Bitcoin Investing Guide

As the first and most well-known cryptocurrency, bitcoin has captured the attention of investors from all over the world, and for good reason. Bitcoin has seen an incredible price appreciation since its inception in 2009, growing from $0 to its all-time high of over $68,500 in January 2023.

As Bitcoin continues to prosper, so too does the opportunity for investors to make a profit from this digital currency. But how exactly can you invest in Bitcoin? This guide will show you step-by-step how to buy Bitcoin and where to buy BTC at the best price. We'll also touch on Bitcoin's investment prospects, among other relevant topics.

Start investing in BTC now with ByBit!What Is Bitcoin?

Bitcoin is a decentralized digital currency that can be used to purchase goods and services. Transactions are verified by network nodes through cryptography and recorded in a public-dispersed ledger called a blockchain. Bitcoin was invented by Satoshi Nakamoto and released as open-source software in 2009.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services.

The number of Bitcoin users has been rising steadily over the years. By the end of 2023, it’s estimated that there’ll be over 25 million people across the world who own this crypto.

How Does Bitcoin Work?

Now that you know a little more about what Bitcoin is and how it came to be, let’s discuss how it works.

Bitcoin mining

Mining is the process of creating new bitcoins that are entered into circulation. More specifically, miners work as validators of the blockchain network that Bitcoin is built upon.

Each new block of bitcoin transactions must first be mined. Only then can it be added to the blockchain. With the help of special computer hardware and software, miners compete to solve complicated mathematical problems. The first miner to correctly solve the problem can add a new block of transactions to the blockchain.

Since mining new blocks is expensive and energy-intensive, successful miners are rewarded with bitcoin and transaction fees.

Bitcoin blocks are mined once every ten minutes or so. Other cryptocurrencies have different mining rates.

How to mine Bitcoin?Proof of Work (PoW) algorithm

The Bitcoin network relies on a proof of work consensus mechanism. Essentially, it’s a decentralized process for securing the network.

Through proof of work, the network can validate transactions and reach agreements about shared information without involving any trusted third parties.

A network of computers spread across the globe must reach a consensus about which transactions are valid. They do this by working on computer-generated algorithms until a set of validated transactions are grouped into blocks. These validated blocks comprise the blockchain.

Network growth

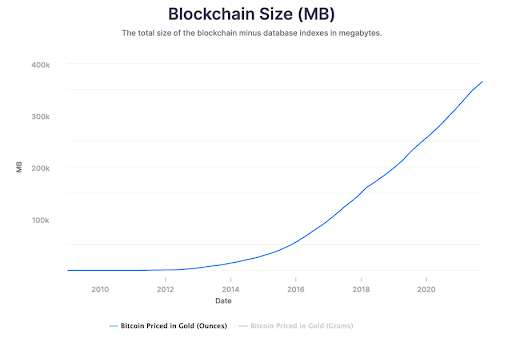

Overall, Bitcoin’s blockchain has continued to grow at an exponential rate since its inception. The blockchain size is indicative of the number of transactions that occur on the network.

Blockchain Size (MB)

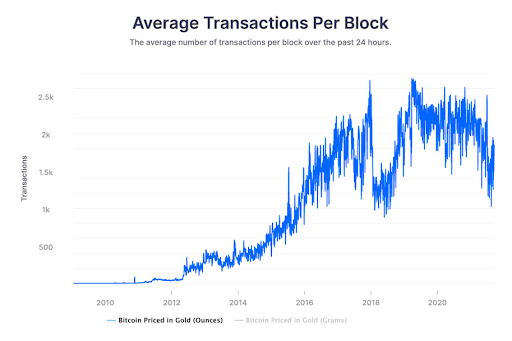

Likewise, the average number of transactions per block is a good indicator of network activity. As shown by the chart below, block transactions correlate to price action. Increased activity occurred around the all-time highs of 2017 and 2020-2023. Overall, the average number of transactions per block is on an upward trend.

Average Transactions Per Block

Top 7 Reasons To Buy Bitcoin Now

The price has corrected significantly

Bitcoin is currently trading at a discount of nearly 66% from its all-time high. While this fall might seem like a crash for majority of assets classes, it is just another routine correction when it comes to cryptocurrencies. A general rule of thumb investors adhere to is the buying-the-dip methodology where an asset is accumulated during its correction. So given the distance from the peak for Bitcoin’s price currently, experts believe that its price has higher chances to find a support somewhere around the current levels, representing a buying opportunity.

Institutional Adoption

When Bitcoin was first launched, all market participants were highly skeptical about its adoption. But slowly and gradually, people are now accepting the innovation and utilizing it for their own operational requirements. In fact, many investment firms and funds now have a portfolio dedicated primarily to cryptocurrencies, majority of which have Bitcoin as the most heavily weighted constituent. This adds a lot of attention and reliability to the crypto’s name as retail investors generally act upon the advisory of these firms.

Lightning network success

The Bitcoin network can process nearly 4.6 transactions per second. While this might be slower compared to the likes of Visa, it does get ahead when it comes to the transaction costs involved. As per blockchain.com, the average fees per transaction (in USD) for Bitcoin currently is approximately $1.43, while the same for Visa can go as high as 3.55% of the transaction amount + a $0.10 flat fee. This has led to a considerable migration of users to the crypto platform for transaction facilitation.

How Can I buy Bitcoin with a Credit Card or Debit Card?H3 Bitcoin has store value

The maximum supply of Bitcoin is fixed at 21 million coins. This means that beyond this point, Bitcoin will provide store value given its limited supply. To understand this better, take the example of gold, which obviously has a limited supply available. In order to store the value of fiat money, investors generally invest their money in gold, which in turn preserves value against factors like inflation. Experts believe that Bitcoin as an investment borrows some of its behavior from gold, having similar characteristics like limited supply and store value, and so many also call it “digital gold.”

The halving cycle makes bitcoin scarce

Let’s first understand what does the halving cycle mean. In order to mine Bitcoin, the miners solve complex computer equations. For solving such equations successfully, they are rewarded with blocks of Bitcoin, and each block contains a fixed amount of bitcoin (6.25 BTC per block currently.) For every 210,000th block mined, the number of bitcoins awarded per block gets halved. So by the next halving cycle (predicted to take place in 2024), miners would only get 3.25 BTC per block, reducing the supply of Bitcoin in the market. And as the basic laws of economics suggest, lower supply, with even stable demand (if not higher,) leads to a higher price.

The bitcoin bull cycle theory

As with any other asset, analysts believe that the price of Bitcoin too moves in cycles. It is said that every Bitcoin bull run is followed by a crypto winter, where the price of the currency falls anywhere between 60-80%, but not significantly breaching the previous cycle high. The same cycle has taken place currently with Bitcoin sustaining the sub-$17,000 levels and bouncing back from there. If this theory is deemed to be correct, then the next bull run might not be far.

Bitcoin is the benchmark for cryptocurrencies

While this might sound ironic, Bitcoin is actually stable relative to the other cryptocurrencies (excluding the currency-pegged stable-coins.) And as it is also the primary crypto, experts often see it as the benchmark for comparison for alternative coins. This adds a lot of trust and following behind its name.

Should I Buy Bitcoin (BTC) 2024? Top Pros and ConsBitcoin Price Predictions 2024, 2025, 2030

Bitcoin Price Prediction 2024

The table below shows the forecasts as of the end of each month in 2023, according to TU analysts price prediction.

| Month | Minimum Price | Maximum Price | Average Price | Change |

|---|---|---|---|---|

| November 2023 | $16,064.124 | $23,623.712 | $18,898.969 | -2.24 % |

| December 2023 | $15,962.483 | $23,474.239 | $18,779.391 | -2.86 % |

Bitcoin Prediction 2025

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2025 | $47,308.37 | $51,743.53 | $53,221.92 |

| February 2025 | $50,314.43 | $52,778.40 | $55,809.10 |

| March 2025 | $52,390.57 | $54,361.76 | $58,448.02 |

| April 2025 | $54,565.04 | $56,536.23 | $60,622.49 |

| May 2025 | $56,261.13 | $58,232.31 | $62,883.94 |

| June 2025 | $56,932.98 | $59,396.96 | $65,795.55 |

| July 2025 | $59,207.69 | $61,178.87 | $68,765.40 |

| August 2025 | $59,938.47 | $62,402.45 | $71,212.55 |

| September 2025 | $62,927.36 | $64,898.54 | $73,708.65 |

| October 2025 | $64,381.52 | $66,845.50 | $76,304.59 |

| November 2025 | $66,211.23 | $68,182.41 | $79,646.87 |

| December 2025 | $68,256.70 | $70,227.88 | $83,055.99 |

Bitcoin Price Prediction 2030

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2030 | $321,465.68 | $351,603.09 | $361,648.89 |

| February 2030 | $345,408.17 | $362,151.18 | $379,229.04 |

| March 2030 | $355,999.80 | $369,394.20 | $397,336.60 |

| April 2030 | $363,387.68 | $376,782.09 | $412,112.37 |

| May 2030 | $367,574.72 | $384,317.73 | $427,183.65 |

| June 2030 | $379,104.26 | $395,847.26 | $442,556.36 |

| July 2030 | $390,979.67 | $407,722.68 | $458,390.25 |

| August 2030 | $410,637.18 | $424,031.59 | $474,699.16 |

| September 2030 | $420,009.53 | $436,752.53 | $491,660.42 |

| October 2030 | $436,460.71 | $449,855.11 | $513,498.05 |

| November 2030 | $449,956.36 | $463,350.76 | $535,990.81 |

| December 2030 | $455,874.77 | $472,617.78 | $554,524.84 |

How to Invest in Bitcoin (BTC)

Understanding how to invest in Bitcoin is the first step in making a successful crypto portfolio. If you're a beginner, here are the steps you need to follow.

1. Find Your Crypto Exchange

The first step to investing in Bitcoin (BTC) is to find the right cryptocurrency exchange. There are many exchanges out there, each with its own set of features, benefits, and drawbacks. Do your due diligence to find an exchange that meets your needs. Some things to look for include the following:

Security: How safe is the exchange? What security measures are in place to protect your funds?

Fees: What are the transaction fees? Some exchanges charge higher fees than others.

Ease of use: How easy is it to buy Bitcoin on the exchange? Is the interface user-friendly?

Supported countries: Does the exchange serve investors in your country?

Payment methods: What payment methods are supported by the exchange?

Choose an exchange that meets your needs and create an account.

2. Open an Account

Once you've found the exchange you want to use, the next step is to open an account. You will need to provide some personal information, such as your name, email address, and date of birth. Some exchanges will also require you to verify your identity with a government-issued ID. The important thing is to make sure you provide the correct information, as this will be used to help protect your funds.

3. Fund Your Account

Now that your account is open, you will need to fund it in order to buy Bitcoin. This can be done by transferring money from your bank account or by using a credit or debit card. Some exchanges also allow you to buy Bitcoin with PayPal. Choose the method that's right for you and follow the instructions on the exchange to make your deposit.

4. Buy Bitcoin (BTC)

Once your account is funded, you can start buying Bitcoin. The process for doing this will vary from exchange to exchange, but the general idea is the same. You will need to select the amount of Bitcoin you want to buy, as well as the price you're willing to pay. You’ll also need to know where to buy Bitcoin.

Once your order is placed, it will be executed when someone is willing to sell Bitcoin at the price you're willing to pay. Most exchanges will allow you to buy Bitcoin with fiat money. To do this, simply enter the amount of Bitcoin you want to buy and select the currency you want to pay with.

You will also need to specify a payment method, such as a bank account or credit card. Once your order is placed, it will be executed when someone is willing to sell Bitcoin at the price you're willing to pay.

5. Withdraw Bitcoin to Wallet

From time to time, you may want to withdraw your Bitcoin to a wallet. This can be done by going to the withdrawal page on the exchange and selecting the wallet you want to withdraw to. You will then need to enter the amount of Bitcoin you want to withdraw and confirm the transaction. Once your withdrawal is complete, it will be reflected in your wallet balance. Read also: Best Bitcoin wallets in the TU article.

Trading Vs. Investing in Bitcoin

One of the most important steps in making a successful crypto portfolio is deciding whether you want to trade or invest in Bitcoin. Each approach has its own benefits and drawbacks, and if you are to master how to make money with cryptocurrency, it's important to understand both.

Trading

Trading is the ideal approach for someone who is willing to take on more risk in order to achieve higher returns. When you trade Bitcoin, you are speculating on the price movement of the currency. You are buying Bitcoin at one price and selling it at another in the hope that you will make a profit.

One of the advantages of trading is that you can take advantage of price movements in both directions. If you think the price of Bitcoin is going to go up, you can buy the currency and sell it later at a higher price. Similarly, if you think the price is going to fall, you can sell your Bitcoin now and buy it back later at a lower price. This flexibility allows you to make money whether prices are rising or falling.

The main disadvantage of Bitcoin trading is that it is a very risky strategy. Prices can move up or down very quickly, and you can lose a lot of money if you are not careful. It is also important to note that you will need to pay fees when you trade Bitcoin, as most exchanges charge a small fee for each trade.

Investing

Investing is the ideal approach for those who want to build a long-term portfolio or who want to take a more hands-off approach. When you invest in Bitcoin, you are buying the currency with the intention of holding it for an extended period of time. You are not looking to make a quick profit but rather to build your holdings slowly over time.

One of the main advantages of investing is that it is a much less risky strategy than trading. This is because you are not trying to make money from short-term price movements but rather from the long-term appreciation of the value of the currency. With investing, you only need to be concerned with the price of Bitcoin in the future rather than its current price.

The main disadvantage of investing is that it can take a long time to see profits. Unlike with trading, you are not looking to make a quick profit but rather to slowly build your holdings over time. This means that you may need to wait months or even years before you see any significant return on your investment.

Best Crypto Exchanges to Buy Bitcoin

Best Crypto Wallets to Store Bitcoin

Crypto wallets are crucial for anyone who wants to own or use cryptocurrency. A crypto wallet is a digital storage space that allows you to store, receive, and send cryptocurrency. There are two main types of wallets: hot wallets and cold wallets.

Hot wallets are online wallets that are connected to the internet. They are convenient to use but are less secure than cold wallets because they are more vulnerable to hacking. Hot wallets are ideal for situations where you want to quickly and easily send or receive cryptocurrency.

Cold wallets are offline wallets that are not connected to the internet. They are much more secure than hot wallets but are less convenient to use because you need to store them on a physical device such as a USB drive or a piece of paper. The best time to use a cold wallet is when you want to store your cryptocurrency for long-term storage or when you want to keep it as secure as possible.

Best Cold Wallet - Trezor

The Trezor Wallet is a hardware wallet used to store cryptocurrencies that includes cryptocurrency exchange functionality. The cross-platform wallet can be synchronized with a personal computer or smartphone after special software has been pre-installed on the device. You can trade on the crypto exchange and conduct transactions from the wallet itself. There are over 1,000 cryptocurrencies and tokens for trading on the exchange, including Bitcoin, Ethereum, Litecoin, and Ripple. The funds on the wallet are stored in Bitcoins. The free-of-charge conversions and transfers to other wallets are icing on the cake. You can use bank accounts, e-wallets, or gift cards and there are no limitations regarding deposits or withdrawals.

Best hot wallet - Trust wallet

Launched in 2017 by a software engineer, Viktor Radchenko, Trust wallet is designed for mobile cryptocurrency that easily supports more than 160 assets. Victor began creating Trust Wallet after he first heard about Bitcoin, but Ethereum encouraged him to explore the crypto world.

He began this project by first creating a tracking app for truckers and then gained enough confidence to try his hand at a digital wallet. This wallet was initially designed to carry ERC223 and ERC20 tokens, but now it can easily hold all kinds of cryptocurrencies.

One of the best qualities of the Trust Wallet is that it has an in-built Web3 browser that easily helps different traders to access all kinds of decentralized applications that are available on the Ethereum platform.

What’s more, this wallet has a direct link with a native decentralized exchange available on the Kyber Network, making it easy for users to purchase coins. It is pretty easy to download the Trust wallet app on your mobile devices through Google Play Store or Apple Store. Additionally, the wallet's software is pretty compatible with Android 5.0 and later devices, plus iOS 10.0 and its advanced devices.

Other Options To Invest in Bitcoin

There are several other ways to invest in Bitcoin, including:

1. Mining

Mining is how new Bitcoins are created. When you mine Bitcoin, you use powerful computers to solve complex mathematical problems. In return for your work, you are rewarded with a certain number of Bitcoins.

Тоp 10 Best Mining Software2. Staking

Staking is a way to earn interest on your cryptocurrency holdings. When you stake Bitcoin, you lock up your coins in order to help validate transactions on the network. In return for your help, you earn interest on your coins.

10 Best Coins to Stake During The Crypto Winter3. Investing in Crypto Projects

Another way to invest in Bitcoin is to invest in cryptocurrency projects. This can include investing in ICOs or IEOs. As an investor, you get a stake in the project and are rewarded if the project is successful.

Which crypto to buy for the long-term? Top 7 promising coins4. Copy Trading

Copy trading is a way to profit from the success of other traders. With copy trading, you choose a trader to copy and then mirror their trades. This allows you to profit from their expertise without having to do any work yourself.

6 Best Crypto Copy Trading PlatformsCan I Get Rich Quick With Bitcoin?

For most people, learning how to invest in cryptocurrency is meant to help them get rich quick with Bitcoin. The fact is, it is possible to make millions with Bitcoin, but it is also very risky.

Investing in cryptocurrency is like investing in any other asset—there are both risks and rewards. The key is to do your research and only invest what you can afford to lose. With that said, there are many people who have made a lot of money from investing in Bitcoin.

The best way to approach Bitcoin investing is with caution and realistic expectations. Don’t expect to get rich quickly, but don’t be afraid to take some risks. With careful planning and a little luck, you could find yourself making a lot of money from Bitcoin.

Summary

As cryptocurrency's influence continues to soar, interest in Bitcoin investment is rising. More people are starting to realize that it's possible to make money investing in this crypto. And with so many options to do so, it's becoming easier than ever to take the plunge.

Still, it's important to approach Bitcoin investment with caution. There are risks involved, and it's crucial to do your research before investing any money. With careful planning and a little bit of luck, you could find yourself making a lot of money from Bitcoin.

FAQ

Is investing in Bitcoin profitable?

Yes, there is a potential to make money by investing in Bitcoin. However, it's important to approach this investment cautiously and do your research before investing any money.

What's the best way to invest in Bitcoin?

There is no one "best" way to invest in Bitcoin. Some ways to invest include buying Bitcoin, mining Bitcoin, or investing in cryptocurrency projects. The best way to approach Bitcoin investment is with caution and realistic expectations.

How risky is investing in Bitcoin?

All investments come with some level of risk. With cryptocurrency, there is always the potential for loss due to volatility or other factors. It's important only to invest what you can afford to lose and to do your research before making any investment.

Can I get rich quick with Bitcoin?

It is possible to make a lot of money from investing in Bitcoin, but it's also very risky. The best way to approach Bitcoin investment is with caution and realistic expectations.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.