8 Portfolio Diversification Strategies To Know

Top commission-free stock broker - eToro

Traditionally, the proportion of stocks and bonds in a 60:40 portfolio was used, where 60% of the investments were in stocks and 40% in bonds. However, in the 21st century, this formula has become worse due to historically low interest rates, increased volatility in the markets, changes in the global economy, and the emergence of new assets. Nowadays, different ways to diversify a portfolio involve:

-

Adding different asset classes to the portfolio - such as: stocks from different sectors, bonds, cryptocurrencies, ETFs and mutual funds, assets from the real estate sector, commodity markets, and cash in different currencies

-

Use of rebalancing, robo-advisors (including AI)

-

Tracking fundamental background

Building a well-diversified investment portfolio is a top wealth accumulation and risk management method. When you spread your investments across varied asset classes, market sectors, industries, and geographic areas, you lessen the adverse effects on your portfolio from underperforming investments. Diversification safeguards against excessive exposure to any specific asset, company, or market.

However, many investors make the mistake of not diversifying enough. This article discusses the 8 smart diversification strategies to make a better portfolio.

-

What is diversification?

Diversification involves strategically distributing investments across various asset classes, market sectors, industries, and geographical areas. This approach aims to minimize the risk and volatility of your portfolio.

-

Why is it important to diversify your portfolio?

By diversifying your portfolio, you mitigate the effects of underperforming investments. It broadens your exposure to growth opportunities in diverse markets, striving to maximize returns while managing risk.

-

Why is investment portfolio important?

An investment portfolio is important because it diversifies an investor's assets, spreading risk across different investments, such as stocks, bonds, and real estate. This diversification helps protect against significant losses if one investment underperforms, aiming for a balanced approach to achieving long-term financial goals.

-

Can you be over-diversified?

No definitive threshold exists that separates a well-diversified portfolio from an excessively diversified one. Generally, investors consider a portfolio with 20 to 30 investments across different stock market sectors adequately diversified.

How can you diversify your portfolio?

Diversification is key for balancing risk and returns in your investments. Understanding different asset classes allows informed allocation decisions across varied sectors, which minimizes risk and maximizes opportunities. Let's understand the asset classes and how they can help you create a diversified portfolio.

-

Stocks - Represent ownership shares in companies. Adding stocks across different industries spreads risk and takes advantage of growth opportunities in multiple sectors

-

Bonds - These are essentially loans to governments and corporations that provide fixed income. Bonds offer lower risk than stocks and provide steady interest income

-

Cryptocurrencies - Digital assets that can provide aggressive yet highly volatile risk/reward opportunities. Handle with care

-

ETFs and Mutual Funds - Basket investment vehicles holding diversified mixes of assets like stocks, bonds, and commodities. Offer built-in diversification

-

Diversify Globally - Investing globally exposes markets with different economic cycles and characteristics than your domestic market

-

Real Estate - Property investments, direct or via REITs, add a tangible asset class with risk/return attributes that contrast traditional securities

-

Commodities - Physical goods like precious metals, oil, or agricultural products can hedge inflationary environments and diversify away from correlated stocks and bonds

-

Cash - Offers liquidity and stability in volatile markets. Cash reduces portfolio volatility, though with very low returns

Adding different representatives of the listed asset classes to your portfolio is a way to diversify.

Add some individual stocks

Adding a selection of individual stocks to your portfolio provides direct exposure to specific companies you believe in.

👍 Pros:

• Stocks can provide growth in your portfolio from rising share prices and dividends. Owning shares in strong companies with competitive advantages and quality management is a proven wealth builder over the long run.

👎 Cons:

• However, stock prices can be volatile in the short term. Owning too few stocks exposes you unduly to company-specific risks. If one stock plunges, it can drag down your whole portfolio. The general rule is to own at least 15-20 stocks spread across different sectors to be adequately diversified

-

Focus on stocks in industries with promising outlooks, competitive dynamics that favor the company, and experienced management teams with good track records

-

Pay close attention to valuation, too—even great companies can be poor investments if you overpay

-

Stocks don't have upfront fees, but you pay commissions when trading. You'll also owe taxes on dividends and any investment gains

Buy Bonds

Adding bonds to your portfolio provides income and stability to balance out the volatility of stocks. Bonds are debt securities where you loan money to a government or company in exchange for interest payments over a set period plus repayment of principal at maturity.

👍 Pros:

• Key benefits of bonds include consistent income, relatively low volatility, and portfolio diversification. High-quality bonds lower your portfolio's risk profile. Government and investment-grade corporate bonds provide safety while still yielding more than cash

👎 Cons:

• Limitations of bonds include vulnerability to interest rate changes and inflation. Rising rates erode bond prices, and inflation reduces real returns. Also, lower-rated junk bonds carry a higher risk of defaults

Spread your holdings across different bond issuers, credit qualities, durations, and segments (government, corporate, municipal, etc).

Add Crypto

Cryptocurrencies offer a new asset class for portfolio diversification. Crypto aims to provide a decentralized digital currency utilizing blockchain technology. The market has grown rapidly in recent years.

👍 Pros:

• Benefits of crypto include diversification away from traditional assets like stocks and bonds. Crypto performance tends to be uncorrelated, so it can react differently than other holdings. The market also offers explosive upside, though with equally extreme volatility

👎 Cons:

• However, crypto investing comes with unique risks. Cryptocurrencies remain speculative investments with a lack of intrinsic value. Massive price swings are common, compounding the high risk. Government regulation also remains a huge uncertainty

As with other holdings, diversification applies. No more than 5% of a portfolio should be held in crypto due to the market's volatility. Within that allocation, diversity across different cryptocurrencies helps manage risk. Use this tutorial → How To Become A Successful Cryptocurrency Investor?

Add ETFs & Mutual funds

Exchange-traded funds (ETFs) and mutual funds provide instant diversification within an asset class. ETFs and mutual funds allow you to gain broad exposure to an index or market sector through pooling your money with other investors. This provides wide diversification with minimal capital.

👍 Pros:

• Benefits include inexpensive access to hundreds or thousands of stocks through a single ticker. Top ETFs track major indexes like the S&P 500. Actively managed mutual funds aim to outperform the market under a fund manager. Certain funds focus on specific sectors, markets, or factors to target areas you want exposure to

👎 Cons:

• Costs do apply for ETFs and mutual funds. Comparison of management expense ratios and commission-free ETF offerings from brokers. There are also risks of tracking errors versus indexes

Diversify globally

Diversifying globally into international stocks provides access to growth outside your home country. Foreign stocks help balance domestic risks in your portfolio. You gain exposure to regions and sectors with favorable growth trends not reflected in U.S. markets.

👍 Pros:

• Adding an allocation to foreign stocks provides numerous benefits. You reduce concentration in any single market. Emerging markets in Asia, Latin America, and Africa offer expanded growth. Developed markets like Europe and Japan provide stability

👎 Cons:

• Implementation options include individual foreign stocks, international ETFs and mutual funds, and U.S. multinational stocks with global revenue. Limitations can include political risks in certain countries and higher expenses for trading and currency conversion

But overall, global assets diversify your portfolio.

Real Estate

Adding real estate to your portfolio diversifies into hard assets and property income. Real estate investment trusts (REITs) allow you to gain commercial and residential real estate exposure. REITs purchase and manage properties and distribute income to shareholders.

👍 Pros:

• Benefits of real estate in a portfolio include asset diversification, stable cash flow from rents, inflation hedging, and REIT tax advantages

👎 Cons:

• Limitations include rate sensitivity and lack of liquidity in directly owned properties. Still, real estate offsets risks in other holdings like stocks and bonds

You can gain exposure through REIT ETFs and mutual funds, private real estate investing platforms, and direct property ownership. Keep targeted allocation low due to illiquidity. But a modest portion of your portfolio in real estate provides diversity.

Commodities

Commodities like oil, natural gas, metals, and agricultural products provide further diversification as real assets. Commodity prices tend to perform independently from stocks and bonds. They can benefit your portfolio when inflation rises or the dollar declines.

👍 Pros:

• Benefits of commodities include portfolio diversification, inflation hedging, and leveraging economic growth in emerging markets

👎 Cons:

• Risks include volatility and complexity of futures and options trading. Government regulation of commodities markets also introduces uncertainty

Implementation options include commodity ETFs tracking energy, metals, or agriculture. Individual commodity stocks provide concentrated exposure.

Hold Cash

Keeping a cash allocation provides stability, liquidity, and dry powder for new opportunities. Cash includes money markets and short-term CDs. Cash provides the ultimate safe haven in volatile markets compared to stocks and bonds.

👍 Pros:

• Benefits of holding cash include stability, liquidity, optionality, and serving as a hedge. Drawbacks are low returns and erosion from inflation over time. Still, a modest cash allocation adds diversity

👎 Cons:

• Target a 5-10% cash allocation. Ramp up near retirement or in volatile markets. Rebalance when cash builds excessively. For large amounts, laddered CDs provide higher safe returns

Overall, cash balances riskier portfolio assets. Owning multiple currencies is another way to diversify your portfolio.

Best stock brokers

Tips to diversify your portfolio

-

Rebalancing involves selling assets that have outperformed to buy more of those that have underperformed. This realigns allocations back to original targets. Rebalance at least annually or when allocations skew over 5% from targets

-

Robo-advisory provides automated portfolio management. You specify your risk tolerance, time horizon, and goals. The robo-advisor then constructs and manages a diversified ETF portfolio tailored to you. Check this review: 12 Best Robo-Advisors in 2024

-

Compounding drives growth over long periods. Dollar-cost averaging smooths out volatility

-

When younger, allocate more to stocks for growth. As you near retirement, shift portions into bonds and cash to preserve capital. Match allocations to your risk tolerance and timeline. For example, at 30 years old, consider 85% stocks, 10% bonds, 5% crypto. At 60, reduce stocks to 40% and increase bonds to 60%

What is an example of a well diversified portfolio?

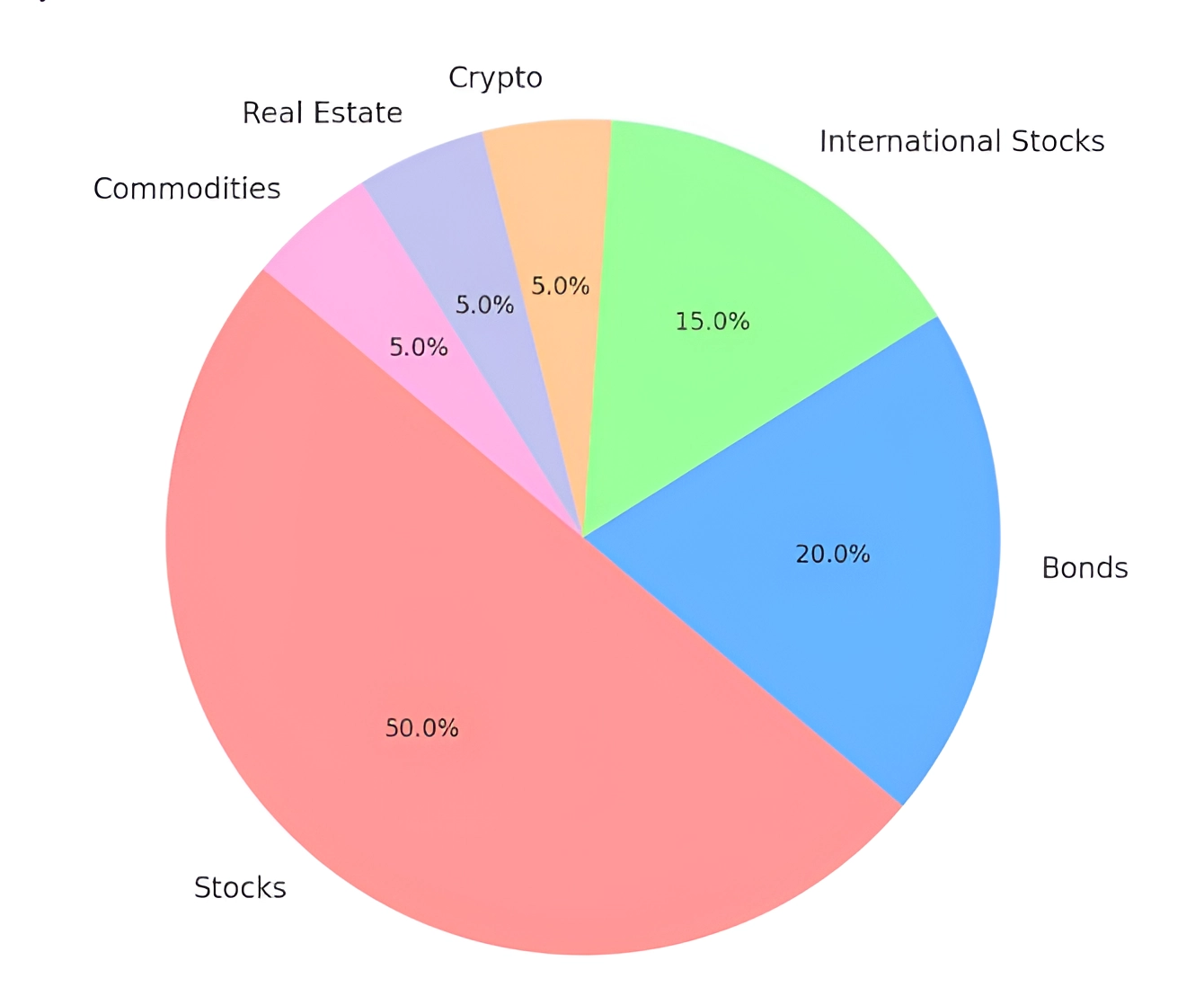

A well-diversified portfolio might allocate 50% to stocks, including a blend of 15-20 individual stocks from various sectors and stock mutual funds or ETFs for widespread market exposure. This substantial stock allocation primarily drives growth during an investor's early career stage.

The portfolio also might feature a 20% investment in bonds, combining government and corporate bonds, to offer stability and income, balancing the stock portion's volatility.

Furthermore, about 15% of the portfolio might go towards international stocks from developed and emerging markets, adding essential geographic diversification beyond domestic equities.

An example of a well diversified portfolio

The remaining 15% might be distributed among alternative asset classes, such as a 5% investment in top cryptocurrencies, another 5% in real estate via REIT funds, and 5% in commodities through a broad basket ETF. These alternative investments further diversify the portfolio beyond stocks and bonds.

Conclusion

Diversification aims to grow wealth over time while managing risk. Spreading investments across different assets, sectors, and regions helps ensure that no single decline severely damages the portfolio. Asset classes with returns that aren't highly correlated can balance each other.

Strategies covered include stocks, bonds, crypto, funds, global assets, real estate, commodities, and cash. Rebalancing and matching allocations to your goals and timeline are also important. Disciplined diversification takes work but can pay off greatly in the long run by optimizing returns for a given level of risk.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.