Your Guide to Small Portfolio Investing Success

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

You can start a small portfolio by following these steps:

- Set your investment goals and horizon.

- Assess your risk tolerance and constraints.

- Choose the right investment account and platform.

- Build your investment portfolio with a mix of assets such as stocks, bonds, ETFs, and mutual funds.

- Monitor and rebalance your portfolio.

Building a small portfolio is a stepping stone for those beginning their investment journey. It helps in developing investment discipline, diversifying investments, and gaining confidence without the need for a large initial capital outlay. Small portfolios also allow investors to make mistakes and learn from them without risking significant sums of money. This article will guide you through the step-by-step process of starting a small portfolio. We will walk you through setting goals, choosing investment accounts and assets, managing risks, and maximizing returns over time.

How do I start a small portfolio: step-by-step guide

This section aims to provide actionable steps and practical advice for starting a small investment portfolio.

Step 1: Set your investment goals

The first step in building a small portfolio is to define your financial goals, investment horizon, and risk tolerance. Are you saving for a down payment on a house, or are you looking to build a retirement fund? Knowing your objectives will help shape your investment strategy and asset allocation.

Step 2: Assess your risk tolerance

Risk tolerance is your ability to endure market fluctuations without panicking. It depends on your financial situation, investment goals, and psychological comfort with risk. Assessing your risk tolerance helps ensure your investment strategy aligns with your comfort level. Tools like risk tolerance questionnaires can be helpful in this assessment.

Step 3: Choose the right investment account

Selecting the appropriate investment account is essential. Common options include taxable brokerage accounts, Individual Retirement Accounts (IRAs), and 401(k) accounts. The right choice depends on your investment goals and tax considerations.

Step 4: Choose the right broker

Selecting a reliable broker is crucial. It should offer user-friendly interfaces and low fees, making them ideal for beginners. Compare platforms based on fees, features, and ease of use to find the best fit for your needs.

| Min. deposit, $ | Stocks | ETFs | Bonds | Options | Futures | Open account | |

|---|---|---|---|---|---|---|---|

| 100 | Yes | Yes | No | Yes | Yes | Open an account Your capital is at risk. |

|

| No | Yes | Yes | No | No | No | Open an account Your capital is at risk.

|

|

| No | Yes | No | Yes | No | No | Open an account Your capital is at risk. |

|

| 100 | Yes | Yes | Yes | Yes | Yes | Study review | |

| No | Yes | Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

Step 5: Build your investment portfolio

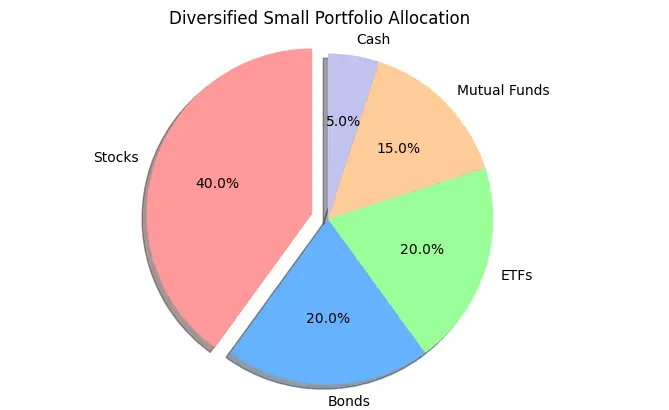

Diversification can help you optimize the risk-return characteristics of your portfolio . Choose a mix of assets such as stocks, bonds, ETFs, and mutual funds. For example, low-cost index funds and ETFs can provide broad market exposure with minimal fees. Stocks can offer growth potential, while bonds provide stability and income.

An example of a diversified small portfolio allocation

An example of a diversified small portfolio allocationStep 6: Monitor and rebalance your portfolio

Regularly reviewing and adjusting your investments ensures they remain aligned with your goals. Rebalancing involves selling over performing assets and buying underperforming ones to maintain your desired asset allocation. This practice helps in managing risk and optimizing returns.

What should be considered for beginners?

As a beginner, your exposure to the investment market and its happenings is low. Starting out with knowledge of these tips can help your progress better.

Start with low-cost index funds or ETFs

When starting a small portfolio , it's essential to focus on low-cost investments such as index funds and ETFs . These investment vehicles typically have lower expense ratios compared to actively managed funds, which helps in maximizing your returns over time. Keeping costs low in small portfolios can help you protect your gains.Importance of dollar-cost averaging

Dollar-cost averaging involves investing a fixed amount regularly, regardless of market conditions. This strategy helps mitigate the impact of market volatility and reduces the risk of making poor investment decisions based on market timing. It would also help you build investing discipline as a beginner .Avoid high-risk investments initially

Avoid high-risk investments such as individual stocks or speculative assets. Instead, focus on stable, well-diversified funds. Once you build knowledge and acumen, your risk tolerance would increase, which is when you may explore riskier options.Focus on learning and education

Understanding concepts such as asset allocation, risk management, and market dynamics will help you make informed decisions. Here are some recommended resources:Books : "The Intelligent Investor" by Benjamin Graham, "A Random Walk Down Wall Street" by Burton Malkiel.

Online courses : Coursera, Khan Academy, and Udemy offer excellent courses on investing.

Financial news : Websites like Bloomberg, CNBC, and Reuters provide up-to-date market news and analysis.

Use a Robo-advisor

Robo-advisors are a great option for beginners who want automated portfolio management. These platforms use algorithms to create and manage a diversified portfolio based on your risk tolerance and financial goals. Benefits of using a robo-advisor include lower fees, ease of use, and the elimination of emotional decision-making in investing.

How to avoid common mistakes

Many beginners make mistakes that can hinder their investment growth. Some of them:

Overtrading: Frequent buying and selling can lead to high transaction costs and tax implications.

Lack of diversification : Investing in a narrow range of assets increases risk.

Ignoring fees : Not paying attention to fees can erode returns.

Emotional investing : Making investment decisions based on emotions rather than logic can lead to poor outcomes.

Stick to a long-term plan and avoid making impulsive trades.

Diversify your investments across different asset classes.

Be mindful of all fees and choose low-cost investment options.

Keep your emotions in check and make decisions based on research and strategy.

Risks and warnings

Staying invested in the market will always keep you exposed to a certain set of risks. To help you tackle them, we have discussed below the common risks and ways to work around them.

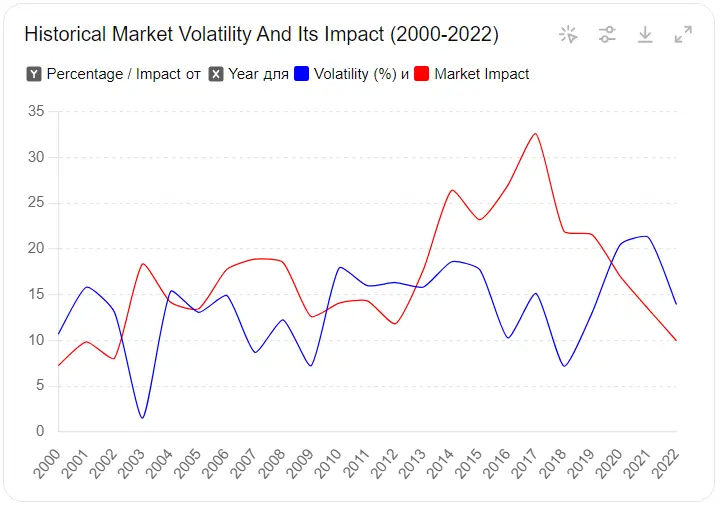

Market volatility refers to the ups and downs in the value of investments. These fluctuations can be risky, but there are ways to manage this risk, such as diversification of portfolio and using stop-loss orders.

Historical market volatility and its impact

Historical market volatility and its impactInvestment losses . Investing always carries the risk of loss, and market downturns are a normal part of the economic cycle. Being prepared for these downturns helps maintain a long-term perspective and prevents panic selling. It's important to remember that markets generally recover over time, and staying invested can lead to gains in the long run.

Importance of emergency funds . Having an emergency fund is important for every investor. This fund acts as a financial cushion to cover unexpected expenses, such as medical bills or job loss, without the need to liquidate your investments at a loss. Ideally, an emergency fund should cover three to six months' worth of living expenses.

Emotional trading is one of the biggest challenges for investors. Decisions driven by fear or greed can lead to significant losses. To avoid this, it's essential to stick to a well-defined investment plan that aligns with your financial goals and risk tolerance.

Historical market volatility

Historical market volatilityHow much can I earn with a small portfolio?

The returns provided by a small portfolio will depend on the subjective choices you make in terms of:

Investment choices . For instance, stocks generally offer higher potential returns compared to bonds, but they also come with higher risk.

Market conditions . Bull markets typically result in higher returns, while bear markets can lead to losses.

Investment horizon . Longer investment horizons allow more time for your investments to grow and recover from market downturns. Compounding interest also has a greater effect over longer periods, significantly boosting your returns.

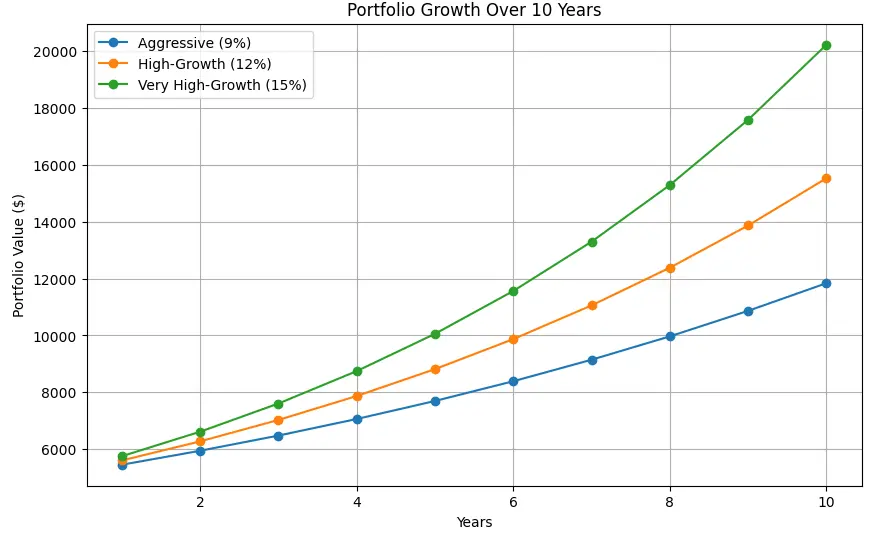

Let's consider a hypothetical small portfolio with an initial investment of $5,000. We will look at three different scenarios based on varying investment choices and market conditions.

Initial Investment: $5,000

Annual Return: 9%

Investment Horizon: 10 years

After 10 years, the portfolio would grow to approximately $11,837.

Initial Investment: $5,000

Annual Return: 12%

Investment Horizon: 10 years

After 10 years, the portfolio would grow to approximately $15,529.

Initial Investment: $5,000

Annual Return: 15%

Investment Horizon: 10 years

After 10 years, the portfolio would grow to approximately $20,227.

Here is the line chart showing the growth of a small portfolio over time for each scenario. The chart illustrates the potential earnings for conservative, balanced, and aggressive portfolios over a 10-year period, highlighting how different investment strategies can impact portfolio growth.

Growth of a small portfolio over time under various scenarios

Growth of a small portfolio over time under various scenariosExpert advice

Building a small portfolio can be a good starting step into building investment discipline. Through my experience, keeping the following things in mind when beginning your investment journey can help you progress faster and better:

Begin investing as soon as possible , even if it's with small amounts.

Spread your investments across various asset classes, such as stocks, bonds, real estate, and perhaps even some alternative investments like commodities or cryptocurrencies.

Assess your comfort level with risk and invest accordingly.

Keep an emergency fund equivalent to three to six months of living expenses.

Continuously educate yourself about the markets, investment strategies, and financial planning.

Stick to a well-defined investment plan and avoid making decisions based on short-term market movements.

Periodically check your portfolio and rebalance it to maintain your desired asset allocation.

Choose investments with low fees and expense ratios, such as index funds and ETFs.

Conclusion

Starting a small investment portfolio is an important first step towards financial independence and long-term wealth. By setting clear financial goals , understanding your risk tolerance , choosing the right investment accounts , and selecting a diversified mix of assets , you can create a strong foundation for your portfolio. Regular monitoring and rebalancing, coupled with a disciplined approach to investing will help you tackle market volatility and achieve your financial objectives. With patience, consistency, and the right strategies, your small portfolio can grow and support your financial goals for the future.

FAQs

How much money do I need to start a small portfolio?

You can start a small portfolio with as little as $100. Many online brokers offer low minimum investments and fractional shares.

What types of investments should be in a small portfolio?

A small portfolio should include a mix of stocks, bonds, ETFs, and possibly mutual funds to ensure diversification and manage risk.

How do I choose the right broker for my small portfolio?

Choose a broker based on factors such as fees, minimum investment requirements, ease of use, available investment options, and customer service.

Can I start a small portfolio with a robo-advisor?

Yes, robo-advisors are a great option for beginners. They provide automated, low-cost investment management based on your goals and risk tolerance.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

A bear market is a period of time in which an investment asset, such as stocks, bonds, or commodities, experiences a decline in price for an extended period of time.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.