Binance Card | How to get and use

Note that Binance presently does not support cryptocurrency bank cards anymore. If you need a similar product, Traders Union recommends that you consider opening a cryptocurrency debit Mastercard from Bybit.

Binance Visa Card is more beneficial than cards offered by competitors, because Binance cardholders do not have to pay any fees, except for the fees charged by the third party. Binance also offers clients the best cash back conditions in the market.

Binance exchange is a dominant player in the world of cryptocurrencies, and the Binance Card, functioning as a bridge between the digital and traditional economy, is a testimony to its innovative prowess. This card effectively makes cryptocurrencies not only an asset for investment but also an available method of payment.

Enabling low transaction fees, high withdrawal limits, and a highly attractive cashback program payable in Binance Coin (BNB), the Binance Card provides a world of benefits for the global crypto enthusiast. It is more than just a card; it’s an entrance to a comprehensive range of benefits and features designed to upgrade your crypto experience.

The Binance Card supports a vast array of cryptocurrencies and integrates seamlessly with your Binance account, offering real-time conversion of your cryptocurrencies to fiat currencies. This article will delve deeper into the concept of cryptocurrency cards, the workings, and features of the Binance Card, how to acquire one, and its specific advantages.

What are cryptocurrency cards?

Cryptocurrency cards, also known as crypto cards or Bitcoin debit cards, are cutting-edge financial tools that allow individuals to use their digital assets in everyday transactions. Much like traditional debit or credit cards, they link the crypto economy and standard commercial operations. Essentially, these cards convert cryptocurrencies such as Bitcoin, Ethereum, among others, into local fiat currencies at the point of sale, obviating the need for manual cryptocurrency sale and bank transfer wait times.

In an increasingly digital world, the arrival of crypto cards signifies a substantial stride towards integrating the crypto economy into everyday life. With the help of these cards, users can easily convert and spend their digital assets where conventional debit or credit cards are accepted. Their existence simplifies the utility of cryptocurrencies, extending them beyond the sphere of mere investments and integrating them into everyday transactions. Consequently, these cards' ease of use and convenience contribute to the mass adoption of digital currencies. The pivotal role of crypto cards in bridging digital and traditional economies presents a promising future where both these sectors seamlessly coexist and interact.

What you need to know about the Binance card?

The Binance Card, a Visa debit card, offers various features and supports a broad range of cryptocurrencies, including but not limited to BNB, BTC, BUSD, and ETH. The card allows for real-time conversion of cryptocurrency to EUR currency when making transactions, making it highly user-friendly.

Key points:

Supported cryptocurrencies. The Binance Card supports a wide array of cryptocurrencies, including BNB, BTC, BUSD, USDT, SXP, ETH, EUR, ADA, DOT, XRP, AVAX, SHIB, LAZIO, PORTO, SANTOS, and more.

Real-time conversion. When transacting, the Binance Card converts your chosen cryptocurrency into EUR in real-time.

Binance account integration. The Binance Card is tightly integrated with your Binance account, providing a seamless user experience.

Card types. The Binance Card is a Visa debit card providing worldwide acceptance.

Global acceptance. Accepted at over 60 million merchants worldwide, the Binance Card allows you to spend your cryptocurrencies anywhere.

No transaction fees. The Binance Card doesn't charge annual or transaction fees, making it cost-effective for crypto users.

Cashback rewards. Binance offers cashback on every purchase made using the card. Cashback depends on your card level, and the BNB coins price you stake in your Binance wallet.

KYC verification. Binance enforces KYC and anti-money laundering measures to protect its users against financial crimes.

How to get a Binance card

Getting a Binance Card is a simple process. Here are the steps:

Step 1. Visit the Binance Visa Card website.

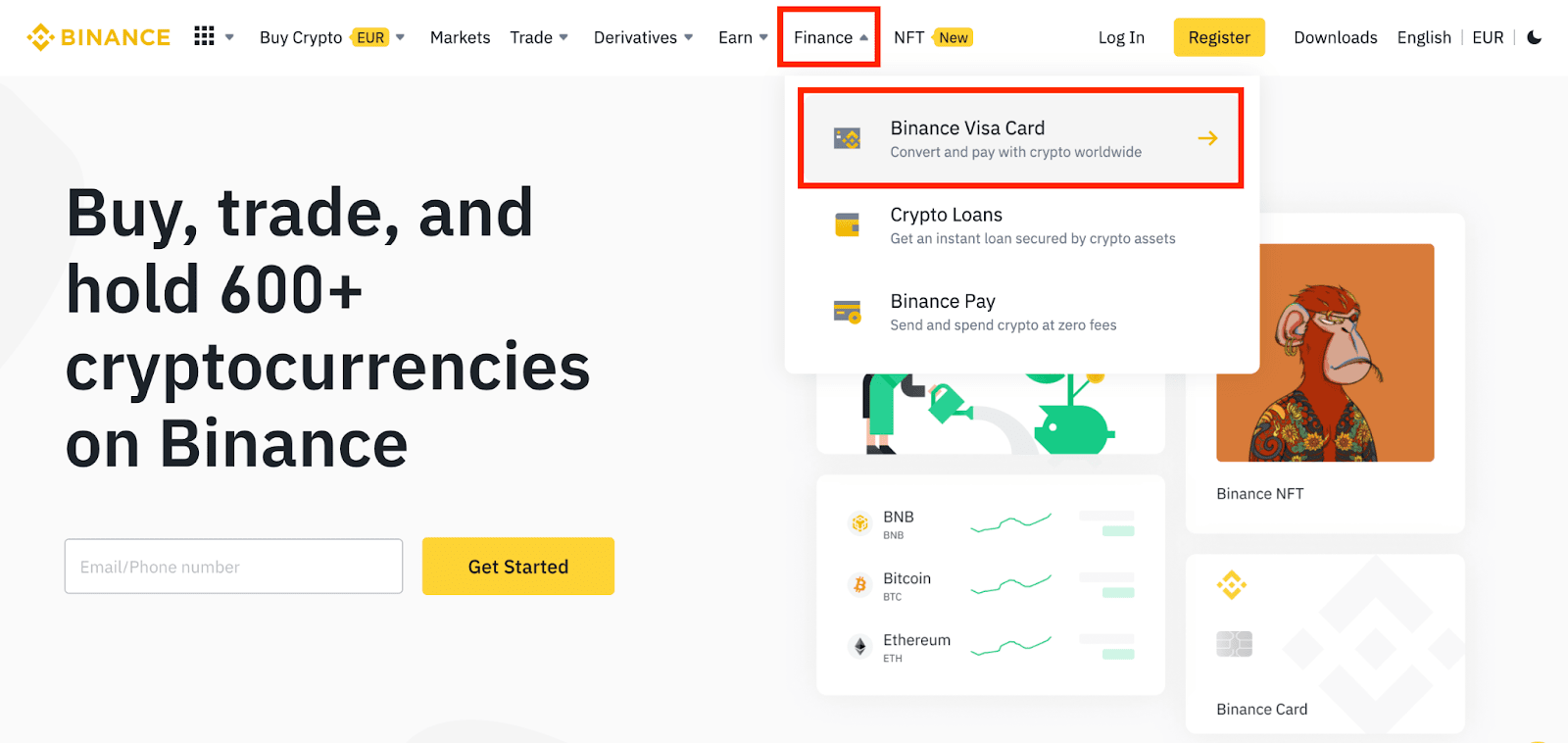

Step 2. Hover over Finance and click Binance Visa Card from the top navigation bar.

How to get a Binance card

Step 3. Select Card in the footer of Binance.com.

How to get a Binance card

Step 4. You must complete Identity Verification and live in a region where the Binance Card is available.

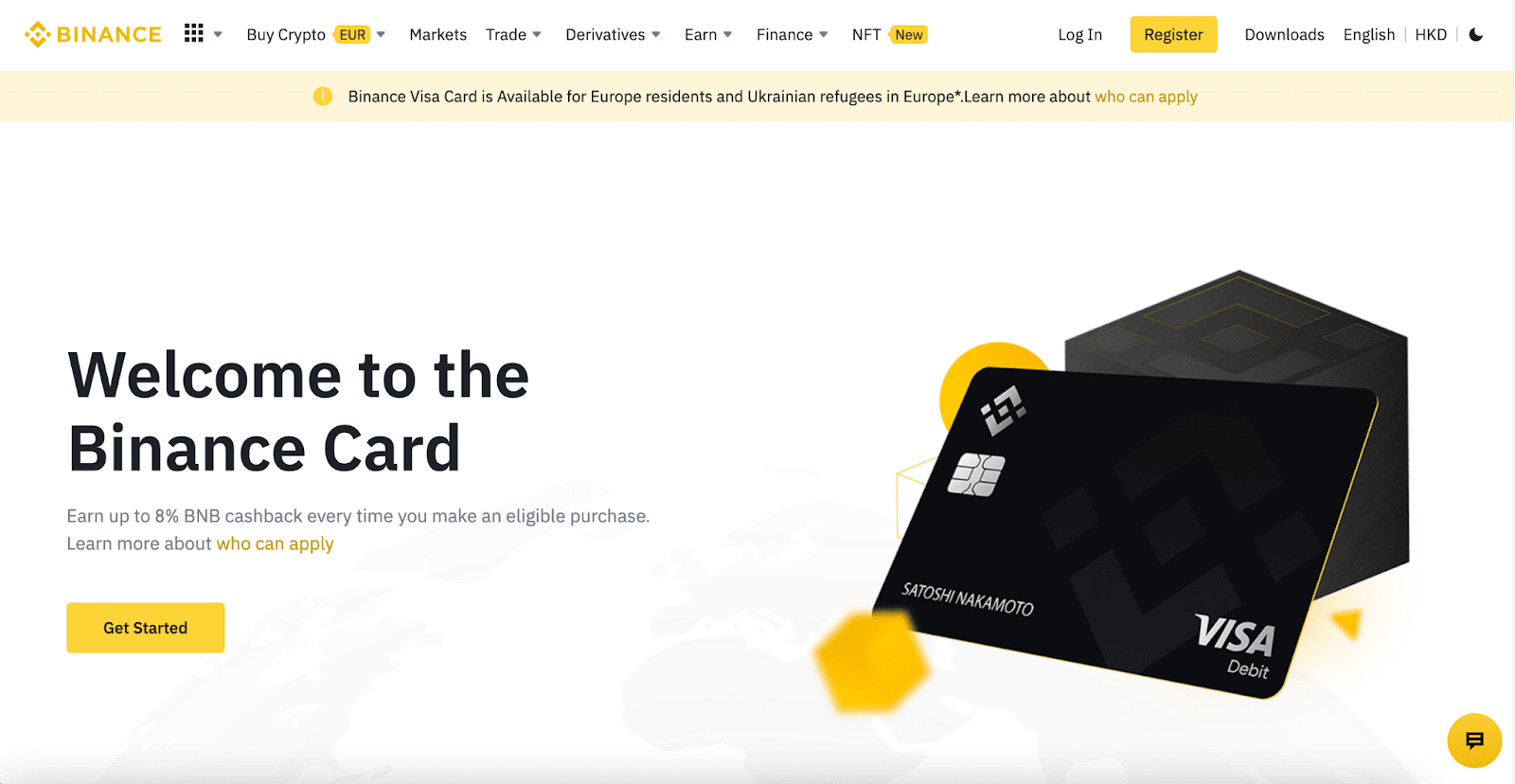

Step 5. Click Get Started on the Binance Card page.

How to get a Binance card

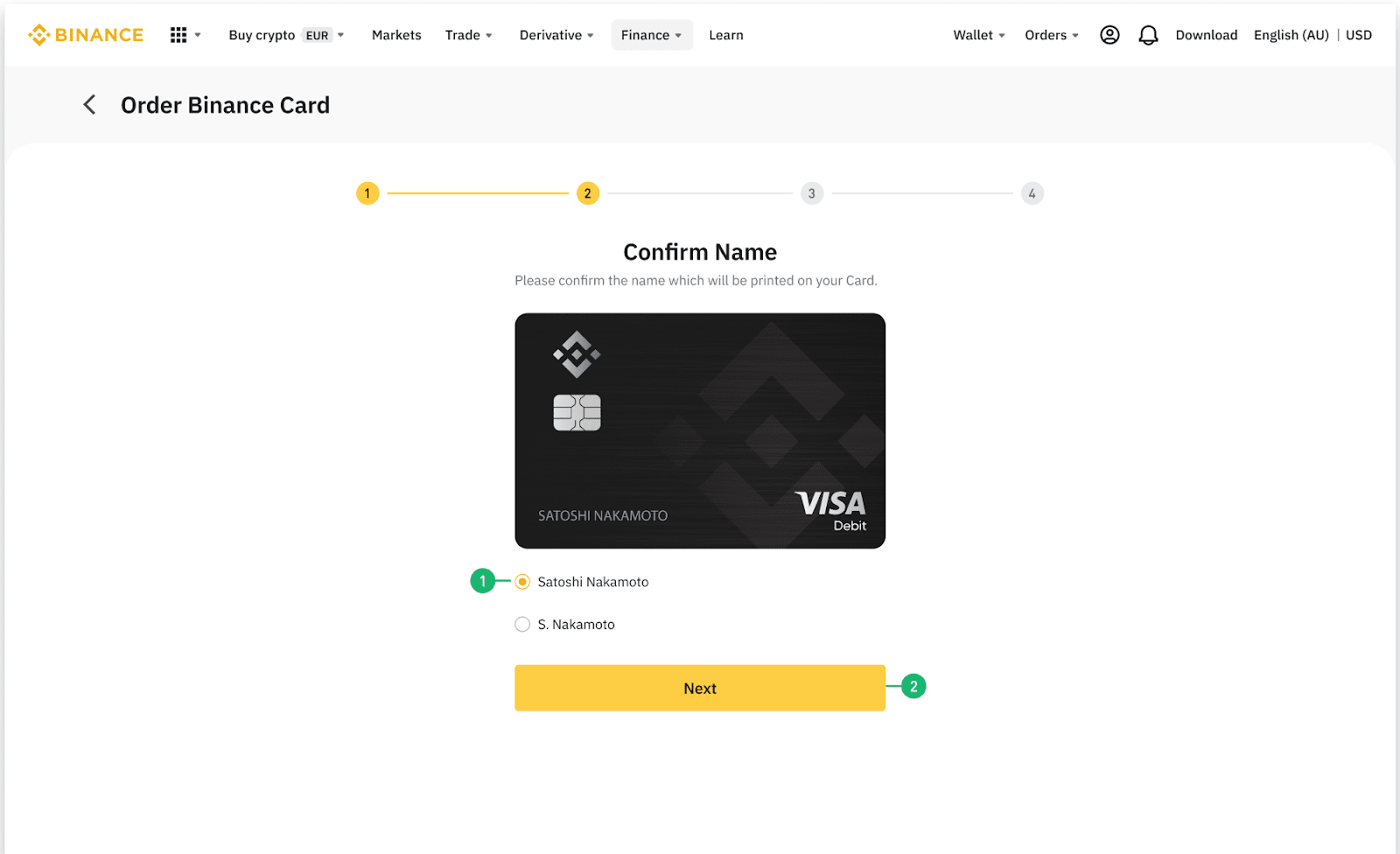

Step 6. Confirm the delivery address for your card. Agree to the Terms of Use, Privacy Policy, Cardholder Agreement, and KYC consent. Click Order to complete the process.

How to get a Binance card

Step 7. Upon successful registration, your virtual Binance Card will be issued instantly and remain valid until your physical card is activated.

Remember that the minimum withdrawal is 0.002 BTC, and you can withdraw from Binance easily.

Binance card benefits

The Binance card is a convenient and cost-effective payment solution for cryptocurrency enthusiasts. Offering zero fees for both the initial issuance of the card, whether virtual or physical and for account closure, it ensures seamless integration into your financial routine with no upfront costs. You are free to discontinue the service at any time without worrying about closure charges.

Benefits of Binance card:

Low transaction fees. Binance card holders do not have to pay administrative, processing or annual fees. Sometimes the cardholder may be charged fees by the services for which payment is made. The conversion fee for the Binance Card, which allows users to convert cryptocurrencies into fiat currencies for everyday spending, is only 0.9%.

No initial issuance fee. There are no fees for the first issuance of a virtual or physical Binance card, allowing users to use the card seamlessly without any upfront costs.

Affordable reissuance fee. If a physical card needs to be reissued for any reason after the initial issuance, a fee of 25 EUR is charged, covering the cost of card production and delivery.

No inactivity fee. Binance card doesn't penalize users for inactivity. Even if the card remains unused for 12 months, no fees are charged, offering the flexibility to use the card as needed without extra costs.

No account closure fee. Binance doesn't impose any charges for account closure. Users can discontinue the service at any time without incurring closure fees.

Universal acceptance. The Binance card, a Visa debit card, can be used anywhere Visa cards are accepted. It offers the same convenience as traditional prepaid debit cards.

Real-time crypto to EUR conversion. The Binance card provides a unique feature of converting cryptocurrencies into EUR in real-time, making it especially useful for EUR purchases.

Rewards with purchases. Users of the Binance card can earn rewards with their purchases, adding an extra layer of benefits for cardholders.

Fund security through KYC. To safeguard against financial crimes, Binance has implemented Know Your Customer (KYC) and anti-money laundering measures. This offers an additional layer of security to card users.

Cryptocurrency flexibility. Given the crypto-native nature of Binance, the card allows users to maintain their funds in cryptocurrencies until the point of sale, allowing the benefits of the potential appreciation of their assets.

How Binance Visa card works

The Binance Visa Card operates like a conventional debit card but with the added benefit of being able to spend your cryptocurrencies directly. It supports multiple cryptocurrencies and converts your chosen cryptocurrency into EUR in real time at the point of sale. This card integrates with your Binance account for a seamless user experience. Accepted at over 60 million merchants worldwide, you can use the Binance Visa Card almost anywhere.

Binance Visa bank card cashback program

Cashback payout system

| Map level | Average amount of BNB in 30 days | Rewards |

|---|---|---|

Card level 1 |

0 |

0.1% |

Card level 2 |

1 |

2% |

Card level 3 |

10 |

3% |

Card level 4 |

40 |

4% |

Card level 5 |

100 |

5% |

Card level 6 |

250 |

6% |

Card level 7 |

600 |

8% |

Conclusion: Should I get a Binance card?

The Binance Card is an excellent option for those heavily invested in Binance Coin (BNB). It offers up to 8% cashback rewards, requiring 6,000 BNB in your Binance Wallet. A more modest 2% cashback is achievable with a stake of 10 BNB. There's a 1% cashback offer for those not wishing to invest heavily in BNB. However, it's disappointing that cashback rewards are solely tied to BNB. The rewards are lacking for those holding large amounts of other cryptocurrencies, like BTC. If you are committed to BNB, then the Binance Card is certainly worthwhile. It's a niche concept, a crypto-cash card tied to a crypto exchange, but for its target audience, it works.

FAQs

Does Binance have a debit card?

Yes, Binance offers a Visa debit card.

What bank cards work with Binance?

VISA and Mastercard credit cards work with Binance.

Is it worth getting a Binance card?

Many people ask: Is Binance safe and worth getting a Binance card? Yes, Binance is safe, and it's worth getting a Binance card because the Binance Card allows instant conversion of cryptocurrencies to fiat; it has no annual or transaction fees, making it cost-effective for users.

How do I get a Binance debit card?

Go to the Binance Visa card website or select card on Binance.com.

Complete Identity Verification.

Order a card.

Create a PIN.

Confirm delivery address, agree to the terms and conditions, and order.

Upon successful registration, a virtual Binance Card will be issued.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).