What Is The Best Type Of Stop-Loss Order?

There are several different types of stop-loss order, though the best one is completely dependent on a trader’s strategy, risk tolerance and preference. A market stop-loss order is quick and simple to use, while a limit stop-loss order is more precise and allows more control. A trailing stop-loss order allows traders to lock in profits, as does a partial stop-loss order, though both are more complex to implement.

A stop loss is an order that traders use to trigger the automatic selling of an investment asset when its value decreases to, or below, a specific price that they set beforehand. A stop-loss order is not to be confused with a ‘take-profit’ order, which automatically sells when a certain profit level is reached. There are different types of stop loss orders that can be placed, each with their own use cases, which traders may select based on their adopted trading or investment strategy and financial goals.

In this article, we’ll be looking at the different types of stop loss orders, the advantages and disadvantages of each type of stop loss order, what factors to consider when choosing a stop loss order, and whether successful traders use them. We’ll break down the various stop loss orders so readers can be better prepared for managing their risk through the efficient use of stop loss orders.

What types of stop losses are there

A stop loss is an order that a trader or investor places that triggers the sale of an asset when its price hits a predetermined level that’s lower than the price at the time of opening, in order to prevent further losses. When someone buys an asset or opens a trading position, they can set the stop-loss order there and then, or any time before its sale. The stop-loss order automatically triggers the sale of the asset if the price decreases later on.

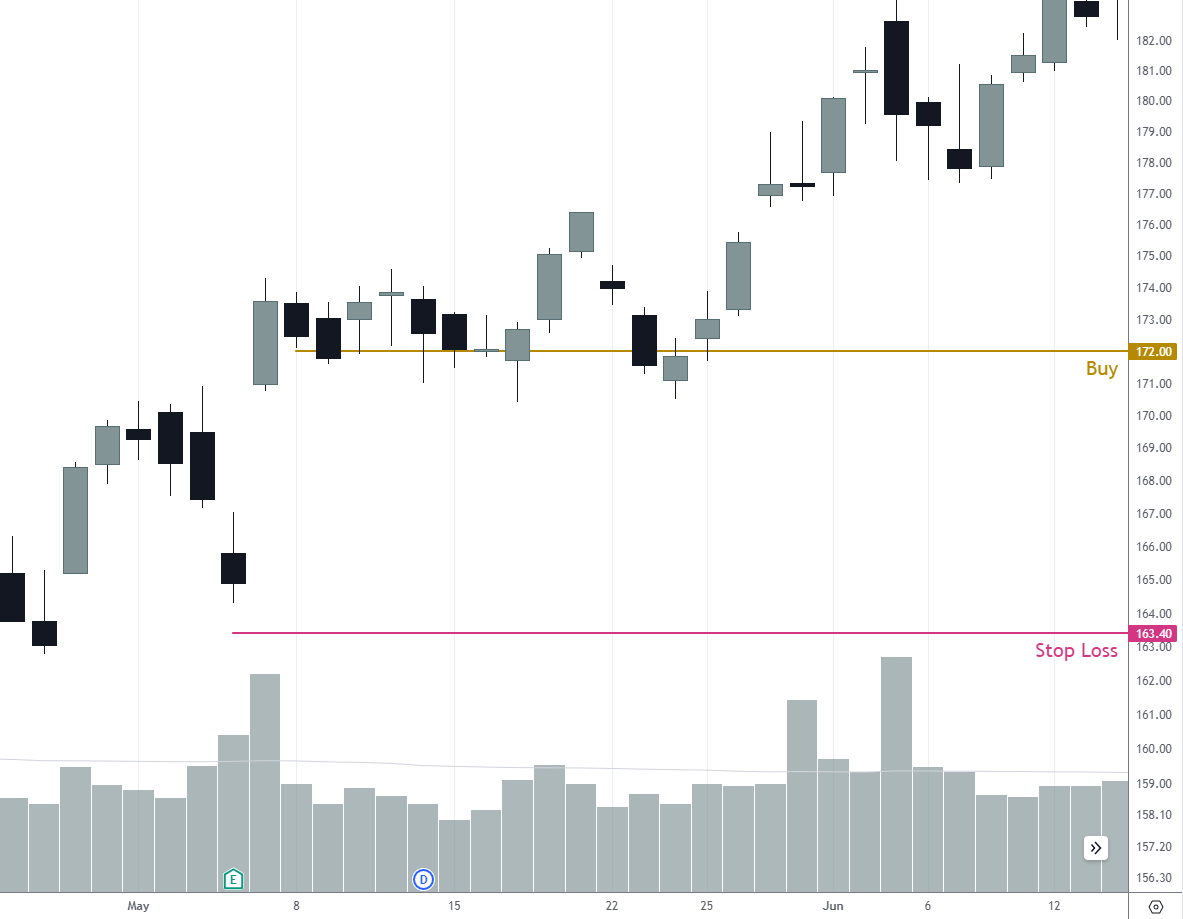

Imagine a trader buys one Apple stock (AAPL) at $172.00. In order to carefully manage their risk, they want to set a stop loss order that will sell their shares if AAPL’s price dips below 5% of its current value. To do this, they set a stop-loss order of $163.40. This means that if at any time, AAPL stock drops to $163.40, even for a second, an order to sell the share will be executed at the nearest available price. This occurs even if the trader is not using the brokerage platform or is not online.

Source:tradingview.com

Stop-loss orders can be used in most financial markets, such as those that trade stocks, Forex, cryptocurrency, futures, options, commodities, bonds, and ETFs.

Stop-loss orders can be a great way to prevent incurring heavy losses when an asset’s price takes a large hit. However, not all stop-losses are the same. Let’s take a look at the different types of stop-loss orders.

-

Market stop loss: This is a standard stop-loss order, sometimes called a ‘stop-order’. It tells a brokerage to stop trading when a certain price is reached (lower than the opening position). The stop order is triggered when an execution occurs at, or below, the set stop price. When this price is reached, a market order is automatically placed to sell at the next available price. The position is closed at the next available price

-

Limit stop loss: A limit stop-loss order, or stop-limit order, is similar to a market stop-loss order, but with a key difference. While both are designed to sell a security at a specified level, a market stop-loss order executes at the best available market price once the stop level is reached. On the other hand, a limit stop-loss order converts into a limit order, meaning it will only execute at the specified limit price or better. This provides more control over the selling price but does not guarantee the order's execution if the market moves unfavorably, i.e. lower than the limit order

-

Trailing stop loss: A trailing stop loss order moves as the bid price of an asset moves higher – in other words, ‘trails’ behind it. The stop price adjusts itself based on a level that you set. For example, if you set a trailing stop loss of 5%, the stop order would be set at 5% below the asset’s current price, even as it increases in value. However, the stop loss order freezes if the asset moves unfavorably, and will not go lower if the asset’s price moves lower. This allows traders to lock in profits

-

Partial stop-losses: A partial stop loss, also known as a ‘partial close’, involves closing only a portion of a trading position when a certain loss level is reached. It allows traders to limit losses on part of their position while keeping the remainder open, providing flexibility in managing risk and capitalizing on market movements

For more information, read the in-depth guide on how to use stop loss orders by one of Traders Union’s experts.

Comparison of stop loss orders

The type of stop-loss order a trader uses depends largely on their own trading strategy, their own risk tolerance, and their financial goals. Let’s take a look at the advantages and disadvantages of each type of stop-loss order.

Market stop loss

👍 Pros

• Simplicity: As the most standard form of stop-loss, it is easy to implement and understand. Most brokerage platforms allow stop-losses to be set at the press of a button., making it accessible to traders of all levels of experience

• Quick Execution: It executes as a market order, ensuring a swift exit once the stop level is reached. Unlike a limit stop loss, it will be executed at the next available price whether that is higher or lower than the amount set by the order

👎 Cons

• Slippage: Particularly in volatile markets, the execution price can deviate significantly from the stop level. A trade might be closed at a very different price than the stop order

• Gap Risk: A standard stop-loss order faces gap risk, as prices may open significantly lower, causing the execution price to be worse than anticipated

Limit stop-loss

👍 Pros

• Control: Limit stop-losses offer traders more control, as they guarantee execution at the level set by the trader, or above

• Slippage: They help avoid slippage, which is a common issue in fast-moving markets where execution prices deviate from the stop level

• Precision: A limit stop-loss allows for precise execution in stable market conditions, particularly when the trader has a specific target in mind

👎 Cons

• Adaptability: If a trader sets a limit stop-loss order, but the market rapidly deteriorates and the asset can’t be sold above the stop price, it may not be possible to execute the order

• Limited Flexibility: It may not execute in rapidly changing market conditions, which limits the flexibility of the order

• More Complicated: A limit stop-loss is more complex to implement compared to a standard market stop-loss order, requiring traders to actively monitor and adjust their limit prices

Trailing stop-loss

👍 Pros

• Adaptable: A trailing stop-loss dynamically adjusts to favorable price movements, which can potentially maximize profits compared to other types of stop-loss orders

• Locks in Profits: It helps secure gains while allowing for potential profits from upward trends. If the market sees unexpected favorable movements, the trailing stop loss automatically adjusts so the trader can profit

👎 Cons

• Complex: A trailing stop-loss is more complicated to implement, and requires ongoing monitoring and adjustments

• Missed Opportunities: It may result in premature selling during short-term price fluctuations. For example, if an asset price suddenly increased significantly, the trailing stop-loss would adjust, increasing the lower limit. If the asset price stabilized and went back down to its original value, the stop-loss order would now be frozen at a higher level, which might result in a premature position close

Partial stop loss orders

👍 Pros

• Profit Protection: A partial stop-loss order allows traders to secure profits on a portion of their position while keeping the remaining open. This provides a balance between profit-taking and potential further gains

• Flexible Risk Management: It provides flexibility in risk management, by adjusting the size of the partial stop-loss order based on market conditions and the trader's risk tolerance

👎 Cons

• Complexity: Is arguably the most complex of all types of stop-loss orders, as traders need to decide on the appropriate size and timing for partial exits

• Potential for Missed Opportunities: Traders risk missing out on potential profits if the market continues to move in their favor after a partial stop-loss order is executed

• Transaction Costs: The use of partial stop-loss orders may result in increased transaction costs due to more frequent trading activity compared to other stop-loss orders

There is an ongoing debate about whether brokerages intentionally seek out stop-loss orders and trigger them for their own gain. This could add a potential additional disadvantage if true. Read our Traders Union article about whether brokers actually hunt down client stop-loss orders.

Best Forex brokers

Key factors to consider when choosing a stop loss order

If a trader decides to implement a stop loss order into their trading, they will then need to decide which type of stop-loss order they want to use. Traders should consider these key factors before making a decision:

-

Risk tolerance: You should consider how much risk you are willing to take. If you are comfortable with a high level of risk and don’t let emotional factors influence your trading behavior when a position incurs some loss, you may want to set a large stop-loss. If your risk tolerance is low, you may be better off choosing a market stop-loss order so that a trade closes at a predetermined level and doesn’t allow emotions to lead to poor decision-making

-

Trading strategy: The type of trading you are engaging in is important in deciding on a type of stop-loss order. If you’re a long-term investor, a limit stop-loss order of 15% might be preferable, as prices might fluctuate massively over time, and you can play the long game while waiting for more favorable prices. However, if you’re an active trader, or a day trader, a 5% level may be preferable. A market stop-loss would also be more quickly executed

-

Market conditions: You should also adapt your stop-losses to current market conditions. If you’re investing in a stock that has weekly price fluctuations of 10% and upwards, setting a 2-3% stop-loss order is probably not a great strategy. If you’re expecting an asset to increase in price due to an upward trend, using a trailing stop-loss might be preferable so you can lock in profits, though of course this doesn’t guarantee profits

Do successful traders use stop losses?

It’s impossible to speak for every successful trader, but generally successful traders do use stop-loss orders. A stop-loss order is a fundamental component of any risk management strategy. This risk management tool is essential for protecting capital, preserving profits, and maintaining discipline in trading.

While the specific approach to using stop losses may vary among traders, the concept of defining and adhering to risk limits is a common thread among successful traders. Stop losses enable them to control the downside, manage their risk-reward ratio, and avoid significant drawdowns in their trading accounts.

Imagine a successful day trader with a portfolio made up of dozens of assets from across multiple financial markets. They would have to keep tabs on economic indicators and market news from an uncountable number of sources, and constantly observe the price movements of multiple assets. Even the most carefully prepared traders might miss a bit of news or market events, or not see a trade signal. Setting stop losses allows them to manage their positions more easily, and stick to their overall trading strategy.

It must be mentioned that just because successful traders use stop-loss orders, does not guarantee success if stop-loss orders are implemented. Stop-loss orders should be used as part of a comprehensive risk management strategy and tailored to fit your own trading approach. For more information on choosing the best stop-loss order, read Traders Union’s article.

Conclusion

As is always the case in the world of trading and investing, it is important to do your own research. While Traders Union can offer advice on the advantages and disadvantages of different types of stop-loss orders, there is no blanket answer for ‘the best type of stop-loss order’. Each type of stop-loss order has its own suitability depending on your own risk sensitivity, trading strategy, and financial goals.

FAQs

Stop-Loss vs. Stop-Limit Order: What's the Difference?

A standard stop-loss order triggers a stop order when the predetermined price is reached, and will sell at the next available price, whether that’s higher or lower than the stop order level. A stop-limit order does almost the same, but will only execute a sale at a price higher than the level stipulated in the stop order.

How to set a stop loss strategy?

Define your risk tolerance and analyze market conditions. Set stop loss levels based on technical indicators, support/resistance, or a percentage of your capital. Ensure a favorable risk-reward ratio. Regularly review and adjust stops as market conditions change, maintaining a disciplined approach to risk management in your trading strategy.

Is hedging better than stop-loss orders?

It depends on the trader's goals and on market conditions. Hedging can provide broader protection but is complex. Stop-loss orders are simpler and are effective enough for risk control.

What are the two types of stop order?

A stop-loss order works by selling an asset when it has decreased in price to a predetermined level, to prevent further losses. A take-profit order is the opposite of this, and triggers an automatic sale when the price has increased to a specific level to protect profits.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.