller trades to get comfortable before committing larger amounts. If you use Expert Advisors (EAs) or trading algorithms, adjust them for the new broker.

How do I transfer funds from one Forex broker to another?

Transferring your funds between two different Forex brokers is very possible and less complicated than you think. You will start by opening an account with the new broker to where you want to transfer your funds. For example FxPro is the broker you want to switch to.

After creating an account with FxPro, you:

-

need to send a screenshot of your virtual wallet from the other broker, which will also show your name and currency, to accounting@fxpro.com;

-

wait for further instructions;

-

will most likely be asked to fill out a transfer initiation form on the FxPro broker’s website by providing details about your old broker, account number, and the assets you want to transfer.

This transfer can take up to 48 hours to complete.

Top-3 Forex brokers

Is it a good idea to switch Forex brokers?

In certain situations, changing Forex brokers can be a wise decision. When considering whether to switch brokers, TU’s expert Mikhail Vnuchkov recommends that you consider the following factors:

Service quality and satisfaction: Switching to a broker with more affordable commissions and spreads can help you save money. Switching to a more simplified option might be wise if your present broker charges high fees or if their procedures are complex. As well, a well-designed platform enhances your trading efficiency. If your current broker’s platform lacks features or is hard to navigate, explore other, better alternatives.

Currency pairs and offerings: You may want to trade specific currency pairs or other financial instruments that your current broker doesn’t offer. Switching to a broker with a broader range of tradable assets can open up new opportunities. Ensure the new broker provides access to the markets you’re interested in because diversification is essential for risk management.

Regulatory compliance and reputation: Compare and research the regulatory status of your current and potential brokers because well-regulated brokers offer better protection for your capital. Look for reviews and ratings to gauge a broker’s reputation. Feedback from other traders can also provide valuable insights into a broker’s reliability.

Costs and fees: Compare the fees charged by different brokers. Consider not only spreads and commissions but also any additional charges, like withdrawal fees. If you find a broker with more favourable fee structures, switching may be worthwhile. High fees can reduce your profits over time.

Trading experience and support: Poor customer service can be frustrating. If your current broker is unresponsive or lacks helpful support, consider switching to one with better service. You should also evaluate the educational materials and resources provided by brokers. A broker that offers educational content can enhance your trading skills. Assess the availability of analytical tools, research, and market insights. Having a strong toolbox can help you make better trading decisions.

Trading psychology: Sometimes, a change of broker can positively impact your mindset. If you feel dissatisfied or stressed with your current broker, switching might alleviate psychological pressure. Unfavourable spreads or slow execution can affect your confidence. Switching to a broker with better execution speed can boost your trading psychology.

Is it time to switch the Forex broker?

Switching your Forex broker is a significant decision that can impact your trading experience and financial outcomes. While it may seem tempting to switch, it’s very important to weigh the potential risks and benefits. Let us take a look at the key factors that expert Mikhail Vnuchkov suggests you should consider before switching:

Downtime and transition costs: When transitioning to a new broker, there’s a possibility of downtime during the switch. Your trading activities may be temporarily disrupted. This switch can come with fees. Plan ahead by choosing an optimal time for the switch. Consider weekends or non-trading hours to minimise downtime.

Adjustments to the new platform: Each trading platform has its own features. Moving to a new one requires adapting to different interfaces, tools, and order execution methods. Familiarise yourself with the new platform before fully committing. Explore its demo features and ensure it aligns with your trading strategy.

Different trading conditions: Brokers vary in terms of spreads, leverage, execution speed, and available instruments. Switching may expose you to altered trading conditions. Research thoroughly. Compare spreads, execution quality, and other relevant factors.

Counterparty risk: Your broker acts as your counterparty in trades. If the broker faces financial difficulties or insolvency, your funds could be at risk. Opt for reputable and regulated brokers. Verify their financial stability and track record. Regulatory oversight provides an added layer of security.

Fraud and unregulated brokers: Unregulated brokers may engage in unethical practices, including fraud. Without oversight, you’re vulnerable to dishonest behaviour. Prioritise regulated brokers. Check their licences and reviews. Avoid brokers with a questionable reputation.

Demo testing: Transitioning without testing the new platform can be risky because unexpected issues may arise during live trading. Use demo accounts extensively. Test order execution, analyse charts, and simulate real trades. Ensure the platform meets your requirements.

When conducting thorough research on the best brokers, consider factors such as regulation, security measures, transaction fees, minimum deposit requirements, customer support quality, and available trading platforms like MetaTrader 4, cTrader, or a proprietary platform. Look for brokers regulated by reputable authorities, like the CySEC, to ensure transparency and accountability. Security features like two-step authentication are essential for protecting your account from hackers. Pay close attention to the broker's fee structure, including any hidden fees, and test out their trading platforms and demo accounts to see if they meet your needs.

What to do before you transfer a brokerage account

When preparing to transfer your brokerage account, there are several important steps to take. Here’s a concise checklist to guide you:

Make a list of your investments: Compile a comprehensive list of all your investments held within the brokerage account.

Download tax documents: Ensure you have copies of relevant tax documents associated with your investments. These may include annual statements, 1099 forms, and other tax-related records.

Review account fees and minimums: Familiarise yourself with any fees or minimum balance requirements associated with your current brokerage account. This will help you make an informed decision with your new broker.

Choose a new brokerage firm: Research and select a new brokerage firm that aligns with your investment goals and preferences. Consider factors such as trading fees, investment options, customer support, and mobile app capabilities.

Initiate the transfer process: Complete a transfer initiation form (TIF) provided by your new brokerage firm. This form initiates the transfer of your account assets. Send the TIF to your new broker, ensuring accuracy and completeness.

Keep financial statements for reference: Retain financial statements from your existing brokerage account for your records. These documents may be useful during the transfer process.

What are the transfer fees for Forex?

When transferring your Forex brokerage account from one broker to another, it’s essential to understand the associated fees:

Outgoing transfer fees: Your current broker may charge a fee for initiating the transfer. This fee varies but can range from $25 to $100 or more. If your broker charges a flat fee of $50, this is the cost you’ll incur for initiating the transfer.

Incoming transfer fees: The new broker may also impose fees for receiving the transferred assets. These fees can vary significantly. Some brokers waive these fees entirely, while others charge a percentage based on the transferred amount. If your new broker charges a 0.1% fee on the transferred value and you’re moving $10,000, the incoming transfer fee would be $10.

Currency conversion fees: If your accounts are denominated in different currencies, currency conversion fees apply. These fees depend on the broker and the specific currencies involved. Converting $10,000 from USD to EUR might incur a 1% currency conversion fee, resulting in a $100 charge.

Wire transfer fees: Wire transfers involve bank fees for processing the transaction. Your new broker may cover these fees, or they may pass them on to you. Do proper research on the transfer fees to be sure. Some brokers may charge a flat $20 fee for incoming wire transfers. Some brokers may have additional charges, such as account closure fees or document processing fees. Always review the terms and conditions to identify any hidden costs.

So the total estimated cost for transferring $10,000 from a different Forex broker to another broker is $180. Fees can vary based on individual brokers, account types, and the specific circumstances of your transfer. Always check with both brokers to get accurate fee information before initiating the transfer.

Tax implications of switching Forex brokers

The tax implications of switching Forex brokers can vary depending on your country and individual circumstances. In most countries, when you trade Forex and make a profit, you are typically subject to capital gains tax.

This tax applies when you close a position at a higher value than when you initially purchased it. The tax rate for switching Forex brokers varies from country to country, especially if you need to sell your assets before transferring your funds, so it’s essential to understand the specific trading tax rules in your location. The 60/40 rule applies in the United States, where 60% of gains or losses are treated as long-term, 40% as short-term, and taxed up to 37% depending on your yearly earnings.

Conclusion

Finally, if you wish to switch brokers without withdrawing and re-depositing, inquire about broker-to-broker transfers from your new broker. While not widely advertised, many brokers support this option. Ensure both accounts are fully validated and be aware of any associated fees. Remember, switching brokers isn’t just about numbers, it’s about finding a partner that aligns with your trading goals. Whether you’re seeking better trading conditions, enhanced features, or simply a fresh perspective, switching brokers is a strategic move.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).