Crypto Pump and Dump Explained

In the end of 2021, a little known coin named Santa Floki (HOHOHO) suddenly surged up within a few hours. Although this coin is no longer listed, investors had an opportunity to earn 5,000% profit at that time. Viking Swap could bring investors over 1,000% in just two days, provided that it was bought no later than November 2 and sold on the following day.

Viking Swap chart

These kinds of short-term price surges that have no logical fundamental explanation are called pumps and the plunge that follows is called dumps. The strategy is called exactly that – Pump and Dump.

In this review, you will learn:

What Pump and Dump is and can this strategy be considered a scam.

Signs of a pump and its possible consequences for investors.

Can you make money on crypto pumps? Instruments for earning money on a Pump and Dump.

How to avoid getting into a pump. What do you need to do if you’ve found yourself in a Pump and Dump.

The review will be particularly useful to those, who like to gamble, want to quickly grow their deposit and to earn on sharp surges of prices without the knowledge of technical analysis.

Start investing in crypto now with ByBit!What is a Pump and Dump and how does it work?

What is a Pump and Dump? A pump and dump is a manipulative scheme of artificial inflation of the price of a security with its subsequent collapse. As a rule, this kind of scheme has an organizer, who uses various instruments to attract private investors in order to sharply increase the number of buy orders. Once the price is inflated, the organizer dumps the asset. The instruments that are used include mass media, messaging apps, social media, newsletters, viral advertising, etc.

A Pump and Dump looks as follows:

-

The organizers choose a platform and a coin, for which a pump will be launched. It is bought in small volumes so as not to influence the price. Most often, it is a little-known coin with a stable horizontal price chart.

-

The organizers launch the first wave of the pump, using mass media and other sources of information to report a rapid price growth. Investors think they have a unique piece of information and therefore they can earn a lot, while in fact, they become victims of the scheme.

-

Under the pressure of the demand, the price starts to grow. Other investors see the growth and also join the movement. The price growth speeds up – the upward movement is called the ‘pump’.

-

The organizers satisfy the growing demand by dumping their assets. The growth stops; private investors are trying to sell the asset, but the number of buyers is much smaller. The price plunges – the downward movement is called the ‘dump’.

-

Presence of the second wave depends on the organizers and the desire of investors to put their money into the asset again. Three waves are rare.

The scheme can also be simpler, but the essence is the same: information is spread in the media that instills confidence of price growth in investors. Sharp increase in purchases inflates the price, and then the dump follows.

There are short and long-term pumps. Short-term pumps last for up to several hours and are local in nature: they are held on a separate platform and practically do not influence the general pricing. Long-term pumps last for several days. A situation, when the price soars (within a few hours) and then falls by stages is possible, usually with the coins with a high level of capitalization.

Risks of participating in pumps

There is only one main risk – late entry in a growing market. Once the price reverses, a sudden imbalance in favor of the sellers happens in the market and you simply won’t have enough time to sell the coin at the buy price. Actually, there is no guarantee that you will be able to sell it at all. You also won’t be able to find out in advance which coin will be pumped and dumped or which coin will be mentioned by accident by Elon Musk or Mark Zuckerberg. Success is determined by the speed of your reactions – the faster you buy the coin after the release of the news, the higher the chance of earning money on it. Sometimes, it is a matter of several minutes or seconds. One more thing – it is important that you sell the coin while there are still active buyers.

There is one more risk – a failed pump and dump. Organized crypto pumps and dumps don’t also yield the expected result. The task of the organizers is to attract a large volume of money to the coin. If it turns out to not be enough for influencing the price substantially, investors will be left with an illiquid asset that will be difficult to sell even at the current price.

The signs of Pump and Dump

Key signs of a Pump and Dump:

-

Abnormal price growth that does not match the growth of the entire market. Shitcoins often follow the general market trend. If a coin like that shows a 100% price growth in a day, while the overall market or Top 50 coins registered a 10% growth, it is a sign that the price is being artificially inflated.

-

Sharp increase of volumes and price on one platform and no similar movement on other platforms.

-

Active advertising of unknown coins in chats, public chats, forums, social media.

Any price surge with no fundamental confirmation, logic, or the one accompanied by an obtrusive marketing campaign is a reason to consider possible risks.

Examples of a crypto pump and dump

In terms of the realization, pumps and dumps can be provisionally divided into four groups:

-

Pumps of top coins by media personalities (accidentally or on purpose – nobody can tell).

-

Accidental pumps. The coins that grow in price for not entirely logical reasons, just because their names sound similar to the major coins.

-

Startups that “tailor themselves” to the current trend, collect money and account a soft or tough scam after some time (officially announce they no longer can support the project and shut down the website).

-

Organized pumps. They are planned in advance. There are small organized pumps; they are held on a specific platform and don’t influence the overall price much, as they are short in nature (i.e. not suitable for arbitration). Large pumps are organized by market makers.

Pumps of top coins.

In the end of January 2023, Elon Musk made an assumption in his post on Twitter that Vikings could travel to the Moon before the US astronauts. Perhaps, this joke had some hidden meaning in respect to BTC’s movement to new all-time highs, but investors decided to react in their own way. VikingsChain, Viking Swap and Space Vikings, who were previously unknown, skyrocketed by over 300% within a few hours. As of today, VikingsChain has already been removed from the CoinMarketCap listing.

A similar situation happened several months prior. In January 2023, Musk posted about a small location called Starbase that was chosen as a spaceport of SpaceX. The namesake coin grew in price by over 4,500% in an hour, but then, quite expectedly, plunged.

Starbase cryptocurrency chart

Pumps and dumps of accidental coins.

On 28 January 2023, Mark Zuckerberg announced the change of Facebook concept in the direction of the Metaverse. The idea of transitioning to the Metaverse incited interest in investors – the prices of the segment leaders Decentraland (MANA) and Sandbox (SAND) immediately soared. However, along with them, the prices of cryptocurrencies with the names that sound similar, but have no relation to the Metaverse whatsoever, also went up.

Metaverse Miner cryptocurrency chart

Metaverse Miner is a shitcoin created to provide mining. However, it seems that investors were not particularly eager to understand the essence of the project, when they were buying up all coins that have Metaverse in their name. The number of the people who lost money on the pump and dump is unknown. A similar situation happened with MetaverseX and Metaverse (ETP) coins.

Scam startups.

This type of Pump and Dump can safely be attributed to fraud, because developers deliberately offer investors an unrealistic idea. The legend is masked behind an ultra-popular existing project. SQUID cryptocurrency that was launched on the wave of popularity of the Squid Game TV show is an example of such a scam. On 29 January 2023 the coin rose by mind boggling 3,380%. Despite that its White Paper prohibits selling the coin, around 40,000 people bought it. And even after its subsequent plunge by 99.9%, and an investigation started by Binance, the coin still rose again by 525% before finally plummeting.

Squid Game cryptocurrency chart

Organized pumps and dumps.

An example of organizing a private pump and dump using Telegram channels is examined below. If a pump and dump reaches a higher level, the price moves on all exchanges simultaneously.

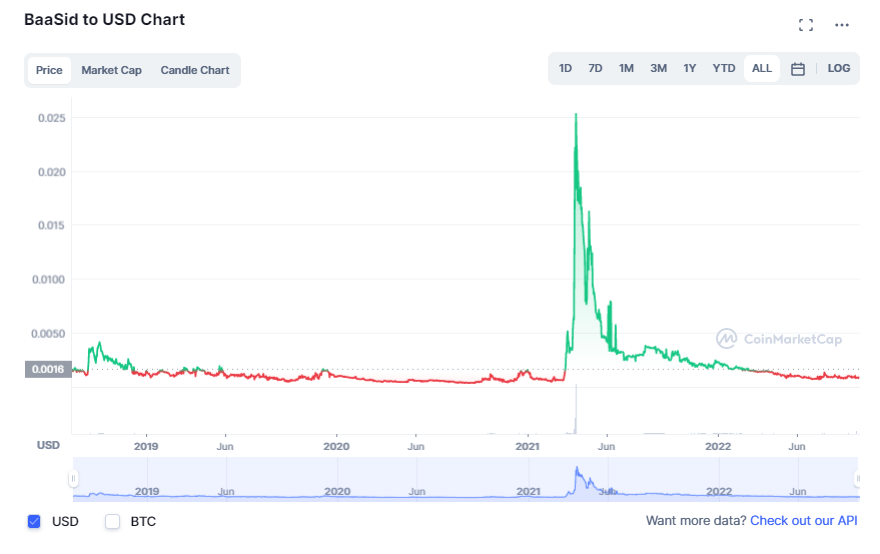

BaaSid cryptocurrency chart

How to avoid getting into a Pump and Dump?

A Pump and Dump strategy may be of interest for people who like gambling and enjoy the process, those who are not particularly concerned about losing money. If you prefer conservative strategies, it is best that you avoid Pump and Dump.

How not to get caught in a Pump and Dump:

Don’t rush to buy during a rapid price growth. Try to determine the reasons first. If only one specific coin is growing and there is no logical reason for it, it could be a pump and dump. The logical reasons include forks, platform upgrades, new partnerships with other networks, startups, involvement of institutional investors in the project.

Avoid coins with ‘shit’ value. Coins worth 0.0000…1 are most frequently targeted by scammers using the Pump and Dump scheme, because they require pouring less money.

Do not rush to react to some statements of certain people. Or you need to react instantly, at the start of the upward movement.

Take notice of the volatility level. During a pump and dump, coin prices can spike by over 1,000% in a matter of several hours. Fundamental movement rarely exceeds 20-30% per day.

Do not rush to invest in coins on presale, which don’t have a working idea and a logical roadmap. An intricate legend, promotion of airdrops, the affiliate program, bonuses are signs of a startup that can be used for a pump and dump and subsequent scam in the future.

Analyze the volatility of the previous trend. If a coin showed a daily volatility of 1-2% over the past year, and then suddenly showed 10% or more in 24 hours, while the general market volatility did not increase, do not rush to buy it.

Unfortunately, you can’t always identify a pump and dump, which may seem as a natural upward price movement. However, if you bought the coin at a time of a sharp price surge, all is not lost.

How to keep you money if you got into a pump and dump:

Don’t rush to sell. If you didn’t sell at the price high, and the price dropped, causing you a loss, you have two options: to sell at a minimum loss or to wait. If the coin is not the ‘shittiest’ of all, there is a chance for the second way of the pump and dump. It is weaker than the first one, but there is a chance of success.

Space Vikings cryptocurrency chart

Space Vikings, for example, which went 600% up in November 2011 following the tweet of Elon Musk mentioned above, showed half the growth of the previous pump two weeks after the dump.

Note! It is reasonable to monitor the second wave only if you accidentally got into the pump and dump of the first wave. Under no circumstances should you buy/additionally buy an asset during the second wave, as that is a guaranteed loss.

Ignore the media. There will be a lot of contradicting information in the media, messaging apps and forums against the background of the pump and dump. You are only interested in dry facts. Use logic, not your emotions.

Accept the loss of money and wait for the right moment to minimize the loss. Once you are in a pump and dump, the loss is already inevitable. From the emotional point of view, it is best to accept the loss and assess the situation with a clear head. Maybe, not all is lost yet.

If you get into a pump and dump, there is nowhere you can complain. So remember that everything depends solely on you.

Can you earn money on a Pump and Dump: tools to make money

Despite the fact that many sources do not recommend getting involved in Pumps and Dumps, it is not all that scary. With certain skills and instruments, you can catch if not the entire upward movement, then at least its part. The most important thing is to sell the asset once the price is driven up and before it plunges.

How to make money on a Pump and Dump:

-

Become an organizer of a pump and dump. For this, you need to create a private group, invite followers and convince them to place buy orders at a specific time.

-

Presale. Almost every cryptocurrency is offered on its website before getting listed at an exchange. Listing at major exchanges drives the price up. Once it reaches its high, the sale begins and the price slides. Although it is not a Pump and Dump per se, there are still some elements of it in this.

-

Buying on a fundamental factor. Speed is important here. When you see a media personality post a tweet, you buy the coin immediately. The question is how you can constantly monitor all news in the market, where every minute is important.

-

Telegram channels.

The latest option is the most realistic one. Private Telegram channels are created by organizers, where they inform about the date and time of the upcoming pump, but announce the name of the coin a few seconds before the start.

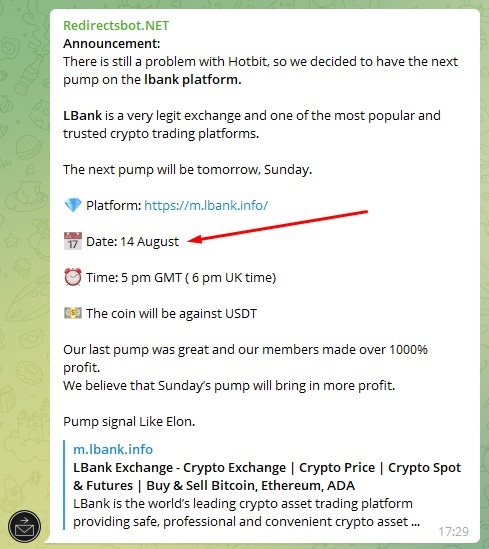

A message about a planned pump and dump in Telegram

24 hours before the start of the pump, the platform, where it will take place is announced and the exact date. Then, the organizers send reminders and instructions on how to register on the platform.

Message with the name of the cryptocurrency for the Pump

The name of the cryptocurrency is announced at the last moment.

Newscrypto cryptocurrency chart

This chart shows that the Pump happened with a delay. Investors did not immediately notice the increase in the volumes of a coin on a specific platform. Two days later, however, the “spark” of the pump lit up a strong upward trend.

NWC price change during the Pump

This is how the results of the Pump look on a platform. Bots are developed for quickly reacting to price movement. In these situations, when the price grows every second, manual opening and closing of positions is not wise.

NOTE! There is no sense in participating in short-term pumps, as without the bots you won’t be able to react to the price change fast enough. Accordingly, there is no sense in subscribing to the channels with 10,000-15,000 members.

Pump and Dump and the law

Many sources call Pump and Dump a scam, but it is not exactly so. On the one hand, the scheme could have been called a scam, if its goal was to mislead and deceive users. However, this is something different. A Pump and Dump has the signs of a pyramid, but another analogy can be drawn as well, one of an accelerated wave cycle. There is inflation of the bubble, attempts of hamsters to hop on the last car of a departing train, dumping of the coins by whales and plummeting of the price. The difference is that it took months for the dotcom or home mortgage bubble to inflate, while everything can happen in a matter of several hours in a Pump and Dump.

The question of compliance of a Pump and Dump strategy with the law is ambiguous for several reasons:

-

How do you prove a collusion of specific individuals? Because colluding to manipulate the price is indeed an offense. Price movement for fundamental reasons is not.

-

How do you identify the organizers? In the regulated markets, it is not an issue, but the cryptocurrency market is essentially not regulated and anonymous.

-

What measures should be taken against the violators? Pump organizers are citizens of different countries with different laws. The global legal machine is clumsy and physically incapable of reacting to all cases of pumps and dumps.

The regulators are negative about Pumps and Dumps, but they cannot do anything. In the end of 2021, the Australian regulator ASIC attempted to infiltrate one of the large Telegram channels, but all they were able to do was to get the channel closed and threaten organizers with penalties.

Cryptocurrency exchanges have a similar situation. Reputation is important for large exchanges and they make enough on the fees they charge on the turnover of top coins. Therefore, they don’t rush to list coins ranked lower than Top 1000 with cent value. The coins the pumpers target are listed on small exchanges, and these exchanges turn a blind eye to price manipulations. Large exchanges have technical mechanisms against pumpers (for example, minimum restrictions for the step in the change of cryptocurrency price), while small exchanges even support Pumps and Dumps.

From the legal standpoint, it is a stretch to consider Pump and Dump schemes a scam. This is more of an ethical and moral issue.

Best Crypto Exchanges

Summary

Things to know about Pump and Dump schemes:

A Pump and Dump is a strategy of artificial inflation of a price of an asset in order to sell it before the price plummets. Organizers of Pumps and Dumps use the media, messaging apps and social media to create reasons for the price to grow. Investors buy up the asset, causing a pump. Once the price reaches its high, the organizers sell the asset, causing a dump.

The target of Pumps and Dumps are little-known coins with a value of a few zeros after the decimal point (0.000…).

You can earn money on Pumps and Dumps if you know about them in advance and buy the coin at the beginning. If the Pump has already started, in no case should you enter the market.

It is important to know the signs of a pump and be able to tell the difference between an artificial and unreasonable price growth and a fundamental movement. This issue was discussed in detail in this review.

A Pump and Dump is a high-risk strategy that can bring 1000% or more profit in a matter of several days. However, without the knowledge, understanding of the mechanism and special instruments, it is best to avoid participating in Pumps and Dumps.

FAQs

How does a Pump and Dump differ from other strategies?

Technical analysis is not used in Pump and Dump, and fundamental factors are used indirectly. The essence of the strategy is to understand which coin could suddenly surge in the short-term in order to buy it at the beginning of the growth and sell it before the price reverses and plunges. The coins show high volatility during a Pump and Dump. Due to the great imbalance towards buyers and then sellers, slippages will be observed in the market. Therefore, you need to buy at just the right time and then sell also at the right time.

Can you earn money on a Pump and Dump?

Yes, you can, but it is not easy and there is a high risk involved. There are three options:

Buy cryptocurrency during the presale. After ICO and listing at major exchanges, the coin price usually goes up, but not always. The drawback of this option is that it may take six or more months to go from presale to the ICO.

Be a member of private groups, where information about a Pump and Dump is published. It is important to buy the coin in the first fractions of a second, before it surges up, and also sell it just as quickly before it plunges. It is best to use robots for this.

Follow media personalities. Price surges of DOGE, VIKC, VIKING and SVT after the actions of Elon Musk are good examples.

A Pump and Dump is rather gambling than an opportunity to earn money.

What are the risks of a Pump and Dump?

The standard risk is losing money during the dump. A classic mistake is to buy coins during active price growth. An investor invests money almost at the peak of the price, the price reverses and he/she can no longer sell the asset, because there are no buyers anymore. The second risk is buying coins during presale. There is no guarantee that the platform will be listed at the exchanges in general and that the price will grow.

Who is the Pump and Dump strategy good for?

For active traders with accounts on several exchanges, including decentralized platforms and platforms ranked below Top 100 by CoinMarketCap. It is also good for traders who have the necessary instruments: memberships in groups and communities, bots for instant opening and closing of positions, a possibility to monitor quotes on several platforms simultaneously, and access to information channels that publish information without delays.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.