Which Сryptocurrencies to Buy Today for the Short Term

Cryptocurrencies that may be of interest to short-term investors:

The best coins for short-term investment are high-liquidity coins that are among the top 100 coins by capitalization. Their daily profitability can be 1%-3%. It is better to buy Bitcoins and altcoins on cryptocurrency exchanges.

-

Which cryptocurrencies will boom in 2024?

According to experts, the entire cryptocurrency market is expected to grow in 2024 outpacing its previous highs. As a percentage, tokens and altcoins below the top 10 coins by capitalization show a greater percentage of growth.

-

What cryptocurrencies are the best investment for quick profit?

Usually, the market grows unanimously. If there is positive news, almost all coins from the top 100 coins by capitalization grow. Certain coins can grow against local news about attracting investments and launching new technologies.

-

Should we invest in cryptocurrencies right now?

Market capitalization is far from its all-time highs, so many experts expect significant growth of cryptocurrencies in the long term. In the short term, it’s better to focus on buy signals.

-

What is the best cryptocurrency for quick profit?

This cryptocurrency is prepared to be listed on major exchanges with a startup launch. Such coins can grow by over 100% within the first days. Take into account the high-risk level — most coins decrease due to sales of cryptocurrencies bought at reduced prices at presales.

Best crypto exchanges for shor-term traders

Best cryptocurrencies to buy now

This block links reviews of the best cryptocurrencies available today for short-term investment. All these are high-liquidity coins that are in the top 100 coins of CoinMarketCap, exist for at least 2 years, and are actively supported by the community and developers.

Important!

The rating of cryptocurrencies is compiled automatically based on Traders Union's own algorithm. It takes into consideration indicators and cryptocurrency intraday activity. Remember that short-term cryptocurrency trading involves high volatility and that no strategy guarantees 100% results. This collection is not investment advice.

VeChain

VeChain (VET) is the native token of the VeChain blockchain platform. VeChain is a public blockchain platform built to improve supply and logistics management, and ensure transparency in various industries, such as production, pharmaceutics, agriculture, and retail trade. The key focus of VeChain is to improve product traceability and authentication through the use of the blockchain technology and RFID (Radio Frequency Identification). The VET token is used for paying transaction fees and staking, and also to ensure security and consensus in the network. VeChain aspires to offer a reliable solution to improve efficiency and trust in business processes.

VET analytical forecastAvalanche

Avalanche (AVAX) is the native cryptocurrency of the Avalanche blockchain platform that provides high transaction speed, security and scalability for decentralized apps (DApps) and financial transactions. Launched in September 2020, Avalanche uses a unique Avalanche Consensus protocol that provides for instant validation of transactions and problem-free confirmations. AVAX is used for paying fees, performing transactions and ensuring the safety of the network. Avalanche enjoys increasing interest in the cryptocurrency community thanks to the platform’s technology innovations and potential for developing various DApps and financial solutions.

AVAX analytical forecastCardano

ADA is the native cryptocurrency of the Cardano platform. Cardano is a blockchain project that was created based on academic principles and tested methods to ensure safety, scalability and stability. ADA was launched in 2017 to facilitate operations in the Cardano network, including transactions and decentralized apps (DApps). The cryptocurrency uses the Proof-of-Stake (PoS) consensus algorithm that provides for a more effective use of resources and sustainability compared to the traditional Proof-of-Work (PoW) mechanism. ADA has become a popular choice for investors and members of the cryptocurrency community thanks to its technical innovations and a positive outlook.

ADA analytical forecastStellar

Stellar (XLM) is a decentralized cryptocurrency created to facilitate quick and cheap international transactions and transfers. It runs on Stellar, a blockchain platform with a focus on financial services, including currency exchange, micro payments and transfers. Stellar uses Stellar Consensus Protocol to confirm transactions. XLM enjoys popularity among financial institutions and payment providers, as it provides quick and reliable transfers across the world, especially in developing countries, where access to traditional financial services may be limited.

XLM analytical forecastTron

TRON (TRX) is the native cryptocurrency of a blockchain platform, which was developed for creating decentralized applications (DApps) and entertainment, social media and online gaming content. Created in 2017 by Chinese entrepreneur Justin Sun, Tron aims to create a global content ecosystem, free of intermediaries, such as YouTube or Apple Store. TRX plays an important role on the TRON Platform, and is used in payments, for incentivizing developers of DApps and rewarding network participants through staking and delegating. Tron has gained wide support in the crypto community and continues to develop as a promising project with an active community.

TRX analytical forecastHow to choose the best cryptocurrencies for short-term investment

Short-term trading is intraday trading or investment with a horizon from several days to 1-2 weeks. The main requirements for coins are high liquidity and high volatility with moderate risks. Such coins can be quickly sold in case of unexpected price reversal with low spread and no slippage.

Short-term trading options:

-

Buy and hold. This is a sale a few days after purchase. This strategy involves buying after news drivers are released.

-

Trend trading, swing trading. This is short-term intraday trading based on technical analysis indicators.

-

Scalping. This is two-directional trading with holding positions on the market from several minutes to several hours.

It is better to buy cryptocurrencies on CEX (Centralized Exchanges) and DEX (Decentralized Exchanges) which have the widest choice of coins. Storing them is best on accounts opened with a CEX or on cold/hot wallets. This option is good for several-day investment. Another option is to open trades with CFDs on cryptocurrencies on Forex. The choice here is limited to the most popular coins, but it is possible to open trades with other assets. This option is good for intraday trading since long-term trading involves spreads.

Criteria for choosing the best cryptocurrencies for short-term investment:

-

Capitalization. The higher the capitalization, the higher the volatility. Capitalization shows investor interest in cryptocurrency.

-

Price movement history. Long-term charts show strong support and resistance levels, average volatility in the short term, investor interest, and fundamental factors that lead to sudden price movements within previous periods.

-

Startup sector. This implies the startup idea, the tasks it is intended for, and a road map. Startups with a narrow specialization can suddenly appear in the short-term period, but their continued growth in the long-term period is questionable.

-

Startup history. For example, platform failures in the short term can result in a strong drawdown.

-

Developers, major investors. For example, Solana’s proximity to FTX (the FTX exchange) has become one of the reasons to control growth in its price.

To compile Traders Union’s rating of the best cryptocurrencies for short-term investment, the following factors were taken into account: capitalization, project reliability and frequency of its mention in the media, startup’s utility for the community, favorable news background, and price dynamics within previous periods.

Tips for novice investors:

-

Follow the ICO (Initial Coin Offering) updates. When a startup is launched, the price most often increases by several times followed by the same sudden decrease. Your task is to buy and sell the coin before its price decreases. Information on future ICOs is available on websites of analytical portals.

For example, the Recently Added tab on the CoinMarketCap portal provides a list of recently added coins.

CoinMarketCap website

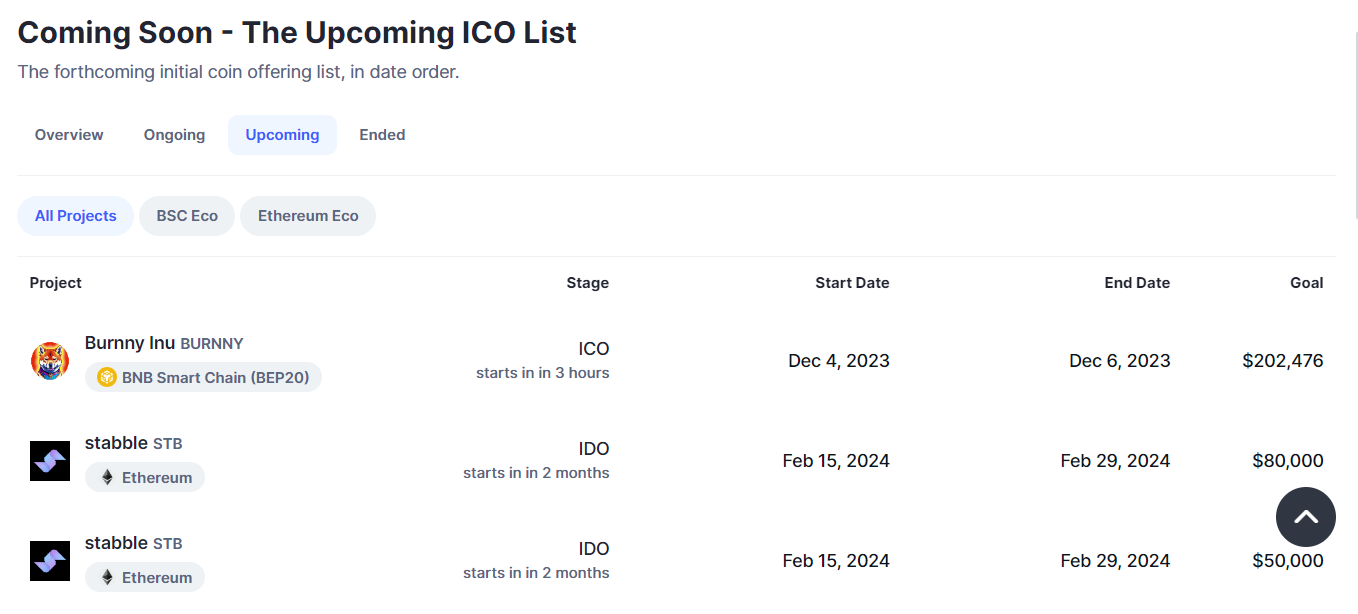

Also, the CoinMarketCap website provides a list of upcoming and recently ended ICOs/IDOs (Initial DEX Offerings). The ended offerings allow investors: to analyze starting and upcoming dynamics, visit startup websites, and check the presale conditions.

CoinMarketCap website

-

Consider purchasing coins at presale. Prior to the launch of a startup, its coins can be purchased directly on the developer’s website. The price can be 10%-20% lower than the price at the time of its launch.

-

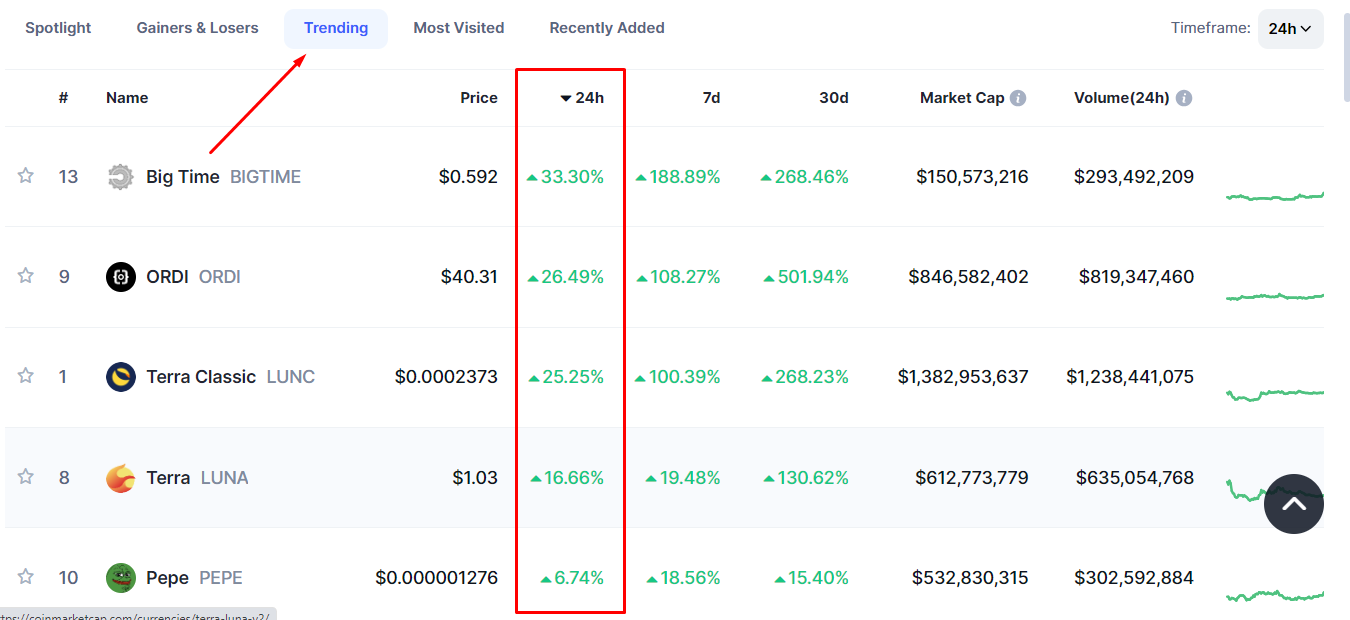

Use the metrics of analytical resources. For example, sort out the most increased coins within the last hour or 24 hours.

CoinMarketCap website

An increase within the last 24 hours doesn’t mean that it will continue further. On the contrary, a strong rollback is possible. It is important to understand the fundamental reasons for this growth. And perhaps you will have time to take part in an uptrend in the short term.

-

Follow the fundamental news. An example is Elon Musk whose comments and Dogecoin deployment policy resulted in a sudden short-term increase of the coin.

-

Follow the airdrop updates. Airdrop is a free or almost free distribution of tokens to users and community members for marketing purposes. For owning tokens you receive additional tokens, which is an opportunity to receive additional income at the moment of a startup launch.

Note:

The above tips apply to coins with different risk levels. For example, you can’t evaluate the startup’s further prospects at the moment of its launch. This risk is high, but at the same time, its profitability can be over 100% within the first days after launch. Coins that are among the top 100 coins by capitalization are on the contrary low-risk instruments, but their potential profitability is much lower.

What news affects the price of cryptocurrency in the short term

Factors that affect the price of cryptocurrency in the short term:

-

Fundamental news affecting the entire market. These are regulatory policies, large investments in crypto technologies, exchange and startup bankruptcy, etc.

-

Local startup fundamental news. These attract new investors and additional investments, increasing TVL (Total Value Locked) for certain types of startups, launching of new products on the startup platform, etc.

-

Total market dynamics mainly set by Bitcoin. If there are fundamental factors for BTC growth, other coins also grow.

Also, in the short term, the price of cryptocurrency may be affected by speculative demand. As soon as the market starts to gradually move up, retail investors start to buy, further accelerating the market. Your task is to buy cryptocurrency before it reaches its peak when the majority starts recording their trades.

Summary

Short-term trading is more complicated as compared to long-term. In the long term, cryptocurrencies are likely to grow, since the gradual easing of regulatory policies and the increasing number of users involved in cryptocurrency technologies are drivers of demand growth. In the short term, traders have to predict a short-term trend and sell the asset. However, in the short term, traders can earn much more due to timely sales before the drawdown. Don’t be afraid to take risks, diversify them, try to keep up to date with the news, be the first, believe in yourself, and you will succeed!

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).