How To Trade Cryptocurrency To Make Profit?

The potential profitability of trading in the cryptocurrency markets depends on many factors, among which is the trading strategy used:

-

Active Day Trading. Potential earnings are highly variable, from substantial losses to multi-million profits (elite traders)

-

Salaried Trader. $60,000 - $120,000+ (average range, top performers earn significantly more)

-

Long Term Investing. Highly variable, potential for life-changing gains (e.g., $1,000 in Bitcoin in 2010 = $200M+)

-

Copy Trading. Advertised returns up to 30% annually, but highly dependent on copied traders

-

Yield Farming. Potential for triple-digit APYs, but high risk (smart contract vulnerabilities, impermanent loss, rug pulls)

-

Staking. 5% - 15% annual returns (lower risk, more passive)

As someone who has been investing in crypto for more than 7 years, in my experience, while crypto day trading can be profitable technically, the vast majority of people lose money. Only the most elite and professional traders are able to reliably make gains. For 90 to 95% of people, they will lose money significantly more than make profits. With that caveat in mind, let's dive into the question: "Is crypto trading profitable? Is day trading crypto worth it?"

Crypto trading has captured the imagination of many, enticed by the potential for significant gains. However, the reality is far more nuanced. This article aims to provide a comprehensive and grounded perspective on the profitability of crypto trading, drawing from my decade of experience in this dynamic space. We'll explore various trading strategies, their inherent risks, and what it truly takes to succeed.

-

How much profit can you make from crypto trading?

The profit potential from crypto trading varies widely based on market conditions, your trading strategy, and risk management practices. Some traders might see substantial gains, while the majority is more likely to experience losses. Approach trading with a well-thought-out plan and realistic expectations.

-

Can you make $100 a day with crypto?

Yes, it's possible to make $100 a day with crypto trading by employing effective strategies and capitalizing on market volatility. However, achieving consistent daily earnings requires a deep understanding of the market, disciplined risk management, and the ability to adapt to changing conditions.

-

Can I make a living with crypto trading?

Making a living with crypto trading is feasible for some, particularly those who have developed a strong grasp of the market, trading strategies, and risk management. Nonetheless, it's important to remember that trading involves significant risks, and most will not manage to achieve consistent profitability.

-

Is cryptocurrency safe to trade?

Cryptocurrency trading carries inherent risks due to market volatility, regulatory uncertainties, and the potential for security vulnerabilities. While it offers opportunities for profit, traders should exercise caution, conduct thorough research, and utilize secure platforms to mitigate risks.

How much do crypto traders make?

The profitability of crypto trading hinges on several pivotal factors: the trading strategy employed, the stage of the market cycle, risk management practices, and, perhaps most crucially, the trader's skill level and emotional discipline.

Since earnings from crypto trading can vary dramatically - from plus millions to outright bankruptcy - let's consider several plausible scenarios:

-

Private Active Day Trader: These traders actively buy and sell cryptocurrencies within the same trading day, aiming to profit from short-term price movements

-

Salaried Employee: Some traders are employed by crypto firms, funds, or proprietary trading desks, earning a fixed salary

-

HODLer: The long-term "buy and hold" investors who ride out the market's ups and downs

-

Copy-Trader: Individuals who replicate the trades of successful crypto traders, essentially mirroring their strategies

-

Farmer, Staker: Those who earn rewards by providing liquidity or validating transactions on various crypto networks

How profitable is crypto day trading?

Day traders in the crypto space operate in a fast-paced, high-risk, high-reward environment. Their trading style revolves around executing multiple trades within a single day, capitalizing on even the slightest price fluctuations.

👍 Pros

• Potential for substantial profits from leveraged positions

• Ability to compound gains rapidly with disciplined risk management

• Freedom and flexibility to trade from anywhere, anytime

👎 Cons

• Significant risk of substantial losses due to the inherent volatility of crypto markets

• Intense psychological and emotional strain from constant market monitoring

• High trading costs, such as spreads and fees, can quickly erode profits

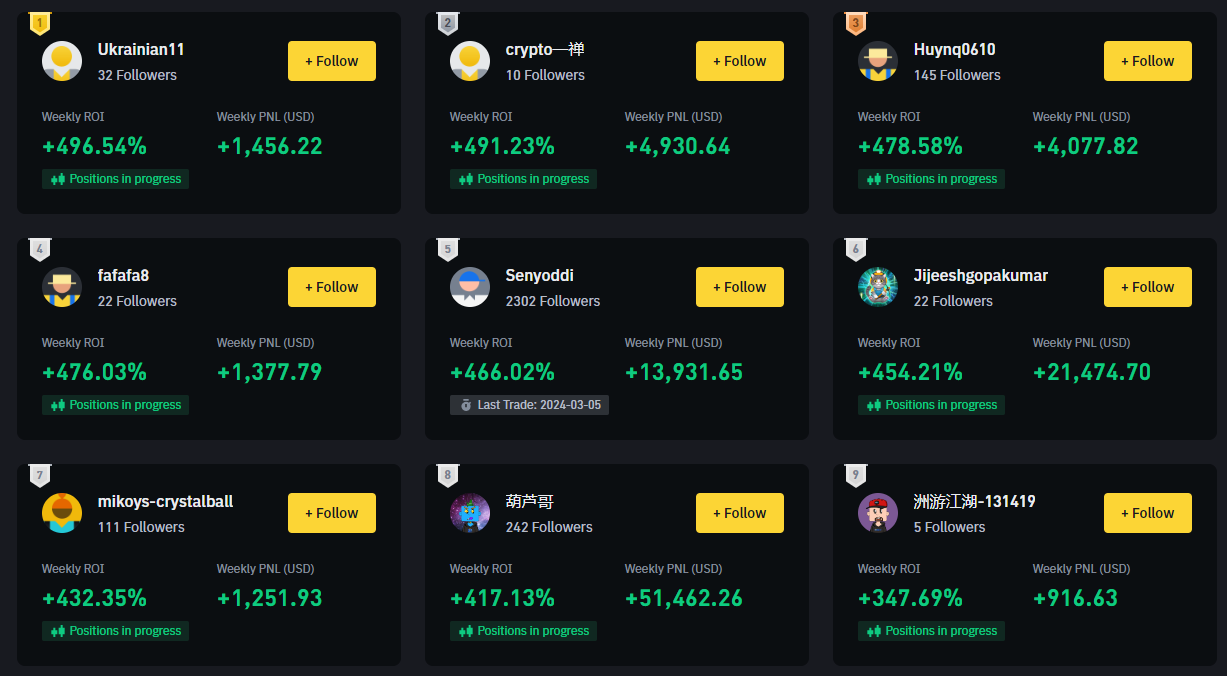

As for potential earnings, the sky's the limit for the most skilled and disciplined day traders. However, precise figures are challenging to obtain due to the opaque nature of the crypto trading world. The Binance Futures Leaderboard provides a glimpse into the upper echelons of crypto futures trading profits:

Binance Futures Leaderboard

While these top traders undoubtedly rake in millions, it's crucial to remember that they represent the crème de la crème - the absolute elite of the trading world. For the average day trader, consistent profitability is an immense challenge.

According to Forbes, only 5% of crypto traders in the UK realized a profit, which aligns with Cointelegraph’s findings that 95% of Bitcoin traders lose money and fail. So, if the statistics are so skewed in favor or losing, why do so many people insist on trading?

In my personal opinion, and from what I’ve seen in my experience, it’s because everybody thinks they will be in that 5% that actually profits. Everybody feels they will be the exception. The reality is, the 5% will likely be occupied by traders who have been trading for the last 10 or 20 years. If that’s not you, statistically speaking, your chances of losing money are much higher than your chances of making profits.

Relevant and insightful information on how to trade crypto for beginners can be found in our article How To Trade Crypto With $100?

What is the salary of a cryptocurrency trader?

Some crypto traders opt for the relative stability of a salaried position with established firms or proprietary trading desks. Their role involves executing trades on behalf of the company, adhering to predefined strategies and risk parameters.

👍 Pros

• Consistent income stream with potential for performance-based bonuses

• Access to state-of-the-art trading tools, research, and resources

• Structured work environment with defined responsibilities

👎 Cons

• Limited upside potential compared to independent trading

• Strict adherence to company guidelines and trading mandates

• Potential job insecurity during market downturns or company restructuring

Regarding salaries, data from Glassdoor suggests that the average annual salary for a crypto trader in the United States ranges from $72,000 to $129,000, with the average being around $96,000.

In terms of overall salary averages (not just in the United States), the average is around $77,000 according to CryptoJobsList.

What is the salary of a cryptocurrency career?

However, it's important to note that these figures can vary significantly based on factors such as location, company size, and the trader's experience and track record.

How much do crypto investors make?

Long-term crypto investors, often referred to as "HODLers," take a more patient and passive approach to the markets. Their strategy revolves around buying and holding cryptocurrencies for extended periods, betting on the long-term appreciation of their investments.

👍 Pros

• Potential for substantial long-term gains as the crypto market matures

• Relatively low-stress approach compared to active trading

• Simplicity of the "buy and hold" strategy

👎 Cons

• Prolonged periods of volatility and potential drawdowns

• Opportunity cost of not realizing gains during bull markets

• Risk of missing out on compounding gains through active trading strategies

Quantifying the potential profits for long-term investors is a tricky endeavor, as it heavily depends on the specific cryptocurrencies held, the entry and exit points, and the overall market conditions. However, historical data provides some insights:

-

Bitcoin: If you had invested $1,000 in Bitcoin in July 2010, your investment would be worth over $200 million today (as of March 2024)

-

Ethereum: A $1,000 investment in Ethereum's ICO in 2014 would be worth approximately $60 million at today's prices

Of course, these are exceptional cases, and not every crypto investment will yield such astronomical returns. However, they do highlight the immense wealth-generation potential for patient and disciplined long-term investors.

Even over the course of one bull market, the gains can be life-changing. That is how I personally prefer to play in the crypto markets. My approach is - I invest during a bear market, and sell during a bull market. In the previous cycle, I managed to make a 6x on my assets by investing in 2019 and selling throughout 2021 and 2022. It’s not something that made me a millionaire, but a 6x on your investment every few years is a pretty good deal in my book.

Is it too late to invest in bitcoin today? Our forecast will help you get valuable information to answer this question: Bitcoin Price Prediction 2024, 2025, 2030 - Will BTC Go Up?

Is crypto copy trading profitable?

Copy trading, also known as social trading, has gained traction in the crypto space as a way for novice traders to potentially profit by replicating the trades of successful and experienced crypto traders.

👍 Pros

• Ability to leverage the expertise and strategies of proven traders

• Relatively hands-off approach, suitable for those with limited time or trading knowledge

• Potential for diversification by copying multiple traders with different strategies

👎 Cons

• Inherent risk of following traders who may experience losses or make poor decisions

• Potential for high fees, cutting into overall profitability

• Lack of control and understanding of the underlying trading strategies

The profitability of copy trading depends largely on the performance of the traders being copied and the associated fees. While some copy trading platforms advertise potential returns of up to 30% annually, these figures should be viewed with caution, as past performance is no guarantee of future success.

It's crucial to thoroughly research and vet any traders or platforms you intend to copy, as well as to exercise prudent risk management practices. Personally, I don’t have a lot of experience with copy trading myself. It’s a good concept, one that I’m sure can work if the right trader to copy is chosen. My only concern would be - if you are not experienced enough to trade by yourself, what makes you experienced enough to be able to pick the right trader to copy? I don’t have an answer to this.

Is yield farming and staking a good way to make money?

Yield farming and staking have emerged as alternative ways to generate income within the crypto ecosystem. These methods involve providing liquidity or validating transactions on various blockchain networks in exchange for rewards or interest payments.

While not technically "trading," yield farming and staking can serve as viable alternatives or complements to active trading strategies. These methods offer a more passive approach to generating returns, with varying degrees of risk and reward.

For example:

-

Staking on major proof-of-stake networks like Ethereum, Solana, or Cardano can yield annual returns ranging from 5% to 15%, depending on the network and the amount staked

-

Yield farming can offer higher potential returns but also carries greater risks. By providing liquidity to decentralized finance (DeFi) protocols and constantly moving capital between different yield opportunities, some yield farmers have reported annual percentage yields (APYs) in the triple digits. However, these high yields often come with significant risks, including smart contract vulnerabilities, impermanent loss, and potential rug pulls

In my view, yield farming and staking can be viable options for those seeking alternative income streams within the crypto space, but it's vital to thoroughly understand the mechanisms of how these methods work, the associated risks and exercise caution.

Another piece of advice I would give is - never purchase coins just because their yield farming APY (annual percentage yield) is high. If you wouldn’t invest in a coin otherwise, don’t do it just so you can use it for yield farming. Extremely high APY is usually only available for highly risky coins, and even those high yields won’t cover the losses you will have if the coin drastically loses in value.

Let’s look at it in an example. Say you buy a coin that’s worth $100 because it gives 300% APY, and you start yield farming. If the coin drops in price by 90% in a year, yes, you will have 3 coins instead of 1, but each of those will be worth only $10, bringing your total net value from $100 to $30. So, the bottom line is - only purchase cryptocurrencies you would invest in anyway, even without yield farming, and then treat yield farming as a nice bonus on top.

Best crypto exchanges

Can I be a successful crypto trader?

While the potential for substantial profits exists in crypto trading, the harsh reality is that consistent profitability eludes the vast majority of traders. Achieving long-term success in this arena requires a rare combination of skills, discipline, and emotional fortitude.

For those who are determined to do this, here are some tips to increase your chances of success:

-

Develop a Well-Defined Trading Strategy: Successful traders have a clear, rules-based approach that aligns with their risk tolerance and investment objectives

-

Master Risk Management: Proper risk management is the cornerstone of longevity in trading. Implement strict position sizing, stop-loss orders, and portfolio heat limits

-

Cultivate Emotional Discipline: Trading is as much a psychological battle as it is a financial one. Develop the ability to detach from emotions like fear, greed, and overconfidence

-

Continuously Learn and Adapt: Markets are dynamic, and successful traders must be willing to constantly evolve their strategies and adapt to changing market conditions

-

Treat Trading as a Business: Approach crypto trading with the same dedication, professionalism, and commitment as you would any other business endeavor.

For a more in-depth exploration of this topic, check out our article: 5 Steps To Start Investing In Cryptocurrencies.

Summary

The question of crypto trading profitability is a complex and multifaceted one. While the potential for substantial gains exists, the reality is that consistent profitability eludes the vast majority of traders. Only the most elite, disciplined, and emotionally resilient traders can reliably generate significant profits in this high-risk, high-reward arena.

For the average individual, crypto trading should be approached with caution and a deep understanding of the inherent risks involved. Alternative strategies, such as long-term investing, staking, or yield farming, may offer more suitable risk-reward profiles for those seeking exposure to the crypto markets.

My parting thoughts are: if you’re a beginner in crypto and you simply want some exposure to the markets, your best bet is to simply invest in Bitcoin and Ethereum, and to wait out the current bull market. You minimize the chance of losing money, and you will still likely set yourself up for sizable gains of at least 2-3x over the course of the next 12 months or so.

Glossary for novice traders

-

1

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

2

Day trader

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

-

3

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

5

Bear market

A bear market is a period of time in which an investment asset, such as stocks, bonds, or commodities, experiences a decline in price for an extended period of time.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).