The Traders Union experts suggest the following step-by-step process to start Forex trading:

Open a trading account

Research the market

Understand currency movements

Devise a trading strategy

Place your trade

Forex trading, also known as foreign exchange trading, is a popular financial market where traders buy and sell different currencies with the aim of making a profit. As a beginner, getting started with Forex trading can be daunting and overwhelming, but with the right guidance and support, it can be a rewarding and profitable experience. In this article, the experts at TU provide you with comprehensive insights and tips on Forex trading for beginners, including the basics of Forex trading, how to get started, and the different strategies you can use to maximize your profits.

The Traders Union experts suggest the following step-by-step process to start Forex trading:

Open a trading account

Research the market

Understand currency movements

Devise a trading strategy

Place your trade

Forex trading happens in a decentralized global market where buyers and sellers exchange currencies at mutually agreed-upon prices. It serves as a means for individuals, corporations, and central banks to convert one currency into another for various reasons. While some currency exchanges are done for practical purposes, many traders aim to profit from the volatility of currency price movements. The high volume of currency exchanged every day can result in extreme price fluctuations, making Forex trading an attractive market for traders looking to make significant profits, but also increasing the risk involved.

Unlike other markets, spot Forex trading does not take place on exchanges, but instead, it is conducted directly between parties through an over-the-counter (OTC) market. The Forex market is open 24 hours a day, allowing traders to engage in currency trading across different time zones. It operates in three different types: the spot Forex market, the forward Forex market, and the futures Forex market.

In Forex trading, traders buy or sell currency pairs depending on their expectations of its future performance. A currency pair consists of a base currency and a quote currency, with the price indicating the value of one unit of the base currency in terms of the quote currency. Traders make exchange rate predictions by analyzing the market to take advantage of price movements in the market, and can either buy (long) or sell (short) a currency pair depending on their expectations.

In this section, the experts have delved deeper into the essential components of successful Forex trading. These guidelines can help novice traders avoid common pitfalls and maximize their chances of making profits.

To better understand the big picture, it's crucial to use longer timeframes such as 60 minutes, 4 hours, and daily charts. Looking at shorter time frames can create an incomplete picture that can lead to inaccurate judgments.

Controlling your risk is a key component of successful Forex trading. Generally, position sizes of 3% to 5% of your trading capital should be the maximum. Additionally, a high leverage ratio can make it very easy to lose more than your account balance can handle.

To increase your chances of success, it's essential to be patient and give your trades time to work. The ability to ride out the market's volatility is a must. As long as your position size is safe, you should wait for larger price swings before considering closing out trades that move against your plan. Stop losses that are too tight can kick you out of a trade just before the market moves in your direction.

Technical indicators can be helpful, but they have limitations. Because they're based on past data, they can't always predict the future. Professionals who use technical indicators often profit from understanding how the masses will react to the data, rather than the data itself.

To avoid information overload and better anticipate trends, it's best to focus on one or two major currency pairs rather than trading too many. Fundamental data is the primary driver of currency prices, and it's essential to follow data releases closely to anticipate market reactions.

Using mini-lots can help you spread out your position and exit or enter trades with more flexibility. Averaging in and out of trades can be a useful strategy, especially for accounts with less than $50,000. To implement this, brokers who don't offer mini-lots may be avoided.

Volatility can increase dramatically around data releases, and it's crucial to exit positions before major releases. Large accounts often follow this strategy to avoid significant losses caused by data releases.

As with any trading strategy, it's best to determine the market's direction before trading. This can be accomplished by examining the price trends and comparing them to past data. However, be cautious when prices are near upper or lower extremes, as a trend change may occur.

Setting your profit target too high can result in losing a winning position. Generally, it's best to take profits at 20 or 30 pips to reduce your overall risk. Spreading your position over multiple entry and exit points can also be helpful in mitigating risk. This is where mini-lots can come in handy. You can also be interested in information about best take-profit strategies.

Forex trading can be a profitable venture, but it requires discipline, patience, and a well-planned strategy. Here is a step-by-step guide to help you get started:

The first step to start trading Forex is to open a trading account with a reputable broker. When choosing a broker, consider factors such as regulation, fees, customer support, trading platform, and available instruments. You can choose between a live account, which involves real money, and a demo account, which allows you to practice trading without risking real money. Before opening a live account, make sure you have a solid understanding of the trading platform and the Forex market.

Before trading Forex, it's important to research the market and find the currency pair you want to trade. The Forex market is influenced by various factors, such as economic indicators, political events, and central bank policies. Stay up-to-date with market news and events by using reliable sources such as financial news websites and market analysis reports. Several significant economic indicators that traders must take into account while trading Forex are GDP, inflation, interest rates, and unemployment rates.

If you think the base currency will appreciate in value relative to the quote currency, you should buy the currency pair. If you think the base currency will depreciate in value relative to the quote currency, you should have a shorting position and sell the currency pair. It's important to have a solid understanding of the fundamentals driving the currency pair and to use technical analysis tools to identify entry and exit points.

Before placing a trade, make sure you have followed your trading strategy. Your strategy should include risk management measures, such as a stop-loss order to limit your potential losses. It's important to have a trading plan that outlines your entry and exit points, as well as your risk tolerance and profit targets.

After you have decided on your trading strategy, it's time to place your trade. You can enter a trade using a variety of order types, such as market orders, limit orders, or stop-loss orders. Market orders are executed at the current market price, while limit orders are executed at a specified price or better. Stop-loss orders serve to minimize potential losses by automatically terminating a trade if the market shifts unfavorably. It's important to monitor your trades closely and adjust your risk management measures as needed.

After your trade has been executed, monitor the market closely. Reflect on how you performed and what you could do better in future trades. It's advisable to keep a trading journal to record your trades, including the reasons for entering and exiting the market and the outcome of each trade. Analyzing your trading journal can help you identify patterns and improve your trading performance over time.

In this section, experts have talked about certain Forex trading strategies that are most suitable for beginners:

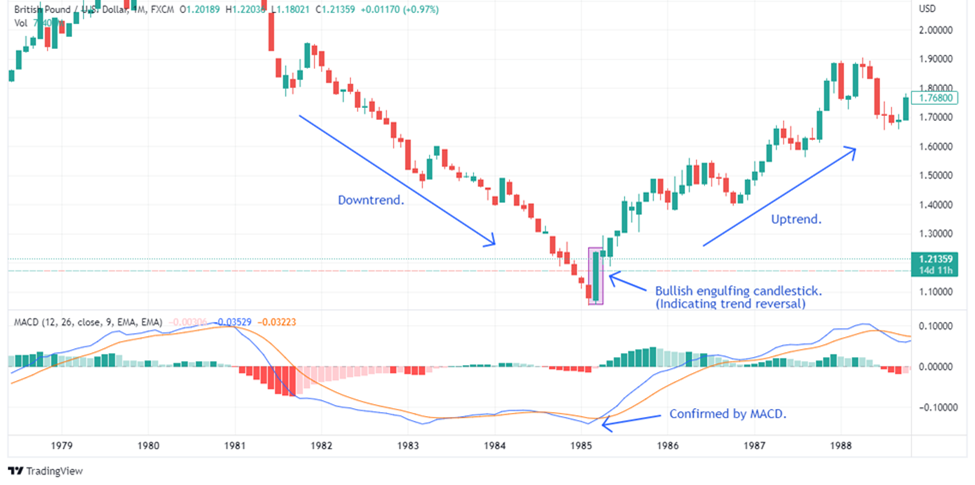

The bullish engulfing pattern is a type of candlestick pattern that signals a potential reversal in a downtrend. It consists of a small red candlestick followed by a larger green candlestick that completely covers the prior one. This pattern suggests a shift in sentiment, indicating an increase in buying pressure over selling pressure and a potential opportunity to go long. Traders often use this pattern along with other technical indicators to validate a bullish trend reversal.

The bullish engulfing pattern

Swing trading is a strategy that aims to capture short-to-medium-term price movements in a currency pair. This strategy involves holding a position for a few days to a few weeks, as opposed to day trading or long-term investing. Swing traders may use technical analysis tools such as moving averages, trend lines, and support and resistance levels to identify potential entry and exit points. This strategy is suitable for traders who have limited time to devote to trading and prefer to hold positions for a few days to a few weeks.

Swing trading

Trend following is a strategy that involves identifying the direction of the trend and following it. This strategy involves buying an asset that is trending higher or selling an asset that is trending lower. Trend following traders may use technical analysis tools such as moving averages, trend lines, and momentum indicators to identify the direction of the trend. This strategy is suitable for traders who prefer to follow the trend rather than trying to predict market movements. In the following illustration, a trend following trader would ideally hold a short position during the downtrend and a long position after the trend reverses.

Trend following

The MACD trading strategy is a well-known technical analysis tool used to detect possible signals for buying and selling. If the MACD line crosses over the signal line, it is a bullish signal indicating a chance to buy, while a bearish signal arises when the MACD line crosses below the signal line, indicating a potential opportunity to sell.

The MACD trading strategy

The breakout strategy involves identifying key support and resistance levels and waiting for a breakout to occur. A breakout occurs when the price of a currency pair breaks through a key level of support or resistance. Traders may use technical analysis tools such as trend lines, moving averages, and Bollinger Bands to identify potential breakout points. When a breakout occurs, traders may enter a position in the direction of the breakout, with a stop-loss order to limit potential losses.

The breakout strategy

Scalping is a strategy that involves making multiple trades in a short period of time to capture small price movements. This strategy involves entering and exiting trades quickly, often within seconds or minutes. Scalping traders may use technical analysis tools such as Bollinger bands, moving averages, trend lines, and support and resistance levels to identify potential entry and exit points. This strategy is suitable for traders who have a high tolerance for risk and can devote a significant amount of time to trading.

Scalping

The following are some expert Forex trading tips for beginners:

For beginners, it's important to ease into trading by making small investments initially. This way, you can learn from your experiences without risking significant losses. As you gain confidence and understanding, gradually increase the amount you invest. Remember, the market won't always move in your favor, so it's essential to be patient and learn from any mistakes made.

When selecting a currency pair to trade, consider your personal strategy and how comfortable you are with market volatility. Seek out active markets with high daily ranges for short-term gains and ensure there's a reasonable liquidity level. Explore different options and select a currency pair that aligns with your objectives.

It's essential to define your trading goals and follow a risk management plan. Trade in the direction of the trend, and establish stop-loss and take-profit points beforehand. Avoid impulsive trading, and remember that sometimes staying neutral can be a strategic decision.

Keep your trading analysis straightforward and focused. Avoid overwhelming yourself with too many technical indicators, as this can lead to confusion. Instead, concentrate on basic questions such as whether a trend exists and identify support and resistance areas to guide your trading decisions.

Analyzing past price movements of an asset can provide valuable insights into how it may behave in the future. Study previous data and use hypothetical scenarios to develop and refine your trading strategies.

Effective money management is crucial to achieving success in trading. Determine how much money you're willing to risk before entering a trade and aim to achieve at least twice that amount in potential profit. Maintaining discipline is important during both good and bad times.

Keep a record of your transactions to better understand your trading patterns, strengths, and weaknesses. By analyzing your past trades, you can focus on improving your decision-making and increasing your overall profitability.

If you find yourself consistently losing money and feeling overwhelmed, it's important to step away and take a break. Clear your mind, and come back to trading with a refreshed perspective.

Focus on executing one trade at a time to avoid overloading yourself. Simpler trades often yield better results, so keep your trading approach streamlined and organized.

When holding positions overnight or for multiple days, be aware of carry costs involved. For instance, higher costs are incurred when selling high-yield currencies compared to lower-yielding ones, so keep such things in mind when trading.

Relying on just one technical indicator can be limiting. To improve your trading analysis, use a combination of oscillators, moving averages, support and resistance levels, and Bollinger Bands to create a more comprehensive understanding of market trends. You may also be interested in the article: How Long Does It Take To Learn To Be A Trader?

Generally, the best time to trade Forex is when the market is most active and volatile. In a study conducted by analysts, Wednesday was chosen as the most favorable trading day of the week, with periods between 6.00-12.00 GMT and 18.00-0.00 GMT as the best time to trade. This is when traders have made the most profits. Additionally, Thursday is also a good day to trade in the short term, while Mondays and Wednesdays are the best days for long-term traders.

During the peak hours of the Forex market, traders can experience higher volatility, which increases the potential for profits. Traders should also keep in mind the opening and closing times of major financial centers such as London, New York, and Tokyo, as these are the times when the market is most active.

According to experts, the best Forex pairs to trade are the major currency pairs, which include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. Most traders prefer major currency pairs due to their high liquidity and tight spreads. These currency pairs are also highly correlated with global economic and political events, which provides traders with ample opportunities to trade.

Aside from major currency pairs, traders may also consider trading exotic currency pairs, which are less frequently traded but can offer higher returns due to their higher volatility. However, trading exotic currency pairs can also come with higher risk, as they are often more sensitive to economic and political events in their respective countries.

It's important to note that different Forex pairs have different trading characteristics, so traders should choose pairs that align with their trading strategies and risk appetite. Traders should also keep an eye on economic data releases and news events that may impact their chosen Forex pairs.

As a novice trader, it's crucial to have a solid risk management strategy in place to ensure that your capital is protected while trading Forex. Here are the top risk management strategies that every beginner should consider:

Forex trading involves leverage, which means you can control a large amount of money with a small deposit. While leverage can magnify your profits, it can also amplify your losses. So, it's crucial to understand the concept of leverage before trading Forex. The higher the leverage, the higher the risk.

Developing a trading plan can help you avoid impulsive decisions while trading. A comprehensive trading plan should encompass your objectives, financial risk threshold, trading approach, and principles for money management. It should also specify the points for entering and exiting a trade, your risk-to-reward ratio, and the particular instruments you aim to trade.

Risk-reward ratio is the ratio of the potential profit to the potential loss on a trade. Setting a risk-reward ratio can help you manage your trades effectively. Experts suggest novice traders to aim for a risk-reward ratio of at least 1:2 or higher.

Stops and limits can help you minimize your losses and maximize your profits. A stop-loss order is an order to close a trade at a predetermined price level to minimize your losses. A limit order is an order to close a trade at a predetermined price level to lock in your profits. Stops and limits should be included in your trading plan.

Managing your emotions while trading is vital. Emotions such as greed, fear, and hope can lead to impulsive decisions and irrational behavior. Novice traders should focus on controlling their emotions while trading by sticking to their trading plan and risk management rules.

The length of time it takes to learn Forex trading depends on various factors, such as the individual's dedication and commitment to learning, their prior experience with trading or finance, the resources available for learning, and the complexity of the trading strategies they aim to employ. Some traders may learn the basics in a few weeks or months, while others may take years to become proficient. Continuous learning and practice are key to success in Forex trading.

There are several ways to learn Forex trading for free, such as online courses, webinars, tutorials, and demo accounts provided by brokers. Many trading platforms offer free educational resources, including articles, videos, and eBooks that cover basic and advanced topics in Forex trading. Additionally, there are various online forums and communities where traders share their experiences and knowledge about Forex trading. It's important to use credible and reliable sources and to continuously update your knowledge and skills.

To trade Forex for the first time, you should follow these basic steps:

Choose a reputable Forex broker that suits your needs and preferences

Open a demo account to practice and test your trading strategies without risking real money

Learn the basics of Forex trading, such as currency pairs, pip values, leverage, and margin requirements

Develop a trading plan that includes your risk management strategy, entry and exit points, and trading goals

Use stops and limits to manage your risks and avoid emotional trading

Keep a trading journal to track your performance and identify areas for improvement

Yes, it's possible to trade Forex with $100, although it may limit the number of trades you can make and the leverage you can use. Some brokers offer micro accounts that allow traders to start with as little as $1, while others have a minimum deposit requirement of $100 or more. It's important to note that Forex trading carries risks, and it's essential to have a sound risk management strategy in place regardless of the amount of money you invest.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.