AI Crypto Trading | All You Need To Know

AI can be used in cryptocurrency trading, but start by learning about Artificial Intelligence and how it works. AI can be used to automate trades, predictive analytics, sentiment analysis, pattern recognition, etc.

AI crypto trading refers to a type of trading that does not require human effort to analyze the crypto market and open trade positions, even though it requires human effort to be set up technically. AI crypto trading is possible with software designed specifically to replace the manual ways traders follow when trading in the crypto space. Trading bots, as they are popularly known on many platforms, can be hosted on a cryptocurrency exchange or integrated with an exchange using an application programming interface (API) for short-term trading or long-term investment.

These AI cryptocurrency trading bots can go beyond simply placing trades for traders; they can also continuously monitor sentiment from social media platforms to ascertain whether the market is in a bullish or bearish state and adjust their trading strategy accordingly. Although AI aims to increase trading efficiency, it is critical to comprehend the legality, risks, and limitations. Read on to learn more about how to use AI for crypto trading.

-

Can AI be used in crypto trading?

Yes. AI can be used in cryptocurrency trading, but start by learning about AI crypto trading and how it works. It can be used to automate trades, predictive analytics, sentiment analysis, pattern recognition, etc.

-

Can AI predict crypto prices?

Yes. However, even though the market has some AI-powered tools for market analysis and prediction, these forecasts are not always accurate.

-

Is AI safe for crypto trading?

In jurisdictions where cryptocurrency trading is lawful, artificial intelligence (AI) is safe; however, traders must understand that trading is inherently risky and that certain technical problems or hacks may present difficulties.

-

Can AI replace traders?

No. With AI crypto tools, traders can swiftly process data, spot trends, and produce insights that will help them make better decisions. So, AI is likely to improve human traders' abilities rather than replace them.

How to Use AI to Trade Crypto

AI-powered tools for crypto trading streamline market analysis, decision-making, and trade execution in the volatile realm of cryptocurrency. Take, for instance, the scenario where an AI-driven trading bot anticipates a surge in Bitcoin's value—it swiftly executes a purchase of the digital currency. Conversely, if a downturn is projected, it promptly sells off a portion or the entirety of a position.

Although artificial intelligence (AI) has entered the cryptocurrency trading market to improve the efficacy and efficiency of trading operations, understanding how to apply AI in trading requires a trader to be aware of the applications for which these tools can be used. One area where AI flourishes is algorithmic trading, which uses sophisticated AI systems to make trading decisions several orders of magnitude faster than any human could. Other ways to use AI to trade crypto include:

Trading automation

Trading automation

You can use AI trading tools to automate various aspects of the trading process, like market analysis, decision-making, and trade execution. These bots are programmed to act automatically based on pre-established parameters, like price changes, technical indicators, and opinions in the market. Instead of relying solely on manual intervention by traders, automation employs predefined rules and algorithms to execute trades automatically based on certain criteria or parameters.

By automating repetitive tasks, trading automation frees up time for traders to focus on strategy development, analysis, and other higher-value activities. However, it also poses challenges, such as the need for robust algorithm development, monitoring for system glitches, and adapting to changing market conditions.

Example of AI tools for trade automation

The Trading Analyst

Trade Ideas

Market Chameleon

Trend Spider

Tech Trader

Tickeron

A trader seeking to enhance their trading performance in situations involving increased competition, market volatility, and complexity can do this by using any of the AI in the example above. When using tools like Trade Ideas for trading automation, the primary objective will be to identify high-probability trading opportunities and make a more efficient trading decision with a faster execution time.

The procedures that this trading automation tool adheres to are:

Scanning and analyzing vast market data like price movements, volume patterns, and news sentiment, to identify potential trading opportunities

Generation of trading ideas based on predefined criteria and user preferences, such as price changes, volume spikes, and technical signals; traders can customize and refine their trading strategies using the platform's built-in screening tools and filters.

Provision of real-time alerts and notifications for potential trade setups and execution of trades automatically based on predefined rules and parameters

👍 Benefits

• Improved efficiency

• Enhanced decision-making

• Increased trade opportunities

• Reduced errors

👎 Challenges

• Using this trading automation tool can be challenging when refining and optimizing trading algorithms to adapt to changing market conditions and maintain competitiveness. To minimize potential losses and guarantee regulatory compliance, efficient risk management procedures must be kept up to date even in the face of automation.

Predictive analytics

Predictive analytics

Artificial intelligence (AI) crypto trading tools, which can examine past data to identify patterns and trends, enable predicting future price movements. AI crypto trading tools collect data from a range of sources, including articles, news articles, market indicators, exchange APIs, and sentiment on social media. After processing, this data is arranged in a way that makes it ready for analysis. Because they recognize correlations and patterns in the data that might point to future changes in price. This entails identifying basic elements like market news and sentiment and technical patterns like candlestick forms. Based on the predictions and risk assessments, AI trading tools can automatically execute trades on behalf of the user. The potential for model errors and unforeseen market events are among the risks and limitations that traders should be aware of when utilizing AI-driven trading tools for predictive analysis.

Example of AI tools for predictive analysis

Kryll.io

Signals

Shrimpy

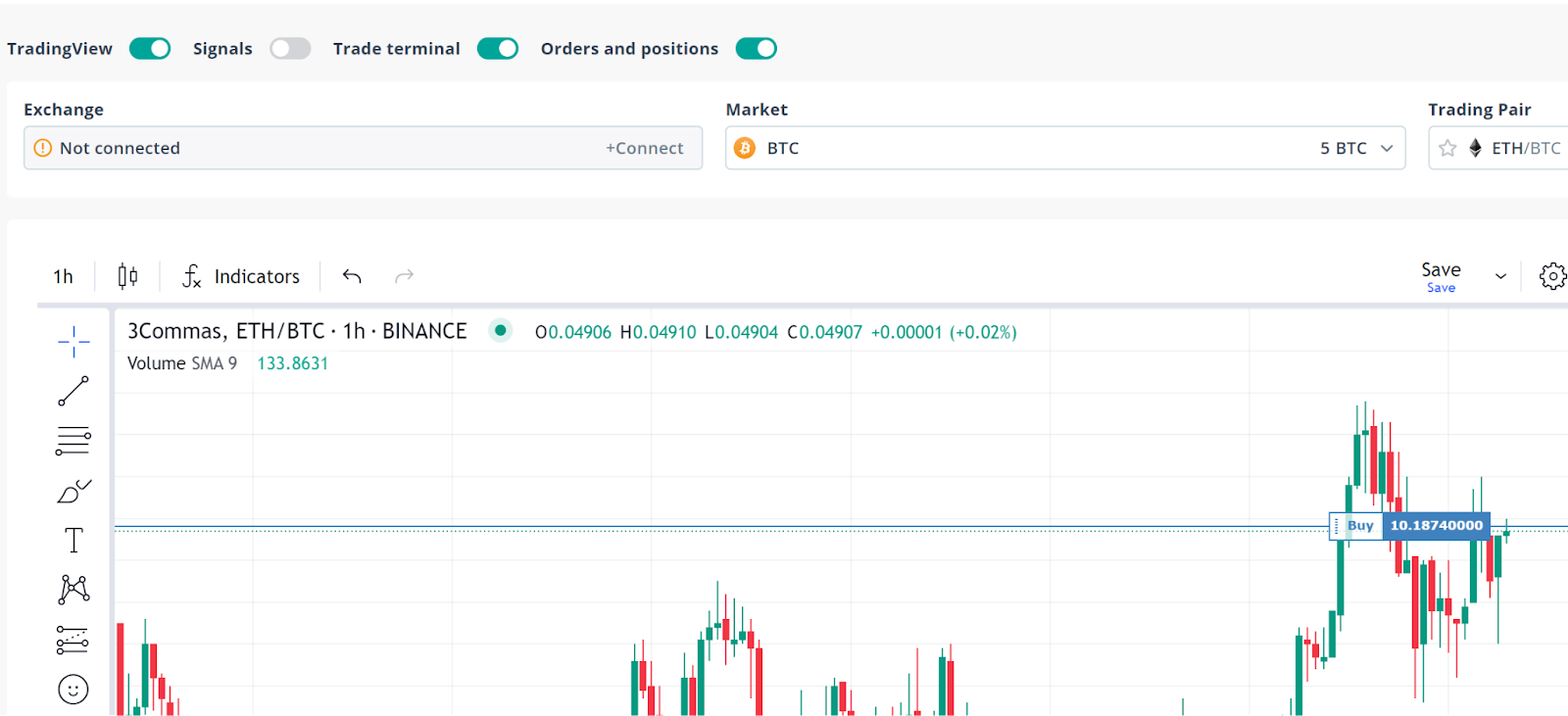

3Commas

For predictive analysis, cryptocurrency traders may need to use artificial intelligence (AI) tools like Shrimpy in order to optimize their trading strategies and capitalize on market opportunities. A trader can use this AI tool to examine historical data, spot trends, and forecast future changes in the price of cryptocurrencies.

Process

Sign up and connect this AI tool with a cryptocurrency exchange.

Configure the AI to collect data from various sources, including market indicators, social media sentiment, and exchange APIs.

Define trading preferences, risk tolerance, and desired investment strategies.

The AI tool gathers data from multiple sources, processes the data, identifies correlations and patterns within the data that may indicate future price movements, and recognizes trends, candlestick patterns, and market sentiment shifts.

Executes trades by leveraging predictive insights to capitalize on market opportunities and mitigate risks.

👍 Benefits

• Improved Decision-Making

• Enhanced Efficiency

• Real-time market execution

👎 Challenges

• Because of the extreme volatility of cryptocurrency markets, using Shrimpy for predictive analysis may contain errors or inaccuracies in the models, which could result in unanticipated results or losses.

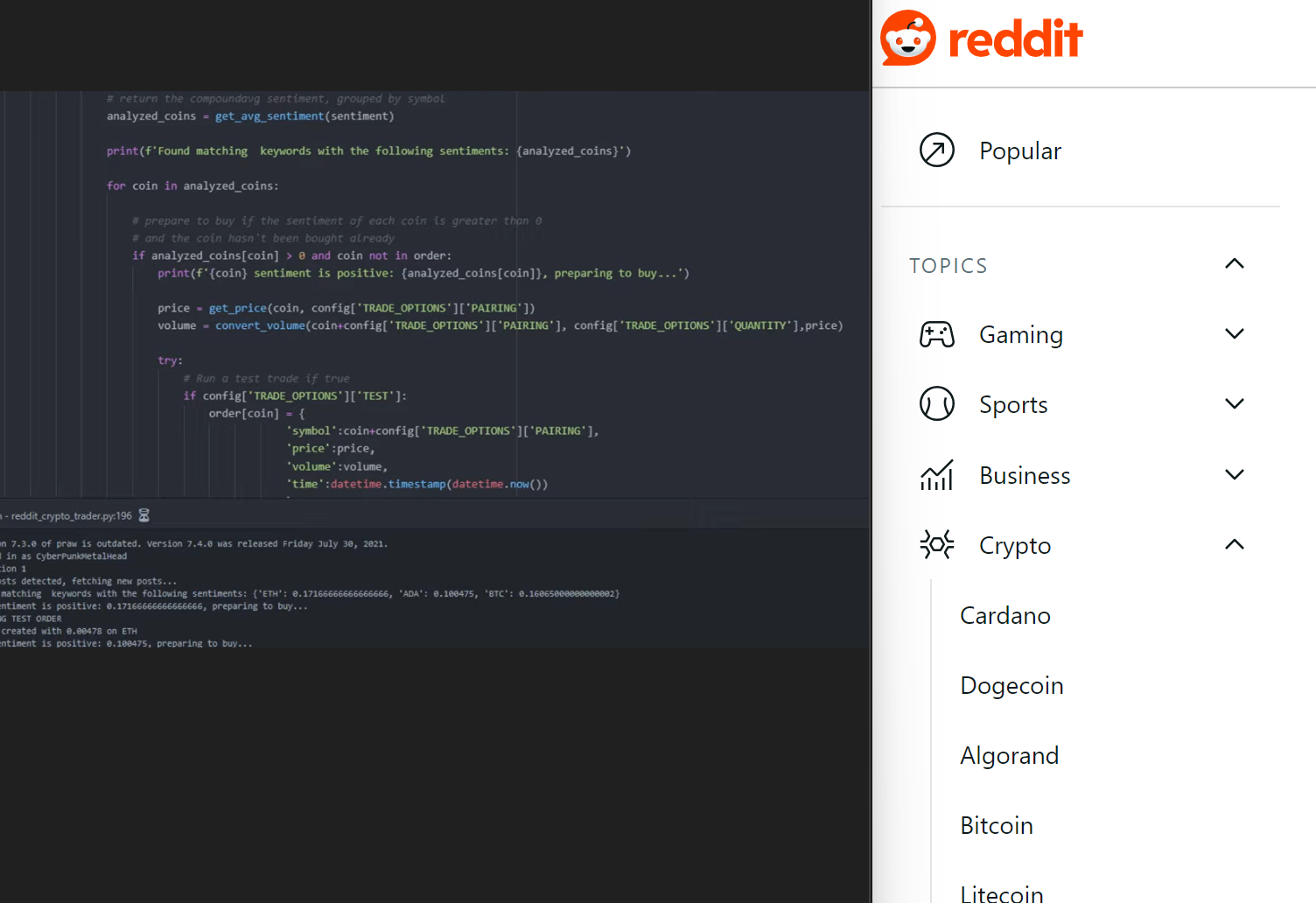

Sentiment analysis

Sentiment analysis

You can employ AI crypto bots for sentiment analysis, as these tools can analyze social media, news articles, and other sources to assess market sentiment. They offer valuable insights into future trends in the cryptocurrency market by evaluating the feelings, attitudes, emotions, and moods surrounding digital assets. AI crypto trading tools for sentiment analysis utilize artificial intelligence algorithms to analyze the sentiment of market participants towards specific cryptocurrencies or the overall market. These tools gather data from diverse sources, employ natural language processing techniques to analyze textual content and categorize it into positive, negative, or neutral sentiment. Traders can utilize the sentiment analysis provided by AI tools to guide their trading decisions.

Example of AI tools for sentiment analysis

Kryll.io

CryptoMood

CoinFi

3Commas

Crytpohopper

Bitsgap

Leveraging AI tools like CryptoMood for Sentiment Analysis help traders track market sentiment across multiple sources, such as social media, news articles, and forums, is a time-consuming task. Trading professionals can spot possible market trends, predict price changes, and adjust their trading strategies based on the AI tool's results. This is due to the AI tool's publication of news about cryptocurrencies and its ability to compile viewpoints from social media activity.

Process

Register and incorporate CryptoMood into an already-existing trading automation system that uses risk control procedures and algorithmic trading techniques.

Data collection from a variety of sources, such as online forums, social media sites, and news websites, and analysis of public opinion regarding various cryptocurrencies.

The tool extracts and analyzes textual content about particular cryptocurrencies using natural language processing (NLP) techniques, classifying sentiment as positive, negative, or neutral.

An assessment of market players' feelings about different cryptocurrencies, highlighting the dominant mindsets, feelings, and attitudes.

Real-time sentiment analysis results are displayed to traders via dashboards or visualization tools.

Based on the sentiment analysis signals, the trader decides whether to buy or sell by incorporating the sentiment analysis data into their algorithmic trading strategies.

👍 Benefits

• Updates on changes in market sentiment and increased market awareness

• Increased Trading Efficiency and Optimized Trading Strategies

👎 Challenges

• The accuracy of sentiment analysis results may vary depending on the quality and reliability of the underlying data sources.

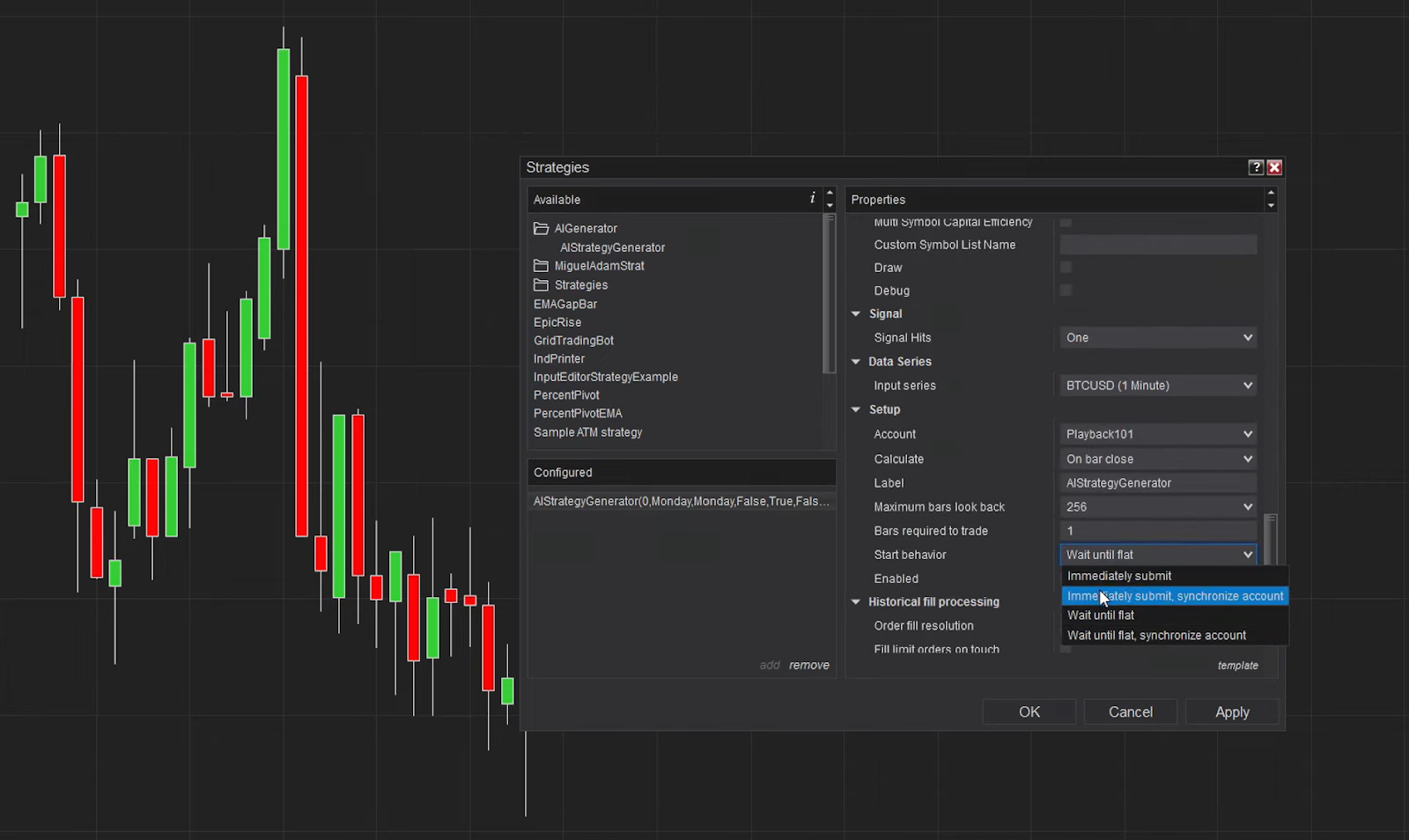

Pattern recognition

Pattern recognition

Technical analysis patterns, such as chart patterns and candlestick formations, can be automatically recognized and analyzed by AI bots used in cryptocurrency trading. These bots analyze vast amounts of historical and real-time market data to recognize patterns that may not be immediately apparent to human traders. The bots collect large-scale datasets from multiple sources, such as news feeds, trading volumes, order book data, sentiment on social media, and historical price data.

The bots utilize sophisticated machine learning and pattern recognition techniques to examine the gathered data and detect recurrent patterns and trends in cryptocurrencies' prices and trading volumes. Following pattern recognition, the bots utilize pertinent attributes or traits to represent each pattern by extracting them from the data.

Example of AI tools for pattern analysis

TradeSanta

Tickeron’s Pattern Search Engine

TrendSpider

CryptoHopper

HaasOnline

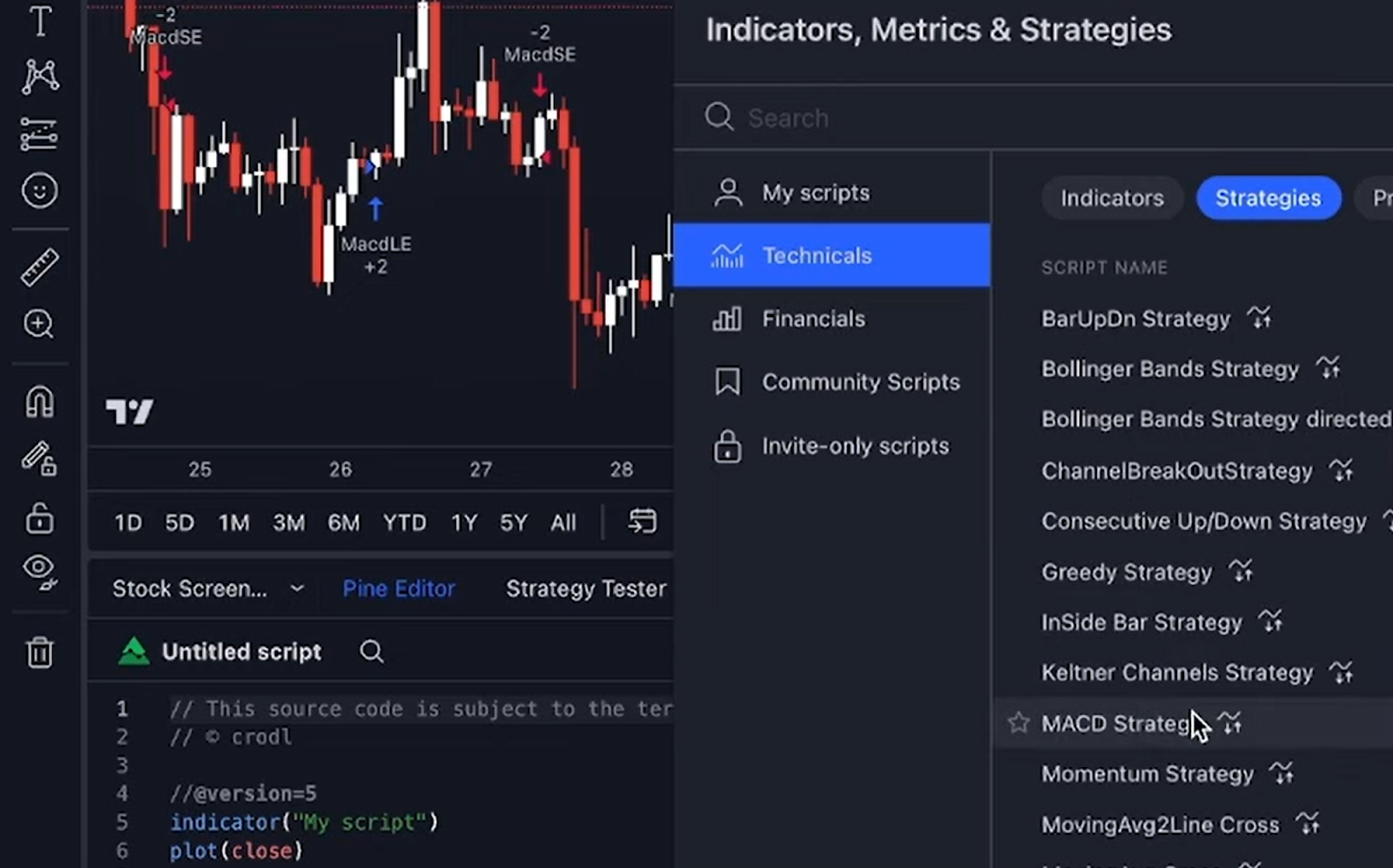

Gunbot

Utilizing artificial intelligence (AI) tools such as TrendSpider for Cryptocurrency Pattern Analysis elevates charting and analysis to a new level by incorporating over 200 built-in indicators, multi-timeframe analysis, and native automated pattern recognition. This AI tool helps to identify and capitalize on profitable trading patterns in the cryptocurrency markets, improve trading accuracy, and lessen emotional bias.

Process

Sign up and launch the AI tool, integrate with preferred trading platform through the SignalStack tool.

TrendSpider aggregates vast amounts of historical and real-time market data from cryptocurrency exchanges, news feeds, social media sentiment, and technical indicators.

Finding possible patterns on charts (such as triangles, wedges, and flags) and in candlestick formations (such as doji and engulfing patterns).

Identifying recurrent patterns and trends through analysis of the data that was gathered.

Highlighting patterns in cryptocurrency price charts to facilitate the identification of patterns that might not be immediately visible to the unaided eye.

Notifications and alerts in real time when new trading opportunities surface.

👍 Benefits

• Enhanced consistency and speeds up analysis

• Beginner friendly and easy to spot reliable patterns instantly without prior skills

• Robust trend line drawing and backtesting functionality

👎 Challenges

• For some users, mastering TrendSpider's extensive toolkit and customization options can be difficult at first due to its steep learning curve. Once more, TrendSpider does not integrate fundamental data or link live brokerage accounts for automated trading because it is primarily focused on technical analysis.

Developing Crypto Strategies with AI

Developing Crypto Strategies with AI

With a wealth of data from numerous sources, AI cryptocurrency trading bots can be used to create trading strategies more quickly. Trading bots gather and assess vast quantities of past and present market data from multiple sources, including order books, price charts, news feeds, trading volumes, and sentiment on social media.

They can recognize levels of support and resistance, technical indicators that indicate possible trading opportunities, and chart patterns like triangles, flags, and head-and-shoulders patterns. Drawing from the observations derived through data analysis and pattern identification, artificial intelligence trading bots aid traders in devising trading tactics. Such tactics may stem from sentiment analysis, identifying volatility breakouts, tracking trends, executing mean reversion strategies, or capitalizing on arbitrage prospects spanning various exchanges.

Example of AI tools for developing crypto strategies

Kryll

3Commas

Automated trading bots

HaasOnline

Using AI tools such as Kryll, traders can develop strategies for opening positions and get assistance in doing so. These strategies enable the bots to assess market data, identify profitable trading opportunities, and automatically execute trades based on predefined parameters.

Process

Register and explore the extensive collection of pre-built trading strategies offered by Kryll.

Create a customized trading plan based on your objectives, risk tolerance, and market knowledge.

Use a variety of technical indicators to determine entry and exit points, such as RSI, Bollinger Bands, and moving averages.

The AI tool uses past market data to perform thorough backtesting of strategies to assess how well they perform in different market conditions.

Deployment to live trading mode on Kryll's platform.

👍 Benefits

• Faster crypto trading strategy development

• Increased Accuracy and Efficiency when used to make data-driven trading decisions

• Improved trade execution and risk management

👎 Challenges

• Developing effective trading strategies requires a deep understanding of market dynamics and technical analysis, so a trader might need to get this knowledge before using this AI tool.

Educational purposes

Learning crypto trading with AI tool

Some AI crypto trading bots can assist in providing educational content to help understand various aspects of crypto trading. These bots are designed to simulate real-world cryptocurrency trading environments for learning and skill development. These bots leverage artificial intelligence (AI) algorithms to replicate the complexities of crypto markets and provide users with hands-on experience in trading without the risks. Educational bots often provide performance metrics and feedback to help users evaluate the effectiveness of their trading strategies. This may include metrics such as return on investment (ROI), win rate, drawdown, and Sharpe ratio. Users can analyze their performance and refine their strategies accordingly.

Example of AI tools for educational purposes

3Commas

Cryptohopper

Pionex

Coinrule

A trader will be better equipped to refine his trading strategies in a simulated environment if he uses AI tools such as 3Commas to improve his crypto trading skills. Without putting money at risk, the trader can test various trading methods and risk management strategies using this AI tool. There are options for instructional materials, such as webinars, articles, and tutorials covering different facets of cryptocurrency trading. Traders can assess the efficacy of trading strategies by incorporating performance metrics like Sharpe ratio, ROI, win rate, and drawdown.

Process

Sign up with 3Commas, choose bot type and connect your exchange.

Visit the learning center to view articles and watch videos about technical analysis and cryptocurrency trading.

Follow, copy, and learn from the trading signals of successful traders.

👍 Benefits

• Availability of a demo account

• Social trading

• 30+ Indicators / 90+ Candle Patterns

• Integration with top crypto exchanges like Binance, BitMex, Bybit, Coinbase Pro, OKEX, etc

👎 Challenges

• The Multiple security breaches on 3Commas puts the AI tool's security under scrutiny.

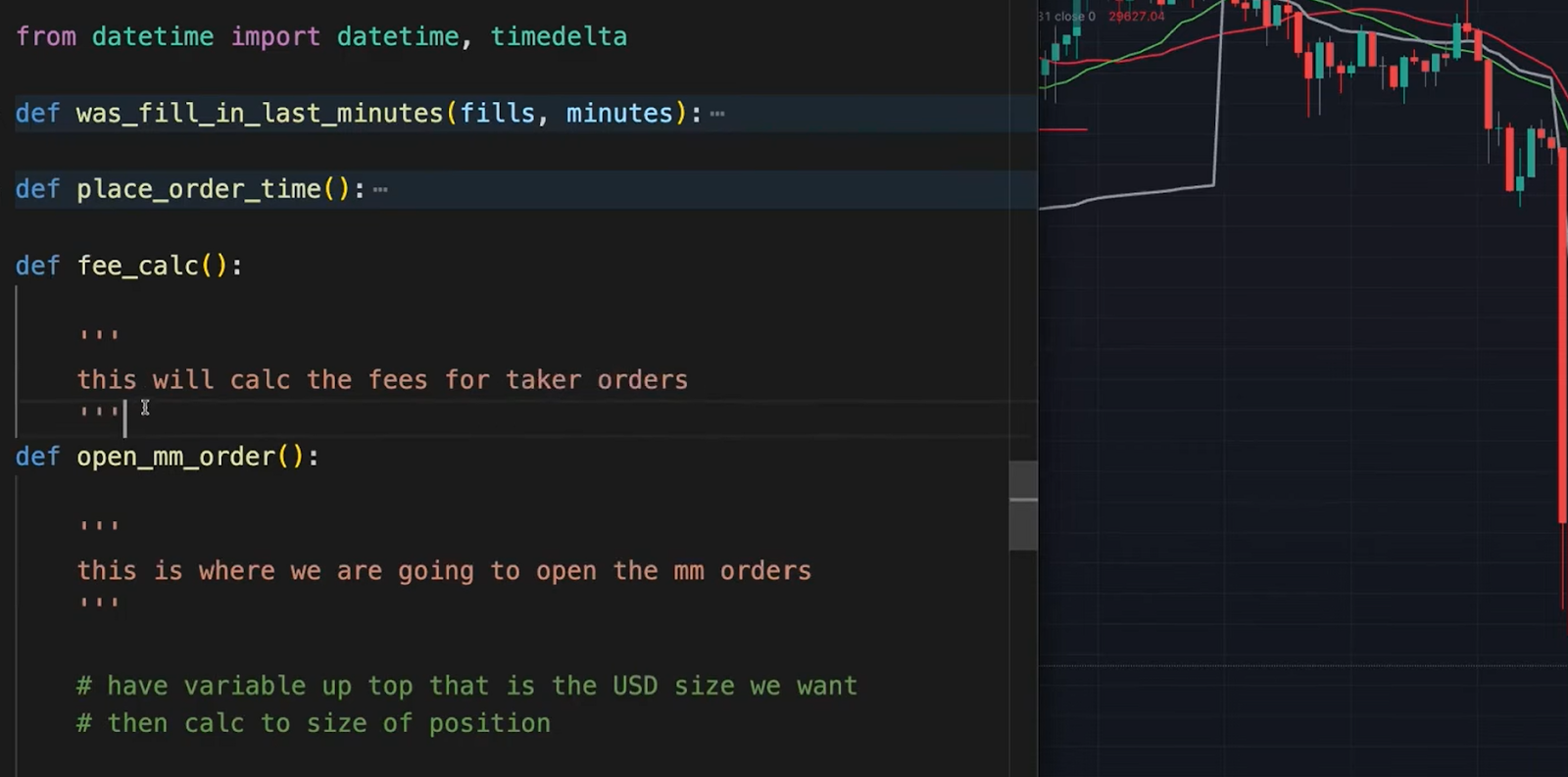

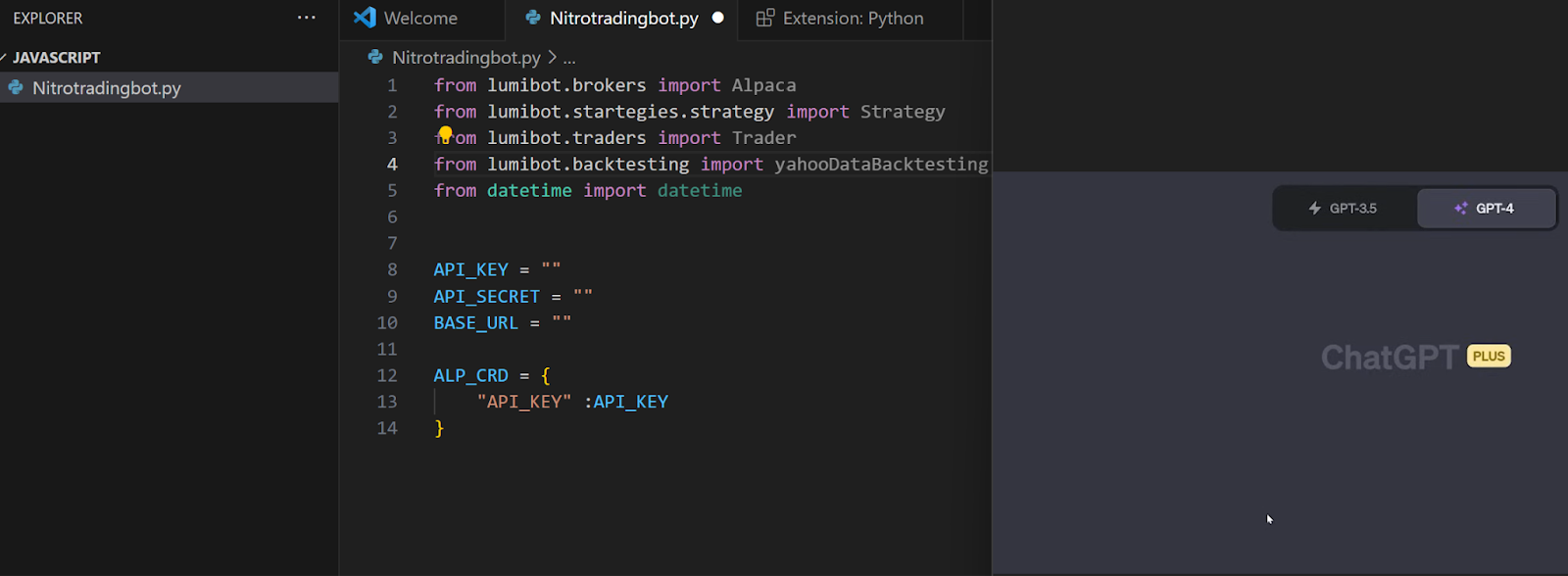

Coding assistance

Coding assistance

Those who implement algorithmic trading strategies can use AI to get help with coding since implementing algorithmic trading strategies involves complex coding tasks to develop and deploy the necessary algorithms. AI-powered tools can generate code snippets or algorithms based on specified criteria or trading strategies.

These tools analyze patterns in existing codebases or historical trading data to suggest optimized code structures. They can assist in optimizing existing trading algorithms for improved performance and efficiency. This may involve identifying redundant or inefficient code segments and suggesting alternative implementations to enhance speed and reduce resource consumption. AI-driven tools can help identify errors and bugs in trading algorithms and provide real-time feedback and suggestions for debugging, reducing the time and effort required for troubleshooting.

Example of AI tools for coding assistance

ChatGPT

GitHub Copilot

Tabnine

OpenAI Codex

Leveraging coding assistance AI tools will alleviate a trader from the challenges of coding complex algorithms efficiently and effectively. The trader can overcome these challenges by integrating ChatGPT, an AI-powered tool for coding assistance.

Process

Install and open a crypto trading coding environment.

Provide ChatGPT with specific criteria and requirements for the trading algorithms, such as technical indicators, risk parameters, and trade execution rules.

ChatGPT generates code snippets based on this input.

👍 Benefits

• Increased Efficiency

• Improved Accuracy

• Real-time feedback for debugging

• Optimization of existing, redundant, and inefficient code segments or algorithms

👎 Challenges

• Notwithstanding ChatGPT's advantages, the AI-powered coding support tool might not be able to fully comprehend the nuances of all trading strategies, which could result in unclear or inadequate code suggestions.

Best crypto exchanges

What makes AI useful in cryptocurrency investing?

When you consider the technicalities surrounding crypto trading, you will understand why AI is a useful tool in crypto investing. For example, cryptocurrency markets generate a vast amount of data from various sources, including price charts, news articles, social media, and trading platforms, and traders must sift through this information to identify relevant signals and trends, which can be overwhelming and time-consuming.

Again, Cryptocurrency prices are influenced by market sentiment, which can be driven by factors such as investor speculation, media hype, regulatory announcements, and technological developments. It can be daunting for novices in the trading industry to navigate the intricate trading platforms, wallets, and exchanges that traders must use.

The intense volatility of cryptocurrency markets is what these AI systems are trained to analyze and spot profitable investment opportunities. AI crypto tools are engineered to optimize the trading procedure, minimize human error, and process transactions at a rate faster than human intervention. Crypto trading bots communicate with markets, evaluate market information, and carry out trades according to preset parameters. In a nutshell, AI bots combat the challenges of cryptocurrency trading by doing the following:

-

Data Analysis and Pattern Recognition

-

Predictive Analytics

-

Automation

-

Market Sentiment Analysis

-

Using encryption methods to safeguard sensitive financial data

Is it legal to trade Crypto with AI?

It is legal to trade using AI crypto trading tools, but the legality may depend on exchange protocols, compliance with financial laws, and legal frameworks in particular jurisdictions. In light of the divergent regulations governing cryptocurrency transactions across nations, the deployment of automated trading systems might face prohibitions. Traders ought to meticulously scrutinize and adhere to the terms of service and regulations stipulated by cryptocurrency exchanges concerning the utilization of automated trading systems, thereby ensuring the legitimacy of their trading endeavors.

While leveraging AI bots can confer benefits in terms of rapidity and efficiency, traders must remain cognizant of the potential hazards linked with automated trading, encompassing probable technical glitches, algorithmic inaccuracies, and instances of market manipulation. Implementing robust risk management strategies can help mitigate these risks and guarantee compliance with statutory obligations.

Is AI crypto trading safe?

The safety of trading with AI crypto bots can only be ascertained after reviewing the pros and cons of trading with this tool. Generally, it is safe to trade with this tool as it takes the normal position of humans when trading in the crypto space, but you must understand that there are some inevitable risks encountered when trading with these bots. This can offer insights into the safety of trading with AI tools. Below are some of the pros and cons of trading cryptocurrency with AI tools.

👍 Pros

• AI systems are far quicker than human traders at executing trades and analyzing enormous volumes of data. Certain trading techniques, including arbitrage, call for a response time that is much quicker than the human eye can follow the market. This process is instead optimized by AI bots.

• Trading bots offer a methodical and disciplined approach to trading by implementing sophisticated algorithmic strategies based on technical indicators, machine learning models, or a combination of factors.

• Artificial intelligence (AI) trading bots can work around the clock, seven days a week, in contrast to human traders, who require breaks. This lets them continuously monitor market conditions and opportunities.

• AI bots trade using preset algorithms and parameters, removing the impact of emotions like greed and fear, which frequently cause human traders to make illogical choices.

• AI bots trade using preset algorithms and parameters, removing the impact of emotions like greed and fear, which frequently cause human traders to make illogical choices.

• With AI, traders can optimize their strategies for improved performance by conducting extensive backtesting using historical data.

• Increased portfolio diversification is possible thanks to AI trading systems' ability to track and trade several cryptocurrencies simultaneously.

👎 Limitations

• AI bots are not impervious to malfunctions or system failures, which, if improperly monitored, can result in losses or missed opportunities. Errors and bugs can occur in even the most advanced AI algorithms, leading to unexpected trading outcomes.

• Overfitting AI algorithms to past data carries a risk and can result in subpar performance in real-time trading scenarios if the market moves differently than it did during training.

• The legal and compliance environment for trading cryptocurrencies and AI-powered trading is still developing, and traders may run into issues in some jurisdictions.

Note:

In terms of security, reputable auto trading AI platforms employ cutting-edge encryption technology to safeguard user data and money. But no system is impenetrable to data breaches or hackers.

Is AI suitable for beginners in crypto trading?

Using AI tools in cryptocurrency trading depends on the individual's level of technical understanding, risk tolerance, and willingness to learn. So, a new trader desiring to use AI crypto trading must do the following:

-

Beginners ought to be familiar with the fundamentals of AI algorithms and how to use them in cryptocurrency trading. Being an expert programmer is not a must, but it can help to have some understanding of ideas like algorithmic trading and machine learning.

-

To avoid legal problems, traders must make sure the AI trading platform they use complies with all applicable regulations in their jurisdiction. Select a trustworthy AI trading platform from your research that provides clear pricing, dependable performance, and excellent customer service.

-

Beginner traders must remain cognizant of the associated risks and be prepared to employ effective risk management strategies.

-

Novices should weigh the cost-effectiveness of using such tools when deciding whether to pay subscription fees or commissions for some AI trading platforms.

-

Start with a modest investment and progressively increase it.

-

Keep an eye on the performance of your AI trading bot at all times, and be ready to modify your tactics as necessary.

-

Keep abreast of the most recent developments in the cryptocurrency space, as well as any changes to regulations and new trends that might affect your trading approach.

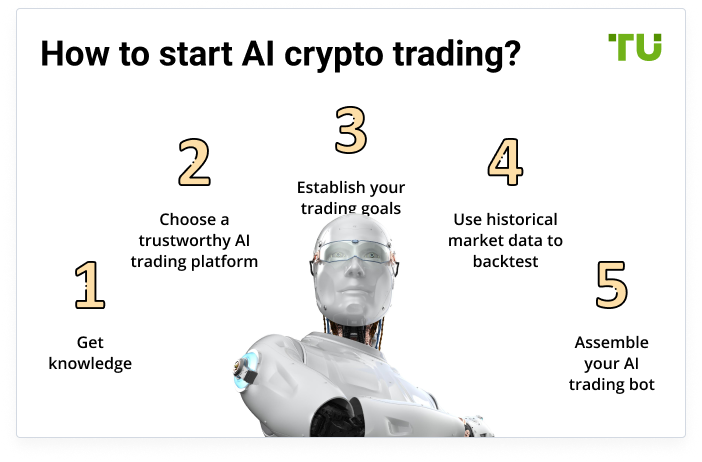

How to start AI crypto trading?

Here's a step-by-step guide on how to start AI crypto trading:

Get knowledge about ideas for crypto exchanges, order types, market dynamics, cryptocurrencies, blockchain technology, and more. Understand the principles of artificial intelligence (AI) and machine learning (ML), as these technologies form the foundation of AI cryptocurrency trading bots.

Choose a trustworthy AI trading platform, register for an account on the preferred platform, and complete the necessary verification procedures. Deposit money into your account using one of the accepted payment methods after account verification.

Establish your trading goals and choose suitable trading tactics for your AI bot. Strategies range from straightforward trend-following techniques to complex arbitrage or sentiment analysis models. Choose investment strategies based on your risk tolerance and investing goals.

Use historical market data to backtest strategies before implementing your AI bot in live trading.

Assemble your AI trading bot by setting up variables like timeframes, risk management policies, trading pairs, and other mutable options. After your AI bot is up and running, keep a close eye on its performance. Monitor metrics like win rate, drawdowns, and profitability.

Top-3 AI crypto trading bots

ByBit Aurora AI

Bybit Aurora AI is an innovative automated trading technology designed to improve and optimize trading strategies using AI. The bot uses advanced artificial intelligence algorithms to analyze market data and formulate optimal trading strategies. The platform offers different types of strategies including stable, high return and high frequency strategies. The Futures Grid Bot AI strategy demonstrates a success rate of over 70% of trades, emphasizing efficiency in generating consistent returns.

The bot is backtested using seven days of data to determine optimal strategy parameters and provide the user with recommendations on how to customize the bot. Historical market summaries are analyzed to identify 18 sets of optimal strategy parameters, focusing on factors such as profitability, arbitrage frequency and drawdown risk.

Bybit Aurora AI has a simple and straightforward interface, which makes it attractive to beginners and experienced traders. They can simply enter their desired investment amount and copy the intelligent parametric strategies formulated by the bot directly. These strategies are categorized as High Yield, Stable, and High Frequency, each tailored to different preferences and trading objectives.

Cryptohopper

One of the leading platforms for automated trading using AI. Cryptohopper supports a wide range of cryptocurrencies and interacts with over 70 leading markets, allowing users to diversify their portfolios and utilize different market opportunities. Within the Backtesting section, you have the capability to assess the strategy's performance using historical data. 8 cryptocurrencies are available: BCH, BNB, BTC, EOS, ETH, LTC, XRP, XTZ.

Sgurtochorper is a set of tools for trade automation focused on the use of bots. Users can create up to 20 bots simultaneously, customize their parameters through a user-friendly interface, and choose from four customizable strategies. Hopper trading bots are created based on three algorithms: automated trading (classic bot with the ability to customize parameters, sell, buy, Stop Loss and Take Profit), arbitrage and market maker.

Integration with 15 cryptocurrency exchanges via API keys allows users to quickly manage their assets on various platforms. In addition, additional tools such as account statistics, signal and strategy elaboration, as well as the ability to test in Paper Trading mode are available. Another feature of Cryptohopper is social trading, through which beginners can follow and copy other traders' strategies.

Learn2Trade

Learn 2 Trade Algorithm is a trading robot that works autonomously and offers unique opportunities by analyzing the market in real time and instantly notifying users of profitable trading opportunities via Telegram. By connecting the Telegram channel to a Cornix account, the client fully automates the trading process. The bot ensures that strategies are run in the background and risks are taken into account, making cryptocurrency trading more efficient and profitable for users.

The main focus of the bot is to identify daily trading positions that open and close within a few hours. However, depending on market conditions, automated trades that stay open longer can also be found. Learn 2's trading algorithm also includes stop loss and take profit price levels before making a trade. The minus of the bot is the lack of a free version.

The Learn 2 Trade bot uses entry and exit strategies, which allows it to manage risk by using limit orders and minimizing potential losses. The accuracy of the L2T algorithm is 79%, helping users avoid unnecessary losses and ensuring consistent profits by utilizing an appropriate balance of risk and reward. The robot uses a 1:3 ratio, setting an acceptable level of risk without the need to place orders manually.

Expert Opinion

While trading bots have existed for some time, their efficacy has surged with the integration of AI technology, facilitated by its rapid advancement. In the dynamic and cutthroat landscape of cryptocurrency markets, traders stand to bolster their profits through the utilization of AI-driven crypto trading utilities, streamlining operations, mitigating risks, and fostering more informed decision-making. It is imperative to opt for a platform for AI-powered cryptocurrency trading that boasts reliability, safety, and user-friendliness. Features and tools requisite for such platforms include diverse order types, sophisticated charting capabilities, and technical analysis resources. Additionally, seamless integration with trading bots via a robust API with access to an extensive array of cryptocurrencies is paramount.

AI trading tools should not overshadow alternative research and analysis methodologies; rather, they should be integrated into a broader investment strategy that encompasses both technical and fundamental analyses. Recognizing that AI tools are vulnerable to security threats and cyberattack akin to other online applications, it is crucial to employ secure tools sourced from reputable channels.

Conclusion

Artificial intelligence (AI) bots for cryptocurrency trading facilitate quicker data analysis, offer opportunities for spot trading, and execute trades in cryptocurrency markets with accuracy, efficiency, and efficacy. Trading bots are not a universally applicable solution, but they can be useful tools when used appropriately. Bots should be used carefully, even though they can automate tasks and increase efficiency.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).