The 5 Biggest Risks Of Bitcoin, And How To Mitigate Them

Bitcoin's 5 biggest risks include:

-

Volatility: Rapid, unpredictable price swings influenced by market sentiment and speculative trading

-

Risks of Technology: Vulnerabilities in blockchain technology and potential code flaws affecting security and functionality

-

Risks of Hackers: Security breaches and thefts by cybercriminals targeting wallets and exchanges

-

Regulatory Risks: Uncertain legal landscape and potential government crackdowns impacting legality and value

-

Human Mistakes: Errors like lost passwords or sending to wrong addresses leading to irreversible losses

The concept of risk is omnipresent when investing in cryptocurrencies, casting a shadow of uncertainty over potential investors and market enthusiasts alike. The cryptocurrency industry, with Bitcoin at its vanguard, embodies a frontier of finance where the rewards can be as high as the risks are daunting.

This article aims to explore a critical problem within this digital Eden: the inherent risks of Bitcoin investing. Yet, within this exploration lies the promise of solutions, strategies and insights aimed at navigating the turbulent waters of cryptocurrency investment.

-

Is Bitcoin a Risk-On or Risk-Off Asset?

Bitcoin is considered a risk-on asset, attracting investors looking for high returns despite its high volatility and market uncertainties.

-

How to secure a Bitcoin wallet?

Secure a Bitcoin wallet by using strong, unique passwords, enabling two-factor authentication, and storing private keys offline in a hardware wallet.

-

Is Bitcoin a safe investment?

Bitcoin, like any investment, carries risks, especially due to its volatility and regulatory uncertainties, making it potentially unsafe for those not prepared for its fluctuations.

-

Is Bitcoin safe if you lose your keys or hard drive?

Losing your keys or hard drive without a backup means losing access to your Bitcoin permanently, making it unsafe in terms of data loss.

What is the biggest problem with Bitcoin?

Investing in Bitcoin, the pioneering cryptocurrency, introduces investors to a realm of potential rewards and significant risks. The allure of high returns is tempered by several inherent dangers that every investor must be aware of.

Below, we outline the five most significant risks associated with Bitcoin investing:

-

Volatility: Bitcoin's price is notoriously volatile, experiencing dramatic fluctuations within very short timeframes. This volatility is driven by various factors, including market sentiment, speculative trading, and news events, making Bitcoin's value unpredictable and investment in it resemble gambling more than traditional investing

-

Risks of Technology: The blockchain technology underpinning Bitcoin is complex and not immune to flaws. Issues such as the potential to alter the 21 million Bitcoin cap or vulnerabilities within the network could pose significant risks to the stability and security of the Bitcoin ecosystem

-

Risks of Hackers: The digital nature of Bitcoin makes it a target for hackers and cybercriminals. High-profile hacking incidents have led to substantial losses for investors, underscoring the importance of robust security measures for Bitcoin wallets and transactions

-

Regulatory Risks: The legal landscape for Bitcoin and cryptocurrencies is still evolving, with the potential for government crackdowns and regulation. Changes in policy can have immediate effects on the value and legality of Bitcoin, impacting investors worldwide

-

Human Mistakes: The decentralized and digital nature of Bitcoin means that user errors can lead to irreversible losses. Mistakes such as losing wallet access, forgetting passwords, or sending Bitcoin to incorrect addresses are not uncommon and can result in the total loss of investment

Understanding these risks is crucial for anyone looking to invest in Bitcoin. While the potential for high returns exists, so too does the possibility of significant loss, driven by factors unique to the digital currency space.

1 Volatility

The volatile nature of Bitcoin is one of its most defining and, simultaneously, unnerving characteristics for investors. Price swings can be abrupt and profound, with double-digit percentage moves within a single day not being uncommon.

This volatility is partly due to the speculative nature of Bitcoin, where investors buy in anticipation of future price increases rather than the intrinsic value of the asset itself, mirroring the risk levels associated with gambling more than traditional investing. Market sentiment can shift dramatically based on news events, regulatory updates, or influential tweets, causing rapid price changes.

To mitigate this volatility, investors can adopt several strategies. One effective approach is dollar-cost averaging, where investments are spread out over time rather than executed in a lump sum, reducing the impact of price volatility on the overall investment.

Additionally, setting clear investment goals and having a long-term perspective can help investors weather the ups and downs, avoiding panic selling during low periods and speculative buying at peaks.

Extreme volatility is bitcoin's biggest risk

he most significant daily rise in the Bitcoin price occurred on October 26, 2019, when it soared 42% to $10,500, marking the largest daily increase since 2011. On the hourly front, the most significant movement was seen on February 22, 2021, when bitcoin created the largest hourly candle in its history when it plummeted $7,000 and then fully recovered - all in 1 hour (example above).

These events highlight the high levels of volatility and associated risks that exist in the cryptocurrency market.

2 Risks of technology

Bitcoin's foundation on blockchain technology is revolutionary, offering unparalleled security and transparency compared to traditional financial systems. However, this technology is not without its risks.

The theoretical possibility of altering Bitcoin's hard cap of 21 million coins through consensus among network participants, or the potential for the network to experience downtime due to a massive coordinated attack, highlights the technological vulnerabilities inherent in the system.

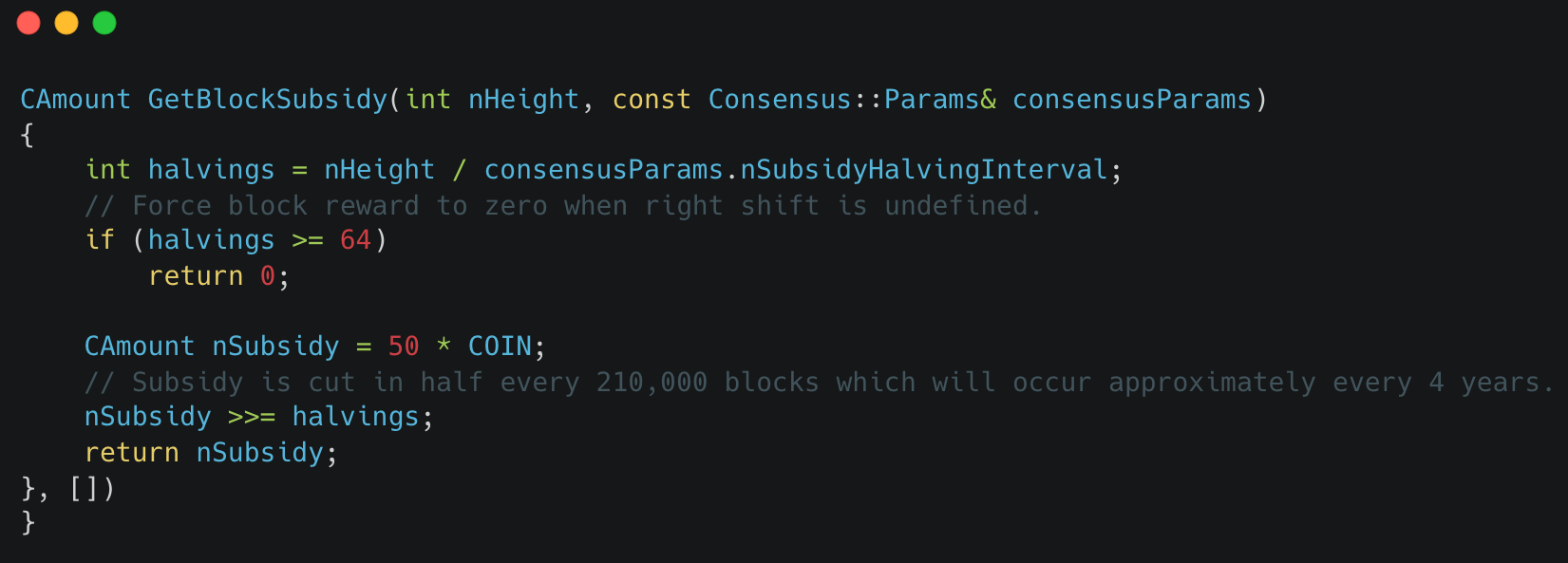

Bitcoin network code fragment that affects the maximum limit = 21 million coins

Mitigating these risks involves a multifaceted approach. Diversification across different cryptocurrencies and blockchain networks can reduce the impact of a single point of failure, spreading risk across various assets. Engaging in thorough research and staying informed about technological developments within the blockchain space can also help investors identify potential vulnerabilities early.

Moreover, supporting and investing in platforms that prioritize security and technological advancements ensures the robustness of the infrastructure underlying Bitcoin investments.

3 Risks of hackers

The digital nature of Bitcoin makes it a prime target for hackers, with several high-profile incidents over the years shaking the confidence of investors in the cryptocurrency's security. From exchange breaches to wallet hacks, these events highlight the vulnerabilities that exist within the ecosystem. The impact on Bitcoin's perception is significant, with each incident renewing concerns about the safety of digital assets.

To enhance security and protect against hackers, consider the following tips:

-

Use hardware wallets: These physical devices store private keys offline, making them immune to online hacking attempts

-

Enable two-factor authentication (2FA): Adding an extra layer of security to your digital wallets and exchange accounts can significantly reduce the risk of unauthorized access

-

Regularly update software: Ensure that your wallet software and any related applications are up to date with the latest security patches.Be careful: information for software modifications and updates must come from a reliable source, so that you don't replace your working version with hacker software

-

Private key management: Never share your private keys and consider using a multi-signature wallet for additional security

4 Regulatory risks

The regulatory environment for Bitcoin and cryptocurrencies remains a patchwork of policies globally, with some countries embracing digital currencies and others imposing stringent regulations or outright bans. The potential for government crackdowns poses a considerable risk, potentially affecting Bitcoin's value and legality. For instance, announcements of increased regulation or investigations into cryptocurrency operations can lead to market volatility.

Considerations for traders include:

-

Stay informed: Keep abreast of regulatory changes in your country and globally

-

Diversify geographically: Investing in cryptocurrencies across different regulatory jurisdictions can mitigate the risk of adverse regulations in any single country

-

Use regulated exchanges: Engaging with exchanges that comply with regulatory standards offers a layer of protection

The approval of Bitcoin Spot ETFs applications has greatly increased the level of trust in bitcoin around the world, but the question of full acceptance by authorities will always be open due to the potential competition bitcoin could pose to fiat money.

5 Human mistakes

Human error represents a significant risk in the management of Bitcoin investments. Common mistakes include losing access to wallets, forgetting passwords, sending Bitcoin to incorrect addresses, or falling victim to phishing scams.

Mitigation strategies include:

-

Backup your wallet: Regularly backup your wallet to recover your funds in case of device failure or loss

-

Use password managers: To avoid forgetting passwords, use a reputable password manager to store your login credentials securely

-

Control access to key wallet data, including backups. Having multiple copies of passwords stored on different media significantly increases the risk of hacking

-

Double-check addresses: Always double-check recipient addresses before sending Bitcoin. Consider sending a small test amount first

-

Educate yourself about scams: Stay informed about common phishing tactics and scams within the cryptocurrency space to avoid falling victim

Famous examples:

-

James Howells: Lost 7,500 bitcoins when he accidentally threw away a hard drive containing them in 2013. The loss is significant as he had acquired these bitcoins back in 2010

-

Stefan Thomas: A software developer who lost access to 7,002 bitcoins due to forgetting the password to his IronKey encrypted flash drive, which requires the correct password within ten attempts before it locks permanently

-

Gabriel Abed: An entrepreneur from Barbados, who lost 800 bitcoins in 2011 after his laptop was reformatted

Best crypto exchanges

Bitcoin vs. stocks: a comparative risk analysis

The investment landscapes of Bitcoin and traditional stocks differ vastly, not just in their nature but also in the risks they pose to investors. A comparative analysis reveals critical distinctions in volatility, influence by external factors, and the drivers of value changes.

Volatility:

-

Bitcoin is renowned for its high volatility, with price swings often occurring within very short timeframes. This volatility is attributed to its relatively small market size compared to traditional markets, making it more susceptible to significant price movements based on trading activity

-

Stocks, while also subject to volatility, generally experience less dramatic shifts. Stock market volatility is often tied to broader economic indicators, company performance, and market sentiment, providing a somewhat more predictable environment based on fundamentals

Influence by External Factors:

-

Bitcoin can see its value dramatically influenced by statements from influential figures or news events. A single tweet from a tech magnate or news of regulatory changes can lead to swift and significant price changes

-

Stocks are influenced by a broader range of external factors, including economic data, earnings reports, and geopolitical events. However, the impact of comments from influential figures does not typically result in as immediate or volatile reactions as seen with Bitcoin, due to the diversified nature of stock investments and the grounding in company-specific fundamentals

Drivers of Value Changes:

-

Bitcoin:

-

Market sentiment and speculative trading

-

Regulatory news and changes

-

Technological advancements and security issues

-

-

Stocks:

-

Company performance and earnings

-

Economic indicators (e.g., interest rates, inflation)

-

Geopolitical events and sector-specific news

-

This analysis reveals that while both Bitcoin and stocks offer avenues for investment, they come with distinct risk profiles. Bitcoin's volatility and sensitivity to external factors present a unique set of challenges, contrasting with the more stable and fundamentally driven stock market.

Since bitcoins are regarded as a riskier investment than stocks, it is considered that the share of bitcoins in your portfolio should not exceed 10%. See the article for more details: How Much Should I Invest In Bitcoin To Start?

Additional tips to reduce risks when investing in Bitcoin

Investing in Bitcoin comes with its set of challenges, but there are strategies that can help mitigate these risks. Below are additional tips aimed at providing investors with a more secure approach to navigating the volatile landscape of Bitcoin investing.

-

Research Thoroughly: Before making any investment, it's crucial to conduct comprehensive research. Understand the technology behind Bitcoin, its market trends, and the factors that influence its price movements. Staying informed through reputable sources can help you make more educated decisions

-

Use a Risk Management Strategy: Implementing risk management strategies such as setting stop-loss orders can help protect your investment from significant losses. Determine the amount of capital you are willing to risk and stick to it, ensuring that you do not expose yourself to undue financial strain

-

Diversify Your Portfolio: Do not put all your eggs in one basket. Diversification is key to managing risk effectively. Consider spreading your investments across different cryptocurrencies, as well as other asset classes like stocks, bonds, and real estate. This strategy can help buffer against the volatility inherent in the cryptocurrency market

-

Avoid Emotional Trading: The cryptocurrency market can be emotionally taxing, with its rapid price fluctuations leading to fear or greed-driven decisions. It's essential to maintain a level head and stick to your investment plan. Avoid making impulsive decisions based on short-term market movements

Adhering to these tips, investors can adopt a more disciplined and informed approach to investing in Bitcoin. While the potential for high returns exists, so does the risk of significant losses. A cautious, well-researched strategy combined with sound risk management practices can help mitigate these risks, allowing for a more stable and potentially rewarding investment journey.

For further insights into Bitcoin investing, read our guide on How To Buy Bitcoin Online | A Guide For Beginners.

Conclusion

Investing in Bitcoin presents a unique set of challenges and opportunities. By understanding the inherent risks - such as volatility, technological vulnerabilities, regulatory uncertainties, the threat of hackers, and the potential for human error - investors can better navigate this dynamic landscape.

Employing strategies like thorough research, risk management, portfolio diversification, and maintaining emotional discipline are essential for mitigating risks. As the cryptocurrency market continues to evolve, staying informed and cautious will be key to seizing opportunities while safeguarding investments in the world of Bitcoin.

Glossary for novice traders

-

1

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

2

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

3

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

4

Mitigation

The idea behind mitigation is to recognize and effectively trade mitigation blocks. These blocks consist of specific price action patterns that signal a change in market sentiment or demand-supply dynamics.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).