NFT tokens: what are they and how do they work?

NFT token or non-fungible token is a special type of cryptocurrency assets that is becoming increasingly popular. They are widely used, as they cannot be forged, split and they guarantee ownership rights to a specific item. TU analysts explain what an NFT is, how it works and also offer a list of marketplaces to buy such tokens.

What is a token?

Before discussing what a non-fungible token is, let’s find out what a token is. Blockchain technology implies that information is built as a chain of blocks. Every block stores a specific entry, which cannot be changed or deleted. Each transaction in a blockchain is confirmed by miners (if the blockchain is based on the Proof-of-Work algorithm and mining is available for it) or validators (if the blockchain is based on the Proof-of-Stake algorithm and requires proof of a stake). Computers, mining farms, mobile devices of these people perform validation of transactions and add blocks to the chain, expanding the blockchain, and all data is stored in strict order. Now, let’s discuss what a token is.

A token is a special type of digital asset, which is not a cryptocurrency. Factually, it is an entry in the blockchain. Tokens have a number of differences from cryptocurrencies. You can see the basic differences below.

| Coins | Tokens |

|---|---|

Coins have their own blockchain, which is the foundation of a digital currency |

Tokens do not have their own blockchain, instead working on a chain of blocks developed for some other coin |

It is more difficult to develop and create coins, as it requires development of a new blockchain first |

Token work on an already existing blockchain, which largely simplifies creation of these digital assets. |

Coins are mainly used for transactions |

Tokens can be used not only for transactions. |

Ordinary tokens are equal and interchangeable. This means that if you have one token, you can equally exchange it for another one and you won’t lose anything at that. That’s where they are different from NFTs.

What is an NFT?

NFT is a non-fungible token, which means that this token or a group of tokens are absolutely unique. They cannot be equally exchanged and the information contained in them is unique. NFTs can be of different value, depending on the data stored in them.

Every NFT token is unique and therefore it is simply impossible to equally exchange it. They may contain different information, making the value of a token or a group of tokens different. Even if you exchange one token with another one of the same value, you will have an entirely different NFT containing absolutely different information.

NFTs cannot be split. It is impossible to make two tokens out of one with the equal, half, value. It can only be one and the information contained in it cannot be changed or damaged. However, NFTs can be composite in nature. For example, one album of 10 songs can be encrypted in 10 different tokens.

NFT use cases

The uniqueness of NFTs is that they can carry different encrypted information.

For example, these tokens can be associated (contain) with:

-

Art;

-

Music;

-

Text;

-

Video;

-

3D models, etc.

In the 4 years of existence of the NFTs, many people have already used this technology. Let’s see some of the examples.

NFT in Music

DJ 3LAU became the first musician in the world to sell his new album via an NFT. He earned $11.6 from the sale of his album through non-fungible tokens. Also another artist Grimes sold her album through NFTs. In total, she sold 400 NFTs with her album, making $5.8 million.

An unpublished song by Elon Musk could have become another example. In this Twitter, Musk posted about some unknown song. He said he digitized it and turned it into an NFT, which he intended to put up for auction. The auction did start and the amount reached $1 million, but in the end the deal fell through. Musk decided not to sell his song.

NFT in Art

A unique example of encrypted NFT image is the image of Banksy, an artist whose name is unknown. His piece Morons was purchased by a blockchain company Injective Protocol for $95,000 from a gallery in New York. After that the company made a performance turning the image into an NFT and burning the original. Therefore, the Morons no longer physically exists, but it does exist as a non-fungible token.

Another example is the image Everydays: The First 5000 Days by Beeple. Artist Mike Winkelmann, known professionally as Beeple, became one of the first artists to sell his masterpieces as NFTs. He sold his first image as a tokenized asset in October 2020 for $66,000. In January 2023, this image was sold at an auction for $69 million. Also, this image was the first NFT in history to be sold at Christie’s.

NFTs on Social Media and in Memes

The most well-known example of NFTs on social media is the token associated with the first tweet of Jack Dorsey. Dorsey, who was one of the creators of Twitter and is now a popular crypto enthusiast, encrypted his first tweet. It was published on March 21, 2006 with the message: “just setting up my twttr”. The tweet was sold for $2.9 million Dorsey stated that he would donate the money to fight COVID-19.

Even memes were sold as NFTs. The Nyan Cat meme is a known example. The NFT contains a GIF file with an image of a flying cat leaving a rainbow trail. The creator of the meme Chris Torres developed an NFT dedicating it to the 10th anniversary of Nyan Cat’s creation. The token was sold at an auction for $590,000 and its buyer became the official owner of the Nyan Cat meme. Any images and GIFs published online are copies.

NFT is Simple. How Does it Work: an Easy Example

Let’s see the differences between a token and a NFT using a simple example. Let’s say that you lent $100 to your friend for a period of 30 days. In 30 days, your friend will return $100. It could be a different banknote or banknotes, but the value won’t change. That’s how ordinary tokens and cryptocurrencies work. If, for example, you give 1 BTC and then buy 1 BTC you will have exactly one Bitcoin on your account. Its value can be different only due to the current rate, but sometime later, it will become the same.

Now, let’s look at how NFTs work. Let’s assume that you gave your friend a unique trading card with Michael Jackson’s autograph, which he signed with a feather pen. He will not be able to give you back another card, because that will be an entirely different asset. A signature may be distorted a bit or there could be other differences. One way or the other, your card is unique and there cannot be another one that is absolutely identical to it.

NFTs work in the same way. There cannot be two identical NFTs, even if they are of the same value with the token that you gave. The value of each token will also be calculated individually. The token that you gave can become more expensive tomorrow and the token that you got could lose its value the next day. Or vice versa. Be that as it may, the value of each NFT is determined individually.

NFT Token vs. Ordinary Token: Comparison

For convenience, we have drawn up a table with a short comparison of ordinary tokens and NFTs. Let’s see how they are different.

| Token | NFT |

|---|---|

Interchangeable. If you exchange one token for the other, nothing will change |

Non-interchangeable. If you exchange one token for the other, you will have an entirely different asset, even if it has a similar value |

Can be split to two and more parts |

Cannot be split |

Can contain the same information |

Contains different information. Each NFT token is unique |

The value is determined for all tokens. Tokens of the same type have the same price. The price changes for all tokens simultaneously |

Each NFT has its own price depending on the information it carries. The price of an NFT is calculated for each token separately |

Used for payment for goods or services on the platforms to which they are linked |

Thanks to its uniqueness, NFTs can be used to verify the ownership rights to unique items, for example collectibles |

NFT statistics

The first NFT was created in 2017 against the background of the first cryptocurrency boom. Ethereum smart contract technology was used for its creation. Monitoring of such tokens is performed by the Nonfungible service.

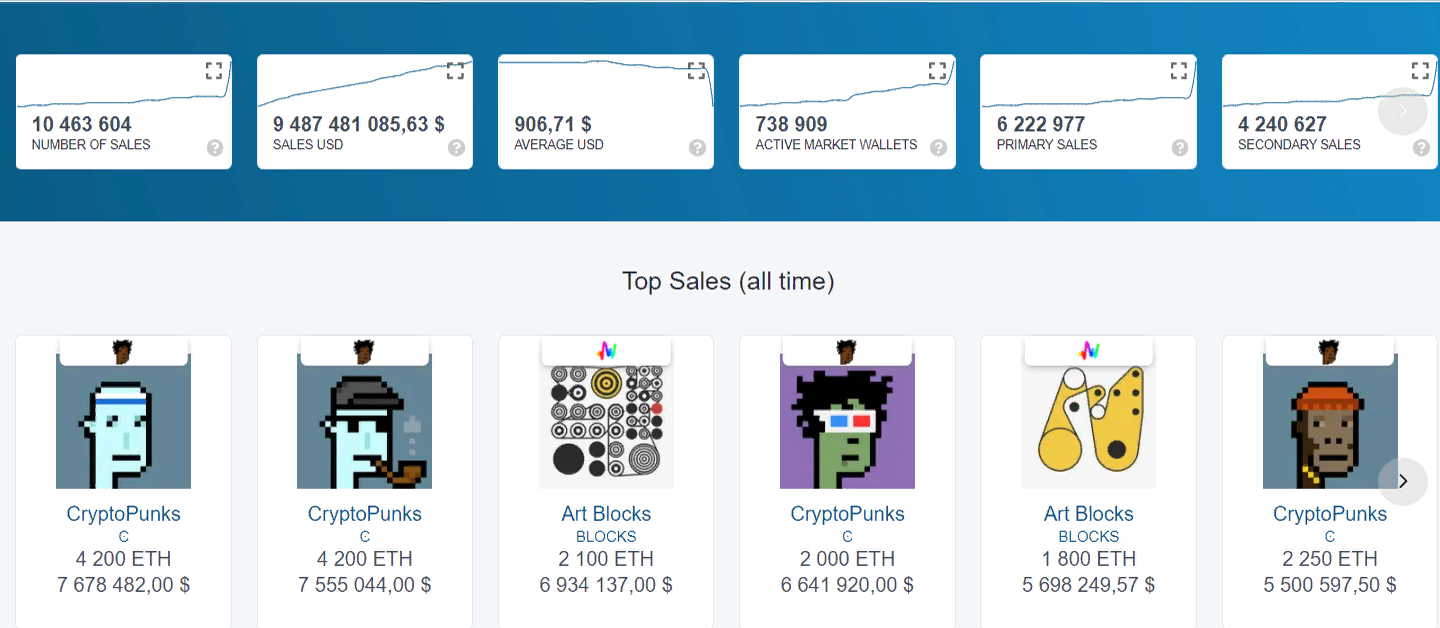

As of 2024, the service provided the following statistics:

-

Number of NFT sales: 10,463/604

-

Sales volume: $9,487,481,085.63

-

Average price of 1 NFT: $906.71

-

Number of active market wallets: 738,909

-

Number of primary sales of tokens: 6,222,977 NFTs

-

Number of secondary sales of tokens: 4,240,627 NFTs

Latest statistics and the most expensive NFTs in history

The most expensive NFT of all time is NFT Crypto Punks. The value of the transaction amounted to 124,457 Ethereum crypto coins or $532 million. The record-setting transaction took place on October 27, 2023.

Let’s also see the most expensive NFT projects. As a basis of evaluation, we will use the volume of transactions that were performed with non-fungible tokens of different projects in all time. As of 2023

The Top 5 projects, according to Nonfungible, include:

-

Crypto Punks – $1,543,953,985

-

Art Blocks – $1,170,352,032

-

Bored Ape Yacht Club – $1,094,001,790

-

Meebits – $306,523,720

-

SuperRare – $179,932,328.

NFT statistics by sales volumes

Basic types of NFTs

You already know that NFTs can be of all sorts and that you can literally encrypt anything in them for a popular meme to a masterpiece worth tens of millions of dollars. Tokens are differentiated by two basic criteria. Let’s take a closer look at them.

Changeability

For example, they are classified by changeability. In this case, there are three types of NFTs:

-

Non-changeable (ERC-721 standard). There is an individual smart contract for these tokens. It is applied for items, of which there is only one copy, and they cannot be replaced with anything. For example, Beeple’s Everydays: The First 5000 Days cannot be replaced with anything. There is only one original copy of it.

-

Partially changeable (ERC-1155 standard). These tokens can be issued in several copies but executed in one smart contract. For example, 400 NFTs were sold as the album of Grimes. If two owners exchange these albums, nothing will change for them.

-

Composable (ERC-988 standard). These tokens imply a share of ownership of anything. For example, you can turn a property into a token. Imagine an apartment that has three owners. Each of them gets a share of the token carrying information about the property and the share in this apartment.

Each of these types of tokens are widely used in many areas. We will discuss these areas below.

Main Areas of Use

There are five basic areas of use of non-fungible tokens, including:

-

Gambling – 32%. In gambling, usually chips are encrypted in NFTs, which can then be exchanged by gamblers for their win. Or these could be special rewards for participation in special offers, prize draws, tournaments, contests.

-

Gaming – 13%. For gamers, unique access keys to the account in a game are often encrypted in NTFs. Also different achievements, titles, etc. can be turned into non-fungible tokens.

-

Luxury items – 7%. With NFTs, you can buy luxury items or a share in them. For example, these can be jewelry or precious stones. Often, such NFTs can be exchanged for real objects. For example, Icecap offers NFTs associated with diamonds.

-

Art – 6%. These NFTs allow you to become an owner of different objects of art or a share in them. These could be different items, such as paintings, sculptures, etc.

-

Collectibles – 2%. These NFTs are associated with collectibles. For example, they are widely used for encrypting trading cards, including with autographs of celebrities – musicians, athletes, etc.

Other types of NFTs account for 40%. For example, they can be used to establish a share in property or business (NFTs are used to encrypt stocks, other securities); unique domain names and many other things can be encrypted in such tokens.

Gambling |

32% |

Gaming |

13% |

Luxury items |

7% |

Art |

6% |

Collectibles |

2% |

Other |

40% |

How to invest in NFT?

Investing in cryptocurrencies and digital assets has become widely popular. NFTs can also be considered as an investment asset. People invest in property, luxury items and art objects, rare, collectible items. NFTs essentially work in the same way. The only exception is that you won’t physically own an asset (a diamond from Icecap will not be stored in your bedroom, although that’s also entirely possible), but a token will confirm your ownership right.

In addition, NFTs can also be viewed as an investment asset. Take for example the Crypto Punks collection. These are tokenized collectible cards that don’t exist physically. At that, the price of each card is different, with the maximum price exceeding $500 million. Therefore, even if you are not buying a share of a diamond, NFTs can still become an investment asset.

You can earn a profit from an NFT only by re-selling it at a high price. You can sell a token after some period of time (Buy & Hold) or right away, if you find a collector or an investor, who will be prepared to pay more. NFT trading is different from trading ordinary tokens or cryptocurrencies. They are sold and bought at special marketplaces. You need to open an account at a marketplace, fund your account and after that you can perform any transactions with tokens.

Marketplaces for buying NFTs

In the 4 years of existence of non-fungible tokens, many marketplaces were created, where you can buy or sell tokens. Some organizations even launch their own platforms. For example, the National Basketball Association (NBA) has launched an official platform, where you can buy NFTs associated with videos or GIFs with an image of different historical moments.

TU analysts have prepared a list of Top 3 universal marketplaces, where you can buy or sell NFTs. See our list below.

Binance NFT

Binance NFT is an NFT marketplace of the largest cryptocurrency exchange Binance. Traders can trade more than 300 types of cryptocurrencies at this crypto exchange, as well as learn to work with digital assets, buy and sell crypto using different methods. Binance NFT is an NFT exchange that was launched in 2023. It focuses on selling collectible and gaming NFTs. You can buy them with Ethereum or BUSD.

Binance NFT Marketplace

Rarible

NFT Rarible exchange offers a large choice of tokens, including objects of art, music, photos, domain name and many other things. Any person who opens an account on the platform can be a buyer and a seller. For example, Lindsay Lohan was a seller of an NFT token on Rarible. The exchange is growing actively. In January 2023, held a Series A investment round, raising $14.2 million. The list of investors included such reputable funds as Venrock Capital, CoinFund and 01 Advisors.

Rarible Marketplace

OpenSea

OpenSea is the largest NFT marketplace in the world. You can trade any type of NFTs here, including tokens associated with luxury items or property. OpenSea works with three blockchains: Ethereum, Polygon and Klaytn. NFT can be created on each of them, while the tokens from each of these blockchains are sold at the marketplace.

OpenSea Marketplace

Summary

NFT is a special non-interchangeable type of token. They carry information about specific objects of value. NFTs strongly differ from ordinary tokens, as they contain unique data, with the value of each NFT being different than that of the others. These digital assets can be used to buy assets or a share in them. They are used for the sale of objects of art, music, securities, property, luxury items, etc. They can be considered an investment asset, as they can represent high value.

FAQs

Can I create an NFT?

Yes, any person can create an NFT. Marketplaces, where such tokens are sold, also offer the services for creating NFTs.

Are NFTs legal?

The majority of countries do not have laws regulating cryptocurrencies and digital assets. However, the majority of countries do not prohibit the use of NFTs.

How much can I earn from NFTs?

The amount you can earn from NFTs is essentially unlimited. Everything depends on the tokens you are working with and the assets they are associated with. The more expensive these assets are, the more expensive the NFTs will be. In addition, NFTs can be a stand-alone asset and they can also grow in price. However, don’t forget about the risks. The price of the tokens can drop or they may not be of interest to other users.

Can I buy an NFT at a traditional cryptocurrency exchange?

NFTs are unique assets and therefore they are not traded at traditional exchanges. However, some exchanges create NFT marketplaces and trade non-fungible tokens there. For example, Binance has its own NFT marketplace.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.