What is Solana (SOL)? Is it Better Than Ethereum?

When thinking of cryptocurrencies to invest in, the first that come to mind are often Bitcoin and Ethereum. What many people don’t realize is that there are many other promising cryptocurrencies to invest in, although they might not be as popular or well-known.

One such cryptocurrency is Solana (SOL). It’s one of the fastest-growing cryptocurrencies of the past year and its growth has surpassed both Bitcoin and Ethereum. And with a market cap of about $73 million, it’s also now the fifth-most popular cryptocurrency after overtaking Cardano.

But what exactly is Solana and how does it work? More importantly, should you invest in Solana? In this post, we’ll look at these questions and more in more detail.

Start trading cryptocurrencies right now with Binance!What is Solana (SOL)?

Created in 2017 and run by the Solana Foundation in Geneva, Solana is a blockchain designed specifically to host a variety of decentralized, scalable applications. Due to its design, it's capable to perform more transactions faster compared to other blockchains like Ethereum and it’s also able to offer significantly lower transaction fees.

Solana History Timeline

Solana co-founder Anatoly Yakovenko previously worked in the field of distributed systems with companies like Qualcomm. Through his work, he became aware that a reliable clock simplified network synchronization and that, as a result, the network could be a lot faster.

His idea was that using proof of history would lead to far greater speeds than other blockchain networks and would allow a network to scale beyond the limitations of Ethereum. It’s as a result of this that Solana was born. The project was released in February 2018 and it showed that it could verify 10,000 transactions in just over half a second.

After further improvements, the project was scaled up in June 2018 to run on cloud-based networks and by January 2023, Solana had processed over 40 billion transactions at a cost far lower than other, similar systems.

What Problems Does Solana Solve

Solana aims to solve three problems that befall many other blockchain networks and technologies.

These are:

-

Speed. As mentioned earlier, Solana can process transactions a lot faster than other blockchain networks. For instance, it can process far in excess of 50,000 transactions per second while networks like Ethereum averages about 13 transactions per second and Bitcoin supports only about 5 transactions per second.

-

Costs. Solana’s fees average about $0.00025 per transaction while Ethereum averages about $6.90 per transaction. To put this into perspective, a $1 million transaction would cost about $10 to process on Solana while the same transaction would cost about $300,000 on Ethereum.

-

Scalability. With a network that’s significantly faster and costs that are substantially lower, Solana is inherently more scalable than other blockchain networks.

How Does Solana Work?

The goal of Solana’s design was to use software algorithms in such a way to eliminate bottlenecks in the network and allow the blockchain to scale according to the network bandwidth. In other words, the higher the network’s capacity, the more transactions it will be able to manage.

In fact, Solana’s architecture has a theoretical upper limit of 710,000 transactions per second on a standard Gigabit network and this number increases to 28.4 million transaction per second on a 40-Gigabit network. As a result, Solana’s architecture has all the desirable attributes of a blockchain. Simply put, it’s decentralized, secure, and scalable.

At the core of its performance credentials lies Solana’s consensus model. Unlike other cryptocurrencies like Bitcoin that use a proof-of-work model, Solana use a proof-of-stake consensus model like Cardano. This model has inherent speed benefits.

In Solana’s case, this model is also reinforced with Tower BFT consensus that enables the network to reach consensus even though there might be potential attacks from malicious nodes. It does this by enforcing a universal source of time across the network by using proof-of-history. In turn, this creates a record for all transactions on the blockchain that serves as a permanent record of all the nodes running the network.

Tower BFT uses this proof-of-history as a permissionless system to provide a decentralized clock that helps to secure the network and reduces the processing power needed to process transactions since it doesn’t have to process prior transactions. This results in Solana being so fast.

Other technologies that play a role in Solana’s performance is its transaction parallelization system, Sealevel, and its mempool system, Gulfstream. Sealevel allows parallel smart contract runtime while Gulfstream forwards transactions to validators before prior transactions are finalized.

This, in turn, increases the concurrent and parallel transaction capacity of the network and maximizes transaction confirmation speed.

Solana Use Cases

Solana is much more than just a mere currency and it can be implemented in several.

Cases including:

-

Cryptocurrency. Like other cryptocurrencies, Solana can be used as a currency. So, you can send or receive Solana just like you would, for instance, Bitcoin. And because it can be used as a currency, it could possibly also be used to pay for products and services.

-

Smart contracts. Smart contracts are becoming increasingly popular in several sectors and like Ethereum, Solana can be used to run smart contracts that automatically execute the terms of a contract.

-

Non-fungible tokens. Solana can also power non-fungible tokens or NFTs that would, for instance, allow digital artists to sell their art to consumers.

-

Decentralized finance. Decentralized finance is becoming increasingly popular as it allows easier access to financial products like loans to a wider range of people.

-

Other applications. Apart from the use cases mentioned above, Solana can also be used for a range of other applications from investing platforms, games, and more.

Solana vs Ethereum - Which is Better?

Considering the above, the immediate question is: Which is better between Solana and Ethereum? To look at this question in more detail, let’s first do a comparison between these two currencies.

| Solana | Ethereum | |

|---|---|---|

Founded |

2018 |

2015 |

Market Cap |

$54 billion |

$454 billion |

Use Cases |

Smart contracts, DeFi, NFTs, Currency, Other applications |

Smart contract, DeFi, Currency, NFTs, Other applications |

Transaction Speed |

On average, about 50,000 transactions per second with a theoretical upper limit of over 700,000 transactions per second |

13 Transactions per second, Ethereum 2 promises up to 100,000 transactions per second |

Limited/Unlimited Supply |

Maximum supply of 489 million tokens |

No limit on supply |

Is Solana an Ethereum Killer?

Because Solana can be used in a similar set of use cases compared to Ethereum, it’s obvious that many will draw comparisons between the two. Both of these blockchains can run decentralized finance applications, are suitable for smart contract use cases, and can be implemented for NFTs.

There are some distinct differences, however, that can put Solana ahead of Ethereum. For one, as mentioned earlier, unlike Ethereum that uses a proof-of-work consensus model, Solana uses a proof-of-stake model. This model is more energy-efficient and allows Solana to provide much faster transactions processing speeds.

Ethereum does, however, have a distinct advantage as it was established long before Solana. As such, it’s built up a huge ecosystem and it’s currently the second-largest cryptocurrency by market capitalization.

Moreover, Ethereum’s ETH2 upgrade and its pivot to a proof-of-stake model is scheduled for 2023. These upgrades and changes promise to make Ethereum more secure, scalable, and sustainable and increase its transaction processing speeds which will put it on an equal footing with Solana.

Ultimately, while Solana is a promising project, it’s simply too early to say whether it will be an Ethereum killer.

Which crypto is the best investment in 2024?Is Solana (SOL) a Good Investment?

Solana has shown massive growth in the past year with the result that many investors are capitalizing on this opportunity. Despite this, there are significant differences between a cryptocurrency like Solana and, for instance, stocks.

When buying stocks, you, in fact, buy part ownership of a company. This means that, if the company grows, your stock will become more valuable. In other words, there’s value behind the stock.

In contrast, Solana, like most other cryptocurrencies, is not backed by any assets or operations that provide value. As such, much of the value in cryptocurrencies relate to speculation that drives the increases in prices. In simple terms, traders bargain on that they can buy a specific cryptocurrency and sell it later on for a higher price.

Solana Demand and Supply

Simple economics dictate that, as the demand for a particular asset increases while its supply decreases, so will its value. In contrast, if there’s an oversupply of a specific asset, its price will fall. With that in mind, let’s look at some reasons why Solana’s demand will increase over time.

These reasons include:

-

It’s fast. As mentioned earlier, Solana is fast. This makes it an ideal solution for many use cases and, as more developers realize the speed benefits it promises, they’ll use it in their projects. And, as more developers use it, the demand for Solana will increase.

-

NFTs are becoming more popular. In recent times, NFTs have become increasingly popular to protect ownership and copyright information. It’s only expected that this trend will continue. As mentioned above, Solana is an appropriate solution for this use case. In fact, it recently made its first foray into NFTs and as it becomes more popular for these use cases, demand will increase.

-

It’s attracting more projects. There are currently over 400 projects that run on Solana’s network including several DeFi projects. As some of these projects, especially in the decentralized finance space become more popular, the demand for Solana will increase.

-

Developers want alternatives to Ethereum. Ethereum is the oldest programmable blockchain and, while very popular and capable, it does suffer some drawbacks. For example, it’s comparatively slower than Solana and much more expensive. As a result, many developers are looking for viable alternatives that can bring down transaction processing costs and increase speed. And this is where Solana comes in. As more developers realize these benefits, Solana’s demand will increase.

-

It allows the exchange of data with other blockchains. Blockchains are generally not good at exchanging data with one another. Solana solves this problem as it bridges the gap between blockchains. For example, with it, projects will be able to exchange data and assets between Solana and Ethereum quickly and easily.

-

List item 6.

Solana Mass Adoption

As with any cryptocurrency, mass adoption attracts more investors. And with more investors come more demand and an increase in prices. With its benefits, Solana has massive potential for mass adoption which will attract even more investors. In fact, Solana is now the third cryptocurrency to be tracked by the Bloomberg terminal after Bitcoin and Ethereum which indicates that it’s on the road to mass adoption.

Price Predictions

In the past year, Solana has shown massive growth. In fact, it was one of the strongest performers for 2023. For this reason, some experts believe that its price could increase to $1000 by 2027.

Keep in mind, though, the cryptocurrency market is very volatile and any investment in cryptocurrencies is still speculative with the result that this price might be realistic or not and could be affected by many factors. For example, if Ethereum 2 brings advances in speeds and transaction processing fees, Solana might lose its advantage and, as a result, value.

Should you Buy Solana (SOL)?

Simply put, Solana shows promise and predictions are that its price will increase in the future. However, it’s relatively new and it might be a good idea to give it some time to determine how it fits into the market and whether it will be a good investment option. Ultimately, whether you should buy Solana depends on your specific investment goals and risk appetite.

Best Exchanges to Buy Solana (SOL) in 2024

At Traders Union, we have compiled a list of the best cryptocurrency exchanges that you can choose from if you want to buy Solana.

These include

-

Binance

-

Coinbase

-

Kraken

-

Bybit

Let’s look at some of these in more detail.

Binance

Binance is not only one of the most popular exchanges in the world, but also the largest. As such, it offers access to a massive range of cryptocurrencies and features an extensive trading platform.

For traders, the platform offers low minimum deposit requirements, low commissions, and a wallet that allows traders to store their cryptocurrencies. In addition, the platform also offers its native coin that’s used internally as a payment unit.

Coinbase

Based in the US, Coinbase is another popular cryptocurrency exchange. With its unique education platform that rewards traders with cryptocurrencies as they learn about them, it’s an especially good option for novice traders.

It gives traders access to a wide range of cryptocurrencies including Bitcoin, Ethereum, Litecoin, Ripple, BitcoinCash, and others. The platform, in addition to its web trading platform, also offers mobile apps that traders can use to trade on the go. Other benefits of Coinbase include excellent security and a free crypto wallet.

It’s no wonder that the platform currently serves over 43 million users from 100 countries.

How to buy Solana (SOL)?

Now that you’ve seen some of Solana’s characteristics and its benefits, you’re probably wondering how you can buy Solana. Let’s look at the process you’ll need to follow a bit closer.

Market Analysis

Before you buy Solana, you should perform a detailed market analysis. In other words, you should determine whether it’s the right time to buy. In this way, you’ll not able to minimize your risks but also maximize your profits.

This process will usually entail looking at news around Solana at the time you want to buy that could influence its price. You should also use technical analysis to study its price action in order to make fairly accurate predictions about how the price will move in the future.

Choosing an Exchange

The next step is to choose an exchange that you’ll use to buy Solana. As mentioned earlier, there are quite a few exchanges available and you’ll need to choose the right one based on your specific needs and requirements. As also mentioned earlier, Binance is an excellent choice, so we’ll use it in this example.

Funding Account

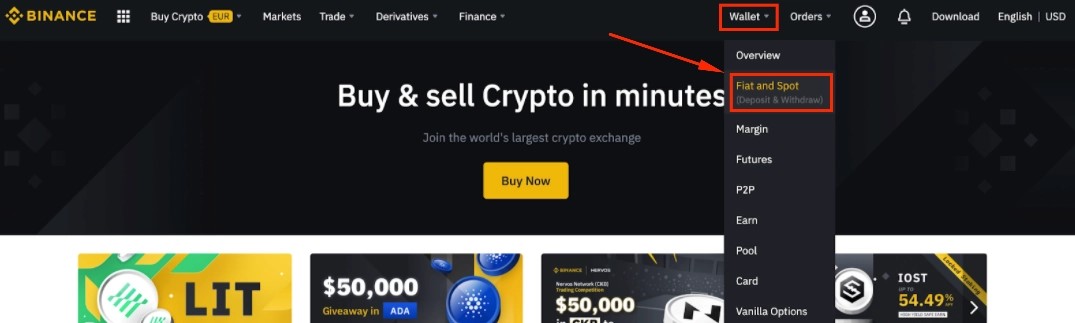

To fund your Binance account, you’ll first need to create a Binance account if you haven't done so already. If you already have an account, you can log into your account. You’ll then need to go to the Wallet tab and select Fiat and Spot.

how to fund your Binance account

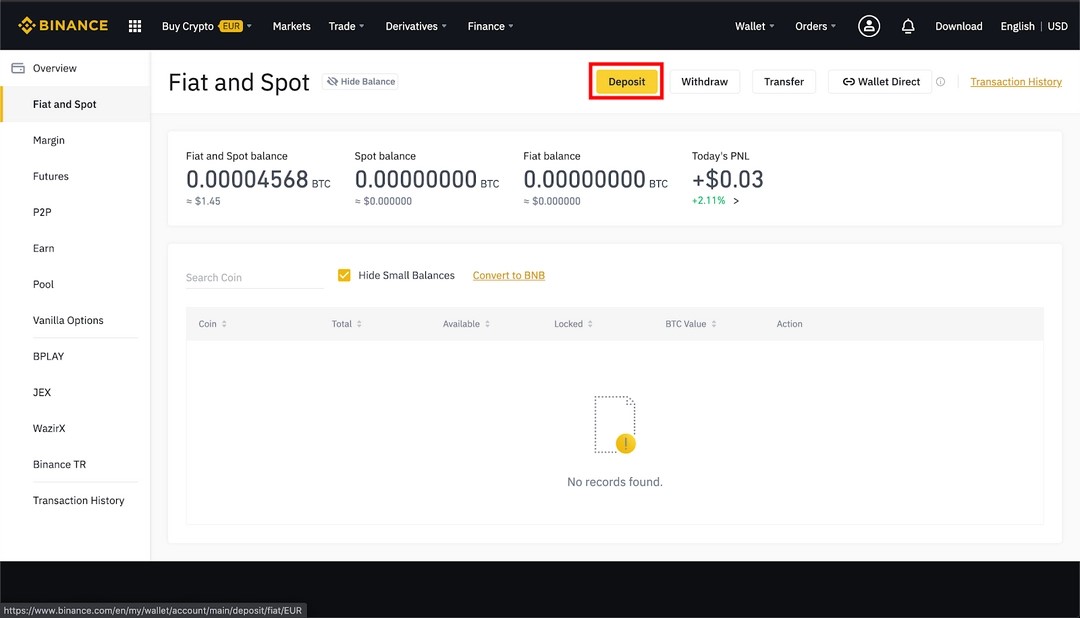

You’ll then click on the Deposit tab.

how to fund your Binance account

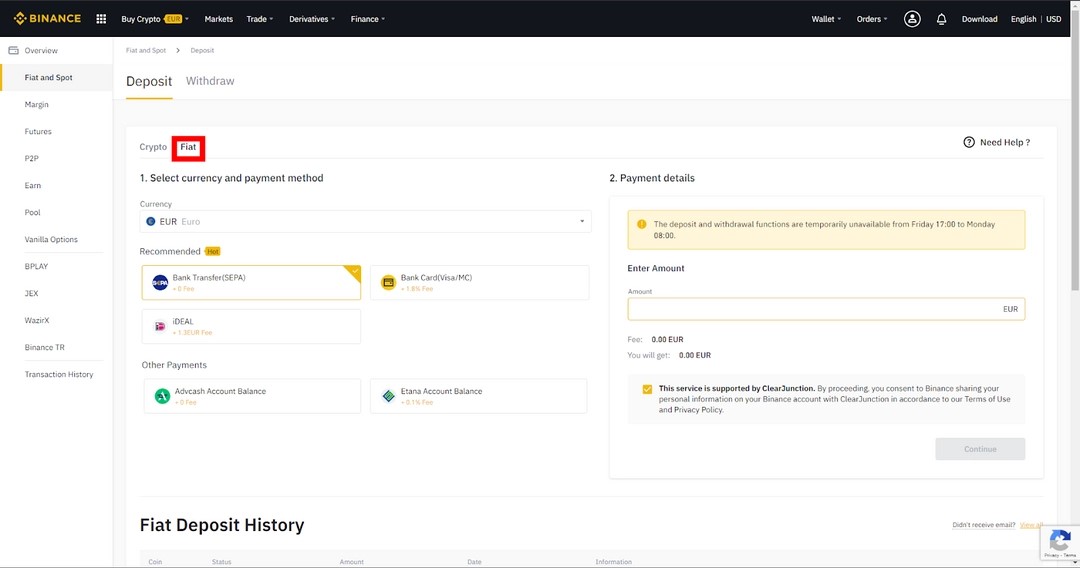

The next step is to select the Fiat tab.

how to fund your Binance account

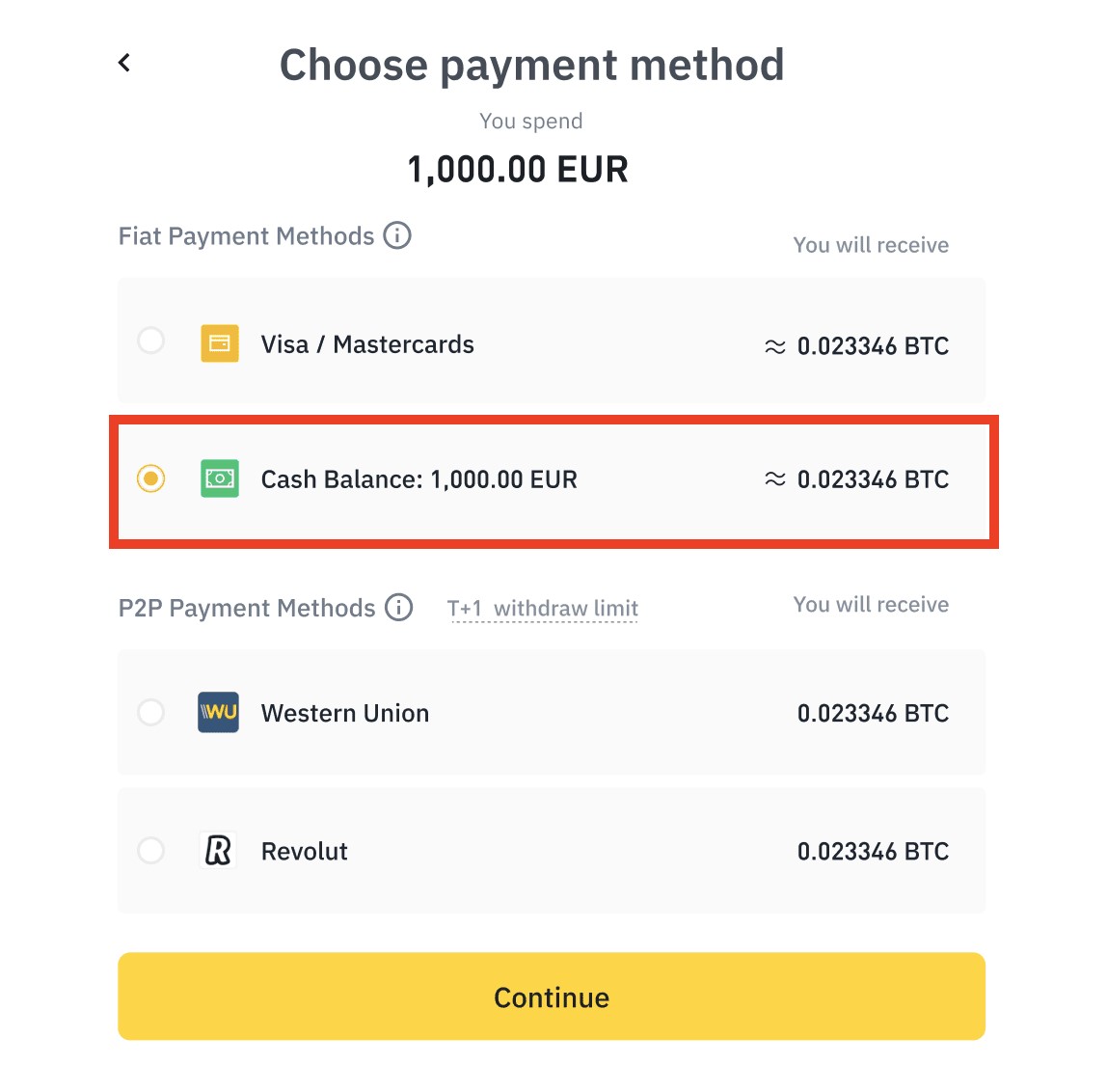

You’ll then be able to select the currency you’d like to deposit and the payment method you want to use. Here, Binance supports credit cards, debit cards, and bank transfers. Once you’ve entered all the details, you can click on Continue to complete the deposit.

Buying Solana

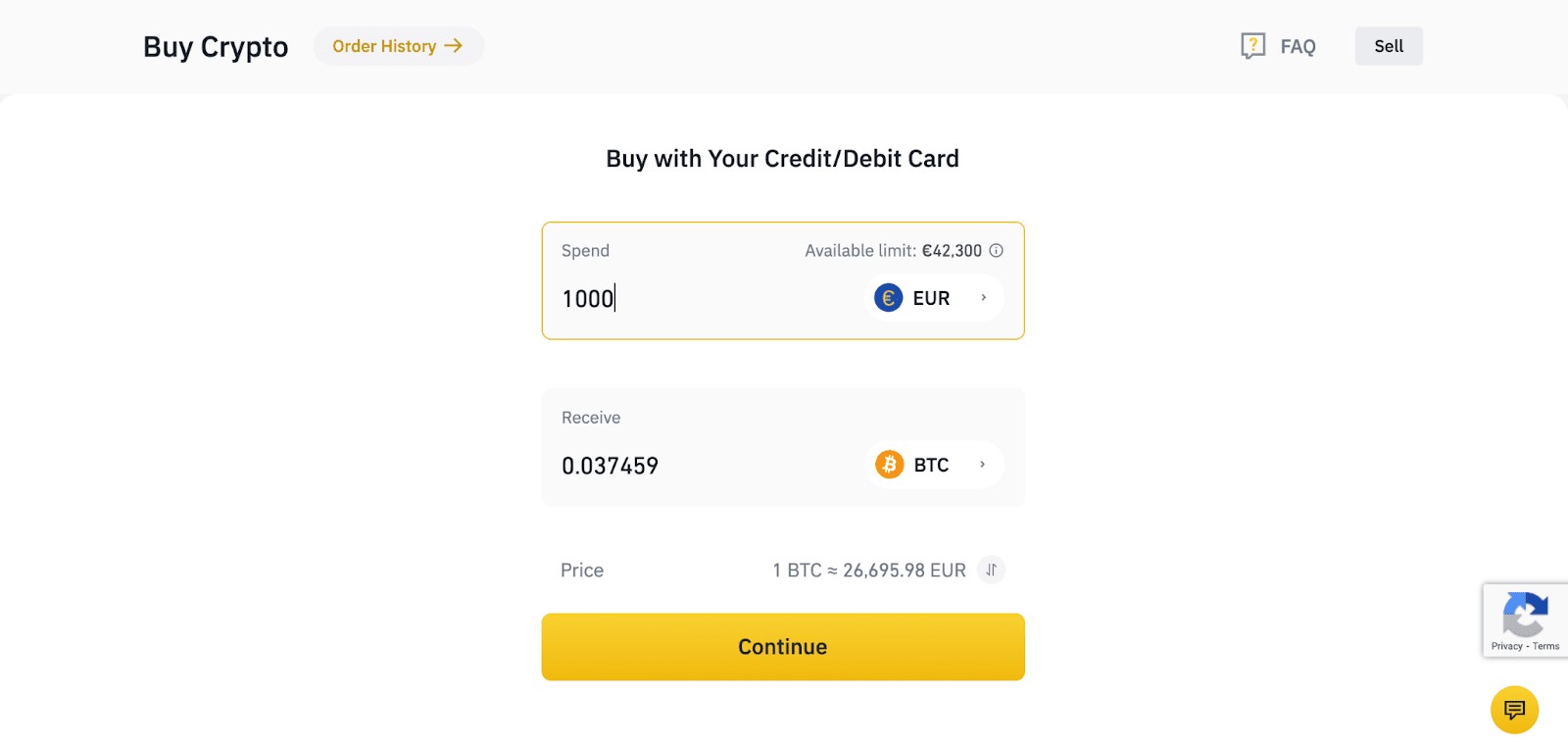

To buy Solana, you’ll also need to log into your Binance account. Once you’ve logged in, you can click on Buy Now. On the page that opens you can then select how much Solana you want to buy.

how to buy crypto on Binance

Once you’ve entered this amount, you can click on Continue. You’ll then select Cash Balance and click Continue. You’ll then be able to confirm your order to make your purchase.

how to buy crypto on Binance

Top 10 Biggest Solana Alternatives

Considering Solana’s performance benefits which lead to more adoption, many investors are choosing to invest in it. However, there are several other options you can invest in. Fortunately, the experts at Traders Union have done in-depth research for you that will make it easier for you to decide what you should invest in.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Cryptocurrency exchange |

547.40$ |

176.82% |

-15.46% |

9.5 |

Invest | |

Blockchain platform |

1.45$ |

161.50% |

-14.26% |

9.2 |

Invest | |

Payments |

0.93$ |

106.44% |

-12.04% |

9 |

Invest | |

Payments |

0.19$ |

190.69% |

-14.62% |

8 |

Invest | |

Blockchain platform |

28.84$ |

139.44% |

-31.12% |

8 |

Invest | |

Payments |

157.80$ |

20.95% |

-34.20% |

7.6 |

Invest | |

Payments |

0.29$ |

66.42% |

-16.68% |

7.5 |

Invest | |

Decentralized exchange |

17.46$ |

131.68% |

-20.23% |

7.4 |

Invest | |

Blockchain platform/Media |

0.08$ |

95.53% |

-20.54% |

7 |

Invest | |

Internet of Things |

1.31$ |

126.22% |

-18.28% |

6.9 |

Invest |

Summary

Although Solana is a fairly recent entrant into the Blockchain space, its performance benefits and its possible use in a variety of use cases, make it a promising alternative to Ethereum. But the question is: Is it better than Ethereum? Ultimately, it’s a promising project but it’s too early to tell whether it will be a competitor to Ethereum that has a larger ecosystem and more adoption.

To learn more about cryptocurrencies like Solana, Ethereum, Bitcoin, and others or for more insights into trading strategies or cryptocurrency exchanges, why not join Traders Union today.

FAQs

What should I buy, Ethereum or Solana?

Both these cryptocurrencies have advantages and disadvantages and what you buy will, ultimately, depend on your specific goals and risk appetite.

What exchange should I use?

Typically, you’ll need to find an exchange with all the features and functionality you require. Any of the exchanges on our list of the top exchanges will serve you well.

Why do I have to pay a fee to buy crypto?

Any crypto transaction has a transaction fee that’s necessary for the maintenance of the network. The exchange passes this fee on to you.

What other cryptocurrencies can I consider apart from Solana?

As mentioned above, our experts have compiled a table with some of the alternative cryptocurrencies you can consider.

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.