Forex Backtesting – A Beginner’s Guide

To backtest your Forex trading strategy, follow these steps

-

Choose a backtesting platform

-

Select the appropriate data range

-

Set your backtesting parameters

-

Run the backtest

-

Analyze the results

For any Forex trader, the final step before trying their strategy out in live markets is to backtest it on historical data. Just with this one step, they can gain remarkable insights into the shortcomings of their strategy, effectively saving a lot of time and money. However, Forex backtesting isn’t as simple as it might sound in theory. So, to clear the air around it, the experts at TU will in this article explore all there is to know about Forex trading strategy backtesting, including details about the process, reputed platforms, result analysis, and a lot more.

What is Forex trading?

Forex trading is the act of trading currencies in anticipation of profits. It takes place in the Forex market, which is the most liquid financial market in the world with an average daily trading volume of nearly $7.5 trillion.

What is Forex trading strategy backtesting?

Forex trading strategy backtesting is the act of trying out a proprietary Forex strategy on historical data to see if it would turn out to be profitable under real market conditions. The main motivation behind it is to confirm the accuracy of the strategy on real-market data.

Why is it important to backtest your Forex trading strategy?

Backtesting a Forex trading strategy is generally advisable, mainly because it offers the following benefits

Helps traders assess the accuracy of a strategy – With a big enough data set, backtesting results can provide a considerable insight into the accuracy level and profitability of a strategy. Knowing the same, traders can decide on other key factors such as the risk-reward ratio and position sizing.

Helps identify the weaknesses of a strategy – Because backtesting happens on actual market data, it can pinpoint the exact shortcomings of the strategy if it were to be applied in the live markets. For example, the strategy may be vulnerable to overtrading. With this insight, traders can work upon the strategy by introducing additional confirmatory signals, and increase the chances of their success.

Helps in strategy optimization – Using backtesting, traders can perform trial and error analysis to judge if the overall success of the strategy can be improved if certain parameters were adjusted, such as the entry or exit levels. As a result, the overall optimization of strategy can be facilitated to a great extent.

Increases confidence – With enough number of trials, traders gain sufficient confidence to back their strategy in times of market turbulence. So, backtesting also provides a sense of comfort in terms of trading psychology.

How to backtest your forex trading strategy

Here’s a step-by-step guide to backtesting your Forex trading strategy

Step 1 – Choose a backtesting platform

The first and most crucial step in the process is selecting the right backtesting platform. For this, you can consider various platforms that offer unique features. Popular options include MetaTrader, TradingView, and NinjaTrader. It's important to ensure that the platform aligns with the specific requirements of your trading strategy.

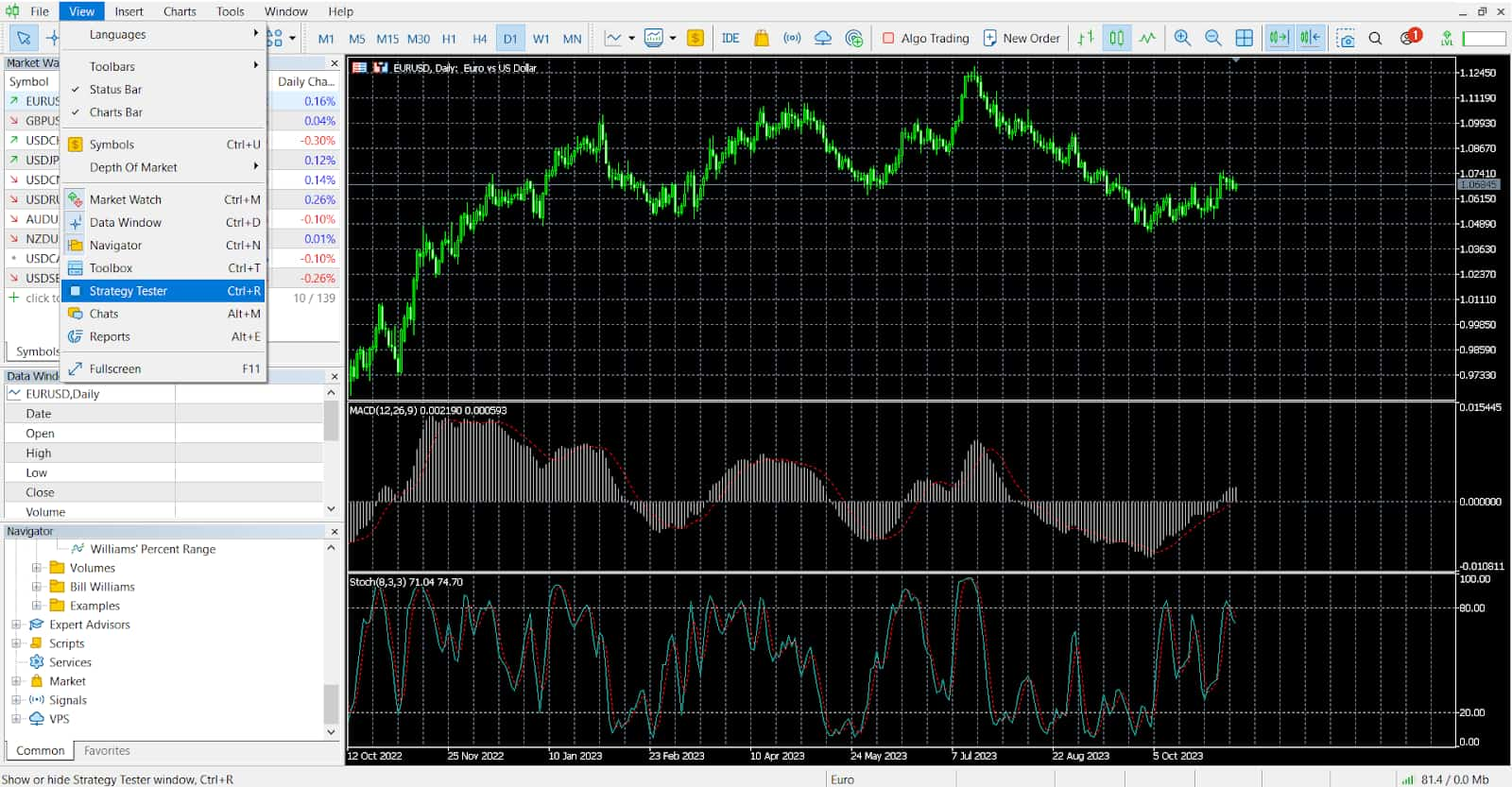

For our guide, we will use the MetaTrader 4 strategy tester. You can open it from the “View” tab. Alternatively, you can also open it using “Ctrl + R”.

Step 2 – Select the Appropriate Data Range

Obtaining high-quality historical data is a must for obtaining accurate background test results. The amount of data you choose should cover a significant period of time, allowing you to evaluate how your system performs under different market conditions. High-quality information helps in avoiding skewed or inaccurate results.

Step 3 – Set your Backtesting Parameters

Before you start backtesting, you need to establish and define the parameters of your workflow. The objective is to replicate your strategy as closely as possible to real trading conditions.

In most backtesting platforms, you are likely to encounter the following input requirements

-

Timeline – A timeline for analyzing a process, providing insight into its business performance over a specific period of time.

-

Data sample frequency – The frequency of the test data, whether daily, weekly, or monthly. This criterion sheds light on the adaptability of the methodology to different time periods.

-

Trading costs – Trading costs, including commissions and slippage, represent the financial considerations associated with the strategy. Careful analysis of these costs on the end result can tell you whether your strategy is actually profitable after operational costs.

-

Position sizing – This refers to the number of positions taken by the system, which is fundamental in risk management and portfolio optimization. Prudent positioning is key to striking a balance between capital preservation and growth.

-

Market Exposure – The degree of exposure to different segments of the market, indicating the strategy's sensitivity to various market conditions and sectors.

-

Volatility – The dispersion of returns on the portfolio, offering insights into the potential fluctuation in value. Understanding volatility is crucial for assessing the strategy's stability and risk tolerance.

-

Stop-loss and levels to take profit – A pre-defined limit at which a strategy starts from a position, either to minimize losses or to make a profit. These layers are an important tool for protecting the division from adverse market developments.

-

Risk management strategies – A variety of strategies for mitigating and controlling risk. Effective risk management is essential to maintain program flexibility in different market conditions.

Step 4 – Run Backtest

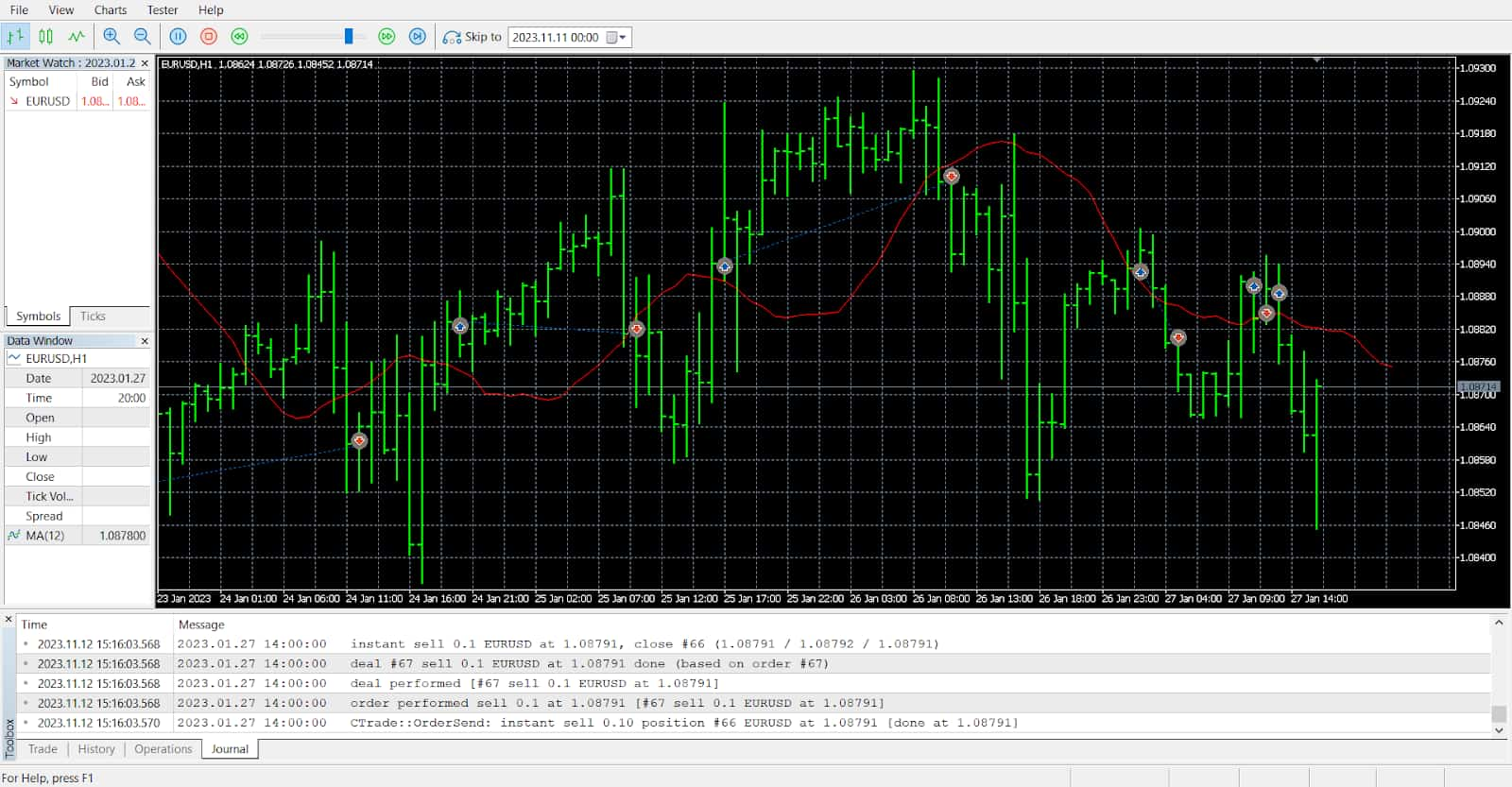

Perform the page test in your chosen platform. The platform will carry out trading based on the rules of your strategy and the historical data you choose. This step provides you with a sampling performance of your system over the selected period of time.

Step 5 – Analyze the Results

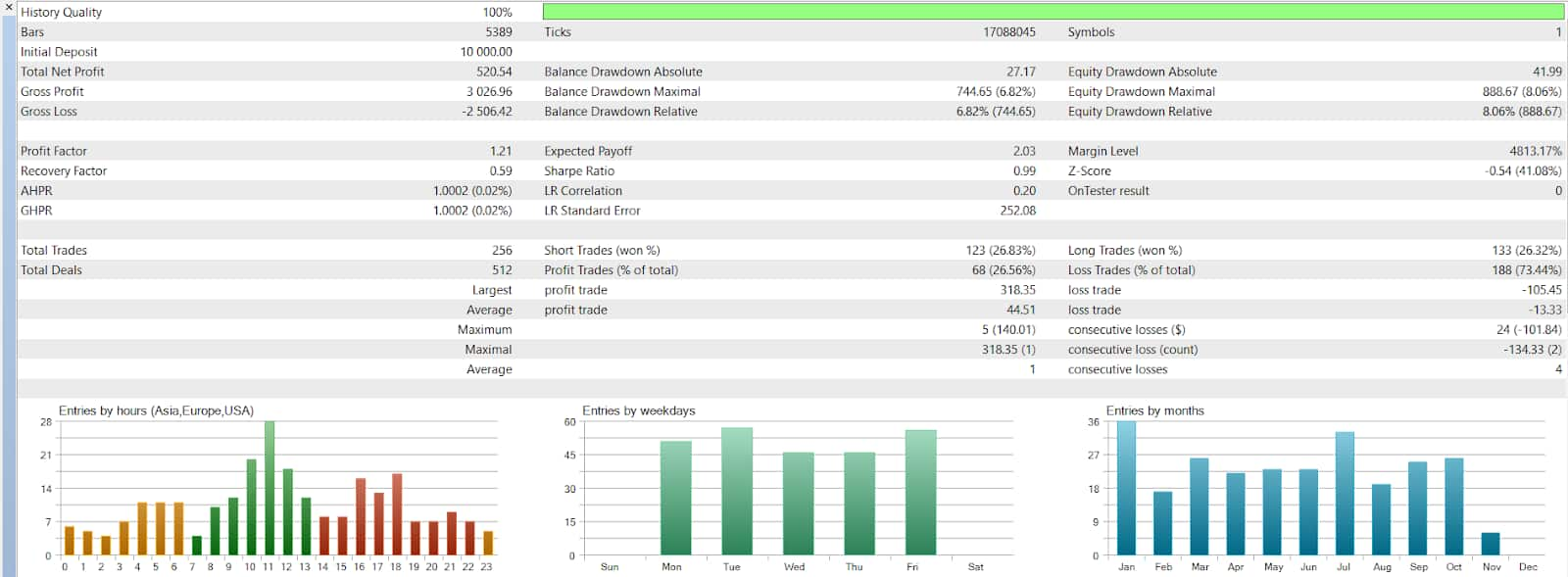

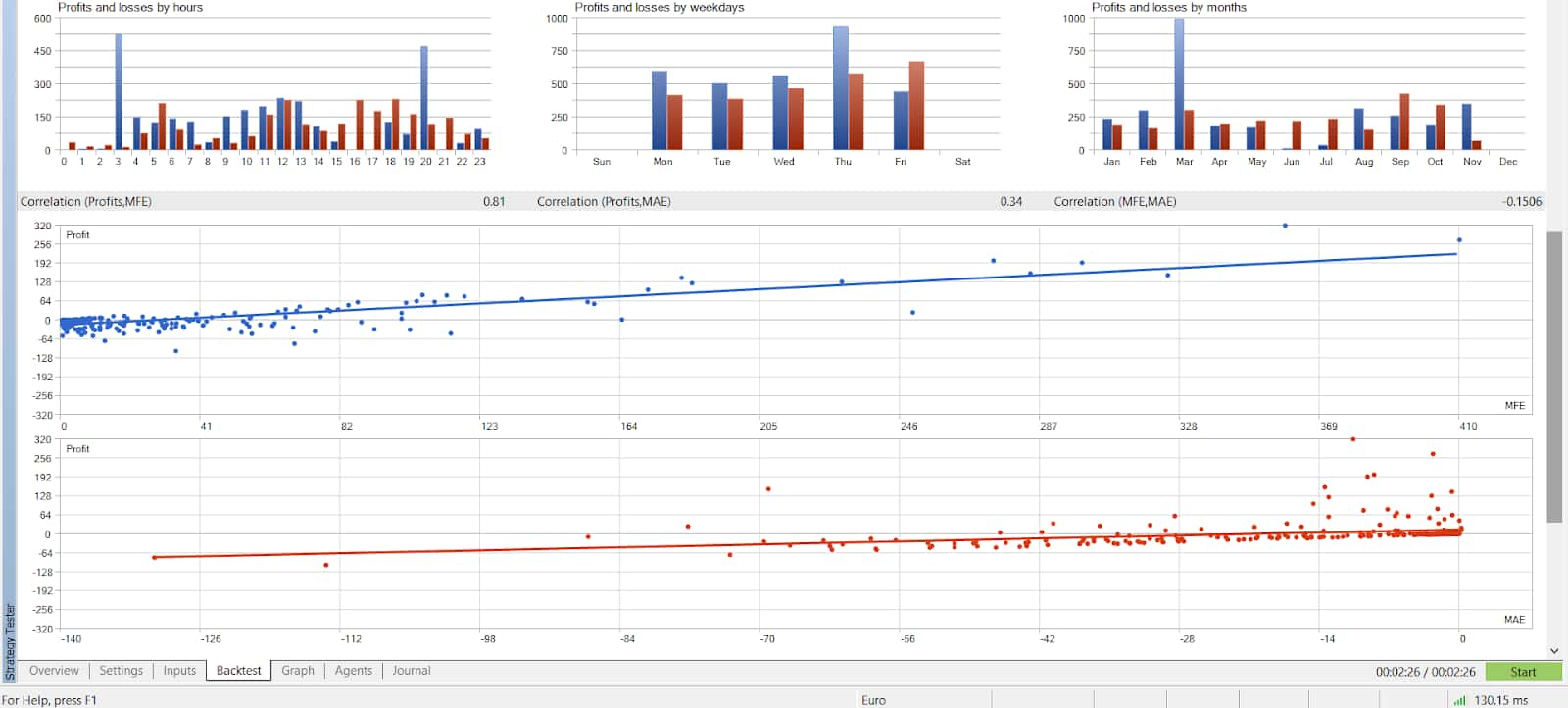

Following the completion of the backtest, it's essential to conduct a thorough analysis of the results. Pay close attention to key metrics such as profit and loss (P&L), maximum drawdown, win rate, and risk-reward ratio. These metrics offer valuable insights into your strategy's effectiveness and its potential for generating profits. Additionally, consider creating visual representations of your strategy's performance through charts and graphs. Visual analysis can assist you in identifying trends and patterns in your strategy's performance.

In MT4, you can go to the “Backtest” tab to get access to a summary of results once the backtest is done.

Types of backtesting

Experts have now reviewed the different variations in backtesting for your reference

Automated backtesting

Automated backtesting is a technique for evaluating the performance of a trading system by employing specialized tools or software, typically in the form of Expert Advisors (EAs) on trading platforms like MetaTrader 4. This approach entails establishing criteria and specific rules within a backtesting tool to construct an objective framework for a thorough and systematic assessment.

Objective criteria

Traders enter standard criteria and rules into the back-testing tool, and define the criteria for their trading strategy.

Accuracy

Automated surface testing allows for human intervention, providing accurate and unbiased results. It does a good job of dealing with a lot of historical information.

Tools

Common automated backchecking tools include MetaTrader 4 and Forex Tester. These platforms enable users to simulate trading scenarios and analyze strategy.

Process

-

Insert EA into the MQL4 folder.

-

Update the ES.

-

Use Strategy Tester in MT4 for background testing.

-

See the results in more detail, including reports and photos.

Limitations

Data quality is important, and some tools, such as MT4, may have limitations on usability and advanced features.

Manual backtesting

It is a manual process where the trader visually analyzes historical data, and identifies and executes trades based on pre-defined rules. It provides a more nuanced understanding of market conditions but a challenge of human discrimination occurs.

Objective Criteria

Like automated backchecking, manual backchecking requires traders to establish specific rules for their processes, reducing subjective influence.

Intervention

Traders manually analyze historical data, identify potential trades, and execute them based on established rules.

Tools

TradingView is a widely used platform for manual backtesting due to its user-friendly interface.

Process

-

Open the currency pair for testing.

-

Utilize the bar replay tool to navigate to the desired starting point.

-

Play the chart, pausing when a trading opportunity arises, and execute the trade.

-

Journal the outcome and repeat the process.

Limitations

Human bias poses a significant challenge in manual backtesting, as traders may subconsciously avoid losses or justify trades differently.

Importance of backtesting

Experts often emphasize the importance of backtesting for any trader as it helps them analyze how their strategies will perform under different circumstances, providing a clear picture of strengths and weaknesses. It also helps them in the following

-

Assess strategy performance – Backtesting provides an objective evaluation of your trading strategy's historical performance. It reveals profitability, win rates, and drawdowns under various market conditions.

-

Identify weaknesses – Analyzing backtest results helps pinpoint weaknesses or flaws in your strategy, enabling necessary adjustments for improved performance.

-

Build confidence – Positive historical results instill confidence in your strategy, offering evidence of its effectiveness and suitability for real-money trading.

Best Forex brokers

Tips and tricks for backtesting your Forex trading strategy

Experts have broken down this section into three aspects

Manual backtesting

-

Define clear rules – Establish well-defined rules covering entry/exit signals, position sizing, and risk management before initiating the backtesting process.

-

Testing multiple time frames – Testing your strategy on different timeframes can help you identify the optimal time frame for your strategy. It can also help you determine if your strategy is sensitive to changes in market conditions.

-

Select relevant data – Choose historical data accurately reflecting the intended market conditions, considering factors like time frame, currency pairs, and significant events.

-

Use quality backtesting software – Utilize professional software offering data integrity checks, realistic trade simulations, and performance metrics for accurate and reliable tests.

-

Leveraging multiple data sources – Incorporating diverse data sources into your marketing strategy analysis is a recommended approach. It allows you to judge both the strengths and weaknesses of your strategy, providing insights into its overall application under various market conditions.

-

Account for slippage and commission – Include slippage and commission costs to obtain a more realistic view of your strategy's performance. If this step is avoided, chances are that a profitable strategy (as per backtests) might result in a net-loss position when applied in live markets.

-

Avoid over-optimization – Strive for a balance between profitability and robustness to prevent overfitting your strategy to historical data.

Tips to enhance backtesting results

-

Incorporate realistic market conditions – Introduce factors like market volatility, news events, and economic indicators to assess your strategy's performance in different scenarios.

-

Perform out-of-sample testing– Validate strategy robustness with out-of-sample testing using a different set of historical data. If the results are similar, the strategy may be applied in live markets.

-

Include walk-forward analysis – The utilization of forward optimization techniques adds a layer of sophistication to your strategy evaluation. This method involves testing your system on a limited historical dataset and subsequently optimizing it based on the results. The aim is to fine-tune parameters and enhance overall performance over time.

Practical and advanced tips

| Aspect | Recommendations |

|---|---|

|

Understand Market Dynamics |

Familiarize yourself with historical economic events and market influences. |

|

Simulate Trading Breaks |

Mimic real-world conditions by incorporating trading breaks and market closures into your backtesting. |

|

Factor in Liquidity Issues |

Test your strategy's performance in both liquid and less liquid market scenarios. |

|

Consider Behavioral Biases |

Introduce delays or imperfections in trade execution to simulate human decision-making. |

|

Analyze Sensitivity to Parameter Changes |

Test how your strategy responds to changes in key parameters. |

|

Stay Updated with Platform Changes |

Ensure your backtesting software aligns with the latest version of your trading platform. |

Analysis of backtesting platforms

As per a study done on top backtesting platforms by Barry D. Moore, CFTe, the following is the analysis of various backtesting platforms through their main pros and cons

| Platform Name | Pros | Cons |

|---|---|---|

Trade Ideas |

Employs three AI trading algorithms that are known for their performance, offering fully automated backtesting, exceptional stock scanning, specific audited trade signals, and the convenience of auto-trading with AI signals. Additionally, it provides access to a live daily trading room. |

Lacks a mobile app, and the initial investment in Trade Ideas Premium may seem relatively high. |

|

Tradingview |

Distinguishes itself with a social-first approach, enabling users to chat, publish, and follow, while also providing easy backtesting and development through Pine Script. It offers a strategy tester for manual backtesting and encompasses global exchange data, supported by a vast community of 13 million active users. |

The absence of real-time news and the limitation to backtesting single instruments, not entire markets, are notable drawbacks. |

|

TrendSpider |

Stands out for its automated trend line detection, automatic multi-timeframe analysis, and a user-friendly yet powerful backtesting feature. It includes real-time exchange data in its pricing and offers automatic Fibonacci trend detection for a comprehensive trading experience. |

Lacks auto-trading functionality and does not incorporate notable social features. |

|

Stock Rover |

Boasts an extensive array of 650+ financial screening metrics, potent stock scoring systems, and unique 10-year historical data for thorough backtesting. It also features Warren Buffett value screeners & portfolios, along with real-time research reports. |

The platform falls short in providing a social community and is more suited for long-term participants than traders. |

|

MetaStock |

Enables users to develop sophisticated systems and backtest entire markets effortlessly. It excels in reporting backtesting profit, drawdown & ROI, and offers exceptional and intuitive forecasting software. It is also renowned for charts, indicators, and real-time news, with excellent customer support and educational seminars. |

Requires scripting skills and lacks automated trade execution. |

|

Offers a diverse range of trade ideas through 45 streams, coupled with real-time pattern recognition for stocks, ETFs, Forex, and crypto. It incorporates AI trend prediction engines and allows users to build custom portfolios with AI assistance. |

Custom charting options are limited, and the platform does not support the plotting of indicators. |

|

|

Portfolio123 |

Provides an extensive suite of 470+ screening metrics, a robust 10-year backtesting engine, and unique 10-year historical data. It also features pre-built model screeners and integrates $0 trading capabilities for added convenience. |

Lacks integrated news, a dedicated app for Android or iPhone, and may initially be complex to use. Additionally, its technical analysis charting could benefit from improvements. |

|

Interactive Brokers |

Excels in fundamental backtesting, offering a superior trading platform with direct market access across all markets and vehicles. |

Limited to users who are IB clients and has restrictions on backtesting with chart indicators and supply/demand analysis. |

|

Tradestation |

Stands out with powerful charting tools, good algo and power tools, and provides free software for brokerage clients with seamless integration. |

The cost per stock trade is $1, which could be a consideration for some users. |

|

Quantshare |

Differentiates itself with a low price point and broker-agnostic backtesting capabilities. |

Information on pros and cons is not provided. |

|

FinViz |

Offers a comprehensive stock screener, real-time stock quotes, and advanced charting tools. Users benefit from data-driven insights, a breakdown of sector performance, and news and analysis aggregation. |

The free version of FinViz has limited features, and its backtesting options are not as advanced as those in Trade Ideas. Furthermore, the heatmaps and industry grouping visualizations lack a dynamic element. |

FAQs

How to backtest forex for free?

The best way to backtest Forex for free is by downloading reliable data through public sources and using spreadsheet programs to run the backtests.

How long should you backtest a forex trading system?

Forex backtesting duration cannot be generalized in years or days as each strategy is unique in its application. However, as per experts, a backtest should cover at least 600-1000 trades.

How do you backtest forex pairs?

Forex pairs can be backtested through any of the following approaches

-

Manual backtesting

-

Automated backtesting

-

Backtesting tools

What is the no code backtesting software?

Tradingview is a popular no code backtesting software.

Glossary for novice traders

-

1

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Overtrading

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

-

4

Trading system

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

-

5

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).