TOP 10 Decentralized Crypto Exchanges in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

OKX - Best crypto exchange for 2025 (United States)

An account on a decentralized crypto exchange is the first step you need to take toward becoming a crypto trader. Decentralized exchanges have recently increased due to the popularity of blockchain technology and cryptocurrencies.

However, since there are many decentralized exchanges available today, it can be challenging for crypto traders to find one that's best for their needs and trading preferences. This guide talks about the ten best decentralized crypto exchanges for traders with different expertise levels, trading requirements, and geographical locations.

What is a Decentralized Crypto Exchange?

Typically, there are two types of crypto exchanges: centralized and decentralized. Centralized crypto exchanges are the more traditional exchanges with a certain degree of regulation. These exchanges require users to deposit their funds into the exchange's wallet and then use those funds to trade cryptocurrencies.

Moreover, centralized exchanges require specific licenses for operation and are regulated. Therefore, they also comply with regulatory authorities.

On the other hand, decentralized exchanges are peer-to-peer apps that don't require users to deposit their funds into an exchange's wallet. Instead, these exchanges allow users to trade cryptocurrencies directly with each other. In addition, it makes decentralized exchanges more secure than centralized exchanges because users don't need to trust the exchange with their funds.

Decentralized exchanges have automated algorithms to coordinate trading between users instead of a centralized financial body acting as an intermediary between the buying and selling parties. Decentralized exchanges also have lower transaction fees since users can hold their crypto assets. Plus, there are fewer regulatory restrictions or burdens.

- Pros of DEX

- Cons of DEX

- No ID verification or KYC needed

- Minimize fake trading volume, and price manipulation

- Lower transaction fees

- Maintains user confidentiality

- Allow users to trade all cryptocurrencies

- Low liquidity

- Lost funds or data cannot be recovered

- Limited support for advanced trading functions

DEX vs CEX: Comparison Table

CEX refers to centralized exchange while DEX means decentralized exchange. Both of these platforms allow users to exchange, sell, and buy cryptocurrency. However, they differ in centralization, transaction fees, security, and other features.

| Features | DEX | CEX |

|---|---|---|

| Book Maintenance | On the blockchain | By a single organization |

| Trading | Peer-to-Peer | IOU-based transactions for database processing |

| Location Specific | No (anyone can use it regardless of geographical location) | Yes (users have to be in a specific location because of KYC compliance) |

| Government Regulation | No (governments cannot interfere in the platform) | Yes (governments can freeze user assets or shut down the crypto exchange) |

| KYC Procedures | No | Yes |

Best Decentralized Crypto Exchange in 2025 - Full List

Decentralized crypto exchanges are ideal for crypto traders who want to enjoy lower transaction fees and higher anonymity. The exchanges in this guide are ranked based on their working mechanism, commission fees, exchange process, and popularity. Here are the top decentralized exchanges for 2025.

Uniswap is among the top decentralized exchanges, being one of the first platforms to gain immense popularity in the crypto world. The platform is an automated market maker, which means it is responsible for matching buyers and sellers to create a liquid market.

The Uniswap protocol is designed to allow users to exchange tokens without needing a third party. The protocol uses Ethereum smart contracts to automate the process of exchanging tokens.

Type

As mentioned above, Uniswap is an AMM. Therefore, Uniswap lets users trade ERC02- tokens with an AMM protocol using liquidity pools. A liquidity pool is a grouping of ERC20 tokens that users have deposited.

The Uniswap protocol is based on creating and destroying liquidity pools. When users want to exchange tokens, they first need to select a liquidity pool. The liquidity pool chosen is then used to execute the trade.

Fees

Every time you execute a trade on Uniswap, liquidity providers earn a specific fee based on the liquidity supplied by them. Usually, this fee is 0.3% of the transactions. However, the fees are up to 1% when exotic pairs are traded and down to 0.05% when stable assets are traded.

- Pros

- Cons

- Full anonymity for users

- Open-source code and high transparency

- Supports a large number of ERC20 tokens

- Only supports Ethereum-hosted tokens

2. Curve

Curve is an ideal decentralized exchange for traders who are interested in stablecoins. The platform has swap solutions for users, allowing them to trade close-in-price assets, such as stablecoins, with low fees.

Curve uses bonding curves to allow users to trade assets with each other. When a trade is initiated, the Curve system creates a smart contract that locks the traded tokens. The locked tokens are then used to generate two new tokens. The first is known as the bonding token and the second as the borrowing token.

The bonding token represents the underlying asset's value, while the borrowing token represents the debt. The bonding token can be used to repay the debt or traded on a secondary market.

Type

Like Uniswap, Curve also works on the AMM protocol. Thus, the platform has liquidity providers who earn fees for supplying liquidity to the market. In addition, the DEX is Ethereum-based and allows users to trade cryptocurrencies based on cryptocurrency pools provided by its users rather than a central order book.

Fees

The fees on Curve are based on the volume of transactions and the exchange rate between stable coins. The website has a real-time calculator that calculates the exchange rate, including the fees. Currently, the fees are 0.04% per transaction

- Pros

- Cons

- Simple smart contracts

- Lower risk of an impermanent loss

- Low transaction fees

- Concerns regarding liquidity returns

- Fluctuating Ethereum fees

3. PancakeSwap

PancakeSwap is among the top decentralized exchanges, supporting many BEP-20 tokens. In addition, the platform also has a governance token called CAKE.

Besides being a DEX, PancakeSwap also has other features like an NFT market, a lottery game, and yield farms. As for the DEX side of the platform, it supports a wide range of features, including limit and market orders, stop-loss and take-profit functions, and margin trading.

PancakeSwap has also been designed for security, with features such as 2FA and a withdrawal lock-in period. The platform is also working on implementing atomic swaps.

Type

PancakeSwap is an automated marker maker built on the BSC or the Binance Smart Chain. Being an AMM, the decentralized exchange has been designed to provide liquidity, security, and governance.

Fees

Every time you make a trade on the platform, you have to pay a 0.25% trading fee. It means you pay 0.25% of your trade transaction in fees. 0.17% of this fee goes back to liquidity pools, rewarding liquidity providers, while 0.05% goes for burn and back buy of CAKE, and 0.03% goes to PancakeSwap Treasury.

- Pros

- Cons

- Supports BEP-20 tokens

- Rewards users that add liquidity to the platform

- Also has other useful functionalities

- Is not beginner-friendly

- Does not have a native wallet

4. SushiSwap

SushiSwap is a decentralized exchange that lets users swap their crypto assets across multiple layer-2 platforms and blockchains. It means you can swap your tokens with other users on the SushiSwap platform and users on other exchanges that support the SushiSwap protocol. The exchange has been built on the 0x protocol and uses ERC-20 tokens. It is also compatible with Ethereum, Bitcoin, and Litecoin.

Moreover, the platform has additional features, such as the MISO launchpad, on-chain lending, and yield pools. MISO lets users launch their tokens, while on-chain lending allows users to borrow tokens from other users on the network.

Type

Since SushiSwap is an automated market maker, you can add liquidity to the platform and earn rewards. Adding liquidity to SushiSwap means you're providing other users with the ability to trade their tokens.

Fees

The 0x protocol charges a minimal fee of 0.3% for each transaction. 0.25% of this fee goes to the liquidity providers, while the remaining goes to the SUSHI token holders.

- Pros

- Cons

- Allows swapping across blockchains

- Supports many assets

- Ease to use and navigate

- Many initiatives based on the native token, such as staking, farming, and liquidity pools

- Security Concerns

5. SpookySwap

Based on Fantom Opera Blockchain, SpookySwap is a decentralized exchange that offers users fast and secure trading. It allows you to trade Fantom-based tokens and other ERC-20 tokens.

The platform also allows users to initiate limit orders along with standard swaps. As a result, users can trade their tokens at the best prices.

Type

SpookySwap uses the AMM protocol to provide liquidity and security. It also offers users the functionality of limit orders, making it a versatile exchange.

Traders have to make MetaMask wallets to connect with Fantom Opera before they can start trading on the platform. After creating this account, you have to connect the wallet to SpookySwap. Then, you can swap any token you want.

Fees

The platform charges a 0.2% fee for every trade. However, the fee is 0.22% for limit orders. 75% of the commission fee goes to liquidity providers, and the remaining is distributed among BOO (the platform's native token) holders.

- Pros

- Cons

- Integrates with MetaMask and Coinbase wallet

- Allows limit orders

- Allows users to earn rewards by providing liquidity to the platform

- Difficult to navigate

6. Raydium

Built on Solana, Raydium is an automated marker maker that gathers liquidity from the order books of Serum (a partner platform) and its users. Since liquidity aggregation is from two sources, Raydium always ensures traders get a handsome price for crypto.

Apart from the decentralized exchange, Raydium also has a launchpad called AcceleRaytor. The launchpad has helped bring many Solana projects to life, including Genppets and Star Atlas.

Type

As mentioned above, Raydium is an AMM. Thus, it works like many platforms listed above. However, the difference between Raydium and other DEX like Uniswap is that the former is built on Solana while most other AMMs are Ethereum-based.

Fees

Raydium charges a 0.25% fee on every trade. 0.22% of this commission fee goes to the liquidity pool and the remaining goes for staking the platform's native token called RAY.

- Pros

- Cons

- Fast transaction speed

- Low fees

- Gives users access to the order books of Serum

- Can only interact with one other DEX

7. Serum

Serum is another Solana-based DEX that offers low transaction costs and fast speeds. Being a permissionless exchange, Serum allows traders to execute trades at unprecedented rates.

The platform supports derivatives trading, which means that users can trade various cryptocurrency derivatives contracts, including perpetual swaps, futures, and options. Serum is also the first DEX to offer a decentralized margin trading platform.

Type

Since Serum has cross-chain support, it lets traders buy or sell assets based on other platforms, such as Polkadot and Ethereum. Other DeFi projects also have access to Serum's liquidity and features, irrespective of their base blockchain.

Fees

Serum charges different fees based on the fee tier for each transaction. For example, 80% of the commission fees go to buy and burn the platform's native token called SRM. Meanwhile, 20% of the fees go to GUI hosting or the project.

- Pros

- Cons

- Offers cross-chain support

- Allows DeFi project access

- Ideal for derivatives trading

- Complicated fee structure

8. QuickSwap

QuickSwap is the best decentralized crypto exchange to trade assets built on Polygon. The platform allows traders to buy and sell ERC-20 tokens with low gas fees and fast speed.

Like SpookySwap, QuickSwap also supports limit orders. Thus, it allows traders to get the best deal and enjoy maximum flexibility when trading.

Type

Being an Ethereum-based permissionless DEX, QuickSwap uses Layer 2 of the Polygon Network for transactions. Thus, it lets users trade assets with almost-zero gas costs at fast speeds.

Fees

Like many other platforms, QuickSwap charges a 0.30% trading fee. It's a flat fee and remains the same, irrespective of the currency pair or the transaction size.

- Pros

- Cons

- Allows permissionless listing

- Supports layer-2 transactions for blazing-fast speeds

- Meager gas costs

- Low liquidity

9. AstroSwap

AstroSwap is a decentralized exchange made for a blockchain called Velas. The blockchain is a Solana fork using ''artificial intuition''. Its technology helps nodes make faster and better decisions without the need for a human. The AI allows nodes to process information faster and more accurately.

The Velas blockchain provides fast, secure, and scalable transactions for businesses and users. AstroSwap is one of the first exchanges built on the Velas blockchain.

Type

AstroSwap claims to be the first ''interstellar DEX'' in the world. In addition, the platform allows yield farming, which means users can earn tokens by locking up their assets.

Although the platform is currently based on Velas, it is designed for Cardano. As a result, users will be able to leverage the Swapz bridge for trading native assets of Cardano on the DEX without the involvement of a queue or waiting time.

Fees

The platform calculates the fees when you initiate a trade. Being an unusual DEX, it can take users some time to get used to the forum. However, that doesn't mean the user experience surrounding fee structures is murky. It's easy to navigate.

- Pros

- Cons

- Allows yield farming

- Lets traders use the Swapz bridge

- Removes waiting times for buying Cardano's native tokens

- Relatively unusual

- Could be hard for beginners

10. TraderJoe

TraderJoe allows users to trade on Avalanche. The decentralized exchange has multiple features: a launchpad, DeFi lending, yield farms, and a swapping platform.

Since the platform has a user-friendly interface, it's the best decentralized crypto exchange for beginners. Currently, you can trade more than 100 Avalanche-based crypto assets on TraderJoe.

Type

The TraderJoe protocol recently announced a system called modular staking. The modular staking system is a new feature that allows users to stake different tokens to receive rewards. It helps diversify the rewards that validators receive and allows for more flexibility when choosing tokens to stake.

By staking different types of tokens, you'll be able to receive rewards from a broader range of activities on the TraderJoe platform.

Fees

TraderJoe charges a 0.05% fee on all trades. The fees go to the xJOE pool.

- Pros

- Cons

- Offer DeFi lending and a launch pad too

- Supports modular staking

- Highly flexible

- Relatively lesser-known

- Does not support as many tokens as other DEX do

Decentralized Exchanges Comparison

| DEX | Rank (CoinMarketCap) | Volume (24h) | Type of Assets | Fees |

|---|---|---|---|---|

| Uniswap | 24 | $328,443,251 | Thousands of ERC-2 tokens | 0.3% |

| Curve | 78 | $276,095,782 | Stablecoins | 0.04% |

| PancakeSwap | 51 | $443,132,415 | BEP-20 tokens | 0.25% |

| SushiSwap | 133 | $218,629,738 | Thousands of ERC-2 tokens | 0.3% |

| SpookySwap | 2977 | $3,463,975 | Thousands of ERC-2 tokens | 0.2% |

Raydium | 178 | $323,098,088 | Thousands of ERC-2 tokens | 0.25% |

| Serum | 159 | $173,448,055 | Cryptocurrency derivatives | Tier-based |

| QuickSwap | 465 | $16,551,764 | Thousands of ERC-2 tokens | 0.30% |

| AstroSwap | 1188 | $222,434 | Thousands of ERC-2 tokens | Variable |

| TraderJoe | 192 | $18,605,208 | Avalanche-based crypto assets | 0.05% |

How to Choose the Best Decentralized Crypto Exchange?

When selecting a decentralized crypto exchange, there are several factors to consider. Here are some of them.

Security

The most crucial factor is the security of the exchange. Ensure the exchange has a good reputation and uses robust security measures, such as two-factor authentication and encrypted wallets.

Daily Turnover

The daily turnover refers to the amount of trading on the exchange. The higher the turnover, the more liquid the exchange. Many decentralized exchanges (DEXs) struggle with liquidity, making it difficult for traders to buy and sell efficiently. An exchange like Hyperliquid solves this problem by implementing a smart liquidity system that keeps markets active, so trades happen quickly with minimal impact on price.

Higher liquidity means you will be able to buy and sell cryptocurrencies more efficiently. Therefore, an exchange with a higher daily turnover will be ideal for active traders.

Fees

Another critical factor is the fees charged by the exchange. Some exchanges have very high costs, while others are more affordable. Make sure you compare the fees before selecting an exchange.

Some crypto exchanges may also have a tier-based fee. If you plan to make larger trades, such an exchange will be suitable since fees are comparatively lower at the top tiers.

Supported Cryptocurrencies

Another important consideration is the number and variety of cryptocurrencies supported by an exchange. How many cryptocurrencies does the exchange support? Are they stablecoins? Are they ERC20 tokens? It would be best to choose the exchange where the tokens of your choice are readily available for trading.

Ease of Use

The last factor to consider is ease of use. How user-friendly is the exchange? Is it easy to navigate? Can you easily find the features you are looking for? The exchange should be easy to use, even for beginners.

DEX Risks: Should I Buy Crypto There?

It's important to note that trading on DEX is not risk-free. For one, exchanges are still a hot target for hackers. In addition, there is always the risk of human error. For example, an exchange could accidentally delete your account or lose your funds.

Before you trade on a DEX, make sure you understand the risks and take appropriate precautions. For example, store your cryptocurrencies in encrypted wallets and use two-factor authentication where possible. Also, only trade with funds you are willing to lose.

How to Buy Cryptocurrency on a Decentralized Crypto Exchange?

To buy cryptocurrency on a DEX, you need a wallet and an account on the DEX. For example, suppose you want to buy cryptocurrency on Uniswap. Here's how to do it.

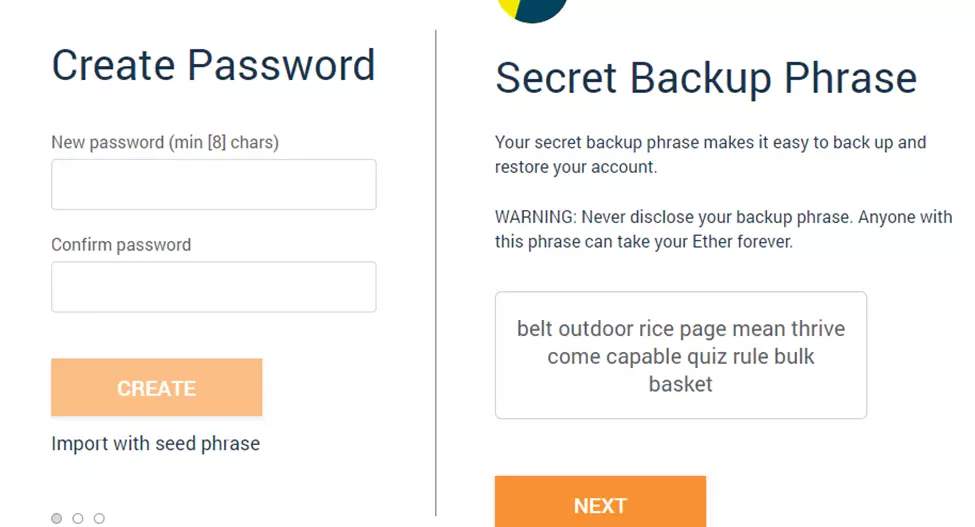

Step 1: Create a Wallet

A wallet allows you to store your cryptocurrencies securely. There are many wallets available, both online and offline. For example, MetaMask is a great place to make an Ethereum wallet since Uniswap is based on Ethereum.

Go to MetaMask.

Download it.

Create a password for your wallet and write the Secret Backup Phrase.

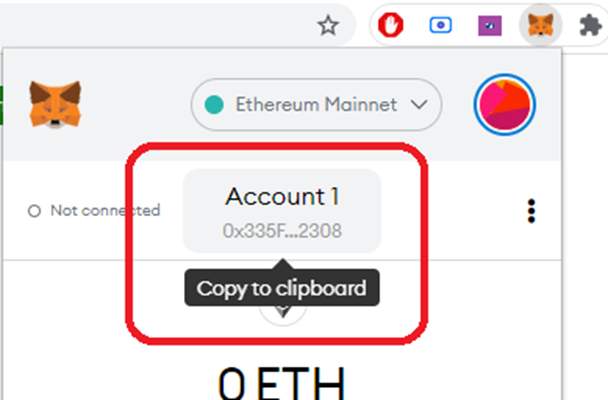

You now have an Ethereum address.

Step 2: Deposit ETH in Your Wallet

Go to an exchange of your choice, such as Binance or Coinbase.

Buy ETH and send it to your MetaMask wallet.

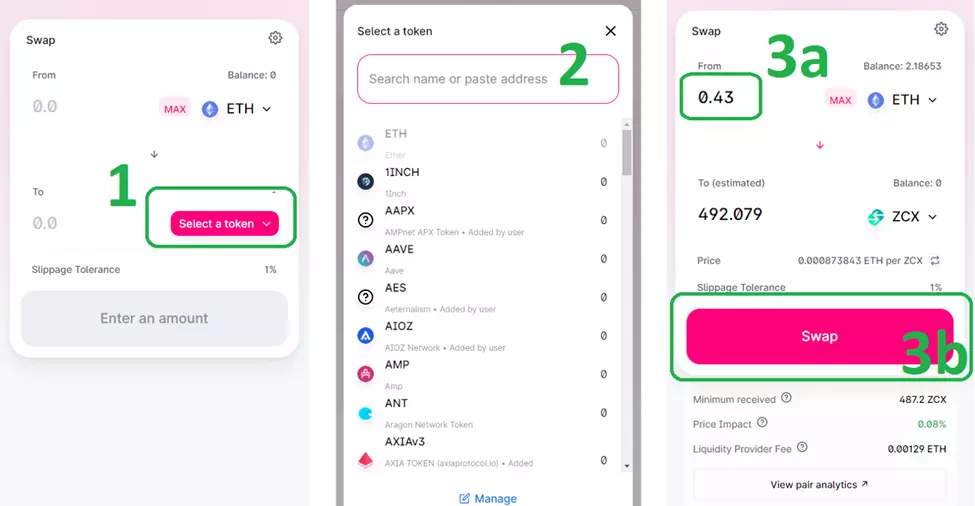

Step 3: Buy Crypto on Uniswap

Now that your MetaMask wallet has ETH, you can use the cryptocurrency to buy other tokens. But, first, go to Uniswap and search for the cryptocurrency you want to buy.

Click on the token and select the amount of ETH you intend to spend. Once you've done that, click on Swap, which will initiate the purchase.

Summary

What is a DEX? A decentralized exchange is a cryptocurrency exchange that does not rely on a third-party service to hold the customer's funds. Instead, trades are executed directly between users (peer-to-peer) through an automated process. The system removes the need to trust a third party with your money and the fees associated with using such platforms.

When choosing the best decentralized crypto exchange, make sure you check the platform's security, commission fees, and functionality. If you're uncertain, select an exchange on the list above.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

Other factors like brand popularity, client support, and educational resources are also evaluated.

FAQs

What is DEX Trading Volume?

DEX trading volume is the total value of all trades that have been executed on a decentralized exchange in a given period.

How does DEX work?

A DEX is a platform where buyers and sellers trade digital assets directly. Since it's decentralized, no intermediary regulates these trades.

What are the Key Features of Top Decentralized Exchanges?

The best decentralized exchanges offer high security, low fees, and easy-to-use interfaces. You should choose a decentralized exchange that meets your individual needs, such as support for tokens you want to trade.

What is the DEX Fee?

The DEX fee is the commission charged by a decentralized exchange for each trade on its platform. A portion of this fee goes to the liquidity providers on the exchange while the rest goes to the platform’s treasure or native token holders.

Related Articles

Team that worked on the article

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

A limit order is a type of order used in trading where an investor specifies a particular price at which they want to buy or sell a financial asset. The order will only be executed if the market price reaches or exceeds the specified limit price, ensuring that the trader gets the desired price or better when the trade is executed.

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.