Top Forex Strategy Builders

The best broker with Forex strategy builder is RoboForex

The best brokers with Forex strategy builders are:

RoboForex strategy builder - Create and automate Forex trading strategies without coding knowledge

Dukascopy Visual JForex - a user-friendly automated trading interface that allows users to visually build, customize, backtest and deploy Forex strategies

Trading Central strategy builder - Design and backtest trading strategies with fundamental and technical analysis

Interactive Brokers strategy builder - Simplify multi-leg options and Forex strategies with one-click execution

Forex Software strategy builder - Generate profitable strategies with backtesting, optimization, and 100+ indicators

Upstox strategy builder - Access ready-made NIFTY & BANKNIFTY strategies for all market trends

Forex trading, although a very lucrative opportunity, has become quite difficult to navigate and understand. However, a strategy builder helps to eliminate this confusion and offers Forex traders a chance to build their own automated strategy without the need of any programming knowledge. This TU guide explores the best brokers offering this feature, including RoboForex, Trading Central, and IBKR. The experts at TU aim to simplify the process of choosing a Forex broker that offers the best strategy builders.

-

How often should I review and update strategies?

It's best to review strategies at least once a quarter but monthly reviews are preferable.

-

How do strategy builders handle commissions and slippage?

Most allow users to specify average slippage and commission amounts which are deducted during backtesting.

-

How accurate are backtests really?

Backtests make simplifying assumptions and don't account for changing market microstructure over long periods. Still, they provide a statistically valid sense of strategy robustness. Walk-forward testing further increases accuracy.

-

What is forward testing and how is it different from backtesting?

Forward testing involves deploying a strategy on a demo account with current live market data instead of historical data used in backtesting. This helps bridge the gap between simulation and reality.

Warning:

There is a high level of risk involved when trading leveraged products such as Forex/CFDs. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is a strategy builder?

A Forex strategy builder is a specialized tool used in Forex trading. It is designed to equip traders with the ability to create and backtest their own trading strategies. The strategy builder allows traders to formulate their own Forex strategy using a wide variety of tools and indicators. With this tool, traders can gain valuable insights into the performance of their strategies, leading to more informed and potentially successful trading decisions.

Best brokers with Forex strategy builder

RoboForex strategy builder

| Features | Description |

|---|---|

|

Visual Interface |

User-friendly interface for easy strategy creation |

| Strategy Chart |

Visualize strategy with entry, exit points, and stop-loss levels |

| Ready-made Strategies |

Predefined entry and exit signals with customizable parameters and settings |

| Backtesting Capabilities |

Assess strategy performance using historical data |

RoboForex Strategy Builder is an advanced builder that is designed for Forex traders to create and implement automated Forex trading strategies. The platform has a very user-friendly interface, making it seamless for all kinds of Forex traders. The tool offers additional features such as Break Even, Payoff Graph, Payoff Chart, P/L Table, and Strategy Chart to help Forex traders visualize and analyze trading strategies effectively.

This Strategy Builder also provides ready-made strategies with predefined entry and exit signals, along with customizable parameters and settings. The visual representation of strategies enhances decision-making and allows for easy customization to suit individual preferences and trading styles. Moreover, the robust backtesting capabilities empower traders to assess strategy performance using historical data, instilling confidence before live implementation.

Dukascopy Visual JForex

| Features | Description |

|---|---|

|

Visual workflow |

Build strategies by dragging and dropping pre-built blocks |

|

Rich library of elements |

Over 40 pre-built blocks covering a wide range of technical indicators, risk management tools, and order execution conditions |

|

Backtesting and optimization |

Test and optimize your strategies on historical data to verify their effectiveness and fine-tune parameters |

|

Live trading |

Trade strategies directly from Visual JForex via one of Dukascopy's trading platforms |

Visual JForex is a powerful automated trading interface developed by Swiss forex broker Dukascopy that allows users to visually build, modify and optimize trading strategies without requiring any coding skills. Traders can leverage a wide selection of pre-built blueprint strategies as templates or design their own unique sets of rules from scratch. The strategy builder employs an intuitive drag-and-drop interface where parameters, indicators and condition blocks can be added and connected to create comprehensive rule-based trading systems. Strategies are thoroughly analyzed through an advanced backtesting feature, which replays historical market data to provide critical risk and profitability metrics prior to implementation. Additionally, traders benefit from robust charting tools that facilitate technical analysis and aid in trade signal generation. Completed strategies may then be seamlessly deployed for live trading through one of Dukascopy's own low-latency ECN brokerage platforms due to the powerful integration between Visual JForex and their entire ecosystem.

Trading Central strategy builder

| Features | Description |

|---|---|

|

Visual Interface |

Intuitive user interface for creating and refining trading strategies |

|

Fundamental & Technical Analysis |

Use both fundamental and technical analysis to create and backtest strategies |

| Predefined Strategies |

Select from pre-curated strategies based on market predictions |

| Backtesting Capabilities |

Test strategies using historical data to gain insights into performance |

| Fine-tuning Strategies |

Refine strategies before applying them in live market conditions |

Trading Central’s strategy builder is another advanced tool designed to cater to traders of all backgrounds. It allows users to create and backtest trading strategies on its platform. In addition, it also allows traders to use both fundamental and technical analysis. One noteworthy feature of this platform is that users can set specific criteria to screen and evaluate investment ideas according to their preferences and risk appetite.

This strategy builder is very easy-to-use and its intuitive user interface allows traders to follow and refine their trading strategies very easily. Traders can customize various parameters such as timeframes, technical indicators to be incorporated, market conditions, and much more.

The tool’s efficient backtesting capabilities are also worth mentioning. Using the same, traders can test their strategies and gain insight into historical data, and know how their strategy has fared in past market conditions. This can be a very important feature, as it allows traders to learn Forex and fine-tune their strategies and make necessary changes to them before putting them in live market conditions.

IBKR strategy builder

| Features | Description |

|---|---|

|

Visual Interface |

Intuitive platform for creating complex multi-leg options and Forex strategies |

| Predefined Strategies |

Choose from a list of predefined strategies for quick strategy selection |

| Interactive Highlight |

Highlight other potential legs for inclusion when selecting initial leg |

| Easy Access |

Toggle on Strategy Builder at the bottom of the option chain to reveal predefined strategies |

Interactive Brokers Strategy Builder is a versatile builder that can simplify the process of creating multi-leg options and Forex strategies. For option strategies, traders gain the ability to build complex strategies such as Butterfly, Box, Strangle, or other named combinations using just a single click.

Using this tool, traders can construct multi-leg strategies by clicking on the bid or ask price of a call or put and adding the respective leg to their strategy. IBKR has further developed a “Predefined Strategies Pick List” option in its tool, which allows users to select from a list of predefined strategies.

The strategy builder is designed to assist traders in such a way that when a trader chooses his desired strategy and hovers over the price of the initial leg, the builder intelligently highlights the other strategy that could be used and included in the existing strategy.

In order to access the predefined strategies, traders just need to open an option chain or a Forex symbol and then use the right-click menu to navigate to the Trading Tools and Option Chain. When you toggle on the Strategy Builder tool at the bottom of the chain, it will reveal a list of predetermined strategies to choose from.

Forex Software strategy builder

| Features | Description |

|---|---|

|

Visual Interface |

User-friendly interface for creating and editing strategies |

|

Expert Advisors |

Trade with Expert Advisors and export strategies for MT4 and MT5 platforms |

| Strategy Optimizer |

Fine-tune strategies using other (and potentially better) strategies as reference points |

| Backtesting Capabilities |

Simulate strategies using historical data to evaluate performance |

| Technical Indicators |

Access to a library of over 100 technical indicators bundled with the software |

The Forex Software Strategy Builder is a comprehensive tool that allows traders to be equipped with a wide variety of tools and capabilities to generate profitable trading strategies. Using this tool, users can find a predetermined strategy of their choice or build one and ensure that it is customized to their trading needs.

For those traders who like to be more creative and intuitive with their strategy, the strategy builder allows the creation and editing of its systems via a user-friendly interface, eliminating the need for advanced coding capabilities. Users can also trade with Expert Advisors (EAs), whose strategies can be exported to the MT4 and MT5 platforms, thereby giving them a hassle-free trading experience.

One of the main features of this tool is its Strategy Optimizer feature, which enables traders to fine-tune their strategies using other (potentially better) strategies as reference points. Furthermore, the software offers a detailed analysis of the positions completed, backtesting capabilities, a position journal, and a well-defined indicator count with account charts.

The Forex Software Strategy Builder also allows traders to run backtests using various interpolation methods and conduct multi-market tests with a single click. This enables traders to check the profitability and robustness of their strategies. Additionally, the software provides regular updates to increase reliability and eliminate common errors.

Furthermore, the software has an extensive library of over 100 technical indicators and offers its users complimentary access to online resources, including both user and developer-made technical indicators. It also has an FSB online community where traders can exchange knowledge and engage with other users to seek help and find invaluable tips to enhance their trading experience.

Upstox strategy builder

| Features | Description |

|---|---|

|

Ready-made Strategies |

Pre-curated option strategies covering NIFTY & BANK NIFTY, useful in all market trends |

| Risk and Reward Insights |

View profit probability, maximum profit & loss, and required funds for a selected strategy |

| Interactive Pay-off Graph |

Visualize "take-home" amounts at different levels, allowing for timely exit from strategies |

| User-friendly Interface |

Easy-to-use interface for smooth strategy execution and analysis |

The Upstox strategy builder offers a wide range of features and capabilities that allow traders to have an enhanced experience. One of its main offerings is the ready-made strategies feature, which allows traders to trade in NIFTY and BANK NIFTY. These strategies are designed in such a way that they cover various market trends and offer a high-profit probability with minimal risk.

Traders have the option to select a strategy or a system according to their individual preferences. If they are risk averse, they can select a strategy with low risk. The strategy builder also offers other insights to traders, such as the maximum profit or loss, the Risk-to-Reward (RR) ratio, the required funds, and the profit probability.

Another feature worth mentioning for this tool is the interactive pay-off graph, which enables traders to assess the ‘take-home’ amounts at different levels. This feature allows traders to have a timely exit from their open positions, allowing them better risk and money management.

Lastly, the Upstox strategy builder has a user-friendly interface and is free to use, allowing easy execution of trades and gaining valuable insights.

The main Features of EA builder

An EA Builder allows traders to build effective and profitable automated strategies. Here are its main features:

Visual interface

An EA builder often has a user-friendly visual interface, thereby eliminating the need to curate strategies with complex coding. These platforms have one-click capabilities and ensure that strategy curation is accessible to traders of all backgrounds

Strategy Wizard

The Strategy Wizard allows traders to simplify their strategy creation process by providing them with step-by-step guidance. Users can also set parameters and define which trading rules they want. This helps them create and backtest a strategy with great effectiveness and control.

Indicator integration

An EA builder has a vast library of technical indicators at its disposal, and the strategy builder allows seamless integration of these indicators into complex Forex strategies. Traders can use these indicators to enhance their strategies and make the most of them.

Customizable parameters

One of the key features of EA builders is their flexibility. They allow traders to set their own trading preferences, such as entry and exit conditions, stop loss levels, position sizing, and much more. This helps in refining the trading strategy as per an individual’s trading needs.

Backtesting

Backtesting is an important step to ensure the robustness and reliability of any trading strategy. With the help of an EA builder, traders can simulate their strategies using historical market data, assess the profitability of their strategies, and further identify potential areas for improvement.

Optimization

An EA builder offers various customization and optimization tools to traders to refine their trading strategies for better performance. Nowadays, these EA builders have many presets and parameters available to them, which you could change and combine to optimize your strategy and get better results in different and varying market conditions.

Code generation

Once you have built and completed your strategy, the EA builder will generate the code for the trading strategy. This ensures that you don’t have to write manual code for your strategy, while the accuracy of the results is also enhanced.

Support for multiple trading platforms

An EA builder supports a variety of trading platforms (such as MT4 or MT5) and is very adaptable to the trading conditions of different brokerage accounts.

How to use RoboForex strategy builder

Step 1:

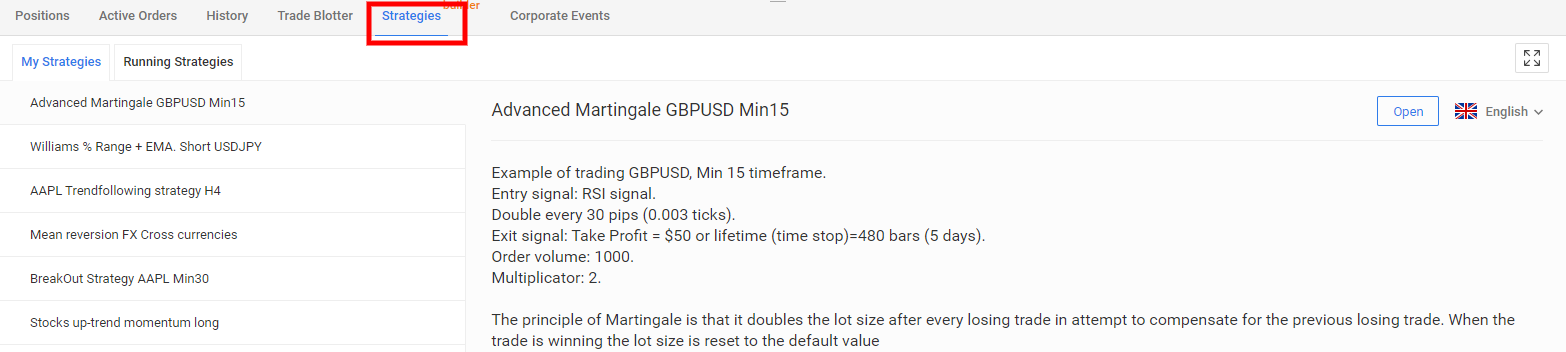

To use the RoboForex strategy builder, open the "Strategies" section in the R StocksTrader platform.

How to use RoboForex strategy builder

Step 2:

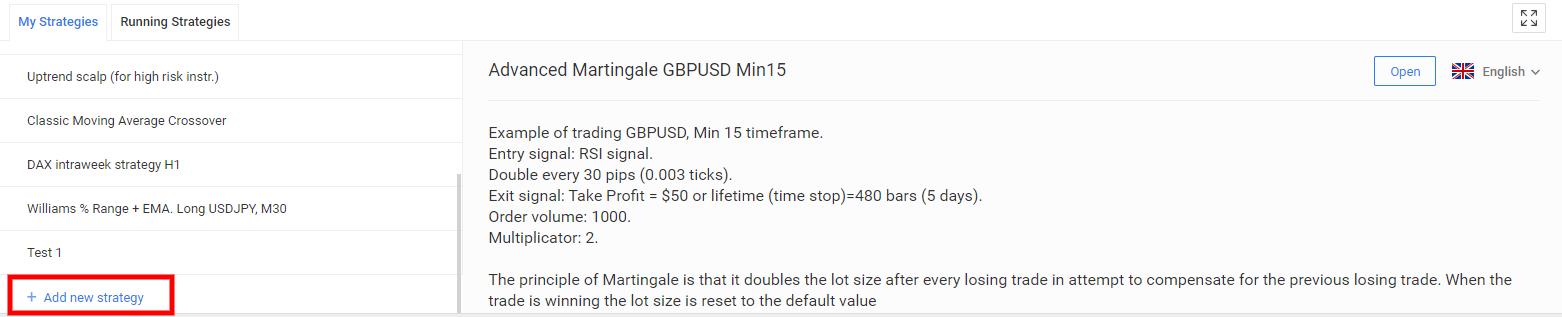

Click on "Add New" and provide a name and description for your trading robot. Access the platform, navigate to "Strategies" and select "My Strategies". Then, click on "Add new strategy" to begin the process.

How to use RoboForex strategy builder

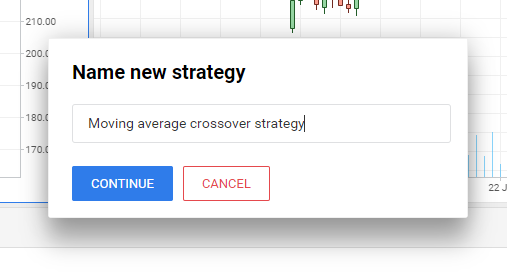

Step 3:

Invent a name for your strategy and provide a brief description. Once you complete this step, you will enter the strategy builder interface.

How to use RoboForex strategy builder

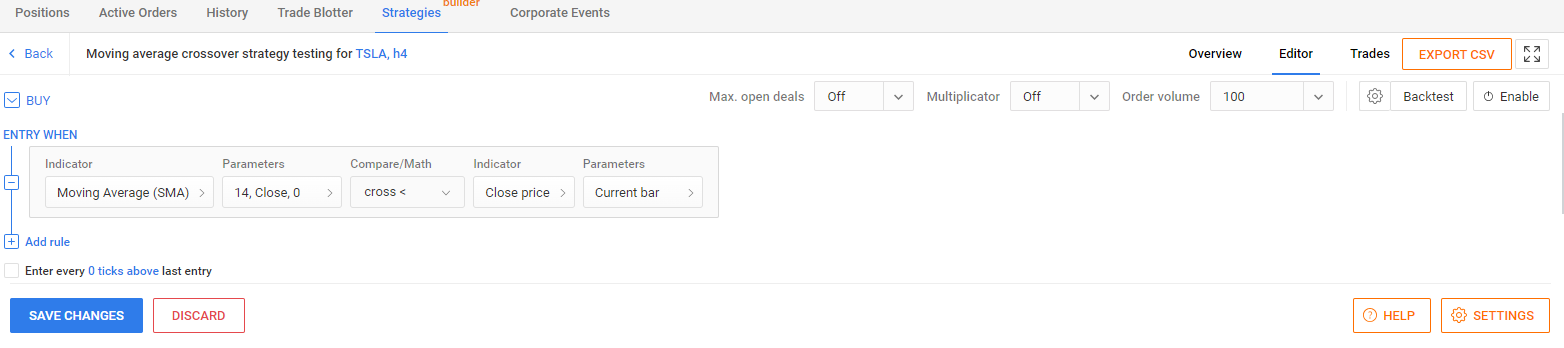

Step 4:

Configure the parameters of your trading system. Start by setting the conditions for a Buy and sell positions, selecting the appropriate indicators, and specifying the conditions as per your strategy.

How to use RoboForex strategy builder

Step 5:

Specify the closing conditions for the Buy position. Additionally, you can set up Stop Loss and Take Profit values to automatically close the position based on the first fulfilled condition.

Step 6:

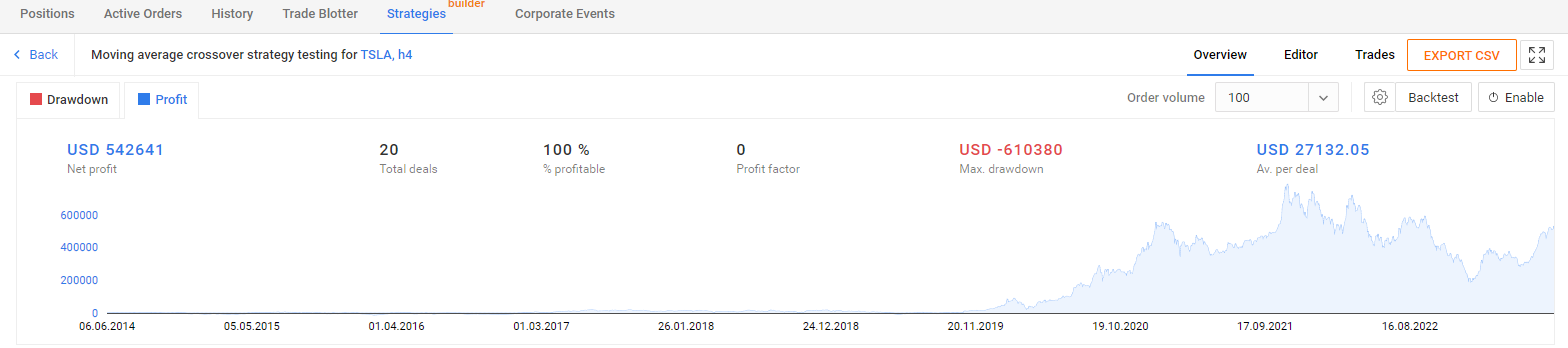

After formulating the opening and closing conditions for the Buy position, choose your preferred trading instrument, select a timeframe, determine the order volume, and click on "Backtest" to evaluate the performance of your strategy.

How to use RoboForex strategy builder

By following these step-by-step instructions, you can effectively utilize the RoboForex strategy builder to create, test, and optimize your automated Forex trading strategies without the need for coding or additional software.

How to analyze the existing trades using RoboForex trading strategy builder

Analyzing existing trades using the RoboForex trading strategy builder is a crucial step in evaluating the performance and effectiveness of your trading strategies. By following a systematic approach, you can gain valuable insights and make data-driven decisions to optimize your trading outcomes.

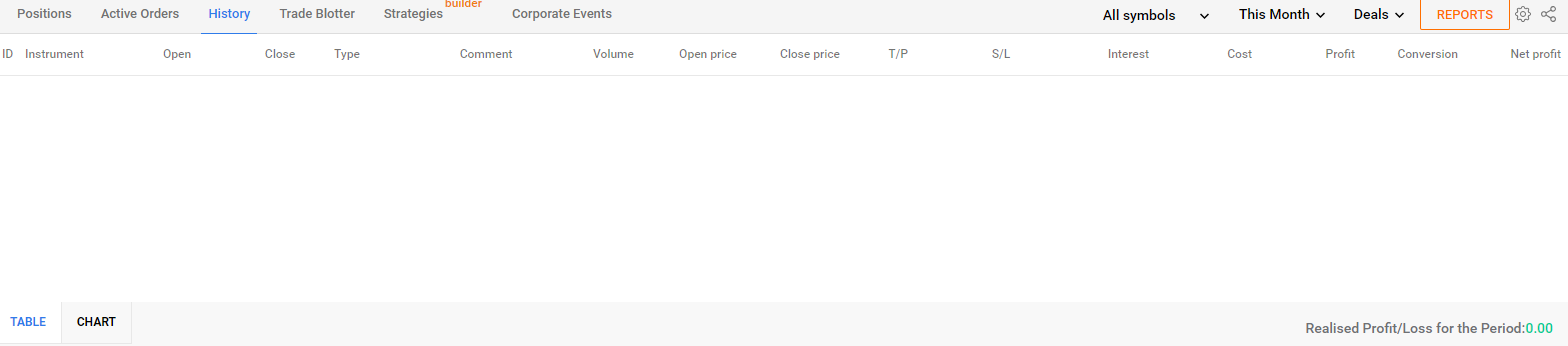

Step 1: Access the "History" section in the R StocksTrader platform and navigate to your existing strategies

How to analyze the existing trades using RoboForex trading strategy builder

Step 2: Review the performance metrics of your trades, including profit/loss, win rate, drawdown, and other relevant statistics. These metrics provide a comprehensive overview of the performance of your trading strategies

Step 3: Examine the trade history and analyze the entry and exit points of each trade. Evaluate the effectiveness of your strategy in capturing profitable opportunities and managing risk

How to analyze the existing trades using RoboForex trading strategy builder

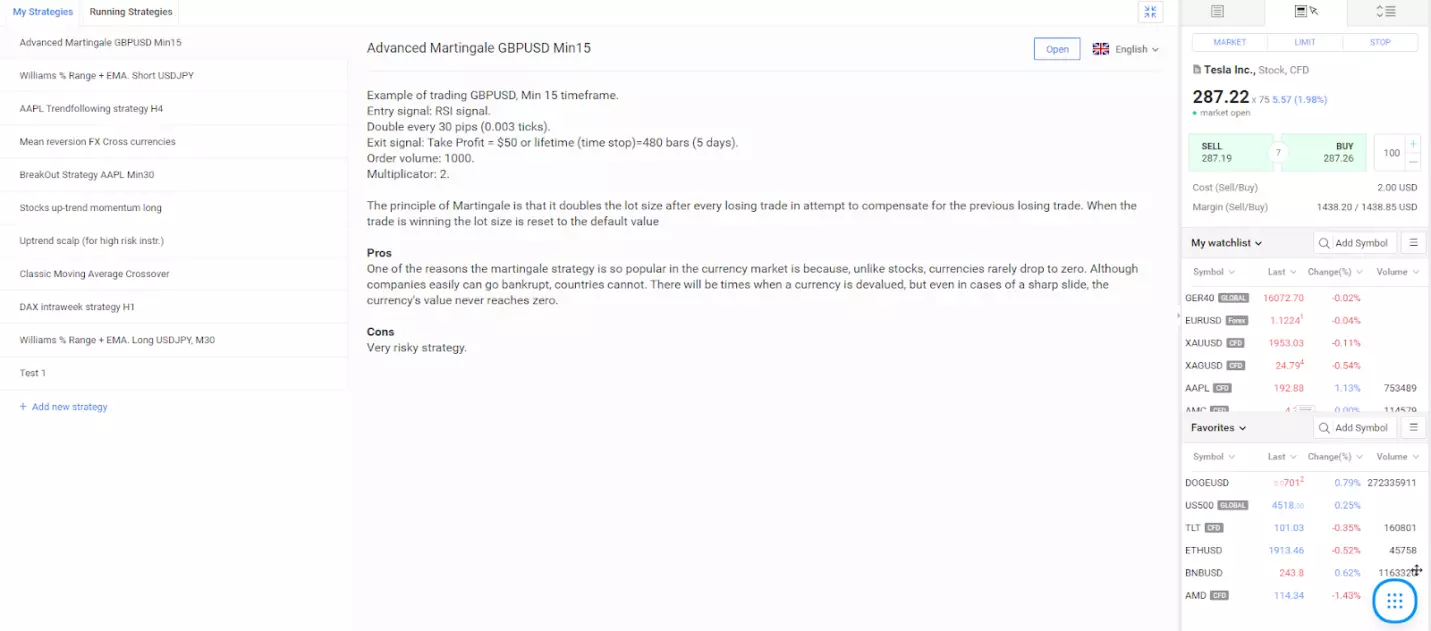

RoboForex Strategy Builder provides a range of ready-made strategies that traders can utilize for their trading activities. These strategies are designed to offer predefined entry and exit signals, along with specific parameters and settings. Here are some examples of the ready-made strategies available:

Advanced Martingale GBP/USD Min15:

This strategy employs the Martingale principle and focuses on trading the GBP/USD currency pair on the 15-minute timeframe. It utilizes the RSI signal as the entry signal and employs a doubling approach for lot sizes. The strategy sets specific exit conditions such as a take profit target or a time stop. While the Martingale strategy can be popular, it is essential to note that it carries significant risk.

Williams % Range + EMA. Short USDJPY:

This strategy utilizes the Williams Percent Range indicator to identify overbought conditions in the USD/JPY currency pair on the 30-minute timeframe. It confirms the short signal using Exponential Moving Averages (EMA) with periods of 50 and 14. The strategy includes specific exit conditions such as a take profit target or a time stop. This approach aims to capitalize on potential reversals in the market.

Mean reversion FX Cross currencies:

This strategy focuses on trading cross currencies, specifically the GBP/NZD pair on the 15-minute timeframe. It employs the concept of mean reversion, where prices and returns tend to revert back to their average values. The strategy utilizes specific entry conditions based on lowest low/highest high and strong candles. It also includes predefined exit conditions such as a take profit target or a time stop.

Advantages of using strategy builder

RoboForex Strategy Builder offers several key advantages that make it a valuable tool for traders looking to automate their trading strategies. These advantages include:

User-friendly interface: The Strategy Builder features a user-friendly interface that is intuitive and easy to navigate. Traders can seamlessly create, modify, and test their trading strategies without the need for extensive programming knowledge. The platform provides a visually appealing and accessible environment for strategy development

No programming knowledge required: One of the major benefits of RoboForex Strategy Builder is that it eliminates the need for programming skills. Traders can design and implement trading strategies using a simple point-and-click approach. This accessibility opens up the world of automated trading to a broader range of traders, regardless of their technical background

Strategy visualization: The Strategy Builder allows traders to visually analyze and evaluate their trading strategies. Traders can view charts, indicators, and parameters in a clear and concise manner, enabling them to gain insights into the performance and potential of their strategies. The ability to visualize strategies enhances decision-making and helps traders fine-tune their approaches for optimal results

Customization options: The Strategy Builder offers customization options, allowing traders to tailor their strategies according to their specific preferences and trading styles. Traders can adjust parameters, set entry and exit conditions, and incorporate various technical indicators to refine their strategies. This flexibility empowers traders to adapt their strategies to different market conditions and optimize their trading outcomes

Backtesting capabilities: RoboForex Strategy Builder provides robust backtesting capabilities, allowing traders to assess the performance of their strategies using historical data. Traders can simulate their strategies in different market scenarios and evaluate their profitability and risk metrics. Backtesting helps traders gain confidence in their strategies before deploying them in live trading

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Backtesting

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

5

Expert Advisor

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).