How Much Money Do I Need To Start Investing In Bitcoin?

-

Bitcoin, a decentralized digital currency, offers investment opportunities at any level.

-

Bitcoin's average annual return from 2013 to 2023 was 230%.

-

The smallest Bitcoin unit is a satoshi, which is one hundred millionth of a Bitcoin.

-

Investments can start as low as $1, allowing access to the cryptocurrency's potential.

-

Younger investors may allocate more to Bitcoin, reflecting a higher risk tolerance.

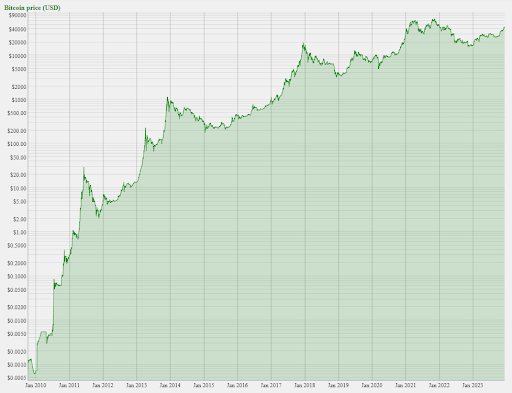

In the financial markets, Bitcoin has emerged as a lodestar, navigating investors toward a new era of decentralized currency. Starting with a price of 0, and increasing to just a few cents in 2010, Bitcoin’s price stands around $43,000 as of December 2023.

The importance of Bitcoins lies in more than the investing opportunity it presents though. It embodies the potential of blockchain technology and the promise of a future where transactions are secure, transparent, and free from the shackles of traditional financial institutions. If you are interested in Bitcoin investment, read this article to learn how much you should invest in Bitcoin to start.

Start trading cryptocurrencies with ByBit-

Can you buy less than a bitcoin?

Yes, you can buy less than one Bitcoin. Bitcoin is divisible to eight decimal places, so you can purchase fractions of a Bitcoin.

What is the smallest part of Bitcoin I can buy?

Bitcoin’s divisibility is one of its most ingenious features. The smallest unit of Bitcoin is known as a "satoshi," named in homage to the pseudonymous (alleged) creator, Satoshi Nakamoto. One satoshi represents one hundred millionth of a Bitcoin, akin to the penny of digital currencies.

In Bitcoin's early years, the notion of dividing a single Bitcoin into eight decimal places might have seemed superfluous. Back then, with values hovering below a dollar, the utility of such small denominations appeared negligible.

Fast forward to today, with Bitcoin's valuation soaring into the tens of thousands, the foresight of this divisibility becomes crystal clear. This granularity enables participation at any investment level, democratizing access to the cryptocurrency for all, regardless of wealth.

Bitcoin's average annual return from 2013 to 2023 was 230%.

The image accompanying this discourse vividly illustrates Bitcoin's meteoric rise from mere cents to its current valuation, underscoring the increasing relevance of the humble satoshi.

Pros and cons of investing in Bitcoin

The landscape of Bitcoin investment is riddled with both potential windfalls and pitfalls. Here, we outline the most notable pros and cons of investing in Bitcoin:

👍 Pros

• Accessibility: Bitcoin allows for the investment of small amounts, enabling wide accessibility and inclusivity. You can start investing in Bitcoin with $1, $10, or $30 - any amount that is insignificant to you.

• Historical long-term performance: Throughout the years, Bitcoin has performed extraordinarily well in the long-term, going from just a few cents to tens of thousands of dollars. For the “invest and forget” type of investor, Bitcoin has brought gains no other asset has.

• Hedge against inflation: With its capped supply, Bitcoin is often viewed as a hedge against inflation, much like precious metals.

• Decentralization: Free from centralized control, Bitcoin can potentially reduce the risk of manipulation and interference.

• Global transactions: Bitcoin can be sent or received globally without the constraints of traditional banking hours or cross-border fees.

• Security of blockchain: The blockchain technology behind Bitcoin provides a secure and immutable transaction ledger.

👎 Cons

• Price volatility: The price of Bitcoin is highly volatile, with the potential for rapid and significant fluctuations.

• Regulatory uncertainty: The regulatory landscape for Bitcoin is still developing, which could impact its adoption and value.

• Security risks: While the blockchain is secure, exchanges and individual wallets are still at risk of hacking and theft.

• Scalability issues: Bitcoin currently faces challenges in scaling up to meet the high transaction volumes without compromising speed or increasing fees.

• Environmental concerns: The mining process of Bitcoin consumes a considerable amount of energy, raising environmental sustainability concerns.

Bitcoin's investment thesis presents a dichotomy: the pros offer a glimpse into a future of financial sovereignty and growth potential, while the cons caution of a market still in adolescence, with all associated growing pains.

Investors must weigh these factors against their personal risk tolerance and investment goals to determine if Bitcoin is a suitable addition to their portfolios.

Best cryptocurrency exchanges

How much can you gain if you invest $30 in Bitcoin?

An investment in Bitcoin is a journey through peaks and troughs, with the potential for both exhilarating gains and significant losses. Considering the average annual return of 230% from 2013 to 2023, a $30 investment at the start of this period would have been subject to an exhilarating rollercoaster of valuations.

The following table shows a historical annual return that investing in Bitcoin would have yielded:

| YEAR | % RETURN |

|---|---|

|

2022 |

- 58.1 |

|

2021 |

64.8 |

|

2020 |

300 |

|

2019 |

91.7 |

|

2018 |

-75.2 |

|

2017 |

2,221.8 |

|

2016 |

130.9 |

|

2015 |

47.1 |

For instance, the colossal 2,221.8% increase in 2017 would have significantly multiplied the initial investment, only for the following year to pare down gains with a 75.2% decline.

To illustrate, if one had invested $30 in Bitcoin in January 2015 and weathered the market's fluctuations, reinvesting the gains each year, the investment's growth would have been remarkable. The year 2020 alone would have tripled the investment value from the previous year's result, emphasizing the potential of Bitcoin as a high-reward asset.

However, past performance is not a guarantee of future results. Additionally, there have been exorbitant price drops in the shortterm, such as the losses in 2022 and 2018.

A $30 investment in Bitcoin made a decade ago had the potential to grow significantly, but it required the fortitude to endure high volatility and the foresight to navigate a new and rapidly evolving market.

For further insight, read our article on Bitcoin Forecast 2024, 2025, 2030.

What is a good amount of Bitcoin to invest?

Determining an ideal investment amount in Bitcoin is entirely subjective and deeply personal, influenced by individual financial circumstances and risk tolerance.

Generally, conventional wisdom suggests that younger investors, with a longer investment horizon, may opt to allocate a greater portion of their capital to high-risk assets like Bitcoin. This is predicated on the notion that time affords them the luxury to ride out market volatility and benefit from long-term growth.

A balanced approach often involves diversifying one's portfolio, with Bitcoin constituting a portion that correlates inversely with the investor's age. Thus, as one age, the investment focus may gradually shift towards more stable and conservative assets. Ultimately, the "right" amount to invest should not jeopardize one's financial stability or long-term goals, regardless of age.

Can I invest in Bitcoin with $1?

Yes, it is entirely feasible to start your Bitcoin investment journey with as little as $1, thanks to the cryptocurrency's divisibility. With one Bitcoin divisible down to 100 million satoshis, even a single dollar can purchase a slice of digital currency.

This low entry barrier opens the door for almost anyone to experiment with Bitcoin investments, allowing for gradual investment increases as one becomes more comfortable and familiar with the cryptocurrency market dynamics.

For those seeking guidance on how much to invest in Bitcoin, read our guide on Should You Invest $100 in Bitcoin Today?

Summary

Even now after 14 years of existence, Bitcoin is rich with potential, offering a gateway into an innovative financial frontier. While the smallest unit, the satoshi, allows inclusivity, the volatility, and emerging regulatory landscape present both potential risks and rewards.

The decision to invest in Bitcoin, from a mere dollar to more substantial sums, must be made with a keen awareness of one's financial landscape and a clear strategy for the future. Age, risk appetite, and investment horizon are crucial factors in this equation.

As we navigate through the undulating terrain of Bitcoin's market, it is the informed choices, bolstered by reliable resources and a diversified approach, that will chart the course to potential prosperity in the burgeoning world of digital currency.

Glossary for novice traders

-

1

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

4

Extra

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

-

5

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.