Note!

the exchanges themselves have different terms for staking the same cryptocurrency in yield, freezing periods, and other nuances.

The Proof-of-Work consensus algorithm was developed in 1999 to protect network systems from tampering and spamming. Developers of the first cryptocurrencies used it as a guide, thereby laying the principles of security and anonymity in cryptocurrencies. The idea of the first cryptocurrencies was that the participants themselves were engaged in generating blocks of the cryptocurrency network and confirming transactions, making calculations, and getting rewarded for it in the form of tokens. These calculations were called "mining”.

At first, there were a lot of people who engaged in mining. But as the number of miners grew, the calculations became more complicated and this inherently prolonged the mining process to such an extent that eventually the time-consuming mining of some coins on a private scale became unprofitable. Special ASIC computing equipment costs several thousand dollars, and the payback period for mining on such equipment starts after 6 months. The payback period for mining on ordinary graphics cards is more than 1 year.

The Proof-of-Stake (PoS) consensus algorithm occurrence has created new opportunities for investors. Costly mining has been replaced by budget-staking, which allows earning money with minimal investment after the first month of investment.

From this review you will learn:

What staking is and how it differs from mining.

Staking: It’s pros & cons.

How to choose cryptocurrencies and exchanges for staking, and how to start making money.

This will interest you!

Start trading cryptocurrencies now with Binance!Staking is the process of storing funds on a cryptocurrency wallet to support all transactions on the blockchain.

For an investor, staking is as follows:

An investor buys a cryptocurrency available for staking, credits it to his wallet or the balance of an account opened on a cryptocurrency exchange.

Cryptocurrency is blocked on the account for a period chosen by the investor according to the trading terms of the operator.

At the end of the term, the investor receives free use of the cryptocurrency along with the interest accrued.

Only cryptocurrencies with PoS or DPoS consensus algorithms are available for staking. Interest is also stipulated by the trading terms and is accrued in the currency of blocked funds.

One theory is that the PoS consensus algorithm was offered in 2012 by the Peercoin cryptocurrency developers. Initially, it was a hybrid Pow/PoS model, which eventually evolved into PoS and a new consensus algorithm DPoS (Delegated Proof-of-Stake) based on it.

The blockchain network is based on transactions and the blocks derived from these transactions. To make a transaction, you need a key that identifies your wallet and the address of the recipient. The situation is more complicated with blocks: it is important to have them confirmed by other participants, and the order of blocks in the transaction log is confirmed by consensus.

Example. The situation in cryptocurrencies is called “double spending". Alex, Amanda, and John are blockchain users. Alex has 1 Bitcoin (let's take it as an example), which he simultaneously transfers to John and Amanda. If John and Amanda do not agree on both of these transactions, then there will be a network problem, because Alex cannot send more coins than he has. But if all members of the network agree on the transaction log, then one of Alex's transactions will be performed and the other will be found to be incorrect.

Proof-of-Work occurs as follows: Network nodes (the miners) perform calculations to confirm transactions and prevent other participants from spending (sending) the same coins twice. The user whose computer found a solution first gets rewarded. Users (miners) are combined into pools to solve problems and find new blocks faster. The remuneration in the pools is distributed among the miners in proportion to the power of their equipment.

The Proof-of-Stake (PoS) consensus algorithm has a different transaction confirmation mechanism. New coins are mined using cryptocurrency staking instead of solving mathematical problems — proof of ownership of the network's cryptocurrency. The nodes (computers) of the network are called validators, the balance of validators is a stake. The more coins a validator has, the more chances it has to validate a new block and get a reward.

Cryptocurrency staking can be compared to bank deposits. The validator deposits the network in the form of cryptocurrency, which is frozen for a fixed period. At the end of this period, the validator receives his deposit and the interest accrued on it. Anyone can become a validator. To do this, just buy a cryptocurrency and block it on the network. The greater the number of coins blocked increases one’s chances to become a validator.

Since only validators receive remuneration, private traders delegate their authority to validators. In other words, they trust their cryptocurrency to validators and get remuneration set by the validator in advance. Often, cryptocurrency exchanges act as validators. This allows them to accumulate cryptocurrency assets on their platforms and earn a small percentage on brokering.

Important. Some cryptocurrency exchanges offer products that are considered to be non-standard in the classical sense of staking:

Binance Staking

ВТС (₿). The Bitcoin network uses a PoW consensus algorithm, so the staking offer is different, presumably. Frozen BTCs can be used by the exchange to provide liquidity or provide paid leverage to traders. It does not change the situation for the investor as he gets interested at the end of the term.

Before agreeing on staking, carefully read the terms and conditions of the cryptocurrency selected.

Staking cryptocurrencies using the PoS algorithm is considered more secure and simplified compared to mining because no additional resources are used. But the algorithm is criticized for the risks of gaining control of the network by validators.

The benefits of staking for the investor are:

Low startup threshold. Depending on cryptocurrency and trading terms, an investment of $10-50 is enough for staking.

You don't need equipment. In mining, you need over 6 months to pay for the equipment. Staking doesn’t require equipment and any earned interest is paid after the first month of investment.

No associated costs. No costs for electricity, farming supplies, etc.

Fixed income. Using staking, the investor knows in advance the amount of income he will earn at the end of the term. The amount of interest depends on the validator and cryptocurrency selected.

There are almost no technical risks and this is the advantage of staking for the investor. If a mining farm fails at any time, nothing will happen to the coins blocked from the top exchanges.

The disadvantages of staking for the investor are:

Blocking cryptocurrency for a fixed period. If an investor withdraws cryptocurrency from a frozen account before the scheduled maturity date, he loses interest at best. Withdrawal can take up to 7 days. Some terms explicitly prohibit withdrawal before the scheduled maturity date. This means that you cannot quickly sell the cryptocurrency when it starts to become cheaper.

The need to be constantly connected to the network. For validators. If you are a private trader, your money is stored in the wallets of the exchange. But if you are a validator and store cryptocurrency on your computer, it must be online at all times. There are penalties for being offline.

But still, there is the risk of price manipulation by validators. In theory, developers can control over 50% of the network's coins through their validators. But in practice, this is possible only for small-capitalization projects.

The difference between PoW and PoS is the technology by which a member of the network generates another block in the blockchain. While PoW involves finding a block by performing complex computations, PoS involves searching a block by a member pro rata to his share of the cryptocurrency.

For the investor, the method of income generation determines the difference between mining and staking:

Mining. You, as an investor, purchase a cryptocurrency farm based on video cards to perform calculations. Install a wallet, connect to the investor pool and start the farm, taking into account the cost of electricity. The reward for each new block is distributed among pool members in proportion to their respective equipment power. This method generates new tokens, which can then be sold at any time.

Staking. Choose a cryptocurrency that supports staking. Then find a service or cryptocurrency exchange that also supports staking. Buy the cryptocurrency and freeze it for a specified period. Get a reward at the end of the term.

You can make money from staking with the help of cryptocurrency exchanges or cryptocurrency wallets.

As a visual aid, the Traders Union has prepared the below table that compares mining and staking according to different criteria in the form of a table.

| Criteria | Staking | Mining |

|---|---|---|

Minimum investment |

Depends on the terms of the exchange/wallet and the cryptocurrency selected. For many cryptocurrencies, it is enough to deposit $10-50 |

Depends on the cost of the equipment. Can be from $1-2 thousand and higher |

Associated costs |

No |

Electricity costs |

Profit margins |

From 1-2% to 120% per annum |

Depends on the market value of the cryptocurrency that is mined. Payback of the farm is 6-12 months. |

Opportunity to earn without additional equipment |

Yes |

No |

The most common options for making money from staking for private investors are cryptocurrency exchanges and cryptocurrency wallets.

Cryptocurrency exchanges. Platforms offer traders dozens of cryptocurrency products. Many of them are a platform for exchanging coins and validators that also provide staking services.

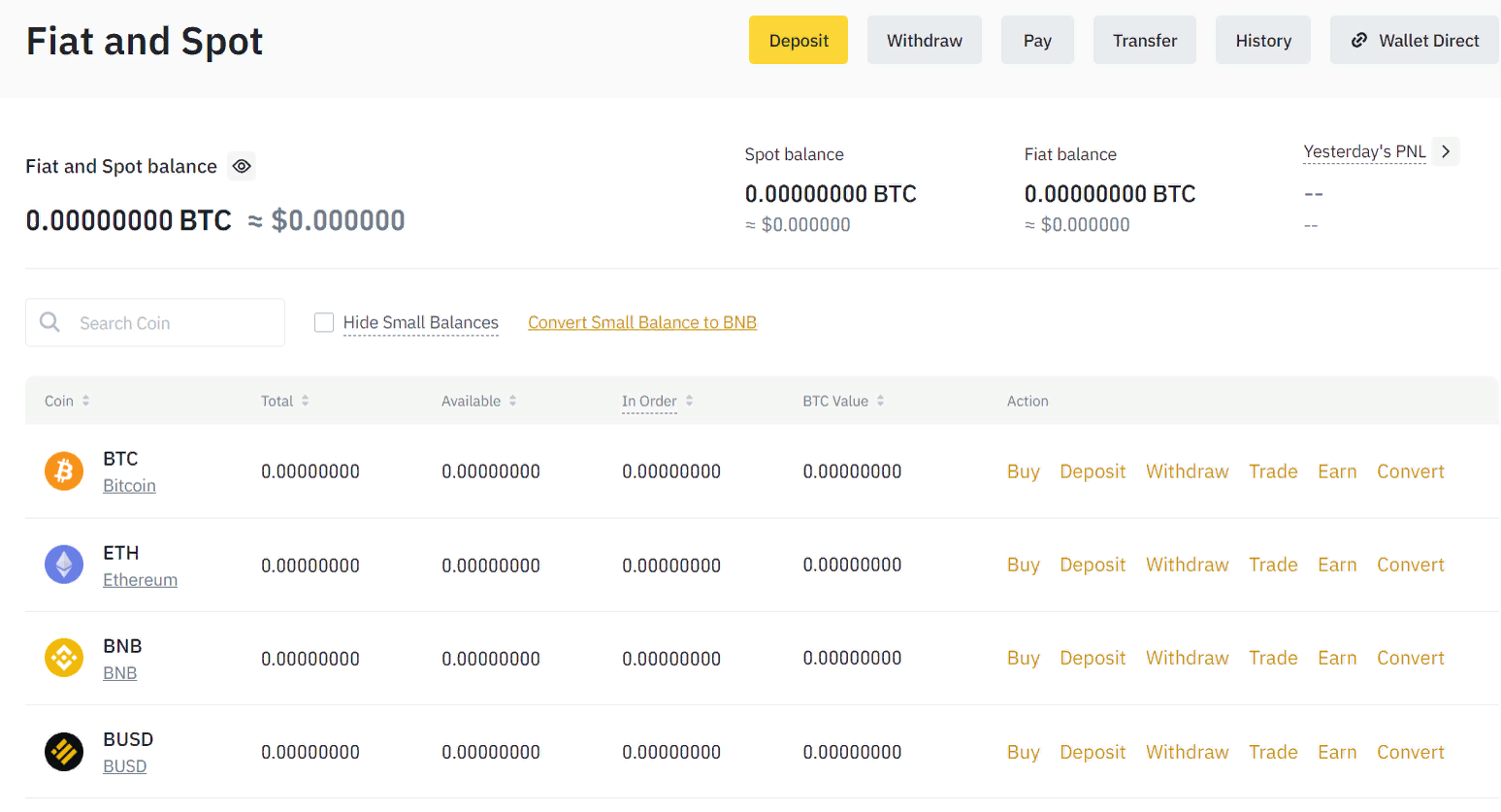

Register on an exchange that provides a staking service. Go through verification.

Deposit cryptocurrency on the account opened during registration. For example, do it directly using a bank card with conversion at the exchange rate.

Select the desired "freeze" feature.

Withdraw cryptocurrency with accrued interest at the end of the term or reinvest it.

Cryptocurrency wallets and service platforms. Some wallets support cryptocurrency staking and can accommodate one or more coins.

Choose a cryptocurrency for staking.

Download and install a wallet that supports staking. You can find it on the exchanger’s website. There are multi-currency wallets that support the staking of several cryptocurrencies.

Examples of multi-cryptocurrency wallets are Ledger and Trezor. Ledger supports XTZ, TRX, ATOM, ALGO, and DOT staking. Trezor works with Exodus wallet and supports NEO, ATOM, ADA, XTZ, ALGO, ONT, and VET.

The algorithm is the same for service platforms. Examples of platforms are Everstake, stake.fish, and Wetez. For example, the Everstake platform supports ATOM, DOT, ADA, XTZ, ICX, and NEAR cryptocurrencies.

The third option is to become a validator by placing your wallet on your computer or a remote server. The entry threshold for validators is from $1,000 to $2,000.

Outcomes depend on the number of coins available. There is a better range on exchanges. According to the analytical portal stakingrewards.com, there are 284 coins available for staking as of December 15, 2023. Some of them are represented on exchanges. For example, about 80 cryptocurrencies are available on the Binance exchange for fixed staking. Trust crypto wallet supports 8 cryptocurrencies.

Profit margins. Wallets designed for specific cryptocurrencies have a higher yield than exchange ones.

According to stakingrewards.com, staking yields can reach up to 120% per year.

For example, Axis cryptocurrency can bring a profit of 115.46% through staking on wallets. To get it, download the Ronin Wallet, designed for Axie Infinity. The yield of the same cryptocurrency on Binance is 105.32%.

Commissions. An exchange is a direct validator for an investor setting fixed staking terms. In the case of wallets, there are staking providers who charge commissions in addition to validators.

Additional benefits. Wallets do not provide bonuses, while many exchanges encourage investors to participate by offering extras such as bonus interest, higher interest compared to the wallets, etc.

Note!

the exchanges themselves have different terms for staking the same cryptocurrency in yield, freezing periods, and other nuances.

Comparative table of cryptocurrency exchanges and wallets/services advantages:

| Criteria | Cryptocurrency | Cryptocurrency wallets |

|---|---|---|

Profit margins |

Lower |

Higher |

Selection of cryptocurrencies |

Great |

Small. Most wallets are designed for a specific cryptocurrency or support less than 10 coins |

Commissions |

Exchange commission |

Validator commission |

Risks |

Risk of exchange hacking, account blocking by the exchange |

Risk of transaction problems in the intermediary chain |

Additional products to make money |

Yes |

No |

In this section, you will get acquainted with popular cryptocurrencies for staking.

These cryptocurrencies have something in common:

High-capitalization cryptocurrencies that support large emerging startups.

They have a low-risk level with a relatively small yield (up to 10% per year). A fall in price is possible only if the entire cryptocurrency market moves downward.

Information on ratings, quotes, and yields as of December 16, 2023.

Binance Coin (BNB) is the main token of the Binance cryptocurrency exchange, including its blockchain Binance Chain and Binance Smart Chain. Binance is the largest exchange in the world in terms of capitalization of cryptocurrencies traded on it and in terms of daily turnover, it outdistances its closest competitors by almost twice. The exchange offers some unique products from NFT and farming to leveraged trading and crypto-loans. The exchange is one of the few that offers P2P trading with links to users' regions and regional payment systems. The ecosystem also includes the decentralized exchange Binance DEX.

BNB ranks third in terms of capitalization, being inferior to BTS and ETH. The value of one token is $544. The yield is 6-9% per year.

Capitalization of Binance Coin

Polkadot (DOT) is a decentralized open-source blockchain that is a direct competitor to Ethereum. The developers tried to create a more technologically advanced platform for creating decentralized applications by inserting an additional layer called parachain. Parachain is an independent blockchain with its own token and the ability to optimize functionality for specific project tasks.

The primary ICO was held in 2017. Since then, the startup's capitalization has gradually grown, and it’s among the Top 10 today. The price of one token is $24.5. The yield is 11.5-16.5% per year.

Polkadot capitalization

Cardano (ADA) is a multilevel, decentralized, third-generation blockchain platform for creating smart contracts, and it is another competitor to Ethereum.

The platform was launched in 2017, but the main growth of quotes came in 2023. And now the platform ranks 6th in terms of capitalization. The altcoin price is $1.3. The yield is 5-8.5% per annum.

Cardano capitalization

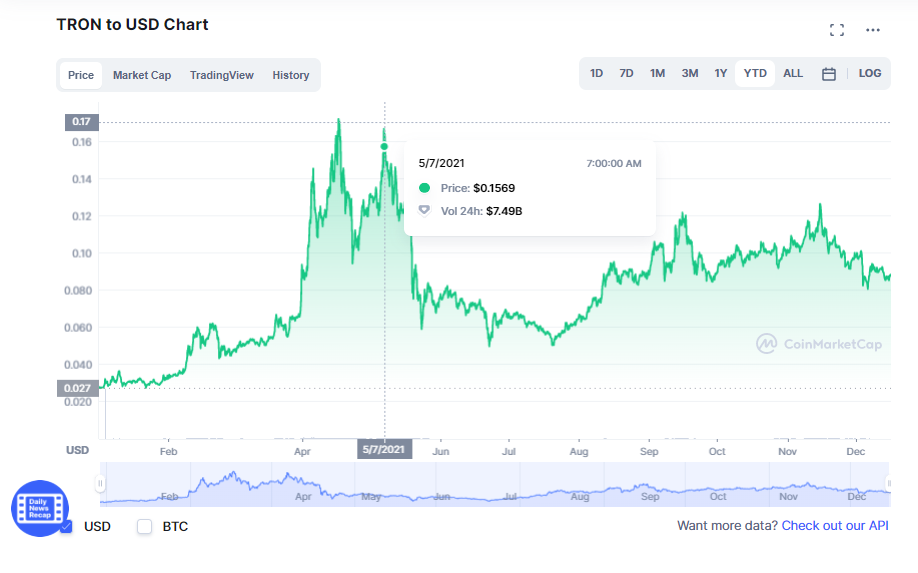

Tron (TRON) is a distributed network for the free exchange of content between users, as well as the development and launch of entertainment applications. The platform is used for downloading; storing; leasing any content; crowdfunding; issuing its tokens; and developing its own software (from small scripts to multiplayer games) based on the blockchain network.

The cryptocurrency ranks 23rd in terms of capitalization and is worth about $0.09. The yield is 5.5-8% per year.

TRON capitalization

Algorand (ALGO) is an open-source platform whose goal is to provide low-cost international payments. The developers aim to compete with payment systems, winning in the speed of transactions, low fees, and the ability to distribute micro-lots among any number of users within 5 seconds.

This cryptocurrency is in the top 25, and the value of a token is about $1.5. The platform needs stakers for security and transaction processing. The project was launched in mid-2019, but at that time investors didn’t appreciate its prospects. Its real growth began in 2023. Staking yields are 5-10% for 1-3 months.

Algorand capitalization.

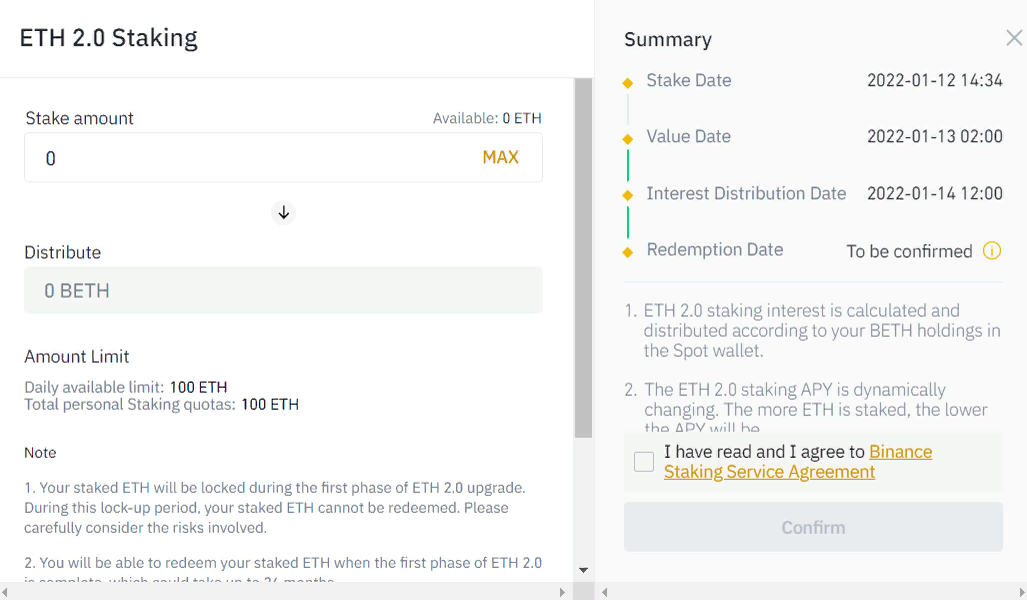

Staking has a minimum entry threshold set by startup developers for validators and by validators for private investors. For example, Ethereum 2.0 validators have a threshold of 32 ETH, which as of mid-January 2023 was just over $120 thousand.

The entry threshold is much lower for private investors, and each exchange has its own terms. A few examples on the Binance exchange are:

Binary X — the minimum amount is 1 BNX, or about $86

Zilliqa — the minimum amount is 100 ZIL, or about $6

Solana — the minimum amount is 1 SOL, or about $165

You can review Binance's staking terms in the window for adding an asset for staking.

The interest rates for cryptocurrency staking depend on the following parameters:

The number of members in the network. The more participants in the network, the lower the interest. That's why there are usually the highest percentages for cryptocurrencies with small capitalization and high market risks.

Validator. Each cryptocurrency wallet and exchange has its own terms. It depends on the internal policy of the validator, the amount of its commission, etc.

The freeze term. Validators are guided by the volatility of the asset. In most cases, more interest is provided for a longer term. For example, for 1 month the investor gets 14% p.a.; for 2 months, it’s 15.5% p.a.; and for 3 months, it’s 19% p.a. In this way, the validator encourages you to freeze your money for a longer period. But there are some exceptions. For example, Binance offers a reward of 50.49% per annum on BNX coin for 10 days, and it’s 20.35% per annum for 30 days (conditions are subject to change).

Type of staking. Staking with a fixed return rate is several times more profitable than staking with a flexible rate. For example, fixed-rate staking for 1 month of SOL on Binance will bring you about 7.5% p.a., and flexible will only bring you up to 2-3% p.a.

The validator can change the asset rate every day, but once coins are blocked, the rate is fixed for the entire staking period.

Plans to change the Ethereum network’s algorithm to the Proof-of-Stake consensus algorithm were announced by Vitalik Buterin years ago. The main goal of the transition was to modernize the network to reduce energy consumption. The transition to Ethereum 2.0 was supposed to take place in 2020, but the Beacon Chain fork was repeatedly postponed for technical reasons.

Beacon Chain is an entirely new ETH blockchain based on the PoS algorithm. The transition to it is supposed to be made in three phases, the first of which (zero phases) started on December 1, 2020. It involved recruiting a certain number of validators, and each had to contribute an amount of 32 ETH to the network. After the minimum required validators were recruited (just over 16 thousand), the Ethereum 2.0 blockchain was realized.

The implementation of the first and second phases (subsequent phases) is scheduled for 2023, but it may be postponed. Ethereum 1.0 continues to exist under the former name Ethereum (ETH) with the PoW algorithm and the possibility of being mined. Ethereum 2.0 is still in test mode and has not been launched as an independent cryptocurrency. Nevertheless, the Ethereum developer platform offers everyone a chance to join the network as a validator.

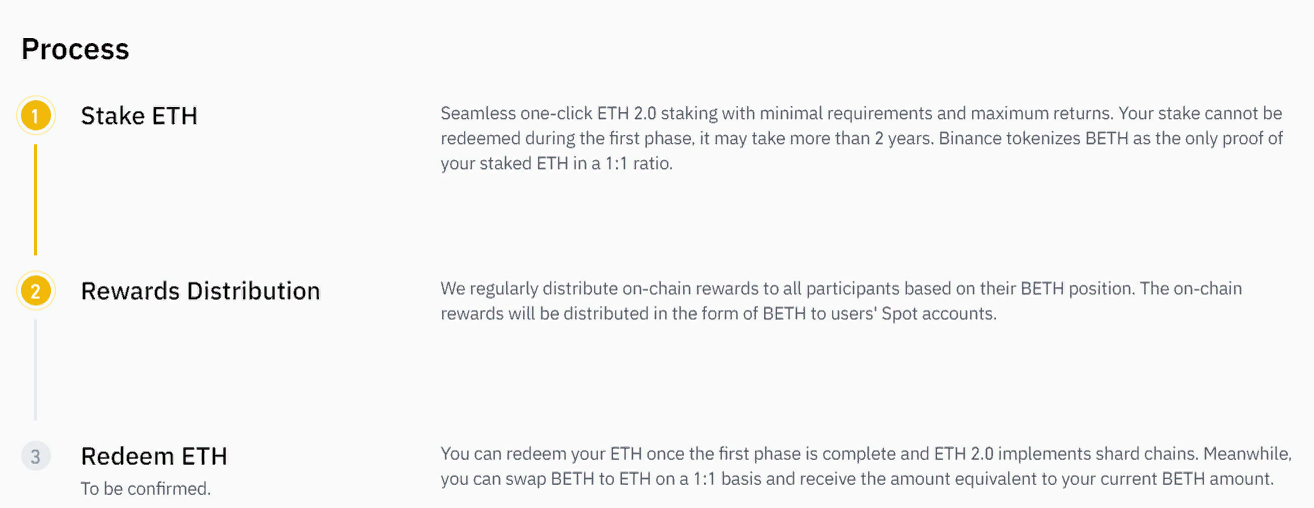

Private investors who don't have 32 ETH have the alternative of delegating their money to Binance's validator. Or in other words, you can use the ETH 2.0 exchange service.

What the close of the Beacon Chain hard fork means for investors:

ETH mining will disappear. Miners will be forced to switch to other coins or sell video cards. The network upgrade involves the creation of two networks, ETH1 and ETH2. ETH1 will remain on the PoW algorithm, but the complexity of calculations will increase hundreds of times, and mining it will eventually become unprofitable. ETH2 will work on the PoS algorithm. Eventually, both networks will merge.

It will be possible to make money with ETH through staking. And it will be easier, with a small starting capital and without the need to buy equipment.

JP Morgan estimates that the cryptocurrency industry now generates about $9 billion in revenues annually. With Ethereum entering this segment, that figure could grow to $20 billion during the first quarter and to $40 billion by 2025.

For investors, this means that very soon mining will be replaced by a more efficient earning option such as staking. And some exchanges offer to invest now in the future ETH2 cryptocurrency.

The Binance cryptocurrency exchange was founded in 2017. Since then, the platform has managed to become the largest cryptocurrency exchange in the world by the number of clients served and cryptocurrencies listed.

Low fees. Due to the leadership in trading volumes, the exchange can reduce commissions to a minimum.

Availability and variation of products for active trading, investing with different levels of risk, and lender functionality.

Supports over 280 cryptocurrencies of all major sectors.

A lot of options to deposit with fiat currencies of payment systems around the world.

Cross-platform convenience.

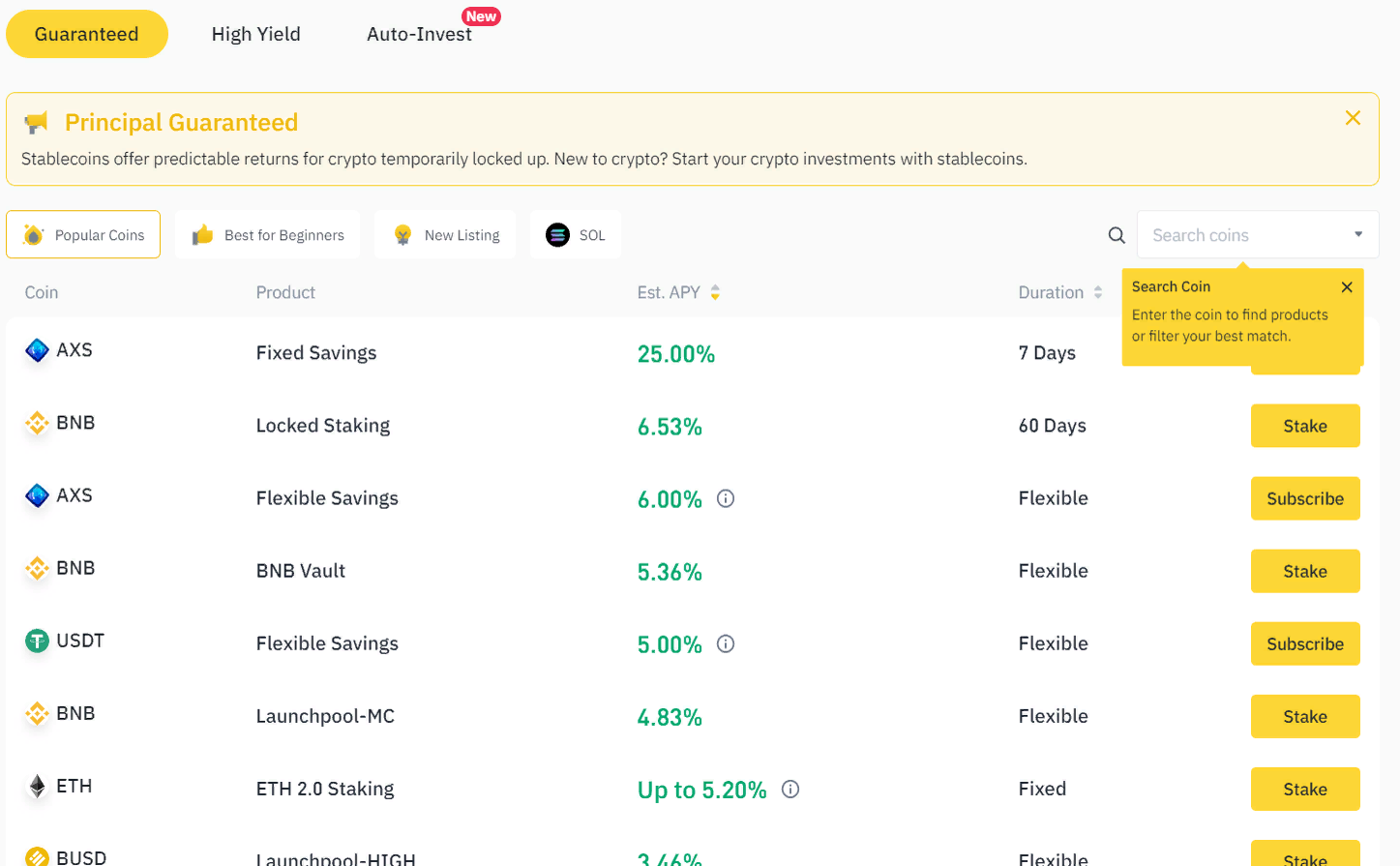

There is a separate Binance Earn section for investors on the Binance platform.

Binance Earn is a general section with a plethora of instruments, interest rates, and other trading terms. Here you can find offers on staking, fixed and floating rate deposits, IEO, etc.

Binance Earn

Launchpad — IEO investments. IEO is the equivalent of an ICO, or an initial public offering controlled by the exchange. Binance itself selects projects for potential investors.

Deposits — cryptocurrencies for earning flexible and fixed-rate deposits.

Staking — cryptocurrencies for making money from staking.

BNB Vault is a BNB yield aggregator that combines floating term deposits, DeFi-staking BNB, and Launchpool.

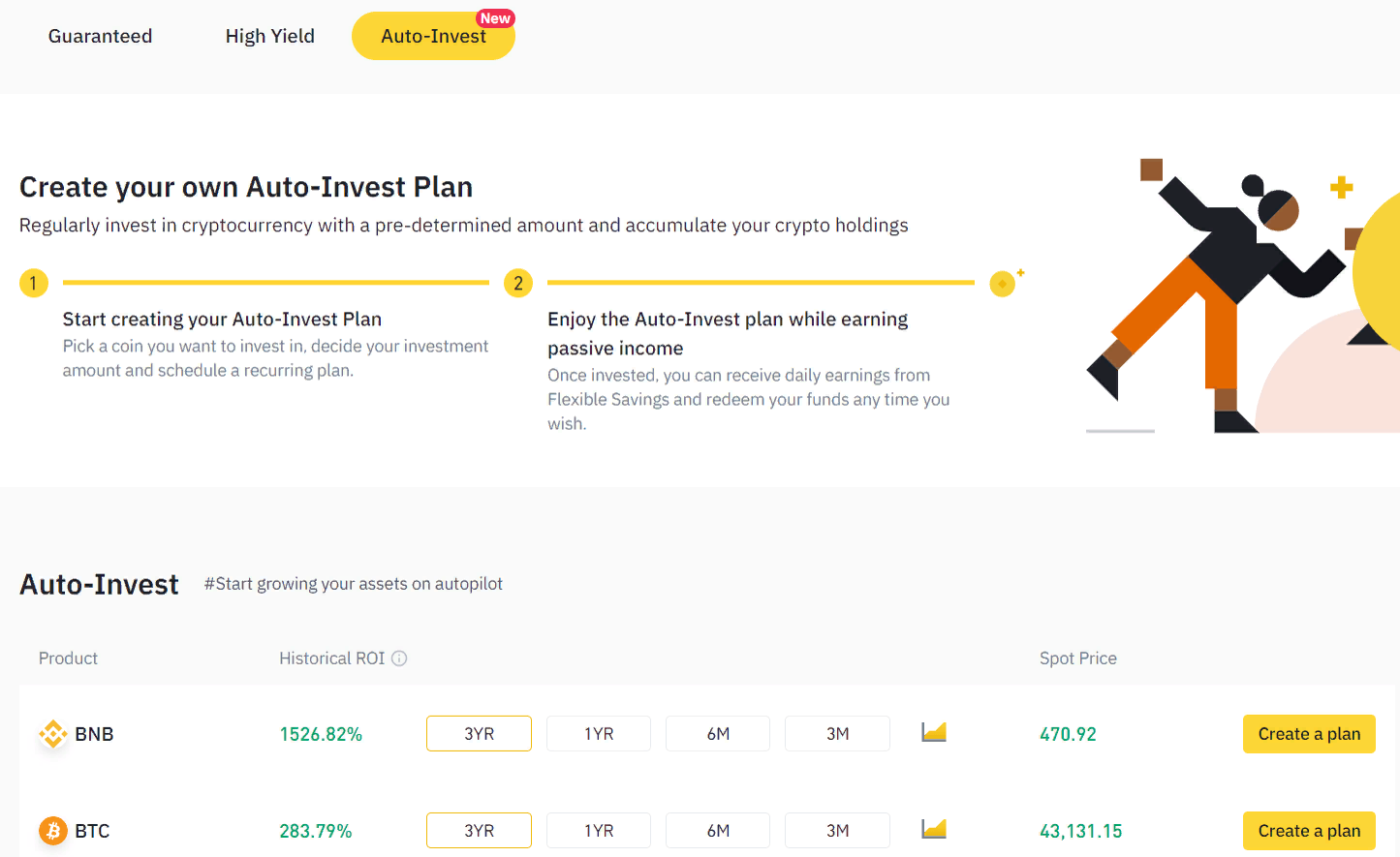

Auto investment is an additional functionality of the section.

auto investment on Binance

Follow the below explanation of the algorithm for staking for profit using the Binance cryptocurrency exchange.

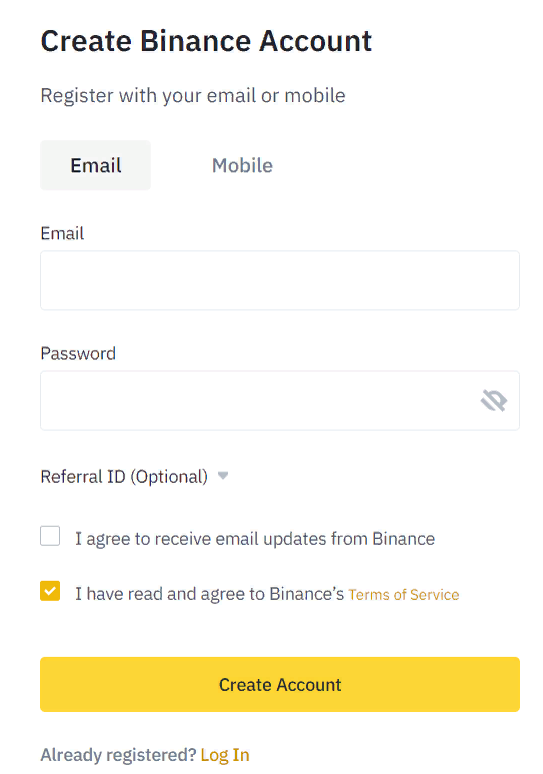

Registration on Binance takes 1 minute. In the upper right corner, click the Register button, enter your email address and account password. Then enter the confirmation code, sent to you to the address you specified.

Binance registration

Verification of identity is required before using all the products of the exchange. Verification may take 1-3 days.

Binance offers the following deposit options:

Replenishment with bank cards.

Replenishment with a cryptocurrency card.

Buying cryptocurrency from traders on the exchange platform.

Purchase of the cryptocurrency that will take part in staking.

Purchase from a Binance fiat balance, if you have one.

Purchase through third-party payment platforms such as Simplex and Banxa.

depositing to an account on Binance

Another option for replenishment. After logging in to your account, select Replenish Wallet from among the account features. In the opened window, select the Enter tab and follow the prompts.

Fixed. A type of staking with no possibility of early withdrawal while earning the accrued interest.

DeFi. This type of staking supports the decentralized finance genre. It is flexible and accrues interest from the first day with the ability to withdraw money at any time.

The list of fixed-stake cryptocurrencies is about 80. It varies depending on the prevailing coin limit.

Fixed staking on Binance

How to choose a cryptocurrency for staking:

The bottom of the startup and the period of its existence, the quoted history. Each cryptocurrency is a payment unit within a startup. The prospects of a startup and, consequently, the value of its altcoin are determined by its usefulness for investors. If the project is not supported by the developers, it will be scammed before the staking period of coins is over.

Volatility. Volatility is lower with the top cryptocurrencies compared to the lower echelon of coins. It means less risk of loss in case of a drawdown.

Staking period. Each cryptocurrency has its own staking period. For some altcoins, it may be the standard 1, 2, and 3 months. For others, it may be 10 days or 6 months. On the one hand, there is a higher percentage of return with a longer period. But also, the risk of price change is higher.

Profit margins. The higher the interest offered, the greater the risk of a price lowering.

As a conservative investment strategy, the Traders Union recommends staking on the maximum possible period with the maximum interest on cryptocurrencies Solana (SOL), Binance Coin (BNB), Neo (NEO), and Polkadot (DOT).

As an aggressive investment strategy with moderate risk, TU recommends staking for up to 1 month on cryptocurrencies Axie Infinity (AXS), Binary X (BNX).

After selecting a cryptocurrency, click Add Assets.

Binance investments

Here, specify the staking parameters, such as the term of the available options and the blocking amount. Note that there are both minimum and maximum amounts. Press the Confirm button and follow the instructions.

For novice investors, staking is one of the best investment options because of:

Low entry threshold. Don’t chase the profit. Understand the principles of the market and study cryptocurrency projects. Go through the complete process, from depositing to withdrawing money.

Passive income. Have you bought a cryptocurrency to sell in a few months at the next historical high? If so, lock it in staking and make extra profit.

Minimum knowledge. In contrast to the stock and currency markets, technical analysis seldom works here. The exception is resistance and support levels, which take into account the psychology of the majority. You have to determine the value of a startup to society, keep track of its development, and follow the general market news that sets the trend.

To start, you need some money on the card, 1-3 days to verify the account on the exchange platform and 10 minutes to execute the transaction.

Staking works, and you're an experienced investor and want to earn 1-2% or more per day on cryptocurrencies? Then get into active trading on Binance! These are the best conditions for you to start!

As of January 2023, miners have mined about 90% of all BTC coins. Transfer to other cryptocurrencies with the PoW algorithm loses its meaning because of the dramatic increase in the complexity of the calculation after the hash rate increases. The ROI of over 6 months makes mining less attractive than staking. Staking can be started with $10-100 and get profit in 10 days.

Validating cryptocurrency exchanges also have other products that can be invested in along with staking, such as:

DeFi farming. For an investor, earning on income farming is similar to staking. Interest is charged for storing cryptocurrency. The difference is in the technical implementation. If staking is a tool to confirm blocks in the PoS algorithm, farming is about maintaining pool liquidity and lending to other participants of the network.

Exchange deposits. This is another instrument with a floating or fixed rate. And also, the difference is only in the technical part and the terms of interest accrual. The exchange can use deposits for its investment purposes, maintaining liquidity, and providing leverage to other traders, etc.

NFT. Some exchanges provide access to NFT auctions. You buy an asset linked to a non-interchangeable token with the expectation that its price will rise over time.

Discover the new world of cryptocurrency investing

What is the difference between mining and staking?

These are fundamentally different types of income:

- Mining is the mining of coins that have not yet been fully issued, by performing mathematical calculations. An investor buys equipment that performs calculations and thus generates cryptocurrency. The complexity of the calculations depends on the number of miners: the higher the hash rate of the network (the computing power of all network equipment connected ), the more complex the calculations, the more time it takes to generate the cryptocurrency, and the more time it takes to see a return on investment.

- Staking is a method of earning interest for holding (“freezing”) cryptocurrency purchased in a separate account for a certain period of time. And, at the end of that period, the investor is paid interest for his troubles. The freezing is required for blockchain network maintenance. If the trader withdraws the cryptocurrency prior to the scheduled maturity date, he loses at least his interest.

Farming is an alternative to staking. It is the process of accruing tokens as a reward for providing liquidity to a project by placing a certain pair of tokens in a pool. It is relevant for cryptocurrencies of the DeFi sector.

What brings more income: mining or staking?

It depends on the investment period and the selected cryptocurrency:

- Staking is more profitable in the short term. You get a fixed percentage at the end of the freeze period, which is 10-90 days for various cryptocurrencies. Then you sell the bought cryptocurrency and benefit if it becomes more expensive or the price has not changed. But there is a possible loss in staking if the cryptocurrency price falls more than the amount of accrued interest.

- Mining is more profitable in the long term. The payback period of the equipment is, on average, 6-12 months and after this period the investor will get a profit. If the price of the cryptocurrency falls, the investor doesn’t lose a cent, but the payback period of the equipment increases. The investor's loss is possible only when the value of the cryptocurrency falls below the cost of production (which is rare) or in the case of premature equipment failure.

In staking, the investor's profit is the interest and the difference between the purchase/sale price of the cryptocurrency. In mining, the investor's profit is the value of the cryptocurrency itself minus the mining operating costs.

How to start making money on staking?

The algorithm is as follows:

- Choose the tokens that you are going to freeze in staking. Focus on the dynamics of the token’s price, its growth prospects, and on the minimal time to keep it frozen. Focus on trading volume, the higher it is, the higher the liquidity of the asset and the more interesting it is for traders. The yield of a token is a secondary factor.

- Buy a token. Set up a wallet for transactions and storage of cryptocurrency and join the pool. The second option is to get verified on the exchange that provides staking services. There is no need for a wallet in this case. The account balance on the exchange platform can be replenished directly from bank cards or e-Systems.

- Specify the account holding the cryptocurrency and fill in the blocking parameters in the staking service.

Interest will accrue at the end of the blocking period.

How much money do I need to start and what are the risks?

The amount to start depends on the minimum entry threshold into the validator pool, provided by its trading terms. Exchanges offer an entry threshold from $30-50 for stable coins and $10-50 for cryptocurrencies of the second-third echelon.

Risks:

- Market. Market volatility averages 1-2% per day and can be as high as 5% or higher. The average staking yield is 5-10% for top cryptocurrencies, 30-50%, and higher for lower echelon coins. If by the end of the coin’s lock-in period, the price at 10% yield drops by more than 10%, you will incur a loss.

- Technical issues. These include everything for system failures, problems with verification of the account, a subsequent failure to withdraw coins, and market risks.

Market risks can be reduced by diversifying risks. Invest part of the money in tokens with the maximum yield for the shortest possible period.

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.