Cryptocurrency Trading Strategy Guide

Seven Crypto Trading Strategies You Need To Know:

-

1

Day Trading & Scalping

-

2

Swing Trading

-

3

Position trading

-

4

Dollar-cost averaging

-

5

HODLing

-

6

Arbitrage trading

-

7

High-frequency trading

Cryptocurrency trading involves buying and selling digital currencies on various online platforms to make a profit. The popularity of cryptocurrency trading can be attributed to its potential for high returns, the 24/7 market availability, the democratization of finance, and the allure of new technology. Additionally, it provides an opportunity for diversification beyond traditional assets.

The crypto market is constantly changing, and staying up-to-date on the latest cryptocurrency trading strategies is key for anyone looking to make a profit. With this in mind, this article will take a look at the top 7 best cryptocurrency trading strategies to learn, providing an overview of each and offering insight into how to choose the right one for your trading style.

Start Trading Crypto Now with ByBit!Key takeaways

-

Short-term trading strategies include day trading and scalping, which offer high potential profits but also carry high risk

-

Swing trading involves holding cryptocurrencies for a few days or weeks to profit from short-term price changes, using technical analysis to identify trends

-

Long-term trading strategies like position trading focus on holding investments for months or years, relying on fundamental analysis and offering the least risk

-

Dollar-cost averaging is a strategy that involves regularly investing a fixed amount of money, reducing risk by distributing purchases over time and allowing for accumulation and portfolio diversification

Crypto trading strategies you need to know

Cryptocurrency trading involves a wide range of strategies, each of which carries its own risks and rewards.

To maximize your chances of success, it is important to understand the different strategies that can be employed. These include:

-

1

Day trading and scalping

-

2

Swing trading

-

3

-

4

Dollar-cost averaging

-

5

HODLing

-

6

Arbitrage

-

7

Each strategy has its own approach and goals, so it is important to research and choose the one that aligns with your trading style and risk tolerance.

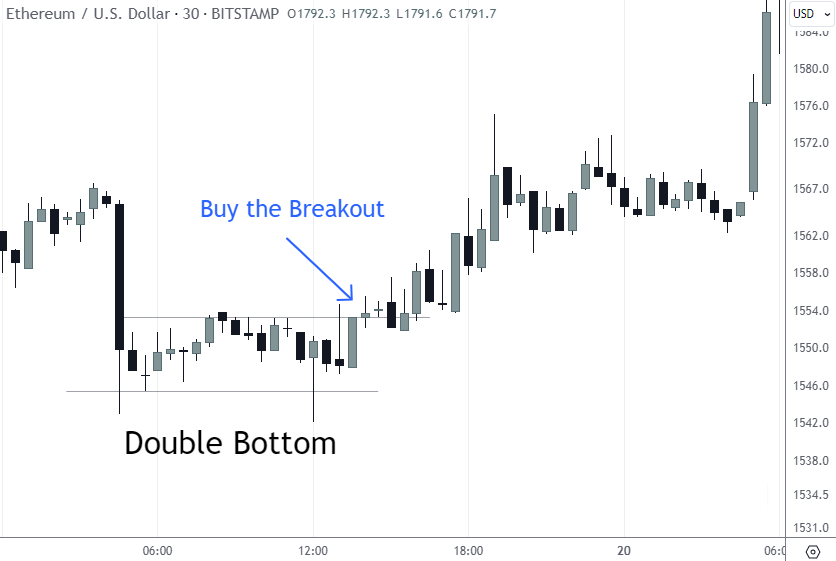

1 Day Trading & Scalping

Day trading and scalping are two of the most popular cryptocurrency trading strategies used by experienced traders to capitalize on short-term market fluctuations. The strategies involve buying and selling cryptocurrencies within the same day, and traders rely on technical analysis to identify trends and patterns in the market.

Source: Tradingview.com

However, these strategies are also very risky, as they require the trader to be able to quickly react to the changes in the market. Furthermore, it requires more time, effort and diligence from the trader, as they need to be ready to make moves at a moment’s notice. Even something as simple as going on vacation and not having access to the Internet could be problematic.

To learn more, our article on strategies to day trade cryptocurrencies provides an in-depth guide on the best ways to approach day trading.

2 Swing Trading

Building on the strategies of day trading and scalping, swing trading is another viable option for traders looking to capitalize on market movements in the medium short term.

It involves holding cryptocurrencies for a few days or weeks, or even months, with the goal of profiting from price changes.

Source: Tradingview.com

Swing trading requires traders to use technical analysis to identify medium-term trends and patterns in the market. It is less risky than day trading, as it allows traders to benefit from larger price movements. On the flip side, it also doesn’t hold the potential for significant everyday profits that day trading does.

Swing trading can be a great way for traders to make profits from cryptocurrency markets, but it requires dedication and knowledge of how to read and interpret charts correctly.

3 Position trading

Position trading is the longest-term of all cryptocurrency trading strategies, and is often favored by experienced traders who prefer to take a more sophisticated approach to the markets. It involves holding investments for months or even years, and requires traders to use fundamental analysis to identify crypto assets with strong long-term potential.

Position trading is the least risky of the three strategies, but comes with its own unique challenges:

-

It requires traders to have a long-term vision and to be able to stomach short-term volatility, both financially and emotionally

-

Ability to identify and capitalize on market opportunities in the long run is required

-

Traders need risk management skills to minimize losses and maximize profits

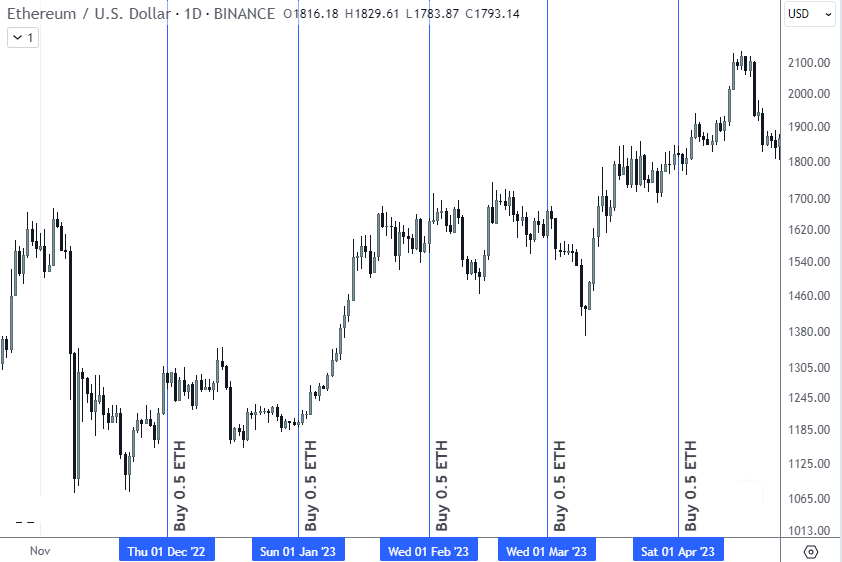

4 Dollar-cost averaging

Carrying on from position trading, dollar-cost averaging (DCA) is another strategy that experienced traders can leverage to capitalize on market opportunities in the long run while reducing the risks.

Dollar-cost averaging involves investing a fixed amount of money into cryptocurrencies on a regular basis (for example, every week, or every month) regardless of the price. This helps to reduce risk by distributing the purchase price over time.

Source: Tradingview.com

It is a great choice for those who don’t want to try and time the market. This strategy gives investors the ability to buy more units of cryptocurrency when prices are both low and high, thereby effectively lowering both risks and potential profits. It also requires very little time and effort, so it’s a fairly simple strategy to follow.

DCA is a good way to accumulate cryptocurrency over the long run and can be used to diversify a portfolio.

5 HODLing

HODLing one’s crypto investments is a strategy that requires patience and faith in the long-term prospects of the crypto market. Simply put, HODLing means holding your crypto assets for the long term. This is usually the strategy of choice for investors who believe the prices of cryptocurrencies will generally rise over time, regardless of short-term fluctuations.

HODLing has some key advantages:

-

No need to monitor markets constantly, as is the case with other strategies

-

Short-term volatility doesn’t affect you

-

Low-risk but potentially high reward

HODLing is a simple, low-stress strategy that doesn’t require any special knowledge or skills. It’s also a great way to build a long-term portfolio.

However, it can be risky if you’re not willing or able to wait for the long term, as cryptocurrency prices can be unpredictable. Therefore, if you’re on a timer, it’s best to look at other strategies that can provide more short-term gains.

6 Arbitrage trading

Arbitrage trading is a popular trading strategy for cryptocurrency traders looking to capitalize on the price differences between different exchanges. It requires traders to identify and execute price differences quickly.

It is a low-risk strategy that offers diversification and low capital requirements. On the other hand, traders may face high competition and the need to use technological and organizational solutions to achieve the necessary speed in conducting trading operations on different crypto exchanges.

Traders should also be aware of the risks associated with this trading strategy, such as market volatility, liquidity, and the need to monitor the markets closely. With the right approach, arbitrage trading can be an effective way to make profits in the cryptocurrency market. Therefore, choosing the right crypto arbitrage strategy is key to achieving success.

7 High-frequency trading

High-frequency trading strategy involves using computers to execute trades at very high speeds and uses algorithms to identify trading opportunities and then place orders automatically. High-frequency trading is very risky and is only suitable for experienced traders with access to high-powered trading software who have the technical know-how.

Some of the advantages of high-frequency trading include quick execution of orders to capitalize on small price differences, lower transaction costs due to the speed of execution, and the ability to detect and act on trading opportunities in real-time.

However, there are downsides to this strategy. These downsides include a high risk of loss due to the speed of trading, the potential for a trader to become overwhelmed, and the difficulty in detecting and capitalizing on longer-term trends.

If this strategy sounds appealing to you, our article on the best crypto trading bots will be a useful read.

Read also: Aggressive entry strategies for fast moving cryptocurrency markets in the TU article.

Best crypto exchanges

Tips for choosing a crypto trading strategy

When it comes to choosing the right cryptocurrency trading strategy, it is important to consider the risk-reward ratio, trading frequency, and capital commitment. The following table outlines the key factors to consider when selecting a crypto trading strategy:

| Factor | Description |

|---|---|

Risk-Reward Ratio |

The amount of risk you are willing to take in relation to the potential rewards |

Trading Frequency |

How often you trade |

Capital Commitment |

The amount of capital you are willing to commit to trading |

It is important to start small (even with a demo account, especially for completed beginners) and to not invest more money than you can afford to lose. Diversifying your portfolio is also key, by opening positions not just on CRYPTO/USD pairs, but on CRYPTO/CRYPTO pairs as well. That way, you are not solely relying on one specific cryptocurrency’s performance.

Finally, using a stop-loss order and taking breaks can help to limit losses and to avoid impulsive decisions. By making sure to consider the risk-reward ratio, trading frequency, and capital commitment when choosing a crypto trading strategy, traders can make more informed decisions.

If you’re a beginner, we have an article about crypto trading strategies for beginners that you may find beneficial.

Conclusion

Cryptocurrency trading is complex and requires knowledge of the market as well as strategies to make successful trades. The most successful traders are those who have a comprehensive understanding of the market and the strategies they use to make trades.

It is important to research and understand the different strategies available, as well as the risks involved. There aren’t “the best” and “the worst” strategies. Every trading strategy has its benefits and drawbacks, and what strategy fits you best will depend on your individual preferences, risk profile, life situation and goals.

By being informed and adaptive, traders can create a profitable trading strategy that works for them.

FAQs

What's the best crypto trading strategy?

There isn't a one-size-fits-all strategy for crypto trading. It depends on individual goals, risk tolerance, market conditions and a trader’s objectives. However, some of the more popular strategies include day trading, swing trading, HODLing (holding long-term), and arbitrage.

Can you make $100 a day with crypto?

Yes, it's possible to make $100 a day with crypto, but it requires a well-thought-out strategy, a good understanding of the market, and often a significant starting capital (or using leverage). However, the volatile nature of cryptocurrencies means profits are never guaranteed, and losses can occur.

Is crypto trading profitable?

Crypto trading can be very profitable indeed, but it's also risky. While many traders have made substantial profits, others have incurred significant losses due to market volatility, lack of strategy, or poor decision-making.

How many strategies are there in crypto trading?

There are numerous crypto trading strategies, evolving with market dynamics. Common ones include day trading, swing trading, HODLing, arbitrage, scalping, DCA (dollar-cost averaging) and trend following, among others. Traders often combine or modify strategies to fit their individual needs and market outlook.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

-

5

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).