Choosing Algorithmic Trading Software

Here are the factors on choosing an algorithmic trading software:

-

Reliability and speed

-

Advanced features

-

Risk management tools

-

Market connectivity

-

Cost and fees

Algorithmic trading, leveraging computer programs to automate trade execution, has become increasingly popular. However, with a multitude of software options available, selecting the right platform is crucial for your algorithmic trading journey. In this guide TU Experts will equip you with the knowledge to navigate the various features, consider key factors like reliability and cost, and ultimately choose the algorithmic trading software that best suits your experience and trading goals.

-

Is algo trading legal?

Yes, algo trading is legal in many jurisdictions, including the USA, as long as traders adhere to relevant regulations set by financial authorities.

-

Which software is best for algo trading?

The best software for algo trading depends on individual preferences, trading goals, and level of expertise. It's essential to consider factors like reliability, features, market connectivity, and cost when choosing the right software.

-

How successful is algo trading?

Algo trading can be successful for traders who employ effective strategies and risk management techniques. However, success varies depending on market conditions, trading strategies, and the skill level of the trader.

-

Is algo trading easy?

Algo trading can be complex and requires a solid understanding of financial markets, trading strategies, and programming languages. While some aspects of algo trading may be challenging, there are user-friendly software options and resources available to help simplify the process for beginners.

Understanding algorithmic trading

Algorithmic trading meaning, also referred to as automated trading or algo-trading, involves using computer programs to execute trades based on predefined instructions or algorithms. These instructions are crafted to make trades considering factors like timing, price, quantity, or mathematical models. The primary goal of algorithmic trading is to remove human emotions from trading decisions, ensuring quicker and more efficient trade execution. It merges computer programming with financial markets to execute trades precisely, offering benefits such as optimal execution, minimal delay, decreased transaction expenses, and automated evaluations of various market conditions.

In simple terms, algorithmic trading functions by translating trading strategies into computer code capable of swiftly and accurately buying and selling assets. By automating trading, algorithmic systems eliminate human errors, reduce the influence of emotions, and allow for evaluating algo trading strategies through backtesting. Nevertheless, algorithmic trading has its downsides, including dependence on technology, vulnerability to market fluctuations, compliance with regulations, high initial investment, and limited customization options.

Furthermore, algorithmic trading operates in the absence of human emotions that might otherwise affect outcomes. Investors typically employ this method when seeking to rapidly buy or sell assets to profit from short-term price shifts.

As a result, traders can engage in numerous trades within a 24-hour period and take advantage of even the smallest changes in value. Besides the stock market, algorithmic trading techniques are prevalent in various other sectors, with notable examples including Forex and cryptocurrency markets.

How to choose algo trading software

Reliability and speed

The reliability and speed of the software are crucial. Look for software with a proven history of consistent uptime and stability. It's important to consider execution speed, including factors such as latency, which refers to the time it takes for your orders to reach the market, and order routing efficiency.

Advanced features

Different software offers various features tailored to different levels of experience. For beginners, prioritizing a user-friendly interface with pre-built strategies might be optimal. Advanced users, on the other hand, may seek features like backtesting capabilities, allowing them to test strategies on historical data, strategy optimization tools for refining algorithms, and options for custom coding to create unique strategies.

Risk management tools

Effective risk management tools are essential in algo trading to mitigate potential risks. Look for software that offers good risk management features such as stop-loss orders, which automatically sell at a predetermined price to limit losses, take-profit orders for locking in gains, and position sizing controls to limit the amount of capital at risk in each trade.

Market connectivity

Ensure that the software connects to the markets in which you intend to trade, whether it's stocks, options, Forex, or others. Additionally, compatibility with your preferred broker is important for seamless trading experiences.

Cost and fees

Algo trading software comes with varying costs, ranging from free basic options to feature-rich platforms with subscription fees. Consider your budget and requirements carefully. Some platforms may charge transaction fees in addition to subscription fees. It's essential to strike a balance between affordability and the features you need.

Types of algo trading software

The types of algo trading software:

-

Trading advisors and bots

Trading advisors and bots

These are pre-programmed trading algorithms and AI trading apps designed to execute trades based on preset strategies. They are easy to use Forex algo trading softwares and often come with a range of predefined strategies, making them suitable for beginners. Some platforms even allow limited customization of these strategies.

Examples:

-

Zignaly: Provides trading signals and automation tools specifically for cryptocurrency trading.

-

Pionex: Offers automated trading bots tailored for cryptocurrency markets.

-

CryptoHopper: Allows users to automate their trading strategies within the cryptocurrency market.

Copy trading

This method involves replicating the trades of experienced traders. Users select a trader to follow based on their performance and risk preferences, and their trades are automatically copied into the user's account. While this approach requires minimal effort, it carries risks as the following trader's strategy may not align with the user's.

Examples:

-

eToro: Known for its CopyTrader feature, enabling users to mimic the trades of successful investors.

-

RoboForex: Provides copy trading services where users can emulate the trades of expert traders.

-

Binance: Offers a copy trading feature for users to follow and replicate the trades of top traders on the platform.

Strategy builders

These platforms (also known as expert advisors) offer visual interfaces for users to construct their own trading algorithms. They typically employ drag-and-drop functionality and pre-built logic blocks, allowing users to design strategies without coding knowledge. While offering more control, these platforms require some understanding of trading concepts and indicators.

Examples:

-

RoboForex: Provides a strategy builder tool for users to develop and test their trading strategies.

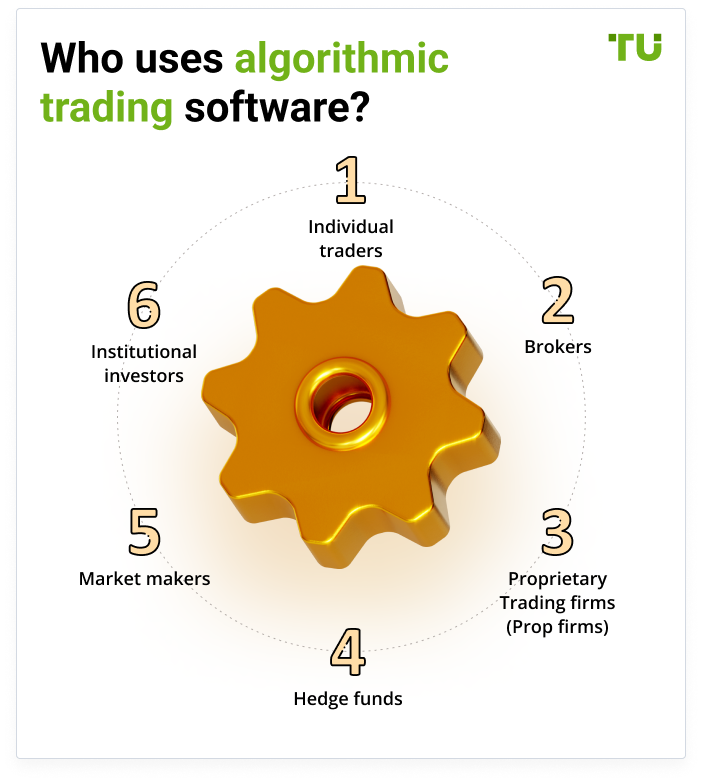

Who uses algorithmic trading software?

Algorithmic trading software is utilized by various entities to improve trading activities and gain a competitive edge in financial markets. Here are the primary users of algorithmic trading software:

Individual traders

Individual traders use algorithmic trading software to automate their trading strategies, execute trades efficiently, and seize market opportunities without constant manual intervention.

Brokers

Brokerage houses and online trading platforms employ algorithmic trading to offer automated trade execution services to clients. This ensures quicker and more precise order placement while enhancing market liquidity.

Proprietary Trading firms (Prop firms)

Proprietary trading firms utilize algorithmic trading software to execute their proprietary trading strategies, optimize trade execution, and generate profits through advanced algorithms and technology.

Hedge funds

Hedge funds extensively rely on algorithmic trading software to implement quantitative trading strategies, manage risk, and achieve superior returns by automating trading decisions based on predefined algorithms and market conditions.

Market makers

Use algorithmic trading to provide liquidity in markets by continuously quoting bid and ask prices. This facilitates efficient trade execution and reduces spreads for traders.

Institutional investors

Institutional investors like pension funds, mutual funds, and insurance companies utilize algorithmic trading software to execute large-volume trades, manage portfolios, and optimize investment strategies based on predefined algorithms and market data.

Algorithmic trading software: free or paid?

When it comes to choosing algorithmic trading software, traders often face the dilemma of whether to opt for free or paid options. Let's explore the pros and cons of each:

Free algorithmic trading software

Free software comes with several advantages. Firstly, it's cost-effective, eliminating the need for upfront financial investment, which makes it accessible to traders with limited budgets. Additionally, it provides an opportunity for novice traders to experiment with algorithmic trading strategies without financial risk. It serves as a learning platform, allowing traders to gain experience and understanding of algorithmic trading concepts.

However, free software also has its drawbacks. It may lack advanced features and customization options available in paid versions. Moreover, limited or no customer support can hinder troubleshooting and resolving technical issues. Security concerns also arise as free software may lack robust security measures, potentially exposing traders to risks like data breaches or malware.

Paid algorithmic trading software

Paid software offers a wide range of advanced features, customization options, and technical indicators, which can significantly enhance trading capabilities. It often comes with better customer support, ensuring prompt assistance and issue resolution. Paid platforms prioritize security measures, safeguarding traders' data and transactions effectively.

Nevertheless, paid software has its downsides as well. The upfront costs or subscription fees may be a barrier for traders with limited budgets. Some paid software can also be complex to use, requiring a learning curve for traders to fully utilize all features. Additionally, traders relying on paid software are dependent on the vendor for updates, maintenance, and support.

In conclusion, the choice between free and paid algorithmic trading software depends on the trader's budget, requirements, and level of expertise.

Is algorithmic trading profitable?

Algorithmic trading has the potential to be profitable for traders who approach it with the right strategies and knowledge. Here are some beginner-friendly tips on how to succeed in algorithmic trading:

Understanding the basics

It's essential to have a solid grasp of financial markets, trading strategies, and the technical aspects of algorithmic trading before diving in.

Learning programming

Familiarize yourself with programming languages like Python, which are commonly used in algorithmic trading to develop and implement trading algorithms.

Backtesting our strategies

Before using your algorithms in live trading, it's crucial to thoroughly backtest them using historical data to evaluate their performance and refine them for optimal results.

Implementing risk management

Protecting your capital and minimizing potential losses is paramount. Implement robust risk management strategies such as setting stop-loss orders and defining risk-reward ratios for each trade.

Staying informed

Keep yourself updated on market trends, news, and developments that could impact your trading strategies. Continuous learning and adaptation are key to success in algorithmic trading.

Starting small

Begin with a small amount of capital to test your strategies in live trading. As you gain confidence and see consistent results, you can gradually increase your trading size.

Continuous improvement

Regularly review and analyze your trading performance, identifying areas for improvement, and refining your strategies based on your trading data and results.

Is algorithmic trading legal?

Algorithmic trading is indeed legal in the USA, with no explicit laws or regulations prohibiting its practice. This means that investors are free to develop and utilize their own algorithms for trading purposes without facing legal constraints. However, the legality of algorithmic trading doesn't mean it operates without oversight. Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) play crucial roles in overseeing US financial markets to ensure fairness and orderliness.

The focus of these regulatory bodies is primarily on maintaining fair and orderly markets, and algorithmic trading falls squarely within their purview. While algorithmic trading itself is not banned, regulations are in place to address potential issues that may arise from its use. These regulations are designed to prevent market manipulation, ensure market stability, and promote proper risk management practices among algorithmic traders.

One of the key concerns addressed by regulations is market manipulation. Practices like spoofing and wash trading, which involve manipulating markets through fake orders or false trading activity, are strictly prohibited. Regulators are vigilant in monitoring such activities to maintain the integrity of financial markets.

Another area of focus is high-frequency trading (HFT), which is a subset of algorithmic trading. While HFT strategies can offer advantages in terms of speed, regulators are mindful of their potential to disrupt market stability. Measures may be implemented to ensure fair access to markets for all participants and prevent any adverse effects on market functioning.

Regulators also emphasize the importance of proper risk management practices for algorithmic traders. This includes having adequate controls in place to prevent system malfunctions or unintended trading activity, which could have bad effects on both individual traders and the broader market.

Conclusion

In conclusion, choosing the right algorithmic trading software involves considering various factors such as reliability, features, market connectivity, cost, and legal compliance. Traders must assess their needs and preferences to determine whether free or paid software best suits their requirements. While free software offers accessibility and learning opportunities, paid software provides advanced features, reliability, and enhanced security. Additionally, it's crucial to ensure that the chosen software complies with relevant regulations to avoid legal issues and maintain market integrity. By carefully evaluating these factors and making informed decisions, traders can effectively leverage algorithmic trading software to enhance their trading activities and achieve their financial goals.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).