What is Mitigation in Forex?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A mitigation block is an area from which price was able to rise to a new high. But if it is lower than the previous one and a bearish breakdown of the mitigation block follows, this area will become resistance. If it is tested, traders may consider opening short positions.

While the term mitigations is broadly associated with general strategic risk management techniques, this article examines a narrower application of the term “mitigation blocks”. It refers to a trading strategy involving a change in the balance of supply and demand.

Based on the available feedback and the idea behind the rationale behind the strategy, understanding what mitigation blocks mean may be useful to you - for example, to optimize your existing trading strategy.

What is Mitigation?

Idea - The idea behind mitigation is to recognize and effectively trade mitigation blocks. These blocks consist of specific price action patterns that signal a change in market sentiment or demand-supply dynamics.

Timeframes - Mitigation can be applied to various time frames in Forex trading. Traders can spot mitigation blocks on short-term intraday charts as well as long-term daily or weekly charts.

Markets - While mitigation is commonly associated with the Forex market, the concept can also be applied to other financial markets, including stocks, commodities, and cryptocurrencies.

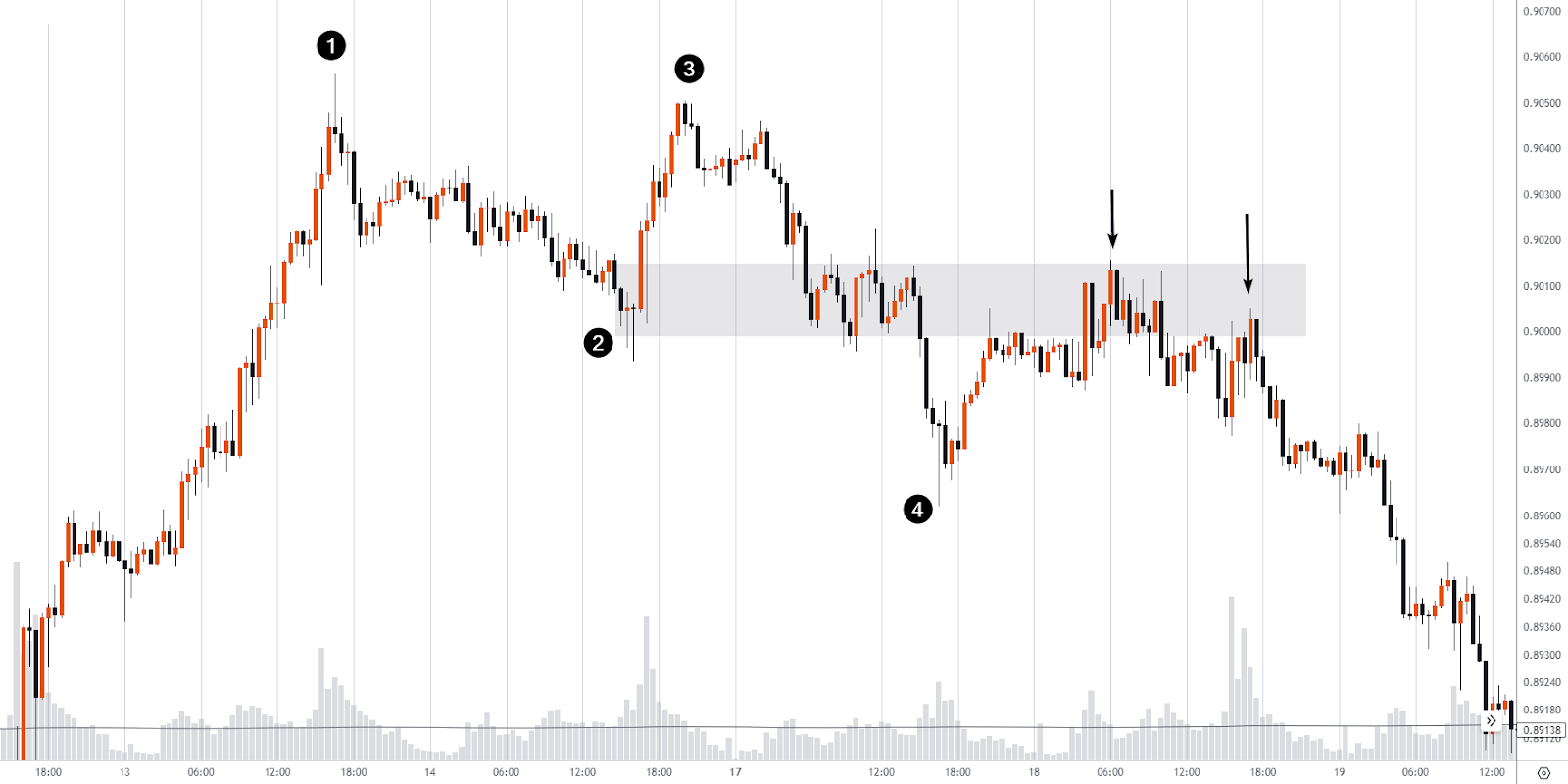

The chart provided illustrates the concept of a mitigation block in Forex trading.

Here's a breakdown of it:

#1 A New Higher High in an Uptrend - The chart shows a market that has been in an uptrend, marked by a series of higher and lower highs.

#2 Swing Low - Following the uptrend, there's a retracement, resulting in a swing low. This is a common occurrence in price movements as markets rarely move in a straight line. The area that served as the basis for the new bullish swing (shown with a gray background) indicates the superiority of demand. This is a potential mitigation block.

#3 Failed New Higher High - Instead of creating another higher high, the market fails to do so and forms a lower high. This change in the pattern signals a shift in market sentiment.

New Lower Low with Breakdown the Low #2 - Subsequently, the market makes a significant move, creating a lower low that breaks below the low marked as #2 on the chart.

The Range Around Low #2 Becomes the Mitigation Block - The area around the low marked as #2 now becomes the mitigation block. This is a critical zone where traders anticipate a shift in market dynamics.

What Happens? (Failed Demand)

The formation of a mitigation block often indicates failed demand in the market. This means that buyers, who were previously dominant, have failed to maintain control. As a result, sellers may become more active, leading to a potential reversal or change in the market trend.

How To Trade Mitigation in Forex?

1) Expect Resistance from MitigationBlock

When the price revisits the mitigation block (the range around the lower low), it often acts as a resistance area. This is because the area that was previously supporting the market may now pose resistance. The arrows on the chart above show times when traders may be most focused to find entry points to enter a short position with low risk.

2) Build a Trading Plan

Developing a well-thought-out trading plan is essential when trading mitigation blocks.

Your trading plan can include the specific entry and exit points based on your analysis of the mitigation block, your risk tolerance level, including stop-loss orders and appropriate position size based on your risk tolerance and the distance to your stop-loss level.

3) Manage Risk

To manage the risks diligently, implement the following risk management techniques:

Place stop-loss orders just beyond the mitigation block to limit potential losses

Maintain a favorable risk-reward ratio for your trades

Avoid concentrating all your trades on a single currency pair or position

4) Fundamental & Technical Analysis

Use fundamental analysis and technical analysis tools such as support and resistance levels, candlestick patterns, and trend indicators, to confirm your trade decisions within the mitigation block.

Tips To Trade Mitigation in Forex

Understanding Support and Resistance

Mitigation blocks often act as key support-turned-resistance levels. To grasp this concept fully, it's essential to have a solid understanding of support and resistance in Forex.

Here’s a more detailed article for you to indicate and use support and resistance effectively.

Practice on a Demo Account

Recognizing mitigation blocks and effectively trading them can be challenging. It's wise to practice your skills on a demo account or with a trading simulator. These tools allow you to apply your knowledge in a risk-free environment.

For guidance on opening a Forex demo account, we recommend reading How to open a Forex demo account.

In Forex trading, especially while exploring strategies like trading mitigation blocks, remember these principles: Acknowledge risks and trade responsibly, maintain discipline by sticking to your plan and managing emotions, create a thorough trading plan, and learn from mistakes by regularly reviewing your trades. These principles will enhance your Forex journey, mitigate risks, and boost your chances of success.

What are the Best Forex trading Platforms for Technical Analysis?

For advanced technical analysis in Forex, TradingView is the top choice. It offers powerful charting tools and the ability to trade directly from the charts with some brokers. However, for beginners, simpler platforms like MT4 or MT5 are more suitable due to their ease of use. It's also essential to choose a regulated broker with low spreads to ensure safety and cost-effectiveness in trading.

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

TradingView Integration |

Yes | Yes | Yes |

|

MetaTrader platfrom |

No | Yes | Yes |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

FAQs

How do you identify mitigation blocks?

Mitigation blocks are identified by observing specific price action patterns, including a new higher high, a swing low, a failed new higher high, and a new lower low that breaks below the second low.

What happens after mitigation in Forex?

After a mitigation block forms, the market often experiences a shift in sentiment. For example, in the case of failed demand, sellers may become more active, potentially leading to a reversal or a change in the market's previous trend.

What is Smart-Money Concept (SMC)?

The Smart-Money Concept (SMC) is a concept of trading, of which the concept of mitigation blocks is a part that refers to the idea that large institutional traders or "smart money" participants, such as banks and hedge funds, often drive major market movements.

What is the best timeframe to trade mitigation blocks?

You can spot mitigation blocks on various timeframes, from short-term intraday charts to longer-term daily or weekly charts. The best timeframe for trading mitigation blocks may vary depending on your trading style and objectives.

Related Articles

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.