How to use RoboForex strategy builder tool

Here are the steps to build your own strategy using RoboForex strategy builder:

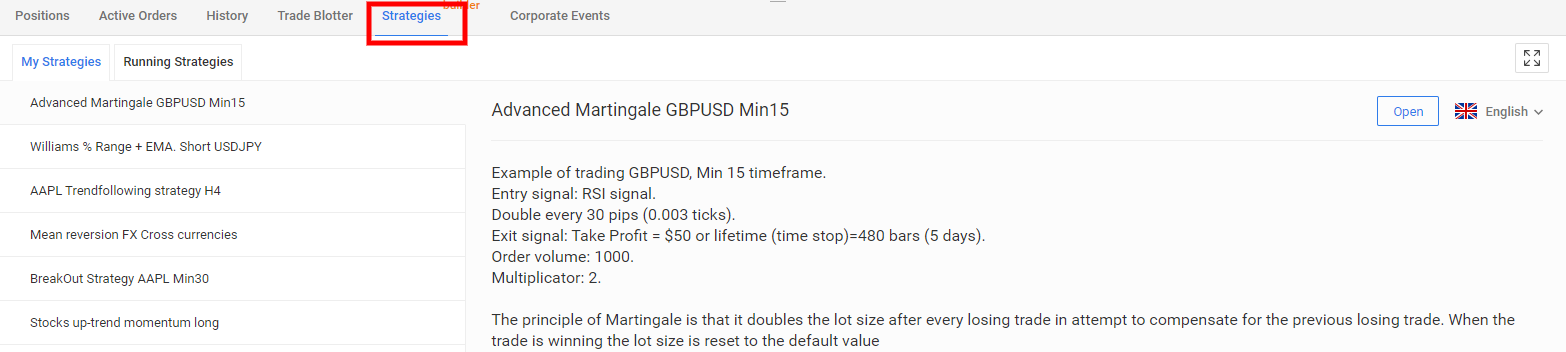

Step 1: Open the "Strategies" section in the R StocksTrader platform.

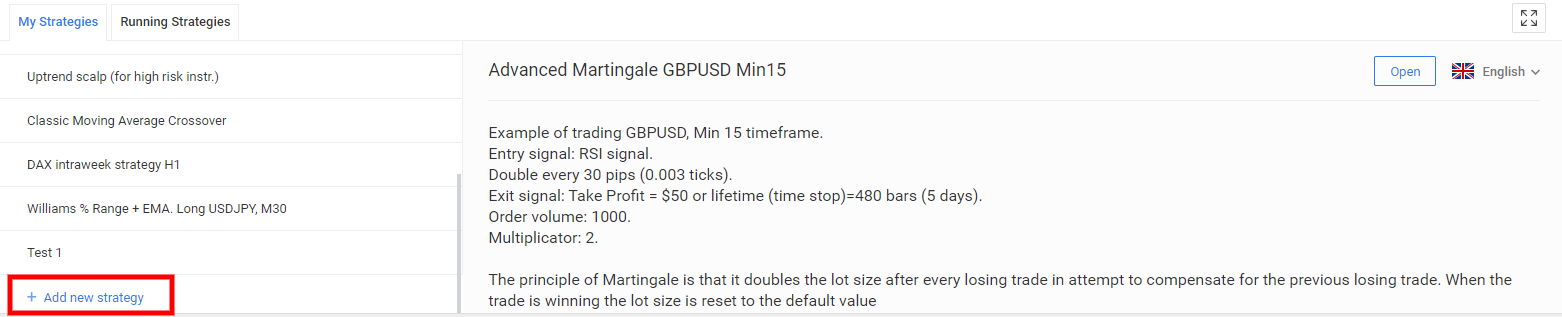

Step 2: Click on "Add new" and provide a name and description for your trading robot.

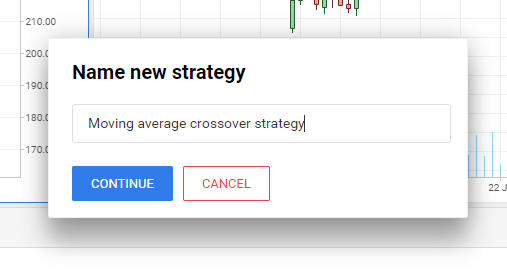

Step 3: Invent a name for your strategy and provide a brief description.

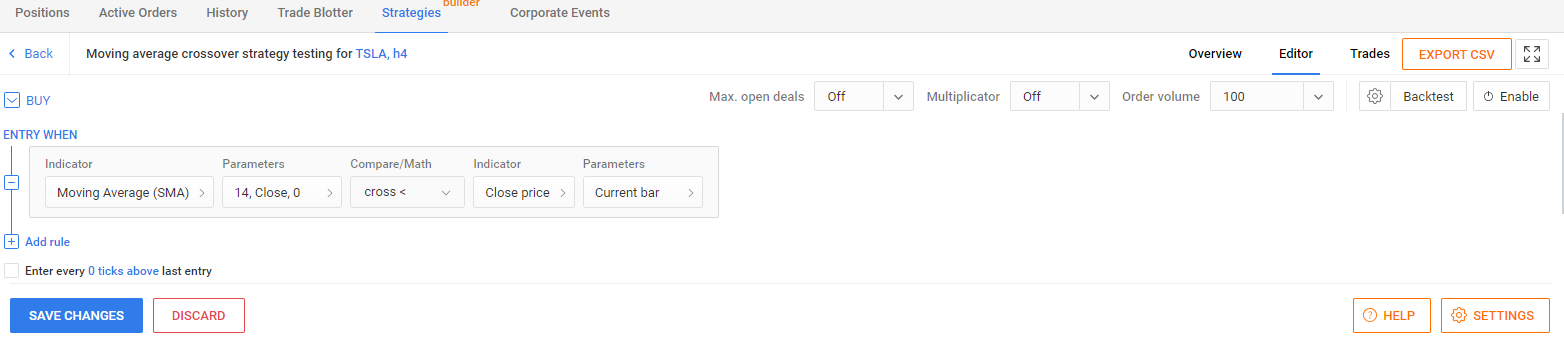

Step 4: Configure the parameters of your trading system, setting the conditions for a Buy position.

Step 5: Specify the closing conditions for the Buy position, including Stop Loss and Take Profit values.

Step 6: Choose your trading instrument, timeframe, and order volume, then click "Backtest" to evaluate your strategy's performance.

Do you dream of creating automated trading strategies but don't know where to start? Unleashing your inner algo-trading genius is easier than you think with RoboForex's powerful yet intuitive strategy builder. This innovative tool opens the door for both coding experts and newcomers alike to bring their wildest trading ideas to life.

In this guide, we'll show you how to use the different modules within the tool to construct robust strategies from the ground up. Whether you want to experiment with technical indicators, optimize entry and exit rules, or automate entire portfolios, the customizable interface makes your vision a few clicks away. With drag-and-drop simplicity and step-by-step testing, you'll gain the confidence to turn any concept into real, working code.

-

What are the costs to use the Strategy Builder?

The Builder is available free to all RoboForex clients. Standard spreads/commissions apply when strategies generate actual trades.

-

Is any prior experience required?

While not mandatory, some market knowledge and strategy testing comprehension is beneficial. RoboForex also offers various educational resources.

-

Can I modify built-in strategies?

Yes, the Strategy Builder allows traders to open and modify any of the premium ready-made strategies provided as templates.

-

How do I deploy a strategy live?

Once tested, go to the strategy page, enable it and set parameters like risk rules. It will then activate and trade automatically.

What is the strategy builder?

The RoboForex Strategy Builder is a powerful yet user-friendly tool that allows you to construct, test, and automate custom trading strategies without any coding required. It comes integrated in all RoboForex client accounts, providing simple visual interfaces where you set the logic for entries, exits and position sizing in your own algorithmic trading robots.

Specifically, the key features and benefits of the web-based RoboForex Strategy Builder include:

-

Drag-and-drop functionality to set entry/exit rules and money management

-

Access to various technical indicators to identify trading opportunities

-

Ability to combine multiple conditions using logic operators

-

Utility for quick testing across historical timeframes and instruments

-

One-click automation of strategies for hands-free trading

-

No prior coding experience or software downloads necessary

In just minutes with an internet connection, you can leverage RoboForex’s servers to rapidly build, test, then implement your own automated trading ideas at no extra cost. It provides retail traders the same power once only available to hedge funds and expert coders. Keep reading as we walk through constructing a sample strategy from scratch to demonstrate just how quick and intuitive the process can be!

How to use RoboForex strategy builder

Step 1:

To use the RoboForex strategy builder, open the "Strategies" section in the R StocksTrader platform.

Opening the Strategies section

Step 2:

Click on "Add new" and provide a name and description for your trading robot. Access the platform, navigate to "Strategies" and select "My Strategies". Then, click on "Add new strategy" to begin the process.

Creating new strategy

Step 3:

Invent a name for your strategy and provide a brief description. Once you complete this step, you will enter the strategy builder interface.

Naming your strategy

Step 4:

Configure the parameters of your trading system. Start by setting the conditions for a Buy and sell positions, selecting the appropriate indicators, and specifying the conditions as per your strategy.

Choose the parameters of your strategy

Step 5:

Specify the closing conditions for the Buy position. Additionally, you can set up Stop Loss and Take Profit values to automatically close the position based on the first fulfilled condition.

Step 6:

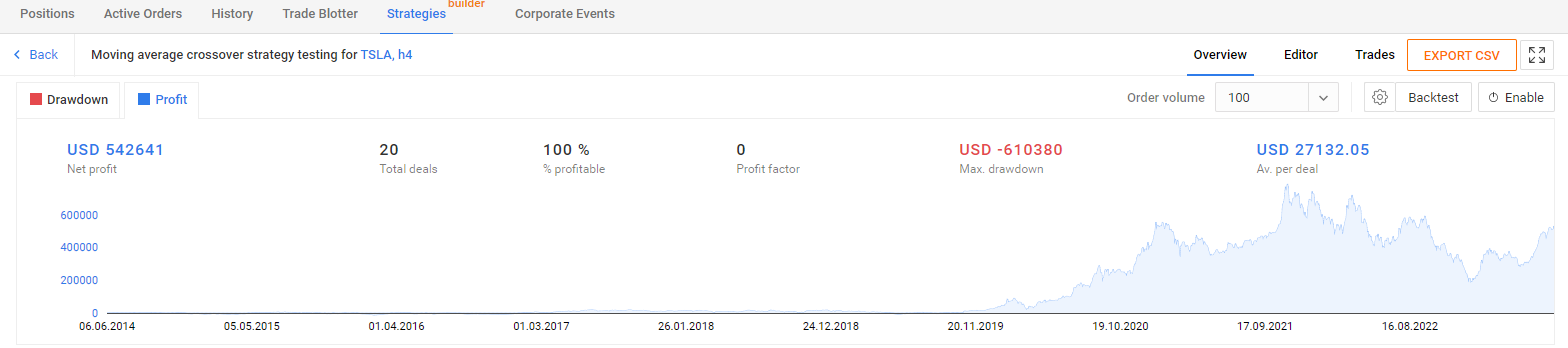

After formulating the opening and closing conditions for the Buy position, choose your preferred trading instrument, select a timeframe, determine the order volume, and click on "Backtest" to evaluate the performance of your strategy.

How to use RoboForex strategy builder

By following these step-by-step instructions, you can effectively utilize the RoboForex strategy builder to create, test, and optimize your automated Forex trading strategies without the need for coding or additional software.

How to analyze the existing trades using RoboForex trading strategy builder

Analyzing existing trades using the RoboForex trading strategy builder is a crucial step in evaluating the performance and effectiveness of your trading strategies. By following a systematic approach, you can gain valuable insights and make data-driven decisions to optimize your trading outcomes.

Step 1: Access the "History" section in the R StocksTrader platform and navigate to your existing strategies.

How to analyze the existing trades using RoboForex trading strategy builder

Step 2: Review the performance metrics of your trades, including profit/loss, win rate, drawdown, and other relevant statistics. These metrics provide a comprehensive overview of the performance of your trading strategies.

Step 3: Examine the trade history and analyze the entry and exit points of each trade. Evaluate the effectiveness of your strategy in capturing profitable opportunities and managing risk.

How to analyze the existing trades using RoboForex trading strategy builder

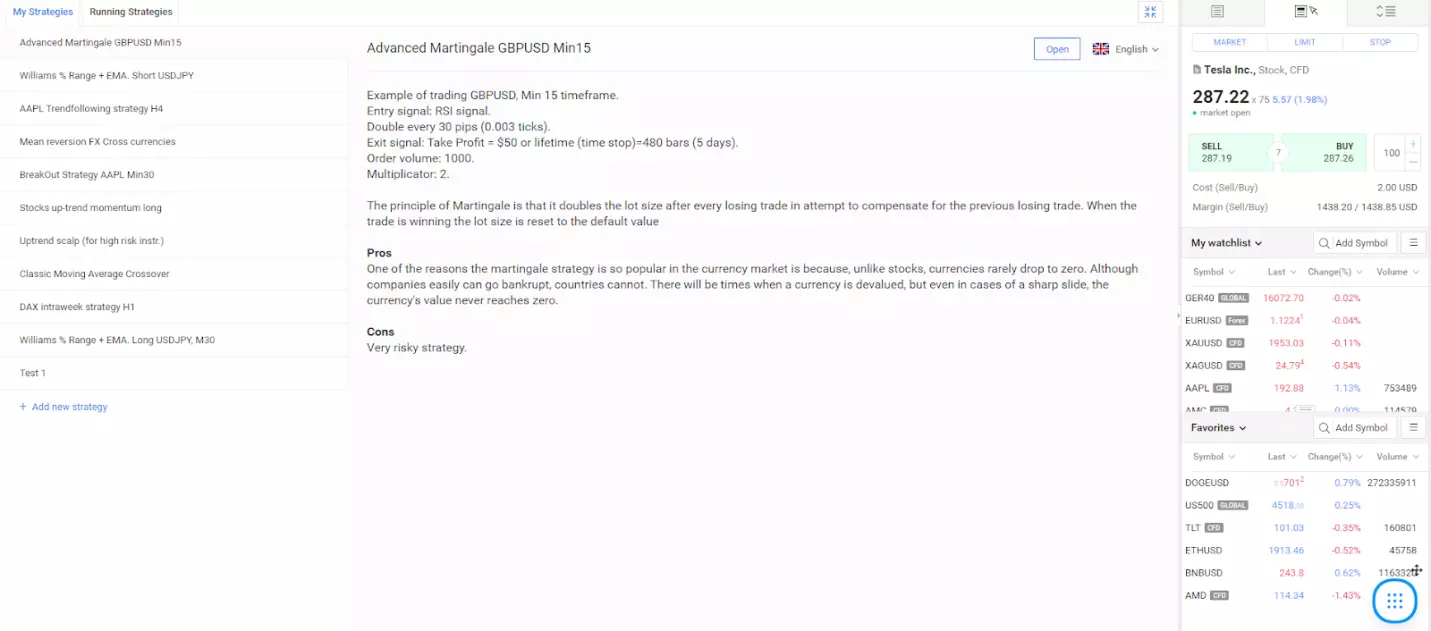

RoboForex Strategy Builder provides a range of ready-made strategies that traders can utilize for their trading activities. These strategies are designed to offer predefined entry and exit signals, along with specific parameters and settings. Here are some examples of the ready-made strategies available:

Advanced Martingale GBP/USD Min15:

This strategy employs the Martingale principle and focuses on trading the GBP/USD currency pair on the 15-minute timeframe. It utilizes the RSI signal as the entry signal and employs a doubling approach for lot sizes. The strategy sets specific exit conditions such as a take profit target or a time stop. While the Martingale strategy can be popular, it is essential to note that it carries significant risk.

Williams % Range + EMA. Short USDJPY:

This strategy utilizes the Williams Percent Range indicator to identify overbought conditions in the USD/JPY currency pair on the 30-minute timeframe. It confirms the short signal using Exponential Moving Averages (EMA) with periods of 50 and 14. The strategy includes specific exit conditions such as a take profit target or a time stop. This approach aims to capitalize on potential reversals in the market.

Mean reversion FX Cross currencies:

This strategy focuses on trading cross currencies, specifically the GBP/NZD pair on the 15-minute timeframe. It employs the concept of mean reversion, where prices and returns tend to revert back to their average values. The strategy utilizes specific entry conditions based on lowest low/highest high and strong candles. It also includes predefined exit conditions such as a take profit target or a time stop.

The main Features of RoboForex EA builder

RoboForex EA builder, also known as the Trading Strategy Builder, is an advanced tool designed to empower traders with the ability to learn Forex and create, test, and implement automated trading strategies effortlessly. With this powerful tool, traders can build strategies without the need for coding or downloading additional software. Let's explore some of the key features of the RoboForex EA builder:

Break Even: This feature allows traders to set a point at which a trade will break even, mitigating risk in volatile market conditions.

The Payoff Graph: Visualize the potential profit or loss of your trading strategy at different price levels. This graphical representation helps you understand the risk-reward profile of your strategy.

Payoff Chart: Similar to the payoff graph, the payoff chart provides a visual representation of the potential profits and losses of your trading strategy, offering insights into its performance over time.

The P/L Table: The Profit and Loss (P/L) table provides a detailed view of the potential profit or loss of your trading strategy at different price levels. It offers specific figures for a more comprehensive analysis.

Strategy Chart: Visualize your trading strategy with entry and exit points, stop-loss levels, and other essential information. This visual representation helps you assess how your strategy will perform under various market conditions.

Advantages of RoboForex strategy builder

RoboForex Strategy Builder offers several key advantages that make it a valuable tool for traders looking to automate their trading strategies. These advantages include:

User-friendly interface: The Strategy Builder features a user-friendly interface that is intuitive and easy to navigate. Traders can seamlessly create, modify, and test their trading strategies without the need for extensive programming knowledge. The platform provides a visually appealing and accessible environment for strategy development.

No programming knowledge required: One of the major benefits of RoboForex Strategy Builder is that it eliminates the need for programming skills. Traders can design and implement trading strategies using a simple point-and-click approach. This accessibility opens up the world of automated trading to a broader range of traders, regardless of their technical background.

Strategy visualization: The Strategy Builder allows traders to visually analyze and evaluate their trading strategies. Traders can view charts, indicators, and parameters in a clear and concise manner, enabling them to gain insights into the performance and potential of their strategies. The ability to visualize strategies enhances decision-making and helps traders fine-tune their approaches for optimal results.

Customization options: The Strategy Builder offers customization options, allowing traders to tailor their strategies according to their specific preferences and trading styles. Traders can adjust parameters, set entry and exit conditions, and incorporate various technical indicators to refine their strategies. This flexibility empowers traders to adapt their strategies to different market conditions and optimize their trading outcomes.

Backtesting capabilities: RoboForex Strategy Builder provides robust backtesting capabilities, allowing traders to assess the performance of their strategies using historical data. Traders can simulate their strategies in different market scenarios and evaluate their profitability and risk metrics. Backtesting helps traders gain confidence in their strategies before deploying them in live trading.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).