Best Profit Taking Strategies: How To Take Profits In Trading

There is no one-size-fits-all answer to the best strategies for using take-profit orders in trading, though generally, it should be used in conjunction with a stop-loss order at a ratio of 2:1 to ensure stringent risk management. The optimal take-profit level will ultimately be decided based on your own trading style, your risk tolerance, and the type of asset you are trading.

A ’take-profit’ in trading is an order that traders set to automatically trigger the sale of an asset when it reaches a certain value. When opening a trade, traders can decide, at that moment or any time before closing the trade, to attach an order to the position that will execute its sale. This is a crucial tool for risk management that locks in profits and minimizes emotional trading. Using take-profits is an integral part of many trading strategies, ensuring that traders stick to a systematic approach and predefined profit objectives.

In this article, Traders Union takes a deep dive into take-profit orders to help you as a reader decide which take-profit strategy is best for you. We explain how to choose the best take-profit strategy, use examples to show you how to use different take profit strategies, investigate the importance of using take profits in different trading strategies, and then offer some insightful tips into using various take-profit strategies.

-

What is a good take profit strategy?

That depends on your overall style of trading and strategy. If day trading, a small take-profit for quick returns may be preferable, whereas for swing trading you can set higher take-profit levels while waiting for more significant returns. A good rule of thumb is to set a take-profit that is twice that of your stop-loss, maintaining a 2:1 ratio.

-

What is a good take profit percentage?

Different percentages work better for different trading styles and assets. Generally, for scalping, aim for 0.2% to 1%. For active day trading, 1% to 5% may work better, and for long-term trading consider anywhere from 5% to 25%. Aim for a percentage that is double what your stop-loss percentage is.

-

What is the best way to take profits from stocks?

Although this will vary greatly for trading style, traders should look at take-profit orders that are 20 to 25% higher than their opening position.

-

What is the most profitable trading strategy?

The most profitable trading strategy varies for everyone and is based on their risk tolerance, market knowledge, and preferences. Some find success in day trading, while others prefer long-term investments. Successful traders often focus on risk management, continually educate themselves, and adapt strategies to changing market conditions.

How to choose the right take profit strategy

The take-profit strategy you opt for should align with your overall trading strategy. Consider the different aspects that define your strategy, and then select a take-profit approach that best complements those aspects. Some factors that you should consider when choosing a take-profit strategy include:

-

Your Trading Style: Are you day trading, swing trading, or scalping? As an active day trader, you may want to use a take-profit strategy that allows you to lock in profits quickly, so smaller amounts such as 1% or 2% usually suffice. If you are a swing trader, you may want to use a wider take-profit strategy that allows you to ride out market swings, anywhere from 5% to 25%. If you’re scalping, you may be looking for take-profit orders of 0.2% to 1% above your position, depending on the timeframes you’re using for your strategy.

-

Your Risk Tolerance: Consider how much risk you are comfortable with. If you are risk-averse, you may want to use a take profit strategy that sets conservative take-profit levels, locking in gains earlier in the trade to ensure a higher probability of profit. If you are comfortable with higher risk and a more aggressive approach, you could set higher take-profit percentages, holding positions for longer and allowing the asset more time to potentially achieve substantial gains.

-

Type of Asset: The financial instrument or asset you are trading will impact the efficiency of your take-profit levels. Some assets, like commodities, are more volatile and therefore riskier when compared to less volatile assets, such as bonds. You will need to adjust your take-profit strategy accordingly, potentially setting smaller take-profit ratios for more volatile assets.

Examples of how to use different take profit strategies

In order to better understand how to implement different take-profit strategies, we’ll use a real-life example in forex trading and apply different approaches of using take-profits to it.

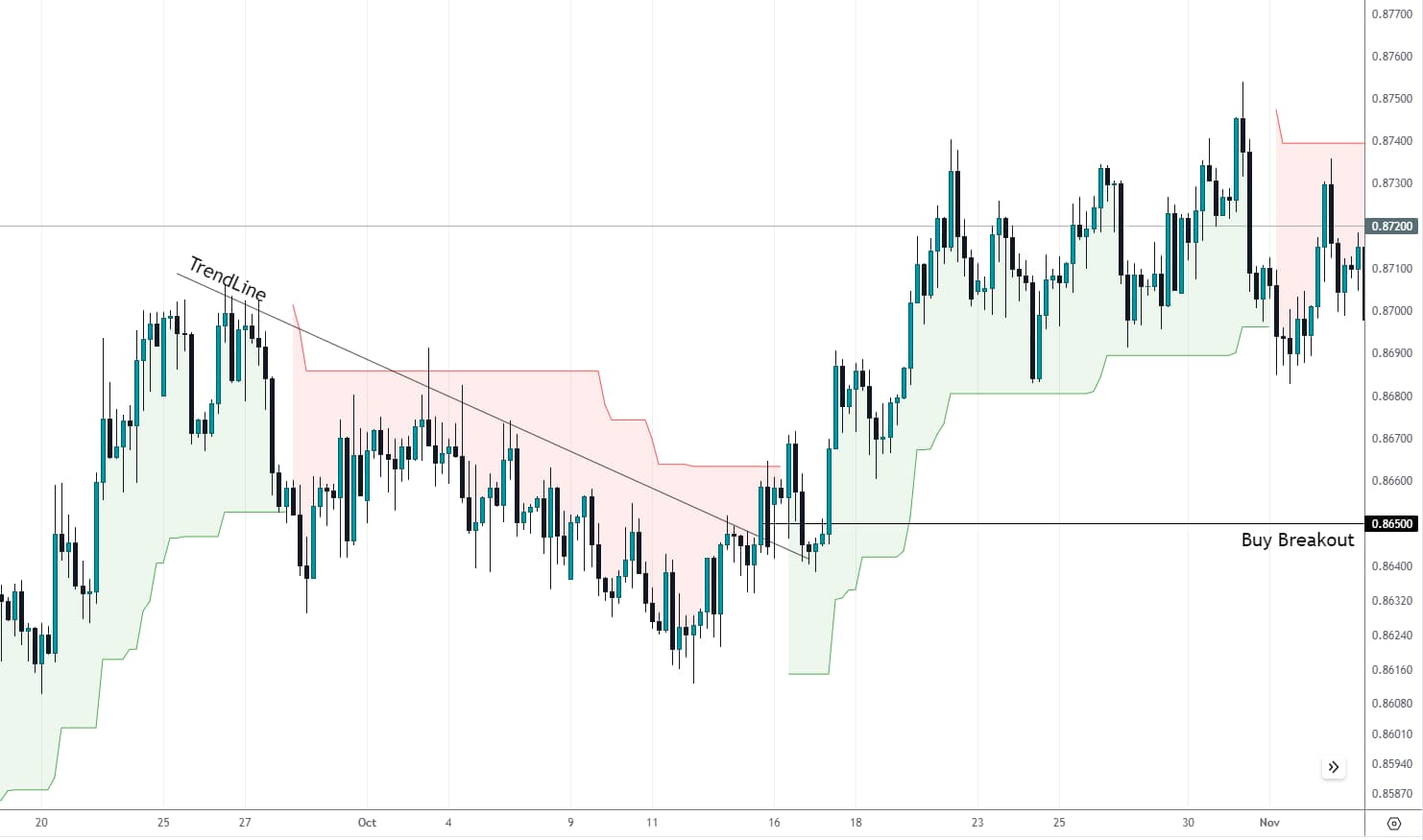

Let’s imagine a trader opening a position on the EUR/GBP currency pair in the forex market. Using an 8-hour candlestick chart, the trader notices the currency pair is showing signs of a potential breakout following a downtrend and buys at 0.86500.

The trader should take a few things into account when setting their take-profit order, which we mentioned in the previous section – their trading style, risk tolerance, and type of asset. However, they should also consider factors unique to the currency pair. EUR/GBP has relatively low volatility when compared to other EUR and GBP pairs, due to the economic interdependence of the UK and EU. In 2023, the currency pair saw a year-high of 0.8969 and a low of 0.8514, with an average of 0.8711.

Different types of take-profit orders for EUR/GBP

How the trader could implement take-profit strategies in this example:

-

Fixed Take-Profit: The simplest type of take-profit strategy is to just use a fixed number. A general rule of thumb is to set the take-profit as double the level of the stop-loss order. As the entry point was 0.86500, if the trader was comfortable with moderate risk, they could set a stop-loss at 0.86100, and a take-profit of 0.87300. The stop-loss is 400 pips below the entry point, and the take-profit is 800 pips above it, maintaining the 2:1 ratio, and both numbers are well within the year’s range.

-

Percentage Take-Profit: This strategy allows the trader to set a take-profit based on a percentage of their entry price. For example, they might set a percentage take profit of 1%, though this is slightly optimistic for the EUR/GBP pair, as it would require an increase of 865 pips to 0.87365. If trading a more volatile pair with a wider range such as AUD/JPY, a higher percentage take-profit would be more suitable.

-

Using the levels of resistance and support. The trader could choose to set their take-profit order (and stop-loss) based on the key support and resistance levels in the current EUR/GBP trend’s movement. This type of take-profit may be better to set later on into the trend. The chart above shows the trend losing momentum at around 0.87300 and finding support at 0.86850. The best practice would be to set the take-profit slightly below the resistance level, to increase the chances of higher profit.

-

Trailing Take-Profit by Indicator: A trailing take-profit is activated only after the initial take-profit level is reached, and continues to rise as long as the price moves in the trader’s favor. The trader could use an indicator for EUR/GBP, such as moving average, BB, or super trend indicator (as shown on the chart), and set a trailing take-profit order based on this analysis.

The advice given here on setting levels for take-profit orders should be taken only as guidance. The appropriate strategy is up to you to decide on as a trader, based on your own risk tolerance and trading strategy. You can also be interested in information about How To Take Profits From Stocks.

The importance of using take-profits in different trading strategies

Take-profit orders are essential for almost all types of traders, regardless of their trading style and strategy. Used alongside stop-loss orders, they can help you to:

-

Lock in Profits: Closing a position at a predefined profit level helps preserve capital. It prevents you from holding on to a winning position for too long, where market conditions may change, and profits could erode. Sometimes it’s better to automatically close at 10% profit for example, than to leave a trade open longer and potentially see value decrease again.

-

Limit Losses: Take-profit orders help you to define your profit targets in advance. By setting a target price at which you are willing to close a position, you can manage your risk, ensuring that potential profits are secured, and potentially avoiding future losses.

-

Improve Trading Performance: Take-profit orders are an integral part of trading strategies. They allow you to execute your strategies systematically, ensuring that you adhere to predetermined profit objectives and overall trading plans. By aligning your take-profit orders with your general strategy, you can become a logical, tactical trader rather than an impulsive, emotion-based one.

-

Prevent Emotional Trading: If you’ve traded before, you’re likely familiar with the feeling of seeing a position increase in value, knowing you should close the trade while in the green, only to leave it open in the hope of further gains. Sometimes this pays off – other times the price dips and you’re back in the red. Take-profit orders prevent traders from falling prey to emotions such as greed or fear.

-

Manage Time: If you’re not day trading, or you’re managing a large portfolio, you’re likely unable to constantly monitor all your positions. Take-profit orders provide a hands-free approach. Once the order is set, the system automatically executes the trade when the target price is reached, saving time and effort.

Best Forex Brokers

Tips on choosing the best take profit strategy

In addition to the advice offered on how to use different take-profit strategies, here are some further tips to assist you in choosing the best take-profit strategy.

You can also be interested in information about How To Calculate A Take Profit When Trading read the Traders Union article.

-

1

Trial & Error: Experiment with different take-profit strategies to see what works best for you and best aligns with your overall trading strategy. You could do this using small amounts of capital or using a demo trading account.

-

2

Flexibility: Just because you set a take-profit order, it doesn’t mean that it can’t later be changed. Maintain some flexibility in your trading strategy and be willing to adjust your take profit strategy as market conditions change. Avoid changing it based on emotions such as greed or fear however, as this defeats the entire purpose of take-profit orders.

-

3

Be Tenacious: Don’t be afraid for a take-profit order to be executed ‘prematurely’ if the market is moving in your favor. Although at times it’s preferable to be flexible and open to adjusting your strategy, it’s also advisable to be headstrong, letting your initial take-profit close in line with your overall strategy, not giving into ‘fear of missing out’.

For further advice and tips on how to assess the best levels for stop-loss and take-profit orders, and determining your own risk-reward ratio, see our article on the Risk-Reward Ratio in Trading.

Conclusion

There is no one-size-fits-all take profit strategy. The choice of strategy depends on your individual circumstances, such as risk tolerance, trading style, and investment goals. Experiment with different strategies and find one that works for you.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.