The Martingale strategy | How does it work in Forex?

Martingale is the favorite word for those who are looking for the “Grail” and are dreaming of rapid growth of their deposit. The strategy seems to be bankable. All you have to do is increase the position volume every time there is a loss, and sooner or later you will make a profit and cover all your losses. But practice shows the contrary: such confidence in probability theory suggests that a person does not know mathematics and statistics. From this review, you will learn what Martingale trading is, why it’s dangerous for novice traders, and how to turn it in your favor.

What is the Martingale strategy and its history?

Its history began in casinos and gambling. We don’t know for sure who was its author or why it got such a name. What we do know is that it was actively used in gambling starting in the 18th century.

The game begins with a bet. A player specifies a sum and makes a decision about the outcome of a certain event. The possible variants are whether the player was right or not.

After each loss, the player doubles the bet by the principle of a geometric progression “1-2-4-8-16-32-64…”, until he wins.

In case of a win, the player returns to the initial bet.

It’s a classic scheme that has been modified several times. For instance, it’s not necessary to specifically double the bet. The player can take a risk by tripling it and not just pay off the previous loss, but also make money. Or lose money even quicker. It’s also unnecessary to go back to the initial bet.

In trading, the Martingale system or strategy involves opening a doubled-up position in the same direction, if you sustain a loss in your previous position until you gain profit. In case of a successful trade, you open a new position at the minimal (initial) volume again.

The Martingale has varieties:

Pyramiding. It’s also a kind of trend trading with the possibility to quickly grow the deposit. The difference is that the volume is increased in stages with the trend in case of a positive result, and not in case of a loss, like in the Martingale.

Reversing. An analog of the Martingale, the difference is that a doubled-up position is opened in the opposite direction in case of a loss.

Which one of these strategies is better? There’s no correct answer. The Martingale system suggests that, according to probability theory, sooner or later a positive result will come. Pyramiding is applicable in swing trading in the trend market. But trends tend to end. Reversing can be gainful in flat, or in Forex markets with anomalous fundamental volatility. But all three strategies are highly risky.

Martingale’s advantages and downsides

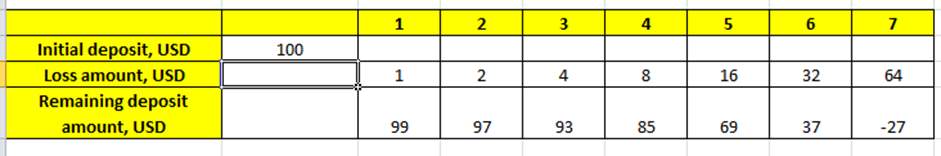

The danger of using the Martingale strategy is well illustrated by the following calculations. Suppose, you have a 100 USD deposit:

You open a 1 USD position. You lose and your deposit is now 99 USD.

You double the position and lose again. Your deposit is 97 USD.

You double the position again, so now your loss is 4 USD, which reduces your deposit is 93 USD. And so on.

The results are clearly shown in the table.

After you lose 6 positions in a row, your deposit will decrease by 2/3. For a 1,000 USD deposit, the number of losing positions in a row reaches nine.

The Martingale is deceitful because the trader’s logic relies upon probability theory. According to it, the chances of a positive outcome are 50/50, and a series of 6 losing positions seems impossible. And here there are two aspects. First, such a losing series is entirely possible. The test results of many strategies show that. Second, in case of a positive outcome you only get back to the breakeven point. For example, if your deposit is 97 USD, then a 4 USD position will increase the deposit to 101 USD. A waste of time and the spread increases your losses.

Pros and Cons

- The advantages of using Martingale:

- The downsides of using Martingale:

- In case of a series of successful positions, the trader will always benefit. The deposit will quickly grow.

- The possibility to build strategies exclusively based on mathematics and statistics without technical analysis.

- The quick loss of a major part of the deposit in case of a long series of losing positions.

- The necessity of large startup capital. The more money you have at risk, the longer the losing series can proceed.

- Breaking risk management rules. The longer the losing series, the higher positions the trader has to place, crossing permissible limits in risk management.

The strategy becomes effective in professional hands. Without a trading algorithm and an elaborate risk management policy it brings losses.

In Forex, the main problem of the Martingale strategy is the drawdown depth, which depends on the cost of a pip. If a trader’s deposit, for our purpose, can take a 300 pip drawdown, then along with the rise of the position volume by 10 times (it’s only 4 trades: 0.1 lot, 0.2 lot, 0.4 lot, 0.8 lot), the cost of a pip rises by the same amount. The permissible drawdown drops to 30 pips. This example doesn’t take into account the reduction of the deposit amount due to the losses in the first three positions of the series.

How does the Martingale strategy work in Forex?

In Forex, the use of the classic Martingale strategy looks the same as in the game sector, the only difference is that the transaction volume is set in lots, and not in specific amounts. Here there’s no upper limit of income or loss, i.e., no such thing as “the bet paid off” or “the bet didn’t pay off”.

Your aim is 50 pips or 5 USD. The stop-loss trigger is set at 30 pips.

The position is closed on the stop order, and the loss is 3 USD.

According to the Martingale strategy in Forex, you have to open a position in the amount that will cover the sustained loss. There are two options. Raise the take-profit to at least 60 pips (but if the price didn’t pass 50 pips the first time, there’s no guarantee that it will pass 60 pips the second time). The second option is to raise the position volume by 2 times, to 0.02 lot. The pip cost will rise to 0.2 USD, which means to cover the loss, you can reduce the take-profit.

In Forex, the application of the Martingale strategy consists in finding the optimal balance between the position volume increase (and the automatic increase in the pip cost), the take-profit level, and the stop-loss setting. Since it’s impossible to infinitely raise the take-profit, the lot volume of the position rises. But that leads to an increased load on the deposit, which is at risk of being nullified by the stop-out.

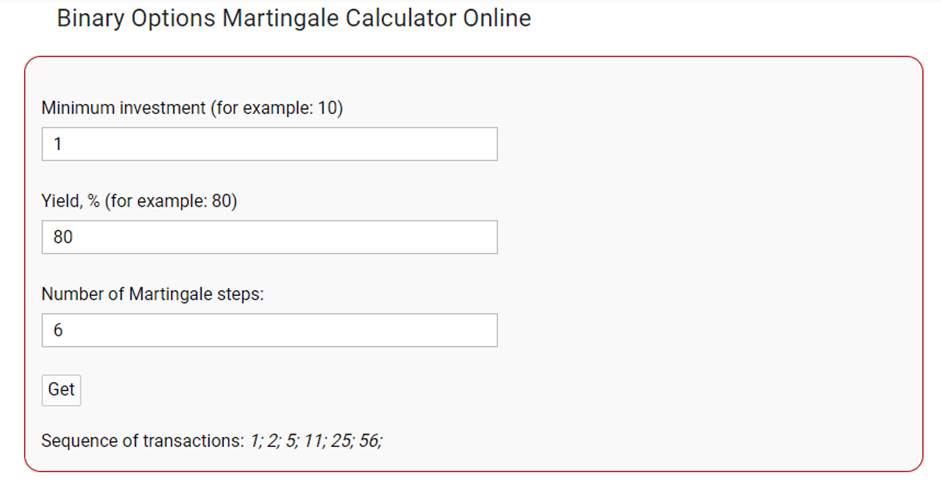

At first glance, such a system of calculation looks complicated. That’s why novice traders either don’t use the Martingale in Forex at all or use it thoughtlessly and lose the deposit. The Martingale is more often applied in binary options, where there’s a specific bet amount, reward amount, and the understanding of whether the bet is right or not. But here’s a nuance. When the coefficient “2” is used, the Martingale remains losing anyway, since, in the case of the right prediction, the reward is less than 100%. That’s why each following bet is calculated separately, taking into account the initial bet and the current yield.

Bet calculation formula as per the Martingale system:

S = X + Y/K, where:

S is the amount of the next necessary bet as per the Martingale system;

X is the amount of the very first bet in trading as per the Martingale system;

Y is the amount of all previous transactions; and

K is the yield for an accurate prediction.

Some calculators automate these calculations.

Martingale Calculator

Martingale CalculatorThis example shows that when the initial bet is 1 USD and the option yield is 80%, after 6 losing transactions in a row the loss will be 102.99 USD.

The Martingale strategy | A simple and a complicated option

The simple Martingale. You opened a position with the trend, but the position was closed on correction with a loss. You keep opening positions with the double lot until a position is closed with a profit. The number of losing positions the deposit can take depends on its amount and the length of the stop-loss, by which losing positions are closed.

The complicated Martingale. Use mathematical calculations to choose the ratio for increasing the position volume based on the following input data: deposit amount, initial transaction amount, expected stop and take-profit levels, risk limit values per trade as a percentage of deposit balance, and the average volume of losing positions in the series.

The complicated Martingale can be supplemented by the pyramiding algorithm or replaced by reversing.

Who will the Martingale strategy suit?

Gamblers who approach trading as a game. Such people don’t worry about possible losses, they enjoy the process itself.

Traders whose goal is to rapidly grow the deposit. The Martingale allows traders to increase the deposit faster than conservative strategies. It’s enough to raise the deposit by 2 times (to breakeven level) to relieve the psychological tension.

Professional traders, including those who use trading advisers. With a reasonable mathematical approach to the Martingale algorithm, you can make your strategy more effective at comparatively low risks. For the sake of discussion, when you raise the risk by 10%, the strategy yield can be increased by 25%.

The Martingale isn’t recommended to novice traders who are not good at mathematics, to long-term investors, or to traders who take losses painfully and don’t control their emotions well.

Is there a “safe Martingale”?

There is no “safe Martingale”. No matter how well you insure your transactions, no matter how confident you are in a positive result, there is no guarantee of 100% success in an open position. And it means that you can lose a double bet anytime. On the other hand, a double bet can work and bring you double profit. That is the risk of Martingale trading.

How to reduce risks when using the Martingale strategy? | Advice to beginners

So, you have decided to try the Martingale? Then follow these recommendations, and they will help you reduce potential risks:

Don’t apply the Martingale in flat trends. Raising your position makes sense when you’ve caught the start of an upward trend. Or if you entered the market too late and have lost money due to its reversal, but you are confident that it will change its direction. In this case, you can double the bet.

Use the Martingale as an additional tool. Trading systems should be based on logic, supported by technical and fundamental analyses, levels, and patterns. And the Martingale is only an income-raising tool.

Start trading with a minimum lot. When you gradually raise the position, you get more possible series.

Strictly stick to risk management. Risk management considers the risk per trade and per total number of trades. Remember: by increasing the position volume in lots, you raise the pip cost, which could lead to a stop-out. Trading without a stop-loss order is strictly forbidden. A take-profit position is desirable, but it can be moved manually.

Exclude short timeframes. At intervals M1-M5 the price movement is practically unpredictable. So, you shouldn’t take the risk of raising trading volumes.

Control your emotions. In games, there is a notion of gambling, i.e., the desire to recoup at any cost. Psychologically, a person may not be ready to accept losses. So, they top up the deposit and try to recoup by doubling the bet. That’s a sure way to lose the deposit.

Before applying the Martingale strategy to a real account, try it on a tester. You must know the average and maximal series of losing positions.

Algorithmic trading with the use of the Martingale strategy

In many sources, the Martingale is called a direct way to lose the deposit. But it’s not so bad if you apply it carefully, wisely, without going too far. Lots of trading advisers, whose algorithm uses the Martingale, are an example of that.

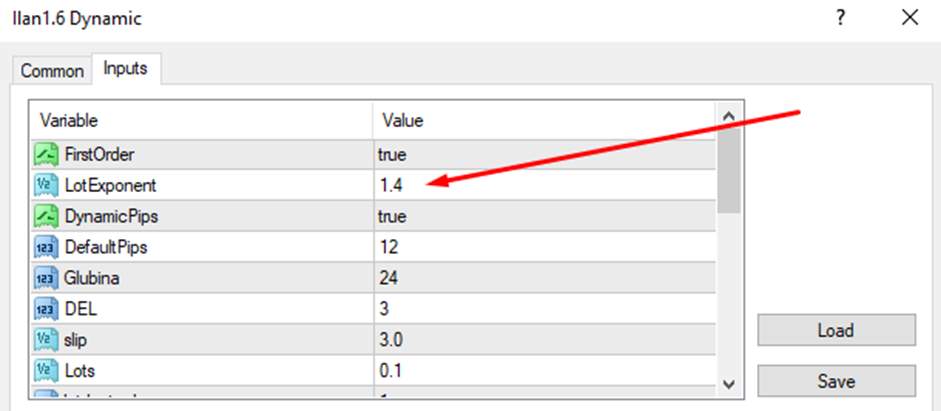

The position volume is increased smoothly, and not by 2 times. For instance, with the coefficient of 1.1 and its gradual raising (1.2; 1.3…).

Unlike the classic Martingale, an advisor takes into account technical indicator data and other tools that raise the probability of the right decision.

In Forex, there are no levels that promote a normal probability distribution, which can raise the probability of success.

Money is withdrawn with constant regularity.

In settings, the Martingale is mostly placed in a separate block, where the trader specifies the coefficient, by which the position is raised in case of a loss, the conditions of its activation, etc. An example of such a well-known adviser is Ilan of any version.

A longtime application of the Martingale always leads to the same result, i.e., a loss. Theoretically, a win is only possible if you have an infinite amount of money, which is not possible. That’s why in Martingale, advisers sooner or later “flush” the deposit. The secret to their success is that they quickly increase the deposit, and the trader has to stop in time and withdraw the money.

Always control the open positions. Such advisers need constant supervision. Sometimes, it’s better to close your positions manually, and not wait for the automatic stop or the stop-out.

Try your adviser on a tester. You need to understand what the mathematical expectation is, how many losing positions in a row the robot gives on average, at what point “the flush” occurs, etc.

Be careful when the adviser “gets carried away”, opening positions with the trend. It can do it while raising the Martingale position. And here the principle of the “leaving train” might work: the top position will be opened with a delay at the moment the trend reverses towards the loss.

Experiment with cent accounts. They have real market quotations online.

Use as much leverage as possible to reduce the broker’s margin. That will increase the longest series of trades.

Withdraw the income from time to time. The primary goal is to fully pay off the deposit and reach the breakeven level. After that, you can raise the risks.

Use a VPS server. In case of a disconnection, you won’t be able to close the transactions manually.

The Martingale advisers are among the high-risk tools, but the risk is compensated by the rate of possible deposit growth. Whether it’s worth it, is up to you to decide.

Should I use the Martingale strategy in trading?

Although many sources warn that it’s unacceptable to try to quickly grow the deposit with the help of the Martingale strategy, there’s nothing too dangerous about it. It’s one of the ways to manage the volumes of transactions based on the results of the previous transactions with elements of statistics and mathematical analysis such as pyramiding or reversing. Along with other tools, it can help to expedite gaining profit, or to pay off a previous loss quicker.

You clearly understand its essence, you are good at mathematics, and you can calculate the Martingale coefficient based on the probability of success and the level of risk.

You combine the Martingale with technical and fundamental analyses.

You accept the risks and are not afraid of losing money.

If you are a novice trader and are not ready to risk your deposit, the Martingale isn’t for you. But if you are a professional and are moderately venturous, why not try?

The best brokers of 2025

In this section, the Traders Union offers a short review of the advantages of brokers that perfectly suit trading strategies with any level of risk.

eToro

This broker is one of the biggest social trading platforms that unites more than 1 million people worldwide.

- The advantages of the eToro broker:

- Regulated by the FCA (Great Britain), and CySEC (Cyprus).

- Direct access to the world’s capital markets.

- More than 2,600 trading tools. No fees on many assets.

One of the platform’s advantages is that investors can directly reach traders to specify strategy details and admission guarantees and ask for additional information, etc. The signal suppliers that have been actively trading for more than a month make the ranking.

RoboForex

RoboForex is one of the best brokers for novice traders. Here one can find everything for a successful start, irrespective of their level of experience, knowledge, or capital. The platform has been developing technological instruments since 2009. In this time, the broker has taken the lead by several criteria and has attracted into its ranks more than 1 million traders and investors from 169 counties.

- The advantages of the RoboForex broker:

- The minimal deposit is 10 USD. There are cent accounts, in which one can hone any high-risk strategies, including the Martingale, with the risk of minimal losses.

- Tight real spreads in ECN accounts that are confirmed by the script, are included in the trading platform.

- Direct access to real capital markets in the US and Europe, where more than 12,000 securities are available for trading. Own platform for the capital market R Stocks Trader.

- CopyFx service. A platform for copying transactions that allows traders to make money on providing signals, and investors – on copying professionals’ transactions. The platform’s unique features are the mechanism of traders’ ranking formation, and risk management for investors.

RoboForex is a responsible and lucid broker that has no limits on the use of strategies.

Bottom line

The Martingale is a strategy with raised risks, which isn’t dangerous if a trader estimates possible consequences and applies risk management. Risk optimization in the Martingale involves combining all analytical tools and raising a position only if there’s a high probability of a positive result. The coefficient for raising a position is calculated mathematically, taking into account a trader’s goals and risk management policies.

FAQs

How dangerous is it to apply the Martingale algorithm and can it bring profit?

The Martingale is one of the riskiest strategies because if the bet is doubled every time, after 4-6 losing positions in a row the deposit will be completely nullified. In a long period, with a limited deposit, the pure Martingale brings a 100% loss (proven mathematically). But applying its separate ideas, supported by testing statistics, can help to grow your deposit relatively quickly. For instance, raising a position smoothly, opening a position in the direction, which is opposite to the loss, etc. Additional tools help to raise the probability of the correct signal.

In what case is it reasonable to apply the Martingale strategy?

This is an individual question. Raising the volume of transactions is permissible if there’s firm confidence in the positive result, transactions are opened within risk management, and you are ready to be responsible for the risks. The Martingale is mostly applied in short-term strategies to rapidly grow the deposit: in trading systems based on fundamental analysis, scalping, and swing trading. Conservative algorithms are applied in long-term strategies.

What is the algorithm for using the Martingale in Forex trading?

In the simple variant, you open a transaction with the trend, until it brings profit. And the only thing you change in the transaction parameters is the volume.

- Analyze the market with all available tools. Open a transaction only when you see a strong signal. If it proves to be losing, assess the probability of the next signal. Don’t change the position volume, if you see risks.

- Calculate the coefficient of the position volume increase, based on your own perception of the risk and on the rules of risk management.

- When opening a transaction again, change the values of take-profit and stop-loss, so as not to take unnecessary risks, but to pay off the loss from the previous transaction. Take into account the pip cost.

- Consider the chances of opening a higher position in the opposite direction.

How to reduce the risks when using the Martingale strategy?

The only way to reduce the risk is not to use the Martingale. Increase the transaction volume only in the case where the previous transactions brought profit and can cover the potential loss. In all other cases, applying the Martingale raises the risk.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.