In early 2018, amid the boom in new cryptocurrencies (ICOs);

Pump and Dump: Explained and defined with examples

Pump and Dump is a topic that is increasingly attracting interest worldwide, as evidenced by the statistics of Google Trends.

Interest in Pump and Dumps has 2 clear peaks:

-

1

-

2

In early 2023 amid the hype with GameStop stocks.

We'll look into the matter of these two relatively recent stories in detail below, along with other examples from the past. After all, the Pump and Dump occurred long before the existence of Google Trends.

Best Crypto Pump and Dump Groups

Below you will find all the information.

What is a Pump and Dump?

The Pump and Dump scheme is founded on the basic buy-cheap/sell-high principle of commerce.

Respectively:

-

Pump is an unnatural price inflation of a product.

-

Dump is a natural decline in the price of a product from abnormally high levels.

The Pump segment must be organized by the manipulator (or a group of persons working in a conspiratorial effort), who has accumulated a significant amount of goods earlier at a low price, who then gives a signal to sell the asset with the maximum benefit for himself.

Of course, the desire of a seller to make a profit is natural and justified. However, in pursuit of his own selfish goal, he can use various methods to inflate prices unnaturally, which is the essence of manipulation and fraud.

That is why government officials strictly monitor Forex and other markets to assure that the Pump and Dump scheme is not applied in centralized financial markets. So, those who want to “get rich quick”, as a rule, try to apply this scheme with little-known cryptocurrencies and illiquid stocks from OTC markets.

How does a Pump and Dump scheme work?

The fraudulent Pump and Dump scheme follows a 4-step pattern:

Accumulation.

The manipulator (acting alone or in collusion with a group of persons) accumulates a financial asset at a low price in his account. For example, a share of an unknown company that is being traded at a price below $1 is a penny stock.

Pump.

The manipulator makes an effort to inflate (“Pump”) the stock price. He often claims to have "insider" information about the upcoming good news that will take the price sky-high. As rumors spread, the rising demand, price, and trading volumes of the stock can convince a large number of people to believe the information and buy the stock.

Distribution.

Let's say, as a result of the manipulator’s efforts so far, the price rises 10 fold. The manipulator sells off the stock completely, gaining tenfold profits in a relatively short time.

Dump.

Then a Dump occurs - the price of the asset inevitably returns to its original levels, since there were never any objective non-fraudulent reasons for its rapid growth. As a rule, the return occurs along a sharp downward trajectory.

As a result:

-

The manipulator, or organizer of the Pump, makes the most profit.

-

A small profit or breakeven is recorded by a small number of those traders who managed to enter a position during a Pump and exit during a Dump.

-

Most victim traders suffer losses because they bought at or near the high point.

Pump and Dump: An example

Example. In 2001, 29 executives of the energy company Enron falsified an official income statement to sell more than a billion dollars in sharply advanced shares before the company went bankrupt.

A scene from the movie, "The Wolf of Wall Street"

You may remember the popular film “The Wolf of Wall Street” with Leonardo DiCaprio (based on a true story), where the main character was selling cheap stocks on the phone and making a lot of money.

Comparing his business with the Pump and Dump scheme, we see:

-

The similarity is that Jordan Belfort (prototype of DiCaprio's character) dealt with illiquid cheap stocks (penny stocks), and also acted unethically when he misled buyers by promising them quick high profits from the rapid price rise (Pump).

-

The difference is that initially Jordan himself did not buy/sell shares. He earned a high commission for his services, not from the price difference.

-

Next, the business expanded, and his brokerage company Stratton Oakmont also began to artificially inflate the price of existing stocks using false positives to sell them at a higher price.

A lesser-known film, the crime drama “Boiler Room” (2000), also shows the inside of the junk stock business.

How a high school student made $800K using the pump and dump scheme

Jonathan Lebed became interested in stocks very early on. When he was 12 years old, he finished fourth in CNBC's stock selection competition, turning $10,000 into $240,000 on a demo account. Thus, Jonathan was able to convince his parents to invest in the stock market on his behalf. In 1999-2000, he made a profit of about $800,000 in his spare time. How did he do it?!

Using the Pump and Dump scheme.

Jonathan Lebed

Lebed, when he was in his teens, bought large stocks of shares in small-cap companies and immediately posted 200 to 300 messages on the Yahoo! financial forum, advertising the stocks he had just bought.

He used catchy phrases like:

-

this share will be the next one to rise 1,000%

-

the share, which is now worth a dollar, will be traded at more than $20 per share ‘very soon’.”

The rapidly growing market of internet companies (the “dot-com boom”) has created an environment full of easy wins.

In response to Lebed's fake reports, the volume of trades in the shares he mentioned grew from an average of 60,000 shares per day to over a million. Even Jonathan's teachers bought the shares he recommended. The manipulator himself did not hold the position for a long time. As a rule, he sold his shares within 24 hours after the purchase, making a profit of at least $11,000 per trade.

The Securities and Exchange Commission (SEC) investigated the trades made by Jonathan from August 23, 1999, to February 4, 2000, and announced that 11 of them violated:

-

section 17 (a) of the Securities Act,

-

Section 10 (b) and Rule 10 (b-5) of the Exchanges Act.

Important!

These laws prohibit "acts, transactions, practices or conduct of business that constitute fraud or deception in the offer, purchase or sale of securities, including misstatement or omission of material facts."

Thus, the Securities and Exchange Commission ordered Lebed to pay a fine of $272,000 and more than $12,000 interest. The teenager had to agree with the regulator's decision, although in his opinion, he did nothing wrong. Jonathan claims to have learned how people react to the stock market and acted on that knowledge.

Pump and Dump in stocks

The stock market is a fertile field for the Pump and Dump scheme because:

-

There are a myriad of stocks, especially if you take stocks that are traded on the OTC market (for example, the OTC Bulletin Board or Pink Sheets in the United States);

-

stocks are available to a wide range of people, and transactions with them can be carried out through an online brokerage company and with minimal time delays.

Usually, pump organizers are looking for stocks whose prices are in a long-lasting dull sideways movement (flat state), so that the increased trading activity itself attracts the audience.

It is also desirable for the Pump organizer that the number of available stocks is relatively small - then it will be easier to achieve a state of stock deficit, in which the price for them goes up more easily with each new buyer.

The GameStop shares saga

GameStop is an active chain of stores selling video games and other electronic goods, with more than 6,000 retail outlets in the United States and 17 countries.

The company has developed rapidly since 2000, but then the business began to decline due to the development of online games and digital distribution services. The COVID-19 pandemic dealt the company a hard blow, forcing the company to close 3,500 stores from March to May 2020.

Some hedge funds, in particular Melvin Capital, which rationally thought that the stock could fall lower, took short positions (that is, they borrowed shares and sold them to buy back the shares later at lower prices).

However, the stock of GameStop (NYSE: GME) has come to the fore on the WallStreetBets forum on the Reddit discussion site. This is the place where small risk-averse investors converse. They felt that the stock was undervalued and conspired to buy it in large quantities.

According to some reports, one of the leaders of the WallStreetBets group—34-year-old Keith Gill, a marketing specialist and certified financial analyst (CFA) from Massachusetts—was sure that the price would accelerate its growth due to the short squeeze.

A short-squeeze is a phenomenon where short market participants are forced to close due to strong demand, thereby further increasing the interest of potential buyers. And since short positions in GME shares were in the portfolios of large funds (some shares were even sold more than 1 time), the price went up sharply - from $18 at the beginning of the year to more than $450 per share on January 28, 2023, which attracted attention all over the world.

Jordan Belfort

The real Jordan Belfort (of “Wolf of Wall Street” fame, played by DiCaprio) said on CNN that the situation could be classified as a "modified Pump and Dump." He expressed confidence that the price will go down, as it is caused by the excitement and is not fundamentally supported.

Indeed, in mid-February, GME fell 10 times to $40. This happened, among other things, due to the actions of the authorities. On January 27, 2023, White House spokeswoman Jen Psaki said Treasury Secretary Janet Yellen and others in the Biden administration were monitoring the situation. Then brokerage firms Robinhood, Charles Schwab, TD Ameritrade, eToro, Webull, and others imposed restrictions on the purchase of GME shares (probably under pressure from the SEC regulator, but also because clearinghouses increased the necessary collateral to conduct trades).

The GameStop Corporation

Surprisingly, at the end of February, the shares resumed their growth and in the spring consolidated in a range of about $170. It is possible that the new board of directors, which announced plans for a new $1 billion share issue, was able to use the company's growth in capitalization to reorganize the business.

Anyway, the story with GameStop has clear signs of a Pump and Dump scheme:

-

prior conspiracy of manipulators

-

large profits for those who entered the “long” at the beginning of growth

-

large losses for those who bought at the top and were “short(ed)”, including billions in losses for Melvin Capital, Citron Research, and other hedge funds.

As a result, US senators called on the Securities and Exchange Commission to strengthen regulatory measures "so that markets reflect the real value and not accept highly leveraged rates."

Pump and Dump in the cryptocurrency market

The cryptocurrency market is another great market to organize a Pump and Dump for several reasons:

-

It is a decentralized market with weak regulation.

-

Some cryptocurrencies have a small capitalization, which means that they can be relatively easily concentrated in the hands of the scheme’s organizer or his partners.

-

Convenient pump organization through social media platforms including Telegram and Discord

Unlike typical stock market manipulation, cryptocurrency manipulators do not pretend to have inside information or claim that the coin is undervalued. Instead, the administrators (manipulators) of the social network group publicly state that they are pumping and encouraging others to join.

History of the Cryptocurrency Pump and Dump

In 2017, the cryptocurrency market reached a capitalization of $200 billion, and BTC came close to the level of $20 thousand per coin. A boom in cryptocurrencies got the best of the world. Exchanges opened one after another, and ICOs took place even more often notwithstanding that in many cases the brand new cryptocurrencies did not carry any special intrinsic value.

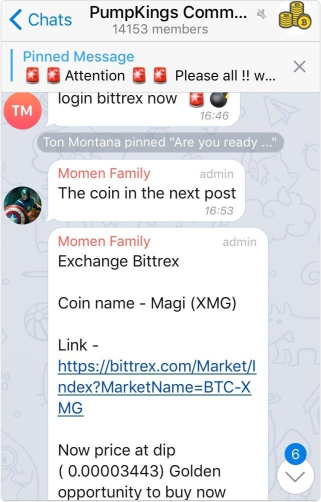

PumpKings Community

Along with this activity in social networks, groups were organized for the Pump of cryptocurrencies. They were filled with members who wanted to get rich quickly and easily amid the boom.

By joining the group, its members knew the time when the pump would take place.

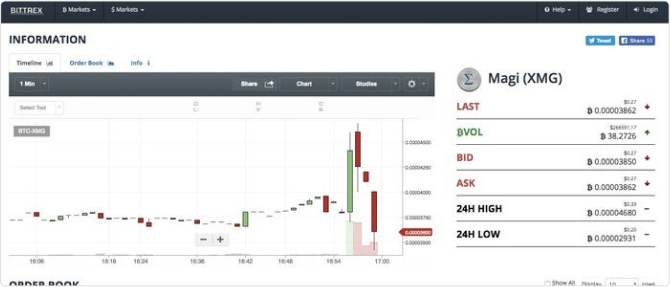

Indeed, at the appointed time, the organizer published a link to the exchange and the exchange ticker (in this case, it was XMG, a coin that was no longer traded on the cryptocurrency exchanges).

In a matter of seconds, the coin's price was skyrocketing on an unusually high trading volume.

As the price rose, the group’s members also spread the word about the Pump, encouraging others to join in and buy the asset, promising high profits to everyone. Fresh growth confirms that the “coin is hot”.

When new buyers enter the market, people who originally bought in the first wave unload their coins at a new, but higher price, expecting to profit from the coins. This wave of selling drives the price down, often below the pre-pumping level.

Magi (XMG)

Cryptocurrency Pump and Dump today

Since 2017, the number of cryptocurrency assets has increased from 1200 to 6000 (roughly).

It would seem that the time of the "Wild West" has passed, "junk cryptocurrencies" have gone into oblivion, and after a while, users should have realized that they would not get a stable profit from participation in the Pumps.

But no. In 2020, Anirud Dhavan and Talis Putninsh from the University of Technology of Sydney (UTS) conducted a study that found that Pump and Dumps are still popular, and cryptocurrency exchanges remain a haven for scammers.

After analyzing data on 200 cryptocurrency pairs for 7 months from the beginning of 2020, the researchers found 355 cases of price manipulation on several cryptocurrency exchanges. The Pump and Dump are estimated to have brought the organizers an estimated profit of $6 million.

Best Crypto Pump and Dump Groups in 2024Anirud Dhawan said in an interview with Yahoo Finance UK:

“If you compare the scale of cryptocurrency manipulation with traditional stock markets, it will be exponentially higher. Even with cheap stocks in the OTC stock markets, you have several hundred cases over 10 years. You have over 300 cases on crypto exchanges in a few months. "

The study concludes that participants are not motivated by rational reasons, but instead participate out of greed, overconfidence, or a desire to play. Pumpers think they can get the timing right and sell before the crash, or they just enjoy the excitement of the ups and downs in prices.

They join communities that are actively promoting on Facebook, Instagram, and Twitter through both advertising and other means, but they all exclusively work with semi-anonymous messaging services such as Discord and Telegram.

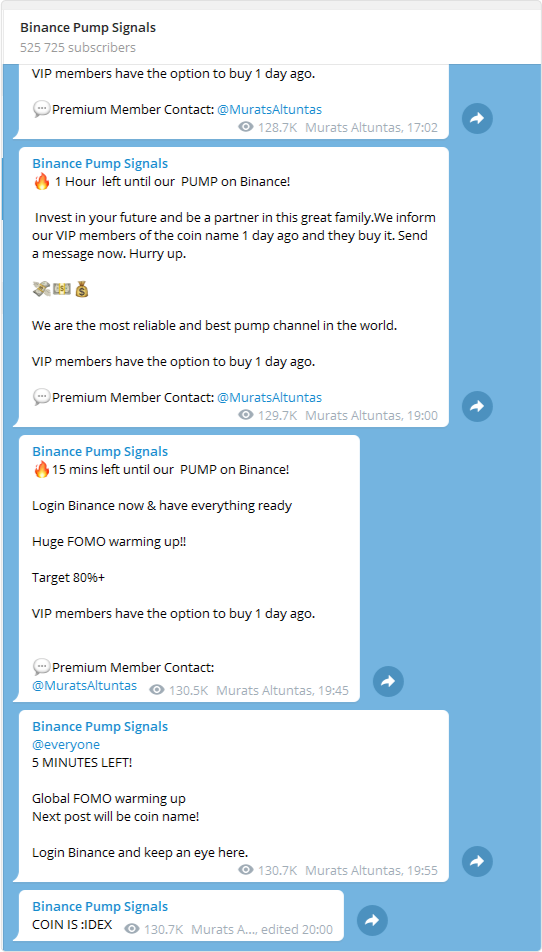

Binance Pump Signals

After the signal is given, the price jumps to its peak but falls precipitously.

IDEX / US Dollar

In this case, the effect of the IDEX coin's Pump lasted 3 minutes, during which the price rose by 50% to Dump even lower than it was before the manipulation.

Obviously, the speed with which the group members enter the long position after the signal is announced is of high importance. To provide an advantage, the group administrator can, for an additional fee, notify those wishing to receive the signal before others. The service fee can range from $10 to $1,000, or the service can be provided free of charge in exchange for a large number of attracted members to the group.

This means that group administrators (pump organizers) will make money anyway, while most of the participants are just gambling.

“80 to 90 percent of people lose, and they probably think they just waited too long before selling a position. Even so, they remain keen to try again, ” cryptocurrency trader Chris Kerner told Business Insider.

“And it becomes an addiction. People just keep losing money until their deposit is cancelled. And the organizer acts like a bandit because he not only makes a profit by buying a coin earlier than anyone else but also charges people for additional services."

How to detect a Pump and Dump scam

The main advice for those who do not want to lose money by participating in the Pump and Dump schemes is to stay cool and sober. Don't let greed and the desire to get rich quickly and easily lead you into an adventure. Therefore:

-

Don't click on ads that promise 100% guaranteed income with a “proven strategy”;

-

Be suspicious of resources that, under the guise of journalistic reports, talk about how ordinary people quickly got rich on cryptocurrencies;

-

Do not join Telegram and Discord groups where the administrator gives signals to buy an asset at a certain time.

-

Do not follow the advice to buy a stock from dubious sources with “insider” information.

-

Try trading on a demo account before risking real amounts

Of course, there are sharp rises in prices. But, as a rule, they have a fundamental rationale. Therefore, use economic calendars, news scanners, expert reviews from licensed brokers in your business.

Trustworthy stockbrokers’ ratings

To invest with confidence and peace of mind, look for licensed brokers who operate under the supervision of a strict regulator such as the US Securities and Exchange Commission (SEC). As a rule, the broker's team has professional advisors who can make rational investment choices for your individual goals. For example:

| Broker | Commission Level | Regulator |

|---|---|---|

Low |

USA (SEC) |

|

Low |

USA (SEC, FINRA), as well as Singapore, Hong Kong. |

|

Low |

USA (SEC, FINRA), as well as Great Britain, Australia, Canada, Japan, Hong Kong, China, etc. |

Webull

Webull is a young, fast-growing broker, founded in New York in 2017 by a former employee of the Alibaba Group. Webull provides access to trading stocks, ETFs, options, cryptocurrencies, but the Forex market is not available.

On January 28, 2023, when the GameStop story was developing in the financial markets, Webull noted a record number of active clients - 952,000 people. One of the reasons for the popularity of the broker is that Webull does not charge commissions for trading in stocks, ETFs, and options listed on US exchanges. Webull is regulated by the SEC, in particular. In May 2020, the Commission allowed the broker to launch a financial advisor robot.

TD Ameritrade

The TD Ameritrade broker was established in 1971. In 2020, it became part of the Charles Schwab broker, and until 2023, their services and accounts will be synchronized, creating a wide choice for clients.

TD Ameritrade benefits from a professional thinkorswim platform and a high level of daily analytics available to clients. The broker's reliability is the highest, because one of TD Ameritrade's partners is Toronto-Dominion Bank, and Charles Schwab shares are traded on the New York Stock Exchange. It is a member of FINRA and SIPC (Organization for the Protection of Customer Accounts), regulated by the SEC.

Interactive Brokers

IBKR is a top-tier US broker established in 1978. There are 24 offices in 14 countries. Interactive Brokers features the widest selection of markets available. The broker's clients can buy securities on 135 exchanges worldwide.

Forex, cryptocurrencies, derivative financial instruments are available. Clients' capitals are protected up to $500 thousand (depending on the jurisdiction), and the broker itself is regulated by reputable bodies such as the SEC (USA), FCA (UK), the Investment Industry Regulatory Organization of Canada, and others. IBKR is listed on the Nasdaq.

Expert’s opinion on Pump and Dump schemes

Ben Yates, a financial technology lawyer at international law firm RPC, told Business Insider: "The reality is that until effective regulation is in place, cryptocurrency scammers will continue to pump."

“A whole new population of people comes to us who are ready to participate in pumping, who probably would never have done this before,” said Tyler Moore, professor at the University of Tulsa and co-author of the article, “Exploring the Pump and Dump Ecosystem of Cryptocurrency,” where more than 3400 pumping cases were reviewed in 2018.

“The longer I worked on Wall Street, the more distrustful I was of 'clues' and 'insiders' of any kind. Beware of hairdressers, beauticians, waiters, and drifters - whoever they are - bringing fractured gifts in the form of advice on buying securities," said Bernard Baruch.

Antony Robertson,

Traders Union Financial Analyst

Reviews of Pump and Dump schemes

Crypto Pump group admins will always want more people in their groups so they can make more profits from explosive moves and so they will often guarantee beginners get rich quick and easy, but in fact, they are guaranteed profits only if buy a coin before the pump.

Jamie Price, 25

Marketing Advisor

US

I tried to buy in as quickly as possible. It didn't work very well. Then I decided to sell at the top of the pumps. It worked better until the second wave of the pump took my short into the ether. As a result, I lost more than I earned but I don’t regret it because it was a valuable experience.

Michael Lawson, 38

Trader

Canada

Stay away from small-cap stocks until you learn the tricks of the trade. Do your own research and treat all news that the stock will do +30%, +80%, +500% soon with healthy sсepticism. Remember, if it sounds too good to be true, it usually is. They are trying to drag you into a scam.

Adam Gillespie, 52

Professional Investor

Italy

FAQ

What is Pump?

This is the rapid inflation of the price of a financial asset. The pump is organized by the one who previously bought this asset, and his goal is to sell it as high as possible.

How are prices pumped?

It all depends on the capabilities of the Pump Organizer. Cold calls, spam emails with the spread of rumors about an imminent price increase can be used. For a joint pump of cryptocurrencies, groups are assembled on social networks, where administrators give a signal to buy a specific coin at a specific time.

Can you make money on a Pump and Dump strategy?

You can if you are an organizer, but this is a scam and may be punishable under the laws of your country. Ordinary participants in the scheme can earn money if they manage to enter at the beginning of the pump and exit before the dump. There is a lot of luck here, so by and large, Pump and Dump is a roulette game.

Will it ever stop?

It is unlikely. The existence of a large crowd of people who want to get rich quickly and easily and the desire of unscrupulous manipulators to sell their shares at the market price or better price is at the heart of all Pump and Dump scams on stock and cryptocurrency exchanges.

And since human nature does not change, there will always be scammers and victims.

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Matthew Du is a SEO Content Marketing Professional and a contributor to the Traders Union website with five years of experience in digital marketing, along with a proven track record in SEO content strategy, media planning, data analytics, and copywriting. He has excellent communication skills and the ability to engage the audience with his deep understanding of the market.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.