Forex is for anybody old enough to generally understand how this works. Statistics show that 49% of Forex traders are people aged between 25 to 44 years with over 72% of them being inexperienced in the market before joining.

This is a huge difference compared to when most Forex traders were trained and experienced.

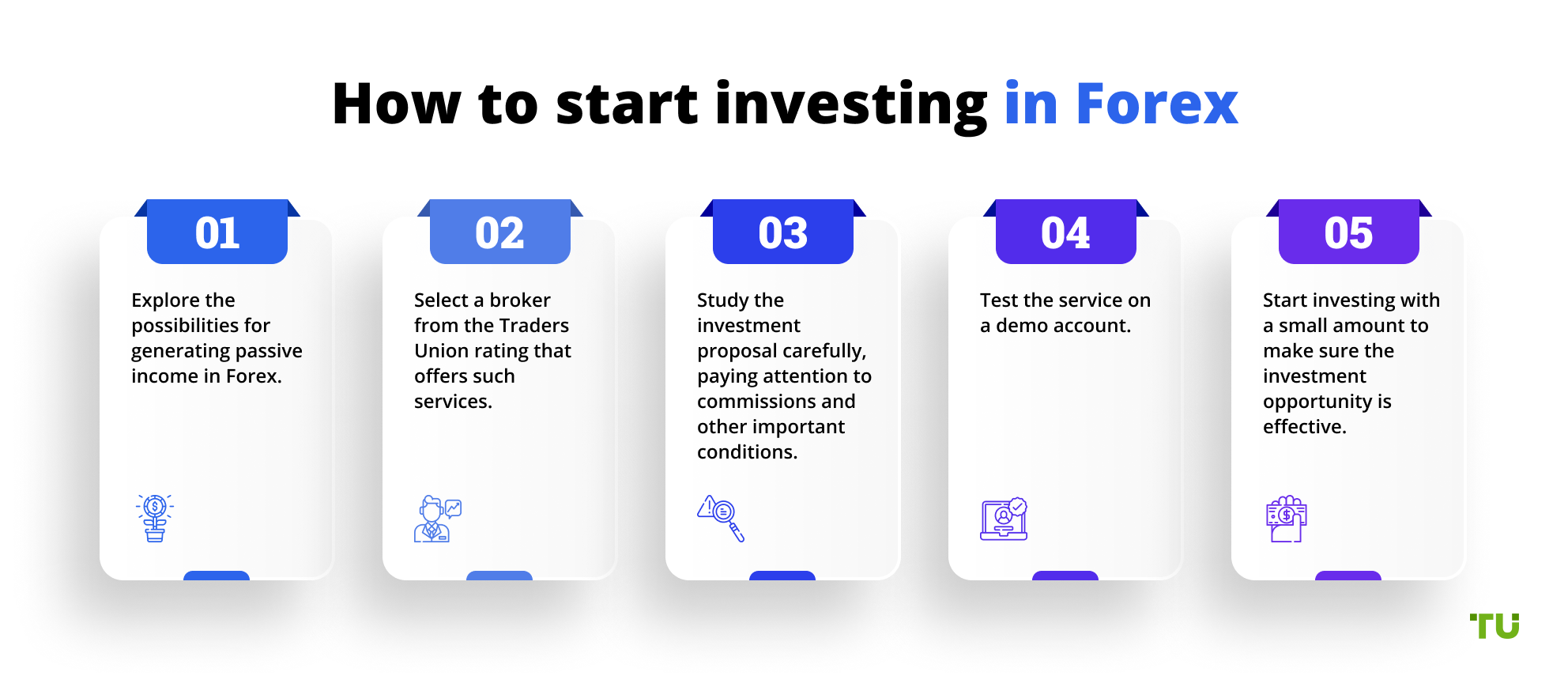

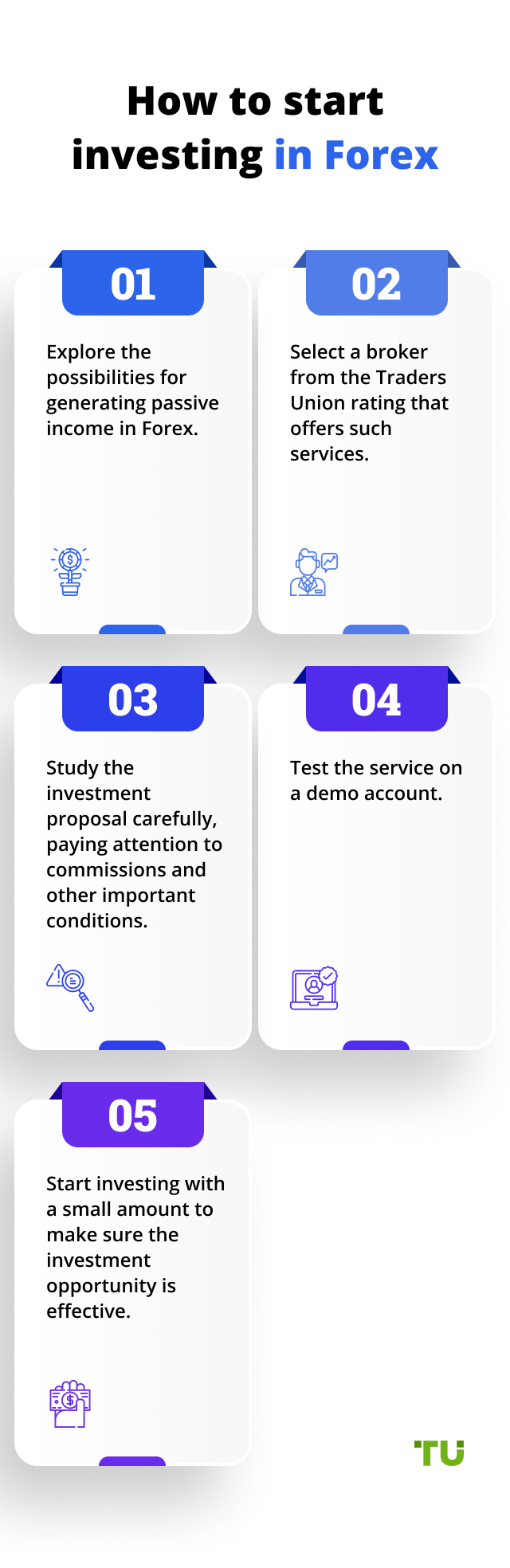

There are several reasons why the market is growing exponentially in popularity. First, it's very easy to access. No certifications or licenses are required. All a potential investor needs is a good computer, a strong Internet connection, and a little capital.