Top 7 Forex Demo Accounts

Best Free Forex Demo Account 2024 - RoboForex

Have you been thinking about dipping your toes into Forex trading but aren't quite ready to risk real money yet? You're not alone. Trading live can understandably feel intimidating without having any prior experience to draw from. Fear not, with countless demo trading accounts now available you have nothing to lose and everything to gain from learning the ropes in a simulated environment first.

In this insightful overview, knowledgeable traders highlight some top-notch platforms where you can freely practice, experiment and build your skills. From robust all-in-one brokers to niche ECN suppliers, there is something here to suit every learning style. Let the experts be your guides as you begin your exploration. Who knows, one day soon you may feel prepared to take the plunge for real.

-

Is demo account trading realistic?

Yes, brokers structure demo environments to closely mimic real trading conditions with real-time market data, spreads, execution speeds and more.

-

Can I transfer knowledge to live trading?

While live markets add psychological pressures, the core trading skills you develop in demo mode can transition seamlessly when you feel ready for real stakes.

-

Do I need any prior experience to use a demo account?

No, demo accounts are designed for complete beginners.

-

How long should I practice with a demo account?

There is no set time but most experts recommend a minimum of 3 months of consistent practice and profitability before considering live trading.

What is a Forex Demo Account?

A forex demo account is a simulated trading environment that allows potential forex traders to test out their trading strategies and skills without any risk. In these accounts, a forex simulator simulates real market conditions. As a result, you can practice trading using different strategies before taking your skills to the actual live market.

Demo accounts are funded with virtual money, so there is no need to deposit any real cash into an account. This makes forex demo an ideal way to learn about the market and explore different forex trading strategies without any financial risks.

Key Targets

Most forex demo trading accounts target beginner to intermediate traders. As a newbie, the accounts provide a risk-free way to test your strategies and learn the ropes of forex trading. For intermediate traders, demo accounts can help you brush up on your skills and experiment with new strategies without the risk of losing your capital.

However, some experienced forex traders also use demo accounts. This is because they can offer an opportunity to test a new broker or trading platform. Experienced traders can also use demo accounts to try out new strategies without risking their live account capital.

Functions of Forex Demo Accounts

Forex trading simulation plays the following main roles:

-

Helping traders learn forex trading mechanics such as placing orders and account management

-

Allowing traders to test out their strategies

-

Helping traders learn how to interpret market news and analysis

The bottom line is that demo accounts allow you to trade like you're in a real account but with virtual money. They help you discover the type of trading that works for you. For example, they can help you learn whether you prefer long-term or short-term momentum trading.

Best Free Forex Demo Accounts

While there are many forex demo accounts in the market, not all of them are created equal. Here is a head-to-head comparison of the best free demo accounts.

| Best For | Trial Period | Supported Assets | $ Virtual Limit | |

|---|---|---|---|---|

Best MetaTrader Demo Account |

30 days |

Forex, Stocks, Indices, Soft Commodities, crypto |

$5000 |

|

Best for advanced forex trading demo |

Unlimited, but expires after 21 days of inactivity |

Forex, Metals, Crypto, Energies, Stocks, Indices |

$10,000 |

|

Best ECN Demo Account |

30 Days |

Forex, Commodities, Indices, Bonds, Futures, and Digital Currencies |

$5,000,000 |

|

Best for Trade CFDs on Forex |

180 days |

Forex, CFDs, Metals, Indices |

$100,000 |

|

Forex copy Trading, Free stock trading |

Unlimited |

Forex, CFDs, Cryptocurrencies, Stocks |

$100,000 |

|

Top Demo Account for Unlimited Forex Trading |

Unlimited |

CFD instruments including metals, share, crypto, forex, and commodities |

$100,000 |

|

Best for Education on Forex Trading |

Unlimited, deactivated after 30 days of inactivity. |

Metals, Energies, commodities,Indices, Stocks |

$100,000 |

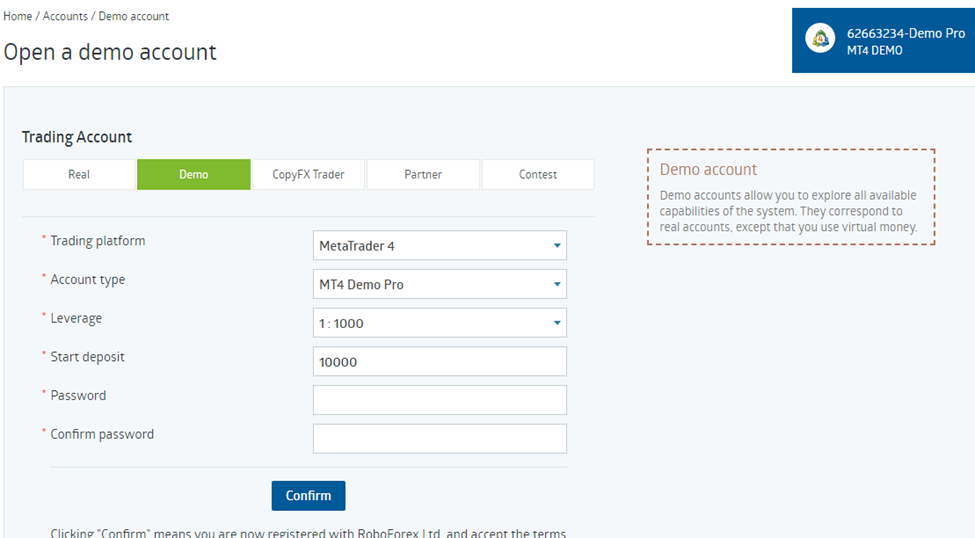

RoboForex MT4 Demo Account

The RoboForex MetaTrader 4 demo account is more suitable for active CFD traders. It allows them to test the broker’s popular MetaTrader 4 platform and experience its advanced features.

RoboForex Demo

The RoboForex MT4 demo account comes with $5,000 in virtual money and access to all the instruments and features available on the live account. These features include over 50 technical indicators, three types of charts for interaction, and three types of order execution. The demo account operates 24 hours a day, from Monday to Friday.

You can use the demo account to trade CFDs on various cryptocurrencies such as Binance Coin, Bitcoin, Ethereum, Ripple, and Stellar. The MT4demo account will also send you alerts and news to help you track all the relevant financial market events.

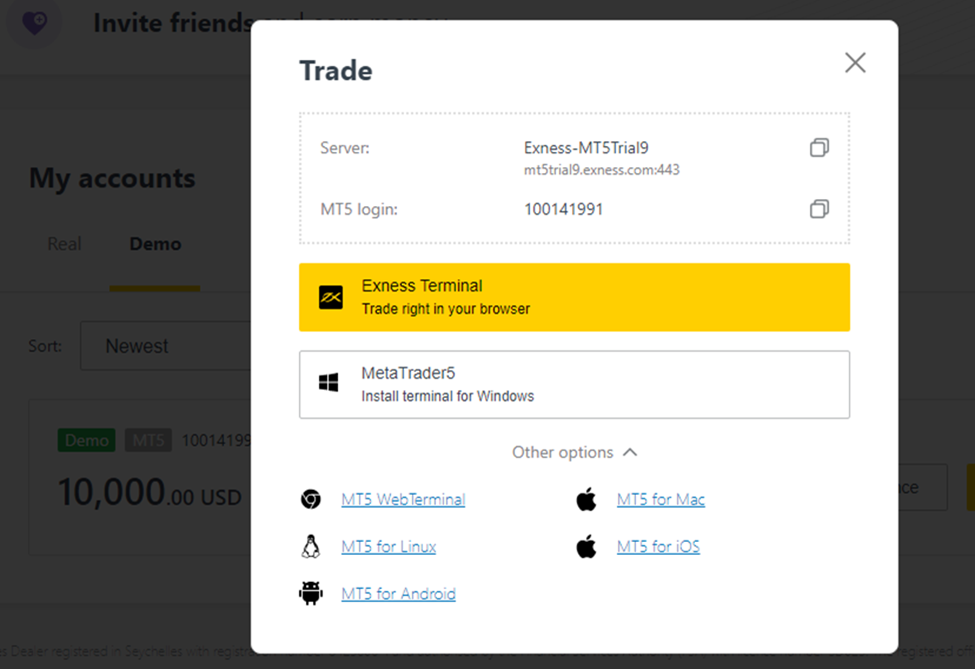

Exness

Beginners and experienced traders can use the Exness demo account. For beginners, the account allows them to learn how to trade, analyze the movement of asset prices, and predict the price directions. Experienced traders can use the demo to test their desired strategies.

The market conditions in the demo market align with those of the real market. No minimum deposit is required to open an Exness demo account.

Once you register, you will receive $10,000 in virtual money. As shown below, you should also specify the platform you want to use. Exness operates 24/5, and anyone in the U.S. can trade between 13.30 and 20:00 during the summer.

Exness

IC Markets Zero Spread Demo Account

This demo account is available for users of both types of markets in IC. That is, the raw and the standard ECN.

The IC Markets Zero Spread Demo Account offers the highest virtual balance of $5,000,000. Even better, the demo trading account does not expire, allowing you to practice until you feel ready to open a real account. The platform offers over 60 currency pairs for forex traders.

IC Markets

When practicing, you can choose from over 1700 available CFDs in stocks, futures, commodities, bonds, cryptocurrencies, and indices. You can trade all currency pairs between 00:01 server time and 23:59 server time every day except Friday, when trading closes at 23:57. You can use either the MT5 or MT4 platforms if your demo account is Standard.

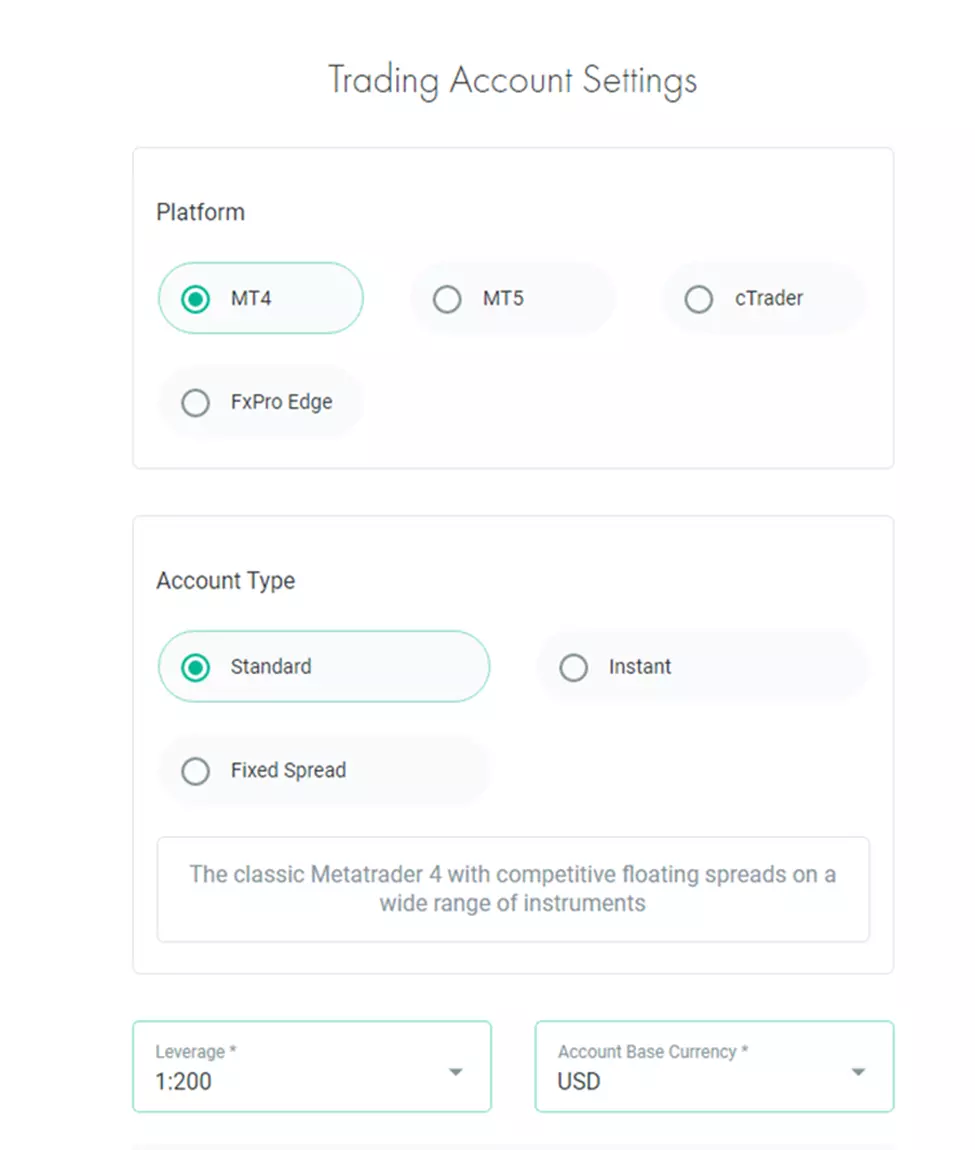

FxPro Demo Account

FxPro’s free demo account gives access to all the features of a live trading account, including real-time market prices. You will have $100,000 in virtual funds to practice with and a time limit of 180 days.

The free demo account is available on the MT4, MT5, Edge, and cTrader platforms. You can use any of these platforms to practice your forex trading skills.

FxPro

When using your demo account, you can access a wide asset selection, including metals, indices, and CFDs on forex. FxPro operates 24 hours a day for five days. These market hours are divided into three trading sessions to suit traders in the Asian, European, and North American regions.

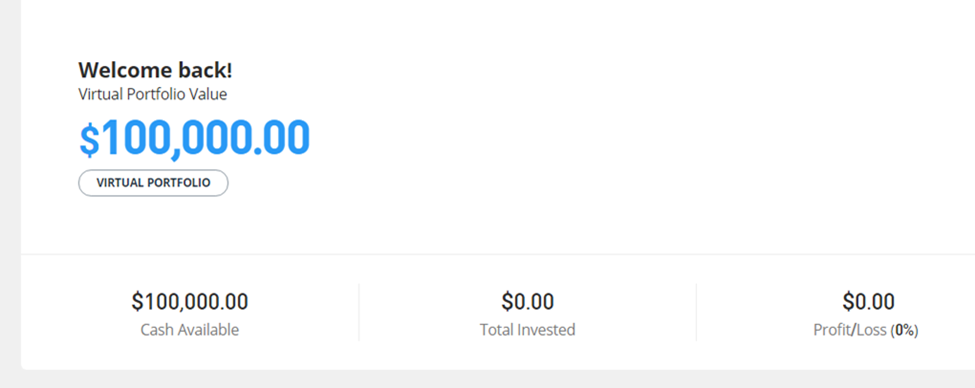

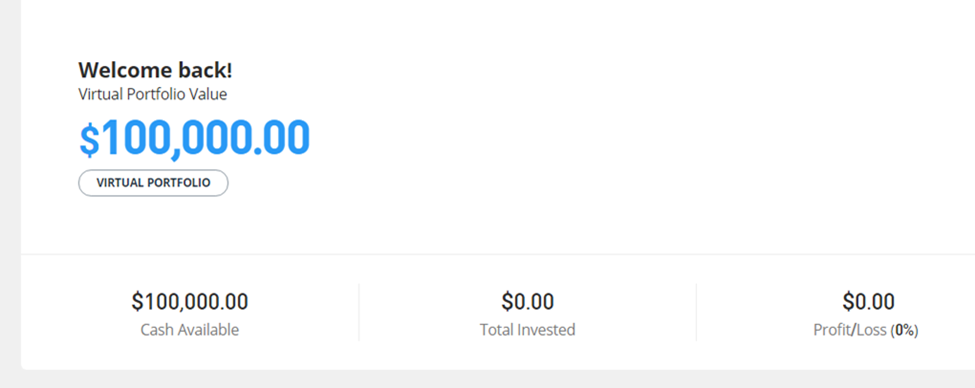

eToro Demo Account

The eToro demo account comes with $100,000 in virtual money and access to all the features available on the live account. You will be able to trade in over 2,000 assets. These assets include stocks, indices, forex pairs, commodities, and cryptocurrencies.

eToro Demo

Copy trading is one of the best features of the eToro demo account because beginners can mimic the trades of more experienced traders and learn from their strategies.

The eToro demo account also allows you to manage your portfolio easily via a simple and clean interface. It will be easy to follow the real trends of each instrument using advanced analytics.

The eToro demo account is free and unlimited. You can use it for as long as you want until you're ready to transition to a live account. On regular business days, eToro’s stock and ETF markets operate from 9.30 am to 4 pm Eastern time, from Monday to Friday. However, the crypto market operates 24/7.

Oanda Forex Demo Account

Oanda Demo provides an opportunity to operate with more than 70 assets, including currency pairs, precious metals, and CFDs on stock indices and commodities

It offers a free forex simulator, and access to the account is unlimited. For a start, your demo account will have $100,000 in virtual money.

You can adjust your leverage or use different trade sizes until you determine your comfort level. You can open an Oanda demo account on a web browser or a mobile app, where you will get everything available on a desktop platform. For example, you will access technical tools for market analysis and chart trading.

Oanda’s operates from Sunday at 5 p.m. to Friday at 5 p.m., New York Time. The platform aligns its trading hours with the global financial markets.

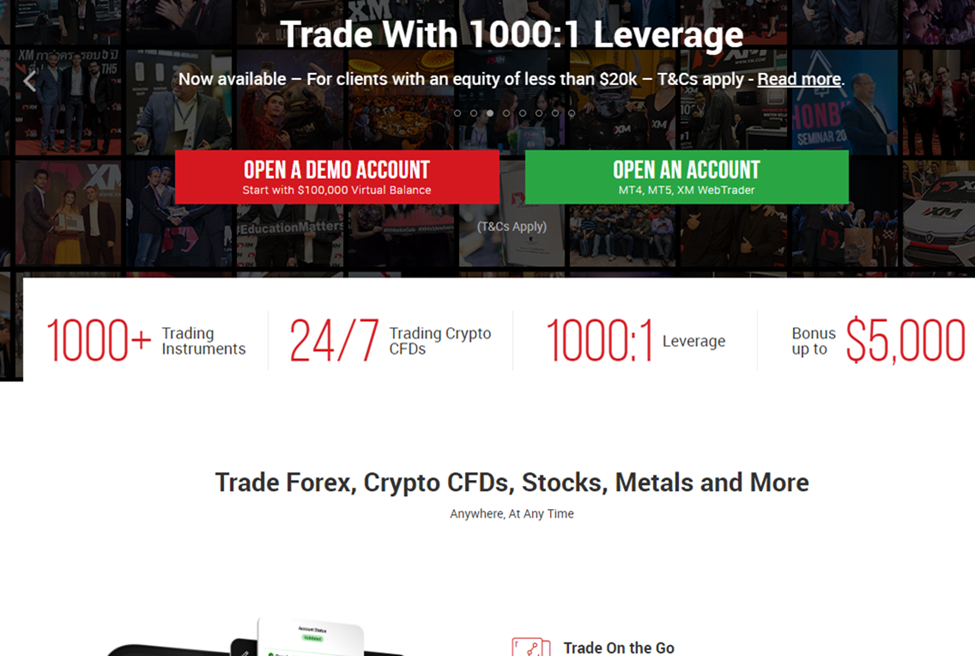

XM Demo Account

XM offers a free demo account for all interested beginners to help them practice trading in forex without risk. The account has $100,000 in virtual funds and has no expiry or trial period.

XM

When opening an XM demo account, you can choose either the standard or the XM Zero account. The former will be compatible with the MT5 and MT4 trading platforms. The latter is also compatible with both but has zero pips, an ultra-thin spread, and more liquidity guarantees.

The free demo account will allow access to over 1,000 trading instruments. These include forex, metals, stocks, and crypto CFDs. You can also use other features such as charting tools while following market developments in real-time.

How to Choose a Forex Demo Account?

Now that we have looked at the best free forex demo accounts, it is time to look at how to choose a free forex demo account. When looking for free forex demo accounts, you need to consider the following:

The Free Trial Period

It's vital to choose a demo account with a free trial period that is long enough for you to learn the ropes and get a feel of how forex trading works. Otherwise, you may be disappointed with the results once you start trading with real money.

Many forex brokers offer free trials that last anywhere from 30 days to 90 days. Some even offer unlimited free trials. For this reason, it's crucial to choose a free trial period that's long enough for you to fully test out the platform without any pressure and make sure it meets your needs.

The Amount of Virtual Funds

The funds can significantly impact the quality of your trading experience or your ability to trade effectively. For example, if you're only given a small amount of money to trade with, you may find that you're quickly limited in your ability to make profitable trades.

On the other hand, suppose you have a large amount of virtual funds available. You'll be able to experiment with different strategies and take on more risks without having to worry about depleting your account balance.

As a result, the amount of virtual funds is an essential factor to consider when selecting a free forex demo account. The virtual funds in a free forex demo account should be enough for you to test different strategies and experience how the market operates.

The Trading Platform

The trading platform is the software that enables you to place trades and monitor the markets. You should choose a user-friendly trading platform with all the features you need. Some platforms are very basic, while others offer advanced features such as news feeds and charting tools.

Find a platform that suits your level of experience and trading style. When you are starting, it is advisable to choose a platform that is simple to use and has a good range of features. As you become more experienced, you can move onto a more advanced platform.

Customer Support

When choosing a free forex demo account, consider the quality of customer support. After all, even the best trading platform will encounter occasional glitches. Also, forex trading can be complex, and you may need help understanding the platform or making trades.

When problems arise, it is vital to have access to a knowledgeable and responsive customer support team. The best customer support teams are available 24/7 and can be reached via live chat, email, or phone. They should also be able to provide step-by-step instructions for resolving common issues.

Why Should I Use Forex Demo Accounts?

There are many advantages of using a demo account, including:

An Opportunity to Test Out Different Trading Strategies

Demo accounts provide the perfect environment for testing out different trading strategies. If you are new to forex trading, you will want to experiment with different approaches to see what works best for you.

You can try out different strategies with a demo account without worrying about losing any real money. If you're an experienced trader, the demo accounts will help you experiment and learn which platform suits your trading strategy best.

Learning About the Features and Tools Offered by Different Brokers or Platforms

As a beginner forex trader, learning about the features and tools available on different platforms is crucial. With a free forex demo account, you can try out the platform or broker of your choice without having to commit any real money. This is a great way to see if the broker or platform offers everything you need.

Learning in a Pressure-Free Environment

The best forex demo accounts allow you to practice for an unlimited time. You can take your time to learn about the market and how it works without feeling pressured to make trades with real money. You will have all the time you need to hone your skills and learn all the basics of forex trading.

Range of Markets to Explore

When you use a free forex demo account, you can access almost all the markets you find on a live account. This includes major currency pairs, minor currency pairs, and exotic currency pairs. These markets allow you to explore different markets and find the ones that suit your trading style.

Building Your Confidence

One of the best things about free forex demo accounts is that they help you build your confidence. When you can practice without worrying about losing real money, you can focus on learning and building your confidence. Once you understand how the forex market works, you can switch to a live account and start trading with real money.

How to Get Started

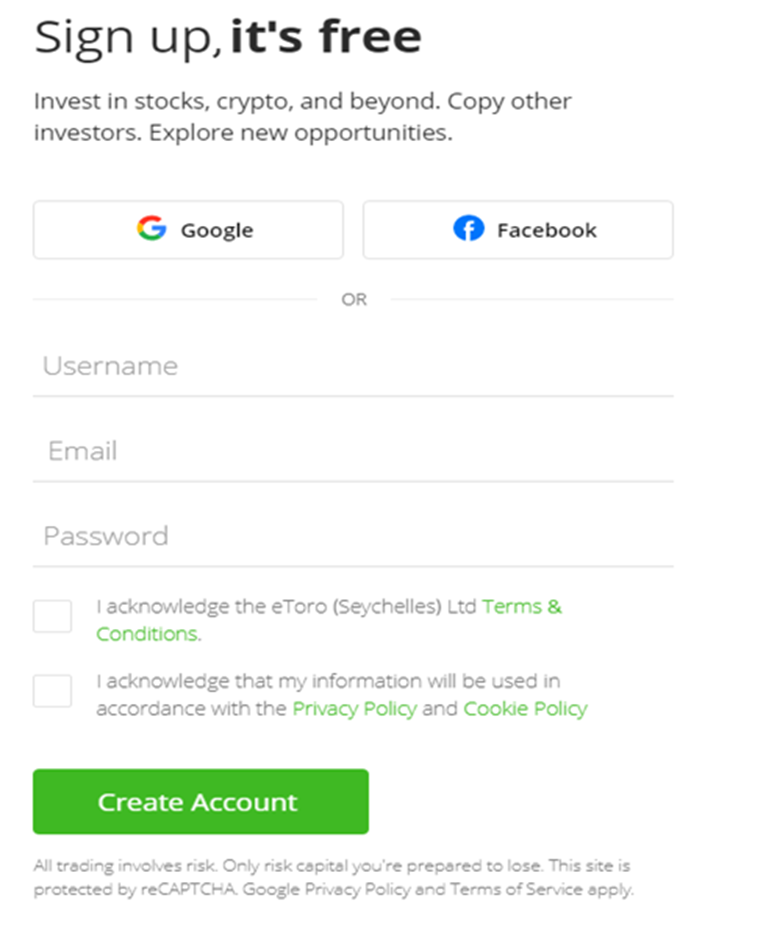

If you're ready to start exploring free forex demo accounts, you can start with eToro since it is one of the accounts that offer the best experience. Here is a step-by-step guide on how to open a demo account on eToro:

Step 1: Visit eToro’s Website

On the eToro website, you will find a registration form once you click on the “let’s start button.”

eToro’s Website

Step 2: Fill Out The Registration Form.

You will be required to provide a username, email address, and password. Once you give the correct details, click on “create an account.”

The Registration Form

Step 3: Verifying your profile

You will receive a confirmation email from eToro through the email address you provided in step 2. You should click on the link attached to the email to confirm your account.

Profile verifying

After verifying your email, eToro will send you directly to the webtrader platform. You can check your spam folder if you don’t see the confirmation email within a minute.

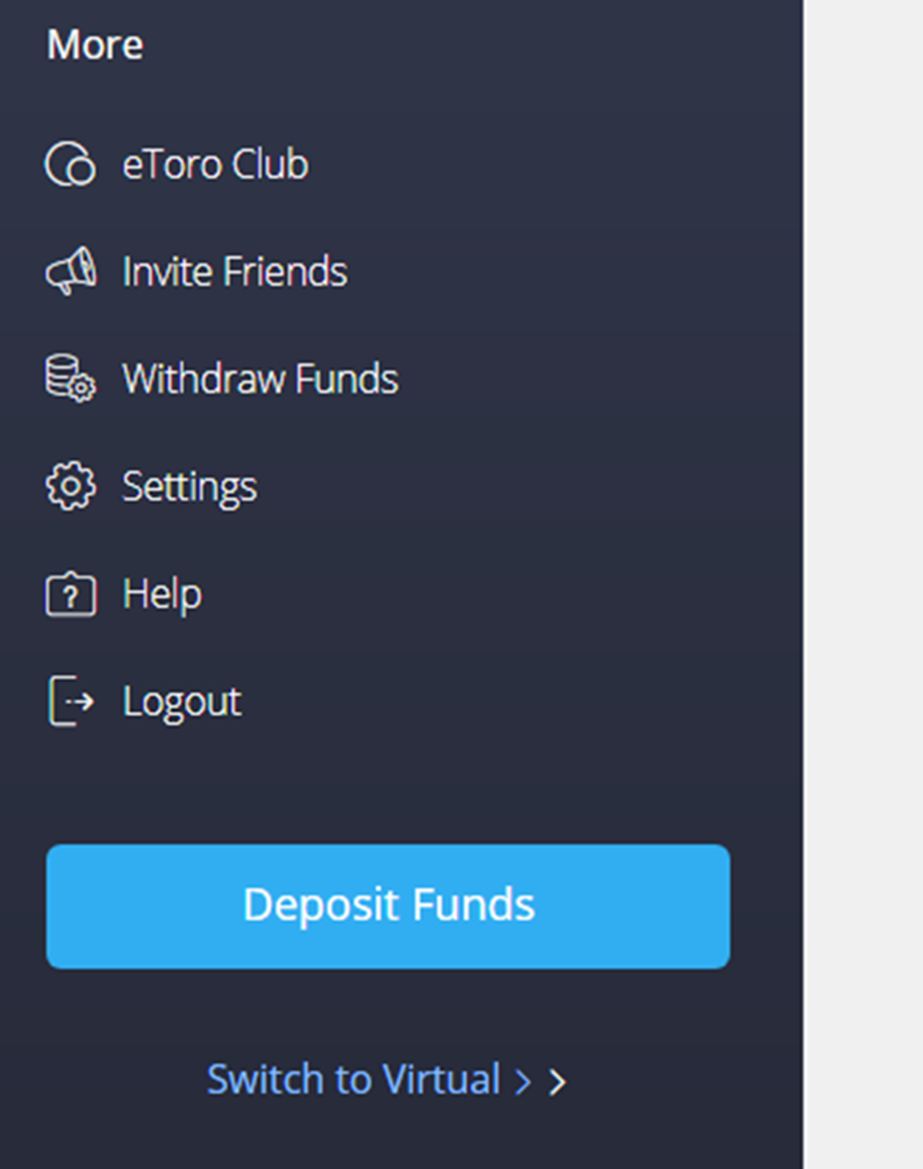

Step 4: Switch to Demo Account

On the main profile, click on the switch to virtual, which is on the bottom left corner of the webtrader platform.

Switching to Demo Account

Step 5: Confirmation

Confirm that you want to switch to a virtual account on the pop-up screen notification. eToro will display your demo account, including the virtual amount available.

eToro Demo Account

The Differences Between Demo & Live Accounts

Both demo and live accounts offer valuable insights into the world of trading. The following differences shed light on the unique aspects of both demo and live accounts.

Financial Resources

In a demo account, traders typically receive virtual funds to practice trading and experiment with different strategies and techniques without risking actual capital. On the other hand, a live account requires real money and it directly impacts trading decisions and potential gains or losses.

Market Conditions

Demo accounts offer an excellent opportunity to practice and familiarize oneself with market conditions and to test trading strategies without any financial risk. Trading in a live account, given all the volatility and risks influenced by economic events and market sentiment, can significantly impact trading outcomes.

Risks and Losses

While demo accounts shield you from financial risks, live accounts expose traders to the true nature of trading. The risk factor in live accounts is amplified when investing real money and facing the possibility of losses.

Psychological Aspect

In a demo account, the absence of real financial consequences often leads to a more relaxed mindset. However, when real money is at stake, emotions such as fear, greed, and impatience can come into play.

Trade Execution

Orders are typically executed smoothly and instantaneously in demo accounts as there are no real-world liquidity constraints. Conversely, live accounts are subject to market liquidity, order queues, and potential slippage.

Emotions and Trader Behavior

The absence of real financial risks in demo accounts often leads to a more carefree and experimental trading approach. However, in live accounts, the fear of losing real money can influence decision-making, leading to more cautious and conservative trading behavior.

Are Forex Demo Accounts Safe?

Forex demo trading accounts are considered safe due to their controlled nature. Demo accounts provide an excellent platform for learning, strategy development, and gaining familiarity with trading platforms. In general, however, it's essential to be aware of potential risks associated with these accounts.

Overconfidence and Risk-Taking

Using a Forex demo account can lead to overconfidence. Since there are no real financial risks involved, traders may take more significant risks and achieve seemingly impressive results. However, these strategies may not yield the same outcomes in live trading.

Limited Market Impact

Trades executed on Forex trading demo accounts do not have a real impact on the market. As a result, traders may not experience the full depth of liquidity, slippage, or order execution speed that occurs in live trading leading to a distorted perception of market conditions.

Platform Discrepancies

While Forex demo accounts aim to replicate the live trading experience, there can be discrepancies between the demo and live trading platforms. The discrepancies include variations in execution speed and spreads, and they can disrupt established trading strategies.

Emotional Unpreparedness

Forex demo accounts may not fully prepare traders for the psychological aspects of live trading. The absence of real financial risks can create a false sense of security, making it challenging to manage emotions such as fear when real money is at stake.

Availability of funds

In a demo account, traders have access to virtual funds, which may not accurately represent the capital they would have in a live trading account. Limited funds in a live account introduce a constraint that can significantly affect trading decisions and strategy.

How long do I need to use a demo account

The length of time you need to use a forex demo account can vary depending on your goals and level of experience. A demo account is a practice account provided by brokers or trading platforms that allows you to trade with virtual money. It's primarily used for learning, testing trading strategies, and gaining familiarity with the trading platform without risking real money.

Here are a few factors to consider when determining how long to use a forex trading demo account:

Learning сurve. TU experts recommend using a demo account for at least 1 to 3 months, ensuring consistent positive results before moving to live trading

Strategy development. TU experts are highly recommended to consistently use a demo account to test strategies

Transition to live trading. When you feel comfortable and confident in your trading skills, you can consider transitioning to live trading with real money. However, it's important to note that trading with real money introduces additional psychological factors and emotions that may affect your decision-making. Before transitioning, ensure that you have a solid trading plan, risk management strategies, and have tested your approach in various market conditions

Ultimately, there is no fixed timeframe for using a best forex demo account. It's a personal decision based on your learning curve, strategy development, and individual needs. Some traders may use a demo account for a few weeks, while others may take several months or even longer. The key is to use the demo account until you feel confident and consistently achieve positive results.

Summary

If you're new to forex trading or looking to switch brokers or platforms, you should consider using a free forex demo account. Demo accounts provide an excellent way to learn about the forex market and how it works without risking any real money. However, you should be careful when choosing your demo account since not all of them are created equal.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.