Index Funds: How They Work. Pros And Cons

Index funds are a type of mutual fund that tracks a market index, like the S&P 500. They allow investors to invest in many stocks at once for diversification and aim to match the performance of the index. Index funds offer low costs, diversification, and passive management compared to picking individual stocks. Over the long run, index funds tend to outperform actively managed funds, making them a solid choice for hands-off investors focused on long-term growth.

Investment can feel like a perplexing maze, full of jargon and challenging decisions. However, Index funds offer a straightforward path through this maze. They provide a simple, cost-effective, and passive way to navigate the market. This article will dissect how these funds operate, their advantages, and points to be mindful of.

When a person invests in an index fund?

When someone puts money into an index fund, it's usually for long-term stuff like retirement or college savings. These funds keep things steady by blending in with how the overall market is doing over time. They suit people aiming for steady, long-lasting gains instead of quick wins.

Is the S&P 500 an index fund?

No, the S&P 500 itself is not classified as an index fund. It functions as a market index, a widely recognized benchmark that monitors the performance of 500 leading publicly traded companies in the United States.

Is an ETF an index fund?

Well, not all ETFs qualify as index funds, although many widely used ETFs do track index performance, essentially making them a category of index fund.

Is an index fund better than a stock?

Deciding if an index fund is better than picking individual stocks depends on what you want and how much risk you're cool with. Index funds spread out the risk and lower the chance of significant losses, but you might miss out on the opportunity for huge gains. If you're all about stability and steady market gains for the long haul, index funds might be your thing. But if you're up for more risk and aiming for the possibility of more significant returns, choosing individual stocks might be more your speed.

What is an index fund?

An index fund functions as a collective effort in the investment landscape. It passively mirrors a specific market index, essentially a collection of stocks representing a particular market segment. Picture it as a basket of diverse stocks bundled together. This approach offers investors a simple and efficient way to invest without the requirement for constant management and decision-making.

Examples

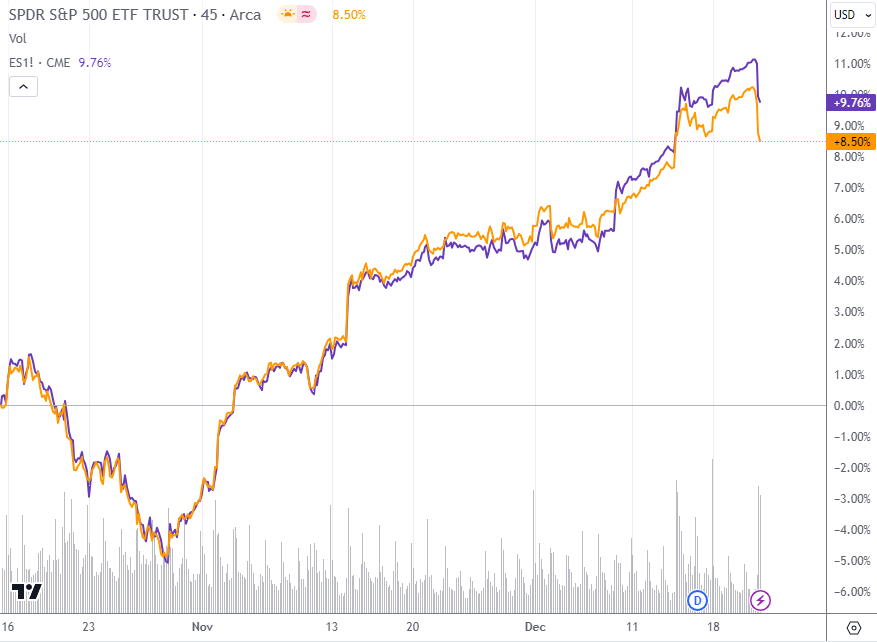

SPY

SPY keeps a vigilant eye on the S&P 500, reflecting the performance of 500 major U.S. companies. It's widely favored for global trading due to its easy accessibility. With a low investment cost (around 0.09%), it's an attractive choice for those seeking long-term participation in the U.S. market, especially for retirement. The picture below shows: in yellow is SPY and in purple are E-mini futures on the S&P-500 index.

SPY vs E-mini S&P 500

IVV & VOO: S&P 500

IVV and VOO function as twins, mirroring the S&P 500 and providing similar benefits. They differ slightly in costs and details, allowing you to choose the one that aligns better with your preferences.

Nasdaq 100: QQQ, Invesco QQQ Trust Series 1

For tech enthusiasts, QQQ and Invesco QQQ Trust Series 1 are champions. They track the Nasdaq 100, housing major tech players like Apple and Amazon. It is ideal for those seeking growth from the tech sector while maintaining safety.

Russell 2000: IWM, IJR

IWM and IJR are underdogs, monitoring the Russell 2000, which features smaller U.S. companies with growth potential. If you're looking for something different from the big players, these could be intriguing for increased earning opportunities.

Dow Jones Industrial Average: DIA, DJIA

DIA and DJIA are akin to mingling with the cool kids of investing. They follow the Dow Jones Industrial Average, comprising 30 renowned U.S. companies—a good choice for those wanting to be part of well-known brands and receive dividends.

MSCI World: ACWI, MSCI World ETF

ACWI and MSCI World ETF serve as your guides to the world, tracking the MSCI World Index with stocks from 23 countries. These could be your preferred options if you aim to invest globally and beyond the U.S.

MSCI Emerging Markets: EEM, MSCI Emerging Markets ETF

EEM and MSCI Emerging Markets ETFs are tailored for risk-takers. They focus on the MSCI Emerging Markets Index, highlighting developing countries like China and India. More risk is involved, but it also increases earning potential for those willing to take the chance.

Vanguard Total Stock Market Index Fund (VTI): VTI & iShares Core S&P 500 ETF (IVV): IVV

VTI and iShares Core S&P 500 ETF are masters of the U.S. market. Beyond the S&P 500, they encompass medium and small-sized U.S. companies. A great choice for those seeking comprehensive exposure in one go for long-term wealth building.

ETF vs. Index Fund: What Are the Differences?

Index Funds: These are investment funds, encompassing mutual funds or ETFs, that passively mirror a specific market index. Their goal is to replicate the composition and performance of the chosen index, providing broad diversification and reduced risk compared to individual stock selection.

ETFs: Exchange-traded funds are a type of investment fund that is traded on stock exchanges, similar to individual stocks. They come with advantages such as liquidity, transparency, and tax efficiency.

To get specific ideas for incorporating ETFs into your investment portfolio, read the article: Top 9 Low-Cost ETFs To Invest

Best stock brokers 2025

How an index fund works

Index funds function by closely tracking a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Here's a breakdown of the process:

Each index fund selects a benchmark, a specific market index representing a particular group of stocks.

The fund manager gathers money from investors and combines it into a pool. Think of it as creating a substantial investment fund with contributions from everyone.

The fund manager then invests the pooled money in the same proportion as the chosen market index. In simpler terms, they replicate the behavior of the index.

Unlike other funds that constantly buy and sell stocks to outsmart the market, index funds avoid this game. They adhere to the plan outlined by the index, reducing the need for continuous management. This approach minimizes costs and fees, offering investors a more straightforward and cost-effective investment option.

👍 Pros of Investing in Index Funds

• Low Cost

Index funds typically have lower fees compared to actively managed funds, contributing to cost savings for investors over the long term.

• Low Risk

Index funds are generally perceived as low-risk investments, tracking the performance of broad market indices and providing stability to investors.

• Diversification

Index funds offer instant diversification by spreading investments across an entire index, mitigating risk associated with individual stock performance.

• Passive Management

Index funds operate passively, adhering to the predetermined composition of a market index. This hands-off approach simplifies investment decisions.

• No Market Analysis Needed

Investors in index funds are relieved from the need for in-depth market analysis. The fund automatically adjusts to the index, eliminating the necessity for constant monitoring.

• Liquidity

Index funds are highly liquid, facilitating easy buying and selling without causing a significant price impact. This liquidity offers flexibility to investors.

👎 Cons of Investing in Index Funds

• Potential for Underperformance

Index funds may underperform the market in the short term, although they align with market trends over an extended period

• Lack of Active Management

The absence of active management in index funds means they may miss opportunities for higher short-term returns that active management strategies could provide.

Who are index funds good for?

Long-Term Investors

Index funds are well-suited for individuals with long-term goals, typically spanning five years or more. They effectively capture the average market return over time, making them suitable for retirement savings, college funds, and other extended-term objectives.

Hands-off Investors

Index funds seamlessly fit the bill for those who prefer a hands-off, passive approach to portfolio management. Requiring minimal research and upkeep, they are suitable for busy individuals or those with limited investing experience seeking a straightforward investment strategy.

Cost-conscious Investors

Index funds stand out for investors mindful of costs. With very low expense ratios, they incur minimal fees for fund management. This cost efficiency can significantly enhance returns over time compared to actively managed funds burdened with higher fees.

Diversification Seekers

Index funds are preferred for those seeking immediate exposure to a broad range of assets within a specific market segment. This inherent diversification substantially reduces risk compared to concentrating all investments in a single basket.

Starting on your index fund investment journey requires a broker. You can read the article on - How to choose a broker wisely for valuable insights.

Summary

Index funds may not promise overnight riches like a treasure map, but they provide a safe and reliable course toward long-term financial security. Think of them as a sturdy galleon, not a speedboat, steadily navigating the market storms and capturing average returns over time. Remember, investing is a marathon, not a sprint. Index funds offer a reliable and efficient path to building wealth over time, protecting money from inflation, and securing a comfortable future.

Glossary for novice traders

-

1

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

2

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

3

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Algorithmic trading

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.