Best Automated Trading for Beginners in 2024

Best Automated Trading Software for Beginners - 1000 pip

Top Automated Trading for Beginners are:

-

1000pip Climber - best trading bot

-

RoboForex - best for copy trading

-

Market Chameleon - offers a number of tools to help traders gain an edge

-

Trade Ideas - backtests US stocks in real-time for high probability trades

-

Trend Spider - offers advanced automatic technical analysis

If you are new to trading or have never done it before, you might be wondering where to start. The good news is there are plenty of automated software solutions for beginners. In this article, we will take a look at how algorithmic trading works, how it can benefit you, and what are the best algorithmic trading software for beginners.

Do you want to start trading Forex? Open an account on Roboforex!-

Which platform is best for automated trading?

There is no one-size-fits-all answer to this question. You need to find a platform that is suitable for your needs and offers all the features that you require.

-

Is backtesting important for automated trading?

Yes, backtesting is an important tool for evaluating your trading system before you put it into action. It allows you to test your strategies on historical data and see how they would have performed under different market conditions.

-

What strategies should I consider before automated trading?

It is important to decide on your trading strategy before you start using an algorithmic trading platform. You need to have a clear idea of what you are trying to achieve and the type of trades that you want to make.

-

Can you make money with automated trading?

Yes, there are numerous success stories of people making millions by trading stocks and currencies using advanced trading bots. However, it is important to remember that you need to spend time learning how the markets work before you can start earning high returns.

What is Automated Trading?

Algorithmic trading, also known as "black box" trading, is a process of using computer algorithms (or programs) to automatically trade financial instruments. The aim of algorithmic trading is to make profits by buying and selling at the right time.

For people who want to learn how to trade without having to actually trade, algorithmic trading can be a good solution. This way you can automate your trades by using pre-programmed rules to make faster and timely investment decisions.

Pros of Automated Trading

Automated trading has a number of pros. Some of these include:

It's efficient

Automated trading speeds up the process of trading and eliminates the chance for human error. If you are a trader, working long hours, or facing tight deadlines, algorithmic trading can make things easier by helping to automate the process entirely. The automated system analyzes data and makes decisions faster than any human leading to better and efficient trading.

Avoids emotional trades

One of the biggest drawbacks of human trading is that we can be influenced by our emotions, which can lead to poor trading decisions. Automated trading removes emotion from the equation, leading to more accurate and profitable trades. When using algorithmic trading software, your emotions can not come into play as you set specific rules that the computer should follow.

Allows backtesting

Backtesting is the process of testing your trading strategy using historical data to evaluate whether it has been successful in the past or not. Backtesting lets you put your trading strategies on auto-pilot mode and find out if they are profitable. Experts recommend that beginners should always test their algorithmic trading strategies before going live with them to avoid making costly mistakes in the future.

Promotes diversification

Automated trading allows you to trade in multiple markets with multiple strategies at the same time. You don't have to depend on one strategy, as automated software gives you the option of using multiple strategies at once. This way you can take advantage of opportunities in any market and trade, which leads to more profit.

Ensures discipline

Trading without a plan can cost you a lot, as it takes only one bad decision to wipe out your entire investment. Automated software eliminates this risk by making pre-determined decisions in volatile markets. This way, you can trade without emotions and stick to your trading plan, which will lead to better discipline and consistency.

Cons of Automated Trading

Of course, automated trading comes with its own set of cons. Some of these include:

Over-optimization

Automated trading systems can be prone to overfitting, where they are optimized so much to historical data that they fail to adapt to live market changes. This can lead to poor performance.

Lack of discretion

Automated systems follow rules strictly and lack a human trader's discretion and intuition to deal with unusual events like major news, geopolitical situations, or central bank decisions, which can significantly impact the markets.

Relies on technology

Automated trading makes life easier and increases accuracy but on the other hand, it also means that your entire system can be compromised because all your trades are executed through technology. In case of a mechanical or electronic failure, you may not be able to make trade orders as they reside in your computer system and not on the server.

Still requires a degree of monitoring

Although the purpose of algorithmic trading software is to reduce human interaction, it still requires a degree of monitoring. The software might be able to make decisions on its own, but you need to keep an eye on the market conditions and ensure that your software is making the best decisions, or if it needs any adjustments.

How Does an Algorithmic System Work?

An algorithmic system is a set of rules that are programmed into a computer system to help it make trading decisions. The algorithm takes into account various factors such as historical data, current market conditions, and the trader's preferences. It then produces a set of buy or sell signals that are used by the computer to place orders automatically in the markets.

Algorithmic trading strategies allow traders to code computer systems that can identify and execute trades based on specific rules.

Some trading strategies might include:

-

Identifying the best price point

-

Timing of trade entry and exit points

-

Lookback periods (how long to hold)

-

Order placement rules (where to place orders)

-

Money management rules

-

Automated Trading Software - Best Options for Beginners

We understand that beginners can have a hard time choosing the right algorithmic trading system. After all, not everyone has the programming expertise to run these things. That's why we have compiled a list of options that can work for someone without any programming knowledge. These options are Algorithmic Strategy Builders.

Best AI Trading Software - Top 6 Providers Review1000pip Climber - Best Trading Bot

The 1000pip Climber is a Forex trading bot that is designed to help users succeed in the foreign exchange market. It is not a free trading bot; it is a paid service. However, it offers a state-of-the-art algorithm that continuously analyzes the FX market, looking for potentially high-probability price movements.

How to Set-Up

To set up the 1000pip Climber Forex Robot, you can follow these steps:

-

Download the Software: Visit the official website or a reliable source to download the software.

-

Install the Software: Follow the installation instructions provided by the developer to set up the trading bot on your preferred trading platform, such as MT4.

-

Configure the Software: Customize the settings and parameters according to your trading preferences and risk tolerance.

-

Connect to a Broker: Ensure that your trading account is connected to a reliable broker that supports the use of automated trading bots.

-

Monitor and Adjust: Keep an eye on the system's performance and make necessary adjustments as needed to optimize your trading strategy.

Please note that the system may not work on some trading platforms, such as MT5, and you might need to use it on a different platform like MT4.

RoboForex - Best for Copy Trading

Roboforex's MetaTrader 4

MetaTrader 4 is one of the most popular algorithmic forex trading platforms in the world. The software offers a wide variety of features, including charting tools, indicators, and automated trading systems. You can also trade manually or use pre-loaded strategies. MetaTrader 4 is a great platform for both beginners and experienced traders.

Is it Free or Paid

MetaTrader 4 is free to download from the Roboforex website. The platform is free to use, but it is only available for trading accounts having more than 300 USD.

How To Set-Up

-

Download the MetaTrader 4 app from the broker’s website.

-

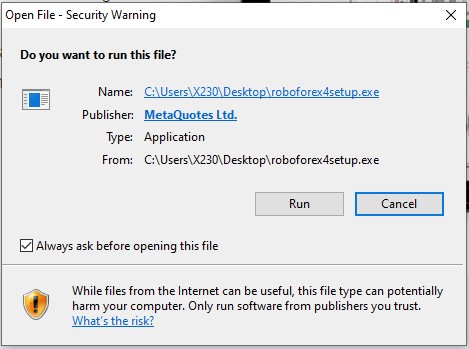

Run the setup. You should come across this screen.

Roboforex's MetaTrader 4 setup

-

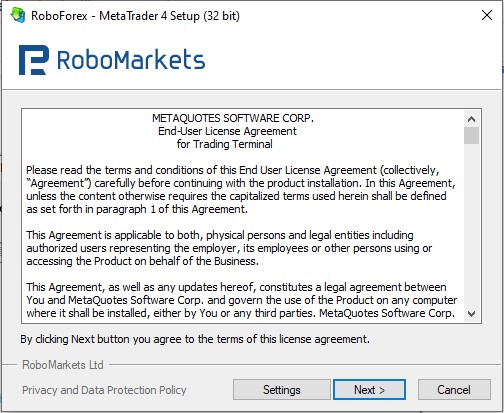

Read and agree to the license agreement.

Roboforex's MetaTrader 4 setup

-

Click "Install" and MetaTrader 4 will start installing.

Roboforex's MetaTrader 4 setup

-

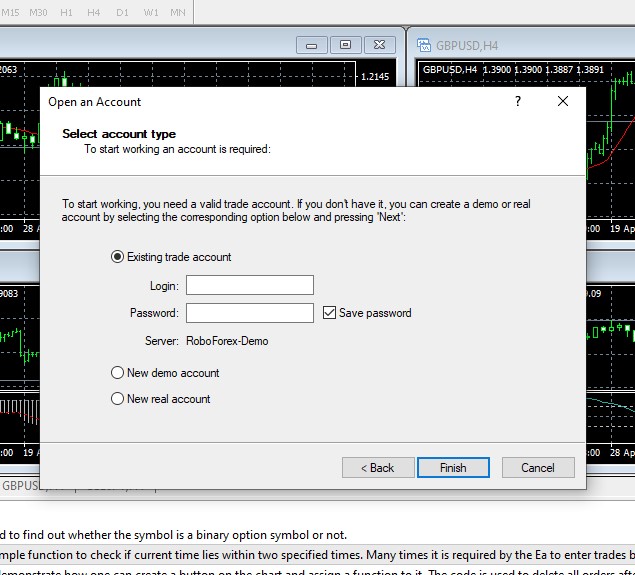

On the next screen, enter your login information and click Finish.

Roboforex's MetaTrader 4 setup

Market Chameleon - Offers a Number of Tools to Help Traders Gain An Edge

Market Chameleon is a comprehensive trading platform that offers a variety of tools to assist traders in gaining an edge in the market. It specializes in providing insights and analytics for stock and options trading.

Is Free or Paid

The platform has both free and paid options. It includes a free tier known as the Starter Plan, which offers basic tools and features. For more advanced tools and features, Market Chameleon offers several paid subscription plans, each tailored to different trading needs and preferences.

How to Set-Up

To set up Market Chameleon, follow these steps:

-

Visit the Market Chameleon website.

-

Choose whether to sign up for the free Starter Plan or select a paid subscription plan.

-

Create an account by providing your email address and creating a password.

-

If opting for a paid subscription, complete the payment process.

-

Customize your experience by setting up stock watchlists.

-

Explore the platform to familiarize yourself with its various tools and features.

-

Optionally, subscribe to receive email updates and alerts relevant to your trading interests.

Trade Ideas Overview

Trade Ideas is a dynamic stock market analysis platform that offers real-time scanning and AI-powered trading tools. It's designed to help traders, especially those focused on US stocks, identify high-probability trades through backtesting and various analytical tools. The platform is particularly valuable for intraday and swing traders, providing them with innovative visualizations and simulated trading environments.

Is It Free or Paid

Trade Ideas operates on a subscription basis and offers different levels of access. It has a free option known as the TI Dashboard, which provides basic functionality. For more advanced features, including real-time data, AI-driven trade signals, and comprehensive charting tools, there are paid plans.

How to Set-up

-

Visit the Trade Ideas website.

-

Choose your desired subscription level: the free TI Dashboard, the Standard Plan, or the Premium Plan.

-

Register for an account by providing necessary details like your email address.

-

For a paid subscription, complete the payment process.

-

Once your account is set up, explore the platform to understand its features and tools.

-

Customize your trading experience by setting up alerts, watchlists, and preferences based on your trading style.

-

Take advantage of the simulated trading feature to practice strategies without financial risk.

-

For comprehensive usage, consider linking Trade Ideas to your brokerage account for seamless trading integration.

Trend Spider - offers advanced automatic technical analysis

Established in 2016, TrendSpider offers a robust suite of technical analysis tools, streamlining the process of finding, planning, and timing trades with precision. The platform facilitates dynamic watchlist creation through its Market Scanner, spanning various timeframes from 1 minute to 1 month. Users can utilize built-in scanners or design custom ones, backed by real-time market data and over 20 years of historical data.

TrendSpider operates as a web-based platform with cloud-based customization storage. Notable features include Smart Charts, which automates time-consuming aspects of technical analysis, enabling swift analysis for multiple securities. Raindrop Charts® offer a unique visualization of market data by focusing on trading volume at each price level. The platform also provides alternative data offerings, strategy testing, and backtesting capabilities for various trading strategies, allowing users to deploy winning strategies as trading bots with ease. TrendSpider's mobile app and Chrome extension keep traders connected to charts and scanners, while integration with external systems and webhook support enhances customization and automation options.

To help traders assess their compatibility with the software, TrendSpider offers a 7-day trial. Read also information about Investfly Review.

How to Choose the Best Software for Automated Trading?

When you are looking for the best software for algorithmic trading, there are certain factors that you need to consider. A good algorithmic trading software should:

1. Act on market and company data

Many algorithmic trading software works on the real-time market and company data. Some programs can be customized according to your company's data. The best trading software must integrate with other software to get the most accurate and updated market data.

2. Minimize latency

Latency is the delay in the time it takes for a signal to be sent from your computer to the exchange. The best software must-have features that help minimize this latency so that your orders are filled as quickly as possible.

3. Ensure customization and configurability

Most algorithmic trading software has built-in algorithms that you can use as-is. The best software should be configurable so that you can set the parameters to your desired values. To get the most out of your software, choose one that you can customize according to your needs and different strategies.

4. Have backtesting features

The best algorithmic trading software must have a dedicated tool to help you backtest on historical data. This will help you analyze the performance of your trading strategies before risking your money on the live markets and it will allow you to choose the most profitable and desirable options for your trading.

5. Be user-friendly

A complicated trading system can be impossible to use for new traders. To get the most out of your software, choose one that is user-friendly and easy to set up even if you are a complete novice. It should have a simple and intuitive user interface so that you can get started without any trouble.

6. Allow unlimited strategies

The best software should allow you to create an unlimited number of trading strategies and test them. You must be able to configure your strategies without any limitations for better customization.

7. Have user reviews

Community activity offers the real-world experiences of people actually using the automated trading software day to day. Take the time to research before deciding.

8. Provide demo version

Take advantage of trial periods offered by reliable software providers. The demo trial should mimic real conditions as closely as possible. Thoroughly test all key functions and workflows you would use during live automated trading. This ensures the software meets your needs before purchasing.

Top Tips for Setting Up a Trading Strategy

When you are starting off in algorithmic trading, it is important to set up your trading strategy correctly from the beginning. This will help to ensure that you make consistent profits and limit your losses. Here are some tips for setting up a successful trading strategy:

1. Decide on your risk appetite

Risk is an important factor in successful trading. Before you set up your strategy, decide on the level of risk that you can afford to take and the amount that you are comfortable with losing. This will help you decide on a realistic profit target and establish a stop loss for your trades.

2. Create a trading plan

A trading plan is an important document that outlines all the trading strategies that you intend to use, your entry points and stop losses, and instructions for exiting a trade. It should also include information such as the time of the trades and how much money you will invest in each trade. You can also create a strategy for different types of market conditions.

3. Set your goals

When you are starting out with algorithmic trading, it is important to set realistic goals for yourself. These should be short-term and long-term targets such as high yield per day or month. You should also set a time frame that you will give each strategy before moving on to another one. This helps you decide if a particular strategy is working well or it is time to move on to the next one.

4. Backtest your strategies on historical data

A backtesting feature is an important tool for evaluating your trading system before you put it into action. You can use historical data to run your system on the markets and check if they are giving you the results that you expect. If not, you can modify your strategies accordingly so that they perform better.

5. Monitor performance

Once you have fine-tuned your strategies, it is important to monitor their performance in the real-time market. When you are trading with real capital, it is important to be aware of any changes in the market dynamics so that you stay ahead of the curve. This will help ensure that your strategies are always profitable and you do not lose out on profits.

Best Trading Bots To Download for Free

Trading bots are automated software that analyze the markets and place trades on your behalf. They function by using predefined rules and conditions, so they can execute trades without any input from the user that's why trading bots serve as a substitute for manual trading.

There are many bots available for free download and some of the best are discussed below.

1. RoboForex

RoboForex Signals is an advanced algorithmic trading software for forex traders who are new to the market. This automated trading bot can be customized to meet your needs and the best part is that it is absolutely free to download.

2. Fortnite

Fortnite trading bots are very popular in markets that are highly volatile and offer a lot of opportunities for quick profits. The bot can be easily customized to place buy and sell orders depending on your trading strategy.

3. Haasbot

Haasbot is a well-known name in the world of bitcoin trading bots. It is an advanced bot that can be used for automated bitcoin trading and comes with a number of free features.

A wide variety of readymade bots are available in the market that you can easily download for free.

Copy Trading - Best Alternative Options

Copy trading is a great alternative to algorithmic trading. It is especially suitable if you are new to the trading scene and would like to learn more about the markets before making any major trades or investments. In copy trading, you can use technology to copy other traders in the hope of replicating their success.

Copy trading is quite advantageous for newbies as they have the opportunity to learn from the experience of more experienced traders. They can also observe the strategies that experienced investors use and replicate them. This can be a great way to learn more about the markets and make some profits while you are at it.

eToro is a great cryptocurrencies trading platform that offers copy trading. You can find a list of successful traders on the platform who allow you to copy their trades. eToro has an easy-to-use web page and mobile app, so you can get started with copy trading in just a few minutes.

Summary

You don't need expert programming knowledge, deep software skills, or even a full command over stocks, cryptocurrency, and market trends to make profits with your trades. Algorithmic trading platforms allow you to set your parameters once and enjoy timely, rational, and automatic trades.

The best part is, you don't even have to curate your own patterns and formulas. With copy trading, you can simply imitate the trading patterns of successful brokers. Although there are a couple of downsides to trading with algorithms, the pros they offer make them more than worth it. As long as you follow some key tips, you will likely earn big using these platforms.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.