Note!

that in order to complete registration, you need to verify your account. Click “Verification” and follow the instructions.

A cryptocurrency broker and a cryptocurrency exchange are two fundamentally different concepts. Both platforms allow you to trade cryptocurrency, but the broker offers indirect trading, acting as an intermediary between traders and the market. A crypto exchange is also an intermediary, but between traders.

Besides the trading principle, a crypto broker and crypto exchange have many other differences. You cannot say that one option is better than the other. Let’s just say that for some situations, it is more beneficial to choose one platform over the other. In order to understand which platform – a broker or an exchange – is best suitable for you, you need to learn about their differences, their benefits and also their specifics.

You can study the hundreds of exchanges and brokers in order to identify and compare patterns, or, you can save your time and effort and read this analytical review prepared by our experts, who have already done research and compared top platforms of both kinds, to find answers to the question about the specifics of these platforms: cryptocurrency brokers and cryptocurrency exchanges.

Start trading cryptocurrencies right now with Binance!

In reality, a cryptocurrency broker is a provisional concept, as by that we mean a traditional forex broker that provides access to the international market for cryptocurrency trading. This means that cryptocurrency is not a priority area of operation of such platforms, but rather one of the several groups of instruments along with fiat, currency indices, options trading, etc.

As a rule, a crypto broker offers two options for making money on cryptocurrency: rate fluctuations trades and investing. Trading based on fluctuation of rates is the most demanded option. The trading is not carried out directly with cryptocurrencies, but rather with CFDs. CFD is a contract for difference of prices concluded between the buyer and the seller. The subject of the contract is the difference in the price of the underlying asset as of the time of conclusion of the contract and as of the moment of closing of the trade.

It may seem that a CFD is similar to a supply contract, but there is a clear distinction – in case of contracts for difference, the seller does not necessarily own the asset and, therefore, the buyer cannot demand it. If from the time of opening of the position until the time of closing of the position, the price of the asset grows, the seller pays the difference to the buyer. If the price dropped, the buyer pays the difference to the seller.

Example of a cryptocurrency CFD – BTC/USD contract. Average spread is 320-450 pips, and average daily volatility – 4.5-4.6%. The volatility of this instrument is higher than the volatility of major currency pairs, but its liquidity is lower. Now, let’s sum up the pros and cons of a cryptocurrency broker.

👍 Pros

• Many other instruments in addition to cryptocurrency CFDs;

• Many deposit/withdrawal options, including debit/credit cards;

• As a rule, copy trading or similar services are available;

• Operation of a crypto broker is regulated at the international level;

• There is always full customer support, including a call center.

👎 Cons

• Not direct cryptocurrency trading;

• Not many cryptocurrency pairs for contracts.

Unlike cryptocurrency brokers, a cryptocurrency exchange prioritizes crypto trading and does not offer its clients other instruments apart from crypto-crypto and crypto-fiat pairs. And yes, it is direct trading, not CFD trading. This means that in the case of the BTC/USD pair from the example above, you do not get the difference between the Bitcoin rates against US dollar, registered at different times, but instead you sell Bitcoin for US dollar and earn your profit on having bought Bitcoin at a lesser price earlier.

Crypto exchanges offer a much bigger choice of cryptocurrencies than crypto brokers. Deposits are accepted in fiat money and in cryptocurrency (another difference, as the broker, as a rule, has fiat accounts, and sometimes you can keep your savings in precious metals). You can transfer cryptocurrency to your account from other electronic wallets and back. In terms of additional instruments, cryptocurrency exchanges sometimes offer De-Fi tokens, futures, Bitcoin options, NFTs - non-fungible or unique tokens, which are specific and cannot be exchanged for another token.

Many exchanges, just like brokers, offer an investment option. It is not copy trading, but specific solutions based on the nature of cryptocurrencies, for example staking, when a trader provides a specific cryptocurrency to be used by a business project on a blockchain for its development, with payment of a reward. Now, let’s summarize the pros and cons of crypto exchanges.

👍 Pros

• Wide selection of cryptocurrencies and tokens (the pool is much wider than any broker provides, often increased through open listing);

• Direct cryptocurrency trading – a trader does not get the difference of prices in fiat currency, but sells/buys one cryptocurrency for another (or for fiat);

• Although cryptocurrencies prioritize direct crypto trading, they offer many adjacent instruments, for example futures or options trading;

• Many exchanges introduce service tokens that help reduce trading fees; and there are also other ways to reduce commissions.

👎 Cons

• There are no other instruments, but cryptocurrencies and their derivatives;

• In the majority of cases, the exchanges are not regulated by law.

In order to compare the pros and cons of cryptocurrency brokers and cryptocurrency exchanges better, we used the current leaders of respective TU ratings. RoboForex is the leader of the brokers’ rating, and Binance top the rating of the exchanges. They are not only the best, but also typical representatives of their segments. Therefore, it is rational to compare their features and possibilities in order to understand the difference using specific situations.

Cryptocurrency brokers offer indirect cryptocurrency trading; fiat pairs (for example EUR/GBP, EUR/USD, USD/JPY, etc.) account for the lion’s share of their trading volume. Often, they also provide access to trading shares of large companies, for example RoboForex allows you to trade Apple, Amazon, Facebook, Netflix shares. Another trading option offered by crypto brokers is trading indices. These are the instruments formed by groups of securities, which show the change of their value. The most popular index is the industrial index Dow Jones.

RoboForex and other top brokers offer access to trading commodities (sugar, wheat), precious metals (gold, silver) and energies (oil, coal). Some of the segments are more liquid than the others. Success of trading largely depends on the actual market and trader’s strategy. In addition to cryptocurrencies, an objectively good broker provides access to trading practically anything that has value in the global financial market.

The situation with cryptocurrency exchanges is different. Many register at the exchanges to buy cryptocurrency and sell it later at a better exchange rate. It is a popular type of investment in cryptocurrencies. However, the real capabilities of crypto exchanges are much wider. For example, Binance offers conversion, a simple exchange of one cryptocurrency for another at the rate of the exchange. There is a classic and advanced direct crypto-crypto and crypto-fiat pairs trading.

In addition to traditional spot trading, Binance offers margin trading with leverage (by the way, many forex brokers also provide leverage, while for cryptocurrency that is a rather rare option). Binance, just like many top crypto exchanges, also offers P2P trading – cryptocurrency exchange between the platform users on their own conditions. The exchanges also sometimes offer derivatives trading. In particular, Binance offers quarterly and perpetual futures with settlements in USDT and BUSD (USD-M type) and with settlements in cryptocurrencies (COIN-M type).

Trading Leverage - What Level Of Leverage to Choose? Learn more about itTherefore, while cryptocurrency exchanges work strictly with cryptocurrencies and their derivatives, they offer a wide cryptocurrency-related choice of instruments. Note that many crypto exchanges support currency accounts, which means that you can withdraw both cryptocurrency and fiat money.

The absolute majority of top cryptocurrency exchanges charge a fee for trading cryptocurrency as a percent from the value of the trade. For example, in spot trading at the first trading level, Binance charges 0.1% fee for taker and maker. This means that regardless of the type of trade, you will pay 0.1% of its value to the exchange, thus providing the exchange with a profit from your trading.

There is also a withdrawal fee; it is a fixed amount and does not depend on the withdrawal amount. For example, you withdraw Bitcoin and you pay a fixed fee of 0.0000048 BTC to the exchange no matter how much you withdraw. Often, the withdrawal fee depends on the asset, sometimes on the withdrawal change and even the network that you are using. Cryptocurrency exchanges clarify all this information in the Commissions and Fees section (the name may differ, but there is always such a section on the website).

How to withdraw cryptocurrencies from Binance? Learn more about itA withdrawal fee in the majority of cases is the only type of non-trading fee charged by an exchange. There are no exchanges on our top list that charge a deposit fee (third-party services that you use, however, may charge their own fees).

Cryptocurrency brokers may also charge trading fees in the form of a percentage of the value of trade, but usually it is different. Most likely, spread is deducted from the client’s profit from a trade; it is the difference between the highest buy price and lowest sell price expressed in points (pips). Spread may be fixed (rarely) or floating; it usually depends on the plan. For example, for Prime and ECN Spread plans, RoboForex offers a spread from 0 pips, ProCent and Pro – from 1.3 pips.

As an additional fee, a broker may charge a fixed fee (as a rule in US dollars) per each lot (for example $4). Notably, during leveraged trading, the fee is calculated based on the total amount together with leverage (for example, with leverage at 1:300, if your rate is $10, with leverage it will be $3,000, and the fee is deducted from this amount). Some brokers put the percentage from the trade and spread as one fee.

On average, cryptocurrency exchanges have lower fees than cryptocurrency brokers. For brokers, a lot is determined by the company policy, tariff plan, chosen assets, condition of the market. For the exchanges, trading fees are easily understood even by a beginner, because they are fixed and constitute a percentage of the value of the trade. All companies charge non-trading fees (for example withdrawal fee).

Cryptocurrency brokers offer many deposit and withdrawal options. RoboForex, just like other top brokers of the segment, offers deposit/withdrawal via Visa and MC debit/credit cards, wire transfers through SEPA, as well as electronic transfers through Skrill, Neteller, AdvCash, Perfect Money and Kasaar24.

Top cryptocurrency exchanges also support deposit/withdrawal with debit/credit cards and wire transfers. The Luno Malaysia crypto exchange also accepts credit card and bank transfers. The majority of platforms also accept transfers from practically any electronic and cryptocurrency wallet (you have to be careful, though, because transfers are performed inside one network, for example BTC network is used for Bitcoin, TRC20 for TRON) and you have to specify the network when you are requesting a transfer).

Do you want to trade Bitcoins? Read our complete guide about how to do itRegardless of whether you simply want to buy cryptocurrency, plan to actively trade or invest, you need to open an account on the platform, which you’ve chosen. There are no critical differences between crypto brokers and crypto exchanges in terms of this aspect. In both cases you need to register on the official website of the company and then verify your personal information – submit scanned copies of identification documents (additional actions may be required, for example Binance requests a selfie with documents). Verification can take up to several days and once you’ve passed it you will be granted full access to the features of the platform. Some brokers and exchanges allow you to trade without verification, but with lower limits and limited features.

Read more about 9 Best Crypto Trading BotsIn the vast majority of cases, cryptocurrency brokers are regulated by international organizations that have the right to control the operation of financial companies. This is due to the fact that the operation of the brokers without regulation is essentially illegal. For example, RoboForex is regulated by IFSC Belize (International Financial Services Commission of Belize), license number 000138/210. This means that the IFSC controls the financial operation of the broker and makes sure that the broker observes international financial laws.

As for the cryptocurrency exchanges, unfortunately, not all exchanges are regulated. This is due to the legal specifics of the exchanges, as in many regions they only need to register as a financial organization, but they don’t report to anybody. This kind of practice does not mean that you cannot trust an exchange without the regulator, but you need to understand that such an exchange can close at any moment and you will never be able to recover your money. In this situation, you have to stick to the market leaders. Everything depends on your choice and whether it is the correct one. For example, Binance, a recognized global giant, also does not have any license, but the exchange has been operating successfully for many years.

How to avoid scam? Learn more about itThere are no differences in terms of this feature between cryptocurrency brokers and cryptocurrency exchanges that have to do with the specifics of their work. Everything depends on the particular company. For example, RoboForex offers an extensive FAQ and a number of guides for beginners on crypto trading. There are also detailed video tutorials and the broker regularly holds seminars and webinars, although they are rarely about cryptocurrencies specifically. They are mostly about Forex, stock markets, etc.

Binance cryptocurrency also doesn’t leave its users one on one with the crypto market. The exchange offers detailed guides on trading the most popular cryptocurrencies, including the guide for trading BNB, the platform’s coin. The exchange has a rather simple educational system, although that is not a regular occurrence among the exchanges. Some crypto exchanges have their own Academies with video tutorials and detailed course plans for traders of different levels.

In the majority of cases, the education offered by the broker is more comprehensive than the education offered by the exchanges. This is primarily due to the fact that the brokers offer not only cryptocurrencies, but also many other financial instruments.

Let’s start with similarities. Many cryptocurrency exchanges and crypto brokers offer passive income in the form of referrals. A trader receives a personal link and publishes it on third-party sources. The user, who registers at the exchange using this referral link, becomes a partner (referral) of the trader and brings him profit in the form of a percentage of his trading fees.

Many brokers offer investment programs, and they can be of any kind – from investment in the projects of third parties (the broker may act as an intermediary and guarantor) to copy trading services. For example RoboForex has the CopyFX service that allows you to copy trades of other (successful) traders or their trading strategies.

The exchanges do not offer such services; they have their own investment options, staking (available at the majority of the exchanges) and lending being the most popular ones. Staking is investing in third-party blockchain projects at an interest. Lending is investing cryptocurrency in the structural projects of the platform itself, for example financing other users. In particular, Binance offers these investment options. Some exchanges also offer other investment options to the users (for example mining).

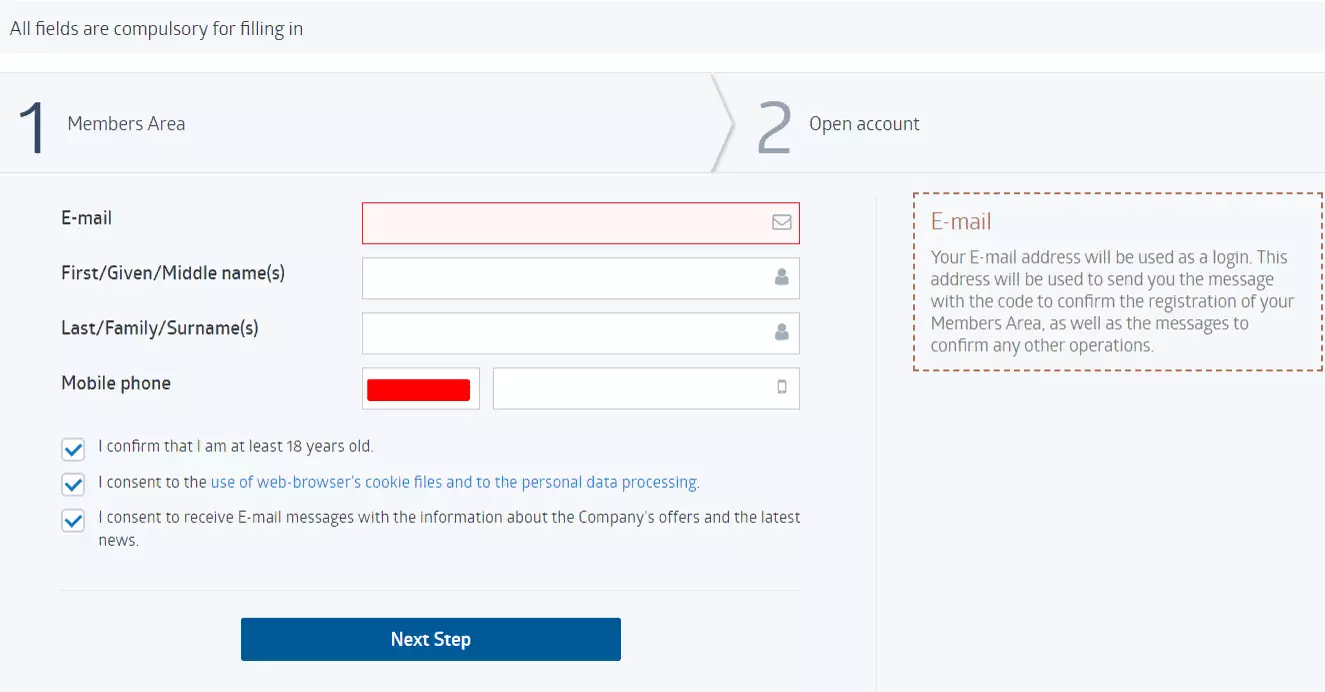

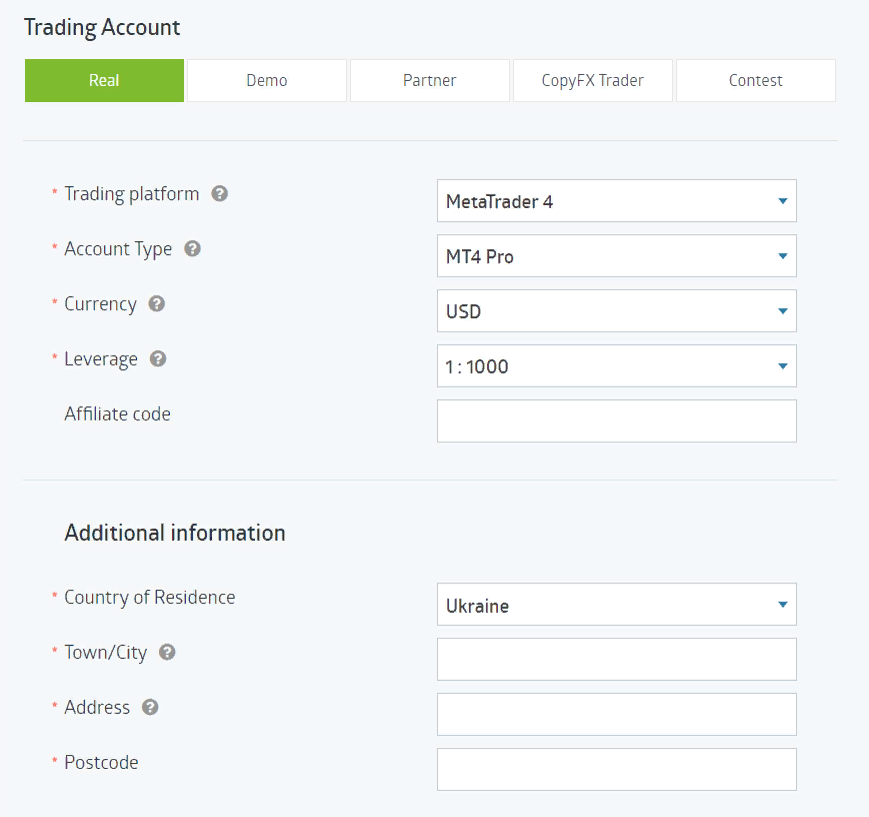

Algorithm of opening an account with a cryptocurrency broker (using the example of RoboForex)

Step 1. On the official website of the broker, click “Open an Account” and follow the instructions. You need to provide your real email and phone number, as the confirmation will be sent to them.

How to start trading on Roboforex

Step 2. Select the type of trading account (real, demo or other). The system generates the password automatically (you will be able to change it later).

Step 3. Choose the trading platform you intend to use, account currency, leverage and provide your address.

How to start trading on Roboforex

Step 4. Save the changes. Download and launch the trading platform, select RoboForex server and start trading.

Note!

that in order to complete registration, you need to verify your account. Click “Verification” and follow the instructions.

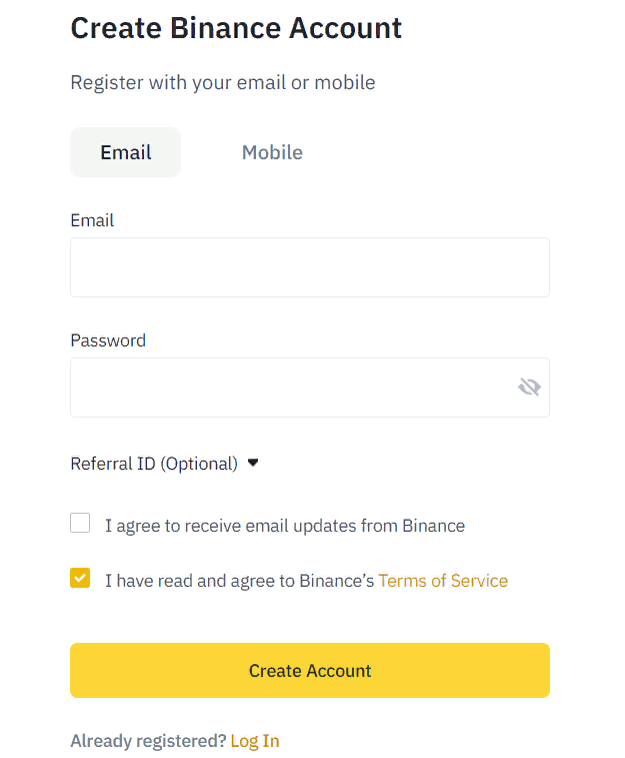

Step 1. Click on the Register button in the top right corner of the official website of the exchange and follow the instructions on the screen. Use your real email and phone number.

How to start trading on Binance

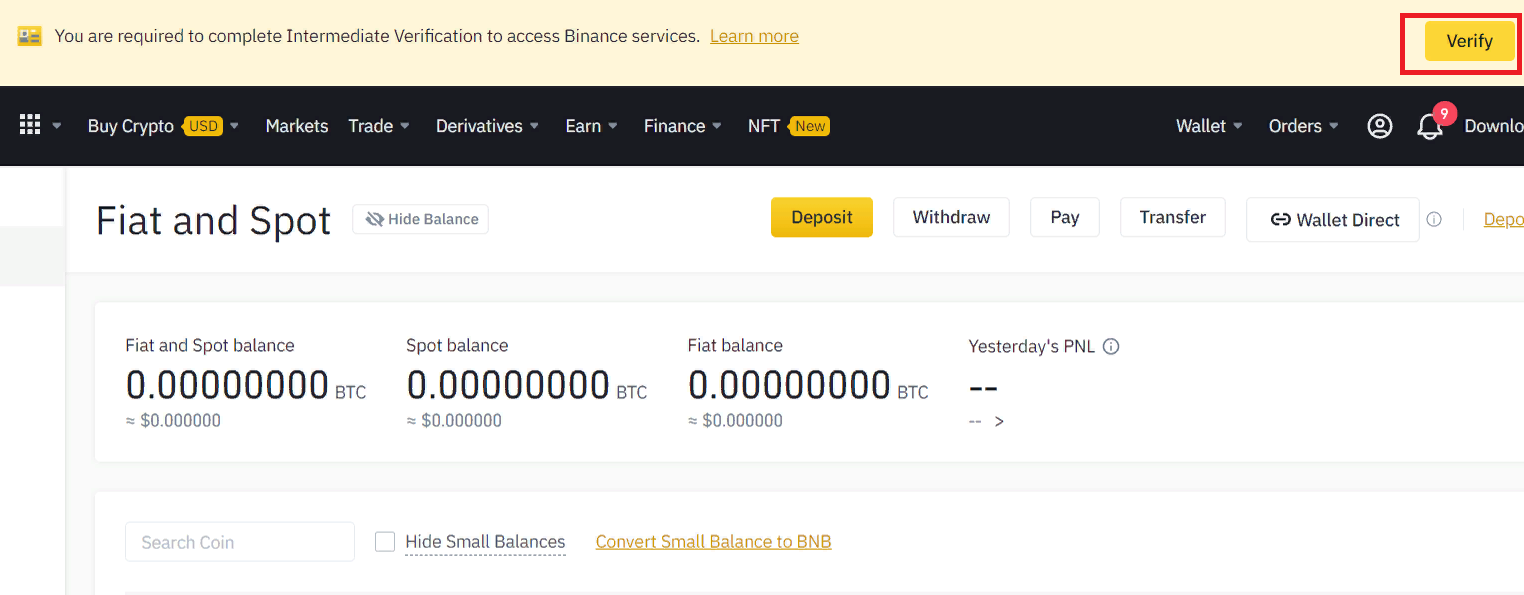

Step 2. Confirmation of registration will be sent to your email and phone; follow the instructions in the message. In the upper part of the screen, you will see the message “Verify Your Account”, click “Verify”.

How to start trading on Binance

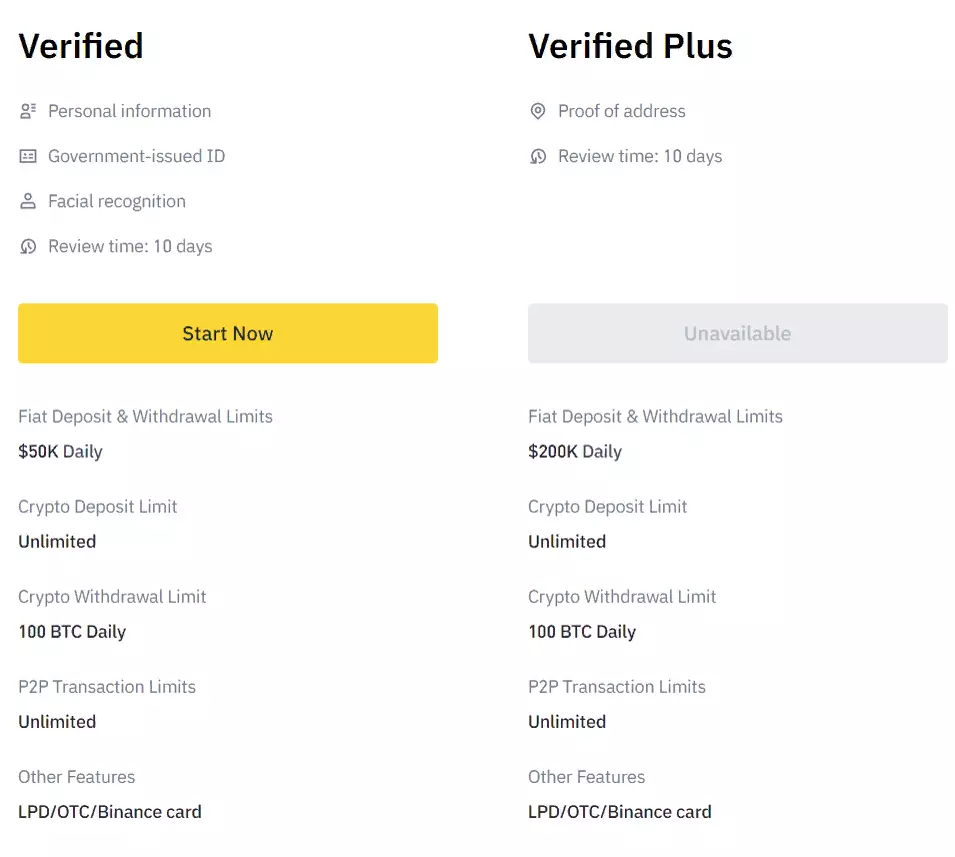

Step 3. Choose the verification type and follow the instructions on the screen (you will need to send scanned copies of your identification documents). You will not be able to trade without verification.

How to start trading on Binance

Step 4. Verification takes up to 10 days. As soon as the exchange verifies your information, you will receive a notification and full access to the features of the platform.

| Criterion | Crypto broker | Crypto exchange |

|---|---|---|

Minimum deposit |

$10 |

$1 |

Regulation |

Yes (IFSC Belize) |

No |

Cryptocurrencies |

7 for MT4 and MT5, 16 for RTrader |

340 |

Instruments of cryptocurrency market |

Cryptocurrency CFDs |

Spot, margin, P2P, derivatives (including futures, options and tokens with leverage), NFTs |

Non-cryptocurrency instruments |

Forex pairs with fiat money, commodities, precious metals, energies, other assets |

No |

Cryptocurrency trading fee |

Floating spreads from 0 pips |

Up to 0.1% for spot |

Deposit/withdrawal options |

Debit/credit cards, wire transfers, SEPA, Skrill, Neteller, AdvCash, Perfect Money, Kasaar24 |

Debit/credit cards, wire transfers, any electronic and cryptocurrency wallet |

Withdrawal to a crypto wallet |

No |

Yes |

Passive income options |

CopyFX (copy trading service), investing in shares, referral program |

Referral program, lending and staking, Binance Earn solutions |

Educational materials |

FAQ, text guides, video tutorials, seminars and webinars, analytical center |

FAQ, text guides, articles, news center |

Support languages |

15 languages, including English, Russian, Ukrainian, Chinese |

19 languages, including English and Russian, but no call center |

The data provided in the table are applicable to RoboForex and Binance. Information may differ for other brokers, but not critically. These criteria can be considered average for the top platforms of the chosen type.

If you want to trade a large number of cryptocurrencies with continuous extension of their available pool, cryptocurrency exchange is for you. The exchange has a generally simpler system of commissions and fees and the fees for trading cryptocurrency is lower. Many crypto exchanges offer different methods of reducing the fees and also investment solutions for passive income (like staking). Therefore, they may also be of interest to investors.

If you want to trade other assets (fiat money, commodities, metals, etc.) in addition to cryptocurrency, you will need a cryptocurrency broker, as the exchange simply does not offer these options. Brokers offer more instruments, as cryptocurrency trading is only done via CFDs and you earn money on pure speculation, without even buying the cryptocurrencies. Top brokers also offer investment options, and as a rule, there are more of them than the crypto exchanges have. For example, brokers offer copy trading services.

A cryptocurrency exchange is for: those who want to trade only cryptocurrencies at low fees. You can trade from a PC or a smartphone; the interface of the trading platform is very simple.

A cryptocurrency broker is for: those who want to trade not only cryptocurrency, but also fiat money, indices, commodities and other assets. The brokers offer more options for investing.

Minimum deposit: $10

Cryptocurrencies: BTC, BCH, DSH, EOS, ETH, LTC, XRP for MT4 and MT5, BTC, BTG, DASH, EMC, EOS, ETC, ETH, GNT, IOTA, LTC, NEO, NMC, OMG, QTUM, SNT, XRP for RTrader

Crypto trading account types: Prime, ECN, Pro-Standard, Pro-Cent, R-Trader

Spread: floating, from 0 pips

Instruments other than cryptocurrencies: fiat trading on Forex, shares, indices, commodities, precious metals, energies, ETFs

Regulation: IFSC Belize

Minimum deposit: $1

Cryptocurrencies: Bitcoin, Litecoin, Ethereum, Ripple, Bitcoin Cash

Crypto trading account types: Standard, Pro, Zero, Raw Spread

Spread: floating, from 0 pips

Instruments other than cryptocurrencies: fiat trading on Forex, stock assets and commodities

Regulation: CySEC, FCA, FSCA, FSA

Minimum deposit: 1$

Cryptocurrencies: Bitcoin, Bitcoin Cash, Cardano, Chainlink, Dogecoin, Ethereum, Filecoin, Litecoin, Polkadot, Ripple, Solana, Uniswap

Crypto trading account types: Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica

Spread: floating, from 0 pips

Instruments other than cryptocurrencies: currencies, stocks, indices, metals, oil and gas, commodity futures

Regulation: FSC

Minimum deposit: no

Cryptocurrencies: 47, including Bitcoin, Bitcoin Cash, OMG, Litecoin, Stellar, Monero

Crypto trading account types: Demo, Libertex, Rumus, MT4-Instant, MT4-Market, MT5-Instant, MT5-Market

Spread: floating, from 0 pips

Instruments other than cryptocurrencies: forex trading, stocks, indices, metals, commodities and energies, ETFs

Regulation: no

Minimum deposit: 1$

Cryptocurrencies: ВТС, ВСН, DASH, ETH, LTC, ZEC, XRP, XMR, EOS, NEO

Crypto trading account types: W-CRYPTO

Spread: floating, from 0 pips

Instruments other than cryptocurrencies: forex currencies, metals, oil

Regulation: The Financial Commission, FSA, VFSC

Check whether cryptocurrencies and other assets you are interested in are in the list of instruments.

Assess the trading volume and popularity of the broker, check its rating, read reviews.

Learn about the regulation of the broker. Evaluate available account types; a demo account is a plus.

Learn about the broker’s spread, withdrawal fee, and whether the withdrawal options you are planning to use are available.

If you are a beginner, do not choose the brokers with high minimum deposit.

Minimum deposit: $1

Number of cryptocurrencies (and examples): 340, including Bitcoin, Litecoin, Ethereum, Dogecoin, Ripple, Binance Coin

Fees on spot: up to 0.1%

Available instruments: spot, margin, P2P, derivatives, NFT

Investing in cryptocurrencies: lending, staking, Binance Earn

Minimum deposit: $1

Number of cryptocurrencies (and examples): 68, including Bitcoin, Litecoin, Ethereum, Cardano, Bitdao

Fees on spot: up to 0,1%

Available instruments: spot and derivatives

Investing in cryptocurrencies: staking, mining, dual mining

Minimum deposit: $2

Number of cryptocurrencies (and examples): 123, including Bitcoin, Litecoin, Ethereum, Solana, Tether

Fees on spot: variable

Available instruments: spot

Investing in cryptocurrencies: staking

Minimum deposit: $1

Number of cryptocurrencies (and examples): 91, including Bitcoin, Bitcoin Cash, Ethereum, Monero, Ripple

Fees on spot: up to 0.26%

Available instruments: spot, margin, indices, futures, over-the-counter trading

Investing in cryptocurrencies: staking

Minimum deposit: depends on the asset

Number of cryptocurrencies (and examples): 382, including Bitcoin, Tether, Ethereum, Ripple, Litecoin, Stellar

Fees on spot: up to 0.2%

Available instruments: spot, derivatives, P2P

Investing in cryptocurrencies: staking and saving

Check the number of cryptocurrencies the crypto exchange offers, and currency pairs; pairs with fiat is a plus.

See the instruments the exchange offers access to: spot, margin, derivatives, P2P, etc. The more instruments the exchange offers, the wider opportunities you have.

Learn about additional services, such as lending, staking, other investment options, over-the-counter trading.

Check the Minimum deposit of the exchange, usability of the trading platform and trading and non-trading commissions and fees.

Check the position of the exchange in our rating, read reviews and compare the exchanges that you like.

Cryptocurrency brokers are fundamentally different from cryptocurrency exchanges. Brokers do not allow trading cryptocurrency directly, only as CFDs, and they always have fewer such assets in the pool. However, in addition to cryptocurrencies, brokers offer other instruments – from currencies to commodities and energies. Unlike exchanges, brokers are in the vast majority of cases regulated by reputable international organizations. Leverage and investing is available on both types of platforms.

Therefore, if you want to professionally trade only cryptocurrencies, then a crypto exchange will be a more preferable option for you. However, if in addition to cryptocurrencies you are interested in other assets and not interested in direct trading, it would be wiser for you to choose a crypto broker. The type of the platform is always chosen based on the goals of the trader.

At an exchange, you trade cryptocurrency directly, and with a broker – a contract for difference in the price between opening and closing of the position. Brokers offer access to a much smaller number of cryptocurrencies than exchanges and, as a rule, charge higher commission.

There are no conceptual differences. You need to register on the official website and open an account (it is automatic at the exchanges and with the brokers you set the parameters of the account). Then you need to pass verification – send scanned copies of identification documents. Verification may take from 1 to 10 days.

In order to work with a broker, you need to download and install on your PC the trading platform that the broker supports. Most frequently, these are the MT4 and MT5 platforms. In order to trade at an exchange, you don’t need to download anything, as the trading takes place in the browser. Many exchanges also offer their proprietary mobile application, so that you are not tied to your PC.

First, you need to decide which type of the platform you need. Then review and evaluate top companies from the TU’s ratings. Compare them by trading volume, minimum deposit, available instruments, user reviews. Choose several platforms and review their offer in detail. Test the platforms and choose the one you feel most comfortable working with.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.