BaFin | Financial Regulator of Germany

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

BaFin, in German, stands for "Bundesanstalt für Finanzdienstleistungsaufsicht". It is the federal financial supervisory and primary regulatory and supervisory authority for financial institutions and markets in Germany. A financial regulator is a government body that is mostly independent or a division of the National Bank or Ministry of Finance,that is responsible for the licensing and control of non-banking and sometimes banking sector participants. Depending on the jurisdiction, regulators differ in their mandate, resources, and strictness. But they all have the same purpose, which is to ensure that licensees observe local and international laws; promote the attractiveness of their jurisdiction; and promptly resolve disputes between licensees and their clients.

Holding a license enables a broker to:

-

Operate legally and transparently in compliance with international laws

-

Advertise its financial services in the regulator’s jurisdiction, which gives brokers a competitive advantage.

-

Increase the influx of clients because traders trust licensed brokers more than unlicensed ones.

A license is a documentary confirmation of the broker’s adherence to high standards of excellence.

For a trader, a license reflects the broker’s reputation. A proper license suggests that: “If this broker holds a license, it means that the broker abides by the laws and regulations and can be trusted.” This conclusion is logical. Brokers pay enrollment fees and annual contributions and disclose their financial statements and organizational structure to regulators. They don’t want to risk their reputation, as traders’ trust means an influx of client funds.

In this post, TU explores BaFin’s functions, mandate, advantages, procedure for finding licenses on the website, and procedure for filing complaints, as well as reviews and an expert’s opinion of this regulator.

Functions of BaFin

BaFin was created in 2002 by the merger of three supervisory agencies. The regulator is subordinate to the German Government and cooperates with the German Federal Bank. BaFin’s mandate covers the whole financial sector of the country, including banks. The regulator is financed from licensees’ contributions without the usage of budgetary funds. A license from BaFin is mandatory for all registered legal entities. Each type of service rendered is licensed on separate conditions.

Tasks and purposes of BaFin in the Forex market:

-

Grant licenses in compliance with the laws of Germany and the EU, as well as the Markets in Financial Instruments Directive II (MiFID II).

-

Oversee and control the banking and non-banking sectors. Monitor licensees’ solvency and ability to fully carry out their obligations.

-

Ensure that licensees provide services in accordance with regulatory standards.

-

Develop risk reduction mechanisms. Participate in the development of legislation that regulates the interaction between financial market participants.

-

Examine licensees’ financial statements on a regular basis.

-

Counteract money laundering, illegal money turnover, and other types of forbidden activities.

-

Combat financial manipulations and the use of insider information, etc.

-

Protect the rights of investors and financial service users.

Compared to other regulators, BaFin has broad powers. Cooperation with financial authorities in both Germany and the EU, enables it to instantly get detailed information about a broker, its subsidiaries, and transactions, and stop any attempted violation. The regulator’s mandate includes all enforcement tools from warnings and fines to initiation of a broker liquidation procedure.

To obtain a BaFin license, a broker has to:

-

Follow recommendations in relation to operating capital. Its amount is determined individually, depending on the license type and services offered by the broker.

-

Observe the account segregation principle, according to which clients’ accounts are separated from the broker’s accounts.

-

Have at least 2 residents of Germany in its top management.

-

Provide a detailed scheme of anti-crisis measures in case of force-majeure or similar circumstances, including the protection of clients’ interests.

-

Complete yearly disclosure of the company’s financial state and transactions and annual audits, as mandated by BaFin.

BaFin can conduct unscheduled inspections and change the amount of reserved capital, depending on the broker’s capital turnover.

Information on the official website

Overview of the BaFin website:

-

Upper main menu.

BaFin Review — Section of the website

-

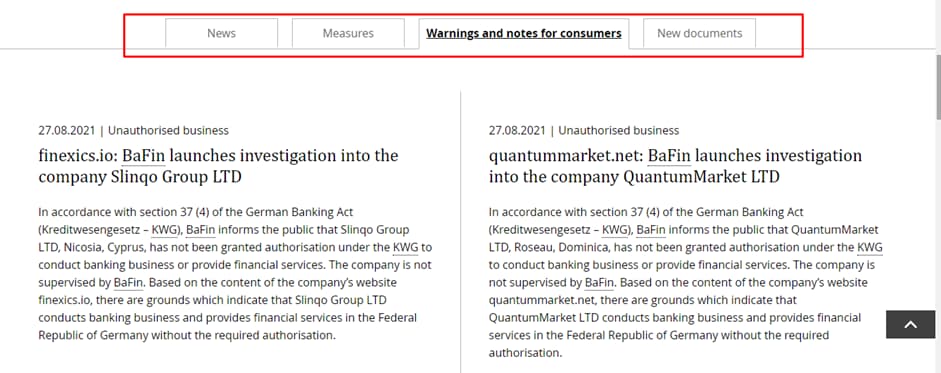

News and useful links. Information about investigations, warnings, applied sanctions, changes in legislation and regulations, etc.

BaFin Review — Section of the website

-

Footer. Here you can find the site map, basic conditions and terminology, documents about personal information security, etc.

BaFin Review — Section of the website

Main menu structure:

-

Companies is a section for legal entities such as banks, startups, insurance and investment funds. There are also regulations and guidelines here.

-

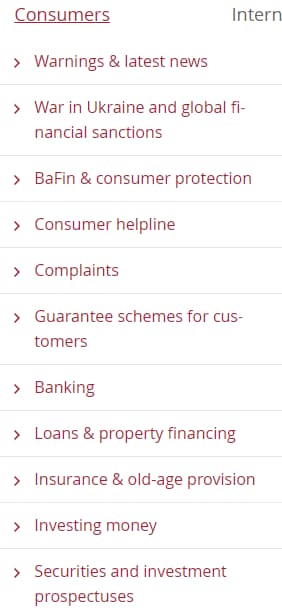

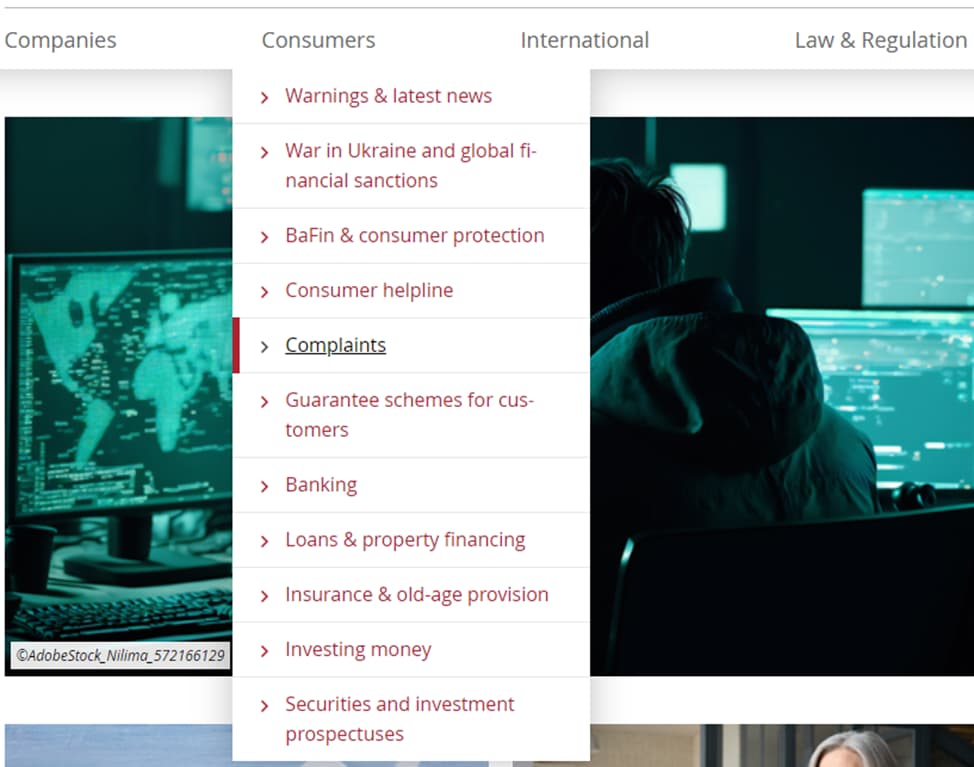

Consumers is a section for clients of brokers and other licensees. Here you can file a complaint, find information about warnings, discover common fraud schemes, etc.

-

International is a section about European supervision and international cooperation.

-

Laws & Regulations. Administrative acts, legal issues, and recommendations.

-

Publications & data. Annual reports, statistics, development strategy, speeches, interviews, and expert opinions.

-

BaFin comprises a section about the regulator such as functions and history, organizational structure, contacts, and careers at BaFin.

These sections interest traders:

-

News. In this section, you can find warnings about violations committed by brokers and information about investigations. A broker’s license may remain valid, but violations may be a red flag for traders.

-

Consumers is a section with a theoretical information basis for traders and clients of other financial organizations.

BaFin Review — Section of the website

To obtain a BaFin license, a broker has to:

The regulator’s website has a convenient structure and search system. Licenses can be found with a few clicks.

To confirm a broker’s license on the BaFin website, do the following:

-

1

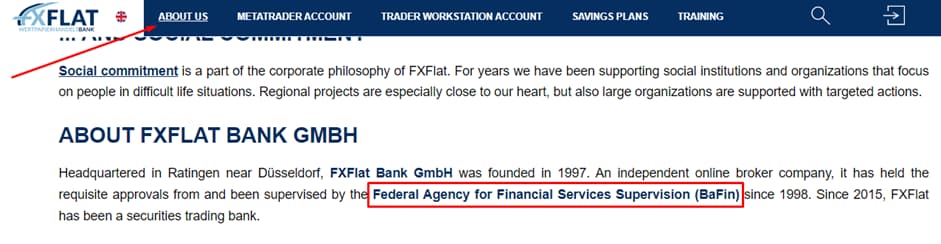

Find a broker with a BaFin license. It is preferable to have the license number, but searching by the broker’s legal name also works. The license number can be in the footer or the About Us section of the broker’s website.

BaFin Review — Section of the website

-

2

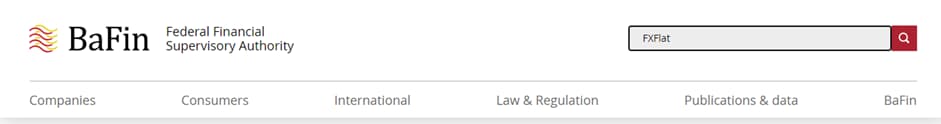

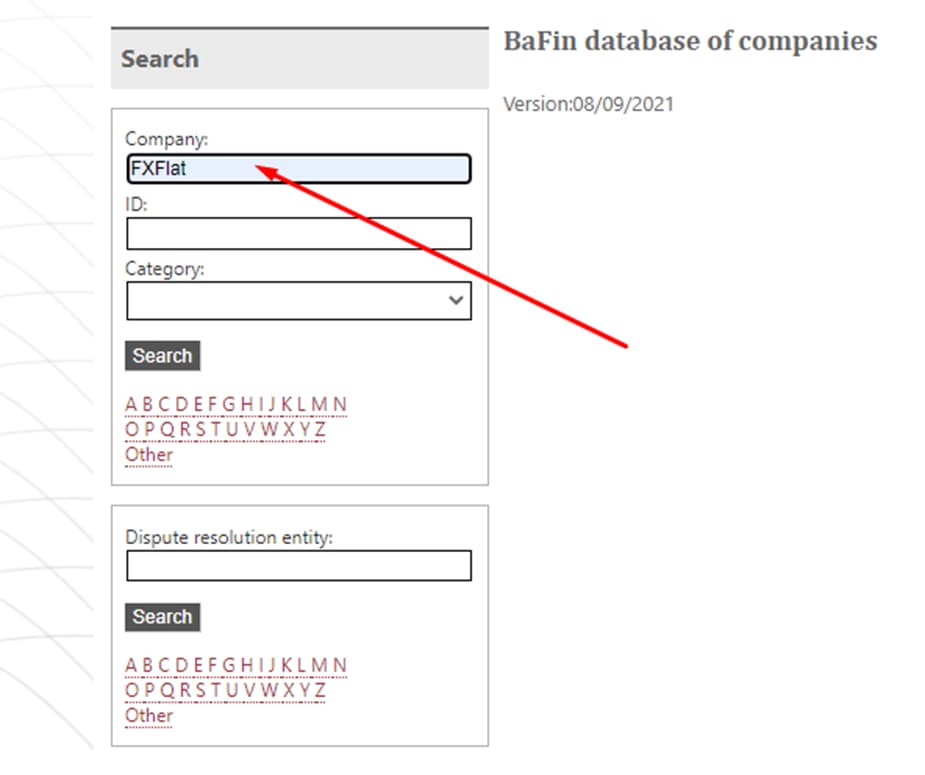

On the BaFin’s homepage, enter the company’s name or license number in the search box.

BaFin Review — Section of the website

-

3

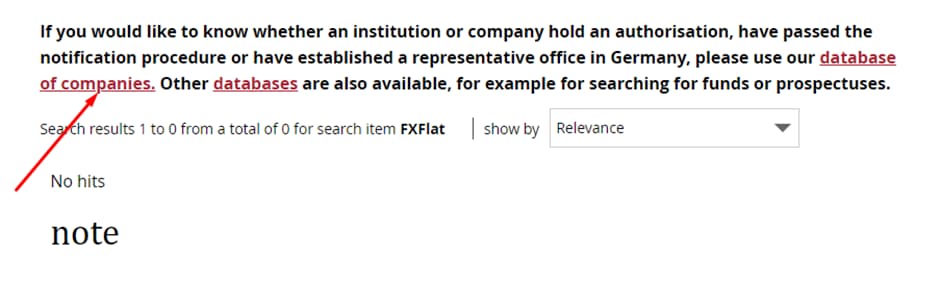

If the search result registers “no hits”, use BaFin’s “database of companies” to continue your search.

BaFin Review — Section of the website

-

4

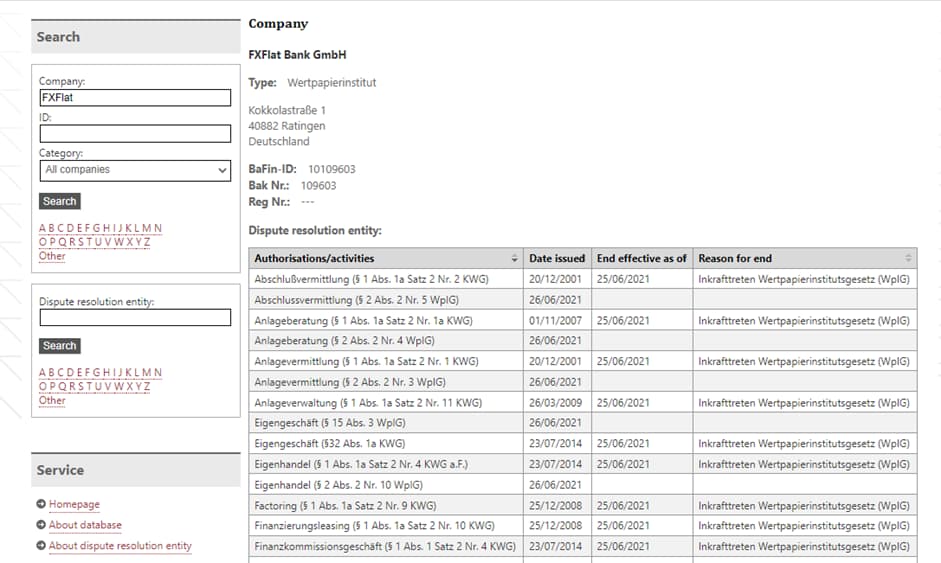

In the search form, include the available details. In this case, it’s the company’s name.

BaFin Review — Section of the website

-

5

View the license information.

BaFin Review — Section of the website

Here you can see that some of the permissions have expired and some have been active since the middle of 2021. To further analyze this information, you need to know the basics of the applicable German law. For example, “Abschluss vermittlung” is about intermediary services and “Anlage Beratung” is about investing.

BaFin’s basic requirements for brokers

Basic requirements to obtain a license:

-

Meet sufficient capital norms.

-

Have a risk management system.

-

Fully disclose information about the company and its executives.

-

Cooperate in conducting scheduled and unscheduled audits.

-

Strictly follow the rules of doing business established by all regulators in the eurozone.

-

Have at least 2 residents of Germany on the management team.

-

Open a physical office in Germany.

BaFin’s requirements are some of the strictest in Europe. After a license is acquired, it is even more difficult to fully comply with all norms of European legislation, which, for example, limits maximum leverage, requires full disclosure of money turnover information, etc. A broker has two options: (i) minimize competition by obtaining a BaFin license and become one of the most reliable and transparent companies in Europe; or (ii) violate European laws, obtain offshore licenses, and forfeit traders’ trust.

BaFin license | Pros and cons

For brokers, a BaFin license has only one disadvantage: strict requirements that must be fulfilled completely. The regulator requires maximum transparency and disclosure of information and promptly reacting to any contraventions. BaFin has enough full-time employees to control all licensees, and violations of requirements can lead to a complete prohibition on operating in the EU. For traders, in most cases, a BaFin license has nothing but benefits.

👍 Advantages of trading with a BaFin-licensed broker:

• The financial laws of Germany were developed on the basis of the European Union law. A BaFin license is valid in any EU country and respected by regulators on a par with local laws. A BaFin license means that a broker can legally operate in any EU country. This fact testifies to the highest degree of reliability.

• Strict control and unscheduled inspections guarantee that a broker fulfills its obligations. Any violation is stopped at an early stage.

• BaFin has broad powers. It is an independent authority cooperating with the German Federal Bank and the Ministry of Finance. The regulator can initiate the liquidation of a broker, among other things.

• Clients’ accounts are segregated, i.e., traders’ funds are separated from the broker’s operating account. In case of the broker’s bankruptcy, the management of clients’ accounts is undertaken by another company.

A BaFin license is a guarantee that a broker is under strict and constant supervision. The license acquisition conditions are strict, but the right to operate in any country of the European Union is worth doing transparent business and upholding a good reputation. For a trader, a valid BaFin license is the best confirmation of the broker’s reliability.

👎 Disadvantages of trading with a BaFin-licensed broker:

• A BaFin license does not entitle brokers to operate in U.S. markets. Traders can get access to U.S. financial markets only through U.S. brokers licensed by U.S. regulators.

• No compensation fund.

• Bureaucratic red tape.

On the other hand, the bureaucratic demands help BaFin maintain an unbiased approach to settling disputes.

BaFin’s jurisdiction

Germany is a party to the European Economic Area Agreement. This is an agreement about free trade that allows all BaFin-licensed brokers to offer their services to any EU member state through a single EU license. In other words, BaFin-licensed brokers must also fulfill the requirements of other eurozone regulators in compliance with MiFID II.

For Asian traders, access to European markets through BaFin-licensed brokers is not a problem on the condition that laws valid in a non-resident’s country and the eurozone are not violated. There may be exceptions for sanctioned countries.

Submission and consideration of complaints

BaFin responds to all complaints by individuals and tries to consider each as promptly and objectively as possible. Therefore, when filing a complaint, provide the fullest possible description of the problem. Include the time of every action, and add references to the violated clauses of your agreement with the broker, screenshots of the trading platform, your user account, and screenshots of your conversations with the broker’s support service.

How to submit a complaint to BaFin:

-

1

On the BaFin website’s homepage, go to the Consumers section and select Complaints.

BaFin Review — Section of the website

-

2

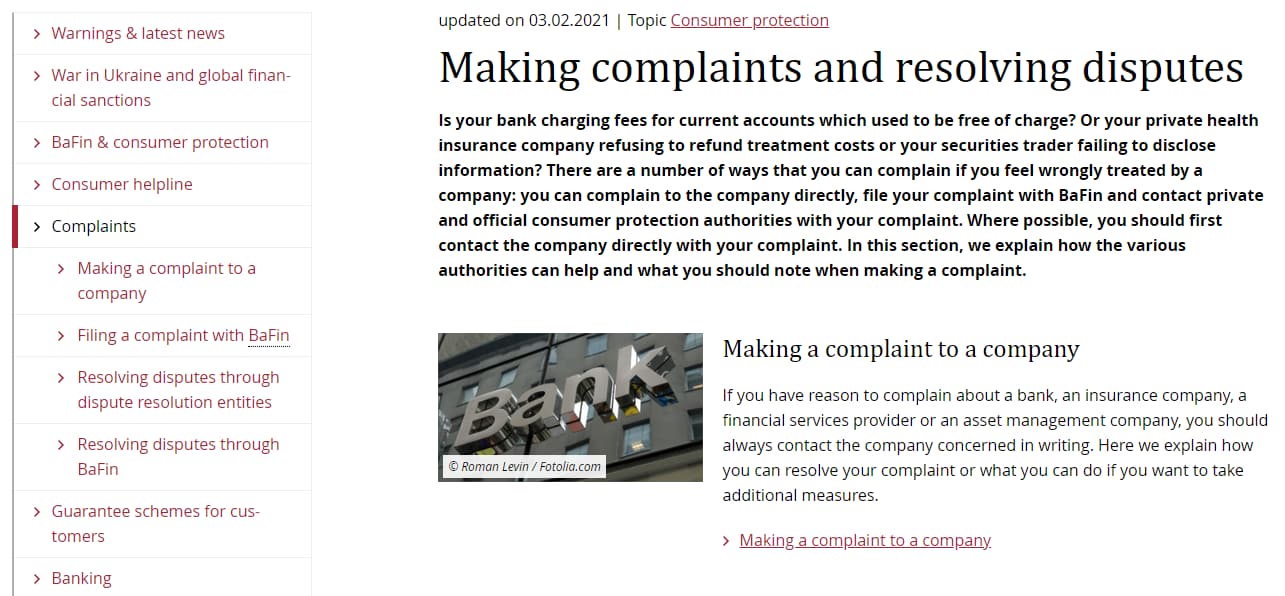

Select one of these four options:

•Making a complaint to a company that holds a BaFin license. Follow the link to get recommendations on how to do it as effectively as possible. •Filing a complaint with BaFin. •Resolving disputes through dispute resolution entities recognized by the Federal Office of Justice. For example, through an ombudsman. •Resolving disputes through BaFin, namely its dispute resolution panel. -

3

The second option, Filing a complaint with BaFin, is best where a broker violates the offer conditions.

BaFin Review — Section of the website

Here you can review the complaint filing procedure. Everything is clearly explained in detail. At first, you might get confused by the numerous links, but they are necessary for your complaint to get exactly to the person who can help fix your problem. Structuring client requests enables the regulator to respond to complaints quickly.

Note the scheme on the left: it will help you find the right section if you go to the wrong one.

-

4

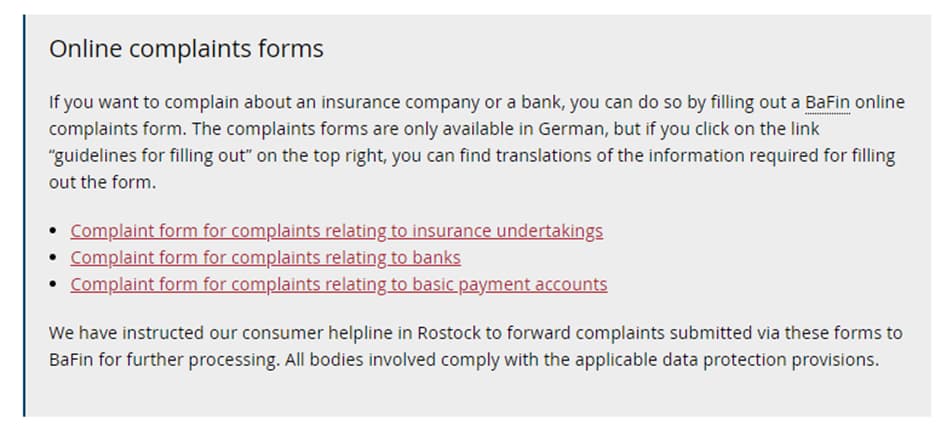

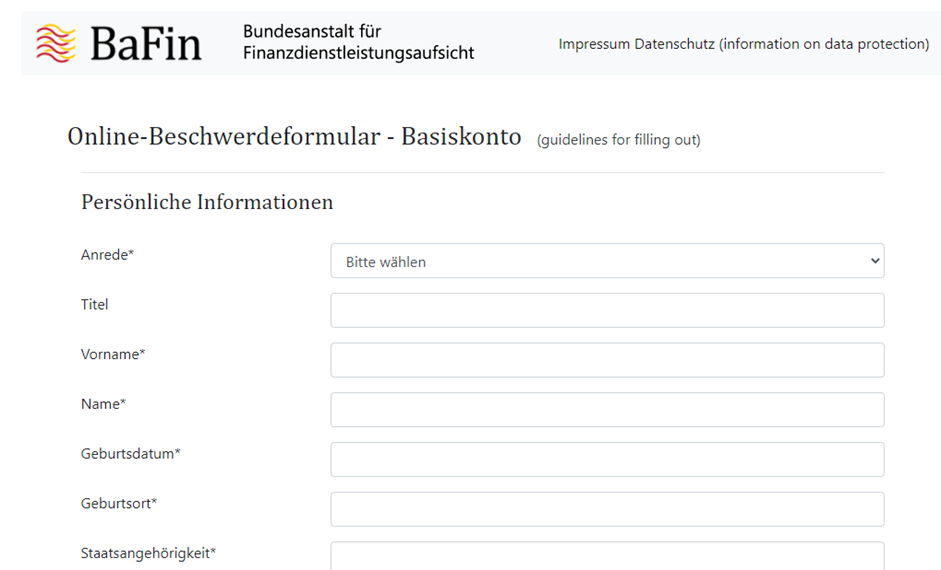

Select a complaint form.

BaFin Review — Section of the website

-

5

Fill out the form.

BaFin Review — Section of the website

How to check on a BaFin-licensed broker

TU analysts value your time. Every month, they view regulators’ websites and update information about every broker in the brokers rating. If a broker has several licenses, you don’t need to look for them on each regulator’s website, as the rating displays current information on all valid licenses. Besides that, TU monitors warnings. If a regulator issues a warning or applies sanctions to a broker, you will learn about it on Trader Union’s website.

Expert’s assessment

BaFin is one of the strictest supervisory authorities in Europe. The regulator has several significant advantages:

-

Germany is part of the EU and its law is integrated into the European financial laws. BaFin recognizes licenses from other eurozone countries that meet MiFID II. Likewise, a BaFin license is accepted in other eurozone countries. For a broker, such a license means a good reputation and client base growth. For a trader, it’s a 99.9% guarantee of a company’s reliability.

-

Cross-checksThe European Economic Area rules oblige brokers to fulfill the requirements of every regulator in the EU. It means that if a BaFin-licensed broker fails to meet the norms of a jurisdiction, it will have problems with its regulator. On the other hand, the broker is additionally checked and can provide services without geographical limits.

-

BaFin has access to the highest-level databases. Its supervision and control powers are comparable to those of the Federal Bank with which it cooperates closely. BaFin has over 2000 people on its staff and can perform unscheduled inspections and liquidate companies for violations.

Another benefit for traders is that BaFin is interested in upholding its status as a strict and reliable regulator. That is why it quickly responds to complaints and often takes the trader’s side.

Conclusion

If a broker loses its FSCA (South Africa) license, that’s not a problem because it continues operating in all other countries, except South Africa. But if the broker loses a BaFin license, it can no longer operate anywhere within the EU. The company can obtain a CySEC (Cyprus) license, but the latter is trusted a lot less. In that case, the broker will be subject to several restrictions in Europe and clients will trust it less. A BaFin license testifies that a broker can and should be trusted!

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 proprietary trading strategies. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is BaFin?

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

What do I get from trading with BaFin-licensed Forex brokers?

-

1

A BaFin license means that a broker operates in compliance with EU financial laws and MiFID II. The broker’s transparency and reliability are confirmed by the regulator.

-

2

Every trader can get legal and information help regarding cooperation with brokers and other financial organizations.

On the regulator’s website, you can monitor information about changes in EU financial laws and warnings to brokers.

How to check if a broker holds a BaFin license?

Two options:

-

1

On the BaFin website’s homepage, enter the broker’s license number or legal name in the search box. If you get no hits, use BaFin’s “database of companies”. Enter the broker’s details in the search form.

-

2

On the Traders Union website, open the broker’s page and view all currently valid licenses and warnings, if any, from the regulator.

How to submit a complaint against a broker to BaFin?

-

1

On the BaFin website’s homepage, go to Consumers and select Complaints. Follow recommendations, select the necessary links, and read a detailed guide on how to prepare a complaint.

-

2

Every client of TU is entitled to free legal help. TU’s lawyers always support traders and are ready to render professional assistance in resolving disputes with brokers who are members of TU. If reaching an agreement that satisfies both parties is not possible, TU’s lawyers will help you file a complaint with BaFin for free.

Glossary for novice traders

-

1

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).