Building Your Crypto Portfolio: A Beginner's Guide

Building a crypto portfolio can be an important event that will affect your financial future. Consider the following steps in doing so, which may be of assistance to you:

-

Understand your investment goals and risk tolerance.

-

Choose a secure, user-friendly trading platform with low fees.

-

Employ strategies: value investing, growth investing, technical and fundamental analysis, HODL.

-

Diversify: established coins, altcoins, stablecoins, emerging sectors.

-

Regularly review and manage your portfolio to adjust to market changes.

-

Start with a balanced mix: Bitcoin, Ethereum, promising altcoins, and innovative tokens.

With its unparalleled potential for substantial returns, the crypto market presents a unique, albeit volatile, frontier of investment opportunities. However, the dynamic nature of this market underscores the importance of a well-structured approach to building a crypto portfolio. Navigating the complexities of cryptocurrency requires a strategic mindset.

This article aims to demystify the process, offering a comprehensive guide to creating a crypto portfolio that aligns with your financial goals and risk tolerance. Here, we define the problem of market unpredictability and provide a solution through strategic portfolio creation, ensuring readers are well-equipped to embark on their crypto investment journey.

-

Is crypto good for portfolio?

Yes, including crypto in a portfolio can enhance diversification and potential for high returns, but it also increases exposure to volatility.

Initial steps to create a crypto portfolio

Creating a crypto portfolio demands a foundational understanding of your investment goals and risk tolerance. This initial step is crucial, it shapes your investment strategy, influencing every decision you make thereafter.

Are you in it for the long haul, aiming for steady growth over the years, or are you seeking quick returns, despite the higher risk? Your answers to these questions will guide your approach, helping you to navigate the volatile waters of cryptocurrency investment with confidence and clarity.

Selecting the right trading platform is another pivotal step in this process. The ideal platform should offer:

-

User-friendly features, ensuring that even those new to the crypto world can navigate trades with ease

-

Low fees, allowing you to maximize your investment returns rather than losing a significant portion to charges

-

Wide range of assets and services is essential, providing you with the flexibility to diversify your portfolio and explore various investment opportunities

-

Robust security measures are non-negotiable. In the digital age, the safety of your investments is paramount, making the security features of a trading platform a critical consideration.

Together, understanding your investment goals and selecting the right trading platform lay the foundation for a successful crypto portfolio. These initial steps are about setting yourself up for success in the complex and rapidly evolving world of cryptocurrency investment.

To get to know the platforms through which you can build your crypto portfolio, read the article: 12 Best Crypto Trading Platforms in 2024

Best crypto exchanges

Key strategies of a balanced crypto portfolio

Crafting a balanced crypto portfolio necessitates a strategic approach that encompasses a variety of investment methodologies. Each strategy caters to different investor profiles, risk appetites, and time horizons.

There are 5 key strategies of a balanced crypto portfolio:

-

Value Investing

-

Growth Investing

-

Technical analysis

-

Fundamental analysis

-

HODL

By understanding and implementing these strategies, investors can navigate the volatile crypto market with greater confidence and efficacy.

Value Investing

A cornerstone strategy in traditional markets, value investing, adapts to the crypto space through the identification of cryptocurrencies that appear undervalued relative to their fundamental worth. This strategy requires thorough research to uncover assets with solid fundamentals, such as strong use cases, robust technology, and potential for widespread adoption.

Beyond mere coin selection, value investing in crypto also embraces the concepts of farming and staking. Yield farming involves earning rewards through liquidity provision to DeFi (Decentralized Finance) protocols, while staking refers to locking up holdings to support the operation of a blockchain network, in return for more of the staked asset. Both practices allow investors to generate passive income from their investments, enhancing the portfolio's value growth over time.

Growth Investing

This strategy focuses on cryptocurrencies that exhibit potential for significant future growth, often accepting higher risk for the possibility of higher returns. Growth investing often includes investments in newer, less established projects or sectors within the crypto industry, such as meme coins, DeFi, and NFTs (Non-Fungible Tokens).

Meme coins, for example, can experience rapid price surges based on social media trends and celebrity endorsements, despite lacking solid fundamentals. While inherently riskier, growth investing can yield substantial returns if market timing and sentiment are navigated adeptly.

Technical Analysis

Technical analysis involves the study of historical price charts and market data to forecast future price movements. This strategy is predicated on the belief that price patterns and trading volumes can indicate future trends.

Crypto investors utilizing technical analysis apply a range of tools and indicators, such as moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels, to make informed decisions on entry and exit points.

Technical analysis requires a significant time investment and a deep understanding of market psychology and chart patterns, making it more suitable for those with a keen interest in market dynamics.

To get ideas on how technical analysis tools can help you form a crypto portfolio, read the article: Best Technical Analysis Software and Tools

Fundamental Analysis

Contrary to technical analysis, fundamental analysis looks beyond price charts to evaluate a cryptocurrency's inherent value. This involves analyzing the project's whitepaper, development team, technology, market demand, competition, and regulatory environment.

The goal is to invest in cryptocurrencies with strong fundamentals that are likely to succeed and grow in the long term. Fundamental analysis is particularly relevant in the crypto market, where hype can often inflate the value of projects with weak or non-viable use cases.

HODL

Originating from a misspelled word "hold," HODL has become a popular investment strategy among crypto enthusiasts. It involves buying and holding cryptocurrencies for a long period, regardless of market volatility. The rationale behind HODLing is that, despite short-term fluctuations, the value of cryptocurrencies with solid fundamentals will increase significantly over the years.

This passive investment strategy is suitable for those with a high risk tolerance and a long-term investment horizon, who believe in the future of cryptocurrencies.

A balanced crypto portfolio typically incorporates a mix of these strategies, tailored to the individual's investment goals, risk tolerance, and market outlook.

By diversifying across different investment methodologies, investors can mitigate risk while positioning themselves to capitalize on various growth opportunities within the crypto market. The key to a successful crypto investment strategy lies in continuous learning, market research, and an adaptable approach, as the cryptocurrency landscape is constantly evolving.

How do I organize & manage my crypto portfolio?

Organizing and managing a crypto portfolio is an ongoing process that requires attention, strategy, and an understanding of the market dynamics. A well-managed portfolio not only aims for growth but also ensures risk is kept within acceptable limits. Here's how investors can achieve this balance:

-

Diversification: The first rule of thumb in portfolio management is diversification. This doesn't just mean owning a variety of cryptocurrencies; it's about creating a balanced mix that can withstand market volatility. Diversification can be approached in several ways:

Crypto/Crypto vs. Crypto/Stablecoins: Balancing your portfolio between volatile cryptocurrencies and stablecoins (like USDT, USDC, or DAI) can reduce risk. Stablecoins provide a buffer against market volatility, as their value is pegged to stable assets like the USD, offering a safe haven during turbulent periods.

Meme vs. Major Coins: While major coins like Bitcoin and Ethereum are considered more stable and have established use cases, meme coins can offer high-reward opportunities, albeit with higher risk. Including both in your portfolio can balance the potential for growth with foundational stability.

Shorts vs. Longs: Including both short-term trades (shorts) and long-term holds (longs) can diversify your investment strategy within your portfolio. Short-term trades can capitalize on market movements to generate quick returns, while long-term holds are based on the belief in the asset's value growth over time.

-

Regular Portfolio Review: A static portfolio in a dynamic market like crypto is unlikely to perform well over time. Regular reviews and adjustments are essential to keep your investments aligned with your goals and the changing market conditions.

Performance Tracking: Use portfolio tracking tools to monitor the performance of your assets in real-time. This can help you make informed decisions about rebalancing or adjusting your investment strategy.

Rebalancing: Depending on market performance, some assets may outperform others, leading to an imbalance in your portfolio. Periodic rebalancing ensures your portfolio remains aligned with your desired asset allocation, reducing risk and potentially locking in gains.

Understanding Correlated Risks: In the crypto market, many assets exhibit price correlation, moving in tandem based on broader market trends. Recognizing these correlations can help in diversifying risks. For instance, during market downturns, diversifying into assets that are less correlated with the broader market, such as certain DeFi tokens or stablecoins, can mitigate losses.

-

Risk Management: Managing risk involves not only diversifying but also setting stop-loss orders, taking profits at predetermined levels, and never investing more than you can afford to lose. Being proactive about risk can help preserve your capital and take advantage of opportunities as they arise.

Organizing and managing a crypto portfolio is an iterative process that balances the pursuit of growth with the mitigation of risk. Remember, the key to successful portfolio management lies in adaptability and a well-informed strategy.

Example of a good starting crypto portfolio

Creating a balanced and diversified crypto portfolio is essential for both minimizing risk and maximizing potential returns. A good starting portfolio typically includes a mix of established cryptocurrencies, promising altcoins, stablecoins, and tokens from emerging sectors within the crypto ecosystem.

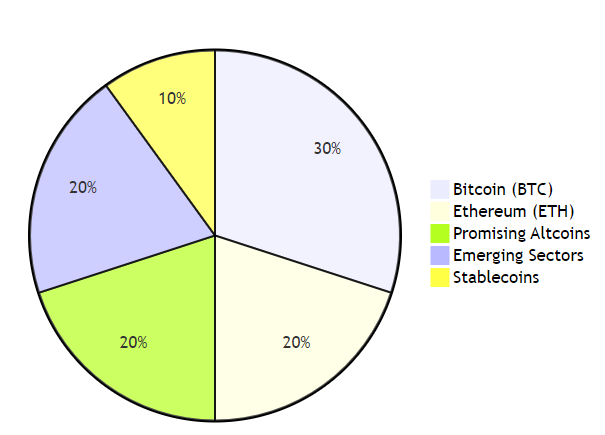

Example of a well-balanced crypto portfolio

Here's an illustrative example of how a well-rounded crypto portfolio might look for a beginner investor:

-

Established Cryptocurrencies (50%): Start with the foundation of any crypto portfolio—established, well-known cryptocurrencies. Allocate a significant portion to Bitcoin (BTC) and Ethereum (ETH), as they are considered relatively stable compared to the vast array of altcoins. These leading cryptocurrencies have shown resilience over time, a strong development ecosystem, and widespread adoption.

Bitcoin (BTC) - 30%

Ethereum (ETH) - 20%

-

Promising Altcoins (20%): Diversify into altcoins with solid fundamentals and growth potential. Look for projects with unique use cases, strong development teams, and supportive communities. Consider coins like Chainlink (LINK) for its leading position in oracle protocols or Solana (SOL) for its fast and cheap transactions all on one chain.

Chainlink (LINK) - 5%

Solana (SOL) - 5%

Avalanche (AVAX) - 5%

Polygon (MATIC) - 5%

-

Stablecoins (10%): Incorporate stablecoins to provide stability and liquidity to your portfolio. These can be a safe haven during periods of high volatility and can also be used to earn interest through various DeFi platforms.

Stablecoins (10%): Incorporate stablecoins to provide stability and liquidity to your portfolio. These can be a safe haven during periods of high volatility and can also be used to earn interest through various DeFi platforms.

USD Coin (USDC) - 5%

Tether (USDT) - 5%

-

Emerging Sectors (20%): Allocate a portion of your portfolio to tokens from emerging sectors like DeFi, NFTs, and Web3, as these represent the cutting edge of blockchain and cryptocurrency innovation. Investments in these areas carry higher risk but also the potential for high rewards.

Stablecoins (10%): Incorporate stablecoins to provide stability and liquidity to your portfolio. These can be a safe haven during periods of high volatility and can also be used to earn interest through various DeFi platforms.

DeFi Tokens (e.g., Uniswap, UNI) - 5%

NFTs & Gaming (e.g. Immutable, IMX) - 5%

Artificial Intelligence (e.g. PAAL AI, PAAL)

Web3 & Infrastructure (e.g., The Graph, GRT) - 5%

This example portfolio is designed to balance stability and growth potential. The allocation to Bitcoin and Ethereum serves as the backbone, providing exposure to the overall growth of the crypto market. The inclusion of promising altcoins introduces the potential for significant returns, while stablecoins offer a buffer against volatility. Finally, the investment in tokens from emerging sectors allows for speculative bets on the future of technology and digital economies.

This example serves as a starting point. The crypto market is dynamic, and successful investing requires ongoing education, diligence, and adaptability.

Conclusion

Creating a balanced and strategic crypto portfolio is paramount to navigating the complexities of the cryptocurrency market.

Understanding investment goals, selecting the right trading platform, employing diverse investment strategies, and regularly reviewing and managing your portfolio allows investors to mitigate risks while seeking growth opportunities.

Embrace a well-informed and strategic mindset, remain adaptable to market changes, and continuously educate yourself to make informed decisions. In the dynamic world of crypto investment, knowledge and strategy are your most valuable assets.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).