Note:

This is a dummy strategy. Replicating the same is not advisable. Make sure you develop and diligently backtest your own strategy and use it only if you find it accurate enough.

Here are the steps to use AI to create a trading strategy:

On your desktop:

Create a free Capitalise.ai account

Connect it to your broker account

Agree to terms and conditions

Start creating automated strategies

On your mobile device:

Download Capitalise.ai app

Select your broker

Free sign-up

Connect to your broker

Accept terms and conditions

Start creating automated strategies

In the ever-changing world of Forex trading, harnessing the power of Artificial Intelligence (AI) has emerged as a game-changer. AI-driven trading strategies offer the potential to enhance decision-making, reduce risks, and optimize returns. In this comprehensive guide, the experts at TU will delve into the realm of AI in Forex trading, exploring the intricacies of creating your own AI-powered trading strategy using Capitalise.ai.

Using Capitalise.ai in your Forex trading is straightforward. Follow these steps to get started on both your desktop and mobile device:

Create a free Capitalise.ai account

Begin by creating a free account on Capitalise.ai. You can do this by visiting their website

How to use Capitalise.ai on desktop

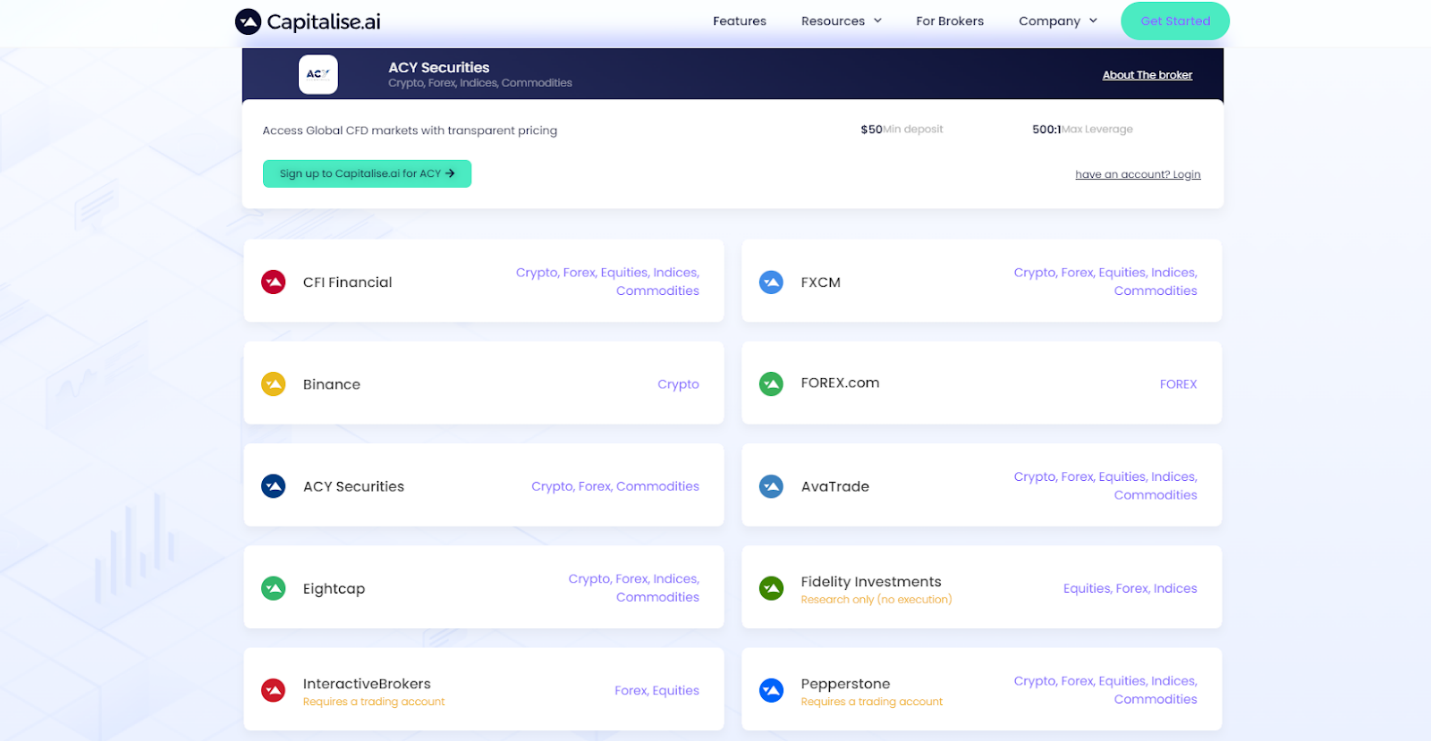

Connect it to your broker account

After signing up, connect your Capitalise.ai account to your broker account. This integration allows Capitalise.ai to execute your trading strategies seamlessly

How to use Capitalise.ai on desktop

Agree to terms and conditions

Review and agree to the terms and conditions set by Capitalise.ai. It's essential to understand the platform's rules and policies

Start creating automated strategies

Once your accounts are linked, you can start creating automated trading strategies. Capitalise.ai provides user-friendly tools to build and customize your strategies based on your trading preferences

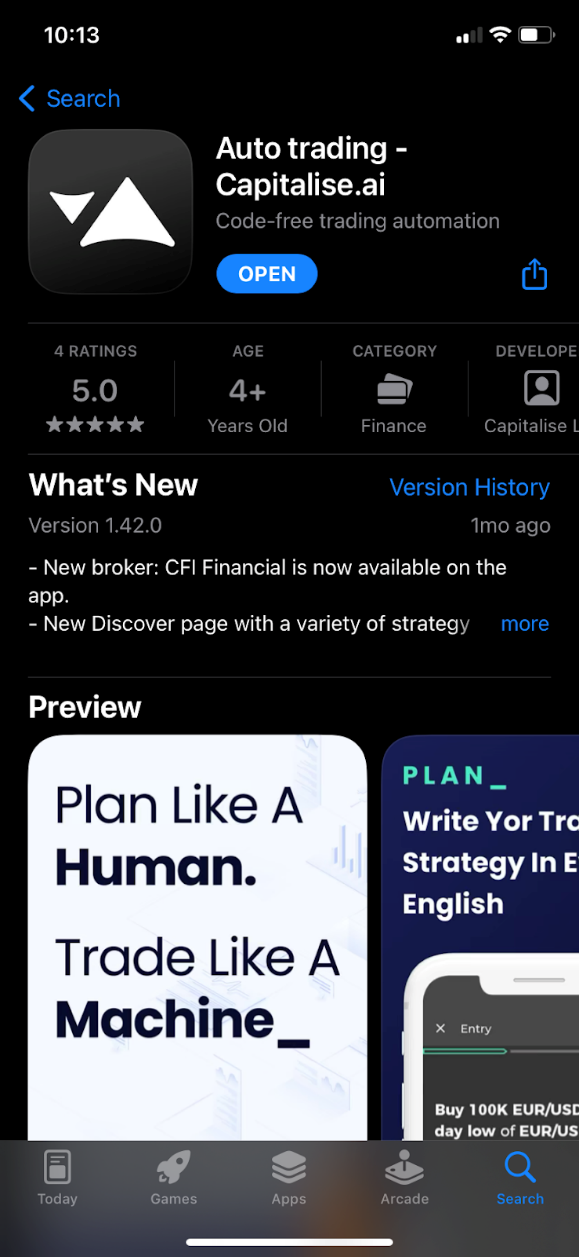

Download Capitalise.ai app

If you prefer mobile trading, download the Capitalise.ai app from the Apple App Store or Google Play Store, depending on your device.

How to use Capitalise.ai on a mobile device

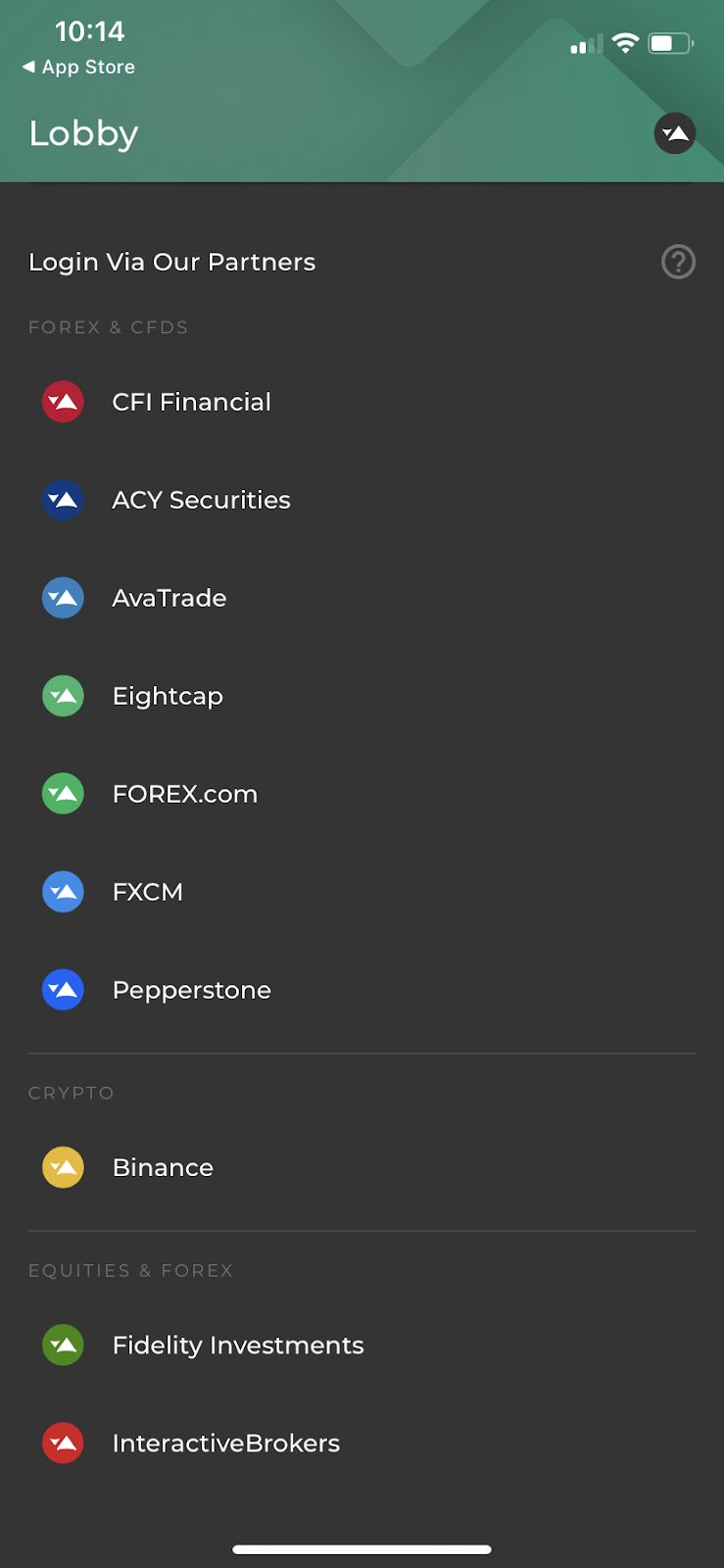

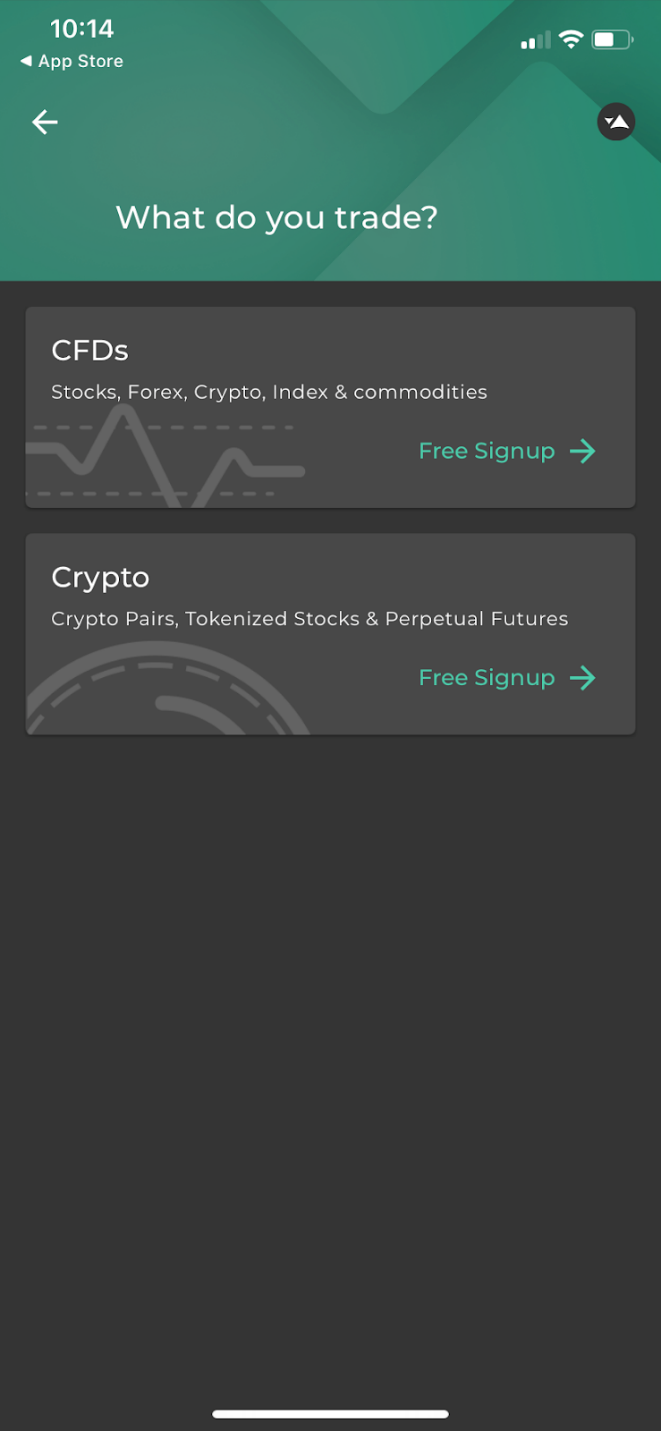

Select your broker

Open the app and select your broker under the “login via partners” section

How to use Capitalise.ai on a mobile device

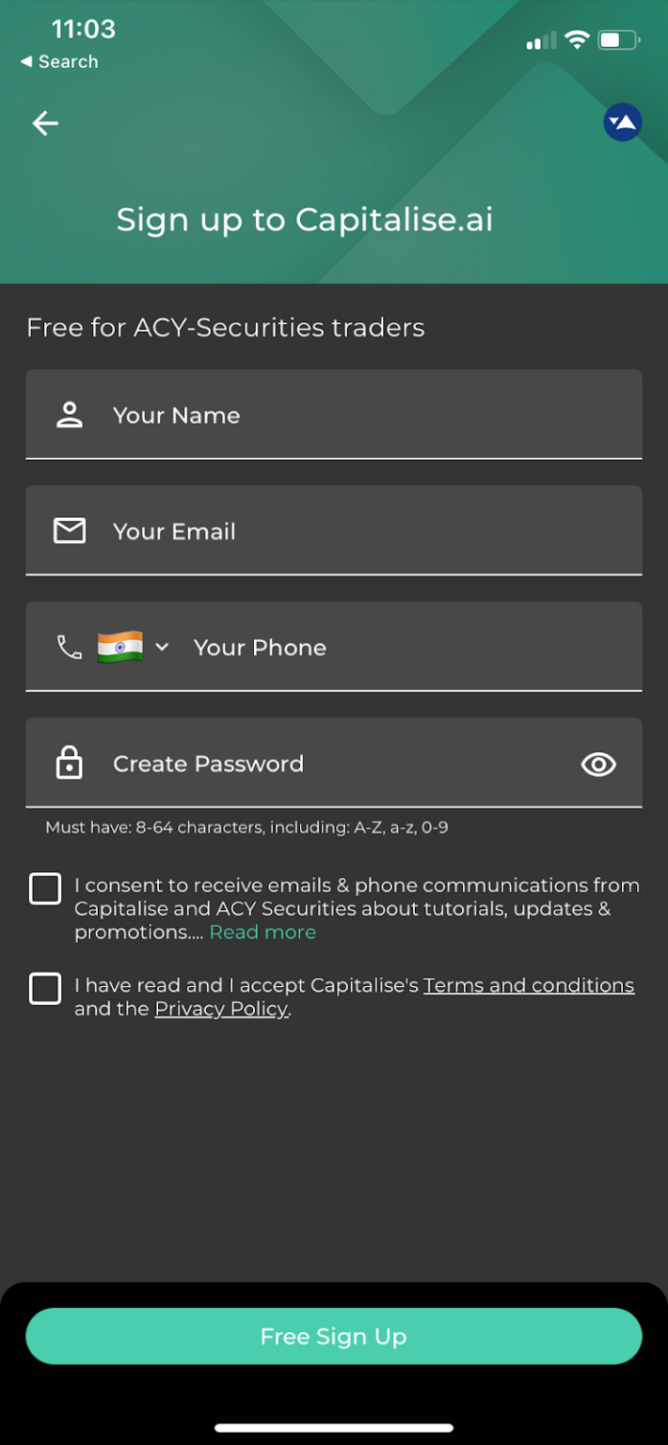

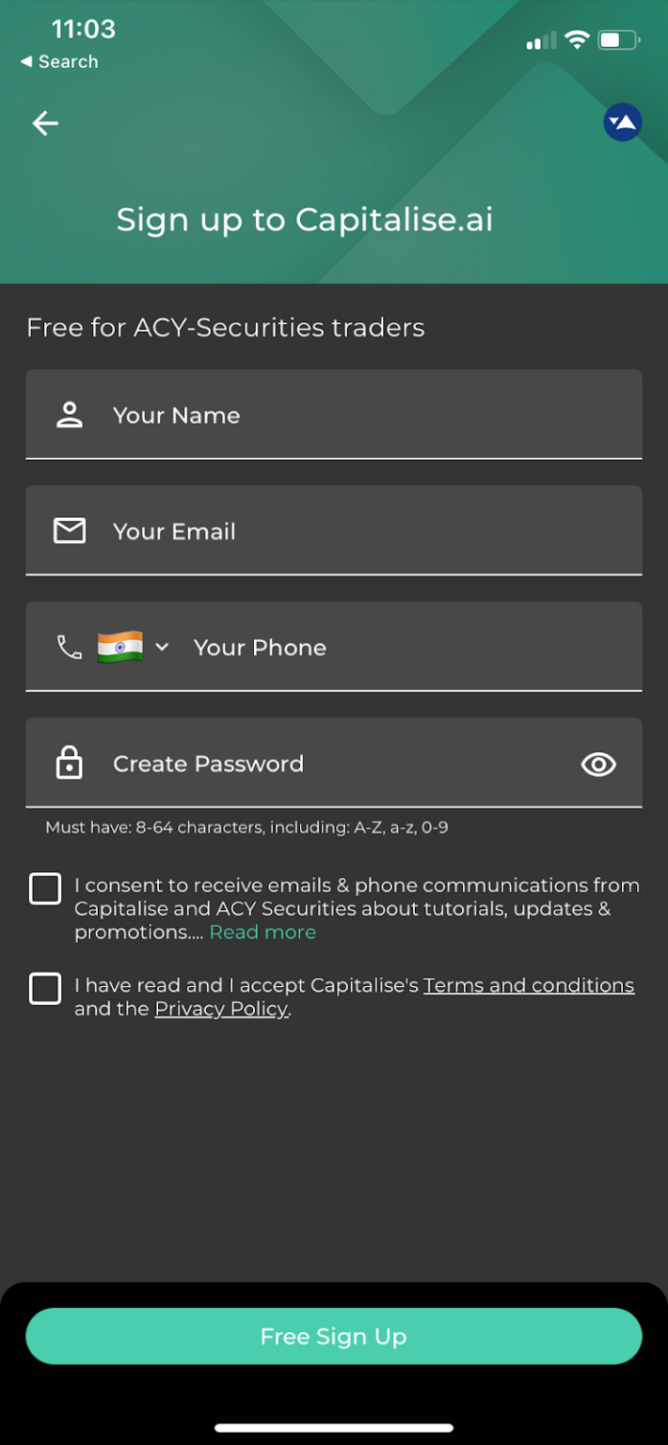

Free sign-up

Choose “free sign-up” to create your Capitalise.ai account directly from your mobile device

How to use Capitalise.ai on a mobile device

Accept terms and conditions

Ensure that you read and accept Capitalise.ai's terms and conditions to proceed

Start creating automated strategies

With your mobile device, you can begin creating automated trading strategies using the Capitalise.ai app. Enjoy the flexibility of trading on the go. Keep reading to find out how you can get started on this

Open the Capitalise.ai app

Begin by launching the Capitalise.ai mobile app on your device

How to create a trading strategy on Capitalise.ai

Create your account

Creating an account is necessary. You may follow the steps discussed earlier for this

How to create a trading strategy on Capitalise.ai

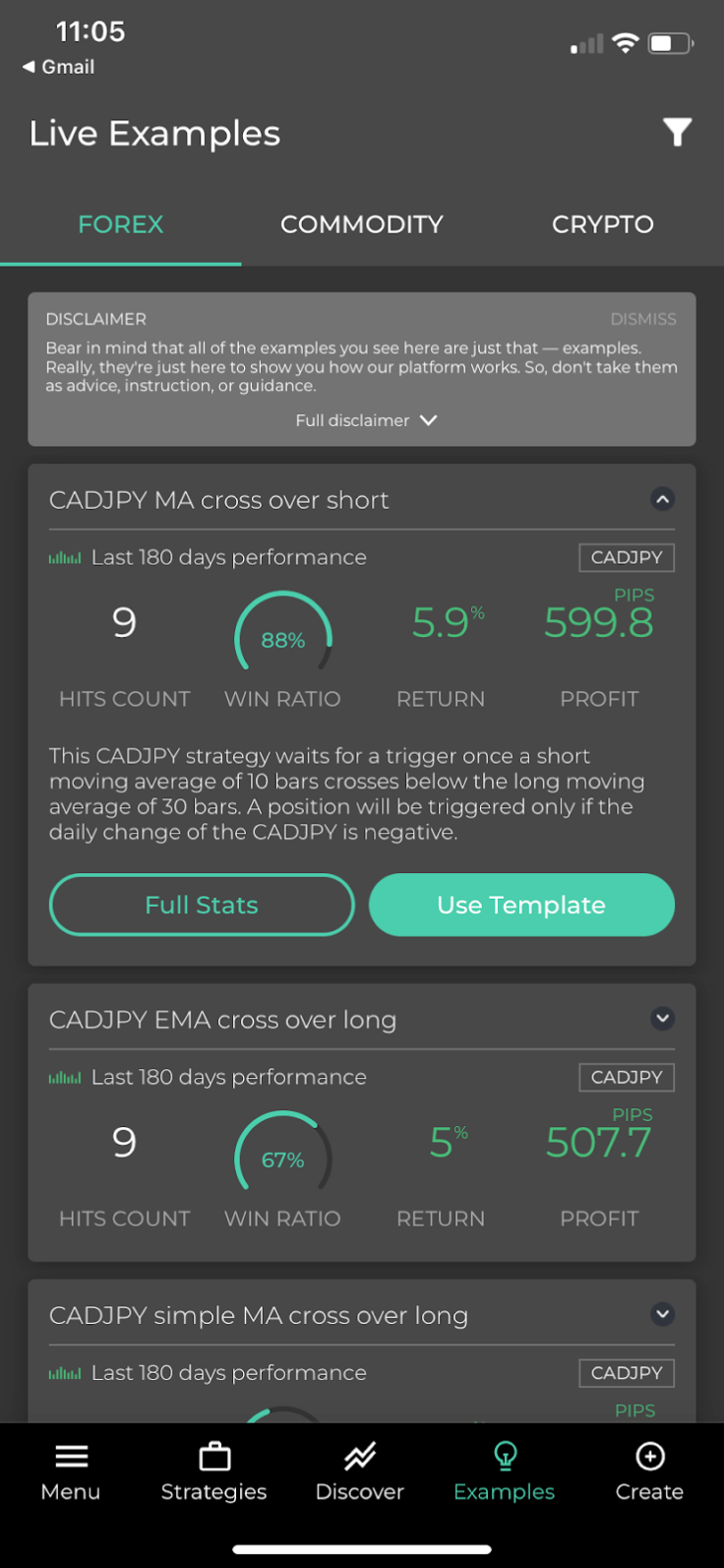

Explore pre-made strategies

Within the app, you'll find a selection of pre-made trading strategies, each with its associated profit percentages. You can browse and select from these ready-made options

How to create a trading strategy on Capitalise.ai

Access the strategy creator

To build a custom trading strategy, navigate to the “Create” option within the app

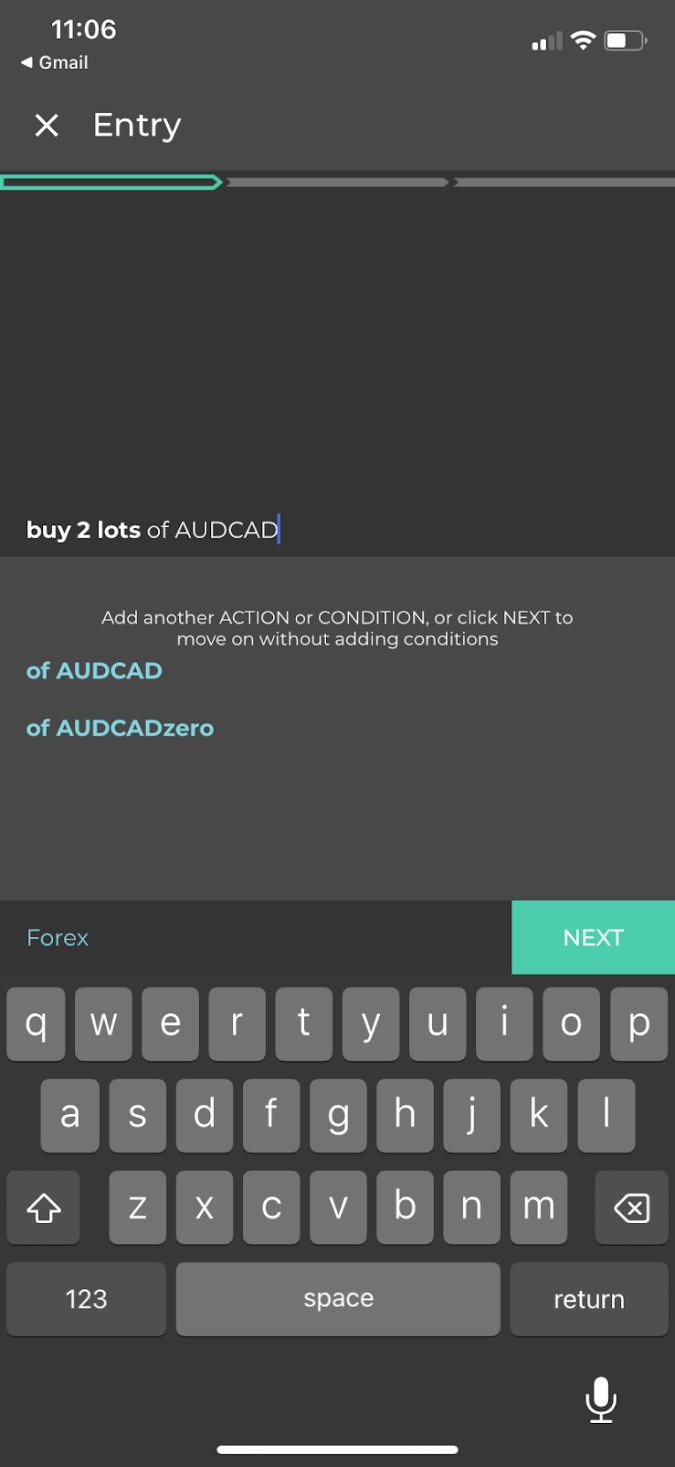

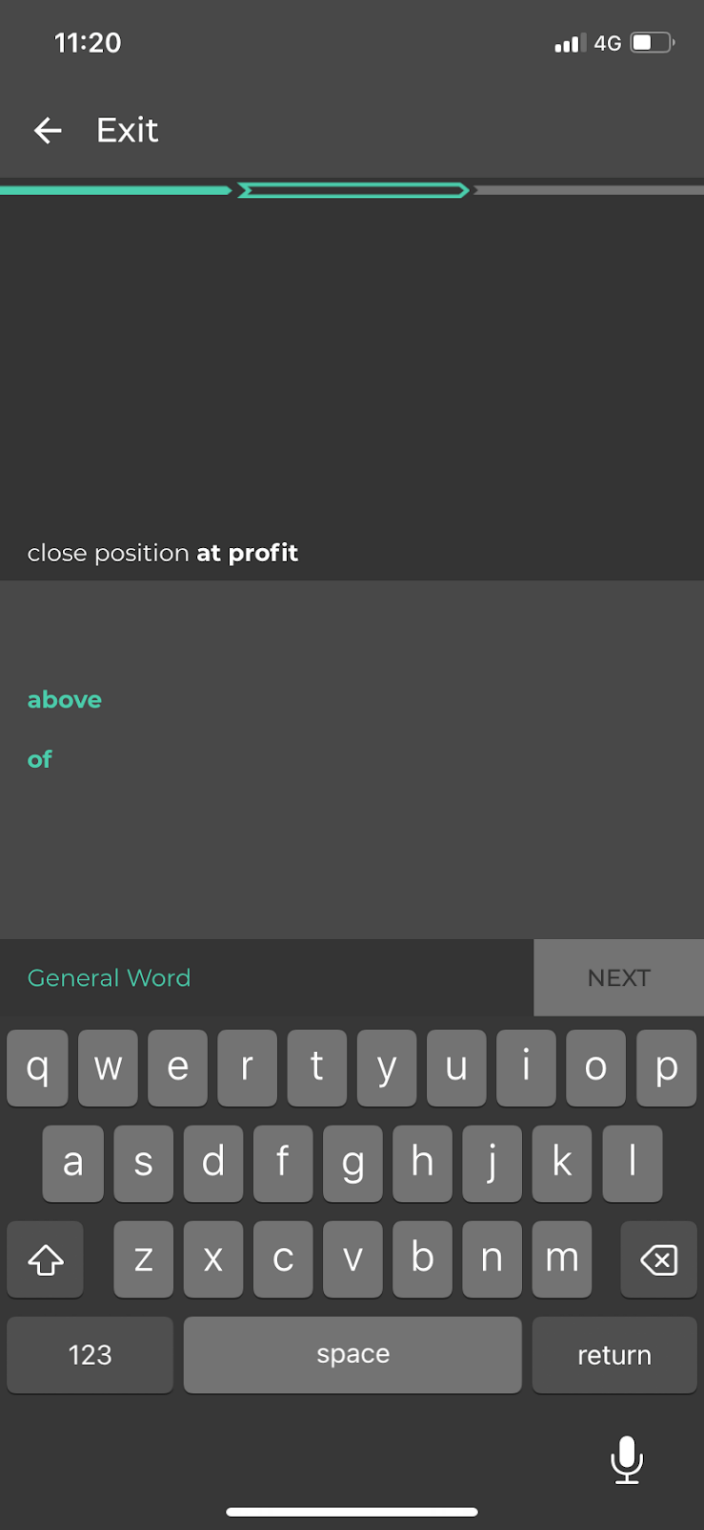

Specify entry and exit conditions

In the strategy creator, define your specific entry and exit conditions for your trades. This includes setting criteria like when to buy or sell a currency pair

How to create a trading strategy on Capitalise.ai

How to create a trading strategy on Capitalise.ai

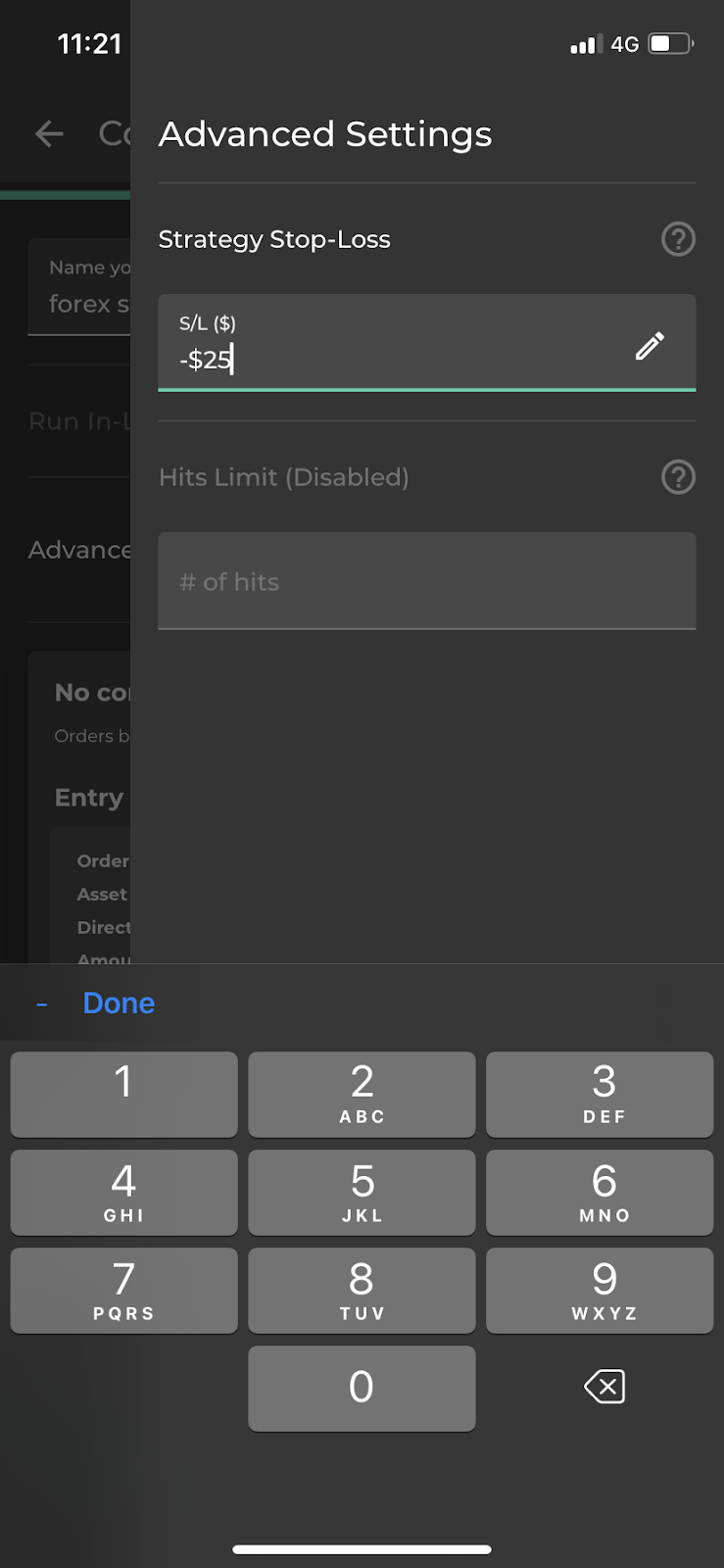

Set stop loss levels

Implement stop loss levels to manage your risk. These levels determine when a trade should automatically close to limit potential losses

How to create a trading strategy on Capitalise.ai

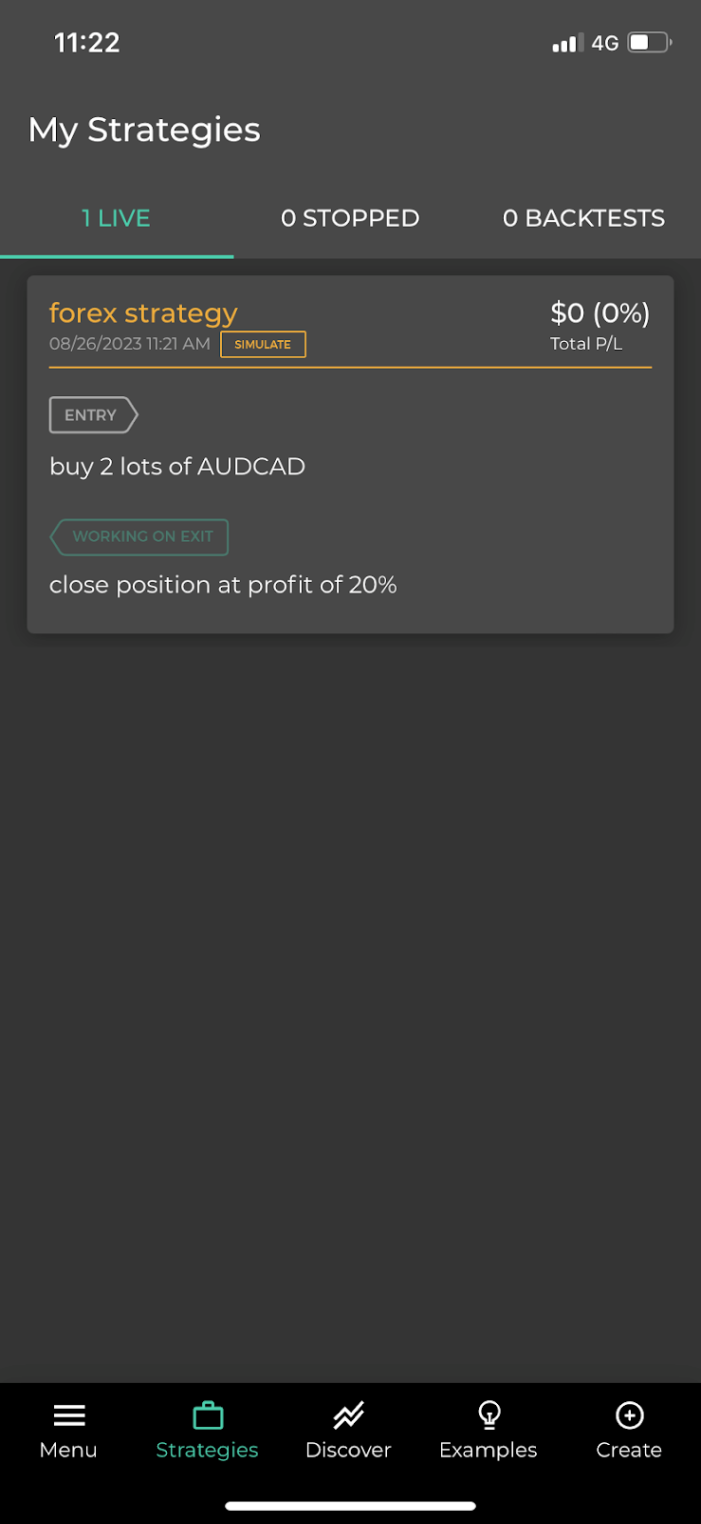

Simulate and backtest

Before executing your strategy in live trading, take advantage of the simulation and backtesting features provided by Capitalise.ai. This allows you to see how your strategy would have performed historically and fine-tune it for optimal results

How to create a trading strategy on Capitalise.ai

Note:

This is a dummy strategy. Replicating the same is not advisable. Make sure you develop and diligently backtest your own strategy and use it only if you find it accurate enough.

A Forex trading bot is a sophisticated piece of algorithmic software that is created to simplify and automate trading activities based on pre-established logic. These trading bots are seamlessly integrated into the trading ecosystem through application programming interfaces (APIs), allowing them to receive real-time data from market analysis tools and execute buy and sell orders for currency pairs via your brokerage account. Essentially, they act as an automated bridge connecting your trading strategy to trade execution.

One of the major advantages of automated trading is its elimination of human emotions. Additionally, Forex trading robots excel in swiftly executing numerous trades, capitalizing on rapid market fluctuations. This efficiency has established them as an essential tool for many institutional traders.

However, it's essential to exercise caution when using trading bots. Algorithms may not always adapt promptly to shifting market conditions, potentially resulting in unfavorable outcomes. For example, a breakout strategy employed during a market consolidation phase can yield unexpected results. Moreover, since trading robots operate continuously, they can inadvertently impact a trader's account if left unattended, executing trades in the background.

In essence, a Forex robot acts as an automated sentinel, diligently monitoring the market for trading opportunities and executing orders on your behalf. Powered by AI algorithms, these bots assess entry and exit points while considering custom parameters set by the trader. They represent an evolution of trading signals, eliminating the need for extensive technical and fundamental analysis while simultaneously enhancing the efficiency and precision of your trading endeavors.

Forex AI trading hinges on the precision of automated systems, each carefully made and rigorously tested by their development teams. These systems operate on the foundation of "if/then" logic, where specific pre-established conditions trigger a sequence of actions, like entering or exiting a trade.

To illustrate this logic further, let's consider an alternate scenario: Imagine your trading robot specializes in the GBP/JPY currency pair. IF the Stochastic Oscillator for GBP/JPY crosses above 80, indicating an overbought condition, THEN the bot swiftly initiates a sell order. Conversely, IF the Stochastic Oscillator dips below 20, indicating an oversold condition, THEN it promptly executes a buy order. This example showcases how these bots can adapt to various trading strategies by customizing their if/then sequences.

These trading bots seamlessly integrate with trading platforms, acting as intermediaries connecting you to a Forex broker. They provide real-time market data, including essential parameters like opening and closing prices, time intervals, and dynamic market feeds. Advanced trading robots leverage data analysis and risk forecasting to make informed trading decisions. They have the ability to identify market trends, monitor localized price fluctuations, scrutinize patterns, and more. Some may even combine multiple technical indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) oscillator to optimize their trading strategies.

Accessing these trading bots is generally user-friendly, often available directly through the provider's website. Users can choose to download the software or use it directly within a web browser. In essence, a Forex robot serves as a versatile tool that caters to traders across the spectrum, from those seeking simplicity to seasoned professionals in search of the benefits of 24/7 automated trading.

Forex robots, powered by artificial intelligence (AI), offer a double-edged sword in the world of trading. Let's dissect the advantages and disadvantages:

👍 Pros

•

1. Improved accuracy and efficiency

AI-driven systems excel at processing vast volumes of data swiftly. Machine learning algorithms analyze historical data, identify correlations, and predict market trends. This leads to more precise trading strategies based on a realistic understanding of market dynamics

•

2. Reduction in human error

The most significant boon of AI in FX trading is the reduction in human errors. Emotional biases and cognitive limitations can cloud human judgment. AI operates independently, steering clear of emotional influences and minimizing the chances of costly mistakes

•

3. Enhanced risk management

AI algorithms recognize market patterns and potential risks by scrutinizing past data. This enables traders to adapt their strategies effectively. By identifying risks, traders can make informed decisions to limit losses and enhance profits

•

4. Automation of repetitive tasks

AI can automate repetitive trading tasks, freeing up traders' time for strategic decision-making. This automation also enhances overall trading efficiency

•

5. 24/7 operation

Forex robots operate continuously, provided there is a stable internet connection. Users can switch between manual and fully automated trading, and automated scanning allows for exploration of a wide array of tradable currency pairs

•

6. More tradable currency pairs

Automated scanning, a core feature of AI-powered systems, enables traders to explore and monetize a broader range of tradable currency pairs. This expanded scope can lead to diversified portfolios and potentially higher returns

👎 Cons

•

1. High initial costs

Implementing AI in FX trading can be costly, especially for smaller businesses or individual traders. The ongoing expenses of maintenance, upgrades, and support add to the financial burden

•

2. Overreliance on technology

An excessive reliance on technology is a looming risk. Traders may become less adept at analytical and critical thinking as they increasingly depend on AI for decision-making. Overdependence on AI could make traders vulnerable to technical glitches or system failures, with potentially severe consequences in the fast-paced FX market

•

3. Rapidly changing market trends

The FX market trends evolve swiftly, which can adversely affect some AI-driven strategies. Adapting to these rapid changes is a challenge that traders employing AI must address

Creating your own Forex robot may seem like a complex task, but with the right tools and guidance, it's achievable even if you're not a coding expert. Here's a step-by-step process to help you get started:

Decide whether you want to code the algorithmic trading strategy yourself or use AI chatbots to assist you. While coding knowledge is traditionally required, some modern platforms, like Capitalise.ai, offer no-code solutions.

If you opt for coding, familiarize yourself with a programming language commonly used in Forex algorithm development, such as MQL for MetaTrader. This foundational knowledge is essential for crafting your strategy.

Explore platforms like Capitalise.ai, which streamline the process for traders without coding expertise. These platforms translate plain language prompts into algorithmic trading strategies, making the creation process accessible to a wider audience.

Regardless of your chosen approach, focus on developing a sound trading strategy. Define the rules, conditions, and parameters that your robot will follow. Consider factors like entry and exit points, risk management, and trade execution.

Test your strategy thoroughly using historical data to ensure it performs as intended. Backtesting helps identify potential flaws and areas for improvement.

Once you're satisfied with your strategy's performance, integrate it into the trading platform provided by your chosen brokerage. Ensure it seamlessly connects to your live trading account.

Regularly monitor your robot's performance in real-time. Be prepared to make adjustments as market conditions change. Continuous optimization is key to long-term success.

Selecting the best AI Forex trading bot can significantly impact your trading success. To ensure you make the right choice, follow these step-by-step guidelines:

Begin by assessing the bot's accuracy rating. The primary goal of using a trading robot is to identify profitable opportunities. Look for a bot with an accuracy rating of at least 95%. To gain further insights, inquire about the vendor's audited track record over a substantial timeframe.

Consider the range of trading opportunities the bot can identify. Bots that analyze a broader spectrum of cryptocurrencies and crypto pairs often uncover more unique trading prospects. Additionally, some AI algorithms search for multiple technical patterns and trends, which can lead to increased daily trading volumes. This is especially important if you aim for high daily trading volumes.

Examine the strategy and level of automation employed by the Forex robot. Different robots may adopt varying risk levels in their strategies. Ensure the bot's rules align with your investment objectives. Additionally, consider the level of automation; while most robots are fully automated, some provide similar services without requiring access to your trading account, adding an extra layer of security.

Rely on truthful and independent reviews to gauge a bot's performance. Trustpilot reviews by real users provide valuable insights. You can also check for dedicated Facebook pages where users share their experiences. Furthermore, search reputable online sources for comprehensive Forex robot reviews, as these often cover features in detail.

Protecting your investment through effective risk management is vital. Look for a bot with a low drawdown rate, as this indicates a smaller reduction in your portfolio's size after a series of losing trades. Although lower drawdown bots may yield slightly lower returns, they offer greater reliability over the long term.

Confirm that the bot has undergone thorough testing. Developers typically use back-testing to evaluate a bot's behavior and the effectiveness of its trading strategy using historical data. Be sure to investigate the testing phase, developer insights, and technical back-testing details to make an informed decision.

Finally, explore whether the bot offers a demo account option. This allows you to test the bot's functionality and performance without risking real capital, providing valuable hands-on experience before committing to live trading.

AI trading bots can be profitable, but their success depends on various factors. Here are key points to consider regarding the profitability of AI trading bots:

Accuracy of algorithms

The overall profitability of AI trading bots is largely dependent on the accuracy of their algorithms. Those bots who have a well-formulated, effective strategy are more likely to generate profits

Market conditions

Different AI bots are suited to varying market conditions. They may work well in trending markets but struggle in ranging or volatile conditions. Therefore, it is very important to gauge a bot’s suitability for different market conditions

Risk management

Effective risk management is crucial to overall profitability. Those bots that incorporate risk management strategies like stop-loss orders can help limit losses

Continuous monitoring

Regular monitoring and adjustments are necessary to adapt to changing market dynamics. Bots that can evolve and optimize their strategies tend to be more profitable

Trading capital

The size of your trading capital can impact profitability. Bots trading with larger capital may generate more substantial profits but also face higher risks

Broker selection

The choice of a reliable broker can influence profitability. Bots need a trustworthy platform with low spreads, minimal slippage, and adequate liquidity

Skill and knowledge

Users' understanding of bot operation and market analysis plays a significant role. Traders with a solid understanding of trading principles can enhance profitability

Yes, AI (Artificial Intelligence) can indeed be used in Forex trading. In fact, it's becoming increasingly common. AI-powered trading systems utilize complex algorithms and machine learning to analyze vast amounts of data, identify patterns, and make trading decisions. These systems can execute trades automatically based on predefined criteria and market conditions. AI has the potential to enhance trading strategies, reduce human error, and optimize trading outcomes.

Determining the "best" Forex trading AI depends on individual trading goals and preferences. There are various AI-driven trading platforms and software available, each with its unique features and capabilities. To find the best one, traders should consider factors such as accuracy, strategy, automation level, drawdown rate, and reviews. It's essential to research and test different AI trading solutions to determine which aligns best with your specific trading needs.

AI is used in the Forex market to automate trading processes, analyze market data, and make informed trading decisions. AI systems can process vast amounts of financial data in real-time, detect market trends, and execute trades with precision. These technologies utilize machine learning algorithms to adapt to changing market conditions and optimize trading strategies. Traders can employ AI for tasks like pattern recognition, risk management, and strategy development, ultimately improving their trading efficiency.

Automated Forex trading can be profitable, but success depends on various factors. The profitability of automated trading systems is influenced by the accuracy of the algorithms used, the quality of strategy implementation, market conditions, and risk management. Traders should thoroughly backtest their strategies, monitor performance, and continuously optimize their automated systems to maximize profitability. While automation can reduce emotional bias and human error, it doesn't guarantee profits, and losses can still occur.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).